February 2026

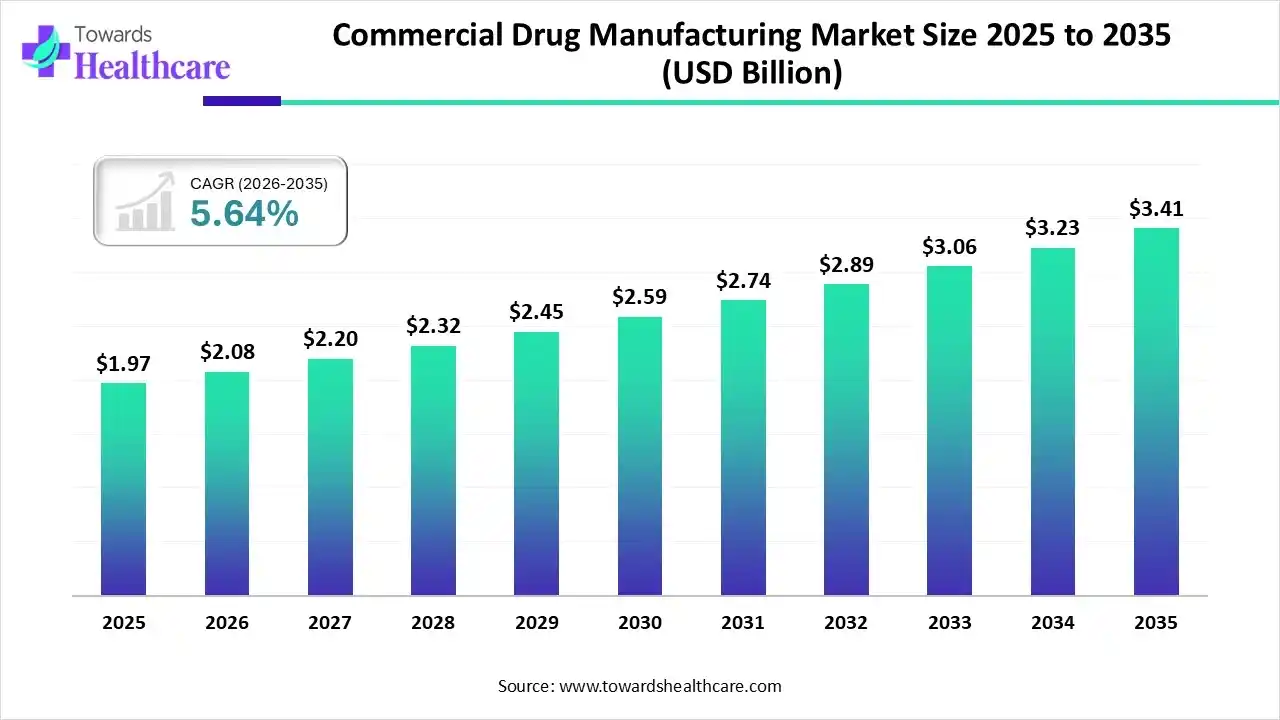

The global commercial drug manufacturing market size was estimated at USD 1.97 billion in 2025 and is predicted to increase from USD 2.08 billion in 2026 to approximately USD 3.41 billion by 2035, expanding at a CAGR of 5.64% from 2026 to 2035.

The market is expanding steadily, driven by rising medicine demand, increased outsourcing to CMO/CDMOs, technological advancement, and growing production of biologics, generic and complex pharmaceutical formulations worldwide.

Commercial drug manufacturing is the large-scale production of pharmaceutical products for market distribution including APIs, formulations, and biologics, in compliance with regulatory and quality standards. The commercial drug manufacturing market is growing due to rising global demand for affordable medicine, increasing prevalence of chronic diseases, and rapid expansion of generic and specialty drugs. Pharmaceutical companies are outsourcing manufacturing to CMOs and CDMOs to reduce costs and accelerate production. Additionally, advancements in manufacturing technologies, regulatory compliance capabilities, and growing focus on biologics and biosimilars are further supporting market expansion.

Artificial intelligence is transforming the commercial drug manufacturing market by improving process efficiency, quality control, and predictive maintenance. AI enables real-time monitoring, reduces production errors, accelerates scale-up, and supports regulatory compliance, helping manufacturers lower costs, improve consistency, and increase overall productivity across pharmaceutical manufacturing operations.

Pharmaceutical companies are increasingly outsourcing manufacturing to specialized CMOs and CDMOs to reduce capital investment, enhance flexibility, and accelerate product launches, making outsourcing a long-term growth driver for the commercial drug manufacturing market.

Growing demand for biologics, biosimilars, and specialty drugs is pushing manufacturers to invest in advanced facilities, single-use systems, and skilled expertise, shaping the future toward high-value, technology-driven pharmaceutical production.

The integration of automation, AI, and data-driven manufacturing is improving operational efficiency, quality assurance, and regulatory compliance, enabling manufacturers to optimize production processes and remain competitive in an evolving global pharmaceutical landscape.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.08 Billion |

| Projected Market Size in 2035 | USD 3.41 Billion |

| CAGR (2026 - 2035) | 5.64% |

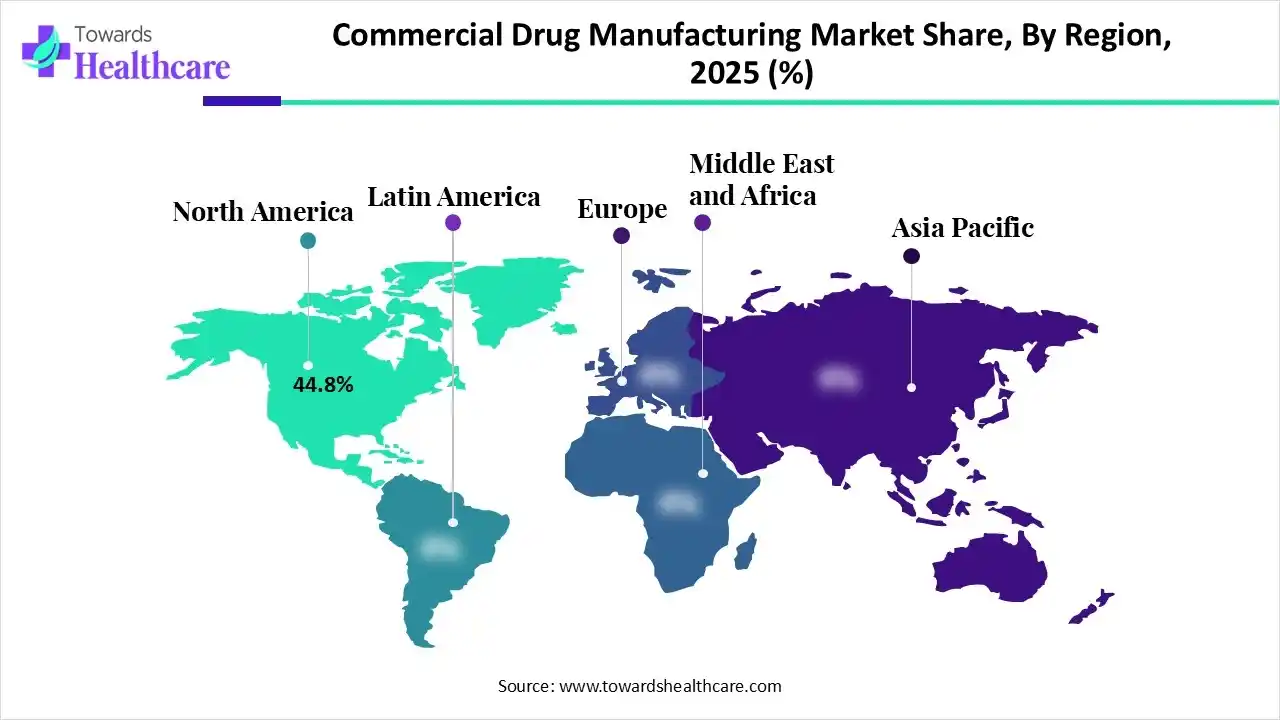

| Leading Region | North America by 44.8% |

| Market Segmentation | By Molecule Type, By Manufacturing Mode, By Formulation, By Technology, By Region |

| Top Key Players | F. Hoffmann-La Roche Ltd., Novartis AG, GlaxoSmithKline plc, Pfizer, Inc., Merck & Co., Inc., AstraZeneca |

Why Did the Conventional Small Molecules Segment Dominate in the Market in 2025?

The conventional small molecules segment dominated the commercial drug manufacturing market with a share of approximately 58% in 2025 due to its established production processes, lower manufacturing costs, and wide application across chronic and acute therapies. Strong demand for generic medicines, patient expire of branded drugs, and easier regulatory pathways further supported large-scale production and market leadership of small-molecule drugs.

Biologics & Biosimilars

The biologics & biosimilars segment is expected to grow at the fastest CAGR during the forecast period due to rising prevalence of complex and chronic diseases, increasing adoption of targeted therapies, and strong demand for cost-effective biosimilars. Advancements in bioprocessing technologies, expanding regulatory approvals, and growing investments in biologics manufacturing capacity are further accelerating segment growth.

How the In-house Manufacturing Segment Dominated the Commercial Drug Manufacturing Market in 2025?

The in-house manufacturing segment dominated the market with a share of approximately 59% in 2025 as pharmaceutical companies prioritize greater control over production quality, intellectual property, and regulatory compliance. Established manufacturing infrastructure, improved capacity utilization, and the need to ensure supply chain reliability, especially for high-volume and critical drugs, supported continued reliance on internal manufacturing capabilities.

CMO/CDMO

The CMO/CDMO segment is expected to grow at the fastest CAGR during the forecast period as pharmaceutical companies increasingly outsource manufacturing to reduce capital investment and operational risk. CMOs and CDMOs offer scalable capacity, advanced technologies, and regulatory expertise, enabling faster product development and commercialization. Growing demand for biologics and speciality drugs further supports the accelerated growth of this segment.

Why the Tablets & Capsules Segment Dominated the Commercial Drug Manufacturing Market?

The tablets & capsules segment dominated the market due to their cost-effective production, long shelf life, and ease of transportation. High patient preference, accurate dosing, and widespread use in treating chronic and acute conditions supported use in treating chronic and acute conditions supported large-scale manufacturing. Additionally, well-established production technologies and strong demand for generic oral formulations reinforced the segment’s market leadership.

Injectables

The injectables segment is expected to grow at the fastest CAGR during the forecast period due to increasing demand for biologics, biosimilars, vaccines, and oncology therapies that require parenteral administration. Rising prevalence of chronic and critical diseases, along with the need for faster therapeutic action and improved bioavailability, is driving injectable adoption. Additionally, advancements in sterile manufacturing, fill-finish capabilities, and regulatory support are further accelerating segment growth.

Why Did the Batch Manufacturing Segment Dominate in the Market in 2025?

The batch manufacturing segment led the commercial drug manufacturing market share of approximately 74% in 2025 due to its widespread adoption, operational flexibility, and suitability for producing a wide range of drug formulations. Its well-established regulatory acceptance, ease of quality control, and ability to manage variable production volumes made batch manufacturing the preferred technology for commercial drug production, particularly for generics and small-molecule drugs.

Continuous Manufacturing

The continuous manufacturing segment is expected to grow at the fastest CAGR during the forecast period due to its ability to improve production efficiency, reduce costs, and ensure consistent product quality. This technology enables real-time monitoring, faster scale-up, and lower material waste. Increasing regulatory support, adoption of advanced automation, and the need for flexible, high-throughput manufacturing are further accelerating the shift toward continuous manufacturing in the commercial drug manufacturing market.

North America dominated the global commercial drug manufacturing market in 2025 with an approximate 44.8% share due to its strong pharmaceutical infrastructure, high R&D spending, and presence of leading drug manufacturers and CDMOs. Favourable regulatory frameworks, advanced manufacturing technologies, and strong demand for innovative, biologics, and specialty drugs further supported large-scale production and market leadership across the region.

US Market Leadership Driven by Innovation and Manufacturing Strength

The U.S. captured the largest revenue share in the commercial drug manufacturing market in 2025 due to its pharmaceutical innovation ecosystem, advanced manufacturing infrastructure, and high healthcare spending. The presence of major pharmaceutical companies and leading CDMOs, combined with. robust regulatory oversight and rapid adoption of advanced manufacturing technologies, supported large-scale production. Strong demand for branded, biologic, and specialty drugs further reinforced the market leadership.

Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period due to expanding pharmaceutical manufacturing capacity, lower production costs, and increasing outsourcing from global drug manufacturing. Rapid growth in generic drugs, rising healthcare demand, supportive government initiatives, and a skilled workforce in countries such as India and China are further accelerating regional market expansion.

India’s Rapid Rise in the Commercial Drug Manufacturing Market

India is anticipated to grow at a rapid CAGR during the forecast period due to its strong position in generic drug production, cost-competitive manufacturing, and a large base of regulatory-approved facilities. Increasing global outsourcing to Indian CMOs and CDMOs, expanding biologics and biosimilars capacity, supportive government initiatives, and rising domestic healthcare demand are further driving accelerated market growth.

Europe is anticipated to grow at a lucrative rate during the forecast period due to strong regulatory standards, advanced pharmaceutical manufacturing capabilities, and increasing focus on quality-driven production. Rising investments in biologics, biosimilars, and specialty drugs, along with expanding CDMO activities and supporting government initiatives, are strengthening Europe’s position in the global commercial drug manufacturing market.

UK’s Accelerated Growth in Commercial Drug Manufacturing Market

The UK is anticipated to grow at arapid CAGR during the forecast period due to its strong life science ecosystems, advanced manufacturing infrastrcturem and increasing investment in biologics and specialty drug production. The growing presence of CDMOs, a supportive regulatory framework, and strong collaboration between industry and research institutions are further accelerating innovation, capacity expansion, and market growth.

| Companies | Headquarters | Offerings |

| F. Hoffmann-La Roche Ltd. | Basel, Switzerland | Oncology drugs, immunology therapies, diagnostics, personalized medicine, biologics, and companion diagnostics |

| Novartis AG | Basel, Switzerland | innovative branded medicines, generics (via Sandoz spin-off legacy), oncology, cardiovascular, neuroscience, and immunology therapies |

| GlaxoSmithKline plc | London, United Kingdom | Vaccines, respiratory medicines, HIV treatments, oncology drugs, and specialty pharmaceuticals |

| Pfizer, Inc. | New York City, United States | Vaccines, oncology, internal medicine, rare diseases, anti-infectives, and biologic therapies |

| Merck & Co., Inc. | New Jersey, United States | Oncology (immuno-oncology), vaccines, infectious disease treatments, cardiovascular and metabolic therapies |

| AstraZeneca | Cambridge, United Kingdom | Oncology, cardiovascular, renal and metabolic therapies, respiratory drugs, immunology, and biologics |

By Molecule Type

By Manufacturing Mode

By Formulation

By Technology

By Region

February 2026

February 2026

January 2026

January 2026