February 2026

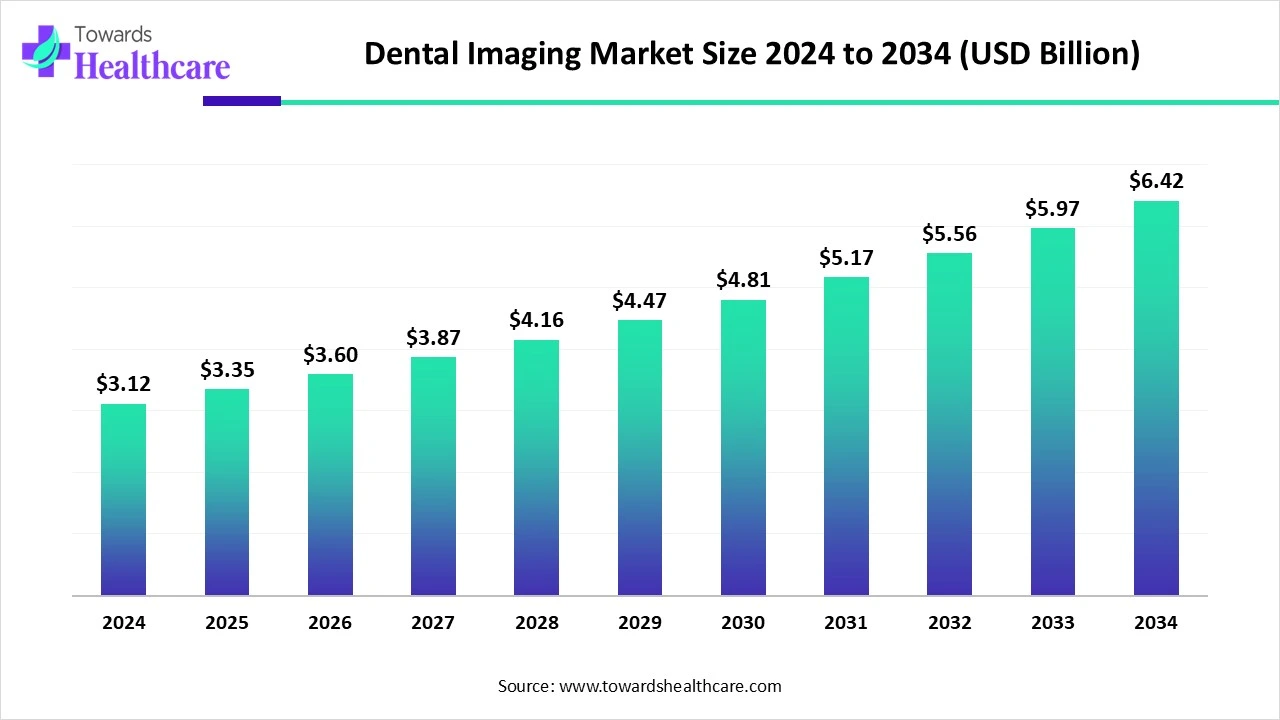

The global dental imaging market size marked US$ 3.12 billion in 2024 and is forecast to experience consistent growth, reaching US$ 3.35 billion in 2025 and US$ 6.42 billion by 2034 at a CAGR of 7.46%.

The dental imaging market is witnessing steady growth driven by the rising prevalence of dental disorders, increasing awareness of oral health, and demand for early and accurate diagnosis. Advancements such as 3D imaging, cone-beam computed tomography (CBCT), and digital radiography are enhancing precision and treatment planning. Additionally, the growing adoption of cosmetic dentistry and minimally invasive procedures is fueling demand. Supportive government initiatives, along with investments in modern dental infrastructure, further contribute to the expansion of the dental imaging market.

| Table | Scope |

| Market Size in 2025 | USD 3.35 Billion |

| Projected Market Size in 2034 | USD 6.42 Billion |

| CAGR (2025 - 2034) | 7.46% |

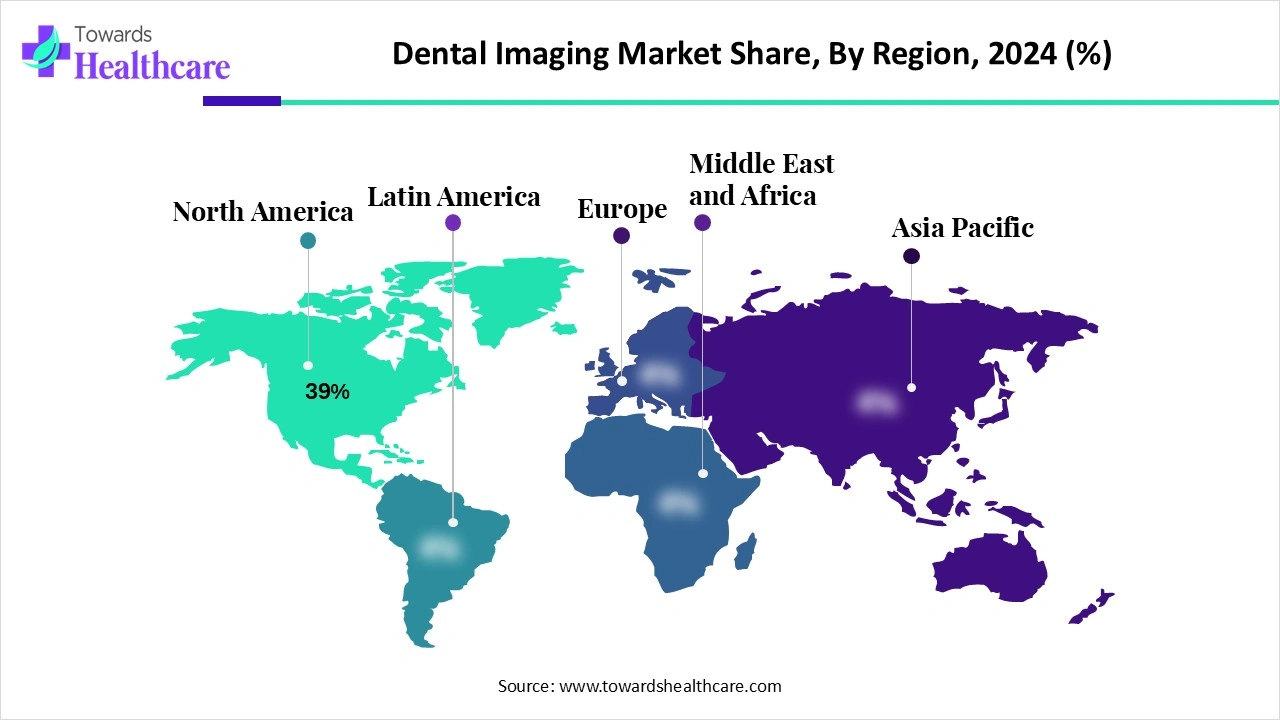

| Leading Region | North America Share 40% |

| Market Segmentation | By Modality, By Technology, By Software, By Clinical Application, By End User, By Region |

| Top Key Players | Dentsply Sirona, Envista Holdings – DEXIS / KaVo Imaging / i-CAT, Planmeca, Carestream Dental, Vatech, ACTEON Group, Align Technology, Medit, NewTom (Cefla Group), PreXion, Owandy Radiology, Air Techniques, FONA Dental, Genoray, Runyes Medical, Pearl AI, Overjet, VideaHealth |

The Dental Imaging Market covers devices, sensors, and software used to capture, reconstruct, view, and analyze images of teeth, jaws, and surrounding structures. It spans intraoral 2D, extraoral 2D (panoramic/cephalometric), 3D cone-beam CT (CBCT), intraoral scanners, and imaging/AI software. Demand is fueled by digital dentistry, implantology/orthodontics growth, DSOs consolidation, chairside workflows, and cloud/AI-enabled diagnostics.

The market is expanding as dental clinics and hospitals increasingly adopt advanced imaging tools to improve efficiency and patient care. Growing demand for painless and minimally invasive procedures is encouraging the use of digital and 3D imaging systems. Rising disposable incomes and higher spending on cosmetic and restorative dentistry are also contributing to the market growth. Furthermore, continuous R&D efforts and integration of AI in medical imaging technologies are creating new opportunities, driving strong adoption across the sector.

Technological Advancements: Innovations such as cone-beam computed tomography (CBCT), 3D imaging, and digital radiography offer greater precision, faster results, and better treatment planning, driving market growth.

Introduction of Advanced Imaging Systems: Frequent launches of modern systems such as 3D CBCT, intraoral scanners, and digital radiography devices are enhancing diagnostic accuracy, boosting adoption among dental clinics and hospitals.

AI is transforming the market by enabling faster and more precise image analysis, reducing diagnostic errors, and supporting early detection of oral diseases. It automates routine tasks like cavity detection, root analysis, and treatment planning, allowing dentists to focus more on patient care. AI-powered imaging also enhances workflow efficiency, integrates seamlessly with digital platforms, and aids in personalized treatment. Additionally, its ability to analyze large datasets improves clinical decision-making, boosting adoption across dental practices worldwide.

For Instance,

Technological Advancements in dental Imaging Equipment

Advances in dental imaging technology are fueling market growth by providing dentists with more precise and detailed visualizations of oral structure. Modern tools like digital scanners, 3D CBCT systems, and AI-powered imaging enable faster, more accurate diagnoses and treatment planning. Enhanced image clarity, reduced radiation exposure, and seamless integration with digital workflows make these innovations highly appealing to dental professionals. As clinics strive for efficiency and improved patient care, adoption of these cutting-edge imaging solutions continues to expand rapidly.

For Instance,

Radiation Safety Concerns

Concerns over radiation exposure are restricting the dental imaging market because patients and practitioners remain cautious about potential health risks. Even with advancements in low-dose and digital imaging systems, fears about repeated exposure, especially for children and sensitive groups, can reduce the frequency of scans. This hesitancy limits the routine use of imaging technologies in dental practices. Consequently, despite innovations that improve diagnostic accuracy and efficiency, these safety worries continue to slow wider adoption of dental imaging solutions.

3D and CBCT imaging Expansion

The growth of 3D and CBCT imaging in dental care offers future opportunities by providing detailed, multi-dimensional images that enhance clinical decision-making. These technologies allow dentists to plan treatment more accurately, reduce errors, and perform complex procedures efficiently. Increasing patient demand for precise, minimally invasive treatments and the rising adoption of advanced dental technologies in clinics worldwide are expected to drive the widespread use of 3D and CBCT systems, fueling market expansion.

The intraoral imaging segment led the market in revenue due to its critical role in everyday dental care. Tools like sensors, PSP scanners, and intraoral x-ray units allow dentists to capture detailed images of teeth and surrounding tissues quickly and accurately. Their convenience, reliability, and effectiveness in detecting cavities, root issues, and other dental conditions make them highly preferred in clinics, resulting in widespread adoption and the largest share of the market.

The cone-beam CT (CBCT) segment is projected to grow rapidly in the dental imaging market as it offers comprehensive 3D imaging that enhances diagnostic accuracy and treatment precision. Its use in complex dental procedures, including implant planning, endodontics, and orthodontics, makes it increasingly valuable for dental professionals. Growing awareness among dentists about the benefits of advanced imaging, coupled with technological improvements that reduce scan time and radiation exposure, is accelerating adoption. This combination of efficiency, safety, and detailed visualization drives the market growth.

In 2024, the digital (CMOS/PSP) segment led the market due to its superior efficiency and image quality. These technologies allow quick capture and processing of high-resolution dental images, simplifying diagnosis and treatment planning. Easy integration with digital workflows and electronic patient records further enhances their appeal to dental practitioners. Their ability to reduce time, improve accuracy, and streamline clinical operations has driven widespread adoption, securing the highest revenue shares for the digital imaging segment.

In 2024, the imaging acquisition & 3D planning software segment dominated the market due to its ability to streamline dental workflows and enhance clinical decision-making. The software allows dentists to generate detailed 3D models, plan complex procedures, and predict treatment outcomes accurately. Its compatibility with digital imaging devices and ability to improve precision, efficiency, and patient-specific care have driven widespread adoption, making the segment the leading contributor to market revenue.

The AI/automation segment in dental imaging is expected to grow at the fastest CAGR due to its ability to enhance diagnostic accuracy and treatment planning. AI-powered tools can automatically detect caries, bone loss, and other pathologies, reducing human error and saving time. Automation also improves workflow efficiency and enables personalized treatment recommendations. As dental practices increasingly adopt advanced technologies to improve patient outcomes and optimize clinical operations, demand for AI-driven imaging software is projected to rise rapidly during the forecast period.

The implantology & oral surgery segment dominated the market due to the critical need for precise planning and execution of complex procedures. Advanced imaging systems, such as CBCT and 3D scanners, enable accurate assessment of bone structure, nerve positioning, and implant placement, reducing surgical risks. Rising demand for dental implants, increased prevalence of oral diseases, and growing adoption of minimally invasive surgical techniques have further driven segments' high revenue shares, making it a dominant application area in the market.

The orthodontics segment is projected to expand rapidly as more patients seek straightening and cosmetic dental solutions. Modern imaging tools, such as 3D scanners and CBCT providers, provide detailed visualization of teeth and jaw structure, enabling precise treatment planning and customized aligners. Growing focus on non-invasive orthodontic solutions and rising investment in advanced dental technologies are driving faster adoption of imaging systems in this clinical application, leading to the highest expected CAGR.

In 2024, the independent dental clinics segment accounted for the largest market share due to their widespread presence and consistent investment in modern imaging technologies. These clinics rely on devices like digital X-rays, intraoral scanners, and CBCT systems to provide accurate diagnoses and efficient treatment planning. Their emphasis on high-quality, patient-centered care, coupled with the growing demand for routine checkups and cosmetic procedures, has fueled the adoption of advanced imaging solutions, securing the highest revenue contribution among users in the market.

The Dental service organizations (DSOs)/group practices segment is projected to grow fastest as large dental networks expand and prioritize consistent, high-quality care across multiple clinics. These organizations invest in advanced imaging tools such as 3D scanners, CBCT, and digital radiography to streamline operations, improve diagnostics, and support efficient treatment planning. Rising patient demand for comprehensive dental services, combined with the scalability and efficiency benefits of centralized imaging systems, is driving accelerated adoption in DSOs and group practices during the forecast period.

North America led the market share 39% in 2024, due to widespread use of advanced imaging technologies and a mature healthcare system. High patient awareness of oral health, growing demand for cosmetic and preventive dental procedures, and significant investments in digital and 3D imaging solutions fueled adoption. The presence of major dental equipment manufacturers, continuous technological innovations, and easy access to skilled professionals further strengthened the region’s position, enabling it to achieve the largest revenue share globally.

The U.S. market is expanding due to increasing demand for accurate diagnostics, preventive care, and cosmetic dental procedures. Widespread adoption of advanced technologies such as 3D CBCT, digital radiography, and intraoral scanners is enhancing diagnostic precision and treatment planning. Rising awareness of oral health, a growing geriatric population, and higher patient spending on dental care further support market growth. Additionally, continuous innovations, favorable reimbursement policies, and the strong presence of key dental imaging manufacturers are driving expansion in the U.S. market.

The market in Canada is growing due to increasing patient awareness of oral health and rising demand for preventive and cosmetic dental care. Adoption of advanced imaging technologies, including digital radiography, CBCT, and 3D scanners, is improving diagnostic accuracy and treatment outcomes. Government support, favorable healthcare infrastructure, and investments in modern dental clinics further boost market expansion. Additionally, the growing prevalence of dental disorders and the emphasis on minimally invasive procedures are driving the adoption of dental imaging solutions across Canada.

The Asia-Pacific market is projected to register the fastest CAGR as more countries invest in modern dental infrastructure and technology. Rising awareness of oral health, expanding middle-class populations, and increased spending on cosmetic and preventive dentistry are driving demand. Adoption of advanced imaging systems like 3D scanners, CBCT, and digital radiography is growing rapidly, supported by government initiatives and collaborations between local clinics and global dental equipment manufacturers. These factors are fueling swift market growth in the region.

Dental imaging R&D involves several key steps, including developing new imaging technologies, enhancing existing ones, and applying them to improve diagnosis, treatment planning, and patient care.

Key Players: Midmark Corporation, Technologies Corporation, Dental Imaging

Dental imaging, including various X-ray methods, relies on proper packaging and serialization to maintain storage, identification, and traceability. X-ray films such as bitewing, periapical, and occlusal are carefully packaged to protect them from light and damage. Unique identifiers on film packets or digital images ensure accurate tracking and record-keeping, which is essential for patient safety, quality control, and efficient management of dental imaging data.

Key Players: Dentsply, Sirona, Planmeca, Acteon Trident

Dental imaging plays a vital role in dentistry by helping practitioners diagnose conditions and plan treatments with precision using tools such as digital X-rays, CBCT 3D imaging, and intraoral cameras. These technologies enhance diagnostic accuracy, support effective treatment planning, and improve patient communication, ultimately leading to better clinical outcomes and higher-quality patient care.

Key Players: Sirona, Carestream Dental, VATECH

In November 2024, at RSNA, Detection Technology, a leading provider of X-ray detector solutions, introduced an upgraded portfolio of 20 flat panel X-ray detectors aimed at improving medical imaging. The detectors offer high frame rates, excellent image quality at low radiation doses, and a wide dynamic range, supporting applications such as image-guided surgery, wireless radiography, fluoroscopy, oncology, and dental imaging. Tuomas Holma, Director of Product Management, stated that their surgical imaging solutions provide versatile options using both amorphous silicon (a-Si) and IGZO (indium gallium zinc oxide) detector technologies.

By Modality

By Technology

By Software

By Clinical Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026