February 2026

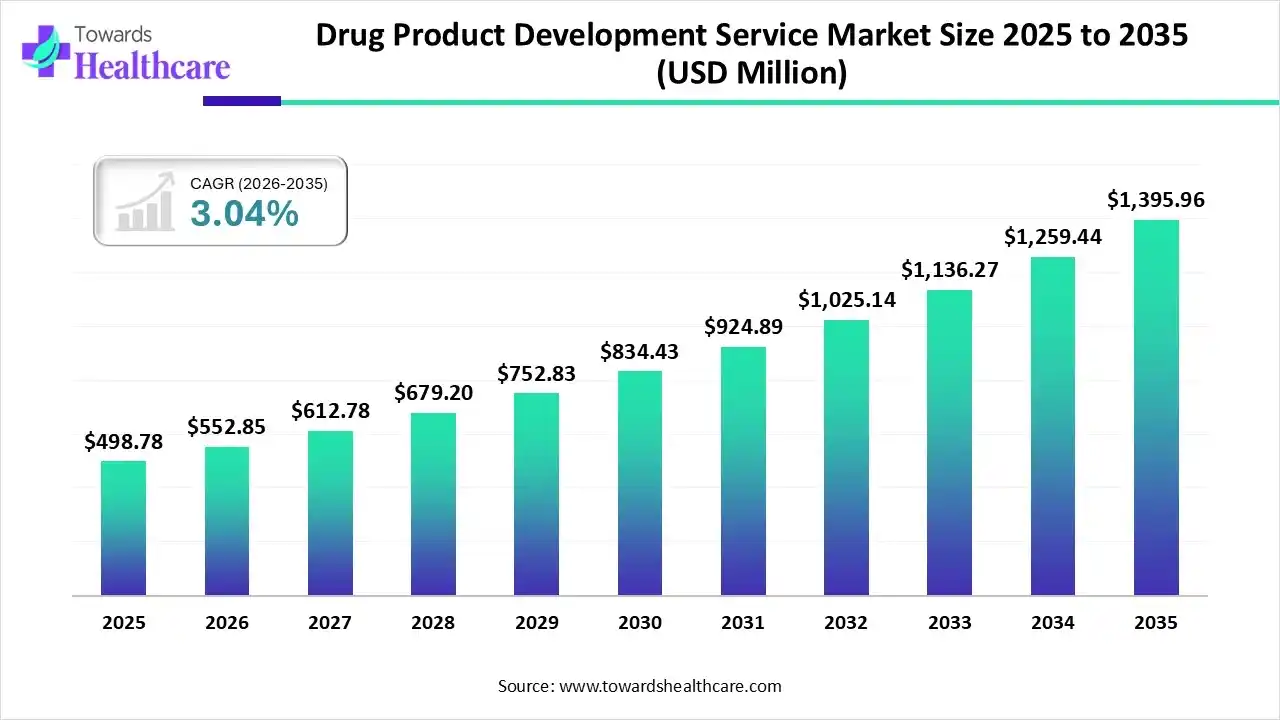

The global drug product development service market size was estimated at USD 340.04 million in 2025 and is predicted to increase from USD 350.38 million in 2026 to approximately USD 458.76 million by 2035, expanding at a CAGR of 3.04% from 2026 to 2035.

The global market is propelled by the accelerating demand for diverse biologics, like C&G therapies, vaccines, and other tailored therapies, mainly in cancer and autoimmune diseases. Furthermore, they are highly adopting AI integration in the manufacturing of these products to raise scalability and efficiency.

The drug product development service market in 2026 is a specialized segment of the pharmaceutical outsourcing industry focused on bridging the gap between drug discovery and commercial manufacturing. This market encompasses formulation development, analytical testing, stability studies, and clinical trial material (CTM) production. The globe has been putting efforts into the transformation of mRNA technology for tailored cancer vaccines & therapies for rare diseases and autoimmune disorders.

The leading firms are widely promoting “non-psychedelic" psychedelics, like the Mindstate Design Labs, which employed AI in the analysis of over 70,000 human-reported experiences to develop MSD-001, which boosts neuroplasticity without inducing hallucinations. Moreover, in the same era, MIT researchers adopted generative models to discover new antibiotic structures with greater activity against drug-resistant bacteria (MRSA).

Day by day, computer-based simulations are greatly replacing or supplementing traditional animal &, eventually, human trials to project efficacy and toxicity, speeding up the complete timeline.

The era is focused on pre-validated, platform-based autoinjectors to reduce expenditures, regulatory limitations, and time-to-market.

Researchers are actively emphasizing nanomedicines and nanorobots to target specific cells, especially for cancer therapy, to increase effectiveness & lower systemic toxicity.

| Key Elements | Scope |

| Market Size in 2026 | USD 350.38 Million |

| Projected Market Size in 2035 | USD 458.76 Million |

| CAGR (2026 - 2035) | 3.04% |

| Leading Region | North America |

| Market Segmentation | By Service Type, By Molecule Type, By End-User, By Region |

| Top Key Players | Thermo Fisher Scientific (Patheon), Catalent, Inc., Lonza Group AG, Recipharm AB, Piramal Pharma Solutions, Evotec SE, Siegfried Holding AG, WuXi AppTec, Eurofins Scientific |

Why did the Formulation Development Segment Lead the Market in 2025?

In 2025, the formulation development segment dominated with approximately 35% share of the drug product development service market. A significant catalyst is the rising need for precision, patient-focused medication specifically in oncology & rare diseases, which requires small-batch, specialized formulations. Currently, the market has been widely leveraging advanced microfluidic mixing platforms, which enable the reproducible, large-volume production of nanoparticle formulations, with consistent particle size and encapsulation effectiveness.

CTM Manufacturing

The CTM manufacturing segment will expand rapidly. It is mainly fueled by the surging development of biologics, cell & gene therapies, and antibody-drug conjugates (ADCs), which demand highly specialized manufacturing expertise & infrastructure. Many players are moving towards continuous manufacturing, single-use bioprocessing, & automated technologies to allow better, rapid, and robust production. Whereas Scimplify, a digital platform (ATOMS), facilitates real-time visibility into the CTM development, manufacturing, & quality control process.

Which Molecule Type Dominated the Drug Product Development Service Market in 2025?

The small molecules segment captured nearly 55% share of the market in 2025. The worldwide increasing instances of cancer, metabolic diseases and lifestyle-related issues are propelling demand for novel, efficient, and cost-effective small molecule therapies. However, robust leaders are highly leveraging generative AI, like Insilico Medicine’s Chemistry42, Terray Therapeutics’ EMMI, to evolve molecules, estimate ADMET properties, and majorly drug-target interactions.

Biologics

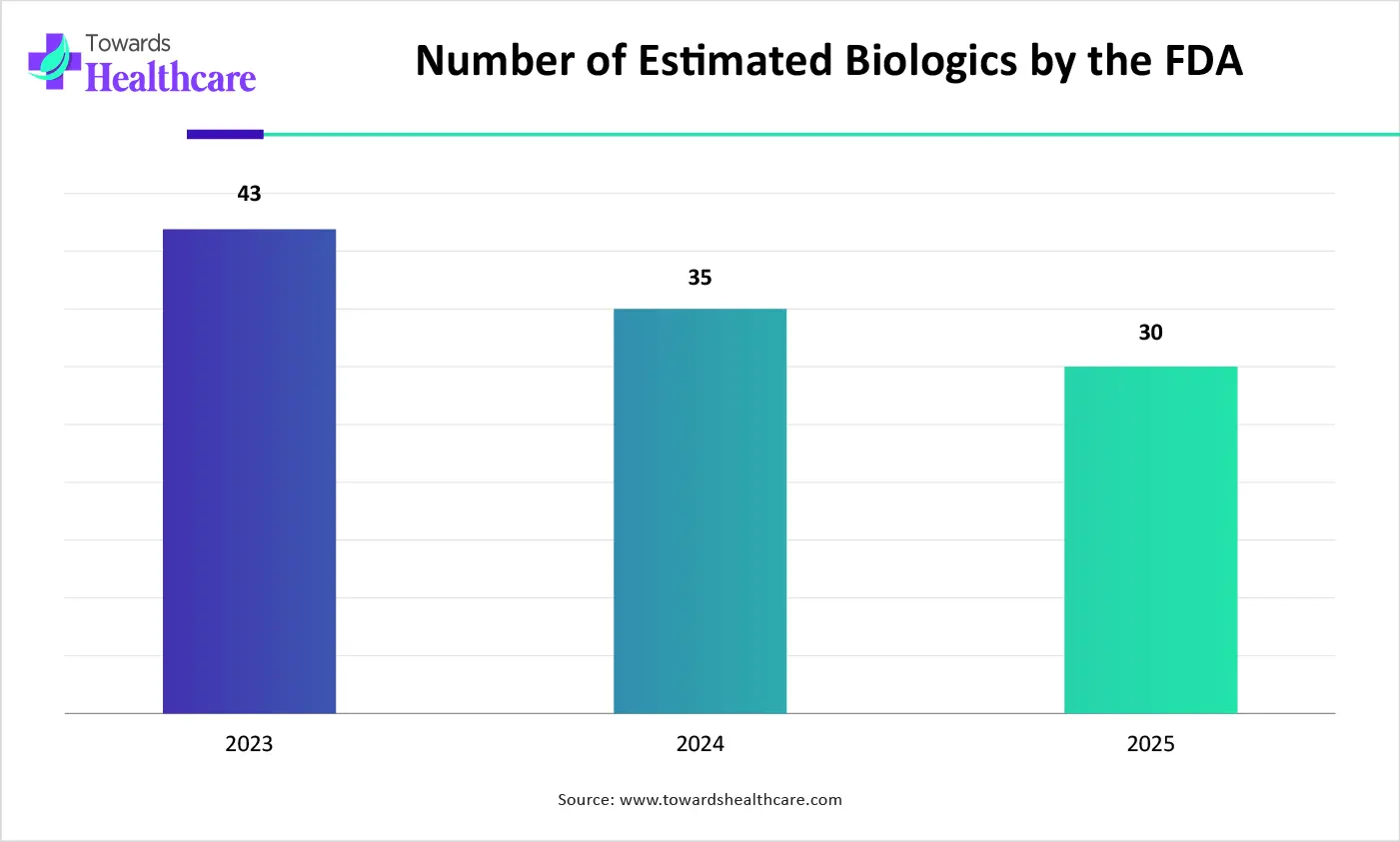

In the future, the biologics segment will expand at 12.1% CAGR. These molecules provide increased selectivity & minimal toxicity compared to small molecule drugs, which drives their adoption in treatment. The market is revolutionizing services from cell line development, media improvement, and process development to GMP fill-finish, which lowers time-to-clinic by up to 30%.

How did the Pharmaceutical Companies Segment Dominate the Market in 2025?

In 2025, the pharmaceutical companies segment held approximately 47% share of the market. Exceptional R&D investment, the need for quicker time-to-market, and escalated outsourcing to Contract Research Organizations (CROs) are driving the expansion of these firms. Also, they are stepping toward the reduction of carbon/water footprints in production, leveraging biodegradable packaging, and executing green chemistry in drug synthesis.

Biotechnology Companies

The biotechnology companies segment is predicted to expand at a rapid CAGR. Many outsourcing partners are facilitating modern capabilities in cell culture, protein chemistry, and formulation development. With a major involvement, firms are exploring specialized services to bolster cell & gene therapies, such as vector manufacturing & allogeneic, i.e. "off-the-shelf" cell therapy development. Recently, Lonza introduced the AAW Automated Assay Workstation to automate lab routines, with minimal manual error in biologics, mRNA, & analytics.

In 2025, North America registered dominance with nearly a 41%–44% share of the drug product development service market. This is driven by a high concentration of well-funded biotech startups & the strongest adoption of AI-first drug design. Numerous players are accelerating the expansion of the U.S. capacity, such as Gilead Sciences, which initiated construction on a 180,000-square-foot development and manufacturing hub in California.

U.S. Market Trends

Moreover, the U.S market led due to certain companies implementing advanced IA integrations, broadening their production capabilities with an immersive R&D investment, and also the FDA has been pushing approvals process.

Asia Pacific is anticipated to expand fastest, as many pharma companies are highly outsourcing to APAC for services, specifically, clinical development, regulatory affairs, & production. Alongside, the region is focusing on greater adoption of AI-assisted drug discovery, nanotechnology, 3D printing, and new drug delivery solutions. For example, WuXi AppTec's innovative Shanghai development center, & Phillips Medisize’s acquisition of Vectura for boosted inhalation delivery.

India Market Trends

Whereas India is massively supporting CDMO and manufacturing progression, including recently, Granules India began the acquisition of Swiss CDMO Senn Chemicals to raise peptide development capabilities. As well as, Strides Pharma developed OneSource, India's first specialty pharma CDMO, promoting complex injectables and ocular products.

Europe is predicted to witness notable growth, as the region is spurring different digital tools, like Manufacturing Execution Systems (MES) & Process Analytical Technology (PAT), to enhance yields and bolster traceability. Somehow, it is also innovating inhalation drug delivery, including smart inhalers and eco-friendly propellants, to boost adherence & lower environmental impact.

UK Market Trends

Recently, the UK approved around 20 advanced therapy medicinal products (ATMPs), with Autolus Therapeutics' obe-cel authorized for leukemia, which demonstrated robust, domestically developed, & manufactured cellular therapies.

| Company | Description |

| Thermo Fisher Scientific (Patheon) | Its offerings comprise formulation development, analytical testing, sterile injectables, oral solid doses, softgels, & clinical trial logistics. |

| Catalent, Inc. | This mainly covers small molecules, biologics (sterile injectables), & cell/gene therapies. |

| Lonza Group AG | Its services include specialized, sterile parenteral dosage forms, formulation improvement, analytical development, stability studies, & container closure integrity testing. |

| Recipharm AB | This offers diverse services from pre-formulation and API development to clinical trials, scale-up, and commercial manufacturing. |

| Piramal Pharma Solutions | A firm specializes in the production of oral solids, liquids, creams, ointments, and sterile injectables. |

| Evotec SE | It unveiled "Data-driven R&D Autobahn to Cures" to raise drug stability, bioavailability, and manufacturing effectiveness |

| Siegfried Holding AG | This facilitates complete CDMO services for oral solid dosage forms, steriles, & ophthalmics. |

| WuXi AppTec | It extensively offers preclinical to commercial services for small molecules, biologics, & oligonucleotide therapeutics. |

| Labcorp (Fortrea) | Their offering encompasses end-to-end consulting, regulatory affairs, and patient-focused solutions. |

| Eurofins Scientific | They cover CDMO services for drug product development, including formulation, analytical development, & clinical trial manufacturing. |

By Service Type

By Molecule Type

By End-User

By Region

February 2026

February 2026

February 2026

January 2026