December 2025

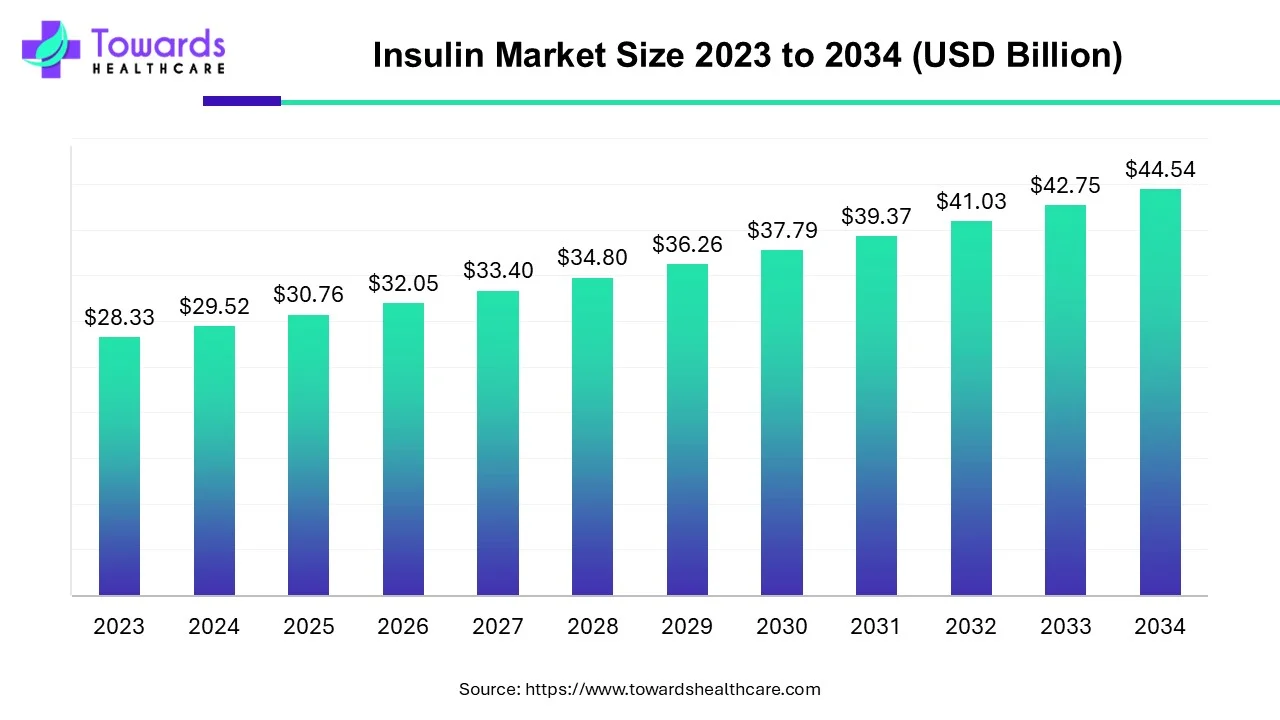

The insulin market size is anticipated to grow from USD 32.05 billion in 2026 to USD 46.42 billion by 2035, with a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2025 to 2034.

The insulin market deals with the development, production, distribution, and innovation of insulin for chronic conditions of diabetes. One kind of hormone is insulin. The body uses insulin to facilitate the entry of blood glucose into cells, giving them the energy they need to operate. One of the main factors contributing to the development of diabetes is ineffective insulin. An estimated 530 million persons worldwide are projected to have diabetes, with a global incidence of 10.5% among adults between the ages of 20 and 79. Approximately 98% of diabetes diagnoses worldwide are for type 2 diabetes. However, this percentage varies greatly between nations.

According to data from the Diabetes Surveillance System, around 11.3 percent of adults (37.3 million) had diabetes in 2022; of them, 28.7 million had been diagnosed, 8.5 million were anticipated to remain undiagnosed, and 95% had type 2 diabetes. Insulin is the most effective therapy for diabetes, a difficult condition. In both outpatient and inpatient settings, the care of diabetes requires an interprofessional team approach at all times. The usage of insulin is rising due to the rising incidence of diabetes, which fuels the expansion of the insulin market.

| Key Elements | Scope |

| Market Size in 2026 | USD 32.05 Billion |

| Projected Market Size in 2035 | USD 46.42 Billion |

| CAGR (2026 - 2035) | 4.2% |

| Leading Region | North America |

| Market Segmentation | By Product, By Source, By Distribution Channel, By Application, By Delivery Device, By Distribution Channel, By Application, By Region |

| Top Key Players | Eli Lilly, Novo Nordisk, Sanofi, Boehringer Ingelheim, Biocon, Lupin Ltd., Wockhardt Ltd., Becton, Dickinson and Company, B. Braun SE |

Product Insights

By product, the premixed long-acting segment held the largest insulin market share in 2023. Premixed insulin comes in a variety of formulations, such as Humulin, Novolog, and others. Some people find it simpler to administer these kinds, which mix short-acting and intermediate-acting insulins in one bottle or an insulin pen. Pre-mixed insulin has the advantage of combining both long-acting and fast-acting insulin. Only one injection is required, and there is no need to mix the insulin. Patients who require sliding scale therapy and a basic insulin treatment plan are typically supplied pre-mixed insulins.

By product, the rapid-acting segment is anticipated to grow at the fastest rate during the forecast period. Extremely fast-acting insulin includes the kind known as rapid-acting insulin. In order to prevent your blood glucose from rising too high after eating carbs, you take it before meals. This means that it starts working extremely soon. Some other names for rapid-acting insulin include lunchtime insulin or bolus insulin. There are now more alternatives for bolus insulin thanks to novel ultra-rapid-acting insulins, and patients with diabetes may adjust their dosage more easily due to their fast mode of action. Diabetes type 1 patients frequently receive prescriptions for rapid-acting insulin. That being said, there could be instances in which they are also recommended for type 2 diabetes. Two types of insulin that work quickly include Humlog and Novorapid.

For instance,

Source Insights

By source, the insulin analog segment dominated the insulin market in 2023. Based on their PK characteristics, insulin analogs are categorized as quick, short-, intermediate-, and long-acting drugs. Insulin analogs that act quickly and short-acting have been utilized as bolus doses, whereas items that work slowly and long-acting have been used as basal doses. Analog insulin is produced in a lab utilizing recombinant DNA technology to develop insulin proteins within E. coli, just like human insulin. Insulin analogs offer more dosage flexibility than previous insulin formulations, which may enhance patient satisfaction and adherence to treatment. They are also linked to a decreased risk of hypoglycemia and improved glycemic control throughout postprandial and fasting periods. Furthermore, compared to NPH insulin, long-acting insulin analogs—specifically, insulin detemir—are linked to a lower risk of weight gain. When combined, these traits might result in benefits related to healthcare costs.

Distribution Channel Insights

By distribution channel, the retail pharmacies segment dominated the insulin market in 2023. The growing demand for drugs and services to address chronic illnesses, including diabetes, cardiovascular disease, and respiratory diseases, is a major factor driving the worldwide retail pharmacy industry. Retail pharmacies have a tremendous chance to become more comprehensive care providers and improve patient outcomes as a result of this increasing demand. Pharmacies and patent medicine shops provide helpful advice on food choices, exercise regimens, and other crucial lifestyle adjustments that are necessary for the management of diabetes.

By distribution channel, the hospital pharmacies segment is expected to grow at the fastest rate during the forecast period. Hospital pharmacists are great candidates to take part in multidisciplinary efforts for in-patient care because they have extensive expertise in assessing medication therapy, providing therapeutic suggestions, and carrying out treatment plans. Their initiatives to support strict glycemic control in the hospital might involve implementing guidelines, advocating for the safe and proper use of medication across the hospital, evaluating drug use and costs, screening patients, risk assessment, and bedside instruction, among other things.

Application Insights

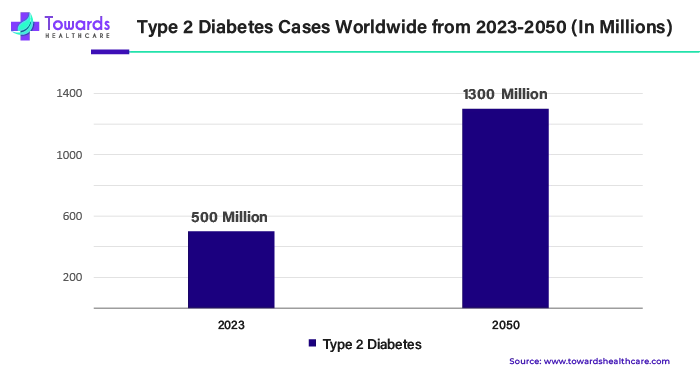

By application, the type 2 diabetes segment dominated the insulin market in 2023. When healthy lifestyle changes and other diabetes therapies are not enough to regulate blood sugar, people with type 2 diabetes may need insulin therapy as part of their treatment. It is well acknowledged that type 2 diabetes poses a major threat to public health and has a significant influence on both life expectancy and medical costs. The world's diabetes burden is on the rise due to urbanization and rapid economic growth.

For instance,

By application, the gestational diabetes segment is expected to grow significantly during the forecast period. An increasingly significant public health issue is gestational diabetes mellitus or GDM. Depending on screening methods, diagnostic standards, and the ethnic makeup of the background population, the frequency of GDM varies greatly around the world, ranging from 10.1% in Eastern and South-eastern Asia to 13.61% in Africa. The frequency of GDM is between 3 and 35% in India, the most populated country in the world.

Delivery Insights

By delivery device, the insulin pens segment held the largest insulin market share in 2023. Insulin pens provide several benefits over conventional vial and syringe injections, including convenience of use, increased accuracy, and improved quality of life for diabetics, albeit pen usage varies by nation. Insulin pens provide simple push-button injections by combining the syringe and vial into a single instrument. When compared to individuals who use the vial and syringe approach, insulin pen users have also been shown to have higher injection frequency and a lower frequency of hypoglycemic incidents. In contrast to vials and syringes, insulin pens are "preferred in most cases," according to the American Diabetes Association's 2023 Standards of Care.

By delivery device, the insulin pumps segment is anticipated to grow at the fastest rate during the forecast period. A multitude of features included in insulin pumps enable individuals to better manage their diabetes and enhance the lives of those who have battled it. Insulin pump therapy, also known as continuous subcutaneous insulin infusion, is one of the most significant developments in diabetes technology in the last 50 years. With fewer injections, insulin pump treatment enables more accurate and customizable insulin dosage. A large number of people with type 1 diabetes report utilizing insulin pumps in order to achieve better glycemic control and a more flexible lifestyle than what MDI treatment can provide.

For instance,

Distribution Channel Insights

By distribution channel, the retail pharmacies segment dominated the insulin market in 2023. Retail pharmacies play a significant role in the delivery of dietary supplements, blood glucose meters, testing strips, needles, and prescription and over-the-counter drugs. These help people with diabetes manage their condition effectively on their own. Retail pharmacists are positioned as significant players in the management of diabetes because of their accessibility. They are essential to the treatment of individuals with Type 2 Diabetes (T2D) and can offer advice on dose and administration.

By distribution channel, the hospital pharmacies segment is expected to grow at the fastest rate during the forecast period. Managing the use of pharmaceuticals in hospitals and other medical facilities is the main goal of hospital pharmacy. In order to maximize patient outcomes, objectives include medicine selection, prescription writing, procurement, delivery, administration, and review. Before using any medicine, it is crucial to make sure that the correct patient, dosage, administration method, time, medication, information, and paperwork are all followed.

Application Insights

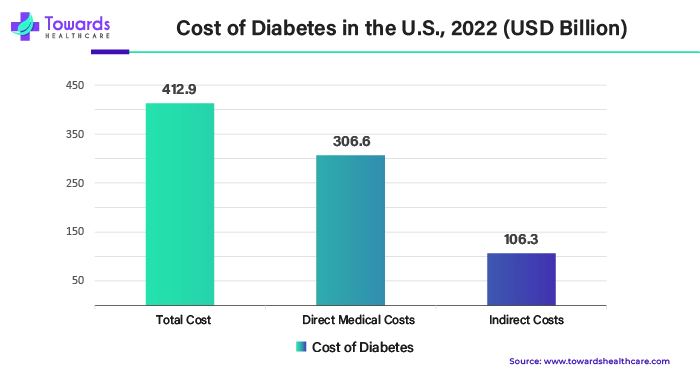

By application, the type 2 diabetes segment dominated the insulin market in 2023. Globally, the prevalence of diabetes mellitus (DM) and obesity has been steadily rising. 10.5% of people worldwide between the ages of 20 and 79 are thought to be living with diabetes at the moment. Diabetes is the most expensive chronic ailment in the United States, with an annual total cost of $413 billion.

By application, the gestational diabetes segment is expected to grow significantly during the forecast period. The exact cause of gestational diabetes in some women and not in others is still unknown to researchers. Being overweight before conception frequently contributes. Normally, a number of hormones regulate blood sugar levels. However, hormonal changes that occur during pregnancy make it more difficult for the body to properly process blood sugar. Blood sugar levels rise as a result. In the U.S., gestational diabetes affects between 2 and 10% of pregnancies. Over the course of 10 to 20 years following pregnancy, women with gestational diabetes mellitus (GDM) have an elevated risk of 35 to 60% of acquiring diabetes mellitus.

North America dominated the global insulin market in 2025. The rising prevalence of diabetes and growing awareness of its treatment drive the market. The availability of state-of-the-art research and development facilities leads to the development of advanced drug delivery systems for the targeted and painless delivery of insulin. The rising adoption of advanced technologies drives the latest innovations in insulin delivery devices.

It is estimated that around 8.7 million Americans rely on insulin for their survival. The U.S. government’s Insulin Value Program caps out-of-pocket insulin costs at $35 or less per month. Favorable reimbursement policies, from private and government insurers, also govern market growth in the U.S.

Around 3.7 million people, or 9.4% of the total Canadian population, are diagnosed with diabetes. Health Canada regulates the approval and distribution of insulin in Canada. The average cost of insulin in Canada ranges from $900 to $1,700 per year per person.

Asia-Pacific is expected to witness the fastest growth rate in the insulin market during the predicted timeframe. The rising geriatric population and the increasing prevalence of chronic disorders other than diabetes are the major risk factors of diabetes in Asia-Pacific countries. Several government organizations launch initiatives to combat diabetes and create awareness of early diagnosis and treatment of diabetes. The increasing investments, collaborations, mergers & acquisitions promote the development of insulin devices.

In November 2024, Sanofi announced an investment of 1 billion euros ($1.05 billion) to establish a new insulin production base in Beijing. The investment marks a significant stride in the Chinese market, owing to China’s policies of opening up and encouraging innovation and a sound business environment for foreign enterprises.

The prevalence of diabetes in India is 10.1 crore, as per the 2023 report by the Indian Council of Medical Research (ICMR). The annual spending of India on diabetes treatment is Rs 1.5 lakh crore. The Pradhan Mantri Jan Arogya Yojana (PMJAY), or Ayushman Bharat, provides free coverage for the treatment of diabetes to over 500 million people.

Segmentation A (Drug)

Segmentation B (Delivery Device)

By Region

December 2025

November 2025

January 2026

October 2025