January 2026

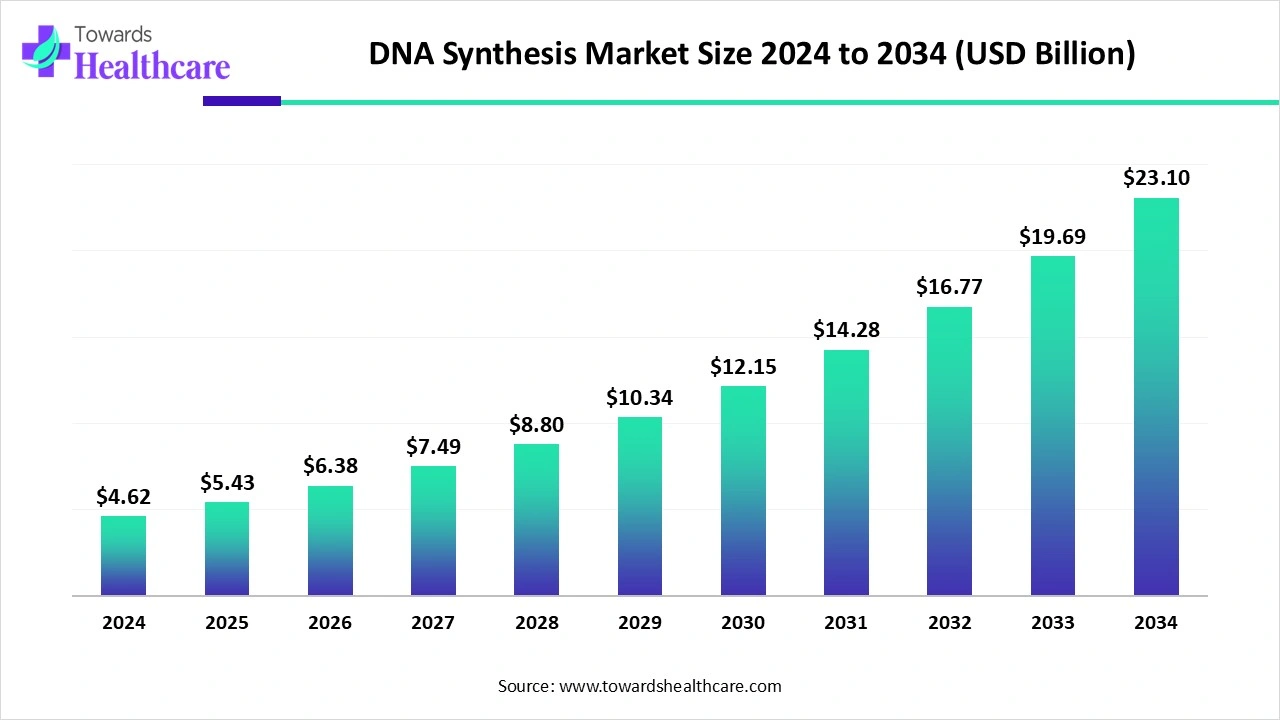

The global DNA synthesis market size is calculated at US$ 4.62 billion in 2024, grew to US$ 5.43 billion in 2025, and is projected to reach around US$ 23.1 billion by 2034. The market is expanding at a CAGR of 17.42% between 2025 and 2034.

Synthetic DNA is essential for gene cloning, precise genetic changes, and the development of cutting-edge genome editing technologies like CRISPR-Cas9, which need specialised gene synthesis to create therapeutic genes, regulatory elements, and gene editing tools. great-quality, dependable synthesis services are in great demand as a result of the substantial growth in demand for custom-designed DNA sequences brought about by the expansion of research in these areas. The use of synthetic DNA is anticipated to increase in both academic and commercial research contexts as genetic material manipulation methods become more widely available and advanced.

| Table | Scope |

| Market Size in 2025 | USD 5.43 Billion |

| Projected Market Size in 2034 | USD 23.1 Billion |

| CAGR (2025 - 2034) | 17.42% |

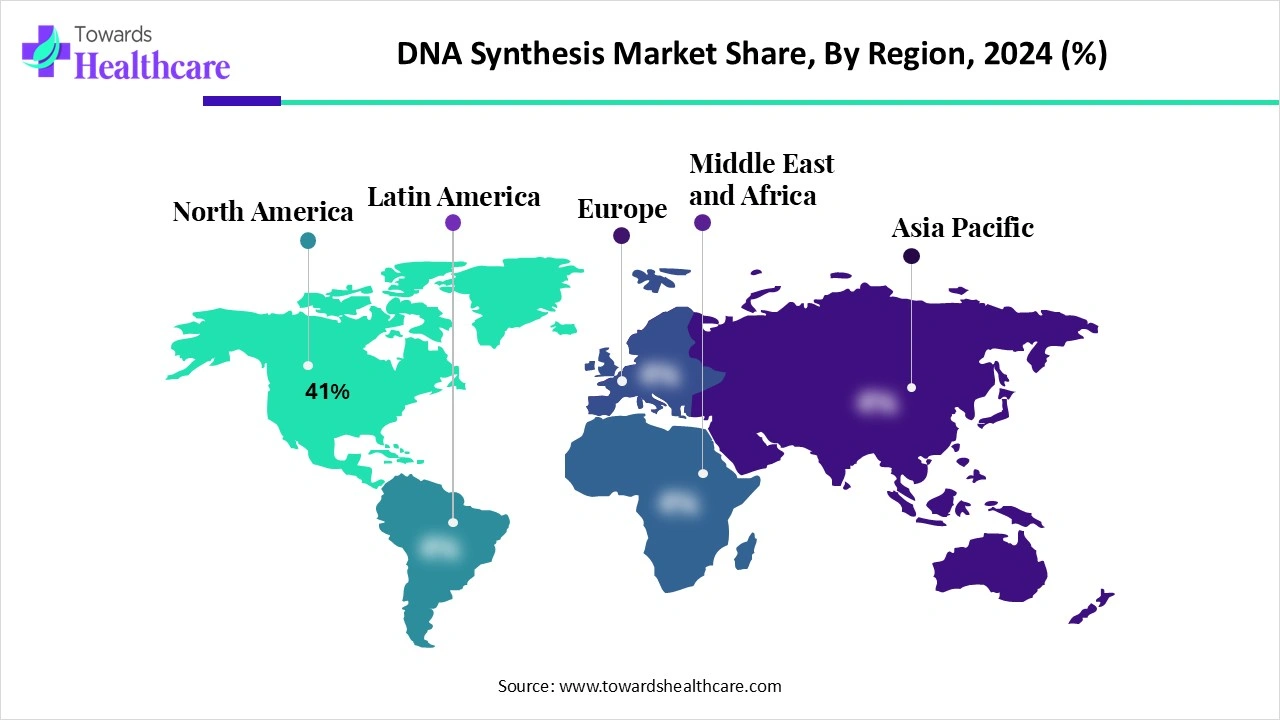

| Leading Region | North America 41% |

| Market Segmentation | By Product Type, By Technology, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Integrated DNA Technologies (IDT, Danaher), Twist Bioscience, GenScript Biotech, Agilent Technologies, Eurofins Genomics, Merck KGaA (Sigma-Aldrich), Illumina, Inc., DNA Script (enzymatic DNA synthesis), Brooks Automation, OriCiro Genomics, ATUM, Codex DNA, Blue Heron Biotechnology, BioCat GmbH, Genewiz Japan (Azenta Life Sciences), Evonetix Ltd., Synbio Technologies, Scarab Genomics, Creative Biogene |

The DNA synthesis market encompasses technologies, products, and services used to artificially design and construct DNA sequences for research, diagnostics, and therapeutic applications. DNA synthesis enables customized oligonucleotides, synthetic genes, and DNA fragments that support genomics, synthetic biology, drug discovery, personalized medicine, and cell & gene therapies. With advancements in enzymatic DNA synthesis, automation, and AI-driven design, the market is experiencing strong demand across academic research, biotechnology, pharmaceuticals, and industrial applications. Key growth drivers include rising investment in synthetic biology, CRISPR-based genome editing, and the growing adoption of DNA-based vaccines and therapies.

Rising collaboration among key players: DNA synthesis is a highly essential part of both the pharma and biotechnology industries; hence, key market players are collaborating in order to provide advanced technologies and procedures to improve DNA synthesis processes.

For instance,

Gene editing technologies may be transformed by artificial intelligence (AI), which would increase accuracy, efficiency, and speed up research. Additionally, AI systems are very good at deciphering the large, intricate datasets produced by genome sequencing. By creating tweaks, researchers may create variety, which AI can then utilise to improve its models and forecast how genetic alterations would impact biological processes, eliminating the need for laborious human study. AI may be used as a "virtual experimenter" by researchers as well. Compared to the lengthy process of waiting for physical tests to finish, this is more efficient.

Rising Demand for Gene Therapies

Because gene therapy may treat uncommon illnesses and genetic problems, technological breakthroughs, and major investment in research and development, its demand is expected to expand dramatically by 2030 and beyond. Developing a cell and gene therapy requires a large quantity of unique DNA, and development pipelines usually go through several construction steps.

Ethical Concerns in DNA Synthesis

Although genetic methods have a lot of promise, they also bring up moral questions about safety, equality, and privacy. The potential to change the genetic code prompts concerns about how genetic alterations may affect people, communities, and ecosystems. Careful thought should also be given to matters like genetic discrimination, consent for genetic testing, and fair access to genetic technology.

What are the Opportunities in the DNA Synthesis Market?

If DNA can be produced cheaply and in large quantities, engineering biology, medicine, data storage, and nanotechnology will all advance quickly. Automation will make it easier for non-experts to understand DNA synthesis. Additionally, new synthesis techniques will keep developing with an unwavering focus on offering environmentally friendly solutions, reducing the possible negative effects on the environment caused by the usage of toxic chemicals and organic solvents.

By product type, the oligonucleotides segment held the largest share of the DNA synthesis market in 2024. Numerous molecular biology procedures, such as PCR, DNA sequencing, labelled probes, plasmid assembly, and genomic alterations, depend heavily on oligonucleotides. The potential of oligonucleotide synthesis will keep growing, leading to novel and practical applications in fields such as gene editing, personalised medicine, and gene control.

By product type, the synthetic genes segment is estimated to grow at the fastest CAGR during the forecast period. The fields of biotechnology and medicine are among the main uses for artificial DNA synthesis. This method is being used by researchers to create microorganisms that can produce industrial chemicals, biofuels, or lucrative medications. For example, genetically modified organisms (GMOs) that can produce insulin, antibiotics, or vaccines more effectively and economically than conventional techniques have been made possible by synthetic biology.

By technology, the solid-phase DNA synthesis segment held the largest share of the market in 2024. Multi-kilogram amounts of oligonucleotides for usage as therapeutic molecules may now be synthesised using solid-phase techniques. For all of these reasons, automated solid-phase processes are nearly always used to synthesise oligonucleotides. Compared to solution synthesis, solid-phase synthesis offers several benefits.

By technology, the enzymatic DNA synthesis segment is expected to estimated to grow at the fastest CAGR during the forecast period. Enzymatic DNA synthesis (EDS) is a potential benchtop and user-friendly technique of synthesising nucleic acids that employs enzymes and moderate aqueous conditions in place of solvents and phosphoramidites. The most promising strategy for next-generation artificial DNA synthesis is thought to be template-free enzymatic methods.

By application, the research & development segment held the largest share of the DNA synthesis market in 2024. High-throughput DNA synthesis technology has made tremendous strides in genomics and synthetic biology research in recent years. These artificial DNA strands provide a versatile tool for genetic modification and research, and they may be employed for a variety of practical applications and studies. Researchers can produce and examine genes in a controlled setting thanks to DNA synthesis. This capacity is crucial for investigating genetic disorders, comprehending how genes work, and creating novel treatments.

By application, the therapeutics development segment is expected to estimated to grow at the fastest CAGR during the forecast period. In gene therapy, DNA and RNA are used. Human gene therapy has the potential to be a useful tool in the fight against acquired immunodeficiency syndrome, cancer, diabetes, high blood pressure, coronary heart disease, peripheral vascular disease, neurodegenerative diseases, haemophilia, cystic fibrosis, and other genetic disorders if it is properly supervised and given enough time.

By end-user, the academic & research institutions segment held the largest share of the market in 2024. Public and private research institutions share the fundamental goal of advancing society via the rigors research of their faculty and graduate students. The basic research that propels scientific and technological advancement is started by public research universities, according to the American Academy of Arts and Sciences (AAAS).

By end-user, the biotechnology & pharmaceutical companies segment is estimated to grow at the fastest CAGR during the forecast period. The market is growing as a result of the growing use of synthetic DNA products by biotechnological and pharmaceutical businesses to create new treatment options for a range of illnesses. Additionally, the market's growth is being driven by the growing number of regulatory approvals and gene-based therapy launches by biotechnology and pharmaceutical businesses.

North America dominated the market share 41% in 2024. In the field of genomes, the region is dominant because to its strong R&D infrastructure, concentration of important firms, and top research institutes that specialise in synthetic biology and gene editing technologies. Research on the need for efficient therapies for chronic illnesses has increased as a result of strategic actions by major actors and increased financing for research.

DNA synthesis is rising in the U.S. due to the rising demand for personalized medicine and gene therapies. For instance, in July 2025, CMS announced that 33 states, along with the District of Columbia and Puerto Rico, will join the Cell and Gene Therapy (CGT) Access Model, a daring new strategy for providing state-of-the-art treatments to Medicaid-eligible individuals with sickle cell disease. Participating states greatly increase access to transformational care, accounting for around 84% of Medicaid enrollees with the illness.

In March 2025, Genome Canada said today that the Canadian Precision Health Initiative (CPHI) has received $81 million from the Government of Canada. A total of $200 million is expected to be invested, with partners from the commercial, academic, and public sectors providing co-funding. With more than 100,000 genomes, the CPHI will build the greatest human genetic data collection in Canada's history, reflecting the diversity of the country's population.

Asia Pacific is estimated to host the fastest-growing DNA synthesis market during the forecast period. Countries like China, India, and many others are taking the lead because of a variety of factors, including increased government support, increased cooperation between academic institutions and major players to develop synthetic DNA technologies, growing awareness of personalised medicines, and a growing pool of highly qualified scientists.

The goal of DNA synthesis research and development (R&D) is to enhance and create ways for producing unique DNA sequences, frequently using phosphoramidite chemistry and enzymatic synthesis. New DNA synthesisers are being developed and tested, new chemistries are being designed to improve speed and accuracy, DNA libraries are being created to screen drug candidates, and genome assembly methods are being advanced to produce bigger, functional DNA constructions.

Top Companies Include: Twist Bioscience, GenScript, Integrated DNA Technologies (IDT), and Thermo Fisher Scientific

Using phosphoramidite chemistry, nucleotides are assembled into a sequence during DNA synthesis, frequently on a solid substrate. To separate the full-length strand, the synthesised DNA must be cleaved off the support, protective groups must be removed, and the result must be purified before the final dose is prepared. For stability, the dried DNA is usually redissolved in a buffer, such as Tris-EDTA, in the final formulation.

Top Companies Include: Twist Bioscience, GenScript, Integrated DNA Technologies (IDT), and Thermo Fisher Scientific

"Patient Support and Services" in the context of "DNA synthesis" refers to the help and resources given to patients and their families, including genetic counselling and support for making educated decisions when DNA synthesis is used in their medical care, such as in gene therapy, personalised medicine, or the interpretation of genetic test results.

In May 2025, short DNA fragments have been handcuffing scientists for decades, forcing them to use laborious cloning procedures in their own facilities to piece sequences together, according to Jason T. Gammack, CEO of Ansa Biotechnologies. With a transparent and cooperative service approach, Ansa is already revolutionising the industry by providing longer, more complicated DNA. Our unwavering commitment to enabling researchers to construct without boundaries and innovate without compromise is seen by the quick expansion in our product length, which went from 600 bases a year ago to 7.5 kb more recently and now 50 kb through early access.

By Product Type

By Technology

By Application

By End User

By Region

January 2026

January 2026

January 2026

January 2026