January 2026

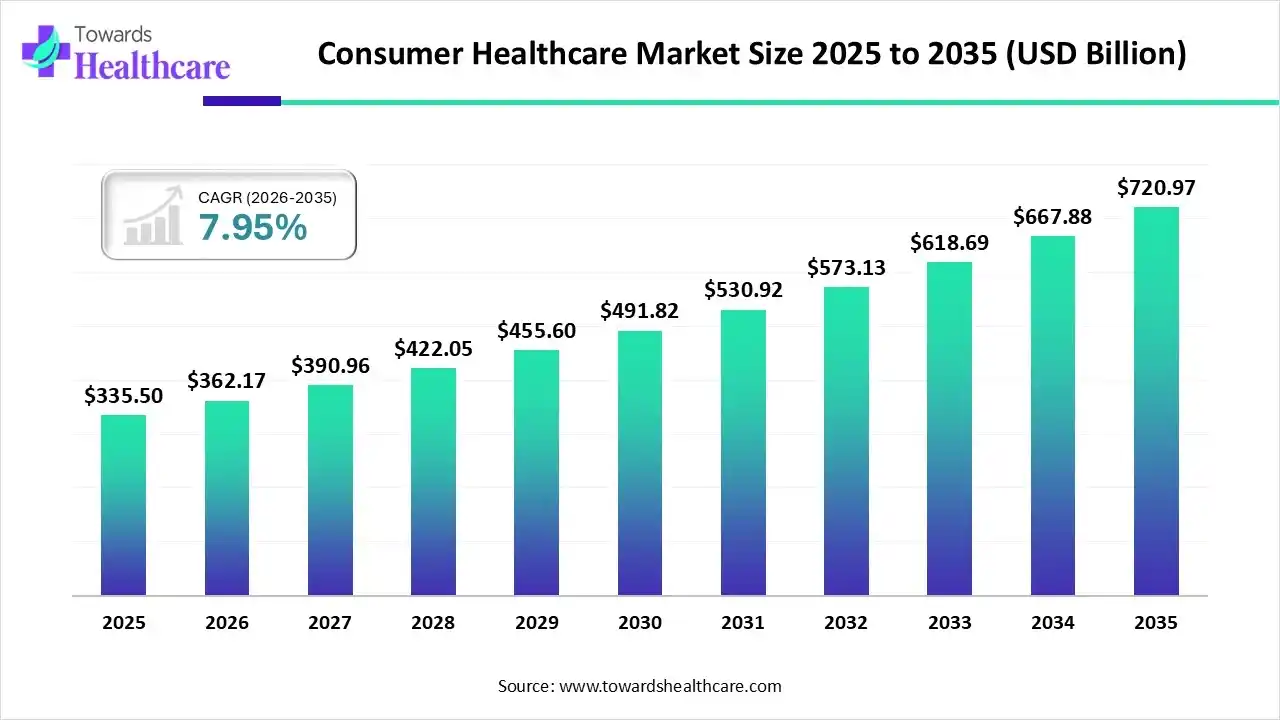

The global consumer healthcare market size was estimated at USD 335.50 billion in 2025 and is predicted to increase from USD 362.17 billion in 2026 to approximately USD 720.97 billion by 2035, expanding at a CAGR of 7.95% from 2026 to 2035.

The market is expanding steadily, driven by rising health awareness, demand for self-care products, and increased adoption of OTC medicines, supplements, and wellness solutions. Growth is further supported by digital health tools, e-commerce penetration, and preventive healthcare trends, enabling consumers to manage their health independently and access convenient, affordable care options.

| Key Elements | Scope |

| Market Size in 2026 | USD 362.17 Billion |

| Projected Market Size in 2035 | USD 720.97 Billion |

| CAGR (2026 - 2035) | 7.95% |

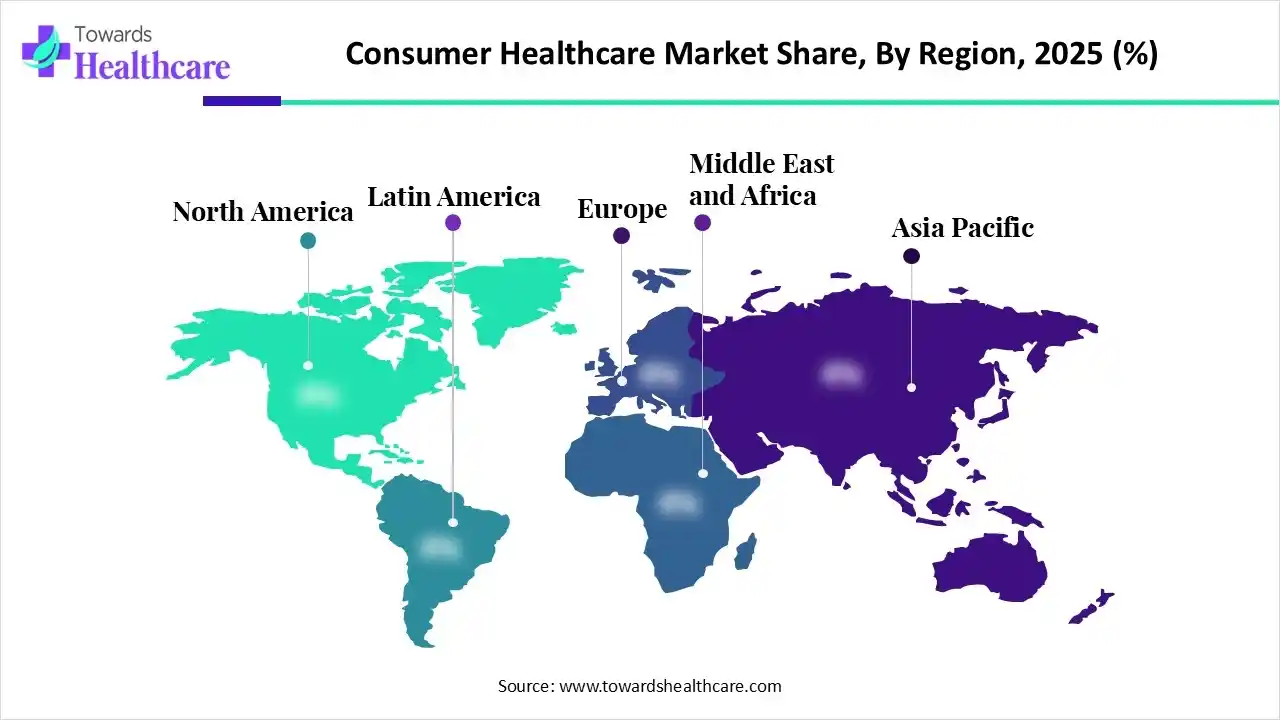

| Leading Region | North America |

| Market Segmentation | By Product, By Distribution Channel, By Region |

| Top Key Players | Abbott Laboratories, Amway Corporation, BASF SE, Bayer AG, Boehringer Ingelheim International GmbH, Chr Hansen Holding AS, Glanbia plc, GlaxoSmithKline Plc, Johnson and Johnson Services Inc., Kellogg Co. |

AI is transforming the market by enabling personalized wellness recommendations, early risk detection, and smarter self-care decisions through apps and wearable devices. It enhances product selection, virtual health assistance, and improves OTC and supplement guidance. AI-driven analytics also help brands understand consumer needs, leading to more tailored and accessible health solutions.

AI, data analytics, and connected devices are driving hyper-personalized nutrition, supplement, and fitness recommendations, enabling consumers to manage health proactively with tailored insights that improve outcomes, engagement, and long-term well-being.

Mobile health apps, telehealth tools, and wearables are transforming self-care by offering real-time monitoring, symptom assessment, medication reminders, and virtual guidance, making consumer health management more accessible, convenient, and technology-driven.

Demand for immunity boosters, mental wellness products, daily supplements, and lifestyle-based care is rising as consumers shift toward prevention, long-term wellness, and affordable self-managed solutions to avoid costly medical interventions.

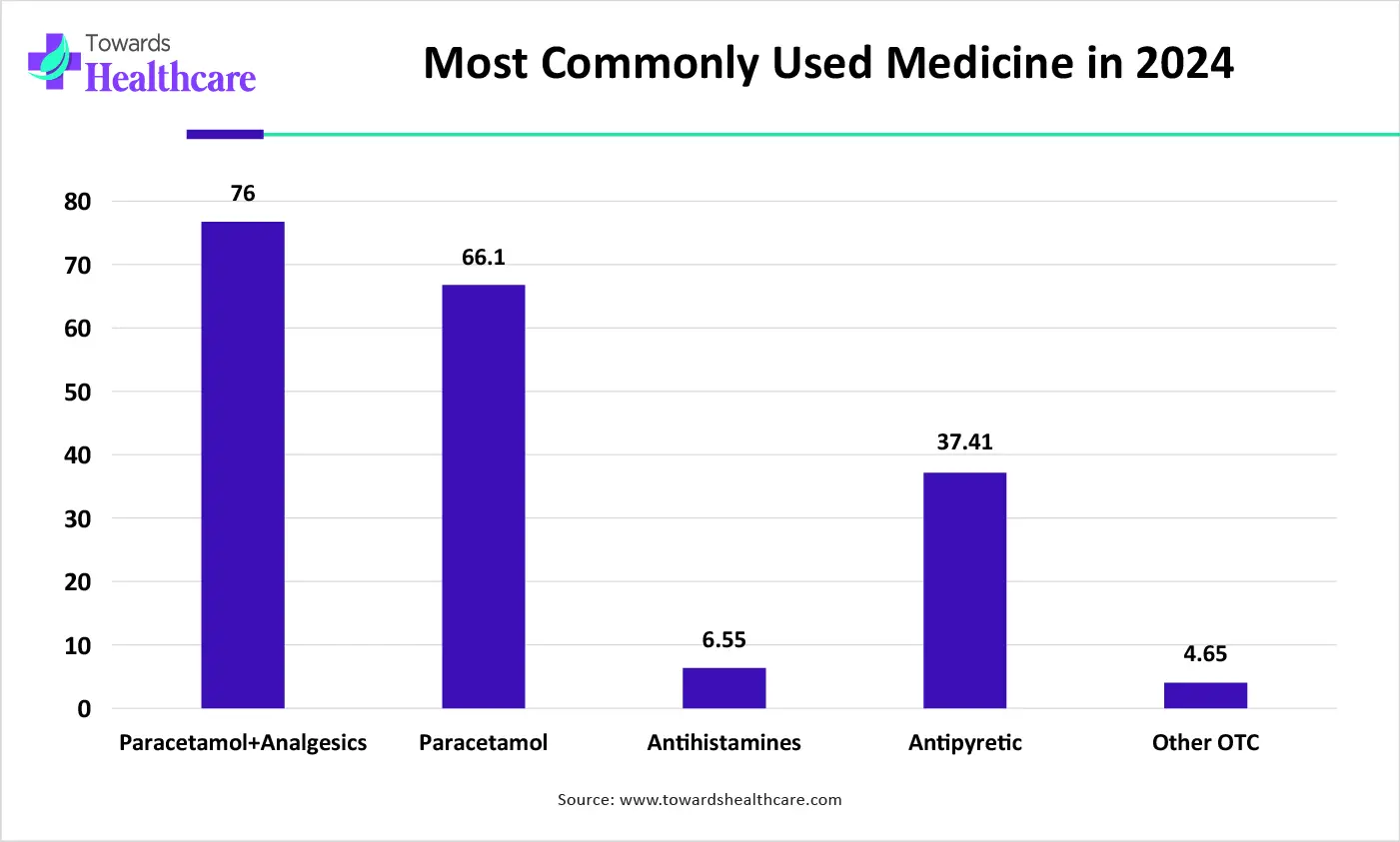

| Medicine/Drug Type | % Used |

| Paracetamol + Analgesics | 76 |

| Paracetamol | 66.1 |

| Antihistamines | 6.55 |

| Antipyretic | 37.41 |

| Other OTC | 4.65 |

Why Did the OTC Pharmaceutical Segment Dominate in the Market in 2025?

The OTC pharmaceutical segment held the largest consumer healthcare market share because consumers increasingly prefer quick, accessible solutions for common health issues. Issues such as pain, cold, acidity, and allergies. Greater self-medication practices, easier product availability in pharmacies and retail stores, and rising health awareness also drive demand. Additionally, expanding digital health platforms and strong marketing by major brands further boost OTC product adoption, keeping this segment dominant.

Personal Care

The personal care segment is expected to grow at the fastest CAGR due to rising focus on wellness, self-care, and preventive skincare routines. Increasing awareness about hygiene, appearance, and daily self-care, along with growing demand for natural and specialized products, supports this trend. Urbanization, social media influence, and expanding e-commerce access further accelerate adoption, making personal care one of the most dynamic and rapidly evolving categories in the market.

What Made the Offline Segment Dominant in the Market in 2025?

The offline segment dominated the consumer healthcare market because consumers still prefer trust, in-person purchases from pharmacies, retail stores, and supermarkets, especially for health-related products. Physical outlets offer immediate product availability, personal assistance, and credibility, which are important for OTC and wellness items. Strong retail networks and easy accessibility across urban and rural areas further reinforce offline dominance.

Online

The online segment is expected to grow at the fastest CAGR due to rising digital adoption, increasing smartphone and internet penetration, and the convenience of home delivery. Consumers prefer online platforms for wider product choices, easy price comparison, and frequent discounts. E-pharmacies and e-commerce marketplaces also offer quick fulfilment, subscription options, and better access in remote areas, making online channels increasingly attractive for healthcare and personal care purchases.

North America dominated the consumer healthcare market due to high health awareness, strong purchasing power, and widespread access to healthcare products. Well-established retail and pharmacy networks, advanced regulatory frameworks, and a large population of aging consumers driving demand for preventive and wellness products also contribute. Additionally, technological adoption, e-commerce growth, and extensive marketing by leading global brands reinforce the region’s market leadership.

The U.S. market is growing due to increasing health consciousness, rising demand for self-care products, and a focus on preventive healthcare. Easy access to OTC medicines, dietary supplements, and wellness products through pharmacies and e-commerce boosts adoption. Additionally, technological innovations, digital health platforms, and strong marketing by key players, along with an aging population seeking joint, heart, and bone health solutions, drive consistent market growth.

Asia-Pacific is expected to grow at the fastest CAGR due to rising health awareness, increasing disposable income, and a growing middle-class population. Expanding urbanization, greater access to OTC medicines, dietary supplements, and personal care products, along with rapid digital adoption and e-commerce penetration, fuel demand. Additionally, government initiatives promoting preventive healthcare and wellness, combined with a large population base seeking modern healthcare solutions, drive significant market growth in the region.

The Indian market is growing due to increasing health awareness, rising disposable incomes, and a shift toward preventive care. Easy access to OTC medicines, dietary supplements, and wellness products, along with expanding e-commerce and digital health platforms, supports adoption. Additionally, busy lifestyles and growing demand for personal care and self-medication solutions further drive market growth.

Europe is expected to grow at a notable CAGR due to increasing health awareness, high adoption of preventive healthcare, and strong demand for OTC medicines and dietary supplements. An aging population, well-established healthcare infrastructure, and easy access to pharmacies and retail channels support growth, while innovations in personal care and wellness products further boost the consumer healthcare market in the region.

The UK consumer healthcare market is growing due to rising health consciousness, increasing demand for self-care and preventive healthcare products, and easy access to OTC medicines and supplements. Strong retail and pharmacy networks, digital health platforms, and a focus on wellness and personal care also drive adoption, while an aging population further supports market expansion.

| Supplement Type | % of Adults Using |

| Multivitamin-mineral | 34-36 |

| Vitamin D | 15-18 |

| Omega-3/Fish oil | 10-12 |

| Probiotics/Prebiotics | 4-6 |

| Fiber supplements | 2-3 |

| Other vitamins (C, E, B-Complex) | 5-8 |

| Company | Headquarters | Offerings |

| Abbott Laboratories | Llinosis, USA | Produces nutritional products, medical-nutrition, and general healthcare products for consumers. |

| Amway Corporation | Ada, USA | Offers health & wellness products, nutritional supplements, vitamins/dietary supplements for the consumer market. |

| BASF SE | Ludwigshafen, Germany | “Nutrition & Health” division provides vitamin ingredients, nutritional ingredients, and raw materials used in supplements/nutraceuticals (human nutrition & supplements supply chain) rather than direct OTC drugs. |

| Bayer AG | Leverkusen, Germany | Offers consumer-health products, including OTC medicines, vitamins/supplements, and over-the-counter drugs as a key global consumer-health player. |

| Boehringer Ingelheim International GmbH | Rhein, Germany | A global pharmaceutical company historically more focused on prescription medicines and pharmaceuticals, though it is listed among the major players in global consumer-healthcare market analyses. |

| Chr Hansen Holding AS | Horsholm, Denmark | Known for producing probiotic cultures and microbes used in food, supplements, and functional-food/health supplement products contributing to gut-health / probiotic supplements. |

| Glanbia plc | Kilkenny, Ireland | Focus on nutrition, sports nutrition, dietary supplements, and consumable nutrition products, e.g., protein supplements, energy bars, and dietary supplement brands for global markets. |

| GlaxoSmithKline Plc | UK | Through its consumer-health / OTC/supplement business, it provides over-the-counter medicines, health products, vitamins/supplements, and OTC drugs globally. |

| Johnson and Johnson Services Inc. | New Jersey, USA | Offers a wide range of consumer-healthcare products: OTC medicines, health supplements, personal care products; historically among the major global consumer-healthcare players |

| Kellogg Co. | Michigan, USA | Though primarily a food & cereals company, some product lines have been linked to fortified foods / functional-food / nutraceutical formats contributing (less prominently) to consumer nutrition/health segments. |

By Product

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026