January 2026

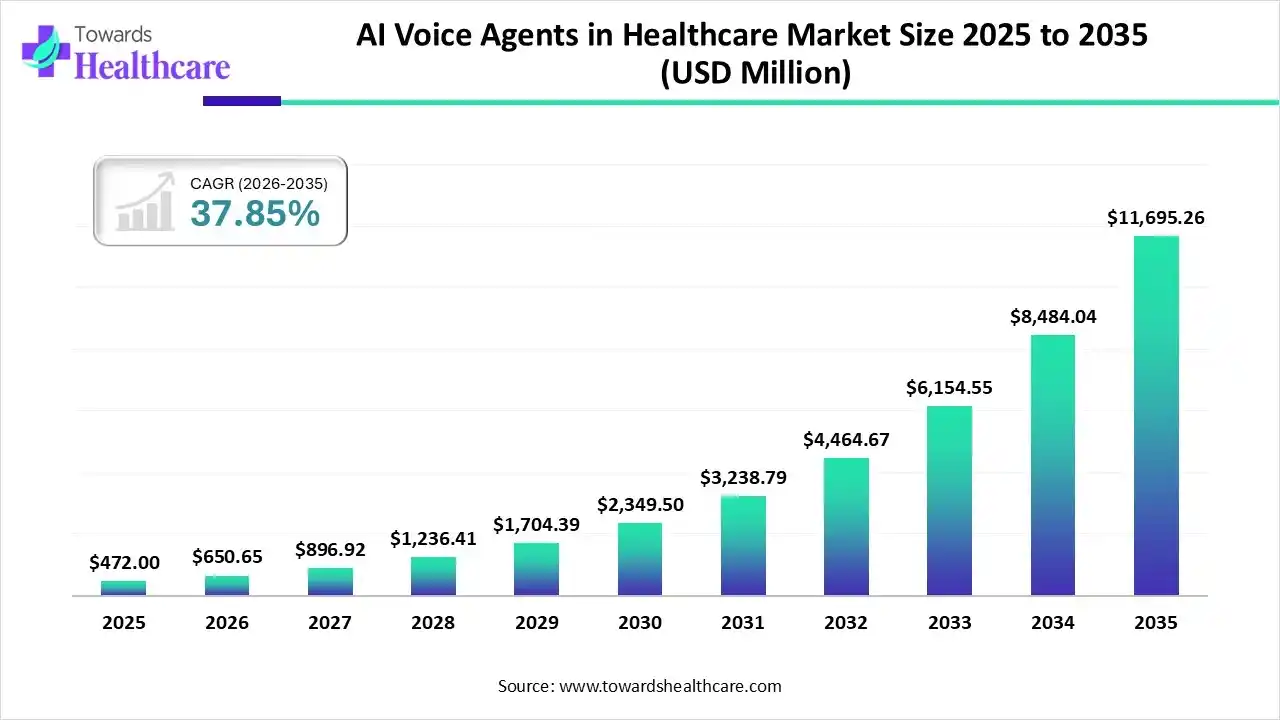

The global AI voice agents in healthcare market size was estimated at USD 472 million in 2025 and is predicted to increase from USD 650.65 million in 2026 to approximately USD 11,695.26 million by 2035, expanding at a CAGR of 37.85% from 2026 to 2035.

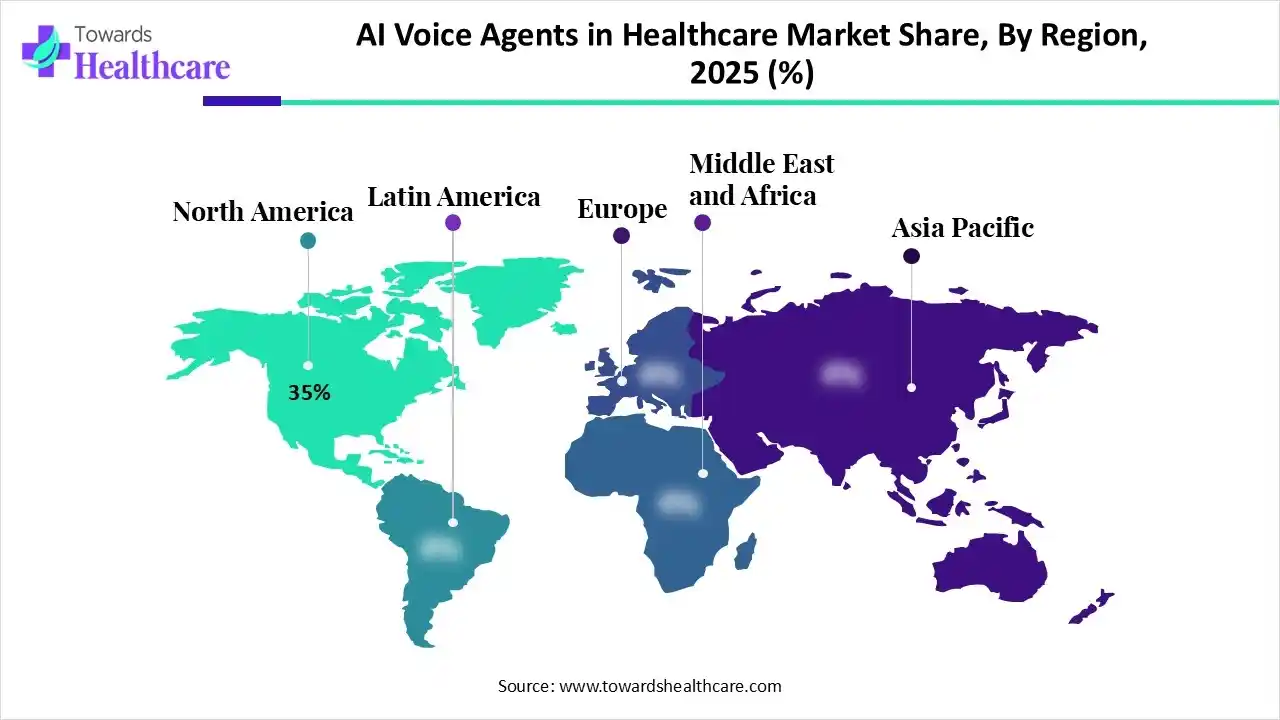

The AI voice agents in healthcare market is growing as providers adopt automated, conversational tools to enhance patient engagement, streamline administrative tasks, and improve clinical decision support. Rising demand for virtual assistants, telehealth expansion, and workflow optimization fuel adoption. North America dominates the market due to advanced healthcare infrastructure, rapid AI integration, and strong investments in digital health technologies.

| Key Elements | Scope |

| Market Size in 2026 | USD 650.65 Million |

| Projected Market Size in 2035 | USD 11,695.26 Million |

| CAGR (2026 - 2035) | 4.64% |

| Leading Region | North America by 35% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By Technology / Mode of Action, By End-User, By Region |

| Top Key Players | Suki AI, Inc., Orbita, Inc., Nuance Communications, Inc. (a Microsoft company), Sensely Inc., Infinitus Systems |

AI voice agents in healthcare are intelligent, speech-enabled systems that use natural language processing to assist patients and providers through conversational interactions. They are transforming the healthcare market by automating appointment scheduling, improving patient engagement, reducing administrative workload, and delivering round-the-clock support. These agents also enhance telehealth triage, capture clinical notes, send medication reminders, and personalize care delivery. By improving accessibility for the elderly and remote populations and ensuring consistent communication, AI voice agents help streamline workflows, support clinical decision-making, and modernize care pathways as healthcare rapidly shifts toward digital-first models.

Which Product Type Segment Dominated the AI Voice Agents in Healthcare Market?

The conversational AI platforms segment is the dominant segment in the market with a share of 40% due to its ability to streamline patient–provider interactions, enhance appointment scheduling, and support remote consultations. Advanced natural language processing, integration with electronic health records, and improved patient engagement drive its widespread adoption across hospitals and clinics.

Virtual Health Assistants

The virtual health assistants segment is estimated to be the fastest-growing in the market due to rising demand for personalized patient care, remote monitoring, and 24/7 support. Its ability to provide medication reminders, symptom tracking, and telehealth guidance, combined with integration into mobile apps and healthcare systems, accelerates adoption.

Why Did the Cloud-Based Segment Dominate the AI Voice Agents in Healthcare Market?

The cloud-based segment dominated the market, with a share of 55%, and is growing rapidly due to its scalability, cost-efficiency, and easy deployment. It enables real-time data access, remote collaboration, and seamless integration with electronic health records. Additionally, cloud platforms support advanced analytics, AI model updates, and telehealth services, driving adoption across healthcare providers.

The on-premise segment is estimated to grow significantly during the forecast period due to its enhanced data security, control over sensitive patient information, and compliance with strict healthcare regulations. Hospitals and clinics prefer on-premise solutions for reliable performance, seamless integration with existing IT infrastructure, and reduced dependency on external networks.

Why Did Patient Engagement & Support Dominant Segment in the AI Voice Agents in Healthcare Market?

The patient engagement & support segment is the dominant segment in the market, with a share of 45% due to its ability to enhance communication between patients and providers, streamline appointment scheduling, provide reminders, and deliver personalized care. Its effectiveness in improving patient satisfaction and adherence drives widespread adoption across hospitals and clinics.

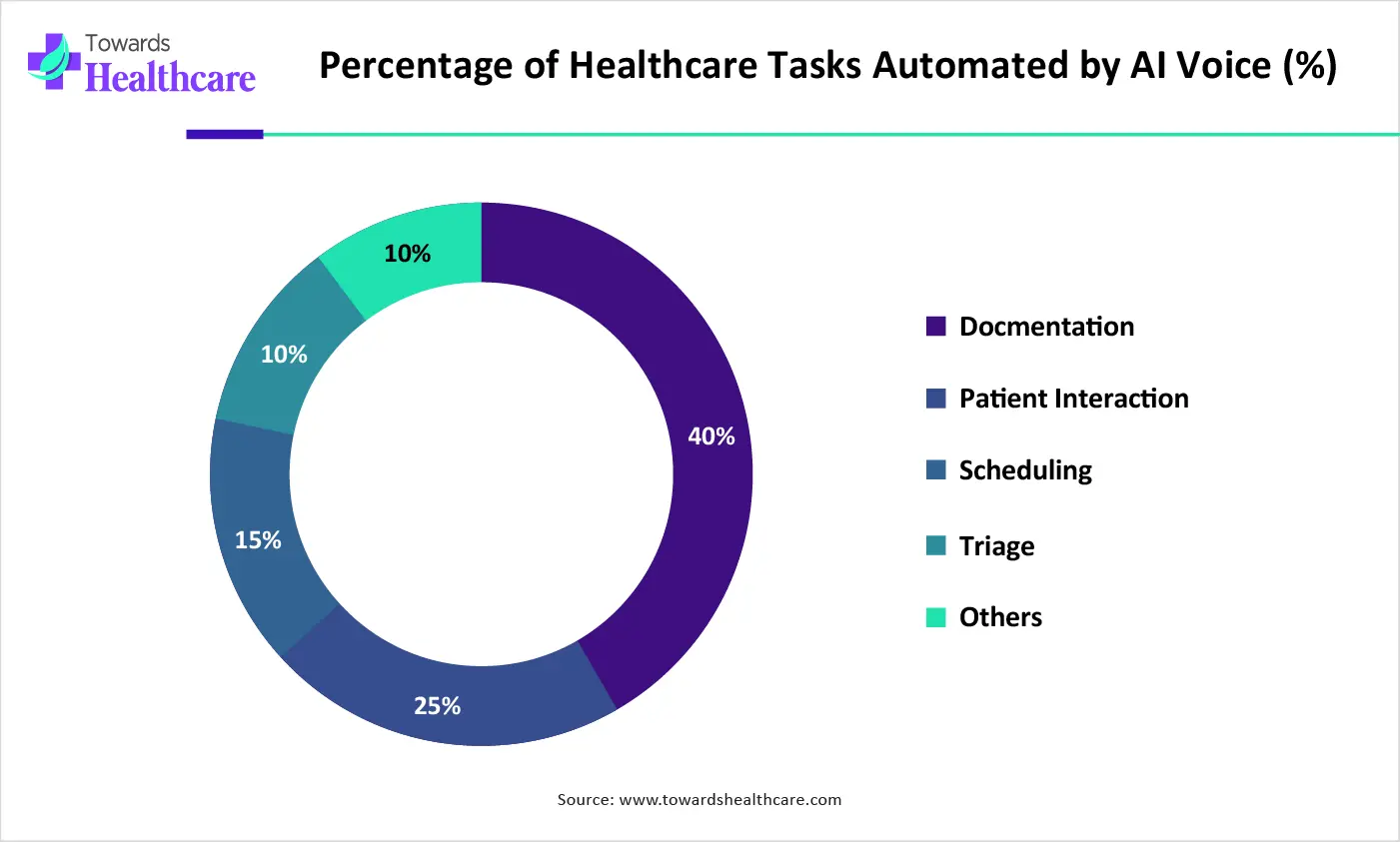

The clinical workflow assistance segment is the fastest-growing in the market due to increasing demand for automation in routine clinical tasks, such as documentation, patient record management, and real-time data entry. By reducing clinician workload, minimizing errors, and improving efficiency, these AI solutions enable healthcare providers to focus more on patient care, driving rapid adoption.

Which Technology / Mode of Action Segment Led the AI Voice Agents in Healthcare Market?

The natural language processing (NLP) & speech recognition segment is the dominant segment in the market, with a share of 45%, due to its ability to accurately interpret and transcribe patient interactions, streamline clinical documentation, and support real-time decision-making. Its integration with electronic health records and enhanced patient-provider communication drives widespread adoption across healthcare facilities.

Machine Learning/AI Algorithms

The machine learning/AI algorithms segment is the fastest-growing in the market due to its ability to continuously learn from vast healthcare data, improve predictive accuracy, and support personalized patient care. Advanced algorithms enhance clinical decision-making, automate administrative tasks, and enable real-time insights, driving rapid adoption across hospitals, telehealth platforms, and remote patient monitoring systems.

Why Did Hospitals & Health Systems Dominant Segment in the AI Voice Agents in Healthcare Market?

The hospital & health systems segment is the dominant segment in the market with a share of 50% due to its large-scale operations, extensive patient interactions, and high demand for workflow automation. AI voice solutions streamline clinical documentation, improve patient engagement, reduce administrative burden, and enhance operational efficiency, making hospitals and health systems the primary adopters of these advanced technologies.

Pharmaceutical & Biotech Companies

The pharmaceutical & biotech companies segment is the fastest-growing segment due to rising adoption of AI voice agents for accelerating clinical trial management, improving data capture, enhancing pharmacovigilance reporting, and supporting real-time communication across research teams. Their strong focus on innovation, automation, and faster drug development drives rapid integration of advanced voice-enabled AI solutions.

North America dominates the AI voice agents in healthcare market with a share of 35% due to its advanced digital health infrastructure, strong adoption of AI-driven clinical and administrative tools, and the presence of leading technology and healthcare IT companies. Significant government support, high healthcare spending, and rapid integration of virtual assistants across hospitals and telehealth platforms further strengthen the region’s leadership.

The U.S. dominates the North American AI voice agents in healthcare market due to its strong healthcare IT infrastructure, rapid adoption of AI-enabled clinical and administrative tools, and the presence of major technology innovators. High investment in digital health, supportive regulatory frameworks, extensive telehealth usage, and a strong focus on automation and patient engagement further reinforce the country’s leadership.

The Asia-Pacific region is the fastest-growing market, with a share of 30% for AI voice agents in healthcare due to rapid digital transformation, expanding telehealth adoption, and rising investment in healthcare AI solutions. Growing patient populations, increasing smartphone penetration, and government support for digital health infrastructure accelerate adoption. Additionally, hospitals in countries like India, China, and Japan are integrating AI-driven voice tools to enhance efficiency and accessibility.

China dominates the Asia-Pacific AI voice agents in healthcare market due to its advanced healthcare infrastructure, strong government support for AI and digital health initiatives, and large-scale adoption of telemedicine. Significant investments by technology companies, rapid urbanization, and a growing demand for efficient patient care further strengthen China’s leadership in the region.

Europe is a notably growing region in the AI voice agents in healthcare market, with a share of 25%, due to its strong focus on healthcare digitization and supportive government initiatives. Robust healthcare infrastructure, widespread adoption of electronic health records, and emphasis on patient-centric care enable seamless integration of AI voice solutions. Additionally, investments in AI technology and regulatory frameworks promoting innovation accelerate adoption across hospitals and clinics.

The UK is growing at a dominant rate in the European AI voice agents in healthcare market due to strong NHS adoption of ambient voice technology, extensive government support for healthcare digitization, and major technology investments. Widespread hospital trials and focus on reducing clinician workload further accelerate AI voice agent integration across the healthcare system.

| Vendor / Company | Headquarters (HQ) | Primary Offerings / What Their AI Voice Agent Does |

| Suki AI, Inc. | Redwood City, California, USA | Their flagship Suki Assistant listens to patient–clinician conversations and automatically generates clinical documentation (notes, orders, summaries). Supports dictation, coding (ICD10/HCC), clinical reasoning, Q&A, realtime EHR integration. |

| Orbita, Inc. | Boston, Massachusetts, USA | Provides a conversationalAI platform (voice + chat) for healthcare, helps build HIPAA-compliant virtual assistants used for patient engagement, self-scheduling, appointment booking, care navigation, pre/postvisit outreach, and care management. |

| Nuance Communications, Inc. (a Microsoft company) | Burlington, Massachusetts, USA | Known for voicerecognition and speech-to-text for clinical documentation, e.g., real-time transcription, voice-enabled workflow automation embedded into EHR systems; used widely for reducing clinician burden and improving documentation efficiency. |

| Sensely Inc. | San Francisco, California, USA | Provides AI-powered “virtual nurse assistant” / virtual healthassistant platforms: voice-enabled interfaces + avatars, used for symptom checking, patient triage, appointment scheduling, insurance queries, chronic disease management, and multilingual patient support. |

| Infinitus Systems | (Global/enterprisescale, originates in the U.S.) | Offers AI voice agents that automate administrative phone calls: benefit verification, prior authorizations, claims follow-ups, patientpayer communications, reducing administrative burden and operational cost for healthcare providers & insurers. |

By Product Type

By Deployment Type

By Application

By Technology / Mode of Action

By End-User

By Region

January 2026

January 2026

January 2026

January 2026