February 2026

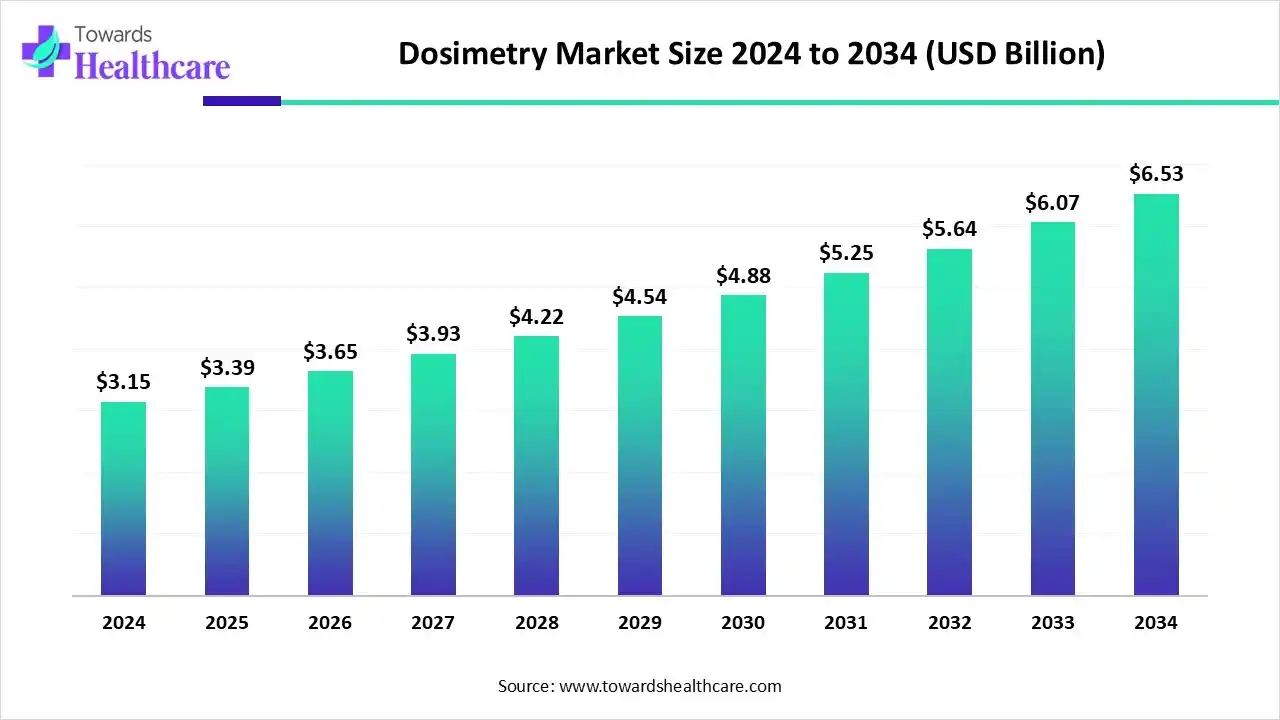

The global dosimetry market size is calculated at US$ 3.39 billion in 2025, grew to US$ 3.64 billion in 2026, and is projected to reach around US$ 7.01 billion by 2035. The market is expanding at a CAGR of 7.55% between 2026 and 2035.

The dosimetry market is expanding significantly as a result of stricter regulatory compliance and growing awareness of radiation concerns. Dosimeters are in high demand because of their capacity to detect and track radiation exposure levels, protecting personnel in sectors including construction, nuclear power, and healthcare. The increasing incidence of cancer and the requirement for precise radiation monitoring in medical applications are major factors propelling the market.

| Table | Scope |

| Market Size in 2026 | USD 3.64 Billion |

| Projected Market Size in 2035 | USD 7.01 Billion |

| CAGR (2026 - 2035) | 7.55% |

| Leading Region | North America by 39% |

| Market Segmentation | By Product Type, By Application, By Technology, By End User, By Region |

| Top Key Players | Landauer, Inc., Mirion Technologies, Inc., Thermo Fisher Scientific, PTW Freiburg GmbH, Radiation Detection Company (RDC), Unfors RaySafe (Fluke Biomedical), IBA Dosimetry GmbH, Polimaster Ltd., Rotunda Scientific Technologies, Sun Nuclear Corporation (Mirion), Fort Calhoun Nuclear Dosimetry Services, RadPro International GmbH, Kromek Group PLC, Atomtex SPE, Biodex Medical Systems (Mirion), Tracerco (Johnson Matthey), Centronic Ltd., Canberra Industries (Mirion), AmRay Radiation Protection, Arrow-Tech, Inc. |

The dosimetry market is driven by rising demand for cancer treatments, increased use of diagnostic imaging, strict regulatory frameworks, and growing applications of nuclear technology in both energy and defense. The dosimetry refers to the measurement, monitoring, and calculation of radiation exposure absorbed by human tissues, equipment, or the environment. Dosimetry plays a critical role in healthcare (especially radiation therapy, nuclear medicine, and diagnostic imaging), nuclear power plants, industrial radiography, environmental monitoring, and research laboratories. It ensures compliance with safety regulations, protects workers and patients from harmful radiation exposure, and helps optimize radiation-based medical treatments.

AI significantly enhances the dosimetry process by providing accurate, rapid dose assessments. It allows for accurate organ dosage estimate by automating the crucial and typically time-consuming process of organ segmentation from CT scans. The smooth integration of personalised dosimetry into clinical processes is made possible by AI's high accuracy in dose distribution prediction, which holds promise for enhanced patient safety and better radiation dose control. Furthermore, AI-driven strategies provide significant improvements over traditional techniques, which frequently struggle with issues like labor-intensive manual procedures and lengthy calculation times.

Rising cancer cases & diagnosis demand: The market is growing rapidly in the healthcare sector due to rising cases of cancer. As the cases of cancer are going to grow globally, the demand for radiotherapy will also increase.

For instance,

| Dosimeter Type | Characteristics | Applications | Advantages |

| Thermoluminescent Dosimeters (TLDs) | Passive devices, measuring cumulative dose via light emitted during heating. | Point-dose verification, total-skin electron therapy, and TBI. | Compact size, reusability, and high accuracy |

| Diodes | Active semiconductor devices provide real-time dose measurements. | Point-dose verification in IMRT. | Real-time data, high sensitivity |

| MOSFETs | Active dosimeters, miniaturized and versatile | Pediatric treatments, small-field dosimetry. | Small size, easy to use, and real-time measurements. |

| EPIDs | Originally designed for imaging, they have been adapted for dosimetry by analyzing exit-beam intensity profiles. | Dose distribution verification in VMAT. | Integrated imaging and dosimetry, seamless workflow. |

| OSLDs | Luminescence emitted upon light stimulation of radiation-sensitive material can be used to measure dosage. | TBI monitoring, small-field radiotherapy, and IORT. | High accuracy, reusability, and excellent stability. |

| Radiochromic Films | Measure dose via color change proportional to radiation, analyzed using optical scanners. | Complex dose distributions, total-skin electron therapy. | High spatial resolution, ideal for complex measurements. |

| Fiber-Optic Dosimeters | Flexible fiber-optic sensors are used for real-time measurements; they cause very little disturbance to the radiation field. | Challenging anatomical locations | Resistant to electromagnetic interference, it provides real-time data. |

By product type, the passive dosimeters segment accounted for approximately 42% of the dosimetry market revenue in 2024. Passive dosimeters are crucial tools for tracking the total amount of radiation exposure in various settings. Following laboratory investigation, these devices provide an accurate and trustworthy estimate of total exposure by accumulating radiation over time.

By product type, the active dosimeters segment is estimated to grow at the fastest CAGR during 2025-2034. For individual dosimetry measurements, active personal dosimeters (APDs) are widely acknowledged as practical and trustworthy tools. When evaluating individual external radiation doses, APDs provide several benefits over passive dosimeters. Real-time radiation monitoring in healthcare is made possible by active dosimeters, which give medical personnel prompt input to reduce exposure and maximise safety.

By application, the medical segment accounted for approximately 38% of the market revenue in 2024. The two main applications of dosimeters in healthcare are to verify the precise administration of therapeutic radiation in cancer treatments (medical dosimetry) and to track employee exposure to ionising radiation (such as X-rays and gamma rays) in order to maintain safety and compliance.

By technology, the thermoluminescent dosimetry (TLD) segment accounted for approximately 36% of the market revenue in 2024. Essential tools for monitoring ionising radiation are thermoluminescent dosimeters (TLDs), often referred to as TLD dosimeters. A thermoluminescent dosimeter is an essential instrument in many different sectors since it delivers precise and trustworthy radiation exposure data. Due to their increased precision in dosage assessments and greater dependability than conventional film badges, they are widely used in a variety of sectors.

By technology, the semiconductor/diode-based dosimetry segment is projected to grow at the fastest CAGR from 2025 to 2034. Because of its compact size, excellent sensitivity, and consistent, linear response to absorbed dosage, semiconductor dosimeters are often employed in radiation treatment. These characteristics enable accurate, real-time, high-resolution dose assessment, which is essential for confirming radiation delivery, guaranteeing patient safety, and modifying treatment regimens in contemporary methods including heavy ion, proton, and external beam therapy.

By end-user, the hospitals & diagnostic centers segment captured approximately 41% of the dosimetry market revenue in 2024. The primary cause of this is the industry's extensive use of radiation-based imaging techniques including X-rays, CT scans, and PET scans. Careful radiation monitoring is necessary because radiation therapy is in high demand for the treatment of cancer. The need for radiation safety solutions has risen as a result of the rising incidence of cancer and other chronic diseases, which has increased reliance on radiation therapy and imaging methods.

North America dominated the dosimetry market in 2024, with a revenue of approximately 39%. Strict regulatory compliance and regulations pertaining to radiation exposure in a variety of industries, including manufacturing, nuclear energy, and healthcare, are the main factors driving the market in North America. Furthermore, by increasing the effectiveness and versatility of these technologies, the region's quick rate of technical development adds to the need.

In January 2024, the $50 million Series B financing for Ratio Therapeutics Inc. (Ratio), a pharmaceutical company that uses a suite of cutting-edge technologies to create best-in-class radiopharmaceuticals for cancer treatment and monitoring, has closed, bringing the total amount raised to date to over $90 million.

In September 2025, the introduction of Cadena Research, a new preclinical contract research organisation (CRO) providing specialised support for early-stage drug development in the radiopharmaceutical industry, is a proud announcement from CPDC, a global pioneer in the discovery and commercialisation of radiopharmaceuticals. The company offers a range of services, such as sophisticated radiochemistry capabilities, toxicity, dosimetry, imaging, screening, lead optimisation, in vitro and in vivo research and development, and more.

Asia Pacific is estimated to host the fastest-growing dosimetry market during the forecast period. Due to the rising use and usage of radiation in the region's end-user sectors, Asia-Pacific is one of the most notable areas. Key nations in the Asia-Pacific area are anticipated to have substantial revenue growth in the worldwide market. due to the growing emphasis on nuclear power for electricity generation in emerging nations like China, Japan, and India in order to fulfil the strict rules for human safety and the rising energy demands.

From the initial concept to a validated product, dosimetry research and development (R&D) is a multi-step process that may be broadly categorised into a lifecycle. Research and development for dosimetry systems include demonstrating their precision, stability, and dependability for the use for which they are designed. Dosimetry systems use ionising radiation to measure and quantify the energy deposited in a substance.

Depending on whether the dosimeter is intended for internal or exterior radiation monitoring, different procedures must be followed during clinical trials and regulatory clearance for medical equipment. Risk-based classification and data reporting criteria define the procedure, which is overseen by health authorities including the U.S. Food and Drug Administration (FDA).

Patient support is an essential, integral part of dosimetry, which is the process of calculating the radiation dose for cancer therapy. Developing a treatment plan that maximises radiation exposure to the tumour while minimising exposure to surrounding healthy tissue is the main responsibility of a dosimetrist. In order to address the psychological and physical toll of cancer therapy, this intricate, technological procedure needs to be combined with extensive patient services.

By Product Type

By Application

By Technology

By End User

By Region

February 2026

February 2026

February 2026

February 2026