February 2026

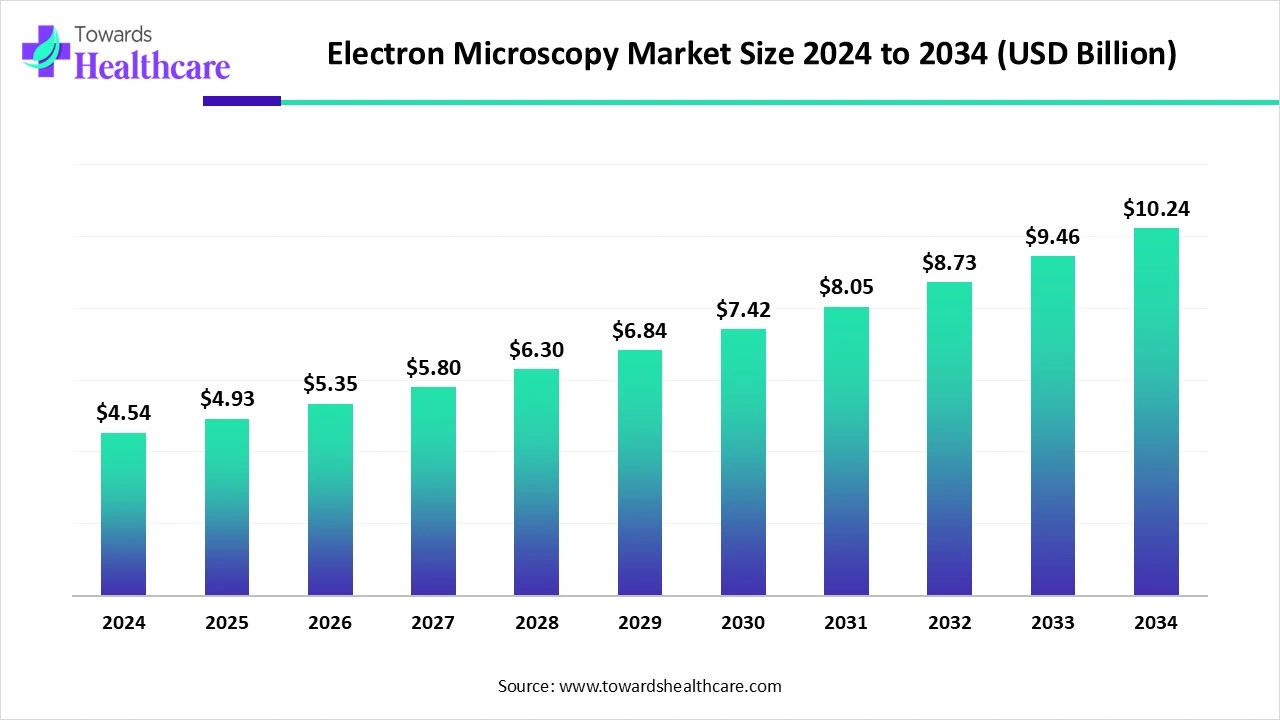

The global electron microscopy market size is calculated at US$ 4.54 billion in 2024, grew to US$ 4.93 billion in 2025, and is projected to reach around US$ 10.24 billion by 2034. The market is expanding at a CAGR of 8.52% between 2025 and 2034.

2025 is an advanced era, which has been developing novel approaches in microscopy, like SEM, cryo-EM, STEM, and other methods. These advances are widely used in drug discovery, virology, and structural biology, expanding the electron microscopy market. Whereas, ongoing developments in nanotechnology research, 3D imaging breakthroughs are expanding the understanding of disease mechanisms. The increasing cases of cancer and Alzheimer's are fueling the adoption of advanced microscopy in drug discovery, drug designing, and protein-ligand interactions.

| Table | Scope |

| Market Size in 2025 | USD 4.93 Billion |

| Projected Market Size in 2034 | USD 10.24 Billion |

| CAGR (2025 - 2034) | 8.52% |

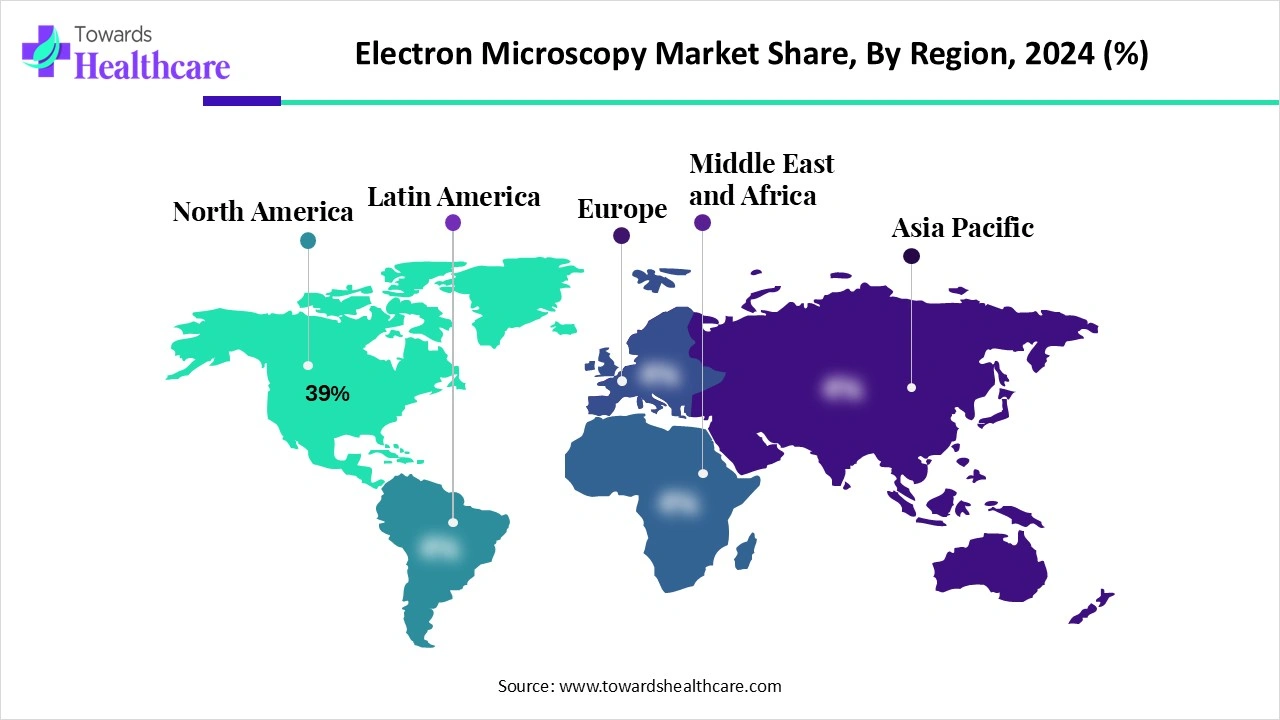

| Leading Region | North America 39% |

| Market Segmentation | By Product Type, By Technology, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, JEOL Ltd., Hitachi High-Tech Corporation, Carl Zeiss Microscopy (ZEISS), Delong Instruments, TESCAN ORSAY HOLDING, Bruker Corporation, Oxford Instruments, Gatan, Nion Company, Raith GmbH, Protochips, Nanomegas, Quorum Technologies, Leica Microsystems, Hiden Analytical, Delmic BV, Park Systems, Angstrom Advanced Inc., Regional academic consortia / specialized startups in cryo-EM software |

The electron microscopy market covers high-resolution imaging systems that use electron beams instead of light to visualize materials, biological samples, and nanostructures at sub-nanometer resolution. It includes Transmission Electron Microscopes (TEMs), Scanning Electron Microscopes (SEMs), Dual-Beam FIB-SEMs, and Cryo-EM systems, alongside accessories such as sample preparation instruments, detectors, and analysis software. These systems are critical in life sciences, materials research, semiconductors, nanotechnology, and industrial QA/QC, as well as in drug discovery, virology, and structural biology. Market growth is fueled by rising demand for nanotechnology research, advanced semiconductor nodes, biologics development, and adoption of cryo-EM in structural biology and drug design.

Ongoing advancements in high-resolution imaging technologies and research and development (R&D) activities are driving global market expansion.

Consistent technological efforts by using AI algorithms are assisting in innovative intelligent data acquisition with smart adaptive sampling, rapid and more precise image processing tasks, comprising segmentation and classification. Additionally, approaches like AI-enabled 3D reconstruction for deeper material and biological structure analysis are also promoting the widespread adoption of these microscopes.

For instance,

Coverage of Superiority and Necessities in Life Science

Majorly, electron microscopes possess superior resolution and power, which helps in the greater visualization and analysis of structures at nanometer scales, and are a vital catalyst in the global electron microscopy market. This is putting a milestone step in scientific advancements around the globe. Moreover, electron microscopes are required for the detailed research of pathology, microbiology, and cell biology, which further offers drug development, disease diagnosis, and clinical trial analysis. These are fueled by the significant public and private investments in the R&D sector, which encourage stepping into innovations.

Developing Complexity and Vacuum Needs

Around the market, novel techniques, such as transmission electron microscopy (TEM), are creating barriers in meticulous and time-consuming sample preparation, like ultrathin sectioning, which can impose artifacts. Somehow, TEMs and SEMs can work only in higher vacuum conditions, which further hinders several kinds of samples.

Ongoing Integrations and Biological Applications

In the upcoming era, the global electron microscopy market will develop a variety of opportunities in the world, such as integration with other analytical tools. These integrations include energy-dispersive X-ray spectroscopy (EDS), which assists in the entire material characterization. Apart from this, numerous studies of biological processes, such as membrane folding and fusion, observe the structure of proteins, and boost drug development by accelerating the understanding of disease mechanisms, are also evolving as a major chance in the respective market progress.

In 2024, the scanning electron microscopes (SEM) segment held a dominant share of the electron microscopy market. The benefits of this microscope, like its high resolution and imaging capability, with significant impact in nanotechnology and the development of new materials, for surface and structural characterization, analysis, and quality control, are fueling its wider adoption. Furthermore, new advances in 3D imaging technologies, particularly serial block-face SEM, focused ion beam SEM, and array tomography, are streamlining 3D reconstruction of biological samples. Also, the use of Correlative light and electron microscopy (CLEM) enables linking light microscopy with detailed SEM ultrastructure, which is propelling the overall biological processes.

Whereas the transmission electron microscopes (TEM) segment is predicted to expand fastest. Factors, like broader demand in nanotechnology research and applications, and the need for high-resolution imaging in materials science, life sciences, and semiconductor industries, are expanding the TEM applications in different domains. A crucial role of TEM in the detection of new and evolution of infectious agents and in the analysis of biopsy samples, mainly in specialized centers, is a critical driver in the electron microscopy market.

Under this segment, the cryo-TEM sub-segment will grow at a rapid CAGR during 2025-2034. This kind of method is prominent in the identification of the structures of macromolecules, huge cellular assemblies, and membrane proteins, which overcome the limitations of other methods. The wider adoption of cryo-TEM in the development of targeted therapies and precision medicine, mainly for complex diseases, such as cancer and neurodegenerative disorders, supports revealing protein-ligand interactions and bolsters the drug design process.

The conventional electron microscopy segment accounted for the biggest share of the market in 2024. A rise in demand for highly resolved images in the life sciences and material science domains, as well as a broader use in quality control stages of pharmaceuticals, are impacting as growth factors for this segment development. Nowadays, the growing cases of chronic issues and heavy investments in nanotechnology and R&D are fostering the further adoption of conventional microscopy.

On the other hand, the cryo-electron microscopy (Cryo-EM) segment is anticipated to register the fastest growth during 2025-2034. The use of Cryo-EM will revolutionize structural biology by providing higher resolution, quicker image processing, and the study of more difficult and varied biological samples, particularly intact cells and tissues. Besides this, innovations in sample preparation, including cryo-FIB and cell micropatterning, are also contributing to a leap forward in this segment. The emergence of automation in both data collection and image processing is minimizing the time consumption in resolving a protein structure, resulting in a faster rise in newly invented Cryo-EM structures in public databases.

Primarily, the materials science & nanotechnology segment was dominant in the electron microscopy market in 2024. Continuous funding in research and nanotechnology for applications in medicine, electronics, biomaterials, and energy is eventually boosting the use of electron microscopy. Moreover, the wider applications of Energy-Dispersive X-ray Spectroscopy (EDX) and Electron Energy Loss Spectroscopy (EELS) are combined with electron microscopes that help in finding the chemical composition and elemental distribution within materials at the nanoscale. Also, diverse applications of Electron diffraction in TEM in detailing the crystalline structure and phase of nanomaterials, support understanding their properties and performance.

The life sciences & structural biology segment is estimated to witness rapid growth. The increasing research activities in cancers & Alzheimer's, along with development in drug design and discovery, are enhancing the adoption of electron microscopy. Volume electron microscopy (vEM) technique assists in determining the 3D ultrastructure of cells and tissues at the nanometer scale, especially fruitful for complex systems, comprising neural circuits and entire organelles are also propelling the comprehensive market growth. Other applications in finding the accurate 3D structures of proteins and large complexes are necessary for recognizing their function and for designing drugs.

By end user, the academic & research institutes segment captured the largest share of the electron microscopy market in 2024. Ongoing government funding for life sciences research, the rising need for deeper structural information in drug discovery and development, are driving the usage of advanced microscopy in these institutes. Alongside, continuous advancements in electron microscopy hardware and software expand its capabilities for basic and translational studies is fueling the adoption in the academic & research institutes.

The pharma & biotech companies segment is anticipated to show rapid growth during 2025-2034. These companies are widely using advanced electron microscopy in drug discovery, quality control, and failure analysis. As well as advances like refinement of cryo-electron microscopy (cryo-EM) for high-resolution biomolecule structure determination, and the alliance of analytical techniques for elemental analysis, is also influencing the market progress. However, innovative cryo-TEM models from Thermo Fisher Scientific and Leica Microsystems, merged in the characterization of nanomedicine and pharmaceutical materials.

North America’s electron microscopy market accounted for a major revenue share 39% in 2024. This regional market is fueled by NIH-funded life sciences, consistent pharma R&D, and the transformation of the semiconductor industry. North America’s robust hub of academic institutions, research labs, and high-tech hubs assists in cutting-edge research in fields, mainly life sciences, biotechnology, and materials science are boosting the adoption of sophisticated microscopy. In 2024, JEOL released the JEM-120i in May 2024, a compact, easy-to-use, and expandable Transmission Electron Microscope (TEM) for various areas like biotechnology and nanotechnology.

The US has stepped into breakthroughs, such as electron ptychography, employed with conventional microscopes, which gain detailed sub-angstrom resolution previously only available with expensive aberration-corrected instruments.

For instance,

Different Canadian universities are using advanced electron microscopes for many research areas, like quantum technology, sustainable energy, and drug delivery. Recently, the NRC has established the NanoMi open-source platform, which enables users to design and develop modifiable, inexpensive microscopes. Other advances, like liquid-electron microscopy, have promising applications in molecular imaging, are acquiring traction, and are being demonstrated by institutions like Structural Oncology LLC.

In the prospects, the Asia Pacific is estimated to grow at a rapid CAGR in the electron microscopy market. ASAP’s market is mainly propelled by the expansion of semiconductor hubs, especially in Taiwan, South Korea, China, Japan, as well as advancing academic infrastructure. These hubs and electronics productions are boosting a demand for advanced approaches, such as Scanning Electron Microscopy (SEM) for quality control and defect analysis. Additionally, ASAP is playing a vital role in large-scale manufacturing and supply chain diversification, supported by competitive labor expenses and well-developed infrastructure.

In January 2024, China launched its first domestically produced transmission electron microscope (TEM), the TH-F120, led by the Bioland Lab, which provides greater stability, coherence, and brightness for capturing high-resolution images.

The market is fostering its production facilities, like COXEM, a South Korean company specializing in the manufacturing and sale of scanning electron microscopes (SEMs). Also, recently, GSEM Korea successfully installed cutting-edge SEM3200 and SEM4000Pro Scanning Electron Microscope (SEM) at its testing center in Korea.

The electron microscopy market in Europe is experiencing significant expansion due to the growing emphasis on interdisciplinary research and cryo-EM. Europe is increasingly focused on the facilities providing the analysis of materials regarding information technology (IT), energy, health, and transportation, led by EU-funded initiatives. Besides this, emerging trends of cryo-EM allow near-atomic resolution imaging of biological samples in their native state, coupled with investments in life sciences and pharmaceutical innovation.

For this market,

By Product Type

By Technology

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026