January 2026

The global fitness tracker for sleep monitoring market size is calculated at US$ 7.64 billion in 2025, grew to US$ 8.88 billion in 2026, and is projected to reach around US$ 34.15 billion by 2035. The market is expanding at a CAGR of 16.15% between 2026 and 2035.

![]()

The market is expanding quickly due to rising awareness of sleep quality, growing health-tracking habits, and increased adoption of smartwatches and wearables. Advancements in sensors, AI-based insights, and integration with mobile health apps are boosting demand. Consumer focus on preventive health and continuous monitoring further drives market growth across all age groups.

| Key Elements | Scope |

| Market Size in 2026 | USD 8.88 Billion |

| Projected Market Size in 2035 | USD 34.15 Billion |

| CAGR (2026 - 2035) | 16.15% |

| Leading Region | North America |

| Market Segmentation | By Type, By Distribution Channel, By Region |

| Top Key Players | Fitbit, Garmin Ltd, Apple Inc., Samsung Electronics Co., Ltd., Xiaomi Corporation, Huawei Technologies Co., Ltd, Polar Electro, WHOOP Inc. |

AI is transforming the market by enabling more accurate analysis of sleep patterns, heart rate, and respiration. It provides personalized insights, predictive recommendations, and early detection of irregular sleep behaviors. AI integration enhances device intelligence, improving user engagement and health outcomes, while encouraging continuous innovation in wearable technology, driving market growth, and expanding adoption across both consumer and healthcare segments.

Wearables are leveraging AI to monitor sleep stages, heart rate, and respiration, providing personalized insights and recommendations to improve sleep quality and overall wellness.

Fitness trackers connect with apps and telehealth services, enabling real-time data sharing, remote monitoring, and comprehensive health management for users and healthcare providers.

New devices feature improved sensors for blood oxygen, heart rate variability, and stress tracking, offering more accurate sleep monitoring and holistic health insights.

Rising health awareness, increasing disposable income, and smartphone penetration in regions like the Asia Pacific and Latin America will drive higher adoption of sleep-monitoring wearables.

Future devices will integrate AI, improved sensors, and multi-metric monitoring, offering more accurate, personalized sleep and health insights.

Wearables will increasingly connect with telehealth and clinical platforms, enabling remote monitoring, early detection of sleep disorders, and enhanced preventive healthcare solutions.

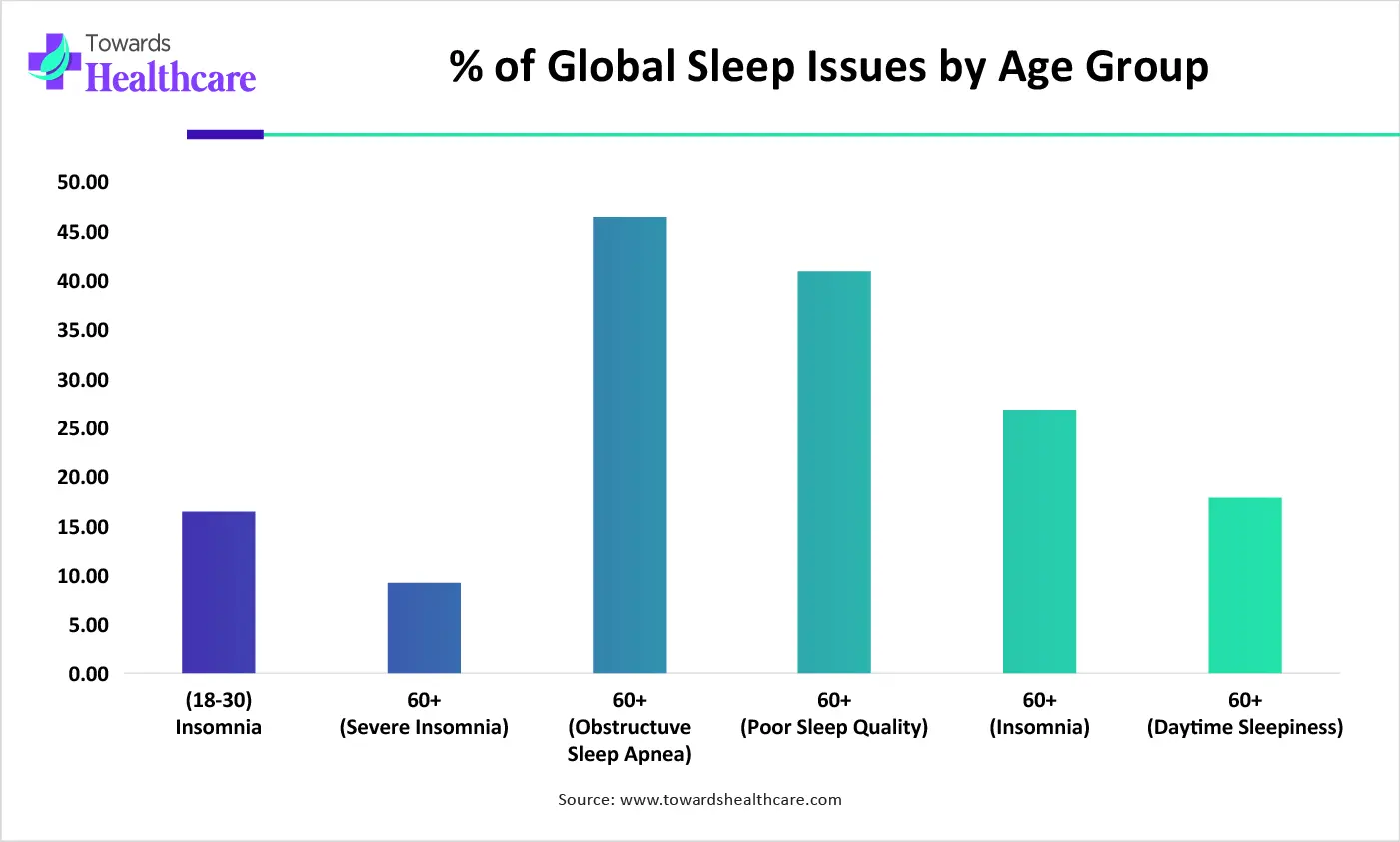

| Age Group | Year | % of Experiencing Sleep Problems |

| 18-30 | 2025 | 16.2% suffering from insomnia |

| 60+ | 2025 | 7.9% facing severe insomnia |

| 60+ | 2024 | 46.6% have obstructive sleep apnea |

| 60+ | 2024 | 40% suffer from poor sleep quality |

| 60+ | 2024 | 29% have insomnia |

| 60+ | 2024 | 19% have daytime sleepiness |

How Does the Smart Watches Segment Dominate the Market in 2024?

The smart watch segment dominates the fitness tracker for sleep monitoring market due to its multifunctionality, combining sleep tracking with heart rate monitoring, activity tracking, and smartphone integration. Consumers prefer all-in-one devices that provide comprehensive health insights and personalized recommendations. Advanced features, stylish designs, and brand reputation from leaders like Apple, Fitbit, and Samsung further drive adoption, making smartwatches the most popular choice over simpler fitness bands or trackers.

Smart Bands

The smart bands segment is expected to grow at the fastest CAGR due to their affordability, lightweight design, and ease of use, making them accessible to a wider consumer base. They offer essential sleep-tracking and health-monitoring features without the high cost of premium smartwatches. Rising awareness of sleep health, increasing adoption in emerging markets, and continuous technological improvements in battery life and sensors are further driving rapid growth in this segment.

In June 2025, Garmin introduced the Index Sleep Monitor, an upper-arm wearable that tracks sleep stages, heart rate variability, blood oxygen, and respiration. Aiming to compete with WHOOP, the device provides detailed insights into sleep quality and overall health.

What Made the Online Segment Dominant in the Market in 2024?

The online segment led the fitness tracker for sleep monitoring market due to the growing preference for e-commerce and digital shopping platforms. Consumers find it convenient to compare products, read reviews, and access a wide range of devices from global brands. Discounts, easy home delivery, and attractive offers further drive online sales. Increasing internet penetration and smartphone usage also support the rapid growth of online channels in this market.

Offline

The offline segment is expected to grow at a significant CAGR due to the rising consumer preference for physically experiencing products before purchase. Retail stores and brand outlets allow hands-on trials, personalized assistance, and immediate purchase, which builds trust in device accuracy and quality. Expansion of retail networks, growing awareness through in-store promotions, and the increasing adoption of wearables in emerging markets are further driving rapid growth in the offline channel.

![]()

North America dominated the market due to high consumer awareness of sleep health, strong adoption of wearable technologies, and widespread use of smartphones and connected health apps. The region benefits from advanced healthcare infrastructure, rising cases of sleep disorders, and early availability of innovative devices from major players. Growing interest in preventive health and increased spending on wellness technologies further support market leadership.

The NIH estimates that 50–70 million Americans have sleep disorders, and nearly one-third of adults, about 84 million, do not get the recommended amount of quality sleep.

The U.S fitness tracker for sleep monitoring market is growing due to rising awareness of sleep health, increasing prevalence of sleep disorders, and a strong shift toward preventive wellness. High adoption of smartwatches and wearables, combined with advanced features like sleep staging, heart-rate tracking, and personalized insights, is boosting future demand. Additionally, supportive digital-health ecosystems and continuous product innovations from major tech companies are driving market expansion.

In June 2025, HHS Secretary Robert F. Kennedy Jr. announced plans for a major national campaign promoting wearable health devices. The initiative aims to encourage Americans to use health data from wearables to make informed decisions and improve their overall well-being.

Asia Pacific is expected to grow at the fastest CAGR in the fitness tracker for sleep monitoring market due to rising health awareness, increasing cases of sleep disorders, and rapid adoption of affordable wearables. Expanding smartphone penetration, growing middle-class spending, and strong demand for digital health solutions further support growth. Additionally, government initiatives promoting preventive healthcare, along with aggressive product launches from regional tech brands, are accelerating the uptake of fitness trackers for sleep monitoring across the region. India’s PLI scheme is pushing local wearable manufacturing, making devices more affordable and widely available. Alongside digital health programs, the government is accelerating the use of wearables across fitness, healthcare, and wellness.

China’s fitness tracker for sleep monitoring market is expanding due to rising awareness of sleep health, a growing urban population facing stress-related sleep issues, and strong demand for affordable smart wearables. The presence of major domestic brands like Xiaomi and Huawei, which offer advanced features at competitive prices, further boosts adoption. Additionally, government support for digital health and increasing smartphone penetration are driving rapid growth across the country.

Europe’s market is growing at a significant rate in the fitness tracker for sleep monitoring market due to rising focus on preventive health, increasing cases of sleep disorders, and strong acceptance of digital wellness tools. High healthcare awareness, widespread use of smart devices, and supportive government initiatives promoting healthy lifestyles further drive adoption. Additionally, the presence of leading tech brands and expanding wearable innovations is accelerating regional market growth.

The UK fitness tracker for sleep monitoring market is rising due to growing awareness of sleep’s impact on overall health, increasing stress-related sleep problems, and strong adoption of digital wellness technologies. High smartphone penetration, advanced healthcare infrastructure, and consumer preference for personalized health insights support demand. Additionally, government emphasis on preventive healthcare and rapid product innovation from leading tech brands is further accelerating market growth.

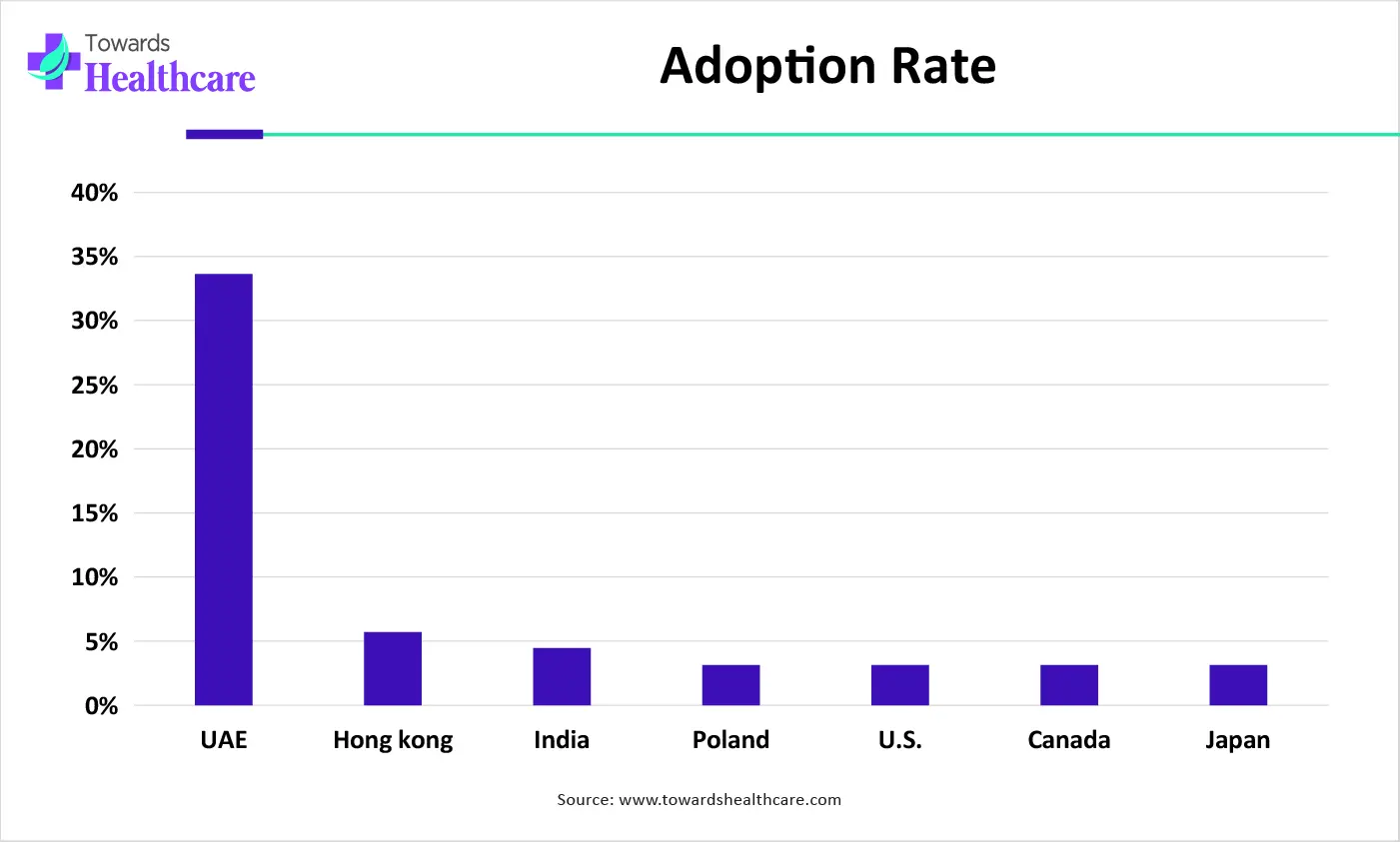

| Country | Adoption Rate |

| UAE | 33.4% |

| Hong Kong | 30.6% |

| India | 29.1% |

| Poland | 28.8% |

| U.S. | 26% |

| Canada | 21.8% |

| Japan | 8.6% |

![]()

| Companies | Headquaters | Offerings |

| Fitbit | San Francisco / Mountain View, USA | Fitbit makes fitness bands and smartwatches that monitor sleep quality, stages, heart rate, SpO₂, activity, and general wellness. |

| Garmin Ltd | Olathe, Kansas, USA | Garmin produces multisport and lifestyle wearables with sleep monitoring, heart rate, activity, and training metrics, aimed at both general wellness and athletic use. |

| Apple Inc. | Cupertino, California, USA | Through Apple Watch and related health apps, the company offers sleep tracking, heart rate, activity, respiratory rate monitoring, and integration with broader health platforms. |

| Samsung Electronics Co., Ltd. | Seoul, South Korea | Samsung’s Galaxy Watch series, Galaxy Watch6 Classic, tracks sleep, heart rate, and activity, and integrates with Samsung Health for wellness monitoring. |

| Xiaomi Corporation | Beijing, China | China Xiaomi offers affordable bands and smartwatches that support sleep tracking, heart rate monitoring, and general fitness tracking, catering to large, price-sensitive markets. |

| Huawei Technologies Co., Ltd | Shenzhen, Guangdong, China | Huawei develops wearable devices (watch & band) with health and fitness tracking, including sleep monitoring, heart rate, stress & wellness features. |

| Withings (Nokia Health) | IssylesMoulineaux, France | Withings offers hybrid smartwatches and sleeptracking devices (sleep quality, heart rate, activity), often blending classic watch design with health tracking. |

| Polar Electro | Kempele, Finland | Polar provides fitness watches and trackers focused on heart rate, activity, and sleep tracking popular among fitness enthusiasts and athletes. |

| WHOOP Inc. | Boston, Massachusetts, USA | WHOOP specializes in wearable bands focused on health analytics, sleep quality, recovery, strain, heart rate variability, and overall wellness monitoring. |

By Type

By Distribution Channel

By Region

North America

South America

Europe

Asia Pacific

MEA

January 2026

January 2026

January 2026

January 2026