February 2026

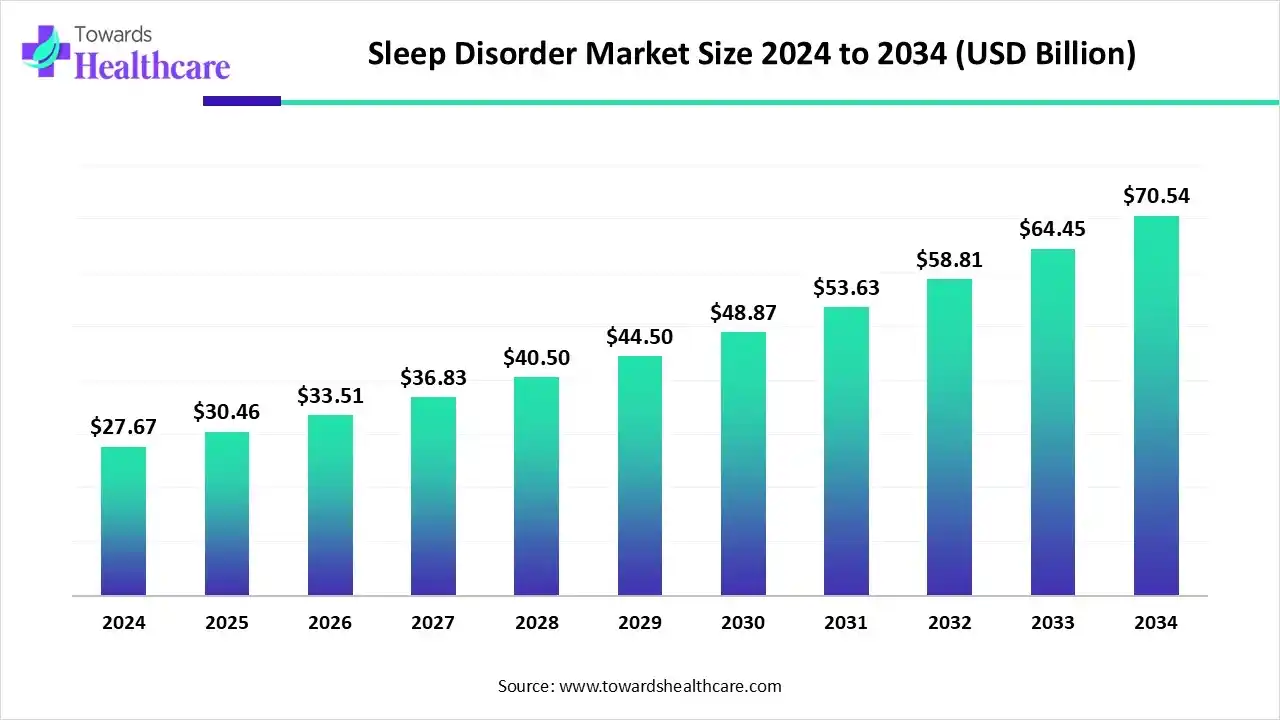

The global sleep disorder market size is calculated at US$ 27.67 billion in 2024, grew to US$ 30.46 billion in 2025, and is projected to reach around US$ 70.54 billion by 2034. The market is expanding at a CAGR of 10.03% between 2025 and 2034.

One of the main causes of the market expansion for sleep disorders is the increasing prevalence of conditions including narcolepsy, insomnia, sleep apnea, and restless legs syndrome. Modern lives that involve high levels of stress, erratic work schedules, and excessive use of digital gadgets have an impact on sleep health. As the cost of treating sleep problems rises, this has resulted in the widespread commercialisation of treatment choices including cutting-edge medications, modern sleep aids, and sophisticated diagnostic and therapeutic instruments.

| Table | Scope |

| Market Size in 2025 | USD 30.46 Billion |

| Projected Market Size in 2034 | USD 70.54 Billion |

| CAGR (2025 - 2034) | 10.03% |

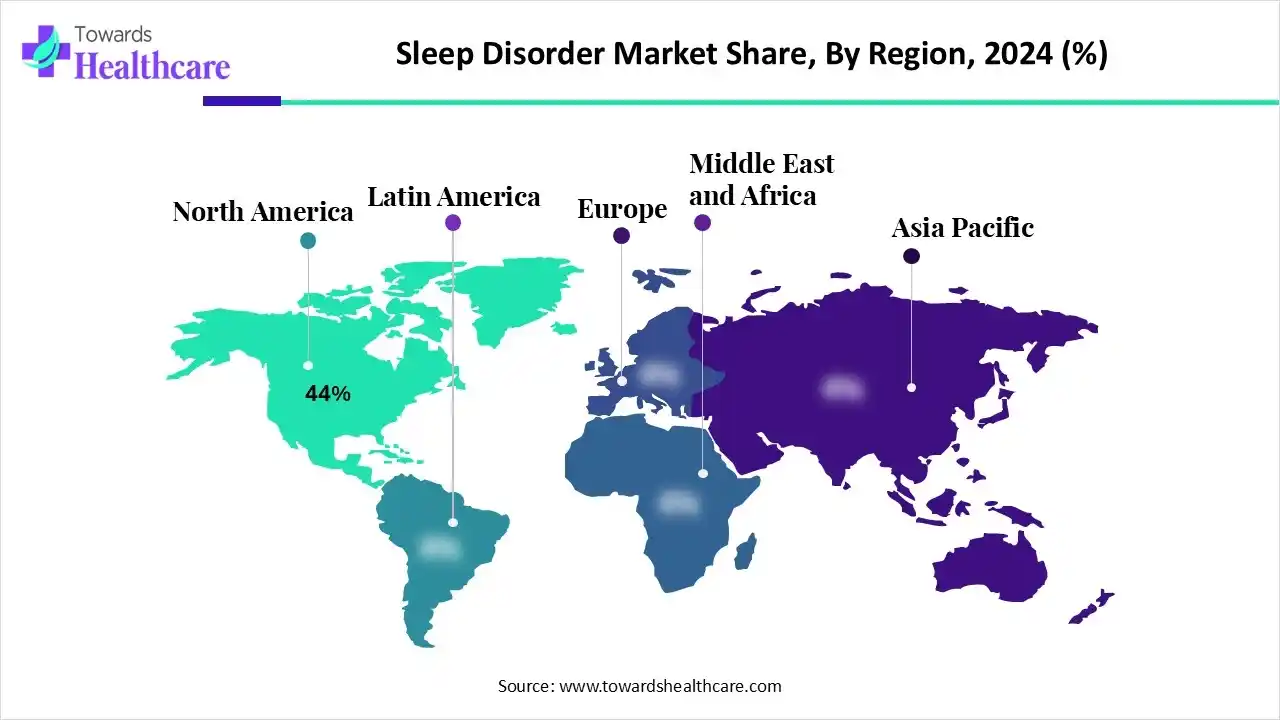

| Leading Region | North America by 44% |

| Market Segmentation | By Disorder Type, By Diagnosis & Monitoring, By Treatment Type, By End User, By Technology, By Region |

| Top Key Players | ResMed Inc., Philips Respironics (Koninklijke Philips N.V.), Fisher & Paykel Healthcare, Compumedics Limited, Natus Medical Inc., Itamar Medical (ZOLL Medical / Asahi Kasei), Vyaire Medical Inc., BMC Medical Co., Ltd., SomnoMed Ltd., GlaxoSmithKline (GSK), Merck & Co., Inc., Jazz Pharmaceuticals plc, Harmony Biosciences, Eisai Co., Ltd., Idorsia Pharmaceuticals Ltd., Takeda Pharmaceutical Company, Teva Pharmaceutical Industries, Sanofi S.A., Braeburn Pharmaceuticals, Pear Therapeutics (Digital CBT-I tools) |

Growing awareness, rising obesity rates, an aging population, and better screening are driving market expansion. These disorders, including insomnia, sleep apnea, restless leg syndrome, narcolepsy, circadian rhythm disorders, and parasomnias, significantly affect quality of life and contribute to chronic diseases like cardiovascular disorders, diabetes, and depression.

The sleep disorder market comprises diagnostics, therapeutics, and devices designed to identify, manage, and treat a range of sleep-related conditions. Continuous advances in sleep technology (home-based diagnostics, AI-driven analysis, connected CPAP devices, wearable trackers) and new pharmacological therapies make this an evolving and high-growth healthcare segment.

Compared to other medical specialities, a significant amount of physiological data is collected in the field of sleep medicine. AI is paving the way for advances in this industry. Beyond autoscoring, AI has the potential to transform sleep medicine by facilitating better management of sleep disorders, early identification, and individualised therapy. Beyond the apnea-hypopnea index, artificial intelligence (AI) is being used to enhance the diagnosis of sleep disorders such obstructive sleep apnea (OSA). Research on sleep medicine may be advanced and patient care can be enhanced by combining AI and ML with big data.

| Category | Drug/Type | Description/Notes |

| Melatonin receptor agonists | Ramelteon | MT1 and MT2 receptor agonist. Its use in children is not approved, being anecdotal |

| Alpha-agonists | Clonidine | They prevent norepinephrine from being released. recommended for children with attention deficit hyperactivity disorder and Tourette syndrome who have sleeplessness. |

| Guanfacine | ||

| Antidepressants | Tricyclics: amitriptyline, doxepin.. | Because of their sedative effects, antidepressants with histamine H1 receptor antagonist activity are used to treat insomnia. However, their usage in children is not well-established, while amitriptyline may be taken into consideration for the prevention of recurrent migraines in children and antidepressants with mental comorbidities. |

| Atypical: mirtazapine, trazodone | ||

| SSRI: fluvoxamine, citalopram | ||

| Benzodiazepines | Anxiolytic and hypnotic effects. Agagonists of the GABA receptor. Although they are not recommended for treating paediatric insomnia, certain children with mental comorbidities may benefit from them because of their anxiolytic impact | |

| Non-benzodiazepine GABA agonists | Zolpidem | Indication for adult insomnia. Two clinical trials in children with zolpidem and zopiclone do not show improvement in sleep in children. |

| Zopiclone | ||

| Plants with sedative effects | Lavender, passionflower, lemon balm, and valerian oil |

Questionable effectiveness. Anxiolytic and sleep-facilitating effect. |

By disorder type, the insomnia segment led the sleep disorder market in 2024, accounting for approximately 37% of the market revenue. For 10% of people, chronic sleeplessness is still a major problem. One of the most prevalent sleep problems among the elderly is insomnia, and by 2050, there will be an estimated two billion older persons worldwide, up from the current 200 million.

By disorder type, the sleep apnea segment is expected to be the fastest-growing during the forecast period. An estimated 936 million adults worldwide suffer with OSA, which raises healthcare expenses 2.5 times more than those of non-OSA sufferers if left untreated. When direct medical expenditures, lost productivity, and accident-related expenses are taken into account, the yearly societal cost of untreated OSA in the United States currently surpasses USD 150 billion. Significant worldwide expenses are also highlighted by recent research, with estimates of yearly expenditures per patient reaching up to EUR 28,000 in the United States and EUR 1700–5000 in Europe.

By diagnosis & monitoring, the polysomnography (PSG) segment led the sleep disorder market in 2024, accounting for approximately 45% of the market revenue. One essential diagnostic technique for assessing sleep problems is PSG. Physicians can establish precise diagnosis and create effective treatment programmes because to PSG's comprehensive evaluation of sleep phases, architecture, and different sleep disorders.

By diagnosis & monitoring, the home sleep testing (HST) segment is expected to be the fastest-growing during the forecast period. They created the home sleep test (HST). When compared to PSG, the HST offers the following benefits: a short waiting period, low cost, ease of use and less interference, and the possibility to test patients in their homes in their natural sleeping environment. Those with a high pre-test chance of developing sleep apnea are the best candidates for this test.

By treatment type, the devices segment led the market in 2024, accounting for approximately 52% of the market revenue. One disorder that might interfere with sleep is sleep apnea. Therefore, it is essential to make sure that this issue is treated as effectively as possible. It is possible to cure this disease and have a decent night's sleep by using gadgets like CPAP machines, position pillows, mouthpieces, tennis balls, or hypoglossal nerve stimulators.

By treatment type, the pharmacological therapy segment is expected to be the fastest-growing during the forecast period. Pharmacological treatment for sleep disorders, such as parasomnias, narcolepsy, insomnia, or restless legs syndrome (RLS), is individualised for each illness. The optimal course of therapy reduces adverse effects and dependency risk while enhancing sleep or wakefulness.

By end-user, the sleep clinics & hospitals segment led the market in 2024, accounting for approximately 58% of the market revenue. Patients with sleep disorders who also have major medical diseases including obesity, obstructive respiratory disorders, or heart problems can be treated in a hospital-based sleep unit. They provide 24/7 emergency support through quick response teams that can be at the patient's bedside right away to aid those in severe distress.

By end-user, the home care settings segment is expected to be the fastest-growing during the forecast period. By offering individualised treatment plans that are catered to each patient's requirements, home health care plays a critical part in controlling sleep problems. Given that around one-third of US individuals have sleep disturbances, home health clinicians are able to perform thorough evaluations of patients' sleeping settings and routines.

By technology, the fixed pressure devices segment led the sleep disorder market in 2024, accounting for approximately 53% of the market revenue. Acute cardiogenic pulmonary edoema, obstructive sleep apnea, and some mild acute respiratory distress syndrome instances are all commonly treated with CPAP. Weaning off of mechanical ventilation, preventing respiratory failure after extubation, and perioperative respiratory support are further therapeutic uses.

By technology, the auto-adjusting devices segment is expected to be the fastest-growing during the forecast period. An APAP machine, also referred to as an auto-CPAP, is a more sophisticated form of CPAP that automatically modifies the positive airflow based on the needs of each individual. APAP devices are frequently a successful method of treating OSA symptoms with little disruption since they adjust to each user's unique breathing patterns.

North America dominated the market share by 44% in 2024. North America is also known for its substantial investments in research and development, as well as its sophisticated healthcare infrastructure. As they create new sleep aids, prescription medications, and over-the-counter formulations for customers to use, large corporations and startups are constantly at the forefront of innovation and product launches. Cultural awareness of health and wellness is driving the industry forward, as more people are looking for holistic and natural solutions in addition to prescription drugs.

There is only one sleep doctor for every 43,000 individuals, despite the fact that over 70 million Americans suffer from sleep problems. This is comparable to a sold-out Citi Field relying on only one doctor. Millions of people are left waiting for care or remaining untreated as a result of this scarcity, and avoidable sleep problems covertly increase the expense of healthcare and chronic illnesses.

In September 2025, leading sleep health technology company Sunrise Group today announced a $29 million investment round to spread its digital sleep clinic, Dreem Health, over all 50 states.

In August 2025, Seven well-known sleep health businesses have been acquired by Resolve Sleep Health, the industry leader in Canada for sleep health goods and services: Aveiro Sleep, CanSleep, Parkland CPAP Services, SleepMedix, Chinook Respiratory Care, FreshAir Respiratory Care, and Breathe Well. With this calculated move, Resolve's expanding network now has 120 clinics coast to coast, including 38 new clinics spread across four provinces.

Asia Pacific is estimated to host the fastest-growing sleep disorder market during the forecast period. The region is influenced by a number of variables, including the shifting lifestyles brought about by urbanisation, which has affected many people's general health. This is raising awareness of the advantages of treating sleep disorders. Japan, China, and India are concentrating on technology developments that will help the region's development.

In September 2025, Eight Sleep, a sleep technology business, said that it has raised $100 million in fresh capital to develop artificial intelligence capabilities for its products, enter the medical field, and grow internationally, notably in China.

In August 2025, the Sleep Company fundraising: Through a combination of main and secondary fundraising rounds, The Sleep Company has raised Rs 480 crore. Over the next two years, it intends to expand its network of 160 stores in 47 cities by adding 130 to 150 new locations. Fireside Ventures, an early supporter, partially withdrew from the deal through secondary share sales.

Europe is estimated to grow at a significant rate in the sleep disorder market during the forecast period. The diagnosis and treatment of sleep disorders have become more popular in European nations as a result of growing concern for sleep-related health and wellbeing. The market is expanding in this region due to the ageing population and increased awareness of the negative effects of sleep disorders on general health. Additionally, technological developments and partnerships between medical facilities and research groups support the growth of the European sleep disorder industry.

In May 2025, Zeus Sleep, a Hampshire-based firm, has received a £150,000 investment from the British Design Fund to assist expedite the development of its innovative sleep apnea and snoring remedies.

By Disorder Type

By Diagnosis & Monitoring

By Treatment Type

By End User

By Technology

By Region

February 2026

February 2026

February 2026

February 2026