March 2026

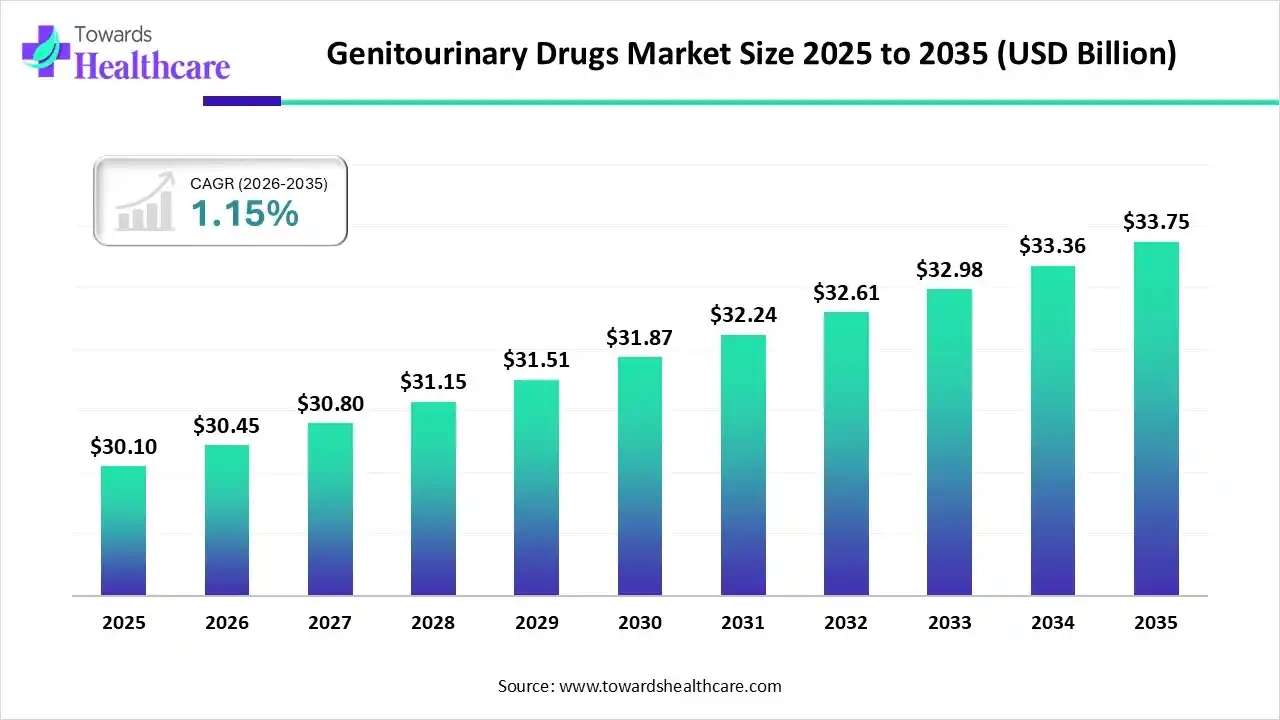

The global genitourinary drugs market size was estimated at USD 30.1 billion in 2025 and is predicted to increase from USD 30.45 billion in 2026 to approximately USD 33.75 billion by 2035, expanding at a CAGR of 1.15% from 2026 to 2035.

Across the world, increasing cancer cases, such as prostate cancer, bladder cancer, and other gynaecological conditions, are fueling demand for advanced therapies. Whereas the FDA is pushing major approvals for these candidates and other immersive treatments.

| Key Elements | Scope |

| Market Size in 2026 | USD 30.45 Billion |

| Projected Market Size in 2035 | USD 33.75 Billion |

| CAGR (2026 - 2035) | 1.15% |

| Leading Region | North America |

| Market Segmentation | By Indication, By Product, By Region |

| Top Key Players | Abbott, Bristol-Myers Squibb Co., Novartis AG, Genentech, Inc., Eli Lilly and Company, Merck & Co., Inc., Pfizer, Inc., AstraZeneca, GlaxoSmithKline, Bayer AG |

Specifically, the global genitourinary drugs market covers drugs used in treating the urinary tract and reproductive organs. However, the worldwide market is mainly driven by a rise in instances of GU disorders, including incontinence, BPH, and cancers, as well as ongoing major R&D investment yielding newer therapies, such as ADCs and biologics, and expanding awareness. At the same time, the key players have received approval for diverse therapies, particularly a combination of pembrolizumab (Keytruda) and enfortumab vedotin (Padcev) as neoadjuvant therapy for adults with muscle-invasive bladder cancer. As well as TAR-200 shown positive results in BCG-unresponsive bladder cancer.

AI algorithms are fostering innovations in diverse kinds of drugs, including genitourinary drugs, which encompass the latest FDA-authorized Paige Prostate Detect by Paige AI. This has major applications in detecting prostate cancer in core needle biopsies, which supports pathologists with optimized workflow effectiveness. Besides this, PROGRxN-BCa was established as an AI-driven model for non-muscle-invasive bladder cancer, which was demonstrated to outperform existing clinical risk calculators in estimating cancer growth.

A prominent trend in the market is the exploration of various targeted interventions in oncology, such as Antibody-Drug Conjugates, hormonal therapies, and different combination therapies for prostate cancer and other GU cancers.

Robust firms are promoting innovations in the sustained-release injectables and depot formulations, as well as intravesical and topical therapies, like nano-formulated creams and direct bladder instillation for localized treatment.

The globe is leveraging integrated telemedicine platforms for remote patient monitoring, consultation, and direct-to-consumer prescription refills for accelerating treatment adherence for conditions, particularly erectile dysfunction and incontinence.

Which Indication Dominated the Genitourinary Drugs Market in 2025?

In 2025, the prostate cancer segment held the biggest share of the market. In this year, nearly 313,780 new cases of prostate cancer were reported in the United States, and it is anticipated to rise to approximately 2.9 million annually by 2040 across the globe. Recently approved Pasritamig (JNJ-78278343) is a first-in-class, bispecific T-cell engager that targets human kallikrein 2 for metastatic castration-resistant prostate cancer (mCRPC) in early-stage trials.

Interstitial Cystitis

The interstitial cystitis segment is predicted to register the fastest growth. According to a study, there are from 52 to 500 cases per 100,000 females and 8 to 41 cases per 100,000 males around the world. Recently, Sunobinop has shown positive results from a Phase 1b clinical study in patients with IC/BPS. Whereas Certolizumab pegol (Cimzia), a monoclonal antibody, is under Phase 3 development for the treatment of IC.

How did the Hormonal Therapy Segment Lead the Market in 2025?

The hormonal therapy segment held the biggest revenue share of the genitourinary drugs market in 2025. Globally, accelerating cases of menopause, andropause (male hypogonadism), PCOS, and prostate cancer are bolstering demand for these therapies. However, Vaginal DHEA (Prasterone) is a locally applied therapy, which converts into both estrogen and androgen within vaginal cells, also facilitates a mechanism to recognize variations of GSM symptoms, like improved sexual function.

Gynecological

Moreover, the gynecological segment will expand rapidly. Nowadays, the population is increasingly demanding contraceptives, novel cancer treatments, like ADCs, PARP inhibitors, and better diagnostics is supporting the respective progressions. The recent developments include Blujepa (gepotidacin), a first-in-class oral antibiotic, which is used to treat uncomplicated UTIs in women and girls aged 12 and older. Alongside, injectable platelet-rich fibrin (i-PRF) or platelet-rich plasma (PRP) are implemented as non-hormonal treatment alternatives for GSM symptoms.

North America held a major revenue share of the genitourinary drugs market in 2025, due to the rising prevalence of BPH, CKD, and incontinence, strengthening awareness of GU health & advancements in drug R&D for newer therapies. Also, the regional companies are encouraging innovations in novel cancer solutions and oral antibiotics.

U.S. Market Trends

Additionally, the U.S. market has been pushing novel FDA approvals for bladder cancer, prostate cancer, and uncomplicated urinary tract infections (UTIs). For example, UGN-102 was developed by UroGen Pharma & it received FDA approval of its NDA for this drug for low-grade, intermediate-risk NMIBC.

The highest growth of the genitourinary drugs market in the Asia Pacific is driven by ongoing extensive developments in excellent diagnostics, treatment facilities, and healthcare access across APAC countries. Apart from this, the region is fostering investments in R&D of novel drugs, like next-generation anti-infectives for antibiotic-resistant UTIs and advanced cancer treatments.

India Market Trends

Furthermore, India will expand fastest, as the government is exploring incentives, like India's Jan Aushadhi Scheme, which emphasizes raising the accessibility and cost-effectiveness of generic drugs and biosimilars.

Europe is predicted to witness notable growth in the genitourinary drugs market. However, the European Association of Urology (EAU) recently revealed updated guidelines for urological infections and bladder cancer. This focuses on offering clear guidance on treatment solutions, such as a robust focus on non-antibiotic treatments, including ibuprofen for cystitis, where appropriate.

Germany Market Trends

The latest AWMF S2 guidelines focus on using symptomatic treatments for mild acute cystitis to lower overall antibiotic consumption. Alongside, Germany unveiled innovative reimbursement models, like for Hemgenix, which is anticipated to widen expensive GU oncology drugs.

| Company | Description |

| Abbott | It specializes in diagnostic tests for bladder cancer and sexually transmitted infections (STIs), and some pharmaceuticals emphasize women's health. |

| Bristol-Myers Squibb Co. | This facilitates treatments for kidney, bladder, and prostate cancers. |

| Novartis AG | A firm primarily focuses on prostate cancer and rare kidney diseases, with recently approved Pluvicto for prostate cancer and Fabhalta and Vanrafia for kidney diseases. |

| Genentech, Inc. | It introduced Tecentriq (atezolizumab), an immunotherapy approved for particular types of bladder and urinary tract cancer. |

| Eli Lilly and Company | Its rigorous product is Cialis (tadalafil) for erectile dysfunction and benign prostatic hyperplasia. |

| Merck & Co., Inc | This offers diverse genitourinary (GU) drugs in oncology, such as KEYTRUDA (pembrolizumab) and WELIREG (belzutifan). |

| Pfizer, Inc. | It focuses on drugs used in treating prostate, bladder, and kidney cancers. |

| AstraZeneca | This unveiled Imfinzi and Lynparza for bladder cancer & prostate cancer, respectively. |

| GlaxoSmithKline | It has received approval for oral antibiotic Blujepa (gepotidacin), used for uncomplicated urinary tract infections (uUTIs) and urogenital gonorrhea. |

| Bayer AG | This explores drugs in prostate cancer and chronic kidney disease, such as Nubeqa and Xofigo. |

By Indication

By Product

By Region

March 2026

March 2026

March 2026

March 2026