February 2026

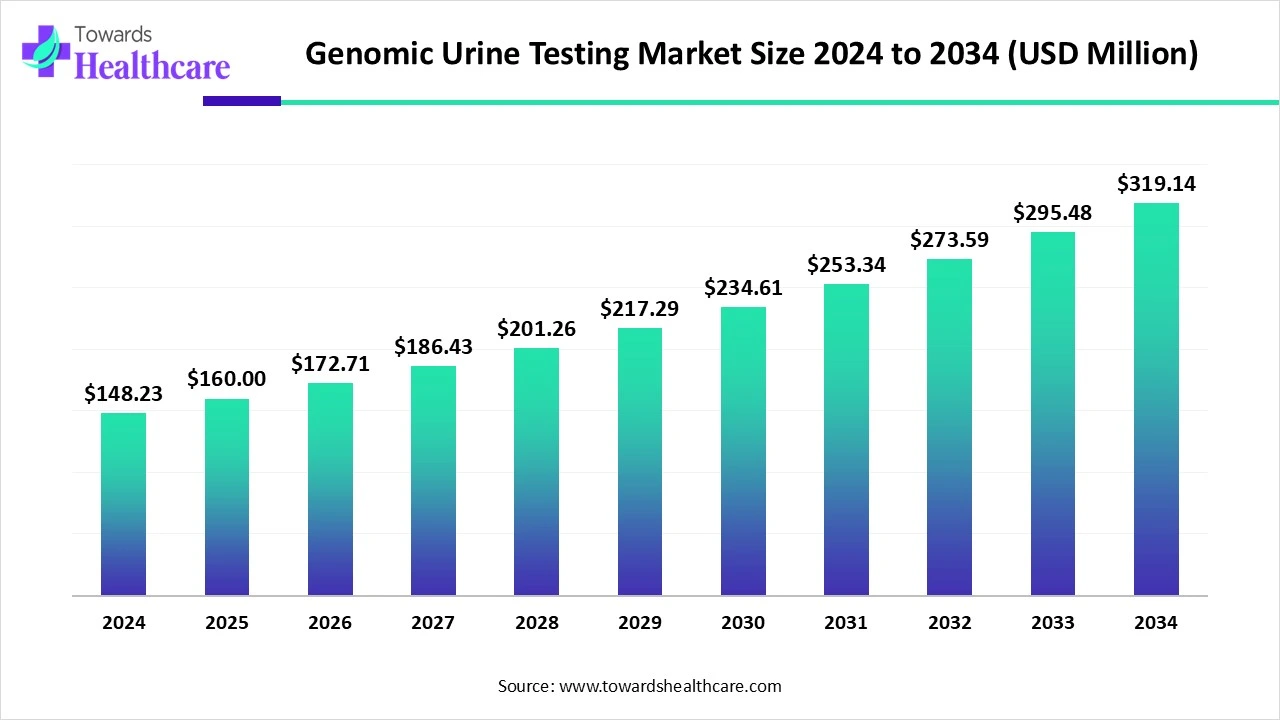

The global genomic urine testing market size is calculated at US$ 148.23 in 2024, grew to US$ 160 million in 2025, and is projected to reach around US$ 319.14 million by 2034. The market is expanding at a CAGR of 7.94% between 2025 and 2034.

The genomic urine testing market is rapidly expanding because of growing demand for non-invasive diagnostics tools, particularly for cancer, urological, and kidney related disease. This method can detect genetic mutation and infection in a urine sample. North America is diminished due to advancements in technology, such as next-generation sequencing and molecular diagnostics. The Asia Pacific region is the fastest-growing due to an increasing aging population, rising demand for personalized medicines, and increasing prevalence of chronic conditions, which drive the market growth.

| Metric | Details |

| Market Size in 2025 | USD 160 Million |

| Projected Market Size in 2034 | USD 319.14 Million |

| CAGR (2025 - 2034) | 7.94% |

| Leading Region | North America |

| Market Segmentation | By Application, By Distribution Channel, By Region |

| Top Key Players | QIAGEN, Becton, Dickinson and Company (BD), Eurofins Scientific, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., Exact Sciences Corporation, Natera, Inc., Genomic Health (a subsidiary of Exact Sciences), Guardant Health, Myriad Genetics, Inc., Roche Diagnostics, NeoGenomics Laboratories, Pathnostics, OPKO Health, Inc., Invitae Corporation, Biodesix, Inc., Veracyte, Inc., Lucence Health, Novogene Corporation |

The genomic urine testing market is rapidly growing because urine testing supports the diagnosis of a broad range of disorders, such as kidney disease, diabetes, liver issues, urinary tract infections (UTIs), and bladder cancer. Genetic testing provides valuable information that informs decisions about the medical care a family member receives. Genomic urine assays are effective at detecting recurrences, sometimes even before clinical diagnosis. Recent research indicates that testing for genetic mutations in urine can identify bladder cancer years in advance of visible clinical symptoms. Overall, genomic urine testing represents a powerful tool for enhancing the management of bladder cancer and potentially other cancers by offering crucial insights into tumor biology, facilitating early detection, and supporting personalized treatment approaches, which contributes to the growth of the genomic urine testing market.

The integration of AI in genomic urine testing is driving market growth, as artificial intelligence has become significant for interpreting genetic testing data. It effectively sifts through large datasets and detects sequencing challenges. AI enhances the accuracy, speed, and effectiveness of data analysis in most genetic tests. AI-driven genetic testing improves diagnostic accuracy, speeds up genome analysis, and boosts preventive healthcare initiatives. As a powerful tool for recognizing genetic mutations, AI-driven technology enables scientists to rapidly and precisely analyze extensive data. This cutting-edge technology enables mutation detection, paving the way for personalized medicine and targeted therapies.

For Instance,

Increasing Aging Population

As the population ages, the tobacco epidemic persists, and occupational chemical exposure rises in developing communities, a significant increase in bladder cancer incidence is anticipated. Smoking remains the primary risk factor for bladder cancer. Furthermore, risk factors are related to specific occupations, including painters, metal workers, leather workers, miners, plastic manufacturers, and firefighters. Bladder cancer is prevalent, with smoking and workplace exposure to suspected carcinogens being the primary risk factors. This increasing demand for genomic urine testing for screening and monitoring contributes to the growth of the genomic urine testing market.

High Cost Challenges

The price of a genomic test is 2 to 3 times greater than that of a traditional test. Moreover, genomic tests generate a significantly larger volume of data initially. Consequently, more resources are necessary for data storage and analysis, resulting in cost discrepancies that hinder the expansion of the genomic urine testing market.

Recent Advancements in Next-Generation Sequencing (NGS)

Recent advancements in next-generation sequencing (NGS) and artificial intelligence (AI) are significantly enhancing the future of personalized medicine. NGS provides the most thorough assessment of the urinary microbiome, identifying microorganisms more effectively than conventional tests like Ctx in both urine and stone samples. Additionally, standard urine cultures can reveal microorganisms in patients who show no symptoms. While Ctx does not offer a reliable gold standard test, it remains uncertain whether NGS can effectively address these shortcomings, presenting a promising opportunity for the genomic urine testing market.

By application, the bladder cancer surveillance segment dominated in the genomic urine testing market in 2024, as genomic urine tests are valuable to detect reappearances, sometimes before the recurrences are diagnosed clinically, which is called the anticipatory effect, or urine tests are applicable to rule out atypical abnormalities of patients with irradiated bladders. A recent advance in genomic urine test, which supports physicians to accurately predict bladder cancer as many as 12 years before clinical symptoms and signs emerge and long before a diagnosis is made with cystoscopy, the most usual process of detection, according to a new study presented at the 2023 American Urological Association (AUA).

The primary detection segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as genome analysis of urine DNA is more effective than urine cytology as a diagnostic tool. The effortlessness of sampling, combined with being rapid and convenient as compared with other traditional tests and procedures. Offers relevant, consistent information related to patient health conditions, which increases demand in the market.

By distribution channel, the hospital pharmacies segment is dominant in the genomic urine testing market in 2024, as it grows in communication with prescribers and other health professionals, superior input in prescribing decisions about medicine, and administration. Hospital pharmacists are accountable for the compounding of various healthcare products for patient administration. They offer convenient access to medications for outpatient and inpatient clinics, modernize inventory management, and contribute to expense savings through negotiation and optimal drug utilization.

The specialty pharmacies segment is expected to fastest-growing over the forecast period 2025 to 2035 as specialty pharmacy offers additional knowledge to care teams, which enhances the patient’s therapy management plan. Specialty pharmacy solutions allow health systems to eliminate much of the organisational burden from providers when prescribing these types of medications. Specialty pharmacy handles chronic, rare, and often challenging medical conditions that need an increased level of patient management.

North America is dominant in the genomic urine testing market with the largest revenue share as increasing advanced electronic health records are used in the healthcare and clinical care administration to capture a variety of medical information from individual patients longer period, as well as to manage healthcare workflows. Presence of modern healthcare infrastructure, strong research ecosystem, and predominant investments in genomics and AI. Rising genomic initiatives support healthcare stakeholders’ detection of genetic variants that raise risk for disease, diagnose people earlier and avoid disease, progress companion diagnostics to personalize treatment with advanced genomic testing, and accelerate the discovery, which contributes to the growth of the market.

For Instance,

In the United States, growing advanced technologies and cost-effective solutions are renovating healthcare. The requirement for personalized medicine and novel treatments is growing in response to the collective number of diseases in the United States. Genomic testing solutions are rising, and numerous health systems are taking the initiative to open specialty pharmacies to support improved service for their patients, which increases the growth of the market.

In Canada, there is a growing demand for genomic testing with expensive NGS technologies among both patients and clinicians. Canada increases breakthroughs in genetic testing, from the discovery of T-cell receptor and the stem cells to the identification of genes involved in urine genomic testing, which contributes to the growth of the market.

The Asia Pacific region is projected to experience the fastest growth in the genomic urine testing market during the forecast period, due to the increasing government-driven precision medicine initiatives focused on affordable, non-invasive testing, established by its provision of most of the capital for initiatives related to the development of advanced technology in Asia Pacific. Genomic testing is growing from a focus on diagnosis at the patient level to prevention at the population level, which contributes to the growth of the genomic urine testing market.

In China, increasing bladder cancer incidence and mortality have escalated dominantly, driven by urbanization, an aging population, and a huge prevalence of risk factors, which drives the growth of the genomic urine testing market. China’s healthcare sector is largely driven by government policies intended to enable rapid urban advancement. The Chinese government has made huge investments in modern infrastructure adoption, which contributes to the growth of the market.

The increasing rate of healthcare startups by 28 %, attracting the maximum number of novel investments in the Indian startup sector, along with fintech fashions. The Indian diagnostics field is on the rise, supported by advanced technology, strategic mergers, and evolving. In India increasing demand for personalized healthcare, integrating genetic testing, AI-driven diagnostics, and digital medical records to detect and prevent various diseases, is causing the growth of the market.

Europe is expected to grow significantly in the genomic urine testing market during the forecast period, due to increasing bladder cancer incidence, which is the fifth most common cancer in Europe, affecting more than 200,000 people per year. It is caused due to changes to the cells of the bladder and is often connected with exposure to some chemicals. Genomic urine testing simplifies early diagnosis of disease, enhances the prognosis of disease results, and allows targeted therapeutic interventions based on an extraordinary understanding of the fundamental molecular features of patients.

For Instance,

Increasing genomic urine testing in Germany is driven by a growing number of aging individuals and their extended periods of poor health, which affect life spans, particularly in the form of age-related diseases, which increases the demand for genomic urine testing. Germany has a largely self-governed devolved curative healthcare system of nursing care, rehabilitative, hospital, and outpatient care for which the Ministry of Health sets the regulatory frame, which also increases the demand for genomic urine testing.

In January 2025, Eric Lefkofsky, Founder and CEO of Tempus, states, “Tempus announces its first-ever, whole-genome sequencing assay, xH. xH is our first product leveraging the full genome in our effort to offer meaningful insights into complex diseases.” (Source - Tempus)

By Application

By Distribution Channel

By Region

February 2026

February 2026

January 2026

January 2026