February 2026

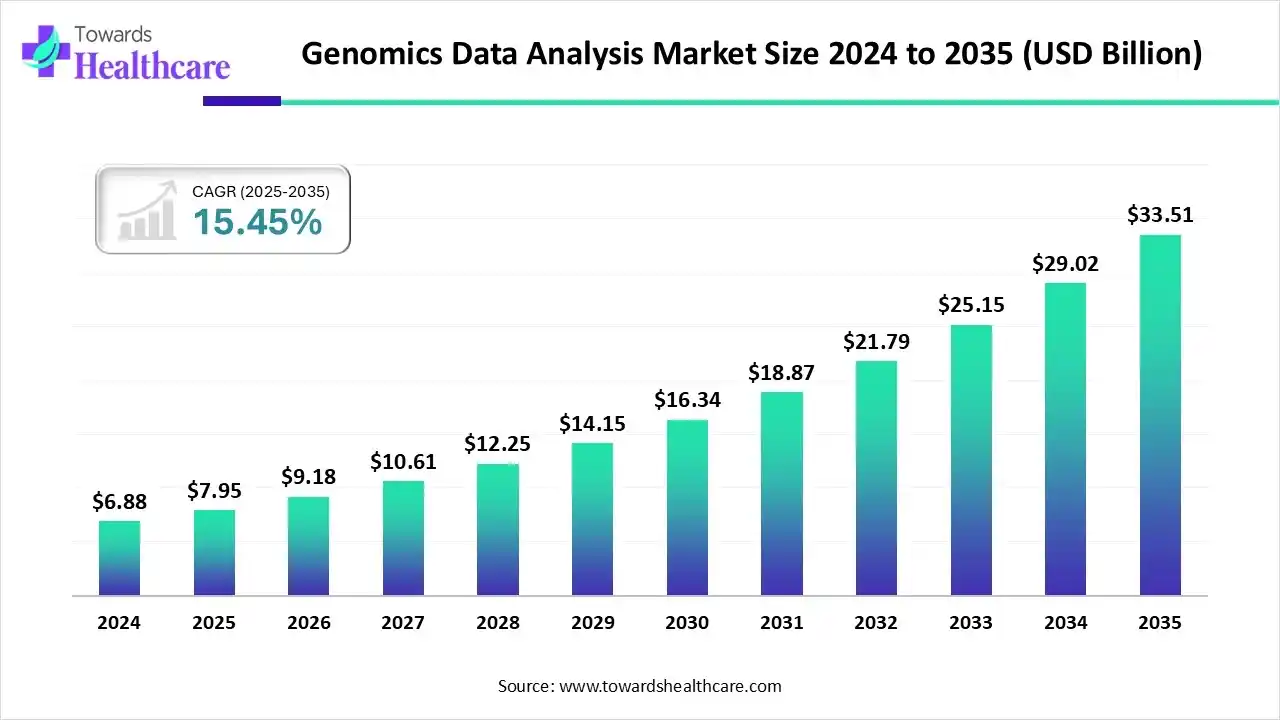

The genomics data analysis market size was reported at US$ 7.95 billion in 2025 and is expected to rise to US$ 9.18 billion in 2026. According to forecasts, it will grow at a CAGR of 15.45% to reach US$ 33.51 billion by 2035.

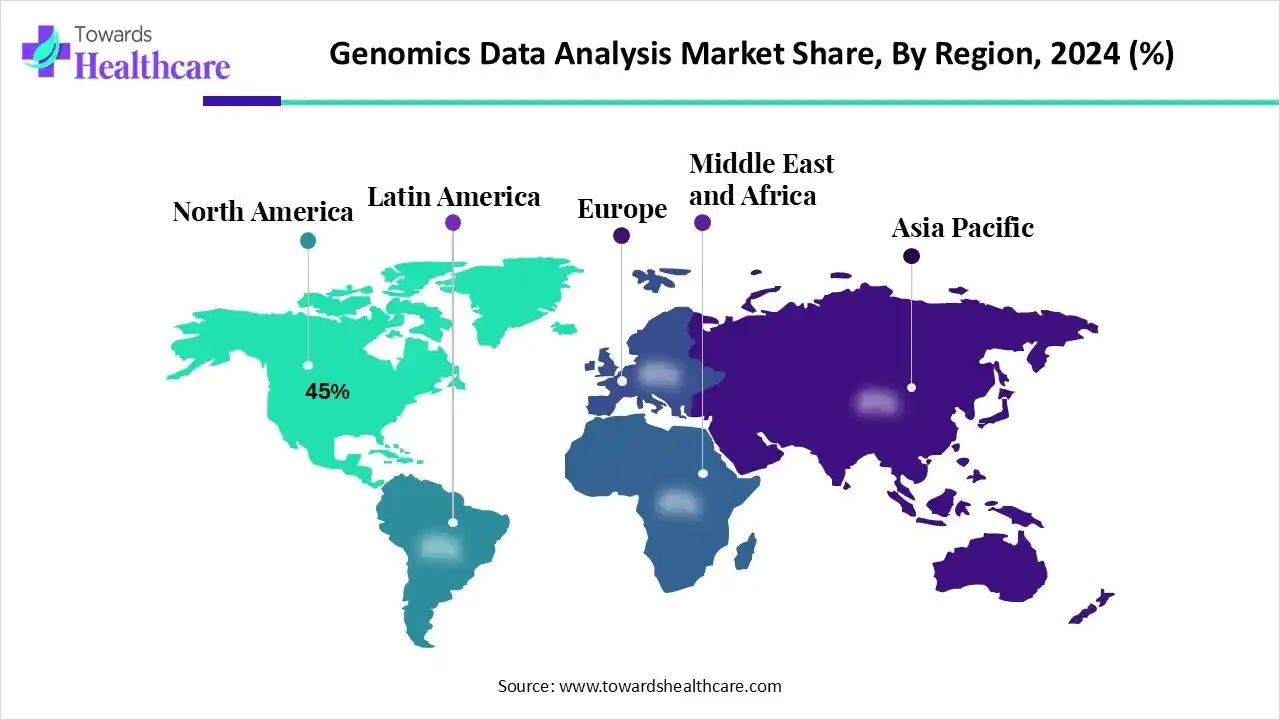

The genomics data analysis market is expanding rapidly, driven by declining sequencing costs, rising precision medicine demand, and large-scale genomic studies. North America leads the market, supported by advanced infrastructure and strong research investments.

| Table | Scope |

| Market Size in 2025 | USD 7.95 Billion |

| Projected Market Size in 2035 | USD 33.51 Billion |

| CAGR (2026 - 2035) | 15.45% |

| Leading Region | North America by 45% |

| Market Segmentation | By Analysis Function / Workflow, By Technology / Data Type Supported, By Deployment / Delivery Model, By End User, By Offering / Revenue Model, By Region |

| Top Key Players | Illumina, Thermo Fisher Scientific, QIAGEN Digital Insights, Roche / Foundation Medicine, DNAnexus, Seven Bridges, SOPHiA GENETICS, Fabric Genomics, PierianDx / Optra Health, Golden Helix, Partek, WuXi NextCODE / WuXi AppTec, Benchling, Google Cloud / Microsoft Azure / Amazon Web Services, PerkinElmer / Congenica, Bioinformatics CROs & service providers, Edico/DRAGEN technology, Veracyte / Natera / Invitae, NextCODE-derived platforms and regional analytics vendors, Startups & specialist vendors |

Genomics data analysis is the process of examining and interpreting DNA and genetic data to identify genes, variation, and biological functions that help in understand diseases, developing targeted therapies, and advanced precision medicine. The Genomics Data Analysis Market comprises software, cloud platforms, bioinformatics pipelines, analytics services, and professional expertise used to process, interpret, and deliver actionable insights from genomic and multi-omics data (WGS/WES, targeted panels, RNA-seq, single-cell, epigenomics, metagenomics).

It spans raw-data processing (basecalling, alignment), variant calling & annotation, structural/complex-variant analysis, expression & single-cell workflows, clinical interpretation and reporting (germline/somatic), population-scale analytics (cohort GWAS/PheWAS), and enterprise data management (LIMS, data lakes, knowledge graphs, regulatory/compliance workflows). Growth is driven by falling sequencing costs, expanded clinical genomic testing, precision medicine initiatives, population sequencing projects, RNA and single-cell adoption, and rising demand for cloud/AI-enabled interpretation and real-world evidence.

For Instance,

AI is revolutionizing the global market by enabling faster data interpretation, accurate variant detection, and predictive modeling. It enhances precision medicine, automates complex workflows, and drives discoveries in disease diagnosis, drug development, and personalized healthcare solutions, significantly improving efficiency and outcomes.

How does the Primary Data Processing Segment dominate the Genomics Data Analysis Market in 2024?

In 2024, the primary data processing segment held the largest market share, with the revenue shares of approximately 22% due to the massive surge in raw sequencing data generated through next-generation sequencing (NGS) technologies. This segment plays a crucial role in ensuring data accuracy, alignment, and quality control, which are essential for downstream analysis, reliable interpretation, and precise insights in genomic research and clinical applications.

Clinical Interpretation & Reporting

The clinical interpretation & reporting segment is projected to grow at the fastest CAGR during in the genomics data analysis market the forecast period due to the rising demand for precision medicine, genetic testing, and personalized treatment plans. Increasing clinical adoption of genomics in disease diagnosis, coupled with AI-driven analytical tools that enhance accuracy and interpretation speed, is further driving the segment's rapid expansion across hospitals, research centers, and diagnostic laboratories.

Variant Calling & Annotation

The variant calling and annotation segment is expected to grow at a notable rate during the forecast period due to increasing advancements in next-generation sequencing (NGS) technologies and the rising need for accurate identification of genetic mutations. Growing applications in disease diagnosis, drug discovery, and personalized medicine, along with the integration of AI and bioinformatics tools for precise genomic interpretation, are further accelerating the segment’s growth globally.

Why Did the Short-read DNA Segment Dominate the Genomics Data Analysis Market in 2024?

The short-read DNA segment dominated the market with the highest revenue share of approximately 46% due to its high accuracy, cost-effectiveness, and scalability for large-scale genomic projects. Its widespread use in clinical diagnostics, cancer genomics, and popular studies, along with established platforms like Illumina, has made it the preferred technology for reliable and efficient DNA analysis across research and clinical applications.

Single-cell & Spatial Transcriptomics

The single-cell & spatial transcriptomics segment is expected to grow at the fastest CAGR during the forecast period due to its ability to provide detailed cellular and spatial insights into gene expression. Rising applications in cancer research, drug discovery, and precision medicine, along with continuous technological advancements and increased funding for single-cell analysis, are driving its rapid adoption across research and clinical settings globally.

RNA Sequencing

The RNA sequencing segment is expected to grow at a notable rate in the genomics data analysis market during the forecast period due to its ability to provide comprehensive insights into gene expression, regulation, and transcript variation. Increasing application in cancer genomics, biomarker discovery, and personalized medicine, coupled with advancements in sequencing technologies and data analysis tools, are further accelerating the adoption of RNA sequencing in research and clinical diagnostics.

For Instance,

What made the Cloud-based SaaS Platforms Segment Dominant in the Genomics Data Analysis Market in 2024?

In 2024, the cloud-based SaaS platforms segment held the largest market share of approximately 48% and is projected to grow at the fastest CAGR due to its scalability, cost-effectiveness, and flexibility in handling large genomics datasets. The increasing adoption of cloud computing for data storage, real-time analysis, and collaboration among researchers and clinicians, along with enhanced data security and integration of AI-driven tools, is further boosting the demand for cloud-based genomics data analysis solutions globally.

On-premise Licensed Software

The on-premise licensed segment is expected to grow at a notable rate in the genomics data analysis market during the forecast period due to the increasing need for data security, control, and customization in genomics research. Organizations handling sensitive patients or genomic data prefer on-premise solutions to ensure regulatory compliance, protect intellectual property, and maintain direct access to high-performance computing resources for complex genomic data analysis.

How does the Pharmaceutical & Biotechnology R&D Segment dominate the Genomics Data Analysis Market in 2024?

In 2024, the pharmaceutical & biotechnology R&D segment led the genomics data analysis market with the largest revenue share of approximately 32% due to increasing adoption of genomics in drug discovery, biomarker identification, and precision medicine development. Growing investments in genomic research, clinical trials, and the integration of AI and bioinformatics tools have further strengthened the role of this segment in accelerating therapeutic innovation and personalized treatment approaches.

Clinical Diagnostic Laboratories & Hospitals

The clinical diagnostic laboratories & hospitals segment is expected to grow at the fastest CAGR during the forecast period due to the increasing use of genomics in disease diagnosis, personalized treatment, and preventive healthcare. The rising demand for rapid and accurate genetic testing, integration of AI-driven diagnostic tools, and expanding adoption of precision medicine are driving significant growth in this segment across healthcare facilities worldwide.

Academic & Research Institutes/Care facilities

The academic and research institute/core facility segment is expected to grow at a notable rate in the genomics data analysis market during the forecast period due to the increasing focus on genomics-based research, government funding, and collaborative projects. Growing adoption of advanced sequencing and bioinformatics tools for studying genetic variations, disease mechanisms, and molecular biology is further driving the segment’s expansion across universities, research centers, and public genomic research facilities.

Why does the Software Licenses & Subscriptions Segment dominate the Genomics Data Analysis Market in 2024?

In 2024, the software licenses & subscriptions segment held the highest market share of approximately 38% due to its flexible pricing models, continuous software updates, and accessibility to advanced analytical features. The growing demand for scalable genomic data analysis tools, along with the increasing preference for cloud-based subscriptions that reduce infrastructure costs and ensure data security, has further driven the adoption of this revenue model among research and healthcare organizations.

Annotation & Curation Services

The annotation & curation services segment is expected to grow at a faster CAGR in the genomics data analysis market during the forecast period due to the rising demand for accurate genomic data interpretation and integration. The increasing complexity of sequencing datasets, the need for expert validation, and the growing adoption of AI and bioinformatics tools to enhance data accuracy and usability are driving the rapid expansion of this service segment across research and clinical applications.

Cloud Compute/Storage & Data Egress

The cloud compute/ storage & data egress segment is expected to grow at a notable rate during the forecast period due to the exponential rise in genomic data generation and the need for scalable, secure, and cost-efficient storage solutions. Increasing adoption of cloud infrastructure for real-time data access, collaborative research, and AI-driven genomic analysis is further driving the segment’s growth across global healthcare and research institutions.

North America dominated the genomics data analysis market in 2024 with a greater revenue share of approximately 45% due to its advanced healthcare infrastructure, strong presence of key market players, and extensive government and private investments in genomic research. The region’s early adoption of next-generation sequencing technologies, integration of AI and cloud computing, and growing emphasis on precision medicine and personalized healthcare further strengthened its leadership position in generating high revenues from genomics data analysis solutions.

The U.S. is transforming the genomics data analysis market through significant investments in precision medicine, large-scale genomic initiatives, and advanced bioinformatics infrastructure. Strong support from government programs like the NIH and private sector collaborations is accelerating innovation. Additionally, the integration of AI, cloud computing, and next-generation sequencing technologies is enhancing data accuracy, scalability, and real-time analysis, positioning the U.S. as a global leader in genomics-driven healthcare advancements.

Asia-Pacific is accelerating the genomics data analysis market through increasing government funding, expanding genomic research initiatives, and rising adoption of precision medicine. Countries like China, Japan, and India are investing heavily in sequencing technologies, data infrastructure, and AI integration. The growing prevalence of genetic diseases, coupled with the establishment of regional genomics centers and collaborations with global players, is further driving market growth and innovation across the region.

India has launched several initiatives to strengthen its genomics data analysis capabilities, including the Genome India Project, which aims to map the genetic diversity of the Indian population. The government is also promoting genomic research through collaborations between research institutes, biotech firms, and hospitals. Additionally, investments in bioinformatics infrastructure, AI integration, and precision medicine programs are enhancing the country’s capacity for large-scale data analysis and personalized healthcare advancements.

Europe has undertaken several key initiatives to advance the genomics data analysis market, including the 1+ Million Genomes Initiative, which aims to share and analyze genomic data across EU countries. The region is also investing in precision medicine, bioinformatics infrastructure, and cross-border research collaborations. Support from the European Commission and partnerships between academic institutions, biotech firms, and healthcare providers are further driving innovation and integration of genomics into clinical practice.

The UK is advancing the genomics data analysis market through the adoption of AI-driven diagnostic tools, 3D imaging, and digital workflow integration in dental practices. The National Health Service (NHS) and private clinics are investing in technologies like intraoral scanners and CAD/CAM systems to enhance accuracy, patient experience, and treatment efficiency. Additionally, government support for digital healthcare transformation is accelerating the adoption of advanced dental technologies nationwide.

South America is accelerating the market through increasing investments in genomic research, collaborations with international organizations, and the establishment of regional genomic databases. Countries like Brazil and Mexico are leading initiatives in population genomics and precision medicine. Growing government support, advancements in sequencing technologies, and partnerships with global biotech firms are enhancing regional capabilities, driving innovation, and expanding access to genomics-based healthcare solutions across the region.

Brazil is transforming the genomics data analysis market through major investments in genomic research, national sequencing programs, and biotechnology innovation. Initiatives like the Brazilian Genome Program aim to study genetic diversity and improve disease understanding. Collaboration between research institutes, universities, and global biotech firms, along with advancements in bioinformatics and precision medicine, is driving Brazil’s leadership in Latin America’s genomics ecosystem and expanding access to personalized healthcare solutions.

The Middle East and Africa are contributing to the expansion of the genomics data analysis market through increasing adoption of advanced dental technologies, growing healthcare investments, and rising awareness of oral health. Countries such as the UAE, Saudi Arabia, and South Africa are embracing AI-powered imaging, CAD/CAM systems, and tele-dentistry solutions. Government initiatives promoting digital healthcare transformation are further enhancing accessibility and driving modernization across dental care facilities in the region.

The United Arab Emirates (UAE) is advancing the genomics data analysis market through strong investments in healthcare technology and innovation. Dental clinics are increasingly adopting AI-based diagnostic tools, 3D imaging, and CAD/CAM systems to enhance precision and patient outcomes. Government initiatives promoting digital health transformation and partnerships with global dental technology providers are further accelerating the UAE’s leadership in modern, tech-driven dental care.

Company Overview

Key Developments and Strategic Initiatives

Technological Capabilities / R&D Focus

Competitive Positioning

SWOT Analysis

Recent News and Updates

Company Overview

Key Developments and Strategic Initiatives

Technological Capabilities / R&D Focus

Competitive Positioning

SWOT Analysis

Recent News and Updates

| Company | Offerings | Recent Breakthroughs |

| Illumina, Inc. | Sequencing technologies, multi-omics workflows, bioinformatics/AI tools | Launched a 5-base solution enabling simultaneous genomic variant + DNA methylation detection from a single sample for multi-omic insights. Collaborated with NVIDIA to develop AI-/multi-omic analytics on the Illumina Connected Analytics platform. |

| QIAGEN Digital insights | Bioinformatics, knowledge-based interpretation tools for NGS data | Acquired AI-powered software provider Genoox (platform “Franklin”) to enhance clinical genomics decision-support. Launched the “PGXI” pharmacogenomics knowledgebase, enabling faster gene-drug insight generation. |

| DNAnexus, Inc | Cloud-based enterprise platform for genomic & multi-omics data management and analysis | Recognized by Frost & Sullivan with the 2024 Global Enabling Technology Leadership Award for its ability to integrate clinical, multi-omics, and real-world data. Also partnered with Panomics, Inc. to deliver interactive multi-omics analytics for biopharma. |

| Roche/Foundation Medicine | Comprehensive genomic profiling (CGP) tests, diagnostics, and genomics data analytics in oncology | Entered a partnership in France to transfer the FoundationOne® Liquid CDx technology (liquid biopsy CGP) to a major cancer center, expanding access to advanced genomics testing. |

By Analysis Function / Workflow

By Technology / Data Type Supported

By Deployment / Delivery Model

By End User

By Offering / Revenue Model

By Region

February 2026

December 2025

December 2025

November 2025