Revenue, 2025

USD 5.78 Billion

Forecast, 2035

USD 15.04 Billion

Rapid Microbial Testing Market Trend for 2026

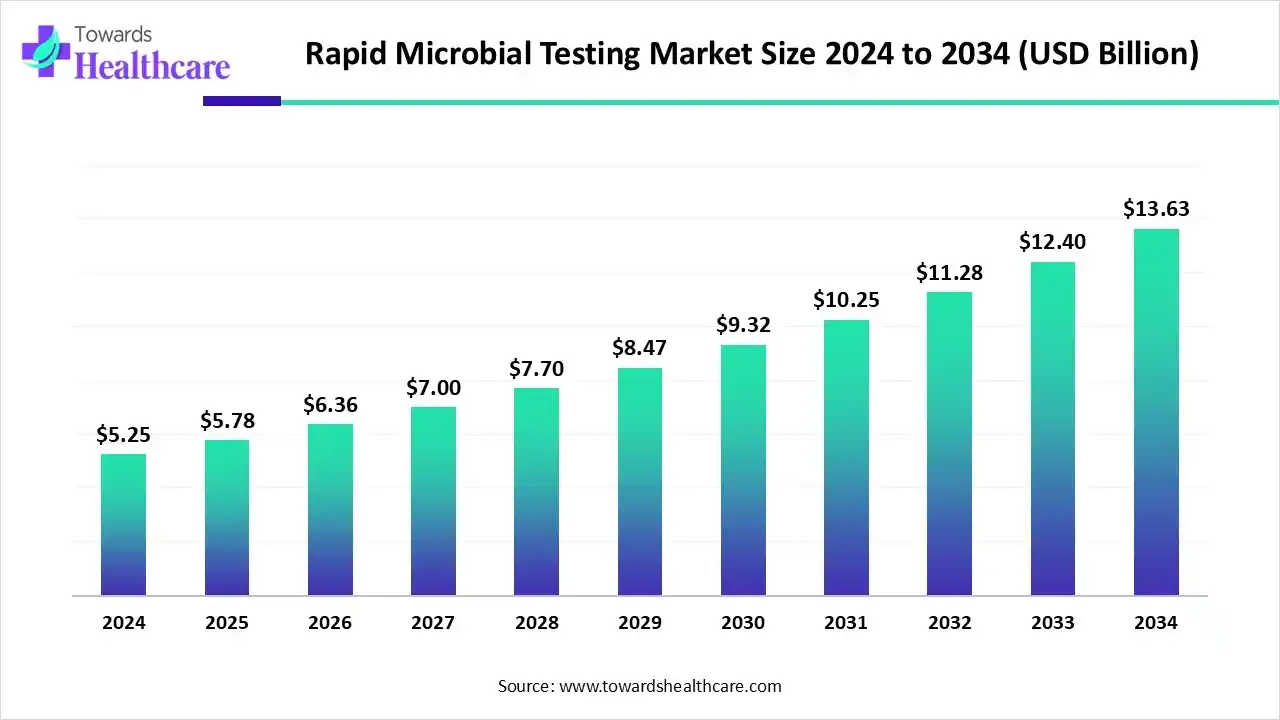

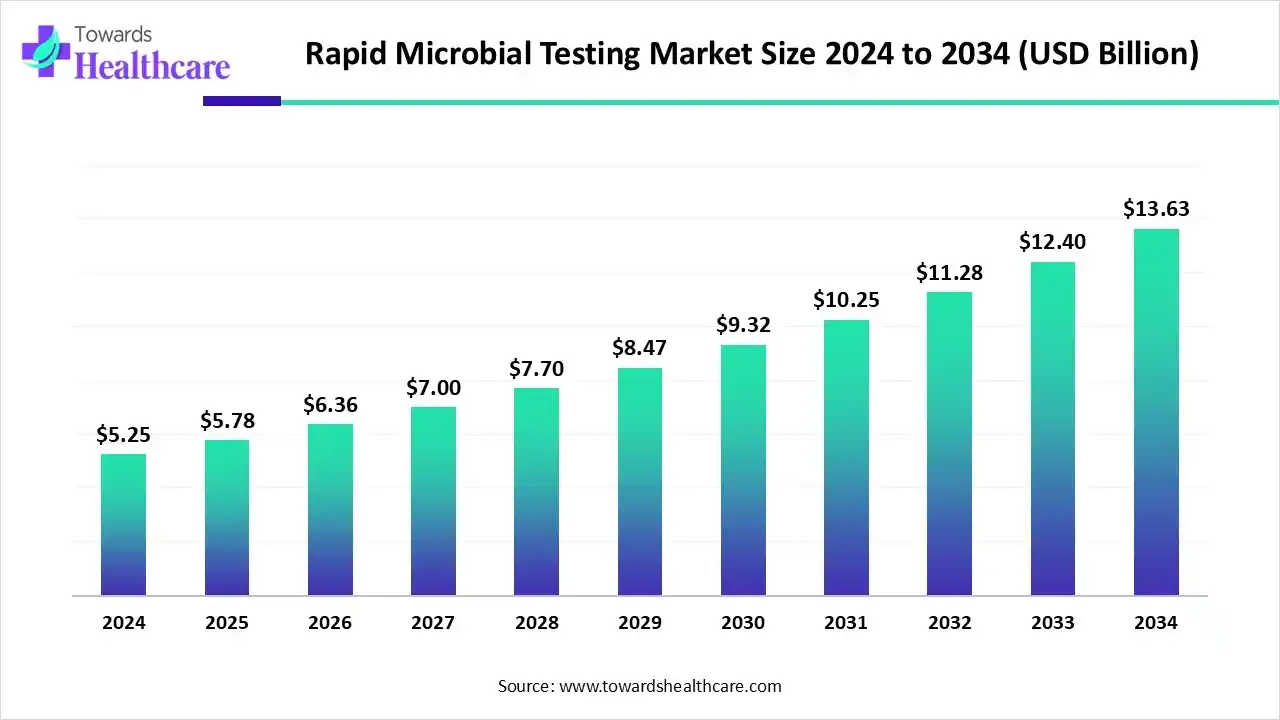

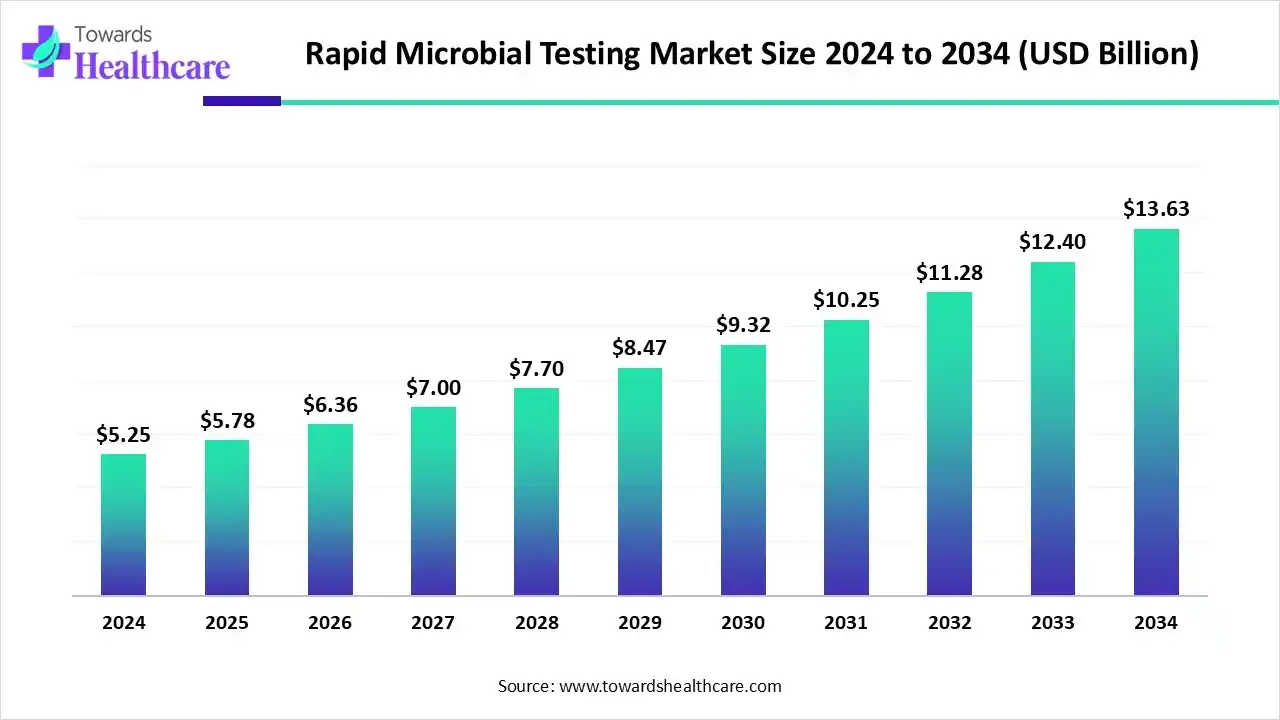

The rapid microbial testing market size marked US$ 5.78 billion in 2025 and is forecast to experience consistent growth, reaching US$ 6.36 billion in 2025 and US$ 15.04 billion by 2035 at a CAGR of 10.04%.

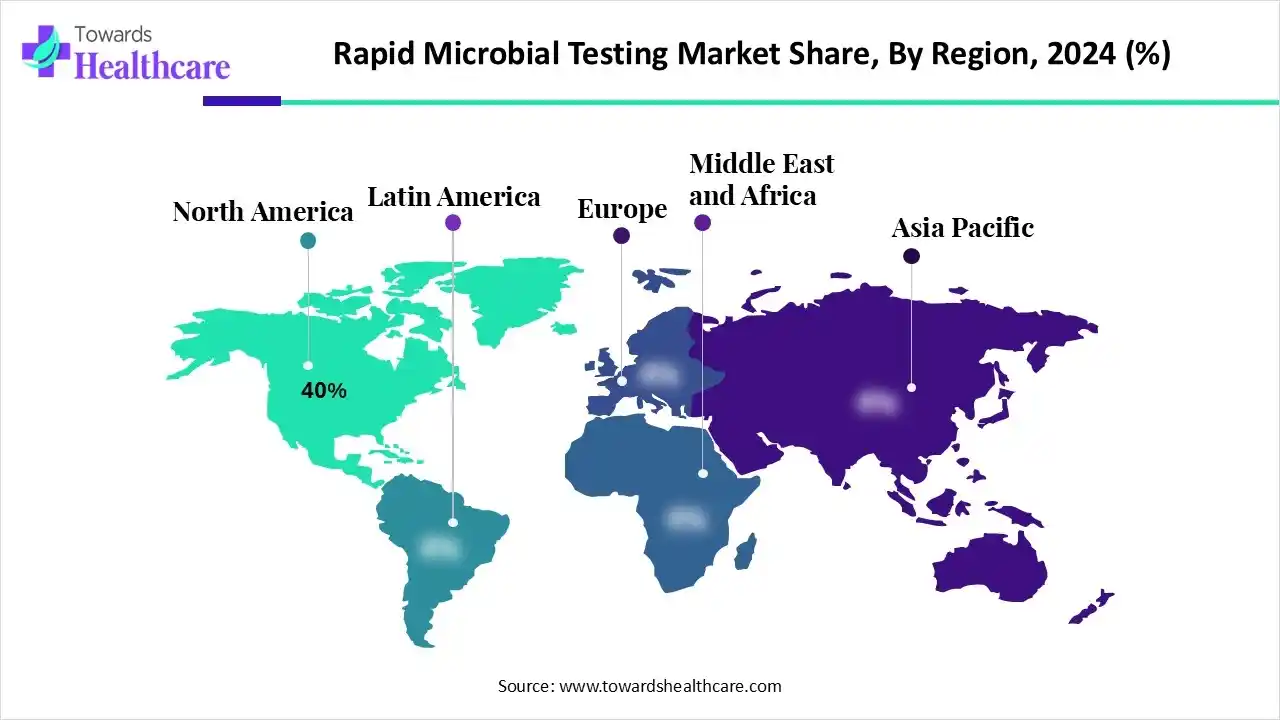

The rapid microbial testing market is witnessing strong growth driven by rising infectious diseases, stringent safety regulations, and advancements in molecular diagnostics and automation. Increasing demand for faster contamination detection in pharmaceuticals, food, and water industries further supports expansion. North America leads the market, followed by Europe, due to advanced infrastructure and high R&D investments.

Key Takeaways

- Rapid microbial testing sector pushed the market to USD 6.36 billion by 2026.

- Long-term projections show USD 15.04 billion valuation by 2035.

- Growth is expected at a steady CAGR of 10.04% in between 2026 to 2035.

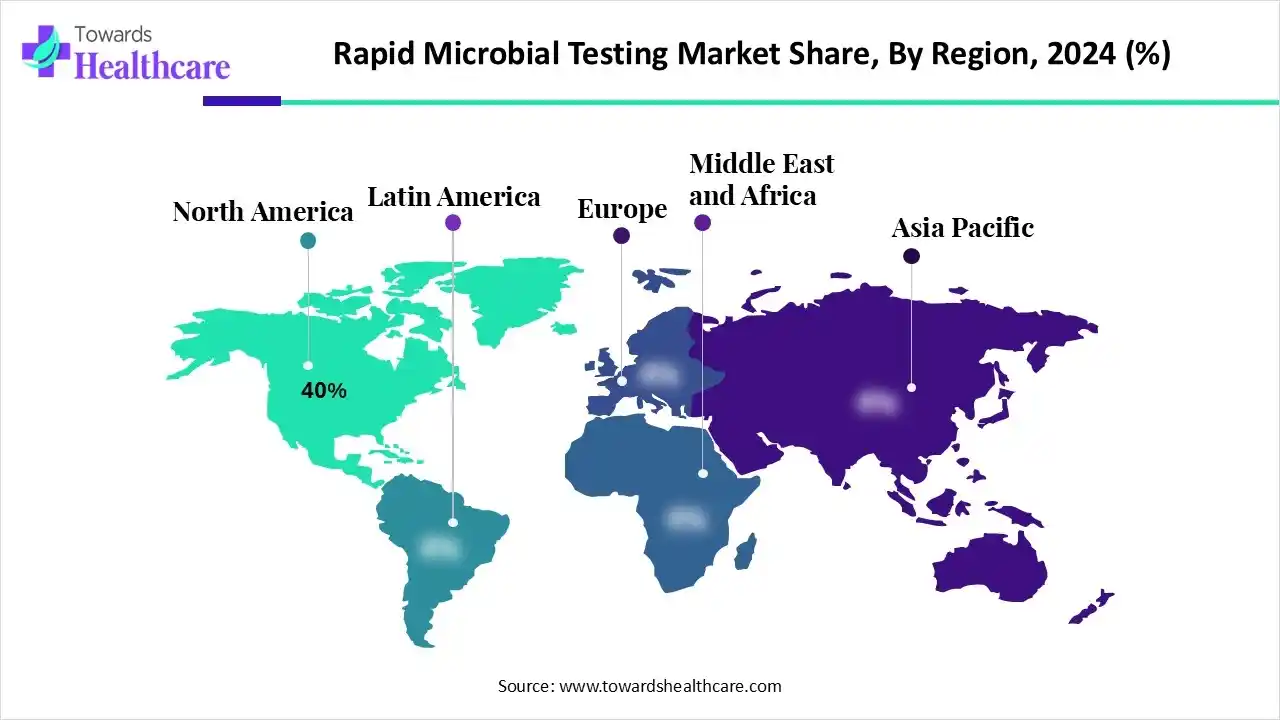

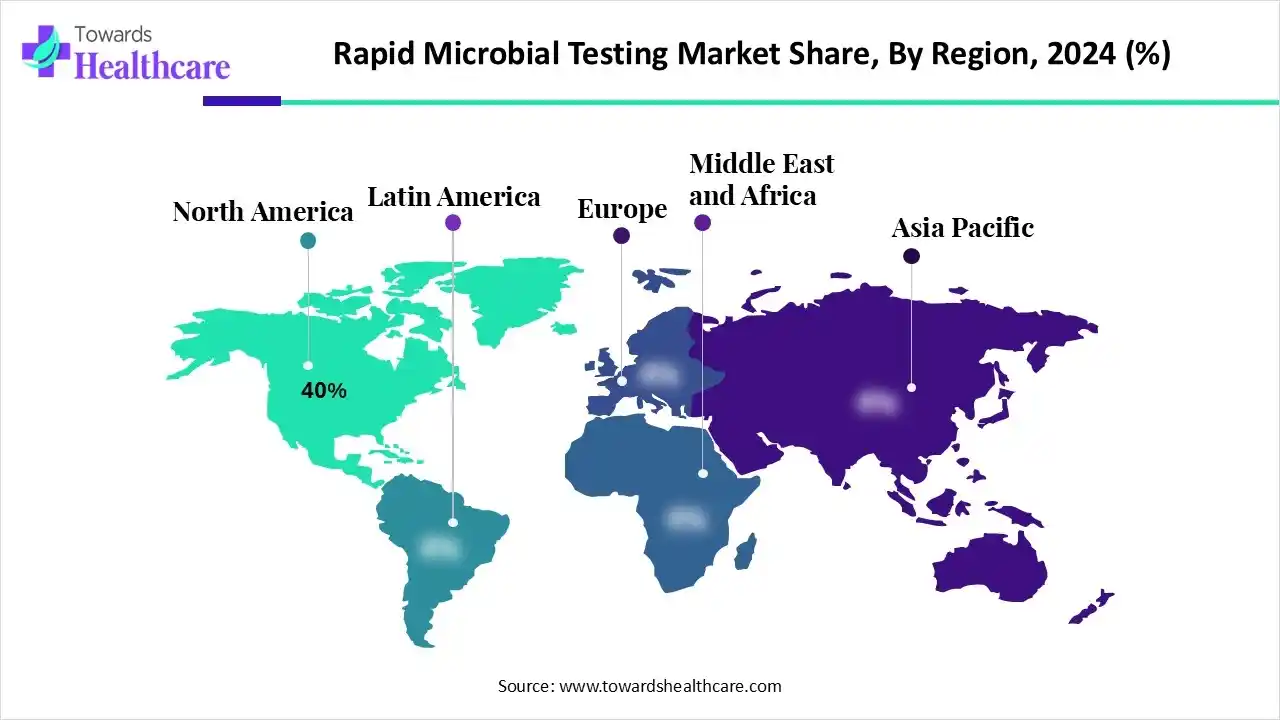

- North America dominated the veterinary rapid microbial testing market with a revenue share of approximately 40% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast Period.

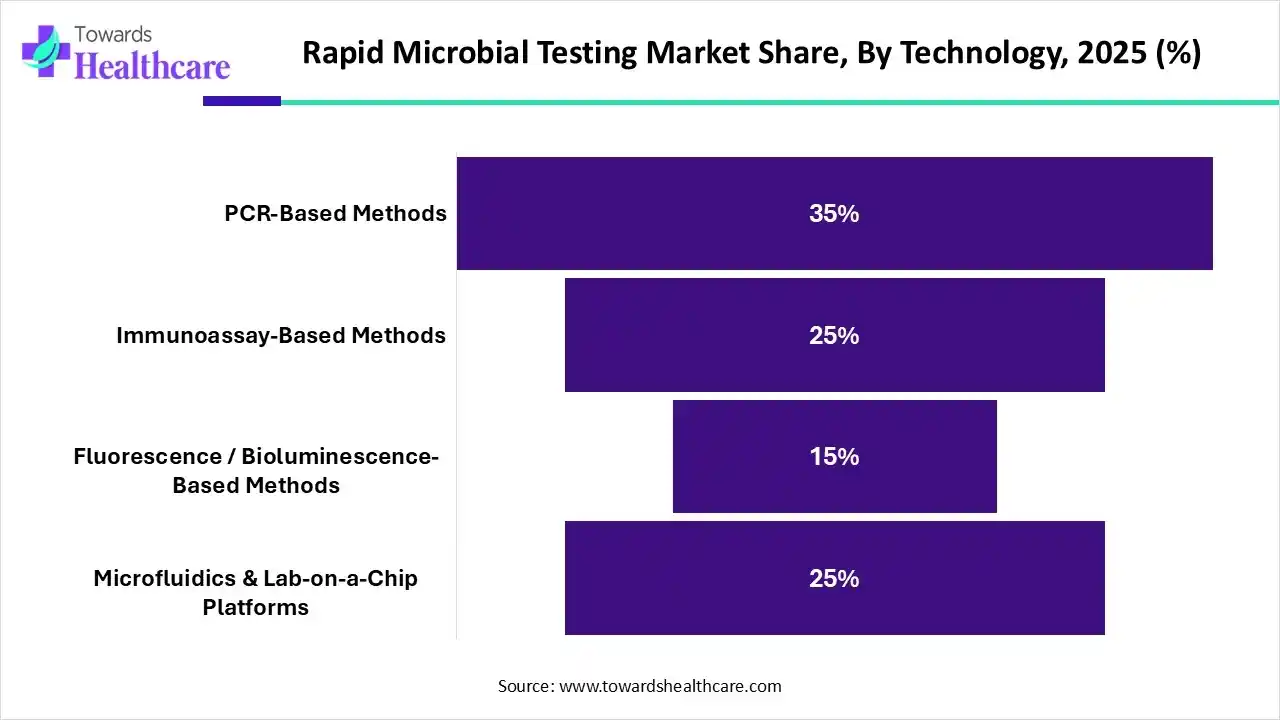

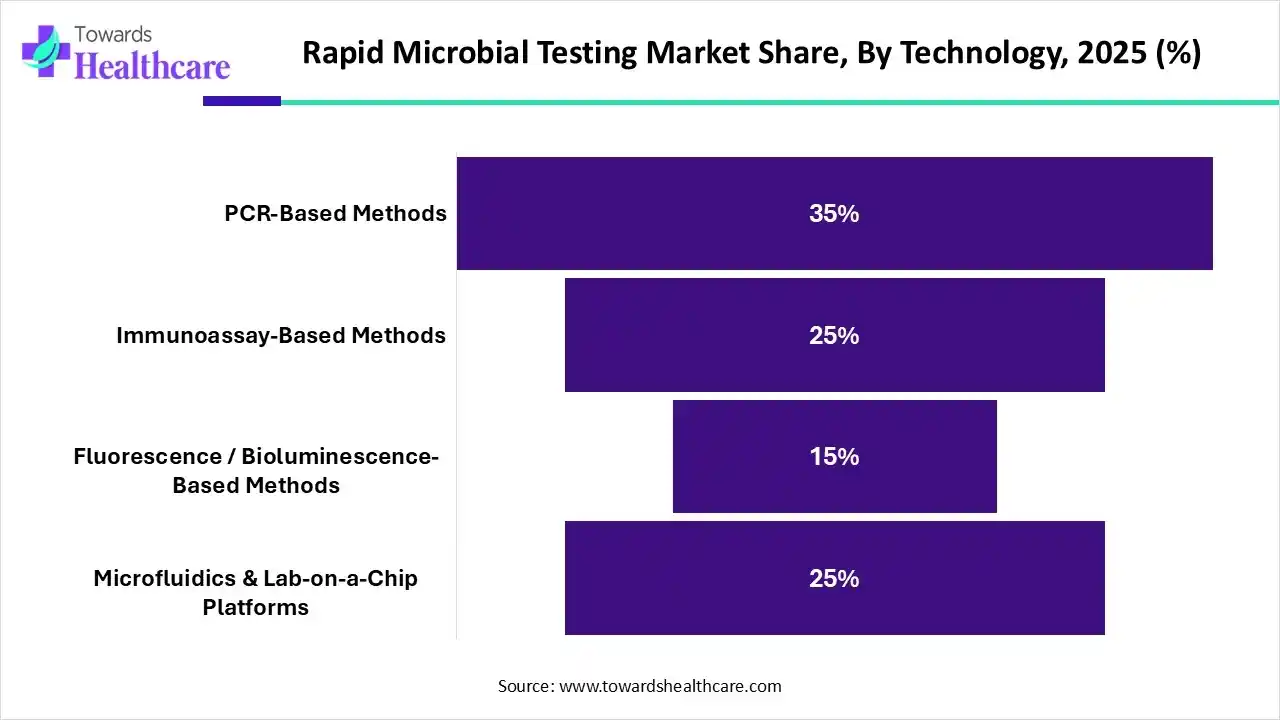

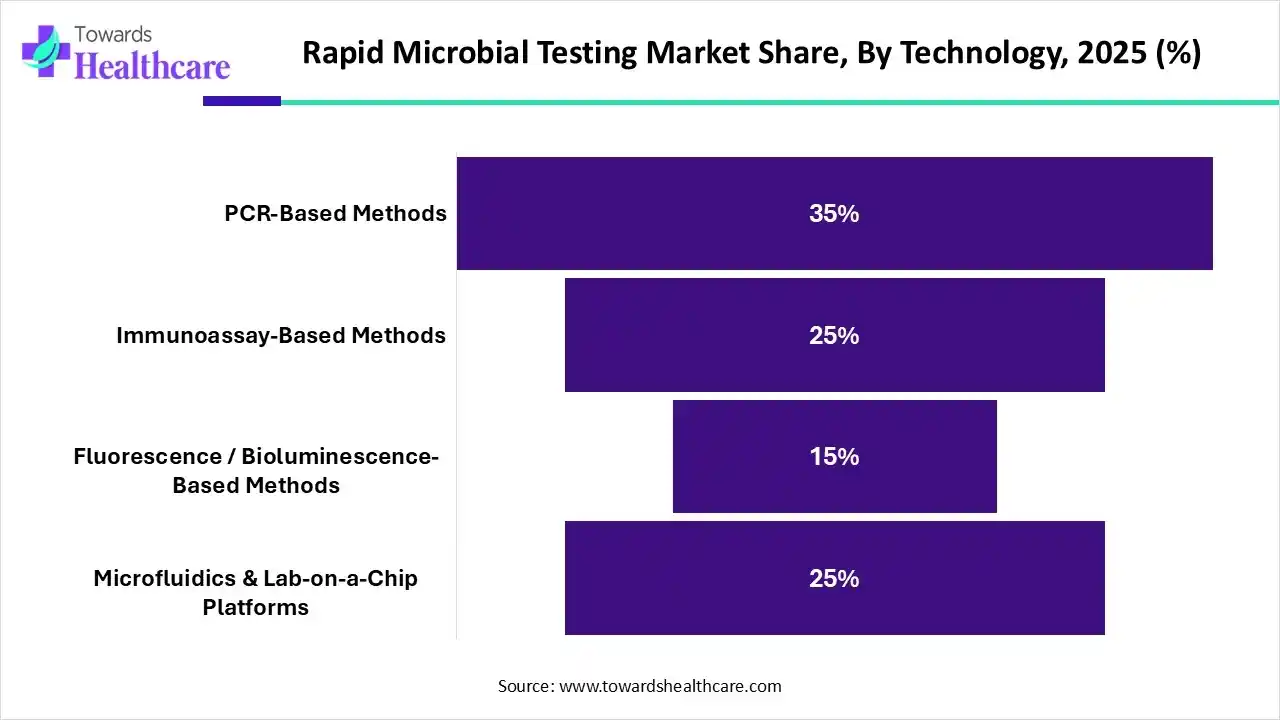

- By technology, the PCR-based methods segment held the largest market share of approximately 35% in 2025.

- By technology, the microfluidics & lab-on-a-chip platforms segment is expected to grow at the fastest CAGR in the market during the forecast Period.

- By product & services, the instruments/equipment segment dominated the rapid microbial testing market with the revenue share of approximately 45%.

- By product & services, the services segment is expected to grow at the fastest CAGR in the market during the forecast Period.

- By application, the sterility testing segment led the market with the largest revenue share of approximately 39.01% in 2025.

- By application, the environmental monitoring segment is expected to grow at the fastest CAGR in the market during the forecast Period.

- By end user, the pharmaceutical companies segment held the highest rapid microbial testing market share in 2025.

- By end user, the contract testing laboratories segment is expected to grow at the fastest CAGR in the market during the forecast Period.

What is Rapid Microbial Testing?

Rapid microbial testing is a technology-driven method used to quickly detect and identify microorganisms in samples, enabling faster results than traditional culture-based techniques. The rapid microbial testing market refers to technologies and services that provide accelerated detection, enumeration, and identification of microorganisms in pharmaceuticals, biopharmaceuticals, food, and environmental samples. These methods offer faster, accurate, and reliable alternatives to traditional culture-based microbial testing, enabling timely quality control, regulatory compliance, and contamination monitoring.

The rapid microbial testing market is driven by stringent regulatory requirements, increasing demand for biologics and sterile products, and the need to reduce product release times. Key applications include sterility testing, bioburden testing, endotoxin detection, and pathogen identification. End-users include pharmaceutical and biopharmaceutical manufacturers, contract laboratories, research institutions, and hospitals. Regions covered are North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Rapid Microbial Testing Market Outlook

Sustainability Trends: Sustainability trends in rapid microbial testing focus on eco-friendly testing materials, reduced reagent waste, energy-efficient instruments, automation, and digital data management to minimize environmental impact and improve resource efficiency.

Major Investors: Major investors in the rapid microbial testing market include Thermo Fisher Scientific, bioMérieux, Merck KGaA, Danaher Corporation, and Sartorius, focusing on innovative diagnostics, automation, and sustainable testing solutions.

Startup Ecosystem: The rapid microbial testing startup ecosystem is growing with innovations in AI-based detection, portable devices, and real-time monitoring, driven by startups like Hygiena, Biomillenia, and 3M’s emerging tech ventures.

Rapid Microbial Testing Market Trends and Future Outlook

1. Increasing Demand for Faster Diagnostics

The growing incidence of infectious disease are increasing the demand for faster diagnostic methods, which is driving the shift from traditional culture-based microbiology towards rapid microbial testing.

2. Growing R&D Activities

The growing R&D activities are leading to a rise in drug discovery and development, along with a focus on bioprocess optimization, which is increasing the use of rapid microbial testing to accelerate their development with high reproducibility.

3. Escalating Applications

The use of rapid microbial testing is increasing beyond the pharmaceutical and biotech applications, driving their adoption across the environmental and food and beverage sectors for the detection of foodborne pathogens and microbial contaminations.

4. Technological Advancements

To enhance the accuracy and offer faster microbial testing, different types of PCR-based methods, biosensors, next-generation sequencing, microfluidic platforms, and automated systems are being developed.

How Can AI Affect the Market?

AI can significantly impact the rapid microbial testing market by enabling faster and more accurate detection of microorganisms through predictive analytics and pattern recognition. It enhances automation in laboratories, reduces human error, and accelerates data interpretation for food, pharmaceutical, and clinical testing. AI-driven systems can optimize testing workflows, improve contamination tracking, and support real-time monitoring, ultimately increasing efficiency, lowering costs, and ensuring higher product safety and regulatory compliance across industries.

What are the Government Initiatives in the Rapid Microbial Testing Market in 2024?

In February 2025, India’s Health Department established Jaipur’s first government microbiology lab to test food samples for bacterial and microbial contamination, aiming to enhance food safety by detecting harmful pathogens.

In January 2025, the Food Safety Department of India inaugurated an advanced microbiology lab in Thiruvananthapuram to test various food products. The lab, equipped with modern technology, was established to strengthen the testing capabilities of regional labs in Ernakulam and Kozhikode.

| Company |

Headquarters |

Major Focus Area |

| Merck KGaA |

Germany |

Microbial detection and quality control solutions for pharmaceuticals and biotech |

| Thermo Fisher Scientific |

USA |

Developing faster, more accurate, and streamlined workflows to improve product safety, ensure regulatory compliance, and support clinical decision-making |

| Charles River Laboratories |

USA |

Bacterial endotoxins testing and general microbial detection and identification. |

| Lonza Group |

Switzerland |

Major focus on endotoxins and pyrogen detection. Microbial testing services, biopharmaceutical development support |

| Sartorius AG |

Germany |

Focuses on technologies that accelerate QC in industries like biopharma and food and beverage. |

Quick Facts Table

| Table |

Scope |

| Market Size in 2026 |

USD 6.36 Billion |

| Projected Market Size in 2035 |

USD 15.04 Billion |

| CAGR (2026 - 2035) |

10.04% |

| Leading Region |

North America by 40% |

| Historical Data |

2020 - 2023 |

| Base Year |

2025 |

| Forecast Period |

2026 - 2035 |

| Measurable Values |

USD Millions/Units/Volume |

| Market Segmentation |

By Technology, By Product & Services, By Application, By End-User, By Region |

| Top Key Players |

Merck KGaA, Thermo Fisher Scientific, Charles River Laboratories, Sartorius AG, Lonza Group, Microbial Detection Technologies, Pall Corporation, Eurofins Scientific, Hamilton Company, BD (Becton Dickinson), VWR International, Agilent Technologies, Advanced Instruments, Microgen Bioproducts, SGS Life Sciences

|

Segmental Insights

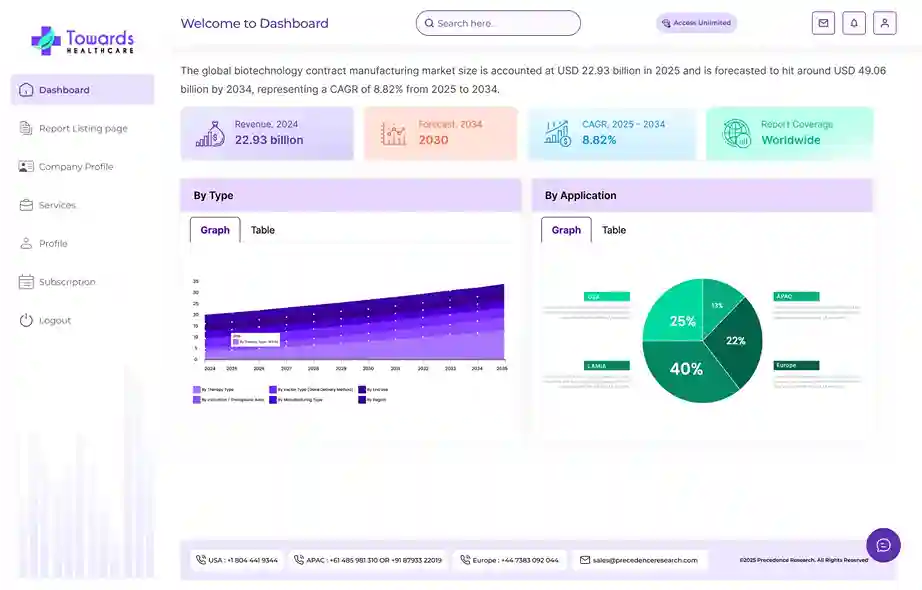

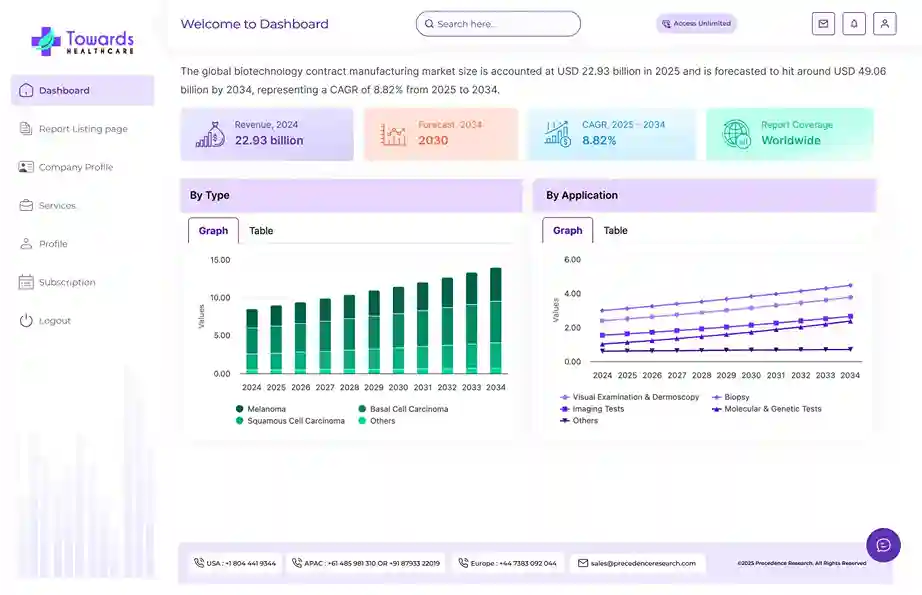

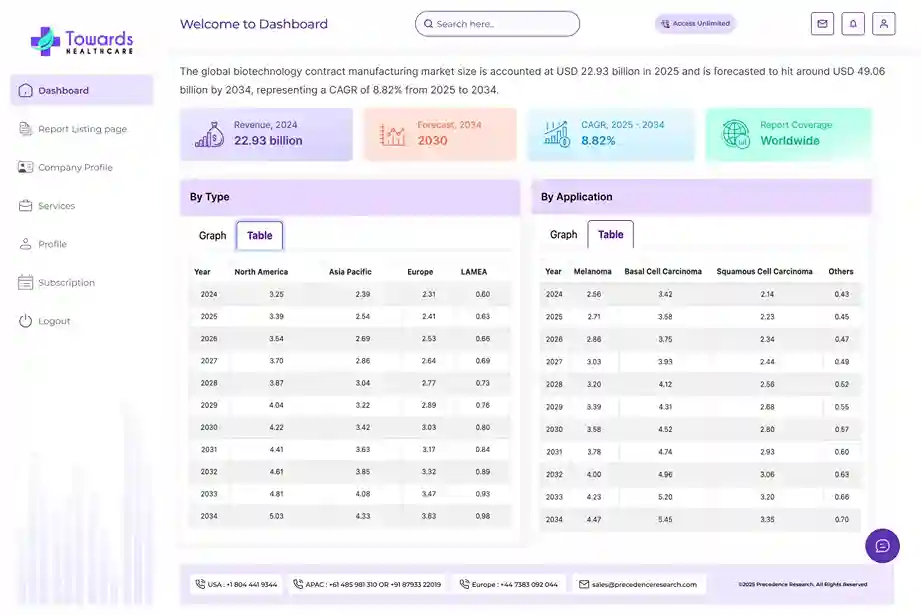

By Technology

How does the PCR-based Methods Segment dominate the Rapid Microbial Testing Market in 2025?

In 2025, the PCR-based methods segment held the largest market share of approximately 35% in rapid microbial testing due to its high sensitivity, specificity, specificity, and adaptability across various applications. Government-backed research, such as the Department of Biotechnology’s development of a miniaturized MPN protocol combined with real-time PCR for microbial detection, underscores the method's effectiveness in diverse settings. Additionally, the Indian Council of Medical Researchers' support for CRISPR-Cas-based TB detection systems highlights the growing reliance on molecular diagnostics for accurate and rapid pathogen identification.

The microfluidics lab-on-chip platforms segment is expected to grow at the fastest CAGR in the rapid microbial testing market due to compact, cost-effective, and portable diagnostic solutions. Government initiatives, such as the Department of Biotechnology funding microfluidic-based on-chip devices, support rapid point-of-care detection using minimal sample volumes. In 2024, DBT reported over 45 funded projects in microfluidics and LOC platforms, highlighting increasing adoption for quick, accurate microbial testing, especially in resource-limited settings.

By Product & Services

| Segments |

Shares 2025 % |

| Instruments / Equipment |

45% |

| Reagents & Kits |

30% |

| Software & Data Analytics |

10% |

| Services |

15% |

Why Did the Instruments/Equipment Segment Dominate the Rapid Microbial Testing Market in 2025?

The instruments/equipment segment dominated the market with a revenue of approximately 45% due to significant government investments enhancing laboratory capabilities. For instance, the Food Safety and Standards Authority of India (FSSAI) has upgraded food testing laboratories with an investment of rupees 482 crore, aiming to improve efficiency, reliability, and automation. Additionally, the Department of Biotechnology (DBT) has supported the development of advanced diagnostic devices, further bolstering the market growth.

The services segment in the rapid microbial testing market is expected to grow at a faster pace during the forecast period due to increasing demand for outsourced testing, quality assurance, and regulatory compliance. Government initiatives, such as the U.S. FDA’s Laboratory Accreditation Program and the European Food Safety Authority’s guidelines, emphasize third-party testing and monitoring, encouraging the adoption of professional microbial testing services for food, pharmaceutical, and environmental safety worldwide.

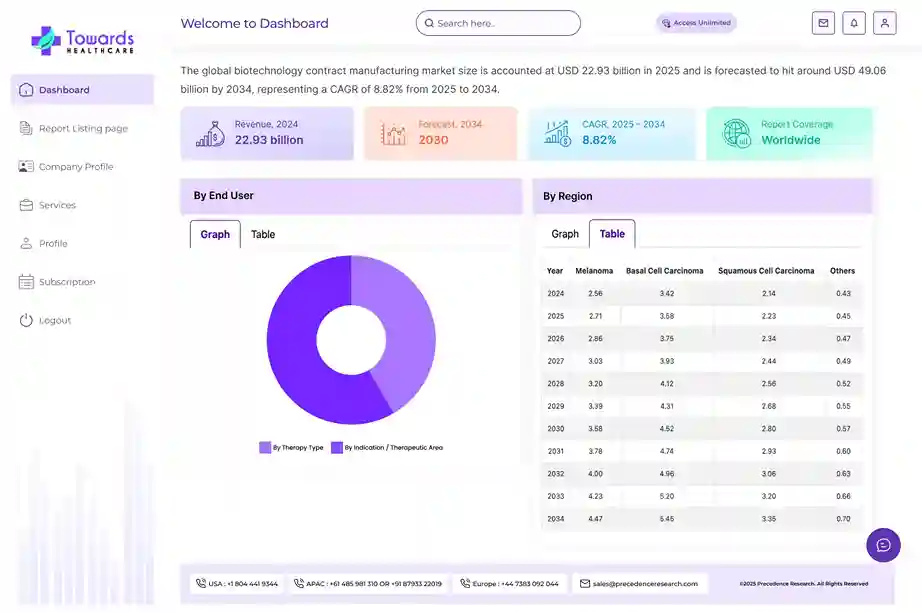

By Application

Why was the Sterility Testing Segment Dominant in the Rapid Microbial Testing Market in 2025?

In 2025, the sterility testing segment led the market with a revenue of approximately 40% due to its critical role in ensuring the safety of pharmaceuticals and biologics. The World Health Organization (WHO) emphasizes sterility testing as a fundamental component in the quality control of medical products, particularly in the prequalification process for vaccines and essential medicines. This focus underscores the segment's dominance in maintaining global health standards and regulatory compliance.

The environmental monitoring segment in the rapid microbial testing market is expected to grow at the fastest compound annual growth rate (CAGR) during the forecast period due to increasing regulatory emphasis on environmental safety and public health. Government agencies worldwide are implementing stricter environmental monitoring standards, leading to heightened demand for microbial testing services. For instance, the U.S. Environmental Protection Agency (EPA) has been enhancing its microbial water quality monitoring programs to ensure safer water supplies. Such initiatives are anticipated to drive the growth of the environmental monitoring segment in the coming years.

By End-User

What made the Pharmaceutical Companies Segment Dominant in the Rapid Microbial Testing Market in 2025?

In 2025, the pharmaceutical companies segment held the highest market share of approximately 45% in rapid microbial testing due to stringent regulatory requirements and the critical need for product safety. The U.S. Food and Drug Administration (FDA) mandates comprehensive sterility testing for all new injectable drugs, biologics, and vaccines, with a typical incubation period of 14 days.

The contract testing laboratories segment in the rapid microbial testing market is expected to grow at the fastest compound annual growth rate (CAGR) during the forecast period due to increasing demand for specialized testing services and regulatory compliance. Government initiatives, such as the U.S. Food and Drug Administration's (FDA) Laboratory Accreditation Program, emphasize the importance of accredited laboratories in ensuring the safety and efficacy of medical products. These programs drive the growth of contract testing laboratories by promoting standardized testing practices and facilitating market access for pharmaceutical companies.

Regional Insights

How is North America contributing to the Expansion of the Rapid Microbial Testing Market?

In 2024, North America led the market share by 40%, driven by strong regulatory frameworks and substantial investments in healthcare infrastructure. The U.S. Food and Drug Administration (FDA) accelerated the adoption of rapid microbial testing methods, including PCR-based diagnostics, to enhance outbreak response capabilities. Additionally, the National Institute of Standards and Technology (NIST) established the Rapid Microbial Testing Consortium to develop standardized testing protocols, further solidifying the region's market leadership.

Which Initiatives taken by U.S. in the Rapid Microbial Testing Market?

In 2024, the U.S. strengthened through key government initiatives. The FDA’s Alternative Methods Program promoted adoption of innovative testing methods to improve accuracy and reduce reliance on traditional approaches. Meanwhile, the NIST Rapid Microbial Testing Methods (RMTM) Consortium held its 4th annual workshop, focusing on standardizing rapid microbial testing protocols and enhancing reliability across laboratories. These efforts highlight the U.S. commitment to advancing testing efficiency and regulatory compliance.

How Canada is Approaching the Rapid Microbial Testing Market?

In 2024, Canada strengthened its market through key government initiatives. The National Microbiology Laboratory (NML) Science Plan 2024–2027 focused on research, diagnostics, surveillance, and preparedness to tackle microbial threats. Additionally, Health Canada updated regulations on food standards, microbiological criteria, and testing methods to modernize food safety frameworks and protect public health. These steps highlight Canada’s commitment to enhancing microbial testing capabilities and ensuring safety across healthcare and food industries.

How is Asia Pacific Accelerating the Market?

In 2024, the Asia-Pacific is expected to grow at the fastest year-on-year rate in the rapid microbial testing market due to rising regulatory standards, expanding healthcare infrastructure, and increased biologics and vaccine production. For example, China’s National Food Safety Standard on Microbiological Examination of Foods, effective September 2025, mandates stricter microbial testing. Combined with government investments in laboratory automation and diagnostic facilities, these factors are driving significant growth in microbial testing across the region.

China Rapid Microbial Testing Market Trends

The rapid expansion of the healthcare sector in China is increasing the adoption of rapid microbial tests for the accurate and rapid detection of the growing infectious disease burden. Additionally, increasing development of biologics, vaccines, and other sterile products are also increasing their adoption rates.

Stringent Regulations Shape Europe

Europe is expected to grow significantly in the rapid microbial testing market during the forecast period, due to the presence of stringent regulations focused on the pharmaceutical, food, and environmental safety, which is increasing the adoption of rapid microbial testing solutions. The presence of advanced healthcare, increasing R&D activities, and technological advances are also promoting the market growth.

UK Rapid Microbial Testing Market Trends

The growing incidence of infectious diseases and hospital-acquired infections are increasing the adoption of rapid microbial testing platforms across the UK. The stringent regulations and increasing interest in antimicrobial resistance are also increasing their adoption rates, where technological advancements are also increasing their innovations.

Increasing Healthcare Investments Fuel MEA

MEA is expected to show lucrative growth in the rapid microbial testing market during the forecast period, due to growing healthcare investments and growing infectious diseases. The expanding healthcare sector, growing food safety demand, and increasing collaboration are also enhancing the market growth.

Saudi Arabia Rapid Microbial Testing Market Trends

Saudi Arabia consists of robust health infrastructures that utilize rapid microbial testing for the detection of respiratory disease, hospital-acquired infections, and foodborne infections. Moreover, the growing demand for point-of-care testing solutions are also increasing their adoption as well as innovations.

Rapid Microbial Testing Market Value Chain Analysis

Clinical Trials

- Clinical trials for rapid microbial testing assess advanced technologies, such as MALDI-TOF MS and PCR-based genotypic methods.

- These trials aim to provide faster pathogen identification and antimicrobial susceptibility testing (AST).

- Applications include detecting infections in hospital blood samples and respiratory infections in primary care.

- The focus is on improving diagnostic speed and accuracy to support timely treatment decisions across clinical settings.

Regulatory Approvals

- Regulatory approval for rapid microbial testing varies based on the method and its application.

- The United States Pharmacopeia (USP) sets standards for tests, including USP <61> and <62>.

- International bodies like ISO and AOAC International offer frameworks and validation processes for approving alternative testing methods.

- These regulations ensure accuracy, reliability, and compliance of rapid microbial testing techniques across industries.

Patient Support and Services

- Patients using rapid microbial testing receive support through hospitals, clinics, and government health programs.

- Rapid diagnostics enable quicker treatment decisions and better health outcomes.

- Patient support emphasizes easy access to testing, prompt follow-up, and education about the testing process and results.

- These services aim to enhance patient experience and ensure effective disease management.

Top Vendors and their Offerings

- Bio-Rad Laboratories- Bio-Rad Laboratories provides life science research and clinical diagnostics solutions, including PCR instruments, microbial testing kits, quality control products, and laboratory reagents for healthcare, biotechnology, and food safety applications.

- IDEXX Laboratories- IDEXX Laboratories specializes in veterinary diagnostics, water testing, and livestock monitoring, offering rapid microbial detection kits, PCR-based tests, clinical analyzers, and software solutions for animal health and environmental safety.

- 3M Company-3M Company provides rapid microbial testing solutions, including environmental monitoring systems, sterility assurance products, laboratory consumables, and diagnostic tools for healthcare, food safety, and pharmaceutical industries to ensure quality and compliance.

- LuminUltra Technologies- LuminUltra Technologies offers rapid microbial detection and monitoring solutions using ATP and DNA-based technologies, providing water quality testing, biofilm monitoring, and microbial assessment tools for environmental, industrial, and wastewater applications.

- HiMedia Laboratories- HiMedia Laboratories provides microbiology products and solutions, including culture media, reagents, rapid microbial detection kits, molecular biology tools, and laboratory consumables for clinical diagnostics, food safety, pharmaceutical, and research applications.

Top Companies in the Rapid Microbial Testing Market

Recent Developments in the Rapid Microbial Testing Market

- In April 2025, Redberry validated a rapid sterility test for pharmaceuticals, cutting the standard 14-day testing period to just 4 days while maintaining compliance and accurate microbial detection.

- In March 2025, Nelson Labs introduced rapid sterility testing at sites in Salt Lake City, Itasca (U.S.), and Wiesbaden (Germany), shortening incubation from 14 to 6 days while staying USP <71> compliant.

Segments Covered in the Report

By Technology

- PCR-Based Methods

- Real-Time PCR

- Digital PCR

- Immunoassay-Based Methods

- ELISA

- Lateral Flow Assays

- Fluorescence / Bioluminescence-Based Methods

- ATP Bioluminescence

- Fluorescent Staining

- Microfluidics & Lab-on-a-Chip Platforms

By Product & Services

- Instruments / Equipment

- PCR Machines

- Bioluminescence Readers

- Flow Cytometers

- Reagents & Kits

- DNA/RNA Extraction Kits

- Assay Kits

- Software & Data Analytics

- Services

- Outsourced Testing

- Validation & Consulting Services

By Application

- Sterility Testing

- Bioburden Testing

- Endotoxin Detection

- Pathogen Identification

- Environmental Monitoring

- Others

By End-User

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Contract Testing Laboratories

- Hospitals & Diagnostic Centers

- Research & Academic Institutions

By Region

- North America

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait