January 2026

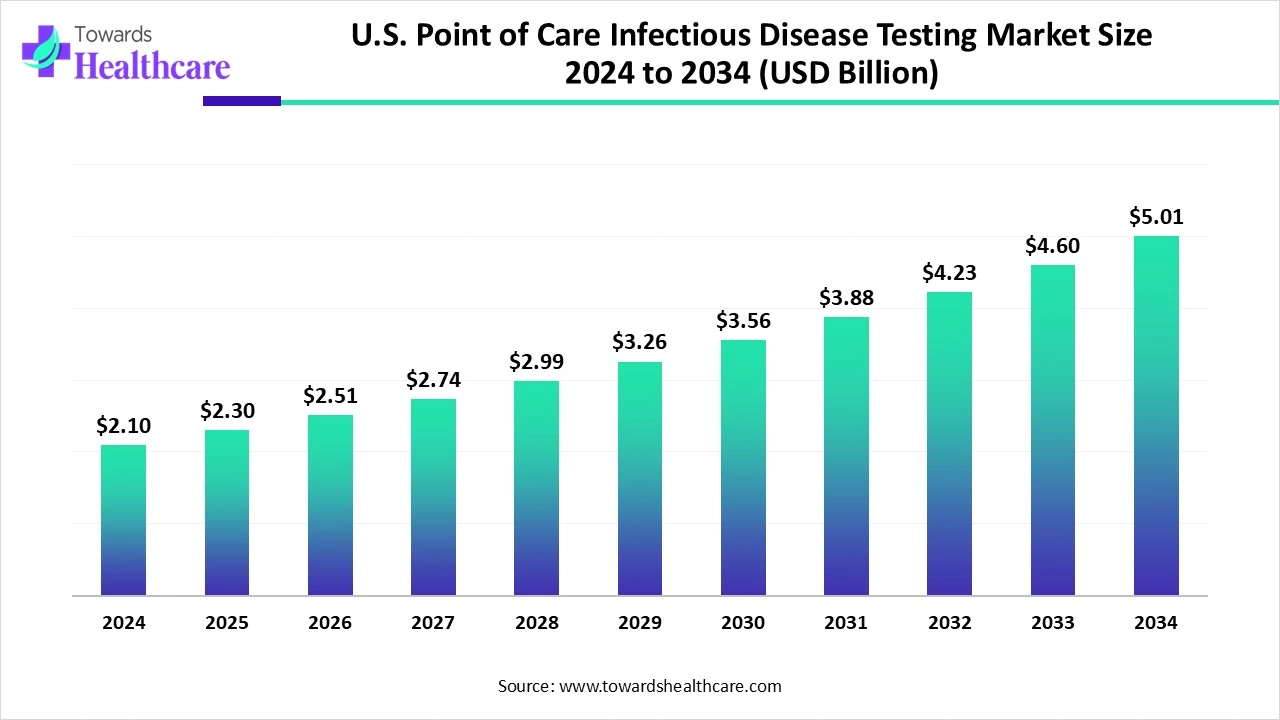

The U.S. point-of-care infectious disease testing market size is calculated at US$ 2.1 billion in 2024, grew to US$ 2.3 billion in 2025, and is projected to reach around US$ 5.01 billion by 2034. The market is expanding at a CAGR of 9.34% between 2025 and 2034.

The healthcare systems, clinical laboratories, pathologists, and clinical testing providers sharply focus on accuracy and proficiency that accelerate testing for certain tests. The prominent organizations include the U.S. Centers for Medicare and Medicaid Services (CMS) and the College of American Pathologists (CAP), which aim to ensure a higher level of accuracy. The POC testing is becoming popular to perform laboratory tests due to numerous advantages like portability, speed, convenience, accessibility, ease of use, and the growing test panels.

| Table | Scope |

| Market Size in 2025 | USD 2.3 Billion |

| Projected Market Size in 2034 | USD 5.01 Billion |

| CAGR (2025 - 2034) | 9.34% |

| Market Segmentation | By Test Technology/Modality, By Pathogen/Indication, By Format/Product Type, By End-User/Setting, By Sample Type, By Region |

| Top Key Players | Abbott Laboratories, Becton, Dickinson & Company (BD), bioMérieux, Cepheid (Danaher), Chembio Diagnostics, QuidelOrtho Corporation, Roche Diagnostics, Siemens Healthineers, Abbott Rapid Diagnostics, LumiraDx, Hologic, Lumos Diagnostics/Cue Health, Sekisui Diagnostics, Mologic / BD Veritor partnerships, Thermo Fisher Scientific |

The U.S. point-of-care (POC) infectious disease testing market deals with rapid diagnostic tests, instruments, consumables, and services that enable near-patient detection and monitoring of infectious diseases (bacterial, viral, fungal, parasitic) including lateral flow immunoassays, rapid antigen/antibody tests, molecular PCR/NAAT portable platforms, isothermal assays (LAMP), multiplexed cartridge systems, and connected reporting/software that are used in clinics, hospitals, pharmacies, urgent care, community/field settings, and home testing.

The government organizations stay committed to robust research and development initiatives. For instance, in June 2024, the National Institutes of Health (NIH) announced a $30 million investment to test the feasibility of a national primary care research network.

Health Tech startups make efforts to boost their businesses, and investors support the adoption of transformative solutions across digital health and med tech. For instance, in December 2024, PocDoc secured £5 million in funding to grow and expand its digital diagnostics business that delivers end-to-end services for the assessment, diagnosis, and treatment of disease.

AI-powered point-of-care testing is advantageous due to faster results, higher accuracy, and improved workflow efficiency. AI allows for resolving the challenges associated with data privacy, training requirements, and algorithm transparency. AI-powered point-of-care testing introduces a transformation in low-resource settings. It reduces healthcare disparities and enhances accessibility.

What are the Major Drifts in the U.S. Point-of-Care Infectious Disease Testing Market?

There is a significant impact of respiratory point-of-care testing on health behaviors, which helps people to take essential precautions to prevent the spread of infection. The novel innovations are improving accessibility to healthcare services. The rapid shift from point-of-care antigen tests to point-of-care molecular tests brought more specificity and sensitivity in the detection of genetic information, particularly RNA.

What are the Potential Challenges in the U.S. Point-of-Care Infectious Disease Testing Market?

The utilization of point-of-care testing and diagnostics outside the laboratory requires certain changes to traditional provider workflows. The massively growing molecular tests require clear and easy-to-follow instructions to utilize for optimal test performance. There are specific requirements for new technologies, which include support for troubleshooting, change management, and provider buy-in.

What is the Future of the U.S. Point-of-Care Infectious Disease Testing Market?

There will be increased access to point-of-care testing and diagnostic-led medicine for more patients with the required treatment and care. The higher sensitivity of molecular tests brings more accurate diagnosis and better treatments that improve health outcomes. The real-time data tracking can potentially improve population health outcomes. The integration of electronic health records (EHRs) and health system technology minimized provider workloads.

The lateral flow immunoassays segment dominated the U.S. point-of-care infectious disease testing market in 2024, owing to the key role of lateral flow immunoassays in screening, at-home and self-testing, and HIV screening, etc. The LFIAs better manage chronic and other health conditions through cardiac marker testing, chronic disease monitoring, pregnancy, and fertility concerns. The digital integration, like AI-powered readers, has reduced interpretation errors and enabled automated analysis.

The rapid molecular NAAT and multiplexed cartridge systems segment is expected to grow at the fastest CAGR in the market during the forecast period due to faster and more accurate diagnosis, decentralized testing, and improved patient management. They facilitate shorter patient stays and reduce healthcare costs. The key features and benefits of these systems include all-in-one automation, ease of use, and platform portability.

The respiratory infections segment dominated the U.S. point-of-care infectious disease testing market in 2024, owing to the key role of point-of-care testing in the optimization of clinical management and enhancing public health surveillance. The POC testing enables rapid diagnosis, facilitates patient triage, informs targeted therapy, and expands access to testing. It reduces unnecessary use of antibiotics and empowers clinical decisions.

The rapid molecular sepsis/BSI panels and point-of-care rapid AST segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the great impact of POC testing in the management of sepsis, rapid identification of pathogens, and reduction of time to effective therapy. The POC testing can rapidly identify effective treatments and improve patient outcomes. It can also optimize personalized therapy and add extra features to molecular testing.

The instrument-free disposable tests segment dominated the U.S. point-of-care infectious disease testing market in 2024, owing to the expansion of point-of-care testing into home and remote settings. These tests enable workplace screening and improve disaster response. They contribute to advancing diagnostics for major disease areas, which involve the management of chronic diseases and rapid testing of infectious diseases. The combination of these advanced diagnostic tests with smart technologies like AI-powered diagnostics and novel biosensing methods allows for automated data analysis and seamless transmission to electronic health records.

The connected multiplex cartridge systems segment is anticipated to grow at a notable rate in the market during the upcoming period due to their role in syndrome testing and patient-centered and decentralized care. The connected systems empower patients with self-monitoring of chronic diseases like diabetes. They advance personalized medicine, tailor treatments, and monitor chronic conditions.

The hospitals & clinical labs segment dominated the U.S. point-of-care infectious disease testing market in 2024, owing to the faster results, timely interventions, improved patient experience, and enhanced accessibility through POC testing. The healthcare facilities experience improved efficiency of healthcare services and efficient management of resources. They adopt several tools and technologies for improved data management.

The pharmacies/retail clinics and home self-testing segment is predicted to grow at a rapid rate in the market during the studied period due to the potential of home self-testing in empowering patient-centered care and offering diverse tests. The advanced methods provide accurate results, while mobile integration helps with tracking and seamless data sharing with healthcare providers. The pharmacies and retail clinics help to increase accessibility and convenience for people.

The nasal/nasopharyngeal swabs and fingerstick blood segment dominated the U.S. point-of-care infectious disease testing market in 2024, owing to the detection of respiratory viruses, patient triage and treatment, patient convenience, and public health surveillance. There is an increased use of these samples in molecular diagnostics, enabling integrated digital health and allowing home-based care. They help in diabetes management, infectious disease screening, and chronic condition monitoring.

The saliva and breath-based assays segment is expected to grow at the fastest CAGR in the market during the forecast period due to the major applications of these assays in oncology and the detection of diseases related to chronic, endocrine, and other infections. They provide non-invasive and rapid diagnostic tools in point-of-care testing, driven by advancements in miniaturized technologies. There are diverse applications of these assays across home care settings, primary care clinics, and specialized oncology areas.

The Clinical Laboratory Improvement Amendments (CLIA) regulations for point-of-care testing were driven by the changes implemented by the Centers for Medicare and Medicaid Services (CMS). These modifications made strong proficiency testing for certain analytes. The RADxTech initiative by the National Institutes of Health (NIH) aims to raise the development, validation, and commercialization of novel home-based and point-of-care tests. The National Institute of Biomedical Imaging and Bioengineering (NIBIB) of the National Institutes of Health (NIH) established the Point-of-Care Technologies Research Network (POCTRN), which has been expanded due to the RADxTech initiative.

The R&D process for point-of-care infectious disease testing involves discovery, feasibility, design, prototyping, preclinical and clinical development, regulatory submission and approval, manufacturing, and market launch.

Key Players: Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Danaher Corporation, QuidelOrtho Corporation, Becton, Dickinson and Company (BD).

The Clinical Laboratory Improvement Amendments (CLIA) and the U.S. FDA contributed to the significant approvals and clearances across hematology, blood banking, infectious diseases, and cardiovascular conditions. The clinical trials were conducted for a rapid molecular diagnostic instrument and assays to detect sexually transmitted infections.

Key Players: Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Danaher Corporation, QuidelOrtho Corporation, Becton, Dickinson and Company (BD).

The rising trend of at-home diagnostics, telemedicine, connected health solutions, AI-powered diagnostics, patient empowered monitoring, etc., boosts patient support and services.

Key Players: Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Danaher Corporation, QuidelOrtho Corporation, Becton, Dickinson and Company (BD).

In April 2025, Robert Ford, CEO of Abbott Laboratories, reported his confidence in the company’s potential in ending up costing through global tariffs with a few hundred million dollars by investing in its distributed production network.

By Test Technology/Modality

By Pathogen/Indication

By Format/Product Type

By End-User/Setting

By Sample Type

By Region

January 2026

January 2026

January 2026

January 2026