Bioanalytical Testing Services Market Size and Trends with Collaboration Landscape Insights

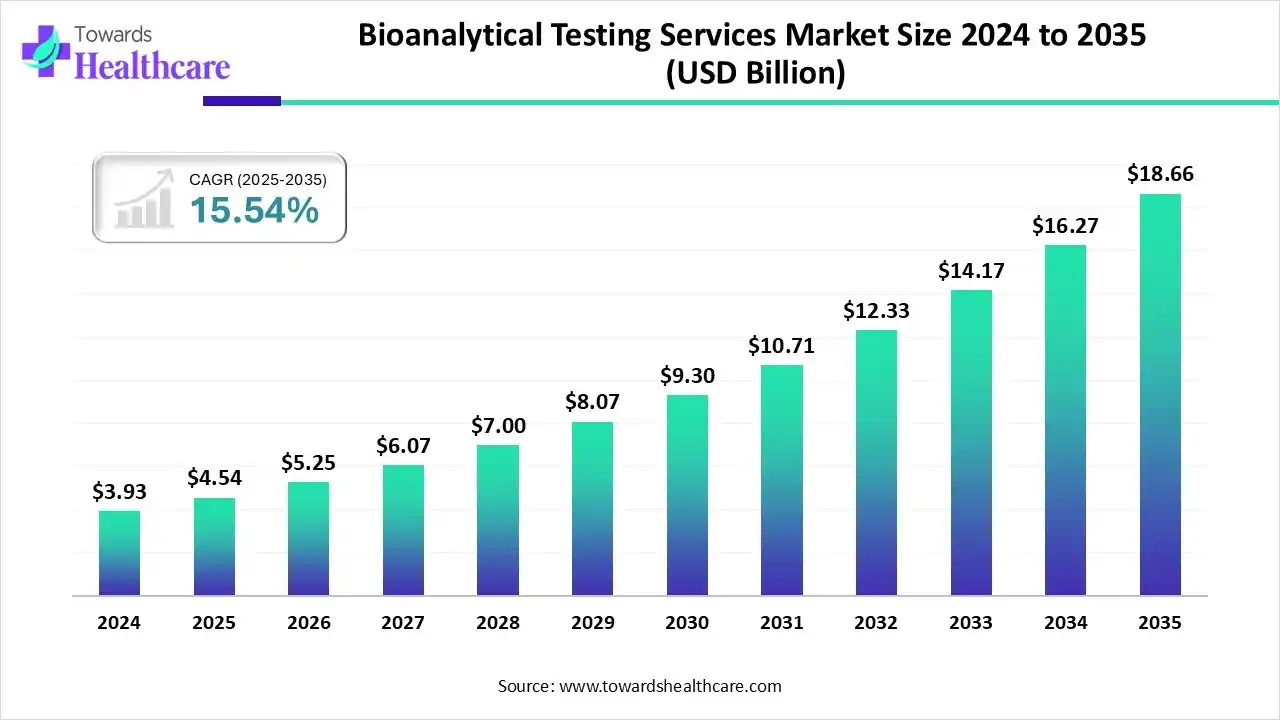

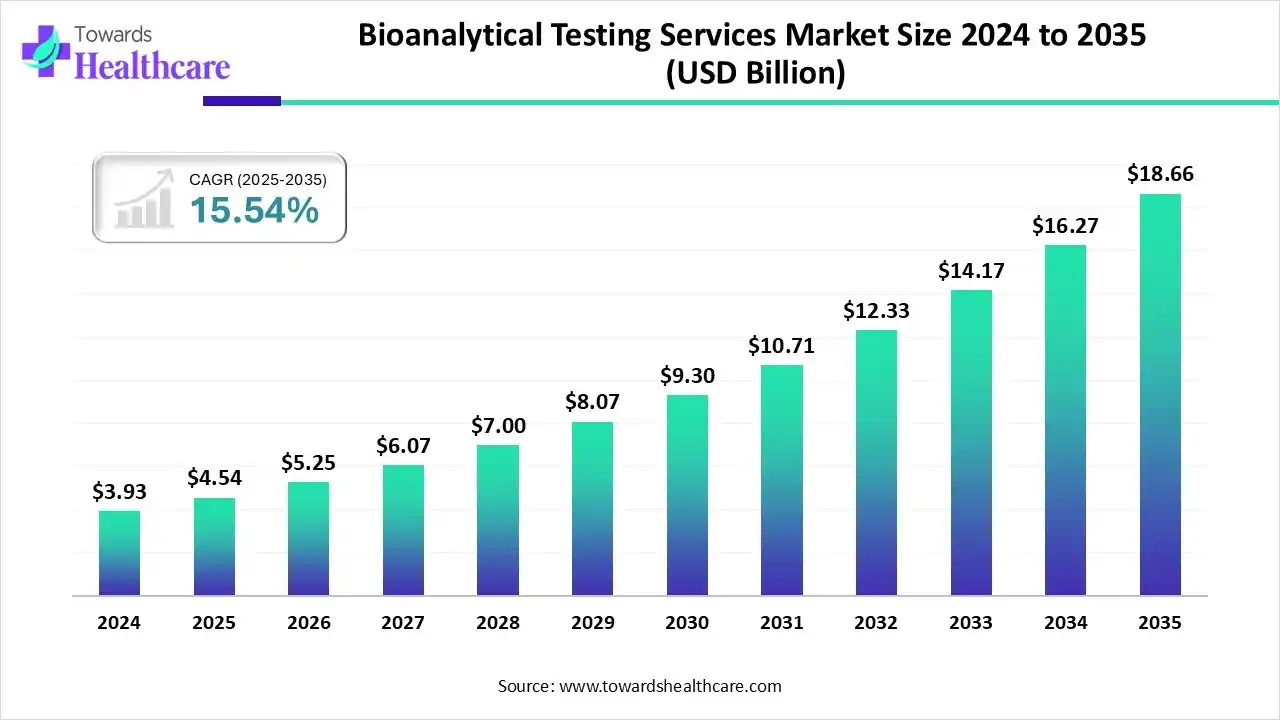

The global bioanalytical testing services market size is calculated at USD 4.54 billion in 2025, grew to USD 5.25 billion in 2026, and is projected to reach around USD 18.66 billion by 2035. The market is expanding at a CAGR of 15.54% between 2026 and 2035.

The bioanalytical testing services market is primarily driven by growing research and development activities and stringent regulatory policies. The growing awareness of the significance of bioanalytical testing potentiates its demand. Increasing R&D investments and the rising complexity of therapeutics boost the market. Artificial intelligence (AI) automates the testing procedures to enhance accuracy and reduce the timelines. Technological innovations, such as ultra-high-performance liquid chromatography (UHPLC) and next-generation sequencing, drive the future of bioanalytical testing services.

Key Takeaways

- Bioanalytical testing services sector pushed the market to USD 4.54 billion by 2025.

- Long-term projections show USD 18.66 billion valuation by 2035.

- Growth is expected at a steady CAGR of 15.54% in between 2026 to 2035.

- North America held a major revenue share of the market in 2024.

- Asia-Pacific is expected to witness the fastest growth during the predicted timeframe.

- By molecule, the small molecule segment dominated the market in 2024.

- By molecule, the large molecule segment is expected to expand rapidly in the market in the coming years.

- By test, the bioavailability segment contributed the biggest revenue share of the bioanalytical testing services market in 2024.

- By test, the bioequivalence segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By workflow, the sample analysis segment accounted for the highest revenue share of the market in 2024.

- By workflow, the sample collection and preparation segment is expected to witness the fastest growth in the market over the forecast period.

- By end-use, the pharma & biopharma companies segment held a dominant revenue share of the market in 2024.

- By end-use, the CRO segment is expected to grow with the highest CAGR in the market during the studied years.

Key Indicators and Highlights

| Table |

Scope |

| Market Size in 2025 |

USD 4.54 Billion |

| Projected Market Size in 2035 |

USD 18.66 Billion |

| CAGR (2026 - 2035) |

15.54% |

| Leading Region |

North America |

| Market Segmentation |

By Molecule, By Test, By Workflow, By End-Use, By Region |

| Top Key Players |

BioAgilytix, Eurofins Scientific, Precision for Medicine, Illumina, Bio-Rad Laboratories, Altasciences, QPS, SpinoS Life Science, IntoxLab, Thermo Fisher Scientific, Syneos Health |

Bioanalytical Testing Services: Empowering Data-Driven Discovery

The bioanalytical testing services market is experiencing robust growth, driven by growing drug discovery and development research, technological innovations, and the increasing number of preclinical and clinical trials. It encompasses services for the identification and quantification of drugs and metabolites in biological matrices, including blood, plasma, serum, cerebrospinal fluid, saliva, and urine.

Bioanalytical testing data help researchers move their drug development program from discovery to investigational new drug (IND) submission and beyond. They are applied in discovery, preclinical, and clinical stages. Bioanalytical testing is conducted for various applications, such as chromatographic bioanalysis, molecular biology, immunology, biomarkers, and non-GLP discovery bioanalysis.

Bioanalytical Testing Services Market Outlook

- Industry Growth Overview: The market is expected to rise rapidly due to technological advancements, such as ELISA and automation. Companies focus on launching their products in emerging countries, necessitating them to comply with evolving regulatory landscapes. This potentiates the need for bioanalytical testing services in the near future.

- Global Expansion: Key players collaborate to access advanced technologies and provide tailored services to researchers across the globe, complying with regulatory policies simultaneously. Global expansion is also needed for companies to deliver their products to a larger patient population.

- Major Investors: Private equity firms and venture capitalists invest heavily in biopharma companies to develop their research and clinical infrastructure. Investments enable companies to purchase novel equipment for bioanalytical testing and expand their services.

AI in Bioanalytical Testing: Smarter Testing, Faster Insights

AI introduces automation in bioanalytical testing services, enabling service providers to perform multiple experiments simultaneously, at a faster rate and with greater precision. Integrating AI and machine learning (ML) algorithms in analytical instruments reduces manual errors and enhances accuracy. AI-enabled robots ensure superior quality control, including visual assessments and high reproducibility. This leads to enhanced productivity and service quality for clients. Thus, AI and ML have been instrumental in achieving remarkable outcomes in analytical testing.

Bioanalytical Testing Services: Collaboration Landscape

| Month, Year |

Company |

Collaborator |

Purpose |

| June, 2025 |

Emery Pharma |

Fortrea |

To provide rapid testing of rifampin for impurities and conduct drug-drug interaction studies |

| March, 2025 |

Emery Pharma |

Centivax |

To leverage Emery’s expertise in developing an IND-enabling GLP-compliant potency release assay for GMP batches of the Centivax pan-influenza vaccine, Centi-Flu |

| October, 2025 |

AstraZeneca BioVenture Hub |

PPD |

To enhance R&D using chromatography, molecular genomics, and proteomics to drive innovation and strengthen the life science ecosystem |

| May, 2024 |

KCAS Bio |

Crux Biolabs |

To provide harmonized spectral flow cytometry across the U.S., Europe, and Australia to support the global needs of clinical research |

Segmental Insights

Molecule Insights

Which Molecule Segment Dominated the Bioanalytical Testing Services Market?

The small molecule segment held a dominant presence in the market in 2024, due to the growing demand for small-molecule drugs and the need to assess the ADMET properties of small molecules. The development of small-molecule drugs does not require complex research pathways, allowing researchers to create more such drug candidates. Bioanalytical testing is essential for small molecules to analyze their DMPK profile from discovery, preclinical, GLP toxicology, and clinical studies.

Large Molecule

The large molecule segment is expected to grow at the fastest CAGR in the market during the forecast period. Large molecules or biologics offer superior benefits compared to small-molecule drugs, such as targeted treatment and reduced systemic side effects. They undergo complex pathways and require specialized equipment for their development and testing. As more and more large-molecule products are being developed, large-molecule bioanalysis has become increasingly more common.

Test Insights

Why Did the Bioavailability Segment Dominate the Bioanalytical Testing Services Market?

The bioavailability segment held the largest revenue share of the market in 2024, due to the need for the development of more efficacious and potent drugs. Bioavailability (BA) refers to the rate and extent to which the active ingredient is absorbed from the drug product and distributed to the site of action. BA testing is essential in the development phase to reveal disadvantageous properties and the possible technological interventions. This enables researchers to modify the properties of drugs and develop more effective products.

Bioequivalence

The bioequivalence segment is expected to grow with the highest CAGR in the market during the studied years. Bioequivalence (BE) refers to the study of the rate and extent to which an active substance of pharmaceutical equivalents reaches the target site. The growing demand for generic drugs and biosimilars potentiates their development. As of October 2025, the U.S. Food and Drug Administration (FDA) has approved 76 biosimilars for different indications.

ADME

The ADME segment is expected to grow at a notable CAGR. Absorption, distribution, metabolism, and excretion (ADME) properties are essential to determine at the early stage of drug development. ADME properties can be determined either through in silico, in vitro, or in vivo procedures. Poor ADME properties are estimated to account for 40% of drug failures in clinical trials. Thus, regulatory agencies necessitate researchers to provide ADME data for drug approval.

Workflow Insights

How the Sample Analysis Segment Dominated the Bioanalytical Testing Services Market?

The sample analysis segment contributed the biggest revenue share of the market in 2024. This segment dominated because sample analysis is the most vital step in bioanalytical testing. Sample analysis is of prime importance during preclinical and clinical testing. The availability of advanced technologies, such as automation, simplifies data analysis for researchers. AI and ML reduce manual errors in sample analysis and lead to higher accuracy results.

Sample Collection and Preparation

The sample collection and preparation segment is expected to expand rapidly in the market in the coming years. Sample collection and preparation involve careful, standardized processes for collecting biological matrices. Samples are also required to be transported and stored properly to maintain analyte stability. Sample preparation is considered the bottleneck step, as the biological matrix has its own unique challenges and complexity.

Method Development and Validation

The method development and validation segment is expected to grow significantly. Method development and validation aim to ensure that the methods used to measure the identity, purity, potency, and stability of drugs are accurate, precise, and reliable. This is a crucial step to determine that the procedures and tests evaluate the method’s performance characteristics. Moreover, it also assists researchers in selecting appropriate analytical techniques.

End-Use Insights

Which End-Use Segment Led the Bioanalytical Testing Services Market?

The pharma & biopharma companies segment led the market in 2024, due to the availability of a favorable infrastructure and suitable capital investments. Capital investments enable companies to purchase advanced equipment and expand their infrastructure. Numerous pharma & biopharma companies offer bioanalytical testing services through their in-house facilities, thereby generating more revenue. Pharma & biopharma companies work on multiple projects simultaneously, necessitating them to outsource their services.

CRO

The CRO segment is expected to witness the fastest growth in the market over the forecast period. Contract research organizations (CROs) have desirable facilities and equipment to provide specialized laboratory services, including method development, transfer, qualification, validation, and sample analysis. CROs provide these services under stringent regulatory guidelines to ensure data accuracy and reliability for regulatory submissions.

CDMO

The CDMO segment is expected to grow in the coming years. Contract development and manufacturing organizations (CDMOs) specialize in the research and manufacturing of drug candidates. They ensure drug stability, safety, and efficacy throughout the entire drug development and manufacturing process.

Regional Analysis

Which Factors Contribute to the Bioanalytical Testing Services Market in North America?

North America dominated the global market in 2024. The availability of state-of-the-art research and development facilities, a strong presence of pharmaceutical and biotech companies, and favorable regulatory support are the major growth factors of the market in North America. Government organizations actively support biotech research through funding and initiatives. Companies from North America aim to become global leaders in drug development and serve a larger patient population.

U.S.: The Powerhouse of Pharma Innovation

The U.S. is home to over 5,000 pharmaceutical companies and more than 3,000 biotech companies. This increases the development of novel drugs, especially biologics and cell & gene therapies, requiring bioanalytical testing services. The increasing number of new drug approvals also propels the market. In 2024, the FDA approved 50 new drugs, and as of October 2025, it approved 34 new drugs.

How is Asia-Pacific Growing in the Bioanalytical Testing Services Market?

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The burgeoning biopharmaceutical sector and the increasing demand for new drug discovery boost the market. The growing awareness of personalized medicines, driven by rapidly changing demographics, promotes the development of novel drugs. China and India encourage foreign direct investments (FDI) in the biotech fields. They also have suitable infrastructure, enabling foreign companies to set up their testing facilities in the Asia-Pacific countries.

Global Capital Fuels India’s Pharma Growth

The FDI inflow for the pharmaceutical sector in India has rapidly evolved over the last decade. Approximately 3% of the total FDI inflow is related to the pharma sector. In 2024, the FDI inflow was Rs 7,500 crore. In February 2025, India hosted the 9th International Symposium on Current Trends in Drug Discovery Research at CSIR-Lucknow to focus on international cooperation, quantum computing, and AI to accelerate drug discovery.

Will Europe Grow in the Bioanalytical Testing Services Market?

Europe is expected to grow at a significant CAGR in the upcoming period. The presence of key players and the rising adoption of advanced technologies augment the market. The growing collaboration among key players to leverage advanced technologies and develop novel products contributes to market growth. Countries like Germany, the UK, and France are at the forefront of expanding their research and clinical trial infrastructure, opening doors for numerous opportunities for foreign researchers.

Key Players Powering Innovation in the UK

Key players, such as Chimera Biotec GmbH, Intertek, and SGS United Kingdom, provide bioanalytical testing services in the UK. The UK ranks second for share of government spending on health R&D and joint third for charitable R&D funding. The Department for Science, Innovation, and Technology (DSIT) recently announced an investment of £55 billion for R&D, improving lives and growing the UK’s economy.

South America: Strengthening Clinical Research Infrastructure

South America’s bioanalytical testing market grows as governments modernize research facilities, expand public–private clinical programs, and adopt GLP-certified labs to support rising drug discovery, pharmacokinetic studies, and regulatory-compliant testing capabilities region-wide.

Brazil: National Drive for Advanced Bioanalysis

Brazil’s growing pharmaceutical R&D investments and ANVISA’s accelerated drug-approval reforms are fueling demand for validated assays, biomarker quantification, and biosimilar characterization through local CROs and newly established bioanalytical laboratories.

MEA: Expanding Pharmaceutical Manufacturing Backbone

The Middle East and Africa witness rapid bioanalytical expansion, propelled by government-funded biotech parks, WHO-backed vaccine projects, and regional initiatives enhancing bioequivalence testing, immunogenicity assessments, and pharmaceutical quality-control networks.

GCC: Strategic Biotech and CRO Partnerships

GCC nations boost bioanalytical testing via national biotech strategies, Saudi Arabia’s Vision 2030 healthcare goals, and UAE partnerships with global CROs establishing advanced labs for biologics, biosimilars, and clinical-trial analysis.

Company Landscape

Charles River Laboratories International, Inc. (CRL)

Company Overview : Charles River Laboratories is a leading global contract research organization (CRO) providing essential products and services to help pharmaceutical, biotechnology, medical device companies, and academic/government institutions accelerate their research and drug development efforts. It is a full-service, early-stage CRO.

Corporate Information (Headquarters, Year Founded, Ownership Type)

- Headquarters: Wilmington, Massachusetts, U.S.

- Year Founded: 1947

- Ownership Type: Public (NYSE: CRL)

- History and Background : Founded by Henry Foster, a veterinarian, who established a lab in Boston to supply local researchers with quality laboratory animals. It grew from a supplier of research models to a comprehensive, full-service, early-stage CRO through organic growth and strategic acquisitions.

Key Milestones/Timeline

- 1947: Founded.

- 1955: Headquarters relocated to Wilmington, MA.

- 2003: Merged with Inveresk (a U.K. research company specializing in clinical research and preclinical testing).

- 2014: Acquired Argenta and BioFocus, establishing full-service, early-stage CRO capabilities (target discovery through preclinical development).

- 2021: Acquired Cognate BioServices for $875 million, significantly expanding Cell and Gene Therapy Contract Development and Manufacturing Organization (CDMO) capabilities.

- Business Overview : Provides integrated drug discovery, non-clinical development, and safety assessment services, along with research models and manufacturing support services.

Business Segments/Divisions

- Research Models and Services (RMS): Research models, genetic models and services, and insourcing solutions.

- Discovery and Safety Assessment (DSA): Discovery, regulated safety assessment, and bioanalytical services.

- Manufacturing Support (Manufacturing): Microbial Solutions, Biologics Testing Solutions, and Advanced Therapies (Cell and Gene Therapy CDMO).

- Geographic Presence : Global operations spanning at least 20+ countries with over 60 research and testing facilities worldwide (as of January 2025). Significant presence in North America, Europe, and Asia.

Key Offerings

- Bioanalytical Services: LC/MS/MS, High-resolution MS (HRMS), Immunochemistry (PK/PD, Immunogenicity), Cell-Based Assays, and specialized support for large molecule, cell, and gene therapy programs.

- Safety Assessment

- Discovery Services

- Research Models & Services

- Biologics Testing and CDMO Services

End-Use Industries Served

- Pharmaceutical and Biotechnology Companies

- Academic Institutions

- Government Agencies

- Medical Device Companies

Key Developments and Strategic Initiatives

Mergers & Acquisitions

- Nov 2023: Acquired Noveprim, enhancing non-human primate (NHP) supply chain capabilities.

- Jan 2023: Acquired SAMDI Tech, Inc., expanding high-throughput screening capabilities.

- Jan 2025: Made a Later Stage VC investment in Deciphex (Other Healthcare Technology Systems).

Partnerships & Collaborations

Continued strategic focus on integrated service models, offering clients end-to-end support from discovery to commercial manufacturing.

Product Launches/Innovations

- Ongoing expansion of non-animal testing capabilities through the development and adoption of New Approach Methodologies (NAMs).

- Focus on Next-Generation Sequencing (NGS) for animal-free pathogen testing in biologics.

Capacity Expansions/Investments

- Investments of $300 million in alternative technologies, with an emphasis on NAMs.

- Implementation of a cost reduction program targeting $75 million in annual savings over several years (as of Q2 2025).

- Launched the Charles River Incubator Program in Wilmington, MA (2024).

Regulatory Approvals

Maintains key global accreditations and compliance standards, including FDA and EMA compliance, and AAALAC International Accreditation.

Distribution channel strategy

Primarily direct sales through dedicated global sales and scientific teams, emphasizing integrated, end-to-end solutions, particularly for early-stage development clients.

Technological Capabilities/R&D Focus

Core Technologies/Patents

- Proprietary research model breeding and maintenance technologies.

- Advanced Cell and Gene Therapy manufacturing platforms (via Cognate BioServices acquisition).

- Proprietary microbial detection solutions.

Research & Development Infrastructure

Extensive global network of state-of-the-art research and testing facilities.

Innovation Focus Areas

- New Approach Methodologies (NAMs): Focus on in vitro models (human cell-based assays, organoids), in silico techniques (AI, machine learning predictive modeling), and in chemico methods to reduce reliance on animal testing (as of Oct 2025).

- Cell and Gene Therapy Services: Continual investment and innovation in CDMO services for advanced therapeutics.

Competitive Positioning

Strengths & Differentiators

- Integrated Early-Stage Expertise: Unique, fully integrated offering from discovery (including research models) through safety assessment and early clinical support.

- Market Leadership in Research Models: The largest supplier of research models globally.

- Strong Financial Performance: Q2 2025 non-GAAP operating margin improvement across all three segments.

Market Presence & Ecosystem Role

- Pivotal player in the life sciences research ecosystem, critical for both large pharmaceutical and smaller biotechnology firms.

- Approximate market share of 35-40% in the broader preclinical research services market.

SWOT Analysis

- Strengths: Integrated service model, global infrastructure, market leadership in research models, strong cash generation.

- Weaknesses: High dependence on animal models (despite NAMs' investment), operational complexity due to diverse segments, and regulatory/ethical scrutiny regarding animal welfare.

- Opportunities: Growing demand for Cell and Gene Therapy services, expansion of NAMs, improvement in biotech funding (expected in H2 2025), targeted expansion in high-growth regions like China.

- Threats: Increased price competition from smaller CROs (particularly in Safety Assessment), cyclical demand from smaller biotech firms, and potential budget fluctuations in government R&D funding.

Recent News and Updates

Press Releases

- Oct 15, 2025: Announced the creation of a global, cross-functional Scientific Advisory Board to guide the strategic focus on New Approach Methodologies (NAMs).

- Aug 6, 2025: Announced Second-Quarter 2025 Results, with non-GAAP diluted EPS increasing 11.4% and non-GAAP operating margin improving across all three segments.

Industry Recognitions/Awards

Information not explicitly found in recent, concise news snippets, but generally recognized as a leading global CRO.

Labcorp Drug Development (A Segment of Labcorp)

Company Overview: Labcorp Drug Development, formerly Covance, is a global contract research organization providing a full suite of drug development services, from preclinical testing and clinical trials to commercialization. It is a key segment of the larger Labcorp life sciences company.

- Corporate Information (Headquarters, Year Founded, Ownership Type)

- Headquarters (Parent Company: Labcorp): Burlington, North Carolina, U.S.

- Year Founded (Parent Company: Labcorp): 1978 (as Roche BioMedical)

- Ownership Type: Public (NYSE: LH)

- History and Background: The Drug Development segment was significantly shaped by the 2015 acquisition of Covance by Labcorp, which established Labcorp as a powerhouse in both clinical diagnostics and drug development services. Labcorp itself has a history of strategic mergers and acquisitions to build its extensive testing network.

Key Milestones/Timeline

- 1978: Founded (as Roche BioMedical).

- 1995: Laboratory Corporation of America Holdings was established via a merger.

- 2015: Acquired Covance, transforming the company's drug development capabilities.

- 2021: Acquired Toxikon (nonclinical contract research) and Personal Genome Diagnostics (PGDx) (oncology testing).

- Sep 2024: Completed establishment of a new laboratory in Greenfield, expanding molecular bio analytics capability.

- Sep 2025: Completed the acquisition of select oncology and clinical testing assets from BioReference Health.

- Business Overview: The Drug Development segment offers end-to-end solutions to the pharmaceutical, biotechnology, and medical device industries, including bioanalytical, clinical development, central laboratory, and preclinical services.

Business Segments/Divisions

- Diagnostics Laboratories: Provides clinical laboratory testing services (Parent company's largest segment).

- Biopharma Laboratory Services (Drug Development): Offers comprehensive drug development, medical device, and diagnostic development services, which include bioanalytical testing.

- Geographic Presence: Global presence, serving clients in more than 100 countries. Operates one of the largest clinical laboratory networks in the world, with a strong presence in the U.S.

Key Offerings

- Bioanalytical Services: LC/MS/MS, Immunoassay, Cell-Based Assays, and specialized large molecule and regulated bioanalysis (e.g., PK/PD, immunogenicity, biomarker testing).

- Central Laboratory Services

- Clinical Development Services

- Preclinical (Nonclinical) Safety Assessment

- Companion Diagnostics

End-Use Industries Served

- Pharmaceutical Companies

- Biotechnology Companies

- Medical Device and Diagnostic Companies

- Hospitals and Healthcare Providers (via parent company)

Key Developments and Strategic Initiatives

Mergers & Acquisitions

- Sep 2025: Completed acquisition of select oncology and clinical testing assets from BioReference Health, further solidifying oncology leadership.

- Oct 2025 (Expected Close): Signed an agreement to acquire select outreach laboratory assets from Community Health Systems across 13 states.

- Oct 2025: Signed an agreement to acquire select assets of Empire City Laboratories (New York and New Jersey).

Partnerships & Collaborations

- Signed several strategic agreements with health systems and regional/local laboratories in 2025 to expand market reach and service offerings.

- Sep 2025: Announced a collaboration with Roche to advance digital pathology capabilities.

Product Launches/Innovations

- Oct 2025: To offer the first FDA-Cleared Blood Test to rule out Alzheimer 's-related Amyloid Pathology in primary care settings.

- Jul 2025: Introduced Labcorp Test Finder, a generative AI tool to simplify lab test search.

- Apr 2025: Launched Molecular Residual Disease and Liquid Biopsy Solutions.

- Expanded its oncology and genetic testing portfolio, including the expanded use of OmniSeq® INSIGHT.

Capacity Expansions/Investments

- Completed a new laboratory establishment in Greenfield (Sep 2024) to expand molecular bio analytics capability.

- Ongoing investment in digital and AI capabilities to enhance areas like pathology, cytology, and microbiology.

Regulatory Approvals

- Jul 2025: Achieved IVDR CE-Marking for PGDx elio™ tissue complete in the EU.

- Oct 2025: Announced offering of the first FDA-Cleared Blood Test for Alzheimer's Disease (fully launched Aug 2025).

Distribution channel strategy

Leverages its extensive network of patient-service centers and laboratories for diagnostics, while the Drug Development segment utilizes a direct sales model for CRO services to biopharma clients.

Technological Capabilities/R&D Focus

Core Technologies/Patents

- Advanced capabilities in genomic testing (PCR, next-generation sequencing).

- Expertise in molecular diagnostics and advanced biomarker testing.

Research & Development Infrastructure

Extensive global laboratory infrastructure, including its central lab and specialized testing facilities.

Innovation Focus Areas

- Personalized Medicine and Oncology: Leading in advanced testing for precision medicine, including liquid biopsy, genetic testing, and companion diagnostics.

- Digital Pathology and AI: Investment in AI and digital tools to enhance efficiency and customer experience.

- Neurology and Alzheimer's Disease: Focus on developing and launching new tests for neurological conditions.

Competitive Positioning

Strengths & Differentiators

- Scale and Scope: Dual leadership in both clinical diagnostics and drug development (including bioanalytical).

- Strong Financial Performance: Q3 2025 revenue for Biopharma Laboratory Services was $799.1 million, up 8.3% organically.

- Unmatched Network: Extensive network of patient service centers and laboratories enhances data collection and clinical trial support.

Market presence & ecosystem role

- One of the largest global life sciences companies; a dominant force in both the clinical lab and CRO markets.

- Drug Development segment annual revenue (2023 data) is approximately $4.2 billion.

SWOT Analysis

- Strengths: Vast scale, comprehensive testing portfolio (5,000+ tests), strong financial profile, integrated clinical and drug development services, active strategic acquisition strategy (2025).

- Weaknesses: High dependence on payer mix and reimbursement policies in the Diagnostics segment, complex regulatory environment, and involvement in various legal actions (common in the industry).

- Opportunities: Rapid growth in personalized and genomic medicine, expansion into international markets, leveraging AI and digital health technologies, and strategic acquisitions to expand market reach.

- Threats: Intense competition in the diagnostic market (e.g., Quest Diagnostics), changing reimbursement models, emerging technologies (e.g., point-of-care testing), and disrupting traditional models.

Recent News and Updates

Press Releases

- Oct 28, 2025: Announced 2025 Third Quarter Results, with the Biopharma Laboratory Services segment revenue at $799.1 million (8.3% organic growth). Updated full-year guidance with a higher Adjusted EPS range.

- Oct 23, 2025: To offer the first FDA-Cleared Blood Test to rule out Alzheimer 's-Related Amyloid Pathology in primary care.

Industry Recognitions/Awards

Information not explicitly found in recent, concise news snippets, but generally recognized as a global leader in laboratory and drug development services.

Top Companies & Their Offerings in the Bioanalytical Testing Services Market

- Charles River Laboratories: The company has experience of over 40 years in bioanalytical services to manage both small-scale studies and large clinical trials for numerous clients.

- ChemExpress: ChemExpress analysis service platform provides integrated services for quality control at all stages of drug development using more than 300 sophisticated instruments and high-level databases.

- IQVIA Laboratories: IQVIA Laboratories offers complete bioanalytical and ADME laboratory services for testing around the globe and across the product development spectrum.

- Intertek: The UK-based company provides GLP and GCP bioanalytical laboratory and bioanalysis testing support services for all phases of drug development, including method development and validation.

- SGS SA: SGS aims to control costs, increase efficiency, and accelerate clinical programs with its globally integrated bioanalytical solutions. The company has recently gained expertise in advanced ELISA equipment and the Gyrolab xPlore system.

Other Companies

Recent Developments in the Bioanalytical Testing Services Market

- In July 2025, Bio-Rad Laboratories, Inc. expanded its range of recombinant monoclonal anti-idiotypic antibodies and SpyCatcher reagents. The launch of novel products facilitates the development of robust and reliable bioanalytical assays against biologic drugs, as well as pharmacokinetic and anti-drug-antibody assays.

- In February 2025, Ardena announced the acquisition of a state-of-the-art drug product manufacturing facility from Catalent, located in Somerset. The company plans to open a new bioanalytical lab as part of its expanding services in North America to provide advanced analytical testing services for both small and large molecules

Segments Covered in the Report

By Molecule

- Small Molecule

- Large Molecule

- LC-MS Studies

- Immunoassays

- Pharmacokinetics

- ADA Assay

- Other

- Other Large Molecule Tests

By Test

- Bioavailability

- Bioequivalence

- ADME

- In vivo

- In vitro

- Pharmacokinetics (PK)

- Pharmacodynamics (PD)

- Biomarker Testing

- Cell-based Assay

- Virology Testing

- Other Tests

By Workflow

- Sample Analysis

- Hyphenated Technique

- Chromatographic Technique

- Electrophoresis

- Ligand Binding Assay

- Mass Spectrometry

- Spectroscopic Techniques

- Nuclear Magnetic Resonance (NMR)

- Others

- Genomic & Molecular Techniques

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Others

- Other Processes

- Sample Collection and Preparation

- Sample Collection, Handling, and Storage

- Protein Precipitation

- Liquid-Liquid Extraction

- Solid Phase Extraction

- Others

- Method Development and Validation

By End-Use

- Pharma & Biopharma Companies

- CDMO

- CRO

- Others

By Region

- North America

- US

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Turkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific (APAC)

- China

- Taiwan

- India

- Japan

- Australia & New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- Middle East and Africa (MEA)

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA