December 2025

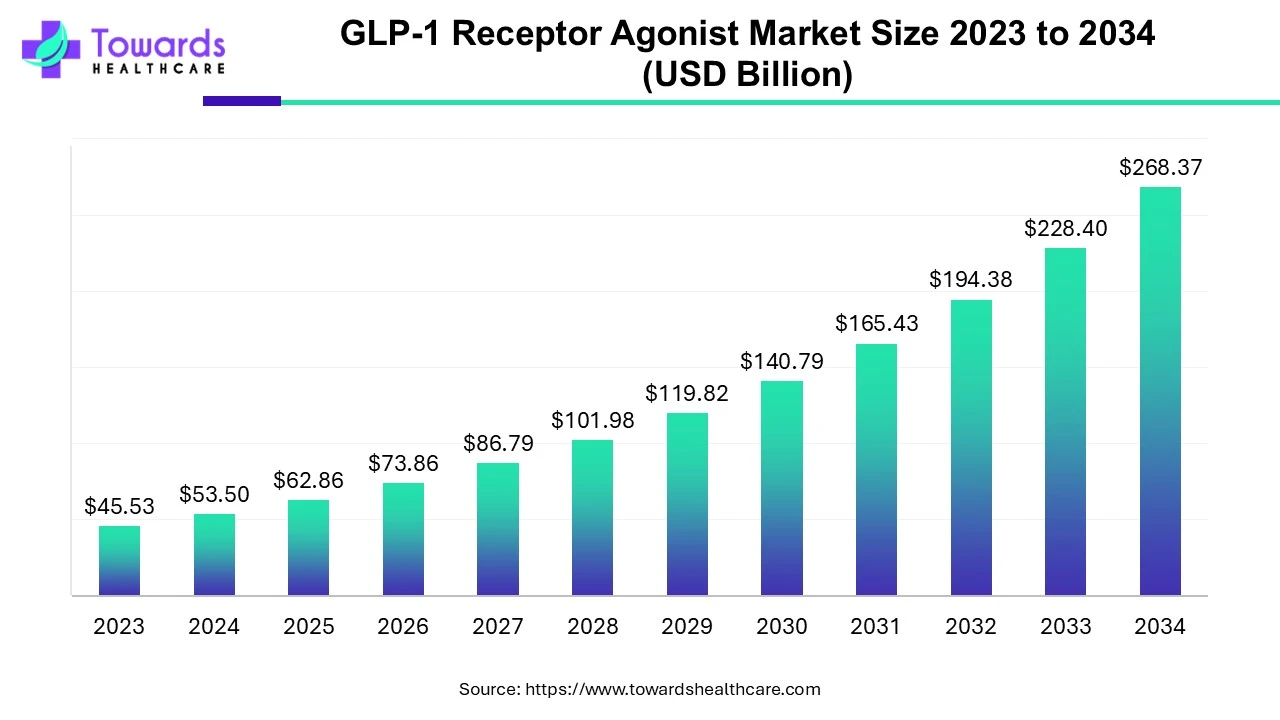

The global GLP-1 receptor agonist market size is calculated at USD 62.86 billion in 2025, grew to USD 73.86 billion in 2026, and is projected to reach around USD 315.33 billion by 2035. The market is expanding at a CAGR of 17.5% between 2026 and 2035. The rising prevalence of diabetes and obesity, growing research and development activities, and increasing investments drive the market.

| Key Elements | Scope |

| Market Size in 2026 | USD 73.86 Billion |

| Projected Market Size in 2035 | USD 315.33 Billion |

| CAGR (2026 - 2035) | 17.5% |

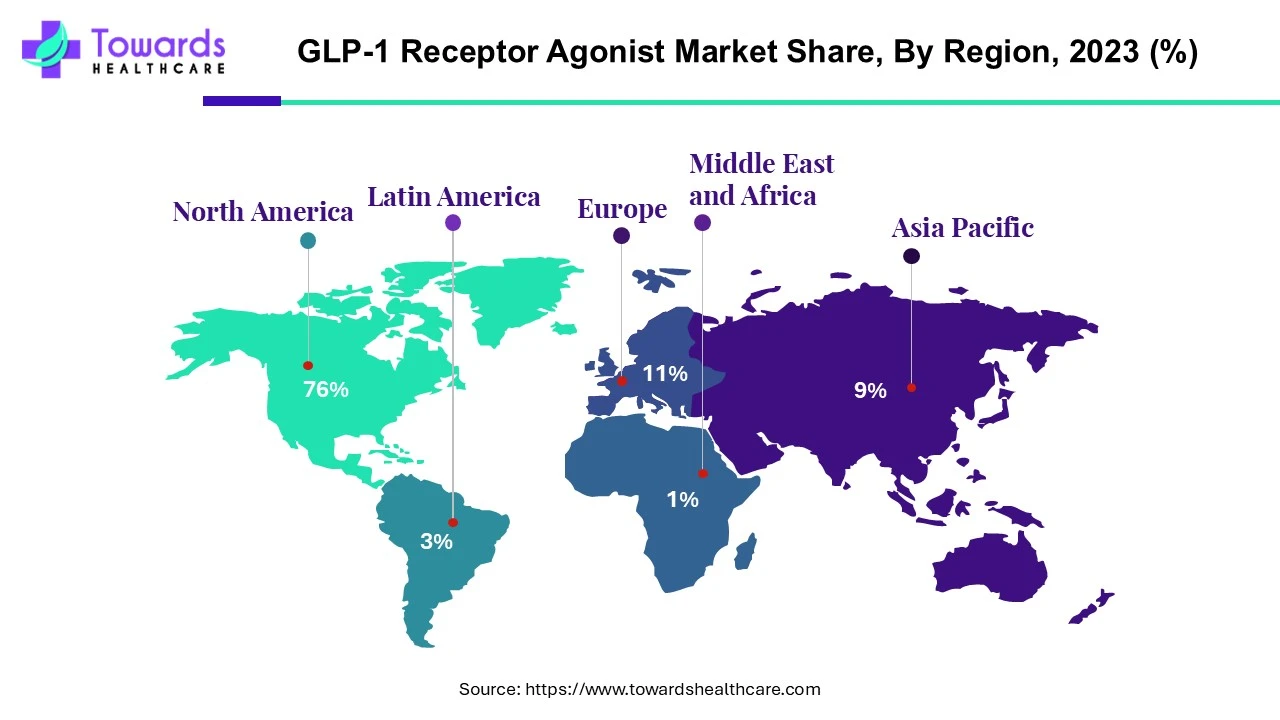

| Leading Region | North America by 76% |

| Market Segmentation | By Product, By Application, By Route of Administration, By Distribution Channel, By Region |

| Top Key Players | Amneal Pharmaceuticals, Ascendis Pharma, AstraZeneca, Boehringer Ingelheim, Eli Lilly & Company, Hansoh Pharma, Innovent Biologics, Merck, Metsera, Inc., Novo Nordisk A/S, Pfizer, Inc., Sanofi, Viking Therapeutics, Inc. |

GLP-1 receptor agonists or incretin mimetics are peptidic drugs that augment the response of GLP-1 receptors. They mimic the actions of the endogenous hormone GLP-1, released by the gut after eating. They are mainly prescribed to lower blood glucose levels and reduce weight. Examples of GLP-1 agonists include Dulaglutide, Exenatide, Liraglutide, Lixisenatide, and Semaglutide. These drugs are prescribed in patients who are unresponsive to metformin due to contraindications or intolerance. They are also prescribed in patients with higher A1c levels, i.e., 1.5% over target, or in patients who do not reach their target within 3 months. Semaglutide and high-dose Liraglutide are prescribed to manage obesity in overweight patients. These drugs are recommended with lifestyle changes and exercise.

The rising prevalence of diabetes and obesity globally is a major public health concern and necessitates early treatment. This potentiates the demand for GLP-1 receptor agonists, boosting market growth. Researchers are investigating the potential of these drugs further. Hence, the growing research and development activities are estimated to propel during the forecast period. The increasing investments and collaborations also contribute to market growth. The advent of advanced technologies transforms the market by introducing various aspects of automation.

Integrating artificial intelligence (AI) in GLP-1 receptor agonist research provides several benefits, including improved efficiency, automating tasks, and enhanced precision. AI can enable the design of novel drugs binding to the GLP-1 receptor and predicting their binding ability with the receptor. Researchers can assess the stability and compatibility of the drug within the receptor. AI and machine learning (ML) algorithms are also used to screen a wide range of known natural compounds that can mimic the action of GLP-1 hormone. Additionally, AI and ML can determine the physicochemical and pharmacokinetic properties of the designed drugs to reduce failure rates. They play a vital role in developing drugs with improved efficacy and fewer side effects in comparatively less time than conventional methods, allowing organizations to save time and costs. Thus, AI and ML have immense potential to revolutionize the market.

For instance,

Favorable Policies

The major growth factor of the GLP-1 receptor agonist market is the favorable government policies to combat diabetes and obesity. The increasing prevalence of such disorders necessitates government organizations to launch initiatives to reduce disease prevalence. At present, more than half a billion population are living with diabetes globally. Similarly, obesity is estimated to affect over 1 billion people globally. The World Health Organization releases guidelines and supports initiatives for the surveillance, prevention, and control of diabetes and its complications. In 2022, the World Health Assembly endorsed five global diabetes coverage targets to be achieved by 2030. Similarly, the member states have adopted the WHO Acceleration Plan to stop obesity, supporting country-level action through 2030. These policies promote the use of GLP-1 analogs to treat more people, increasing accessibility.

High Cost

The major challenge faced by the market is the high cost of GLP-1 receptor agonists. These drugs cost hundreds of dollars per month or sometimes more than $1,000 per month. The high cost is attributed to advanced research and development and drug shortages owing to huge demand. This limits the affordability of many patients, especially from low- and middle-income groups and those who do not have medical insurance, restricting market growth.

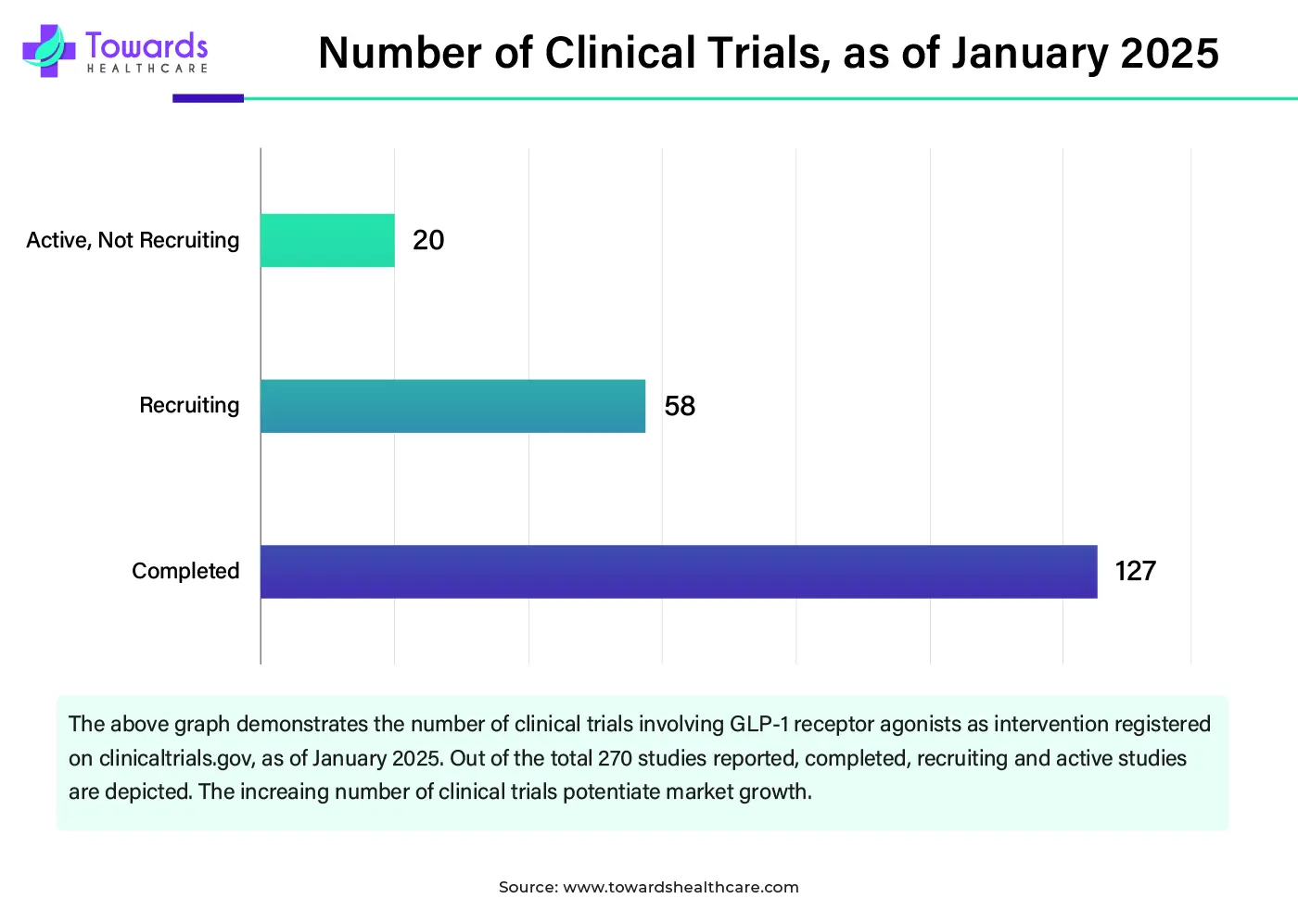

Growing Research and Development

The future of the GLP-1 receptor agonist market is promising, driven by growing research and development activities. The ongoing research mainly focuses on finding extended applications of already existing GLP-1 analogs. Scientists have investigated the role of GLP-1 analogs in treating cardiovascular, skeletal muscle-related, and neurodegenerative disorders. Some studies have reported positive results for these diseases, exploring the potential for healthcare professionals. Some researchers have also determined the effect of GLP-1 analogs in type 1 diabetes. Moreover, the research also focuses on developing novel GLP-1 analogs, owing to the increased demand. The need for improved efficacy and fewer side effects also potentiates the development of novel drugs. The research and development activities are supported by increasing investments and technological advancements. This results in an increasing number of clinical trials.

Why Did the Ozempic Segment Dominate in the GLP-1 Receptor Agonist Market?

By product, the Ozempic segment held a dominant presence in the GLP-1 receptor agonist market in 2024. Ozempic is a brand-name drug for semaglutide approved for the treatment of type 2 diabetes. It is highly preferred due to its benefits, such as HbA1C reduction, significant weight loss, lower risk of heart attack and stroke, and improved cardiovascular health in type 2 diabetes patients. The easy availability and relatively low cost of Ozempic compared to other GLP-1 agonists augment the segment’s growth. In 2023, the sales of Novo Nordisk’s Ozempic crossed $13.9 billion.

Zepbound Segment: Significantly Growing

By product, the Zepbound segment is predicted to witness significant growth in the market over the forecast period. Zepbound (tirzepatide) is an injectable prescription medicine approved for the treatment of obesity. It was also recently approved for obstructive sleep apnea in obese patients. It is recommended to be used with a low-calorie diet and increased physical activity. The increasing prevalence of obesity and extended applications of Zepbound in obese patients promote the segment’s growth.

How Type 2 Diabetes Mellitus Segment Dominated the GLP-1 Receptor Agonist Market?

By application, the type 2 diabetes mellitus segment led the global GLP-1 receptor agonist market in 2024. The rising prevalence of type 2 diabetes mellitus globally and favorable government policies fuel the segment’s growth. The prevalence is high, mainly in emerging economies, due to sedentary lifestyles, bad eating habits, and stress. Several government organizations release guidelines to prevent, diagnose, and treat type 2 diabetes mellitus. This promotes the use of GLP-1 agonists for treating diabetes.

Obesity Segment: Significantly Growing

By application, the obesity segment will gain a significant share of the market over the studied period. The rising prevalence of obesity increases the demand for GLP-1 receptor agonists. According to the World Obesity Atlas, over 4 billion people, or 51% of the global population, by 2035 will suffer from obesity. The development of generic alternatives of GLP-1 agonists by several pharma companies increases the accessibility for many people, helping them to reduce weight.

Which Route of Administration Type Segment Held the Dominating Share of the GLP-1 Receptor Agonist Market?

By route of administration, the parenteral segment held the largest share of the GLP-1 receptor agonist market in 2024. GLP-1 receptor agonists are mainly administered through the parenteral route due to poor oral bioavailability and degradation in the GI tract. They are given by subcutaneous route due to increased efficacy and the ability to avoid first-pass metabolism. Injectable medications have a faster onset of action and are absorbed more quickly.

Oral Segment: Fastest-Growing

By route of administration, the oral segment is anticipated to grow with the highest CAGR in the market during the studied years. There are currently no FDA-approved GLP-1 receptor agonists that can be administered orally. However, several researchers are currently developing oral GLP-1 agonists for treating type 2 diabetes and obesity. The growing research and development activities and increasing investments propel the segment’s growth. The rising collaborations and public-private partnerships also potentiate the segment’s growth.

What Made Hospital Pharmacies the Dominant Segment in the GLP-1 Receptor Agonist Market?

By distribution channel, the hospital pharmacies segment registered its dominance over the global GLP-1 receptor agonist market in 2024. The segmental growth is attributed to the presence of trained professionals, suitable infrastructure, and capital investments. Hospitals are involved in many clinical trials assessing GLP-1 agonists. This benefits several patients suffering from type 2 diabetes mellitus and obesity. Additionally, the increasing number of hospitalizations and the need for prescription medicines allow hospital pharmacies to grow.

Online Pharmacies Segment: Fastest-Growing

By distribution channel, the online pharmacies segment is projected to expand rapidly in the market in the coming years. The rising geriatric population and the increasing adoption of smartphones boost the segment’s growth. The ease of ordering medicines in the comfort of the patient’s home from a wide range of options increases the demand for online pharmacies. Online pharmacies provide special discounts and same-day home delivery, which also drives the segment’s growth.

North America dominated the global GLP-1 receptor agonist market share by 76%. State-of-the-art research and development facilities, favorable government policies, and the presence of key players drive the market. Suitable regulatory frameworks and new product launches also contribute to market growth. The U.S. Food and Drug Administration and Health Canada regulate the approval and marketing of GLP-1 receptor agonists in the U.S. and Canada. In 2023, more than 1 in 3 adults, i.e. 35%, were reported to have obesity in the U.S. While, in Canada, 2 in 3 adults and 1 in 3 children are living with obesity. Hence, the rising prevalence of obesity is likely to affect market growth by increasing the demand for GLP-1 receptor agonists.

U.S. GLP-1 Receptor Agonist Market Trends

The presence of well-developed healthcare infrastructures in the U.S. is increasing the adoption of the GLP-1 receptor agonist. Additionally, the growing incidence of diabetes is also increasing its demand. Furthermore, the growing R&D and faster regulatory approvals are also increasing their innovations, which are supported by healthcare investments.

Asia-Pacific is projected to host the fastest-growing GLP-1 receptor agonist market in the coming years. The rising prevalence of type 2 diabetes mellitus and obesity, rising adoption of technology, and increasing investments drive the market. Countries like China, India, and Japan are at the forefront of boosting market growth in Asia-Pacific. The favorable reimbursement policies also govern the market growth. The Chinese government has included the NMPA-approved GLP-1 receptor agonists in the national medical insurance policy to increase the accessibility and affordability of such drugs. Foreign direct investments and the availability of suitable manufacturing infrastructure also augment the market. The Japanese government has also included semaglutide (Wegovy) under Japan’s national health insurance since February 2024.

China GLP-1 Receptor Agonist Market Trends

China consists of a large population, which is increasing the incidence of type 2 diabetes, driving the demand for GLP-1 receptor agonists. This, in turn, is increasing their production rates, where the growing government health campaigns are also increasing their use and awareness as well. Moreover, the companies are also accelerating their development and innovations.

For instance,

Europe is expected to grow significantly in the GLP-1 receptor agonist market during the forecast period, due to the growing diabetes burden. Additionally, the growing obesity cases is also increasing the demand for GLP-1 receptor agonists, where the presence of the advanced healthcare sector is also increasing their adoption rates. Additionally, the investment and funding are also supporting their advancements, promoting market growth.

UK GLP-1 Receptor Agonist Market Trends

The UK is experiencing a rise in type 2 diabetes and obesity cases, which is increasing the use and demand for GLP-1 receptor agonists. The growing health awareness and presence of robust healthcare systems are increasing accessibility, where companies are collaborating to develop their new formulations.

The Middle East & Africa are expected to grow at a notable rate in the foreseeable future. People are increasingly aware of the benefits and applications of GLP-1agonists in managing diabetes and obesity. Ongoing efforts are made to strengthen domestic manufacturing infrastructure, promoting the indigenous manufacturing of GLP-1 drugs. Favorable regulatory policies and increasing investments also propel the market.

UAE GLP-1 Receptor Agonist Market Trends

The prevalence rate of obesity in the UAE is approximately 10.3% for women and 7.5% for men. The region is emerging as a manufacturing powerhouse to reduce reliance on imports through Jebel Ali Free Zone and Dubai Industrial City, serving local and international markets. This helps the UAE to become a global and regional hub in the pharmaceutical sector.

Latin America is considered to be a significantly growing area, due to the rising burden of obesity and diabetes, and growing research and development activities. High consumer awareness and increasing prescriptions of GLP-1 drugs promote market growth. Regulatory authorities allow foreign companies to set up their facilities in the region to serve the local population. The increasing public-private partnerships and rising R&D investments augment the market.

Brazil GLP-1 Receptor Agonist Market Trends

According to the International Diabetes Federation, approximately 10.6% of the total Brazilian population is currently living with diabetes. In addition, obesity is also a significant health burden among Brazilians. It is estimated that a 1% rise in the obesity rate adds $12.3 million in new hospital admissions through the public health system.

Chirag and Chintu Patel, Co-Chief Executive Officers of Amneal Pharmaceuticals, commented on collaboration with Metsera that the company could extend its pipeline to a new portfolio of injectable and oral weight loss GLP-1 therapies. This enables the company to apply complex pharmaceutical manufacturing to bring these programs to market, providing access to affordable, high-quality, and essential medicines.

By Product

By Application

By Route of Administration

By Distribution Channel

By Region

December 2025

October 2025

December 2025

November 2025