February 2026

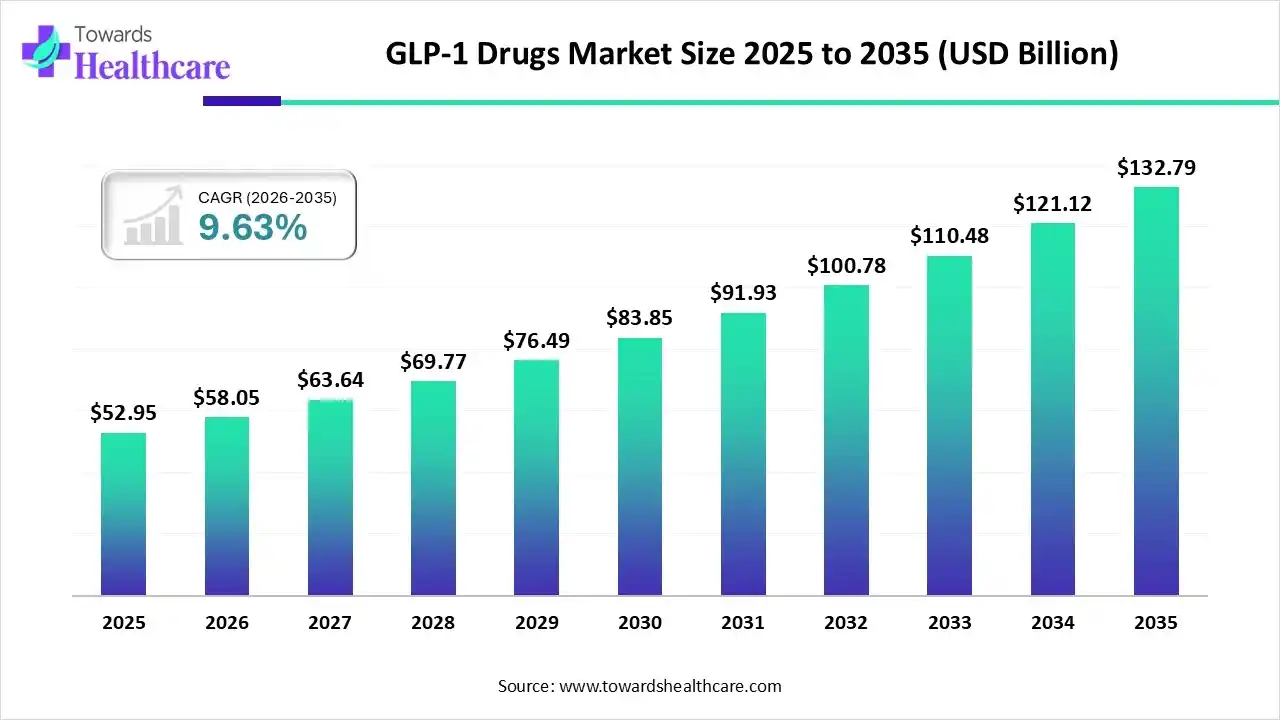

The global GLP-1 drugs market size began at US$ 52.95 billion in 2025 and is forecast to rise to US$ 58.05 billion by 2026. By the end of 2035, it is expected to surpass US$ 132.79 billion, growing steadily at a CAGR of 9.63%.

The demand as well as the use of GLP-1 drugs for the treatment of type 2 diabetes and obesity is increasing. The companies are collaborating to develop and commercialize their product in the market. Various platforms with AI integration are also being developed. At the same time, various research and developments are also being conducted to identify new applications and to develop next-generation GLP-1 drugs. Hence, their use in different regions is increasing. Thus, all these developments are promoting the market growth.

| Table | Scope |

| Market Size in 2026 | USD 58.05 Billion |

| Projected Market Size in 2035 | USD 132.79 Billion |

| CAGR (2026 - 2035) | 9.63% |

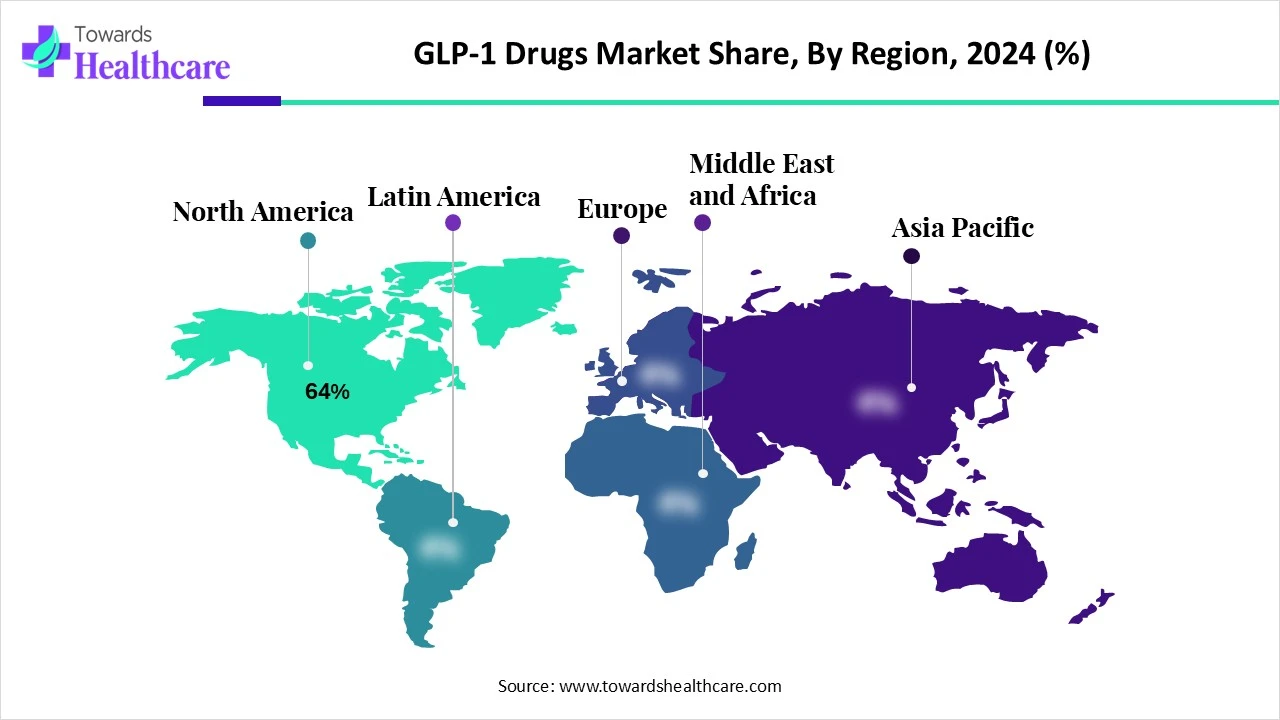

| Leading Region | North America by 64% |

| Market Segmentation | By Indication, By Drug Type/Brand, By Route of Administration, By End User, By Region |

| Top Key Players | Novo Nordisk A/S – Ozempic, Wegovy, Rybelsus, Victoza, Eli Lilly and Company – Mounjaro, Zepbound , AstraZeneca plc – Bydureon (legacy) , Sanofi S.A. – Efpeglenatide (in development), Pfizer Inc. – oral GLP-1 analogs (pipeline) , Amgen Inc. – AMG133 (long-acting GLP-1/GIP), Structure Therapeutics – oral GLP-1 analogs (early-stage), Altimmune Inc. – Pemvidutide (dual agonist, Phase II), Hua Medicine (China), Hanmi Pharmaceutical (South Korea) – GLP-1 candidates , Zealand Pharma A/S – GLP-1/glucagon duals , Boehringer Ingelheim – Obesity-focused GLP-1 pipeline, Jiangsu Hansoh Pharmaceutical – China-based GLP-1s, Innovent Biologics – Biosimilar development, Sciwind Biosciences , LG Chem – Long-acting GLP-1 candidates, BioAge Labs – Neurodegenerative indications for GLP-1, Vertex Pharmaceuticals – Exploring GLP-1 mechanisms in metabolic disease, Peptron Inc. – Sustained-release GLP-1, TheracosBio – Oral peptide development |

The GLP-1 drugs market refers to the market for glucagon-like peptide-1 receptor agonists, a class of drugs that mimic the GLP-1 hormone to regulate blood sugar levels, enhance insulin secretion, and promote satiety. Initially developed for Type 2 Diabetes (T2D), GLP-1 drugs are now widely used in obesity/weight loss management, with emerging applications in cardiovascular and neurodegenerative diseases. The market is experiencing exponential growth due to blockbuster drugs like Ozempic, Wegovy, and Mounjaro, rising obesity rates, and favorable clinical outcomes across multiple indications.

The AI is being used in the discovery and design of next-generation GLP-1 analogs. Various such models, along with machine learning, are also being developed. It is also used to predict the outcomes and the response of the drug, for identifying new applications of the GLP-1 drug. Additionally, new tools are being developed to monitor the responses of GLP-1 in the patient and to track the side effects associated with it. Thus, the quality, effectiveness, and safety of the GLP-1 drug can be enhanced by AI.

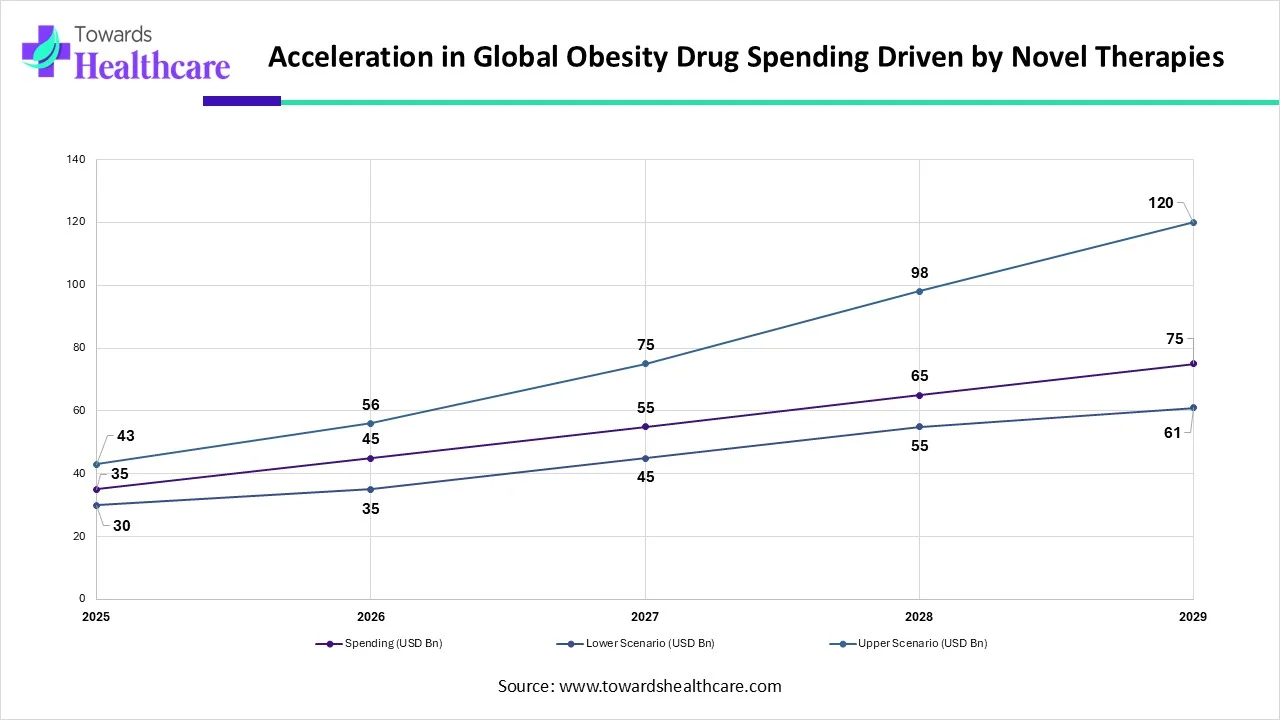

| Year | Spending (USD Bn) | Lower Scenario (USD Bn) | Upper Scenario (USD Bn) |

| 2025 | 35 | 30 | 43 |

| 2026 | 45 | 35 | 56 |

| 2027 | 55 | 45 | 75 |

| 2028 | 65 | 55 | 98 |

| 2029 | 75 | 61 | 120 |

Growing Incidences of Type 2 Diabetes

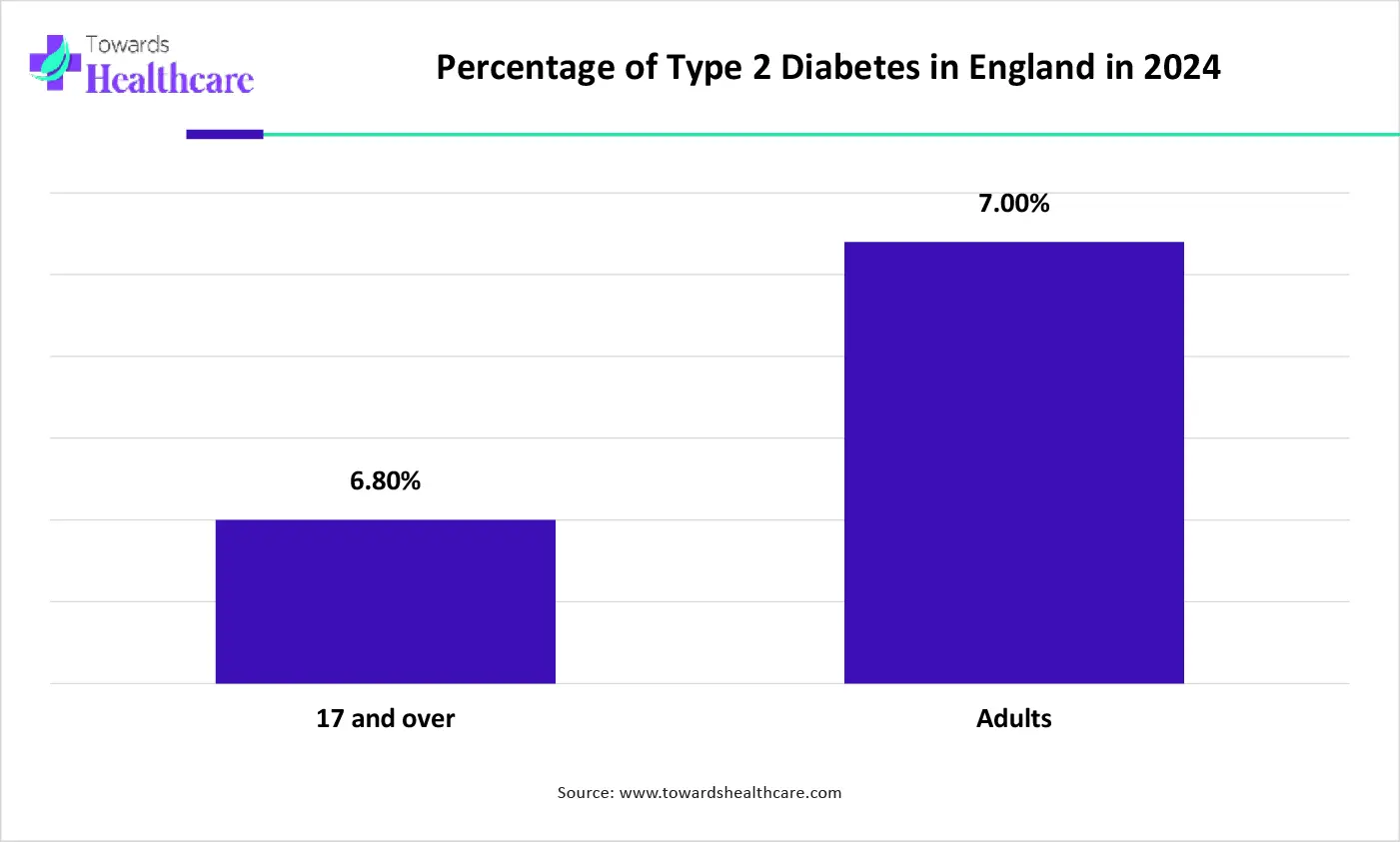

There is a rise in the incidence rates of type 2 diabetes. A large number of the aging population is mainly affected by it. The changing lifestyle and diet are also contributing to the same. Therefore, the demand for GLP-1 drugs is increasing. These drugs are also prescribed to diabetes patients with obesity and cardiovascular conditions. This, in turn, decreases the risk of heart diseases, increasing the patient's adherence to the treatment. Thus, this drives the market growth.

The graph represents the percentage of patients with type 2 diabetes observed in England in year of 2024. It indicates that there will be a rise in cases of type 2 diabetes in adults. Hence, it increases the demand for GLP-1 drugs for their effective management. Thus, this in turn will ultimately promote the market growth.

In 2025, the best GLP-1 tracker is more than an app, it's a precision health co-pilot. It syncs medication schedule with biometric feedback, translating injections into insights. One of the best GLP‑1 trackers for health management in 2025 is Shotsy, a dedicated app designed especially for users of GLP‑1 medications like semaglutide, tirzepatide, Wegovy, and others. Whether the patient is on Ozempic, Mounjaro, or Wegovy, the top trackers now offer automated dose tracking, symptom prediction, and nutrition syncing, turning routine logs into personalized health strategy dashboards.

High Price

The GLP-1 drugs are expensive, which in turn, limits their use. Moreover, the low or middle-income countries are unable to afford them. At the same time, the lack of insurance for these drugs for the treatment of obesity reduces their affordability. This, in turn, affects the adherence of the patient to the treatment, restraining its use.

Why is the Growing Applications of GLP-1 Drugs an Opportunity in the GLP-1 Drugs Market?

The use of GLP-1 drugs for the management of diabetes is increasing. At the same time, their use in weight management is also increasing. This, in turn, is leading to a rise in their adoption rates. Similarly, it is also used as a heart protection drug for reducing the risk of various heart conditions. Hence, new such applications of GLP-1 drugs are being studied, for Alzheimer's, polycystic ovary syndrome (PCOS), Non-alcoholic fatty liver disease (NAFLD), etc. Thus, this promotes the market growth.

For instance,

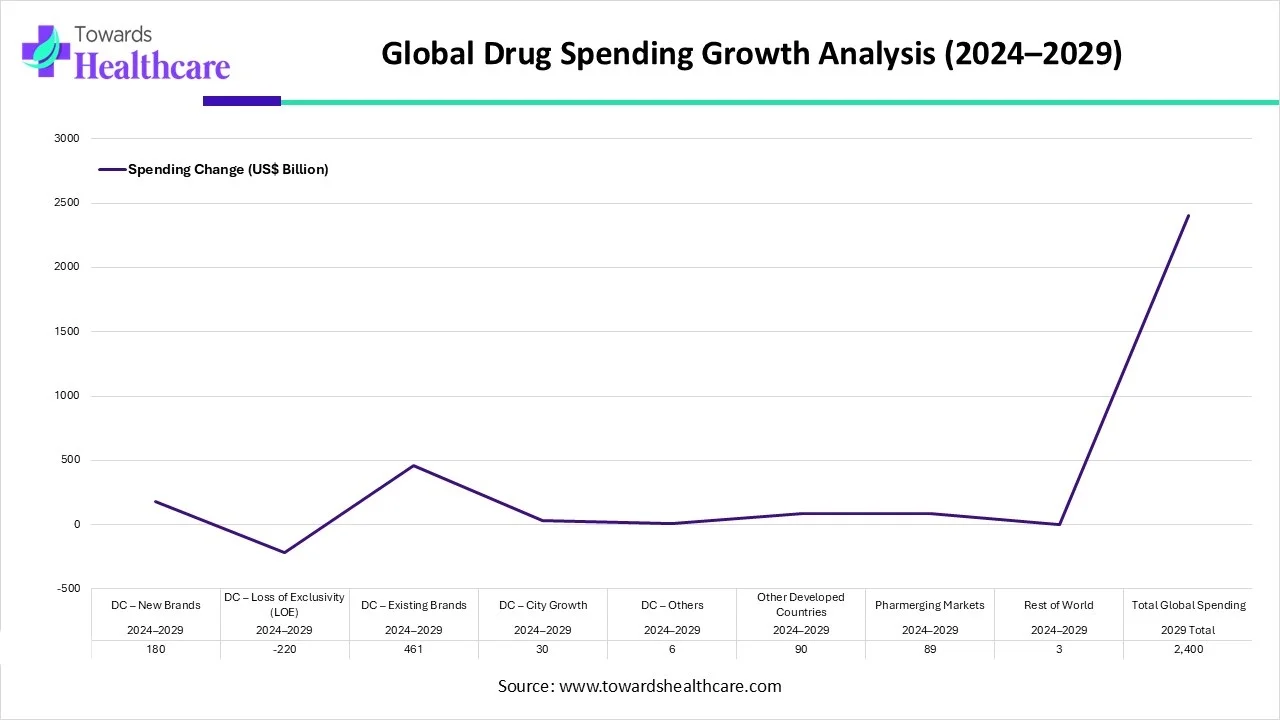

| Period | Growth Driver / Segment | Spending Change (US$ Billion) |

| 2024–2029 | DC – New Brands | 180 |

| 2024–2029 | DC – Loss of Exclusivity (LOE) | -220 |

| 2024–2029 | DC – Existing Brands | 461 |

| 2024–2029 | DC – City Growth | 30 |

| 2024–2029 | DC – Others | 6 |

| 2024–2029 | Other Developed Countries | 90 |

| 2024–2029 | Pharmerging Markets | 89 |

| 2024–2029 | Rest of World | 3 |

| 2029 Total | Total Global Spending | 2,400 |

How Type 2 Diabetes (T2D) Segment Dominated the GLP-1 Drugs Market in 2024?

By indication type, the type 2 diabetes (T2D) segment dominated the market with a 58% share in 2024. Due to the rise in the incidence of T2D, the demand for the use of GLP-1drugs increased. At the same time, they were used as a long-term treatment option for diabetes, and the presence of insurance policies enhanced their use. This contributed to the market growth.

By indication type, the obesity/weight management segment is expected to show the highest growth at a notable CAGR during the predicted time. The growing rates of obesity are increasing the use of GLP-1 for weight management. Moreover, as this use is approved by the regulatory bodies, it is attracting the population. Additionally, next-generation GLP-1 drugs for obesity are also being developed.

What Made Semaglutide (Ozempic, Wegovy, Rybelsus) the Dominant Segment in the GLP-1 Drugs Market in 2024?

By drug type/brand type, the Semaglutide (Ozempic, Wegovy, Rybelsus) segment held the largest share of 49% in the market in 2024. The Semaglutide showed improved efficacy, which in turn contributed to their increased use. Furthermore, as an orally administered drug, it enhances the convenience of the patient. Thus, it was widely prescribed.

By drug type/brand type, the Tirzepatide (Mounjaro, Zepbound) segment is expected to show the fastest growth rate during the upcoming years. Tirzepatide is a dual GLP-1/GIP agonist that helps in controlling glucose and obesity management. This is increasing their use and acceptance rates. Moreover, the growing investment is encouraging their use and development.

Zepbound and Mounjaro Redefine Drug Launch Speed in the U.S. Market

| Drug Name | Peak Monthly Sales Achieved | Time to Reach ~$1B/Month | Sales Trend Over Time | Notes |

| Zepbound | $1.5 B | 12 months | Rapid early growth, stabilizing after Year 1 | Fastest obesity-drug uptake |

| Mounjaro | $3.0 B | 12 months | Strong, sustained growth beyond Year 1 | Highest monthly sales among peers |

| Wegovy | $1.4 B | 36-40 months | Gradual growth with mid-cycle acceleration | Supply constraints impacted ramp-up |

| Ozempic | $1.5 B | 50+ months | Steady, long-term growth | Earlier diabetes focus before obesity expansion |

| Harvoni | $1.0 B (early peak) | 6 months | Declining trend post-peak | Short lifecycle, legacy HCV therapy |

Why Did the Injectable Segment Dominate in the GLP-1 Drugs Market in 2024?

By route of administration type, the injectable segment led the market with a 83% share in 2024. The injectable delivery of GLP-1 drugs shows rapid onset of action and bioavailability. At the same time, due to their long duration of action, the frequency of injections was reduced. This enhanced the patient's adherence to the treatment.

By route of administration type, the oral segment is expected to show the highest growth during the predicted time. The use of oral dosage forms is increasing are they enhance the convenience of the patients. This, in turn, also decreases the risk of infections due to injections. Thus, to enhance their adherence, new oral candidates are also being developed.

Which End User Segment Held the Dominating Share of the GLP-1 Drugs Market in 2024?

By end user, the retail pharmacies segment held the dominating share of 51% in the market in 2024. A large volume of GLP-1 drugs was distributed by the retail pharmacies along with effective guidance on their handling and side effects by the pharmacist. Moreover, this enhanced the accessibility of the drugs. Thus, this prompted the market growth.

By end user, the online pharmacies / DTC channels segment is expected to show the fastest growth rate during the upcoming years. The growing telehealth and weight loss programs are increasing access to the GLP-1 drugs. The home deliveries are enhancing patient convenience. The privacy of the consumers is also being maintained, which is increasing their use.

North America dominated the market share by 64% in 2024. There was a rise in the incidence of type 2 diabetes in North America, which in turn increased the use of GLP-1 drugs. At the same time, the large number of obese patients preferred its use. This contributed to the market growth.

The U.S. GLP-1 Drugs Market Trends

The use of GLP-1 medications in the U.S. is increasing due to growing DTC marketing. At the same time, the industries are developing various such drug candidates to identify new applications of GLP-1 drugs. Moreover, the use of advanced technologies is accelerating their development and production with improved safety and efficacy.

What are the Top-selling GLP-1 Medications in the U.S.?

In the U.S. pharmaceutical landscape, GLP-1 medications have surged to blockbuster status, driven by soaring demand for both diabetes management and weight loss solutions. Leading the charge is semaglutide, branded as Ozempic and Wegovy, which has redefined the category with U.S. sales surpassing $13 billion cementing its role as a cultural and clinical phenomenon. Close behind, Trulicity (dulaglutide) from Eli Lilly maintains a strong foothold with over $7 billion in annual sales.

The Canada GLP-1 Drugs Market Trends

The hospitals and clinics in Canada are using GLP-1 drugs to treat type 2 diabetes as well as obesity. Moreover, the presence of insurance plans is increasing their acceptance rates, which in turn is enabling the patients to adhere to the treatment. Furthermore, their use in cardiovascular conditions is also being researched.

Asia Pacific is expected to host the fastest-growing GLP-1 drugs market during the forecast period. The increasing incidence of lifestyle-related diseases in the Asia Pacific is increasing the demand for GLP-1 drugs. This, in turn, is increasing their use in various healthcare sectors with improved accessibility. This enhances the market growth.

China GLP-1 Drugs Market Trends

The growing rates of lifestyle-related diseases in China are increasing the use of GLP-1 drugs. Thus, the industries are increasing their manufacturing with the utilization of advanced technologies. Additionally, the growing cases of cardiovascular diseases and obesity are also contributing to their increased demand for GLP-1 drugs.

India GLP-1 Drugs Market Trends

The healthcare sector in India is expanding, enhancing the development of GLP-1 drugs. Moreover, the growing awareness, cases of type 2 diabetes, and obesity are increasing its use. Hence, to make them more accessible and affordable, the government is also providing its support.

Europe is expected to grow significantly in the market during the forecast period. The increasing prevalence of type 2 diabetes and obesity in Europe is increasing the demand for GLP-1 drugs. Hence, various reimbursement strategies are being introduced to enhance its accessibility. This promotes the market growth.

Germany GLP-1 Drugs Market Trends

The use of GLP-1 drugs in Germany is increasing due to growing incidences of type 2 diabetes as well as obesity. Thus, to deal with their growing use, different reimbursement policies are also being introduced by the government. At the same time, the industries and institues are studying these drugs for the management of PCOS and cardiovascular diseases.

UK GLP-1 Drugs Market Trends

As the use of GLP-1 drugs is increasing, the industries in the UK are developing various such candidates. At the same time, research is also being conducted to detect other applications of GLP-1 drugs in the treatment of neurodegenerative diseases, PCOS, etc. Thus, these developments are supported by the government funding.

By Indication

By Drug Type/Brand

By Route of Administration

By End User

By Region

February 2026

February 2026

January 2026

January 2026