February 2026

The GLP-1 small molecule market is rapidly advancing on a scale, with expectations of accumulating hundreds of millions in revenue between 2026 and 2035. Market forecasts suggest robust development fueled by increased investments, innovation, and rising demand across various industries.

Particularly, in Asian countries, like India & China, which are facing a massive burden of diabetes cases, with raised concerns regarding obesity and weight management, assisting the development of innovative therapies, like dual target GLP-1 small molecules. Furthermore, diverse biopharma companies are putting R&D efforts to leverage the application of these molecules beyond diabetes and obesity, such as in neurodegenerative conditions and cardiovascular issues, with an immersive role of the FDA & EMA in approval processes.

The global GLP-1 small molecule market includes orally administered, low-molecular-weight therapeutic agents that target the GLP-1 receptor pathway to improve glycemic control and associated metabolic outcomes. Market growth is driven by the rising prevalence of type 2 diabetes and obesity, demand for oral alternatives to injectable incretin therapies, enhanced patient adherence, investment in novel small molecule platforms, and expanding indications related to cardiometabolic health.

These small molecule agonists or modulators aim to replicate some of the benefits of peptide GLP-1 receptor agonists (e.g., incretin effect, improved insulin secretion, appetite regulation) but with advantages in oral bioavailability, dosing flexibility, and potential cost of goods.

Prominently, the ongoing broader application of deep learning and generative models in the designing of newer non-peptide small molecules for mimicking the action of the larger, injectable GLP-1 peptides is fostering the AI algorithms advances. Moreover, the key tech companies are widely using AI for the development of innovative delivery systems, like specific nanoplatforms for boosting the stability and oral bioavailability of both peptide & non-peptide GLP-1 therapeutics.

Current developments are shifting towards the evolution and clinical advances of true small-molecule GLP-1 receptor agonists, such as Eli Lilly's orforglipron, which do not require the same strict dietary conditions for absorption, thereby streamlining patient use and manufacturing.

Recently, the FDA approved semaglutide for new uses, including the reduction of the risk of kidney disease growth and the treatment of MASH (Metabolic Dysfunction-Associated Steatohepatitis).

Researchers are stepping into the conduct of trials to ensure long-term safety, durability, and cardiovascular advantages, along with developing drugs having activity at dual/multi receptors for advanced results.

| Eli Lilly (December 2025) | Planned to invest more than $6 billion in a new production facility in Huntsville, Alabama, to develop small molecule synthetic & peptide medicines |

| Pfizer Inc. (December 2025) | Collaborated with YaoPharma for the evolution, production and commercialisation of YP05002, a small molecule glucagon-like peptide 1 (GLP-1) receptor agonist currently in Phase 1 development for chronic weight management. |

Which Molecule Type Led the GLP-1 Small Molecule Market in 2025?

In 2025, the oral GLP-1 agonists segment captured nearly 50% share of the market. These candidates highly provide cost-effectiveness and accessibility, with elimination of injections with enhanced comfort, storage, and adherence, mainly for once-daily dosing. Also, their greater adoption is driven by their efficacy for Type 2 Diabetes (T2D) & Obesity, with potential for MASH (liver disease) and neurodegenerative conditions (Alzheimer's, Parkinson's). However, GSBR-1290, CT-996, and ECC5004 are under clinical studies.

Dual-Target GLP-1 Small Molecules

The dual-target GLP-1 small molecules segment will expand at approximately 18–22% CAGR. This mainly comprises the combination of effects of GLP-1 receptor agonism with other metabolic hormone receptor agonism, like the glucose-dependent insulinotropic polypeptide (GIP) or glucagon receptors (GCGR). Ongoing development includes VK2735 (Viking Therapeutics), an investigational drug that acts as a dual GLP-1/GIP receptor agonist in both oral and subcutaneous formulations, which is in Phase 3 trials for obesity and will be approved by the FDA either in 2028 or beyond.

How did the Full GLP-1 Receptor Agonism Segment Dominate the Market in 2025?

The full GLP-1 receptor agonism segment held nearly 55% revenue share of the GLP-1 small molecule market in 2025. This MOA benefits by enhancing blood sugar control, substantial weight loss and rigorous cardiovascular benefits. Also, it can leverage improvements in fatty liver disease, kidney health, and neurodegenerative diseases by addressing multiple metabolic defects, unlike older drugs.

Multi-Pathway

The multi-pathway segment is predicted to expand at a nearly 20–24% CAGR. Specifically, small molecules are developed to bias signaling toward particular intracellular pathways (like the cAMP/PKA pathway for insulin secretion or the PI3K/Akt pathway for cell survival) to accelerate therapeutic outcomes and lower side effects. This MOA offers enhanced insulin secretion, suppressed glucagon release, and optimised insulin sensitivity. Whereas, poly-agonists target multiple receptors beyond just GLP-1R.

Which Indication Led the GLP-1 Small Molecule Market in 2025?

In 2025, the type 2 diabetes segment captured approximately 48% share of the market. These molecules facilitate impactful blood sugar control, crucial weight loss, and major cardiovascular/kidney protection. Recently, the FDA approved oral semaglutide (Rybelsus) for lowering significant adverse cardiovascular events (MACE) in adults with T2D.

Obesity & Weight Management

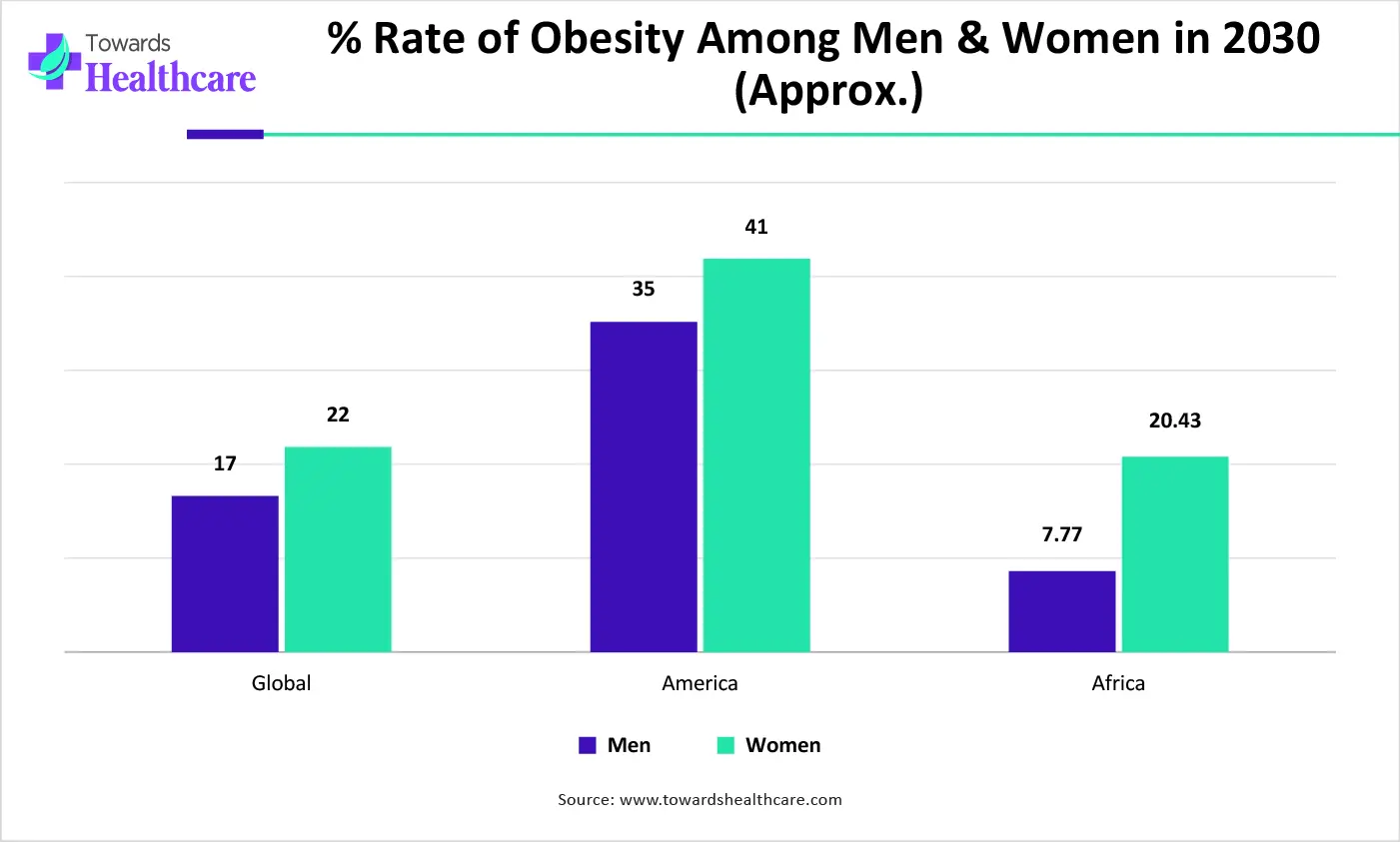

At a nearly 22–26% CAGR, the obesity & weight management segment will expand rapidly. The rising burden of obesity across the globe is shifting towards the wider adoption of convenient oral formulas, like GLP-1 small molecules, with expanded advantages in diabetes, cardiovascular health, and metabolic well-being. Recently, Eli Lilly revealed results from its Phase 3 ATTAIN-1b trial for obesity and ATTAIN-2 trial for obesity in people with type 2 diabetes throughout 2025.

Why did the Oral Tablets Segment Dominate the Market in 2025?

The oral tablets segment held nearly 62% share of the GLP-1 small molecule market in 2025. Specific benefits are needle-free, convenient, potentially affordable, and highly scalable treatment. Nowadays, researchers are innovating non-peptide oral GLP-1s (like Orforglipron) that are chemically stable, favourable for large production, and robust food-independent dosing, which resolves challenges of oral peptides.

Other Oral Delivery Formats

Moreover, the other oral delivery formats segment is anticipated expand at a nearly 20–23% CAGR. Consistent advanced encompass polymeric-based nanoparticles/microspheres and liposomes encapsulated GLP-1 analogues, protecting them from enzymatic degradation and acidic conditions in the stomach. Alongside, firms are leveraging hydrogels to develop a protective matrix to enable prolonged, controlled release in particular gut regions based on local environmental changes, such as pH or temperature.

Why did the Retail Pharmacies Segment Lead the Market in 2025?

The retail pharmacies segment captured an approximate 50% share of the GLP-1 small molecule market in 2025. Especially for injectable GLP-1s, pharmacists guide patients on dosing and side effects. For small molecules, they facilitate easier storage and broader distribution through standard retail supply chains without specialised temperature needs. Whereas pharmacists offer substantial one-on-one counselling on correct administration, potential side effects, like gastrointestinal concerns, and lifestyle changes, including diet and exercise.

Online Pharmacies

The online pharmacies segment will expand at approximately 25–28% CAGR. This primarily comprises telehealth services, which offer on-demand access to clinicians and simplify the process of consultation and prescription acquisition by supporting expanded access and reducing disparities in care. Involvement of pharmacists in online and specialty pharmacies plays a vital role in patient education, handling potential side effects, and navigating insurance limitations, while ensuring proper and safe use of these potent therapeutics.

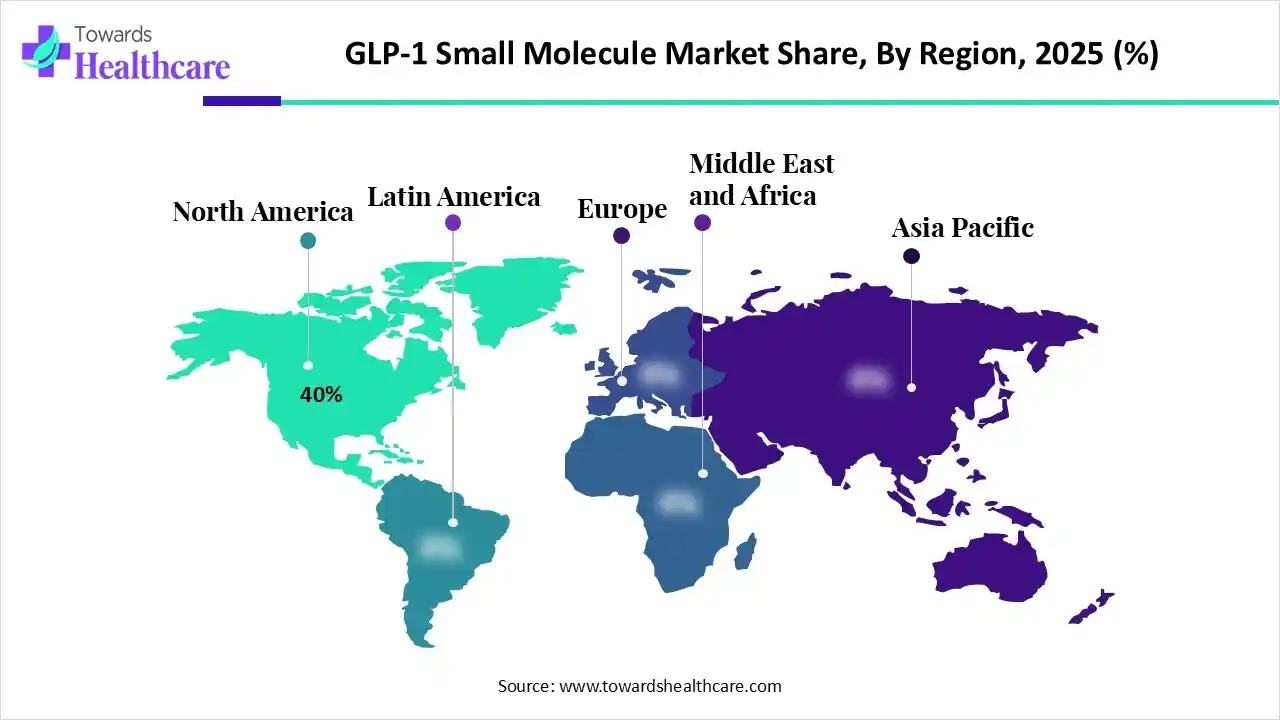

By capturing nearly 40% share, North America registered dominance in the market in 2025. Major drivers are a rise in cases of Type 2 Diabetes and Obesity, mainly in the U.S., and also promising insurance coverage, & swift regulatory approvals (FDA).

For instance,

Day by day, the Asia Pacific is facing a huge growth in metabolic disorders due to the accelerating urbanization, sedentary lifestyles, and dietary changes. Many Indian and Chinese pharmaceutical companies are planning to establish generics and novel formulations to meet the vast local demand and contain prices, such as Biocon Ltd, Tonghua Dongbao Pharmaceutical and Sciwind Biosciences Co., etc.

Furthermore, in China, the GLP-1 small molecule market is bolstering with vital innovations, such as Sciwind Biosciences' Ecnoglutide, a Chinese-developed GLP-1 (a peptide), which has shown robust Phase 3 trial results for weight loss, with a loss of an average of 9% to 13% of their body weight after 40 weeks.

With a notable expansion, European patients are highly preferring oral dosing over injections, which further escalates adherence to treatment strategies and patient compliance. Besides this, various EU companies are consistently pushing R&D steps for creating more efficient, stable oral formulations and combination therapies, which makes treatments more available and feasible.

In November 2025, Eli Lilly and Company planned to build a newer $3 billion production facility in Katwijk, the Netherlands, located within the Leiden Bio Science Park, to widen Lilly's capacity to produce oral medicines and enhance the company's global supply chain.

Whereas German key firms, like CordenPharma, are involved in establishing a novel peptide manufacturing plant in Switzerland as part of a significant investment to boost the production of GLP-1 peptides for the US and European markets.

| Company | Description |

| Eli Lilly | Its prominent candidate is orforglipron (also known as LY3502970), which is under development. |

| Novo Nordisk | They usually provide peptide-based (semaglutide in Ozempic/Wegovy/Rybelsus) and are also heavily investing in these small-molecule GLP-1 agonists. |

| Pfizer | A company exploring its oral small-molecule GLP-1 portfolio through planned deals, notably acquiring rights to Fosun Pharma's YP05002. |

| Roche | Its offering encompasses CT-996, an investigational, once-daily, oral small molecule GLP-1 receptor agonist currently in Phase 2 clinical trials. |

| AstraZeneca | This is specialising ECC5004 (also known as AZD5004), an investigational, once-daily oral drug licensed from Eccogene. |

| Viking Therapeutics | It offers VK2735, a dual GLP-1/GIP receptor agonist in both a peptide-based injectable formulation and an oral peptide tablet formulation |

| Septerna Therapeutics | A firm focusing on GLP-1, GIP, and glucagon receptors, to develop novel GLP-1 small molecule agonists. |

| Structure Therapeutics | It is leveraging next-gen programs, establishing GLP-1/GIP/Amylin/Glucagon Combos. |

| Zealand Pharma | This company prominently offers peptide-based therapeutics. |

| Sanofi | A company is exploring a combination therapy by using lixisenatide, which is a peptide, not a small molecule. |

Primarily, the production of peptide-based GLP-1s comprises complex and expensive manufacturing processes and cold-chain logistics. This further create barrier in scaling up production to meet the huge global demand, which still necessitates crucial investment and regulatory expertise, acting as a hurdle for smaller companies.

By Molecule Type

By Mechanism of Action

By Indication

By Route of Administration

By End-User

By Region

February 2026

January 2026

December 2025

November 2025