February 2026

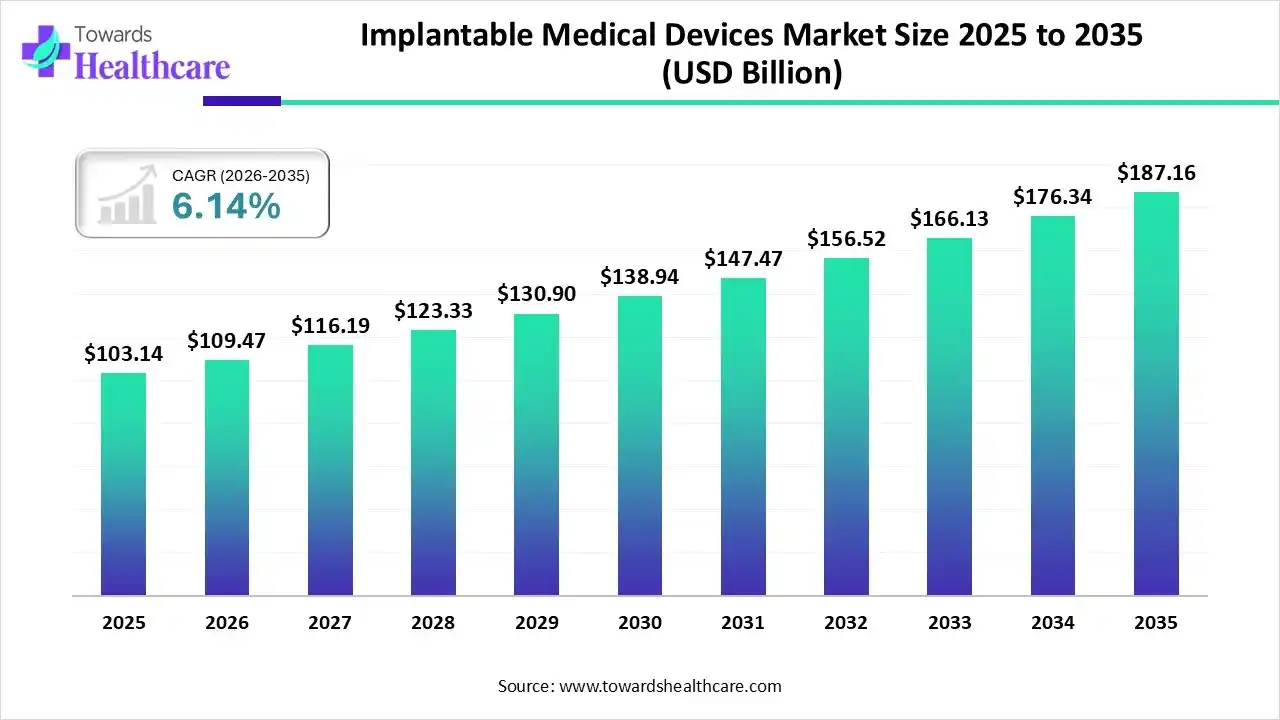

The global implantable medical devices market size is calculated at USD 103.14 billion in 2025, grew to USD 109.47 billion in 2026, and is projected to reach around USD 187.16 billion by 2035. The market is expanding at a CAGR of 6.14% between 2026 and 2035. The rising prevalence of chronic disorders, increasing number of surgeries, and technological advancements drive the market.

| Key Elements | Details |

| Market Size in 2026 | USD 109.47 Billion |

| Projected Market Size in 2035 | USD 187.16 Billion |

| CAGR (2026 - 2035) | 6.14% |

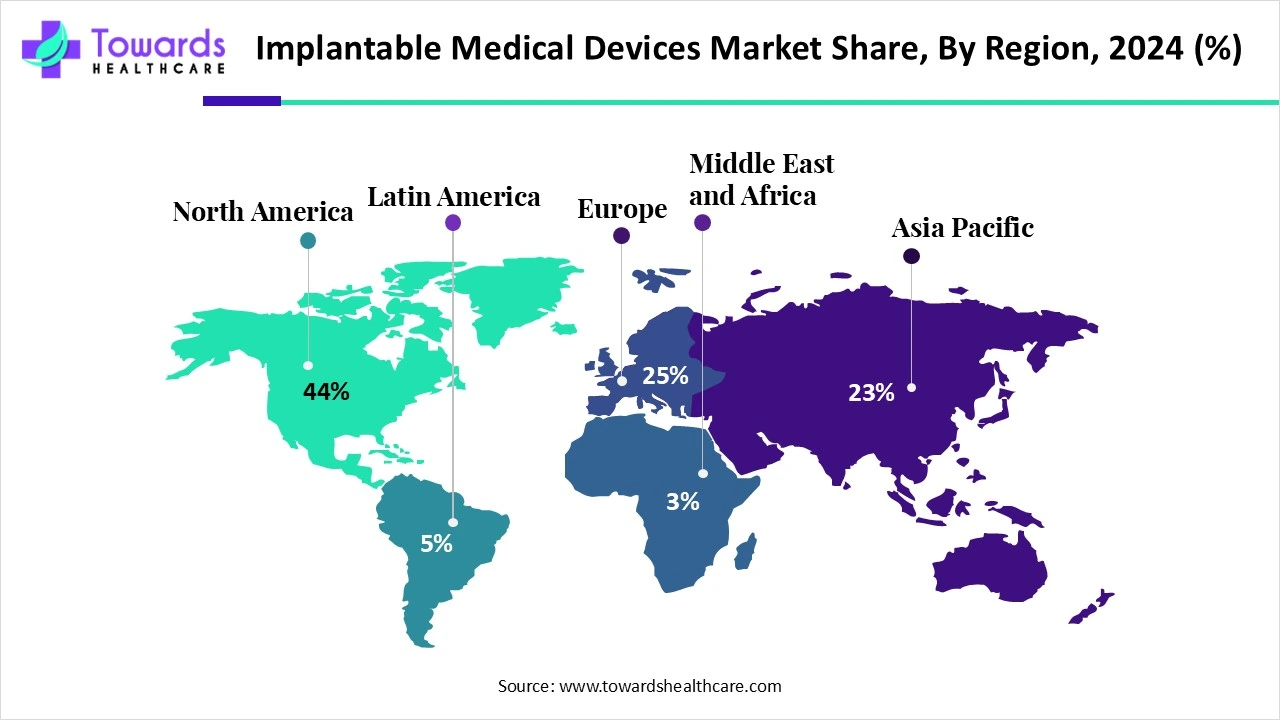

| Leading Region | North America by 44% |

| Market Segmentation | By Product, By Biomaterial, By End-Use and By Region |

| Top Key Players | Abbott Laboratories, Alcon, Cochlear Limited, Fresenius Medical Care, GE Healthcare, Globus Medical, Integra LifeSciences, Johnson & Johnson, Medtronic, NuSil Technology, LLC, Royal Philips, Siemens Healthineers, Silq Technologies Corporation, Stryker Corporation |

Implantable medical devices are tools that are either placed inside the body or on its surface. They are either placed for a temporary or permanent purpose, depending on the patient’s conditions. Some of the most common examples of implantable devices include artificial joints, breast implants, cochlear implants, pacemakers, and intraocular lenses. These devices are used for a wide range of purposes, including prosthetics, medication delivery, monitoring body functions, and providing support to organs and tissues.

The rising prevalence of chronic disorders increases the need for implants to maintain body functions. The increasing number of surgeries globally boosts the market. The growing research and development activities lead to the development of novel implants. Technological advancements such as AI and 3D printing augment market growth. Favorable regulatory frameworks and increasing investments from government and private organizations favor the development of novel implants.

Integrating artificial intelligence (AI) into implantable medical devices leads to the development of “smart implants”. Smart implants contain sensors that provide real-time monitoring data of a patient’s conditions. They also enable healthcare professionals to monitor the health and function of the implant. AI and machine learning (ML) algorithms enhance diagnostic capabilities and facilitate personalized interventions. AI and ML allow researchers to adapt designs to specific patient needs and complex medical requirements and accelerate the development process. Integrating AI in implantable devices exhibits strengths in longevity. AI can enable researchers to develop devices with longer battery life, simplify programming, and enable remote monitoring. AI and ML can also predict rejection rates, allowing healthcare professionals to overcome biocompatibility issues.

Minimally Invasive Surgeries

The major growth factor of the implantable medical devices market is the growing demand for minimally invasive surgeries. Minimally invasive surgeries result in smaller incisions, resulting in faster recovery and fewer complications. It reduces trauma, pain, complications, scarring, and recovery time for patients. It also results in a reduced risk of infection and shorter hospital stay. The increasing number of minimally invasive surgeries potentiates the demand for implantable medical devices. These surgeries necessitate the use of implantable devices. Some common examples include laparoscopes, endoscopes, and robotic surgery systems. These devices are used to view the organs and tissues inside the body during a surgical procedure. It is estimated that 15.2 million laparoscopic procedures, such as cholecystectomy, nephrectomy, and bariatric surgery, were performed globally in 2023. Numerous researchers are developing implantable devices that can be inserted through minimally invasive surgeries, enhancing treatment accessibility.

Biocompatibility Issues

The major challenge of the market is the biocompatibility issue of implantable medical devices. The body’s natural foreign response restricts implantable devices, leading to inflammation, scarring, and potential device failure. This presents a significant risk to the patient, hinders market growth.

3D and 4D Printing

The future of the implantable medical devices market is promising, driven by the advent of 3D and 4D printing technologies. 3D printing is an advanced technology to manufacture three-dimensional objects from digital files. 4D printing refers to manufacturing objects that change shape or properties over time. These technologies offer superior benefits over conventional manufacturing techniques. They lead to the development of personalized implants, depending on the patient’s needs. Implants produced through 3D and 4D printing can act as specific carriers for accurate drug release and delivery and other necessary purposes, enhancing therapeutic effects and reducing side effects. The future of biomedical science, patient-centered care, and medical devices could be completely transformed in the future by further advancements in 3D and 4D printing technologies.

Which Product Segment Dominated the Implantable Medical Devices Market?

By product, the cardiovascular implants segment held a dominant presence in the market in 2024. The rising prevalence of cardiovascular disorders and growing research and development activities boost the segment’s growth. It is estimated that a person dies of cardiovascular disorders every 33 seconds in the U.S. Cardiovascular implants include pacemakers, implantable cardioverter defibrillators, biventricular pacemakers, artificial heart valves, and stents. Advances in microelectronics lead to the development of smart cardiovascular implants, propelling the segment’s growth.

By product, the dental implants segment is expected to grow at the fastest rate in the market during the forecast period. The rising incidences of dental disorders and growing awareness for oral health augment the segment’s growth. In 2023, approximately 1.1 million dental implants were placed in California. Technological advancements in nanotechnology and 3D printing have revolutionized the dental implants industry. Dental implants can also enhance a person’s aesthetic appearance. Thus, the burgeoning medical device and biomedical sectors facilitate the segment’s growth.

Why Did the Metallic Segment Dominate the Implantable Medical Devices Market?

By biomaterial, the metallic segment held the largest share of the market in 2024. A metallic implant is a type of medical device that is made from metals such as stainless steel, cobalt-chromium, or titanium. Metallic implants offer high strength, high fracture toughness, and hardness. Ongoing research efforts are made to enhance the corrosion resistance of metallic implants and improve their biocompatibility. Metallic implants are used in a wide range of applications, from cardiovascular to orthopedic. They are used to produce stents, prosthetics, and drug delivery systems.

By biomaterial, the natural segment is anticipated to grow with the highest CAGR in the market during the studied years. Natural implants are commonly made of hyaluronic acid, chitosan, collagen, gelatin, silk, and cellulose. The growing demand for stem cells and tissues potentiates the development of natural segments. Natural implants offer more biocompatibility than metallic implants. The rising need for biodegradable implants also promotes the segment’s growth. Biodegradable implants eliminate the need for an extra surgical procedure to remove the implantable device, reducing healthcare costs and improving patient compliance.

How the Hospitals Segment Dominated the Implantable Medical Devices Market?

By end-use, the hospitals segment led the global market in 2024. The increasing number of hospitalizations and surgeries due to the rising prevalence of acute and chronic disorders fuels the segment’s growth. Hospitals have favorable infrastructure and suitable capital investments to adopt advanced implantable devices. Favorable reimbursement policies also contribute to the segment’s growth. Hospitals stay up-to-date with the latest technologies and newly launched implantable devices, offering advanced treatment and care to patients.

By end-use, the outpatient facilities segment is projected to expand rapidly in the market in the coming years. The growing demand for minimally invasive surgeries increases the demand for outpatient facilities. Outpatient facilities reduce hospital stays and healthcare costs, improving patient compliance and medication adherence. This ultimately improves the quality of life of individuals.

North America dominated the global market share by 44% in 2024. Favorable regulatory frameworks and technological advancements drive the market. The region has an advanced healthcare infrastructure providing state-of-the-art treatment to patients. The increasing number of surgeries due to the rising prevalence of chronic disorders potentiate implantable medical devices market growth. The increasing investments by government and private organizations to conduct research and manufacture implantable medical devices augment the market.

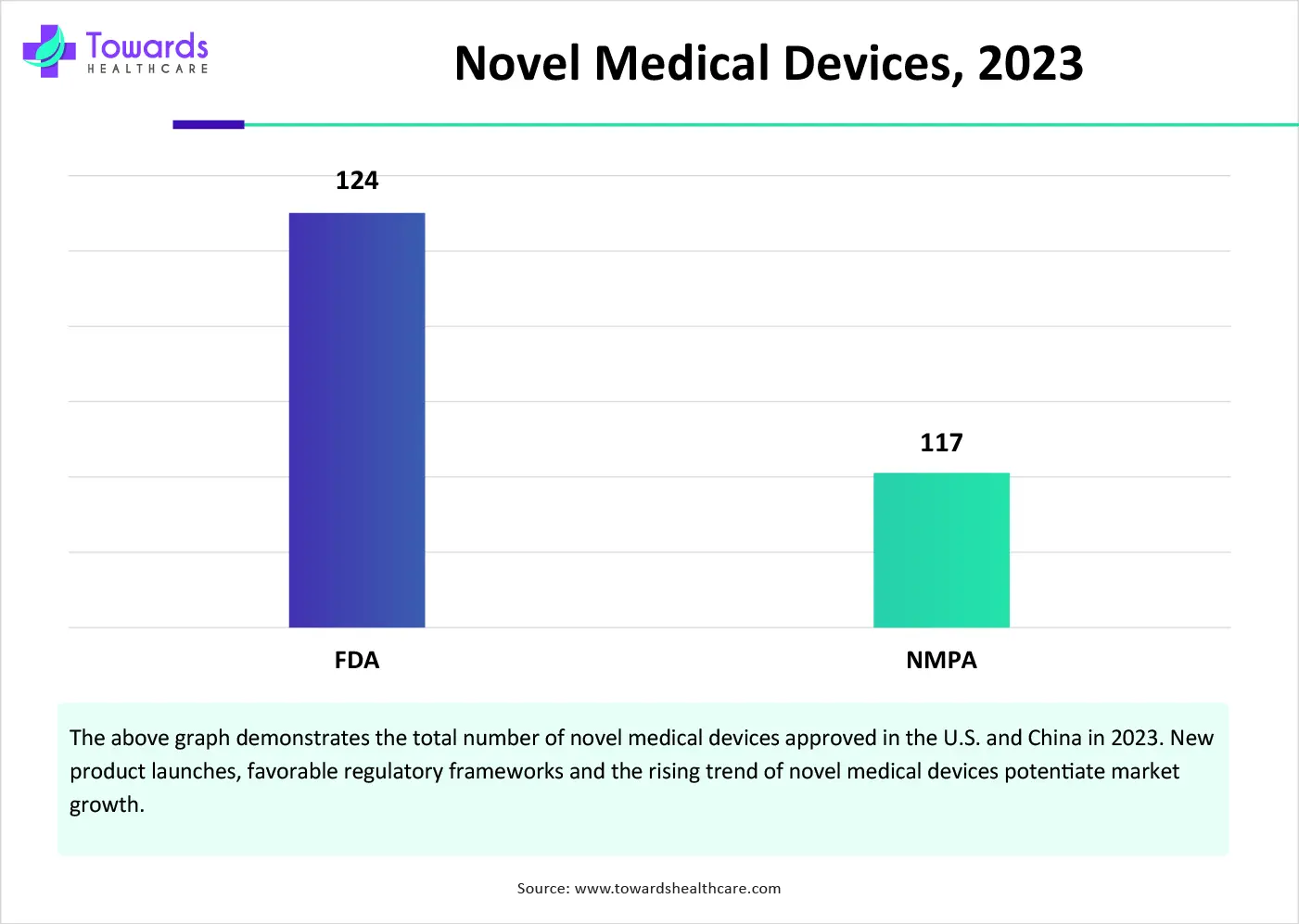

The presence of key players is a significant growth factor in the market. Key players such as Abbott Laboratories, GE Healthcare, and Johnson and Johnson hold a major share of the market. Food and Drug Administration regulates the approval of implantable medical devices in the U.S. According to the American Medical Association, around 10% of Americans will have a device implanted into their bodies during their lifetimes.

Favorable government policies and increasing investments boost the market. The Canadian government focuses on improving the safety and effectiveness of medical devices and optimizing health outcomes for patients. The increasing number of hospitalizations propels the market. In 2023, there were more than 3.05 million hospitalizations in Canada, raising the demand for implantable devices.

Asia-Pacific is projected to host a significantly growing implantable medical devices market in the coming years. The rising geriatric population increases the risk of chronic disorders. The rapidly expanding medical device sector contributes to market growth. The rising healthcare expenditure encourages patients to use advanced implantable devices. Several government and private institutions conduct seminars and symposiums to raise awareness about novel implantable medical devices. The availability of suitable manufacturing infrastructure supports indigenous manufacturing of implantable devices.

China’s National Medical Products Administration (NMPA) approved 117 novel medical devices in 2023. In August 2024, NMPA released the draft of China’s medical device law, “Medical Device Administration Law of the People’s Republic of China,” to underscore China’s commitment to enhancing the safety, effectiveness, and innovation of medical devices.

The increasing investments and medical device startups augment market growth in India. There are about 885 medical device startups in India as of March 2025. The Indian government supports the indigenous manufacturing of medical devices through its “Make in India” policy. The government had launched the Production Linked Incentive (PLI), whose total financial outlay is Rs 3,420 crore, with production tenure from FY 2022- 23 to FY 2026- 27.

Europe is considered to be a significantly growing area in the implantable medical devices market during the forecast period. The European Medicines Agency (EMA) regulates implantable medical devices in Europe. The rising prevalence of chronic disorders promotes the market. More than one-third of the European population, accounting for 35% of people, suffered from chronic disorders in 2023. The presence of key players such as Fresenius Medical Care, Medtronic, and Royal Philips fosters market growth.

Germany is the third-largest medical technology market globally, after the U.S. and Japan. The growing research and development activities lead to the formation of novel implantable medical devices. The German government regulates implantable devices through the Medical Device Regulation (MDR) and the Medical Device Implementation Act (MPDG).

The increasing investments and rising healthcare expenditure favor the market. The Medtech sector in the UK represents over half of all life sciences employment and contributes billions of pounds to the economy. The UK government’s National Health Service (NHS) spends around 17% on implants and prostheses.

Latin America is expected to grow at a notable CAGR in the foreseeable future. The increasing prevalence of chronic disorders, such as musculoskeletal and cardiovascular disorders, leads to surgeries, potentiating the need for implantable medical devices. Foreign companies establish their manufacturing facilities in Latin America to cater to the unmet needs of the local public. The growing research activities and the rapidly evolving clinical trial infrastructure foster market growth.

Brazil has suitable infrastructure for cosmetic and plastic surgeries, encouraging foreign patients to visit Brazil for affordable treatment. Brazil conducts the second-highest number of plastic surgeries in the world, accounting for 3.1 million surgeries in 2024. As of November 2025, a total of 15 clinical trials were registered in Brazil related to implantable medical devices.

The latest research focuses on improving the biocompatibility and leveraging AI/ML algorithms for enhanced functionality.

Key Players: Stryker Corporation, Johnson & Johnson, and Medtronic plc.

Clinical trials assess the safety and efficacy of implantable devices for widespread applications. Regulatory agencies approve these devices based on trial data.

Key Players: A.M.I. Agency for Medical Innovations GmbH, inSoma Bio, Inc., and Abbott Medical Devices

Healthcare professionals guide patients about implantable devices, providing tailored care.

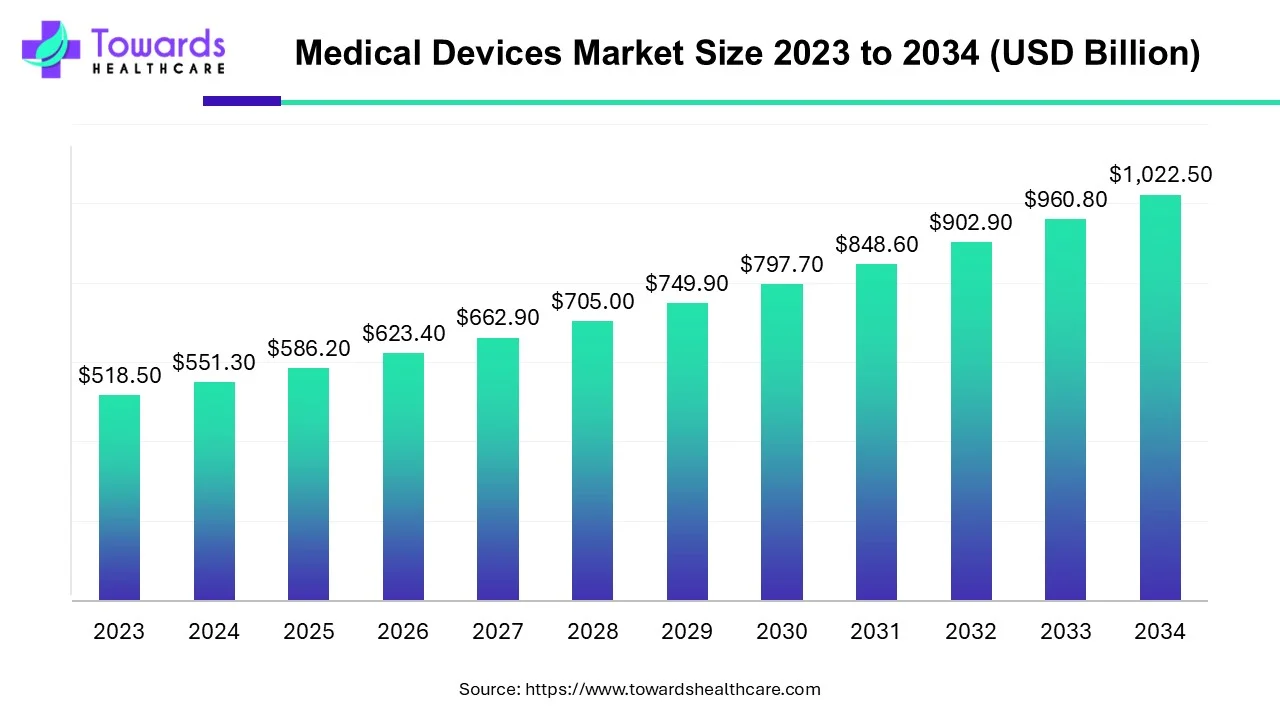

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

Arnaud Mascarell, CEO and Co-founder of FineHeart, commented on the successful filing of six new international patents for FlowMaker that these new patents consolidate the company’s position as a leading innovator in implantable medical devices. He also added that the technological innovations of FlowMaker underline their ongoing commitment to improving cardiac care for all patients worldwide.

By Product

By Biomaterial

By End-Use

By Region

February 2026

January 2026

January 2026

January 2026