January 2026

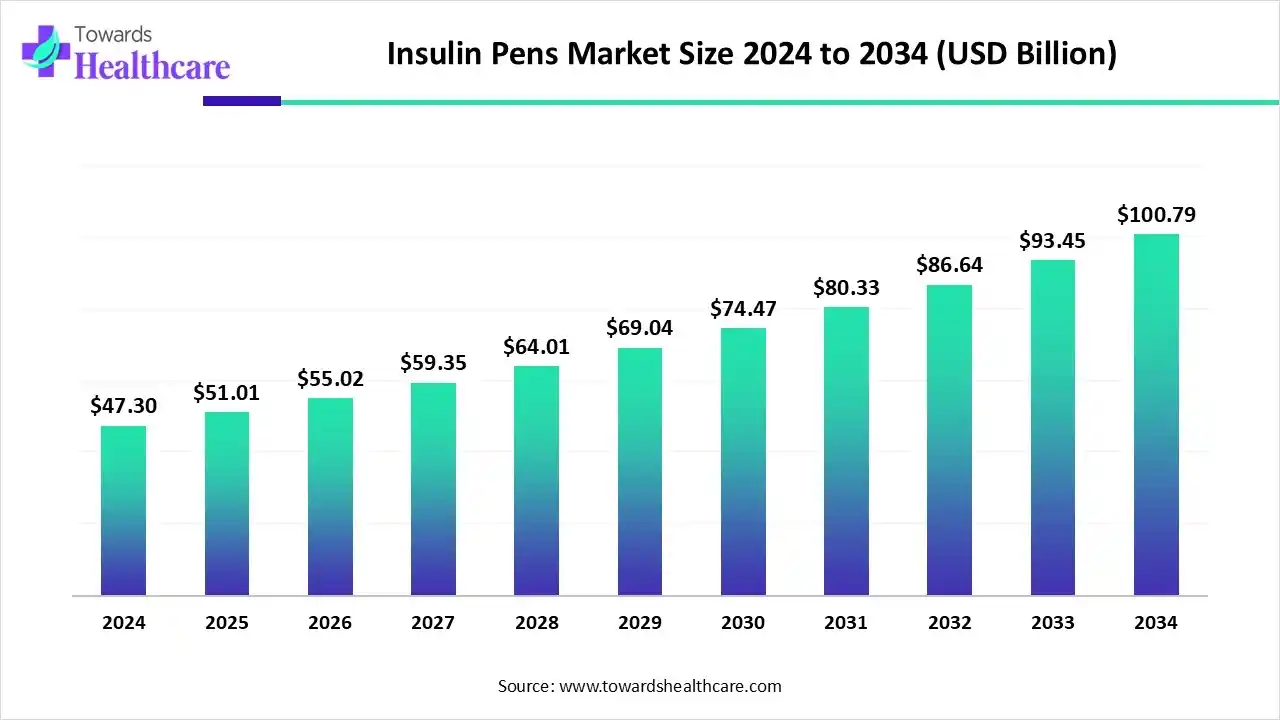

The insulin pens market size was valued at US$ 51.02 billion in 2025 and is projected to grow to 55.03 billion in 2026. Forecasts suggest it will reach approximately US$ 108.72 billion by 2035, registering a CAGR of 7.86% during the period.

The insulin pens market is experiencing steady growth driven by the increasing prevalence of diabetes, growing patient preference for convenient self-administration, and advancements in smart insulin delivery technologies. North America leads the market due to its high diabetic population, advanced healthcare infrastructure, strong presence of leading manufacturers, and favorable reimbursement policies. Rising awareness of diabetes management and ongoing technological innovations are further boosting product adoption, making insulin pens a preferred choice for effective and precise insulin delivery.

| Table | Scope |

| Market Size in 2026 | USD 55.03 Billion |

| Projected Market Size in 2035 | USD 108.72 Billion |

| CAGR (2026 - 2035) | 7.86% |

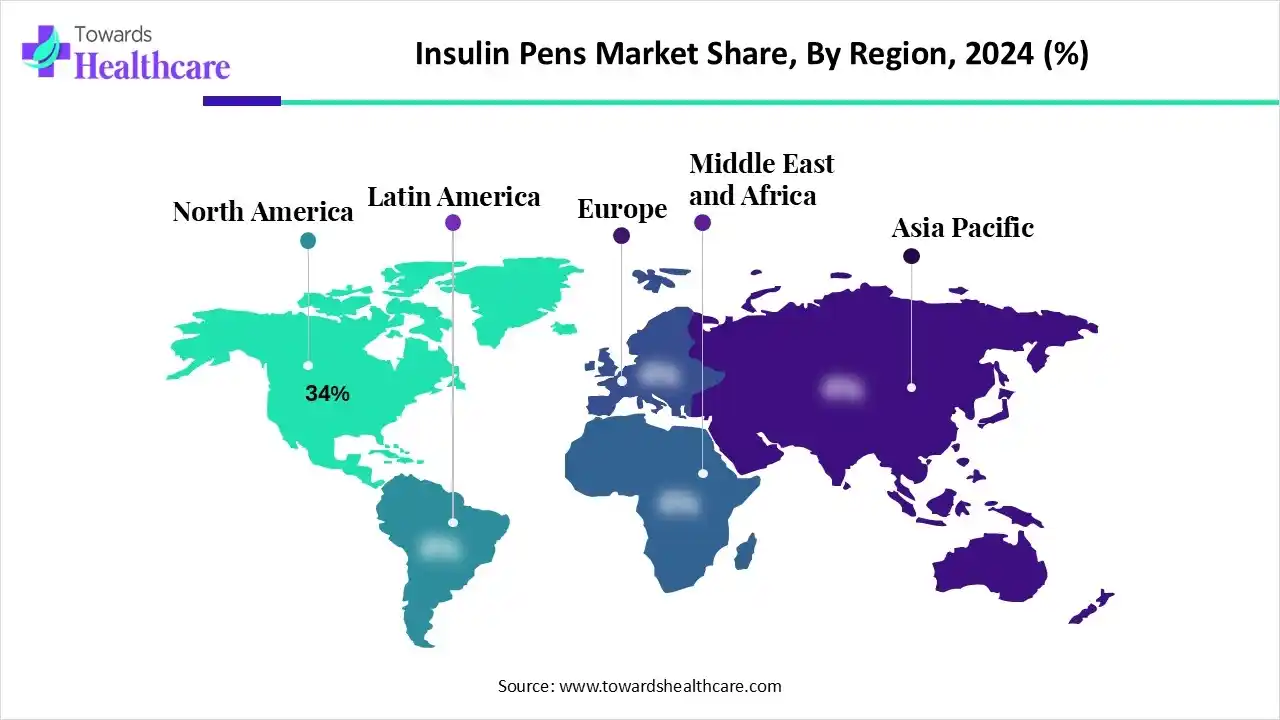

| Leading Region | North America by 34% |

| Market Segmentation | By Product Type, By Technology / Feature Set, By Dosage Capacity / Strength, By End-User / Customer Segment, By Distribution Channel, By Region |

| Top Key Players | Novo Nordisk A/S, Sanofi S.A, Eli Lilly and Company, Biocon Ltd., Ypsomed Holding AG, Becton, Dickinson and Company (BD), Owen Mumford Ltd. |

The insulin pens market is fueled by the rising prevalence of diabetes, increasing patient demand for convenient and accurate insulin delivery methods, and continuous improvements in smart insulin technologies. An insulin pen is a medical device designed to inject insulin more easily and precisely than traditional syringes. It helps patients control blood glucose levels effectively with minimal discomfort. Insulin pens come in reusable and disposable versions, providing portability, accurate dosing, and user-friendly operation for people with diabetes.

AI integration can greatly enhance the insulin pens market by improving precision, personalization, and connectivity in diabetes management. Artificial intelligence enables real-time tracking of insulin doses, glucose levels, and patient behavior to optimize insulin delivery. AI-powered algorithms can analyze data to predict glucose changes, recommend the best doses, and prevent hypo- or hyperglycemic episodes. Connecting with mobile health apps and cloud platforms allows for remote monitoring, giving healthcare professionals the tools to adjust treatment plans effectively. Overall, AI boosts treatment adherence, improves patient outcomes, and increases the efficiency of diabetes care.

Which Product Type Segment Dominate the Insulin Pens Market?

The disposable pre-filled pens segment dominated the market with a 45% share in 2024. This is because of their ease of use, greater convenience, lower contamination risk, precise dosing, and suitability for patients who need frequent insulin injections.

The smart / connected pens segment is expected to grow the fastest in the market due to rising demand for digital diabetes management, real-time dose tracking, and data connectivity. These pens improve treatment accuracy, patient compliance, and healthcare monitoring through integration with mobile apps and cloud-based diabetes management platforms.

The reusable pens with replaceable cartridges segment is notably growing in the market due to their cost-effectiveness, environmental sustainability, durability, and convenience for long-term use, offering accurate dosing and reduced medical waste compared to disposable alternatives.

Why Did the Manual Mechanical Pens Segment Dominate the Insulin Pens Market?

The manual mechanical pens segment leads the market with a 55% share due to their affordability, simple design, and wide availability. These pens provide reliable insulin delivery, easy handling, and minimal maintenance, making them highly favored by diabetic patients in both developed and developing regions for consistent daily use.

The connected / bluetooth smart pens segment is the fastest-growing in the market due to increasing adoption of digital health technologies and data-driven diabetes management. These pens enable automatic insulin dose recording, real-time glucose monitoring integration, and data sharing with healthcare professionals. Enhanced treatment accuracy, better patient adherence, and personalized therapy insights make them highly attractive. Growing smartphone usage, technological advancements, and partnerships between medical device companies and digital health platforms further drive the segment’s rapid global growth.

The memory / dose-tracking pens segment is significantly increasing in the market, holding an 18% share due to rising demand for accurate and convenient insulin management. These pens help patients record previous doses, prevent missed or double injections, and enhance treatment adherence, supporting better glucose control and personalized diabetes care.

What Made Standard Pens the Dominant Segment in the Insulin Pens Market?

The standard (U-100) pens segment dominates the market with a 70% share due to their widespread compatibility with commonly used insulin formulations, established clinical reliability, and global availability. Their standardized dosing system ensures safety, accuracy, and ease of use, making them the preferred choice for both healthcare providers and patients managing diabetes effectively.

The high-concentration pens segment is growing the fastest in the market due to increasing demand from patients needing higher insulin doses. These pens lower injection volume, boost comfort, and enhance adherence for those with severe insulin resistance, providing effective glucose control with fewer daily injections and more convenience.

The multi-dose variable capacity pens segment is significantly expanding in the market due to their flexibility in dose adjustment, cost savings, and convenience for long-term users. These pens enable multiple injections from a single cartridge, reducing waste while supporting personalized insulin therapy and enhancing treatment adherence for diabetic patients.

Which End-User / Customer Segment Led the Insulin Pens Market?

The home self-administration segment leads the market with a 65% share due to the rising preference for convenient, independent diabetes management. Insulin pens allow for accurate dosing, portability, and ease of use, which reduces the need for frequent hospital visits. Increased patient awareness and advancements in user-friendly pen designs further reinforce this segment’s strong market position.

The long-term care / nursing homes segment is the fastest-growing in the market due to the increasing geriatric population and the rising prevalence of diabetes among elderly residents. Insulin pens provide safe, precise, and easy insulin delivery for caregivers, reducing dosing errors. Their efficiency, hygiene, and shorter administration times make them ideal for managing diabetes in institutional settings such as nursing facilities.

The hospitals & clinics segment is growing significantly in the market due to the increasing number of diabetes-related admissions and the rising adoption of advanced insulin delivery systems for inpatient care. Healthcare professionals prefer insulin pens for their accuracy, safety, and ease of use, which helps achieve better glycemic control and lowers the risk of contamination in clinical settings.

Why Did the Retail Pharmacies Segment Dominate the Insulin Pens Market?

The retail pharmacies segment dominated the market with a 50% share in 2024, driven by their widespread accessibility, robust distribution networks, and patient convenience. Retail outlets provide easy access to insulin pens, refill cartridges, and related supplies, allowing patients to manage diabetes effectively with timely access to prescribed insulin products and pharmacist support.

The online pharmacies/E-pharmacies segment is the fastest-growing in the market due to increasing digitalization of healthcare, the convenience of home delivery, and access to a wide range of diabetes care products. Rising internet penetration, attractive discounts, and subscription-based refill services further enhance patient compliance and accessibility, driving rapid adoption of online insulin pen purchases worldwide.

The hospital / institutional procurement segment is notably increasing in the market due to greater bulk purchasing by healthcare facilities, higher demand for diabetes treatments, and a preference for standardized, safe insulin delivery devices to ensure accuracy, hygiene, and efficiency in patient care.

Which Patient Type / Indication Segment Lead the Insulin Pens Market?

The type 2 diabetes segment dominated the market with a 58% share due to the rapidly rising global prevalence of lifestyle-related diabetes and insulin resistance. Patients with type 2 diabetes often need long-term insulin therapy, and insulin pens provide a convenient, accurate, and easy-to-use method of administration, improving treatment adherence and blood sugar control across various patient groups.

The pediatric use segment is the fastest-growing in the market because of the increasing rate of type 1 diabetes among children and teenagers. Insulin pens offer accurate, less painful dosing and simple handling, enhancing treatment adherence, safety, and comfort for young patients under the supervision of parents or caregivers.

The type 1 diabetes segment is notably expanding in the market due to the rising number of insulin-dependent patients needing multiple daily injections. Insulin pens provide accurate dosing, portability, and ease of use, which are crucial for managing lifelong insulin therapy. Their convenience and better adherence make them highly favored among type 1 diabetic patients.

North America led the insulin pens market share by 34% in 2024 due to its high diabetes rates, modern healthcare systems, and presence of top pharmaceutical companies. More patient awareness, supportive reimbursement policies, and quick adoption of smart insulin delivery devices further reinforce the region’s leadership in diabetes management solutions.

According to data published by the Centers for Disease Control and Prevention in May 2024, approximately 38 million people in the U.S. have diabetes, which is about 1 in 10 Americans. Among adults aged 20 and older (August 2021–August 2023), the prevalence of total diabetes was 15.8%, with 11.3% diagnosed and 4.5% undiagnosed. Meanwhile, adult obesity affects around 40.3% of U.S. adults. Because obesity significantly increases the risk of type 2 diabetes, 24.2% of adults with obesity have diabetes compared to 6.8% of normal-weight adults. These trends expand the pool of insulin-dependent patients and increase demand for convenient insulin delivery devices like pens, which greatly boosts growth in the U.S. market.

Asia-Pacific is expected to grow at the fastest rate in the insulin pens market due to the rapidly rising prevalence of diabetes, increased healthcare awareness, and expanding access to advanced treatment options. Growing urbanization, sedentary lifestyles, and dietary changes have increased diabetes cases, driving higher demand for insulin. Also, government initiatives to promote diabetes care, improvements in healthcare infrastructure, and the presence of major pharmaceutical companies in countries like China, India, and Japan further boost the region’s strong growth in insulin pen adoption and innovation.

China leads the Asia-Pacific market because of its large diabetic population, robust domestic manufacturing, and quick adoption of advanced insulin delivery technologies. Government efforts to improve diabetes care, expanding healthcare infrastructure, and increasing consumer demand for convenient, self-injected insulin options further reinforce China’s market dominance.

The rising rates of diabetes and obesity in India is significantly driving the growth of the insulin pens market. According to the International Diabetes Federation, India has around 89.8 million adults (20-79 years) living with diabetes in 2024. Meanwhile, over 25% of Indian adults are classified as overweight or obese, which substantially raises the risk of diabetes. These trends create a larger pool of insulin-dependent patients and increase the demand for convenient, user-friendly insulin pens for self-management across urban and semi-urban populations in India.

Europe is experiencing notable growth in the market due to increasing diabetes prevalence, an aging population, and strong healthcare infrastructure. Widespread adoption of smart insulin delivery devices, favorable reimbursement policies, and a focus on patient-centered diabetes management further support this growth. Continuous innovation by leading pharmaceutical companies improves accessibility and treatment effectiveness across Europe.

South America is experiencing significant growth in the insulin pen market due to the rising prevalence of diabetes, improved healthcare access, increased patient awareness, and greater availability of affordable insulin delivery devices across emerging economies like Brazil and Mexico.

The Middle East and Africa offer a significant growth opportunity in the market due to the rising rates of diabetes, expanding healthcare infrastructure, and increasing awareness of advanced insulin delivery methods. Government initiatives that promote diabetes care and enhance access to modern, user-friendly insulin pens further boost adoption across urban and developing areas.

The market in the UAE has seen significant growth driven by the increasing prevalence of diabetes, lifestyle-related obesity, and greater awareness of advanced insulin delivery technologies. The country’s robust healthcare infrastructure, government-led diabetes management programs, and preference for convenient, accurate self-injection methods have boosted demand for insulin pens. Additionally, growing private healthcare investments and the availability of smart insulin pens through pharmacies and hospitals further reinforce the UAE’s leadership in modern diabetes care solutions.

The research and development phase involves identifying unmet clinical needs, designing insulin formulations compatible with pen delivery systems, and developing advanced features such as smart connectivity and dose-tracking. This stage aims to improve precision, safety, and patient convenience through material innovation, ergonomic design, and integration of digital health technologies.

Key Players: Key players include Novo Nordisk, Sanofi, Eli Lilly and Company, Biocon, and Wockhardt, along with device developers like Ypsomed and Becton, Dickinson and Company (BD). Academic research institutes and diabetes research foundations also play a role in R&D collaborations.

This phase involves pre-clinical testing of device safety, followed by clinical trials to assess insulin delivery accuracy, patient usability, and long-term effects. Once clinical data is collected, companies obtain regulatory approvals from national and international authorities to ensure compliance and market access.

Key Players: Major regulatory bodies and trial authorities include the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), the Central Drugs Standard Control Organization (CDSCO, India), and the Ministry of Health, Labor, and Welfare (Japan). Clinical testing often involves collaborations with hospitals, CROs, and diabetes research centers.

This stage emphasizes patient education, training on pen use, after-sales technical support, and digital monitoring assistance. It also includes awareness campaigns, customer service programs, and integration with mobile apps for data tracking and remote healthcare management.

Key Players: Leading organizations providing patient support include NovoCare (Novo Nordisk), Sanofi’s MyStar Diabetes Support, Lilly Diabetes Care, and digital health partners such as Abbott’s FreeStyle Libre platform and Medtronic CareLink, which integrate insulin pens with continuous glucose monitoring systems.

| Company | Headquarters | Key Offerings |

| Novo Nordisk A/S | Denmark | Offers FlexPen, NovoPen Echo, and NovoPen 6; focuses on reusable and smart insulin pens with digital connectivity for real-time insulin dose tracking. |

| Sanofi S.A. | France | Provides SoloStar and AllStar Pro pens; known for disposable insulin pens compatible with Lantus and Toujeo insulins, emphasizing patient convenience and accuracy. |

| Eli Lilly and Company | United States | Offers KwikPen and Tempo Pen; integrates Bluetooth-enabled dose capture technology with connected diabetes management platforms. |

| Biocon Ltd. | India | Provides Insupen and insulin cartridges for basal and rapid-acting formulations; focuses on affordability and emerging market penetration. |

| Ypsomed Holding AG | Switzerland | Supplies YpsoPen and custom-designed pens for pharma partners; recognized for contract manufacturing and device innovation in insulin delivery systems. |

| Becton, Dickinson and Company (BD) | U.S. | Manufactures BD Viva Pen Needles and collaborates with pharma firms for pen integration; specializes in injection safety and precision engineering. |

| Owen Mumford Ltd. | UK | Develops AutoPen and Aidaptus platforms; focuses on ergonomic, patient-friendly reusable and prefilled insulin delivery devices. |

By Product Type

By Technology / Feature Set

By Dosage Capacity / Strength

By End-User / Customer Segment

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026