February 2026

The global laboratory revenue cycle management market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The worldwide focus on revenue flow through an end-to-end process that encompasses eligibility verification, coding, billing, and reimbursement is supporting the innovations in AI-powered RCM solutions. The global laboratory revenue cycle management market has been putting efforts into cloud-based services to enhance remote patient access, and financial data is encouraging a digital transformation in healthcare with expanded operational effectiveness for providers. And, these advancements are working under a strong regulatory environment, like HIPAA, CLIA.

The laboratory revenue cycle management market encompasses software solutions and services designed to streamline the financial operations of clinical laboratories, including billing, coding, claims submission, payment collection, insurance verification, and compliance management. These solutions help labs reduce claim denials, improve cash flow, ensure regulatory compliance (HIPAA, CLIA), and enhance operational efficiency. Rising laboratory testing volumes drive market growth, increasing healthcare costs, the shift toward value-based care, and the adoption of cloud-based RCM platforms.

The globe is revolutionizing diverse areas with the greater adoption of AI and its respective approaches, which are also boosting the global market development.

2025 is experiencing the growth of AI-enabled approaches in the growing digitalization, including chatbot support in the management of patient billing inquiries, offering payment estimates. As well as AI solutions, setting up payment plans results in greater patient satisfaction and more timely payments. Moreover, AI systems are projecting cash flow, validating patient health insurance coverage, and facilitating tailored patient communication to enhance patient satisfaction and accelerate payments.

For instance,

Demand for Streamlined Operations

The global laboratory revenue cycle management market is driven by a rise in demand for simplifying operations through the widespread adoption of RCM measures. These measures are further boosting billing accuracy, streamlining claim processing, and improving revenue flow through an end-to-end process that comprises eligibility verification, coding, billing, and reimbursement. Alongside, stringent regulatory landscapes and coding standards (such as ICD-10) are required in strong RCM systems to ensure precise billing and adherence to mandated needs. Ongoing changes in regulations also fuel the need for adaptable RCM measures.

Limitations in Investments and Maintenance

The increasing need for a major financial investment in software, hardware, and initial employee training is creating a barrier for smaller labs. Additionally, continuous support and maintenance are necessary for RCM systems, which also enhances expenditures, placing a financial burden on providers.

Focus on Developing Patient-Centric Solutions

The era is imposing wider digitalization, including the global laboratory revenue cycle management market is seeking the development of patient-centric tools. This will foster the provision of diverse tools for price shopping, checking in-network status, and gaining real-time price predictions, which makes the RCM process more transparent and consumer-friendly. Moreover, the market will emphasize on immersion of AI-powered workflows will majorly lower patient onboarding times, resulting in quicker processing and optimized efficiency. Also, the blockchain technology will establish an immutable ledger for patient data, claims, and billing, further supporting in minimizing fraud, improving audits, and ensure regulatory compliance.

In 2024, the billing & coding services segment was dominant in the laboratory revenue cycle management market. Factors, like the growing requirement for price reduction and a rise in the volume of diagnostic testing, are fostering administrative tasks, consisting of coding and billing, for laboratories. The huge adoption of advanced integrated platforms, such as RCM tools with laboratory information systems (LIS), is initiating the RCM process at the test order level with real-time verification and data scrubbing. Currently, the medical coding process is revolutionizing a laboratory's diagnostic services into standardized codes, which are essential for billing and insurance claims.

Whereas the accounts receivable management segment is predicted to expand fastest in the laboratory revenue cycle management market during 2025-2034. This kind of service assists in ensuring timely payment collection from payers and patients, thereby boosting financial stability and cash flow. Emerging advances, particularly specialized aging AR services, are emphasizing analyzing outstanding invoices, simplifying collections for overdue payments, and lowering write-offs. Drivers like an escalating demand for specialized laboratory testing, rising regulatory scrutiny, and the adoption of advanced technology, especially AI and automation, are expanding accuracy and effectiveness. However, AI helps in the analysis of historical data to project probable claim denials and enables proactive corrections before submission, enhancing clean claim rates.

By deployment mode, the cloud-based segment led in 2024 and will register rapid growth in the laboratory revenue cycle management market. Inclusion of affordability, scalability, and flexibility, improvements in data accessibility, and real-time analytics are enhancing the use of cloud-based approaches. Alongside, ongoing collaboration and the increasing need for secure remote access to patient and financial data are incorporated into a digital transformation in healthcare with accelerated operational efficiency for providers. Additionally, cloud RCM measures are exploring AI and machine learning for the automation of different tasks, including claims submission, underbilling detection, and payment reminders.

The hospital-based laboratories segment held a major share of the laboratory revenue cycle management market in 2024. The globe is shifting from fee-for-service models towards value-based care, promoting hospitals to enhance the quality of care while controlling expenses. The feasible unification of Laboratory Information Systems (LIS) and Electronic Health Records (EHR) further confirms real-time data sharing and lowers manual entry, with escalated precision and efficiency. Continuous staff training regarding both billing staff and ordering providers on adequate coding and documentation is assisting in a crucial reduction of claim denials.

On the other hand, the reference & specialty laboratories segment will witness the fastest growth in the laboratory revenue cycle management market in the coming era. Mainly, these laboratories are using RCM for the conversion of diagnostic services into revenue through processes, such as insurance verification, coding, claim submission, and reimbursement. The exploration of artificial intelligence (AI) for predictive denial prevention and automated payment posting, which further simplifies workflows via specialized lab billing software, and coupling with novel technologies to highlight the unique coding complexities and payer relationships in diagnostic services. The emergence of pre-authorization and prior authorization is significant in specific tests to omit claim denials, a vital step in specialty labs.

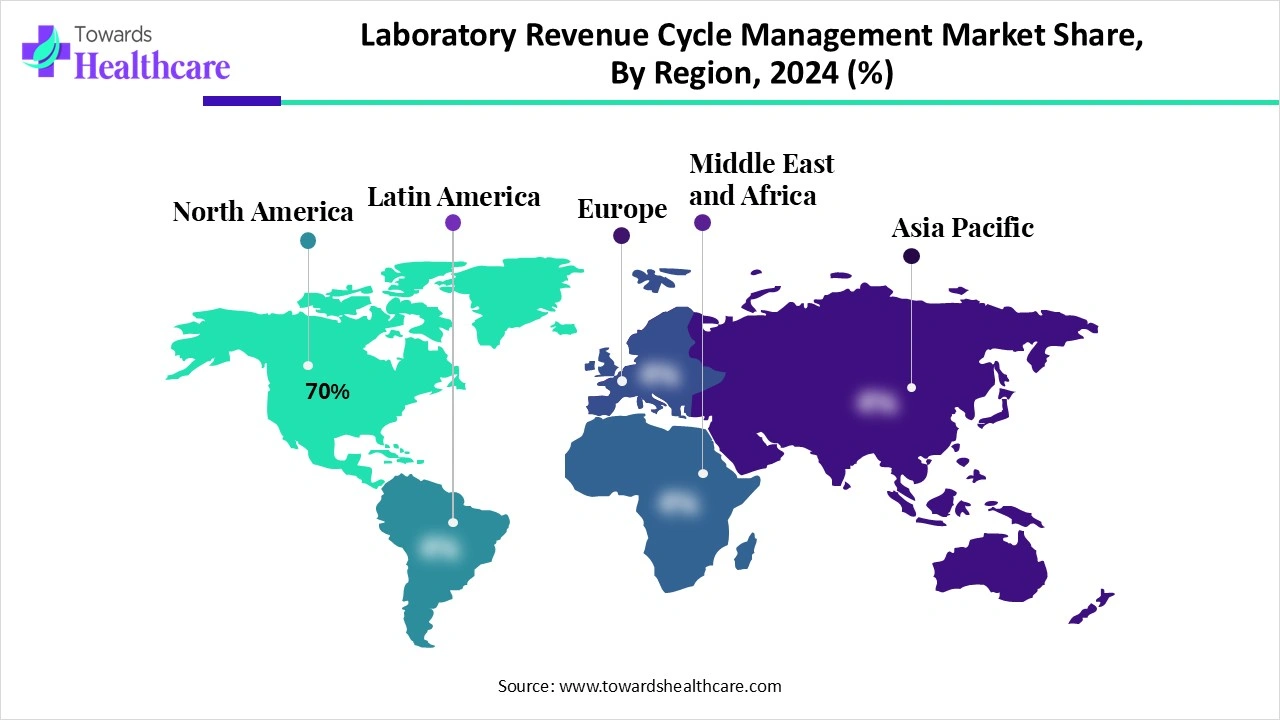

The laboratory revenue cycle management market share 70% in North America accounted for the biggest share in 2024. Due to high adoption of RCM platforms, an established regulatory framework, and advanced digital health infrastructure are fueling this region’s market development is being fueled. Also, a rise in efforts into the development of value-based RCM models by the leading players in this region is impacting the demand for advanced RCM solutions. Currently, Epic has been actively involved in the development and deployment of AI-driven RCM tools that will support tasks, like AI-based coding and generating AI-enabled denial appeal letters, which are now becoming available to users.

In April 2025, XiFin Inc., a leading provider of revenue cycle management (RCM) solutions, demonstrated the power of AI in RCM through collaboration with NY’s leading health system, Northwell Health, at the 30th annual executive War College.

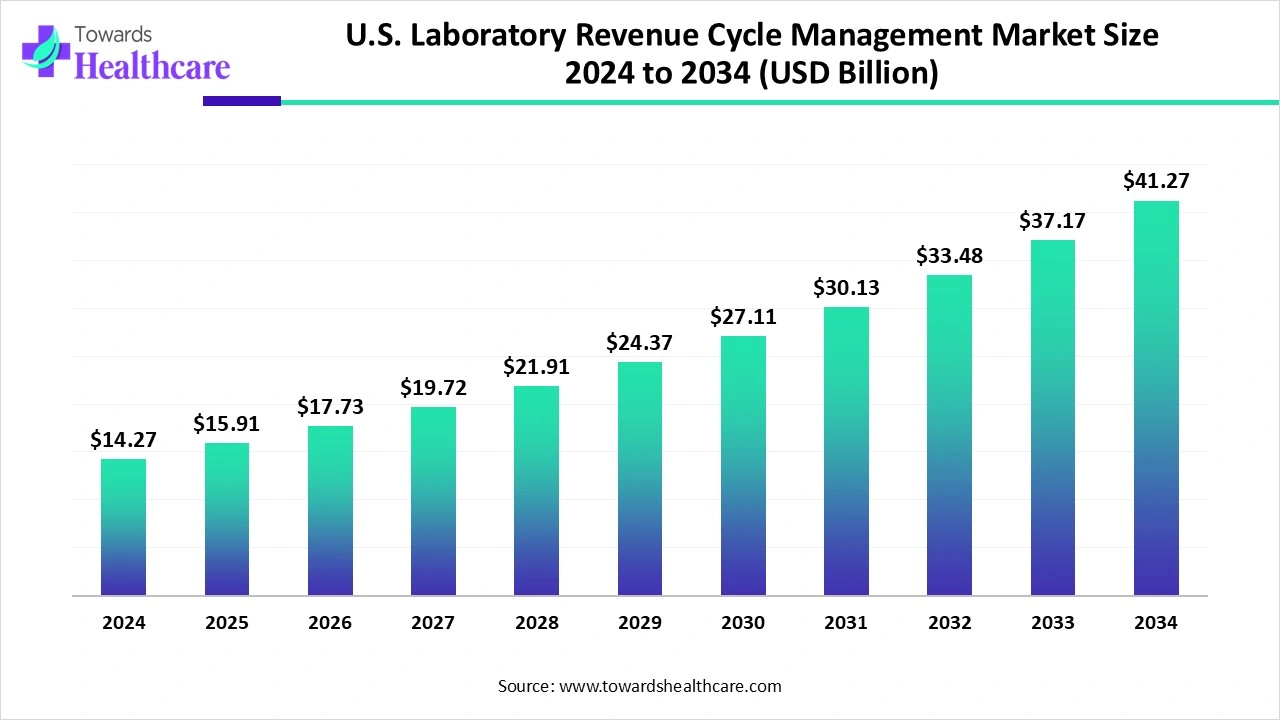

The U.S. laboratory revenue cycle management market was valued at $14.27 billion in 2024 and is expected to grow to $15.91 billion in 2025. Looking ahead, the market is projected to reach approximately $41.27 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.59% between 2025 and 2034.

Recent transformations, like the digitalization of Ontario's health records through OLIS, have placed an emphasis on precise coding and billing for provincial payment systems, and the application of data-driven insights is assisting in the improvement of collections and identifying billing errors. Alongside, recent publications from Canadian associations are leveraging medical laboratories and healthcare providers for updates on RCM practices.

Asia Pacific is estimated to witness rapid growth in the laboratory revenue cycle management market in the upcoming years. An emerging healthcare infrastructure, with growing private laboratory networks, is propelling ASAP’s RCM progression. Along with this, the Chinese and Indian governments are encouraging their policies and initiatives with the promotion of the wider adoption of healthcare IT solutions, which ultimately boosts the entire market expansion. Highly developed and developing ASAP countries are focusing on AI and ML for automated claim processing and predictive analytics, the growth of cloud-based platforms, and transforming blockchain technology for escalated security and transparency.

China’s market is widely adopting international RCM frameworks in China's public insurance-based healthcare system, with a focus on the integration of technology for patient pre-registration, insurance verification, efficient charge capture, and accurate coding (like using China's National Medical Insurance (NMI) guidelines). As well as China is stepping into digital claim submissions and rapid remittance processing for both public and private laboratories.

In November 2024, Infinx Healthcare, a significant provider of AI-driven solutions for healthcare revenue cycle management (RCM), established a new Center of Excellence in Madurai, Tamil Nadu, to propel advancements in healthcare RCM technology while developing major employment opportunities.

The European laboratory revenue cycle management market is experiencing a lucrative growth. A rise in emphasis on cloud-based RCM, effectiveness, and compliance is boosting the widespread adoption of advanced solutions in emerging laboratories and healthcare systems. Furthermore, numerous providers are seeking comprehensive RCM services for the coverage of every stage of the cycle, from patient scheduling and eligibility verification to final payment posting and collections management. Ongoing implementation of a system by a French laboratory that employs artificial intelligence (AI) to automatically promote the correct codes to diagnostic tests, lowering the challenge of human error and accelerating the billing process.

By Service Type

By Deployment Mode

By Laboratory Type/End User

By Region

February 2026

January 2026

January 2026

January 2026