January 2026

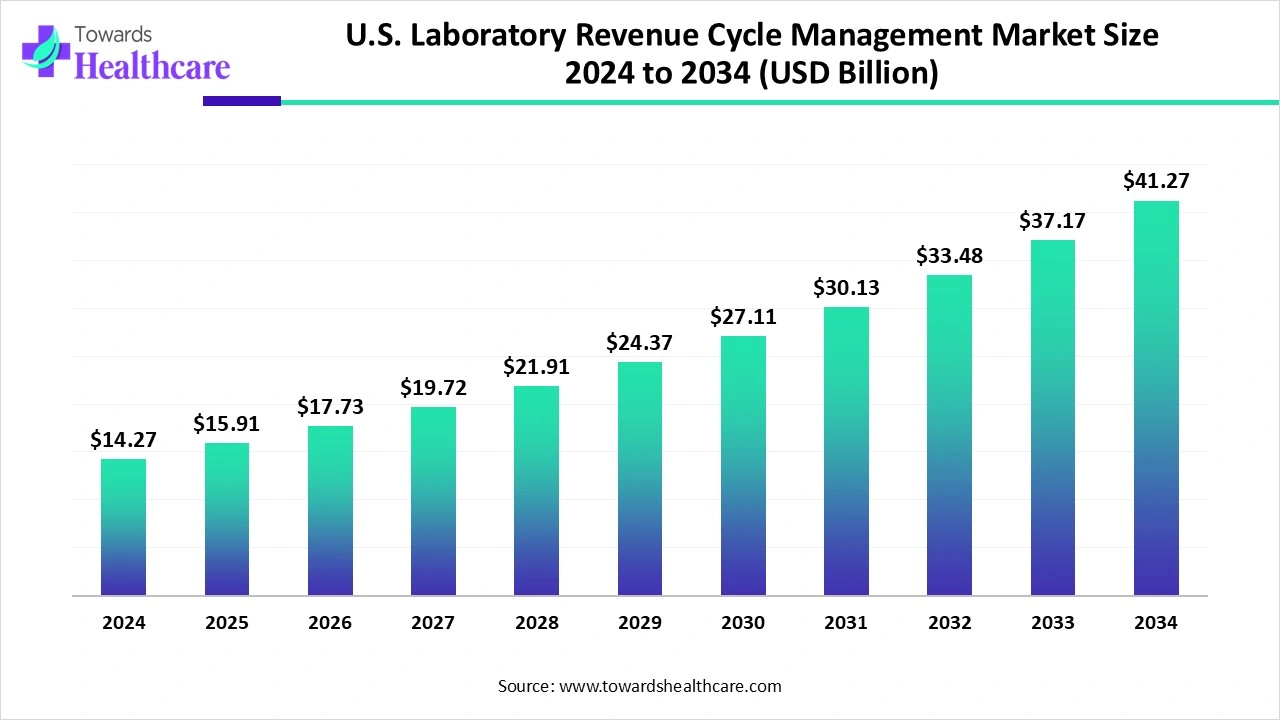

The U.S. laboratory revenue cycle management market size is calculated at US$ 14.27 billion in 2024, grew to US$ 15.91 billion in 2025, and is projected to reach around US$ 41.27 billion by 2034. The market is expanding at a CAGR of 11.59% between 2025 and 2034.

Due to growing healthcare complexities, the use of laboratory revenue cycle management is increasing in the U.S. Therefore, the companies are investing and focusing on acquisitions to enhance their development. The AI is also being used to enhance its workflow and applications. At the same time, the growing number of specialty labs, payer networks, and digital health innovations is increasing their adoption rates in various regions of the U.S. Additionally, the companies are collaborating and launching new RCM platforms. Thus, these advancements are promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 15.91 Billion |

| Projected Market Size in 2034 | USD 41.27 Billion |

| CAGR (2025 - 2034) | 11.59% |

| Market Segmentation | By Component, By Deployment Model, By Function/Workflow, By End-User/Laboratory Type, By Region |

| Top Key Players | ACI Infotech, ACI Worldwide (Healthcare RCM solutions), AdvancedMD, athenahealth, Inc., CareCloud, Inc., Cerner Corporation (Oracle Health), Cognizant Technology Solutions (TriZetto Healthcare Products), Coronis Health (Lab RCM Specialist), Experian Health, LabVantage Solutions, Inc., McKesson Corporation, MEDITECH, Optum (UnitedHealth Group), R1 RCM Inc., Waystar |

Laboratory Revenue Cycle Management (RCM) refers to software platforms, services, and integrated solutions that manage the financial, administrative, and compliance workflows of diagnostic and clinical laboratories in the U.S. It covers processes from patient registration, insurance eligibility verification, order entry, coding, claims submission, denial management, and payment posting to reporting and analytics. The U.S. laboratory revenue cycle management market includes cloud-based SaaS platforms, on-premise systems, managed services, and AI-driven automation layers, tailored for independent labs, hospital-based labs, and diagnostic networks. Growth is driven by rising diagnostic volumes, payer complexity, regulatory pressures (HIPAA, CMS, ICD-10), and adoption of AI/automation to reduce denials and improve reimbursement cycles.

Rising complexities: Due to growing complexities in the documentation, coding, billing, and claims, the demand for laboratory RCM is increasing in the U.S. This, in turn, is increasing their innovations to enhance their applications. Additionally, new collaborations, investments, as well as acquisitions are being announced by the companies to promote their development and utilization.

For instance,

The U.S. laboratory revenue cycle management market is being transformed by the integration of AI. With the use of machine learning (ML), robotic process automation (RPA), and natural language processing (NLP), the decision-making, accuracy, and efficiency of RCM can be enhanced. Predictive analytics is also improved with the use of AI, which mitigates denials and forecasts claim outcomes before submission. The repetitive tasks like data entry, payment reconciliation, and claims processing can be handled using automation. This reduces the errors and promotes the strategic initiatives, such as financial planning and patient engagement. Thus, processes such as revenue recovery efforts, denial management, and compliance audits can be enhanced with AI.

Growing Specialty Labs

There is a growth in the specialty labs contributing to genomics, pathology, or molecular diagnostics, which increases the number of tests conducted. This increases the process of documentation, coding, and billing, increasing their complexities. Therefore, the use of RCM is increasing in these labs to avoid errors and high costs due to claim denials. The growing integration with telehealth is increasing its demand for enhancing the billing and claim workflows. The small specialty labs or startups are relying on the BPO services. Thus, this drives the U.S. laboratory revenue cycle management market growth.

High Cost and Data Security Concerns

For the installation of the laboratory, a high upfront cost is required. Moreover, software updates and training of the staff also add to the cost. This minimizes their adoption by small labs. Additionally, they consist of patient data, where the risk of data breaches, cyberattacks, and unauthorized access can lead to data leakage. Thus, this can discourage the patients. Therefore, the high cost and data security concerns may limit the use of laboratory RCM.

Increasing Use in Diagnostic Laboratories

As there is a growth in the diagnostic laboratories, there is a rise in the demand for disease testing and monitoring. This increases the challenges associated with their claims and billings. Therefore, this increases the demand for laboratory RCMs. The prior authorization issues and inappropriate documentation can be managed with the RCM solutions. It also helps in enhancing the coding accuracy and appeals tracking. Moreover, with their compliance reporting or compliance-integrated systems, they help the consumer to comply with the regulations. Thus, this is promoting the U.S. laboratory revenue cycle management market growth.

For instance,

By component type, the software platforms segment held the dominating share of the U.S. laboratory revenue cycle management market in 2024, driven by core adoption to ensure compliance and efficiency. It was also used to minimize errors and enhance the billing and coding procedures. Moreover, its easy integration with EHR increased their adoption. Thus, this enhanced the market growth.

By component type, the managed services & BPO segment is expected to show the fastest growth rate during the predicted time. They are being used due to growing outsourcing billing amid staffing shortages in the labs. They also help in minimizing the denials. At the same time, their quick implementation and scalability are enhancing their use.

By deployment model type, the cloud-based SaaS segment led the U.S. laboratory revenue cycle management market in 2024, as it was widely adopted for scalability and interoperability. They did not require any specialized infrastructure, which increased their use. Additionally, they also provided enhanced accessibility, which increased their adoption. Similarly, their automated updates and security enhanced the workflow.

By deployment model type, the hybrid segment is expected to show the fastest growth rate during the upcoming years. Their use is increasing to balance compliance/security with cloud agility. This, in turn, is increasing their use of premises as well as for billing systems. Moreover, due to their flexibility, their use is increasing in large labs for various purposes.

By function/workflow type, the claims submission & clearinghouse integration segment held the largest share of the U.S. laboratory revenue cycle management market in 2024, as it is essential for generating lab revenues. The large volume claim increased its use to promote fast payments and minimal denials. It also provided automation, which reduced the chances of errors. Thus, they enhanced the claim validation and acceptance rates.

By function/workflow type, the denial management & appeals segment is expected to show the highest growth during the predicted time. The use of laboratory RCM is increasing due to growing denial rates. They help in minimizing these rates and provide advanced tools and services to minimize the complexities in appeals. Moreover, denial analytics are also being used due to growing outsourcing for their management.

By end user, the hospital-based laboratories segment led the global U.S. laboratory revenue cycle management market in 2024, due to high testing volumes. The laboratory RCM is also being integrated with EHR and LIS platforms to enhance the hospital workflow. Similarly, the complex billing and coding procedure was also streamlined by their use. This, in turn, increased their adoption rates.

By end user, the specialty labs segment is expected to show the highest growth during the upcoming years. Due to the growing precision medicine, molecular diagnostics, and genetic testing expansion, the use of laboratory RCM is increasing in these labs. They are also being used to deal with growing billing complexities. Additionally, they are being used to enhance the security of the data and for denial management.

The U.S. is expected to show significant growth in the market due to the expanding healthcare sector, as the number of hospitals and specialty labs is increasing. This, in turn, is increasing their use for diagnostic purposes. Similarly, the growing demand for disease monitoring and personalized medication, the complications associated with them are increasing. Additionally, their coding documentation is also increasing. Thus, this is increasing the use of laboratory RCM to minimize these complexities and for denial management. Moreover, their growing advancements are also increasing their use. Thus, this is enhancing the U.S. laboratory revenue cycle management market growth.

The graph represents the total number of laboratories present in the U.S. in the year of 2024. It indicates that there will be a rise in laboratories. Hence, it increases the demand for laboratory revenue cycle management to minimize the complexities associated with these laboratory procedures. Thus, this in turn will ultimately promote the market growth.

The Northeast U.S. held the major share of the U.S. laboratory revenue cycle management market. It consisted of a high concentration of large labs and payer networks, which increased the use of laboratory RCM. At the same time, the growth in the specialty labs focusing on genomics or molecular diagnostics increases their use for advanced billing. The claim management and clearinghouse integrations solutions were also utilized to reduce the complexities. The companies also contributed to this growth by developing advanced cloud-based SaaS solutions.

The West U.S. is expected to host the fastest growth in the U.S. laboratory revenue cycle management market during the forecast period. The growing molecular/genomic testing labs and digital health innovation are increasing the use of laboratory RCM. They are being used to provide advanced coding and appeals services along with denial management. Moreover, the companies are also developing new RCM software to enhance data security and claim submission, and clearinghouse integrations.

In June 2025, after the launch of RCM Sphere by Integra Connect, the President, Parag Shah, stated that those embracing intelligent, integrated solutions beyond the fragmented models of the past are the ones moving towards the healthcare future. This RCM Sphere will help to deal with the present and future challenges and enhance sustainable success by improving human expertise, technology, and data. Moreover, throughout the healthcare continuum, new standards for measurable performance, innovation, and leadership will be achieved by Integra Connect with RCM Sphere.

By Component

By Deployment Model

By Function/Workflow

By End-User/Laboratory Type

By Region (U.S.)

January 2026

January 2026

January 2026

January 2026