January 2026

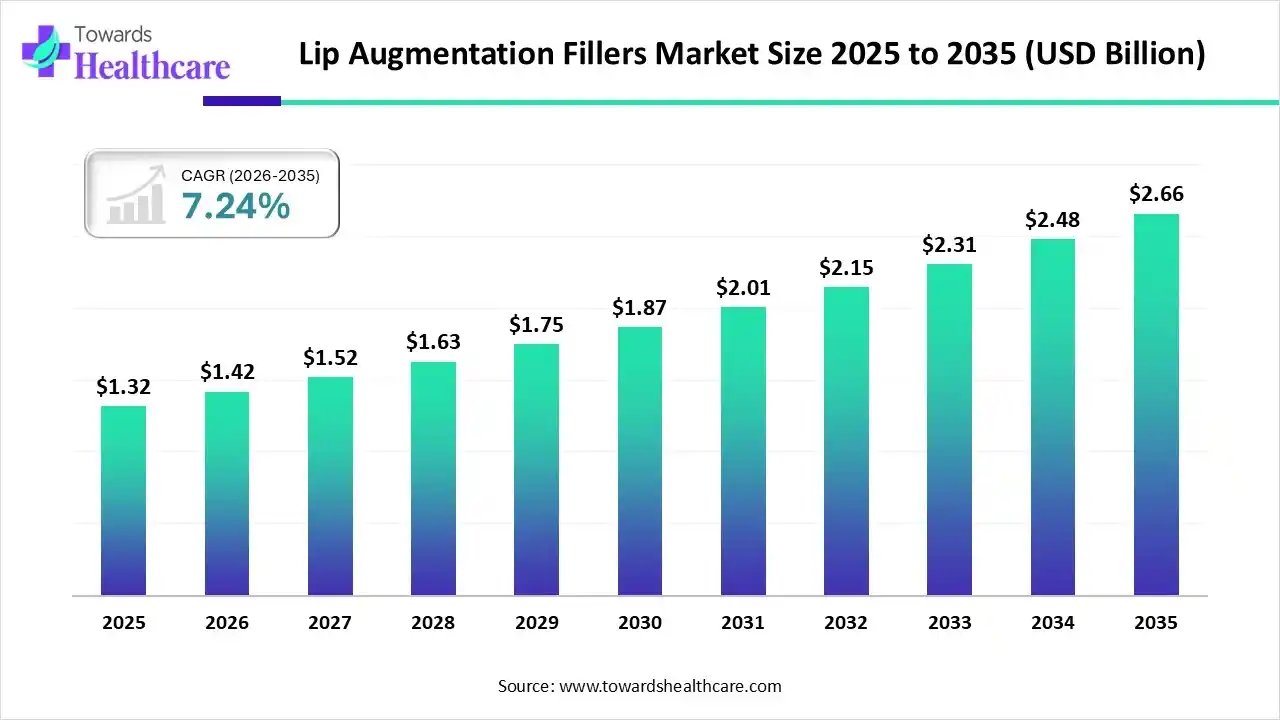

The lip augmentation fillers market size was estimated at USD 1.32 billion in 2025 and is predicted to increase from USD 1.42 billion in 2026 to approximately USD 2.66 billion by 2035, expanding at a CAGR of 7.24% from 2026 to 2035.

The lip augmentation fillers market is massively growing and expanding due to a rapid shift towards personalization and advanced techniques to achieve hydration, shape, and aesthetic look. The popular filler products belong to the leading brands that use hyaluronic acid formulations designed for safety, effectiveness, and flexibility.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.42 Billion |

| Projected Market Size in 2035 | USD 2.66 Billion |

| CAGR (2026 - 2035) | 7.24% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Product, By End User, By Region |

| Top Key Players | AbbVie (Allergan Aesthetics), Galderma, Revance Therapeutics, Merz Aesthetics, Teoxane Laboratories, Prollenium Medical Technologies, IBSA Italia, Medytox, Hugel, LG Chem |

The lip augmentation fillers market is majorly driven by the high preferences of many clients for lip treatments that improve the smoothness, texture, and moisture of lips by using light hyaluronic acid fillers. The healthcare practitioners are highly adopting advanced mapping and injection techniques to define lip borders, tailor the shape, and correct asymmetry. The top companies that are leading with their popular brands in the lip augmentation filler industry are AbbVie, Galderma, Merz Pharma, Revance Therapeutics, Teoxane Laboratories, and many others. These companies are committed to consistent R&D and strategic partnerships to develop next-generation products that offer safety, longevity, and natural results.

AI is a powerful tool to revolutionize facial analysis, 3D modelling, personalized treatment planning, outcome simulation, and patient consultation. AI is transforming the market by enhancing procedural safety, ensuring precision mapping, and providing robotic assistance. AI helps in patient education, patient follow-up, and outcome assessment.

How does the Hyaluronic Acid Segment Dominate the Lip Augmentation Fillers Market in 2025?

The hyaluronic acid segment dominated the market in 2025, owing to its high water-retention capabilities, natural biocompatibility, and safety. It enables deep tissue hydration, smoothing fine lines, and biostimulation. It stimulates the production of collagen in the body, which leads to improved long-term lip health and texture.

Calcium Hydroxylapatite

The calcium hydroxylapatite segment is expected to grow at the fastest CAGR in the market during the forecast period due to its role in long-term tissue regeneration and as a biostimulatory agent. It provides structural support and enables long-term collagen stimulation. It brings the natural improvement in skin quality and thickness that lasts up to 12 to 18 months.

What made Biodegradable the Dominant Segment in the Lip Augmentation Fillers Market in 2025?

The biodegradable segment dominated the market in 2025, owing to its core functions such as natural integration, safety, and biostimulation. There is a high demand for biodegradable materials in lip fillers, which include hyaluronic acid, calcium hydroxylapatite, poly-L-lactic acid, and polycaprolactone. Among these, hyaluronic acid is the most popular due to its highly hydrophilic nature.

Non-Biodegradable

The non-biodegradable segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the provided structural support and neocollagenesis stimulation. The major materials used are PMMA, liquid silicone, polyvinylpyrrolidone-silicone suspension, and polyalkylimide hydrogel. These products are advantageous in terms of longevity, maintenance, and reversibility.

How did the Specialty & Dermatology Clinics Segment Dominate the Lip Augmentation Fillers Market in 2025?

The specialty & dermatology clinics segment dominated the market in 2025, owing to the critical role of lip augmentation fillers in clinical practice for facial rejuvenation & anti-aging, structural & aesthetic correction, and clinical reconstructive treatment. They provide hydration and improve texture. They drive professional expertise, advanced aftercare, and customization.

Hospitals & Clinics

The hospitals & clinics segment is anticipated to grow at a notable rate in the market during the upcoming period due to the medical applications and primary clinical and aesthetic roles of lip augmentation fillers. The lip fillers are used in the treatment of facial lipoatrophy in patients with conditions like HIV. The common filler types used in hospital settings are hyaluronic acid fillers, collagen, and autologous fat grafting.

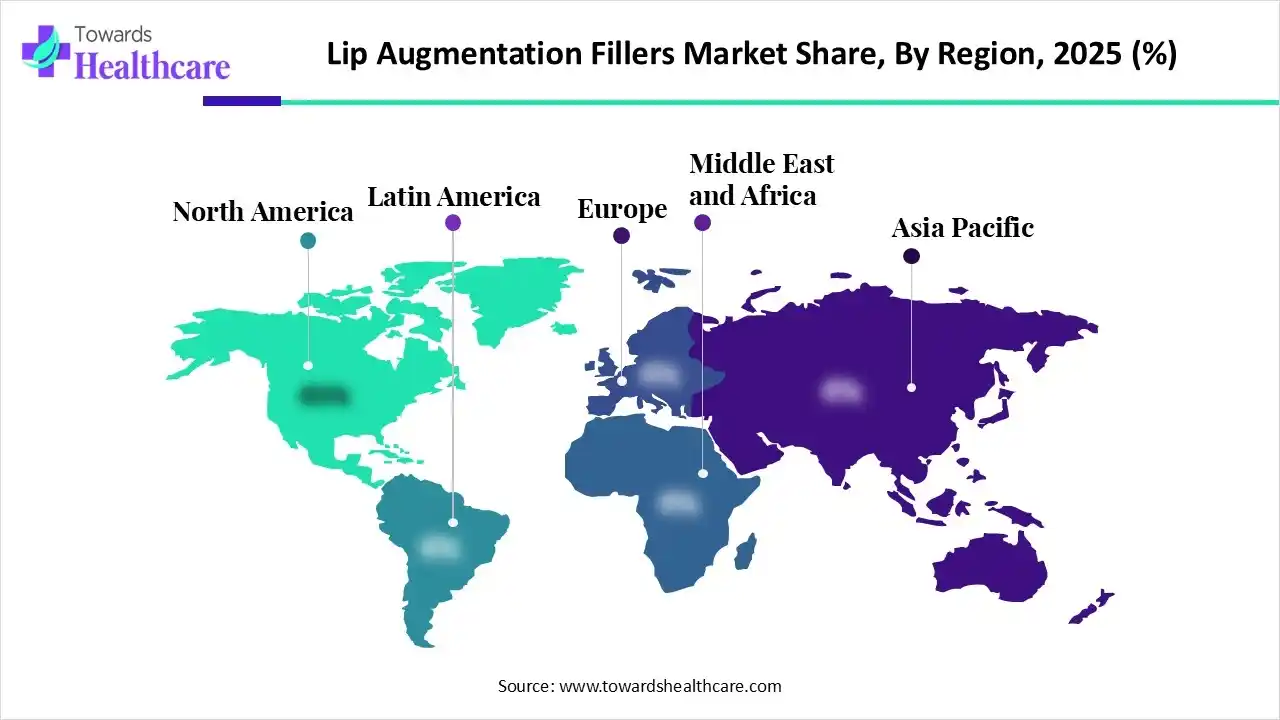

The Asia Pacific was dominant in the lip augmentation fillers market in 2025, driven by the expansion of aesthetic infrastructure and the rising trend of medical tourism. The government regulatory actions were taken by some of the Asian Pacific countries, like Taiwan, South Korea, and Australia. The Ministry of Food and Drug Safety (MFDS) of South Korea introduced strict safety documentation requirements to align with global standards. The Asian Pacific lip augmentation fillers market is driven by the medical tourism support from countries like India, South Korea, and Thailand, and cosmetic surgery tax incentives in South Korea.

The National Medical Devices Policy introduced by the Government of India aims to advance the growth of the medical devices sector. The Ministry of Health and Family Welfare brought stricter labelling and safety testing into action.

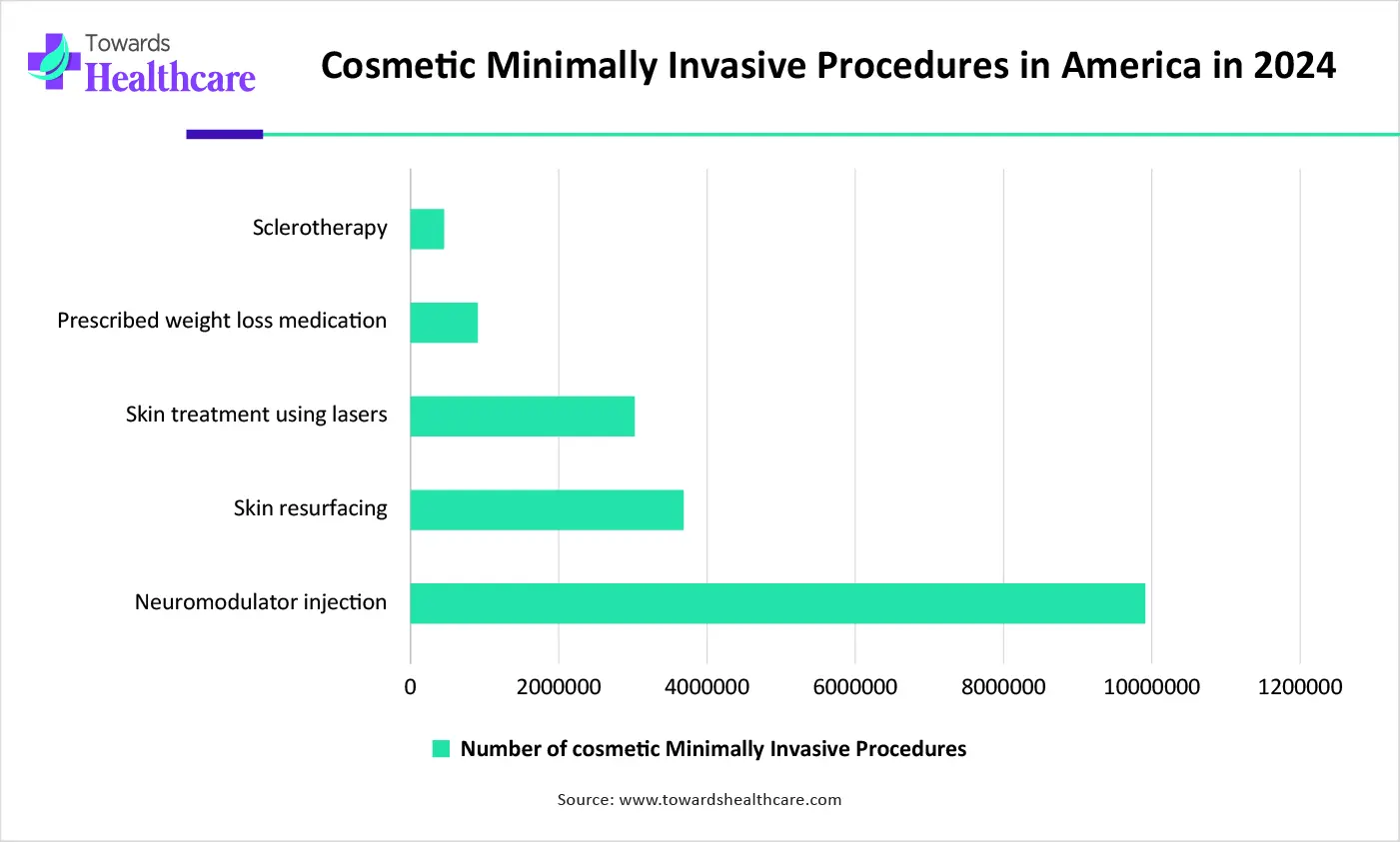

North America is expected to grow at the fastest CAGR during the forecast period, driven by the increasing popularity of minimally invasive procedures and high disposable incomes. In February 2025, Evolus announced the U.S. FDA approval for Evolysse form and Evolysse smooth injectable hyaluronic acid gels. The regulatory programs and oversight frameworks were launched to monitor the manufacturing and safety of all products. Health authorities give a safety warning against needle-free filler devices. The U.S. FDA approved the use of lip fillers only in adults aged 21 or older.

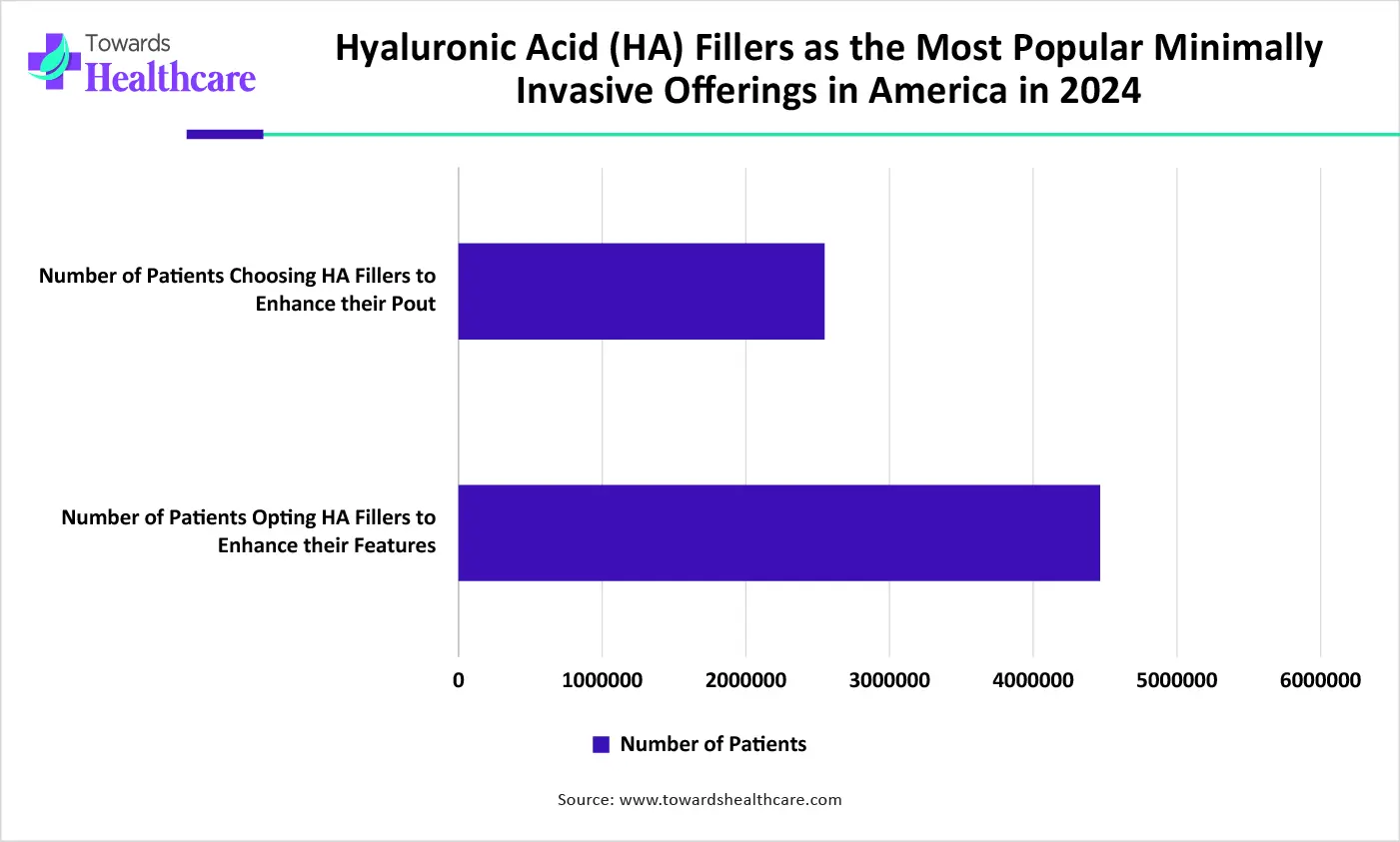

The U.S. federal regulatory actions include FDA safety warnings, public advisory meetings, and the Modernization of Cosmetics Regulation Act (MoCRA). The U.S. FDA approved two new products, including Evolysse™ Smooth & Form and Juvéderm Skinvive. The market in the U.S. is driven by minimally invasive injectable treatments, including lip fillers.

Europe is expected to grow at a notable rate in the lip augmentation fillers market during the forecast period. The European Union introduced stricter safety regulations to manage the medical devices and chemicals used in aesthetic treatments. The EU stated that all dermal fillers must be CE marked as medical devices under the Commission Implementing Regulation. The EU regulations also reported that only trained healthcare professionals are allowed to administer the dosage by using lip fillers or related medical devices.

The UK launched a mandatory licensing system for local authorities to perform medium-risk procedures, including Botox and lip fillers. The UK government has introduced a major suppression on unsafe cosmetic procedures through a new licensing framework in England.

| Sr. No. | Name of the Company | Headquarter | Latest Update |

| 1 | AbbVie (Allergan Aesthetics) | Irvine, California, USA | In September 2025, AbbVie planned to present a multimodal treatment approach at AMWC Dubai. |

| 2 | Galderma | Zug, Switzerland | In November 2025, Galderma received the U.S. FDA approval for Restylane Lyft to enhance the chin profile. |

| 3 | Revance Therapeutics | Nashville, Tennessee, U.S. | In December 2025, Revance Therapeutics launched a new StriVectin TL advanced sculpting neck and jawline mask. |

| 4 | Merz Aesthetics | Raleigh, NC, USA | In October 2025, Merz Aesthetics announced the submission of premarket approval applications to the FDA for Belotero. |

| 5 | Teoxane Laboratories | Geneva, Switzerland | In September 2025, Teoxane reported that the U.S. clinical data confirmed long-lasting natural lip results with RHA 3. |

| 6 | Prollenium Medical Technologies | Richmond Hill, Ontario, Canada | Prollenium Medical Technologies shifted its focus towards regenerative skin technologies. |

| 7 | IBSA Italia | Lodi, Lombardy, Italy | IBSA Italia focused on the Aliaxin line for lip augmentation and is leading with a regenerative aesthetic portfolio with Profhilo Structura. |

| 8 | Medytox | Seoul, South Korea | Medytox has new product launches, including Neuramis Heart and Neuramis skin enhancer. |

| 9 | Hugel | Chuncheon-si, Gangwon-do Province, South Korea. | In September 2024, Hugel published a guide to safe injection of dermal fillers with DICARAT clinic. |

| 10 | LG Chem | Seoul, South Korea | In October 2025, LG Chem sold its dermal filler business to VIG Partners. |

By Material

By Product

By End User

By Region

January 2026

November 2025

November 2025

November 2025