Liposomal Doxorubicin Market Size, Key Players with Insights and Growth

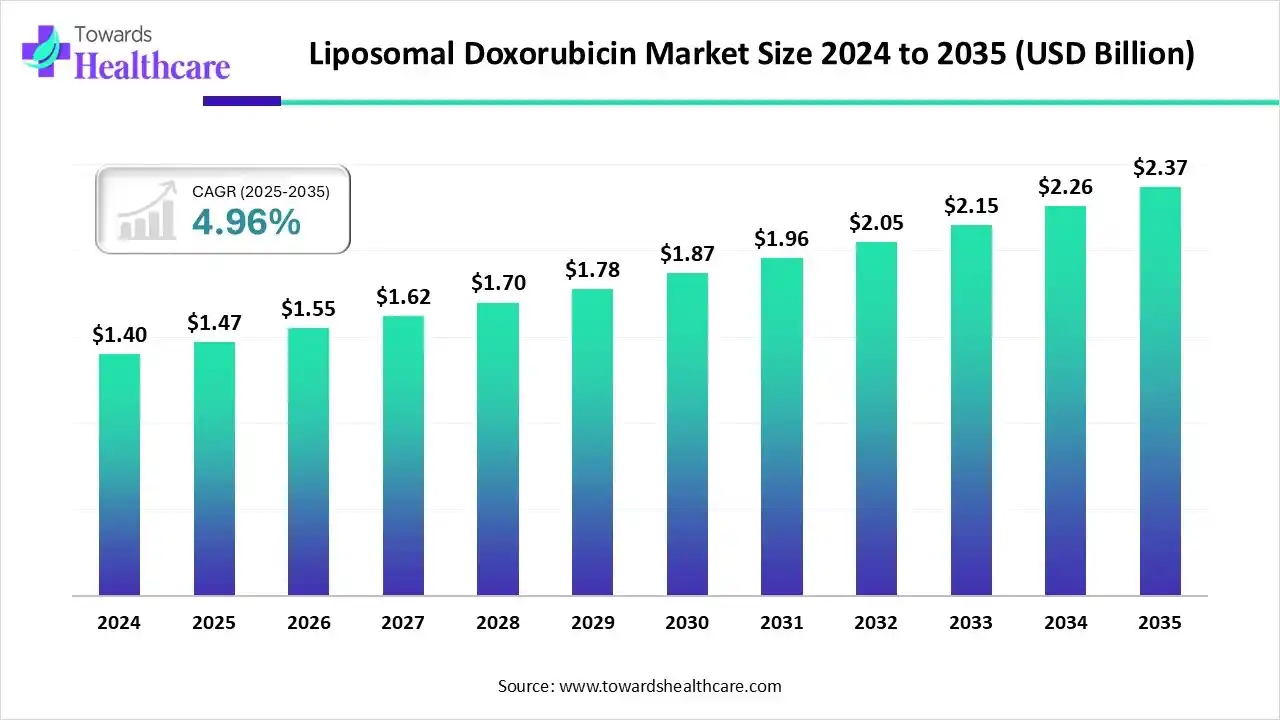

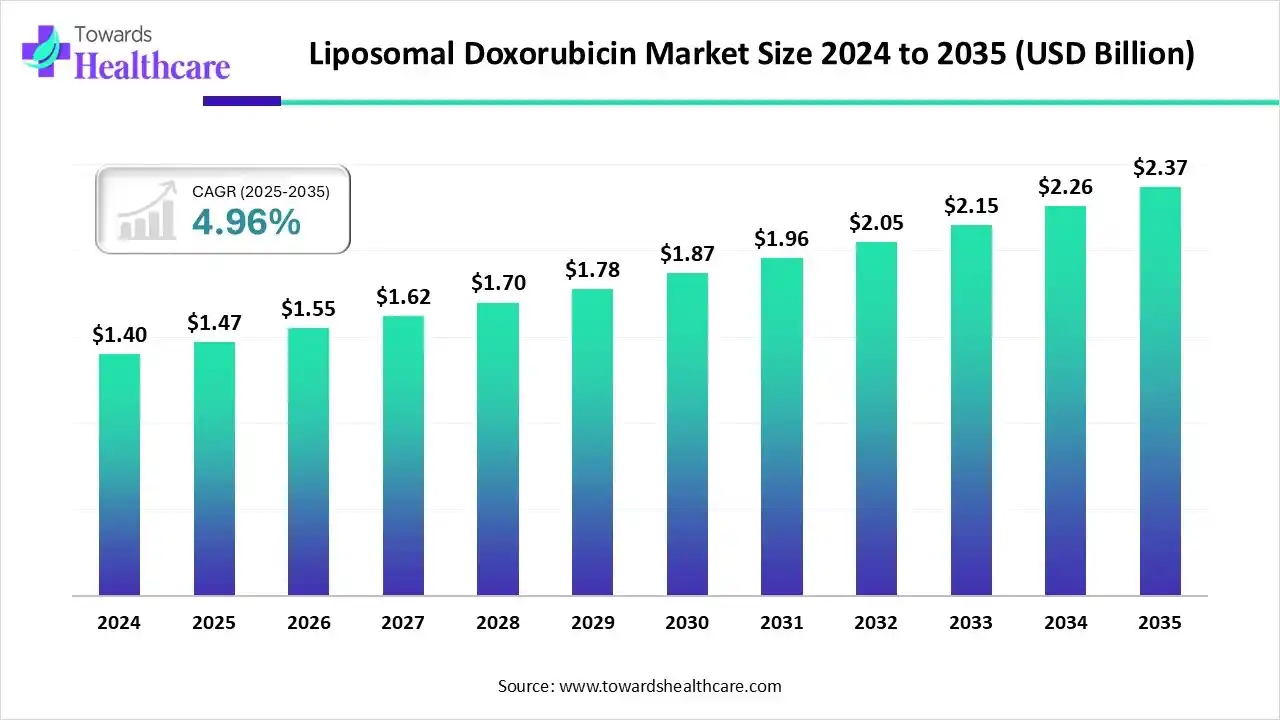

The liposomal doxorubicin market size was reported at US$ 1.47 billion in 2025 and is expected to rise to US$ 1.55 billion in 2026. According to forecasts, it will grow at a CAGR of 4.96% to reach US$ 2.37 billion by 2035.

The liposomal doxorubicin market is experiencing steady growth driven by the rising incidence of cancer, increasing demand for targeted and less toxic chemotherapy, and advancements in nanotechnology-based drug delivery. Strong R&D investments and expanding applications in oncology are further boosting market expansion, with North America holding a major share due to advanced healthcare infrastructure.

Key Takeaways

- Liposomal doxorubicin sector pushed the market to USD 1.47 billion by 2025.

- Long-term projections show USD 2.37 billion valuation by 2035.

- Growth is expected at a steady CAGR of 4.96% in between 2026 to 2035.

- North America dominated the liposomal doxorubicin market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast Period.

- By product, the lipodox segment held the largest market share in 2024.

- By product, the myocet segment is expected to grow at the fastest CAGR in the market during the forecast Period.

- By application, the breast cancer segment dominated the market with the largest share in 2024.

- By application, the multiple myeloma segment is expected to grow at the fastest CAGR in the market during the forecast Period.

- By distribution channel, the hospital pharmacies segment led the liposomal doxorubicin market with the largest revenue share in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR in the market during the forecast Period.

Executive Summary Table

| Table |

Scope |

| Market Size in 2025 |

USD 1.47 Billion |

| Projected Market Size in 2035 |

USD 2.37 Billion |

| CAGR (2026 - 2035) |

4.96% |

| Leading Region |

North America |

| Market Segmentation |

By Product, By Application, By Distribution Channel, By Region |

| Top Key Players |

Sun Pharmaceutical Industries Ltd., Johnson & Johnson Services, Inc., Merck & Co., Inc., Cipla, Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd., Lupin, Cadila Pharmaceuticals, SRS Life Sciences, GSK plc, Pfizer Inc., Sanofi, Sigma-Aldrich Co. |

What is Liposomal Doxorubicin?

Liposomal doxorubicin is a chemotherapy drug in which doxorubicin is encapsulated with liposomes to enhance drug delivery, reduce toxicity, and improve cancer treatment effectiveness. The liposomal doxorubicin market is expanding due to the growing global cancer burden and increasing [reference for targeted drug delivery methods that minimize toxicity and enhance treatment efficacy.

Liposomal formulation offers improved bioavailability, prolonged circulation time, and better tumor targeting compared to conventional chemotherapy. Furthermore, continuous R&D efforts, rising approvals doe new formulations, and increasing adoption of advanced oncology treatments are contributing significantly to the market's strong growth during the forecast period.

For Instance,

- In February 2024, the National Cancer Institute estimated that global cancer cases could rise from 20 million in 2022 to 30 million by 2040, highlighting the increasing demand for advanced cancer treatment solutions.

Liposomal Doxorubicin Market Outlook

- Sustainability Trends: The market focuses on eco-friendly manufacturing, biodegradable lipid materials, and energy-efficient production processes. Companies are also emphasizing green chemistry practices and sustainable packaging to reduce environmental impact while ensuring high-quality drug delivery.

- Global Expansion: Global expansion is driven by rising cancer incidence, increasing clinical trials, and growing access to advanced oncology treatments in emerging economies, supported by strategic collaborations, regulatory approvals, and improved healthcare infrastructure worldwide.

- Startup Ecosystems: The startup ecosystem for the liposomal doxorubicin market is growing with emerging biotech firms focusing on nanomedicine, innovative liposome formulations, and targeted drug delivery. These startups are attracting funding and partnerships to accelerate oncology research and commercialization.

How AI is Revolutionizing the Market?

AI is transforming the liposomal doxorubicin market by enhancing drug design, optimizing liposome formulation, and improving targeted delivery accuracy. It enables faster data analysis, predictive modeling, and personalized treatment approaches, reducing development time and cost. This technological integration boosts research efficiency, product innovation, and overall therapeutic effectiveness in cancer treatment applications.

Segmental Insights

Product Insights

How does the Lipodox Segment dominate the Market in 2024?

In 2024, the Lipodox segment held the largest liposomal doxorubicin market share due to its wide availability, proven clinical efficacy, and cost-effectiveness compared to branded alternatives. Its growing use in treating various cancers, including alternative breast and ovarian cancer, has strengthened its market presence. Additionally, increasing approvals in emerging markets and reliable therapeutic outcomes have further supported the segment's dominance in the liposomal doxorubicin market.

For Instance,

- In August 2024, Lupin Limited launched its Doxorubicin Hydrochloride Liposome Injection in the U.S., offered in 20 mg/10 mL and 50 mg/25 mL single-dose vials, expanding its oncology product portfolio.

Myocet

The myocet segment is projected to record the fastest growth during the forecast period, owing to increasing awareness of liposomal formulations that enhance drug delivery and minimize side effects. Growing clinical acceptance in combination therapies and expanding availability across developed and emerging markets are boosting its adoption. Moreover, ongoing advancements in liposome technology continue to strengthen the growth prospects.

Doxil/Caelyx

The doxil/caelyc segment is expected to grow at a significant rate during the forecast period due to its strong clinical track record and widespread use in treating multiple cancers, including ovarian and multiple myeloma. Its established brand recognition, consistent therapeutic outcomes, and availability in various regions support its demand. Additionally, ongoing research to expand its indications and improve manufacturing processes is further fueling the market's growth.

Application Insights

What made the Breast Cancer Segment Dominant in the Market in 2024?

In 2024, the breast cancer segment dominated the liposomal doxorubicin market due to increasing cases of breast cancer and a strong preference for advanced, less toxic chemotherapy options. The drugs' improved safety profile and effectiveness in managing metastatic and recurrent cases enhanced their clinical acceptance. Moreover, supportive healthcare policies and expanded oncology treatment infrastructure further contributed to the market growth.

Multiple Myeloma

The multiple myeloma segment is anticipated to grow at the fastest CAGR during the forecast period due to the increasing incidence of blood-related cancers and the rising adoption of liposomal formulations for improved patient outcomes. Enhanced drug delivery, reduced side effects, and better tolerance in elderly patients have boosted its demand. Moreover, continuous advancements in oncology research and supportive regulatory approvals are accelerating the segment’s growth.

Ovarian Cancer

The ovarian cancer segment is expected to register notable growth during the forecast period due to the rising incidence of ovarian tumors and the increasing preference for advanced chemotherapy options. Liposomal doxorubicin offers improved therapeutic outcomes and lower toxicity, making it suitable for recurrent cases. Additionally, ongoing clinical advancements, enhanced drug availability, and growing awareness of women’s health are contributing to the segment’s steady expansion.

Distribution Channel Insights

How did the Hospital Pharmacies Dominated the Market in 2024?

In 2024, the hospital pharmacies segment held the largest liposomal doxorubicin market share due to the increasing number of cancer patients receiving inpatient and outpatient care in hospitals. The availability of advanced oncology treatments, proper drug handling facilities, and immediate access to prescribed medications supported this dominance. Furthermore, hospitals' strong distribution networks and collaborations with drug manufacturers ensured consistent supply and effective patient management.

Online Pharmacies

The online pharmacies segment is anticipated to grow at the fastest CAGR during the forecast period due to increasing consumer preference for digital purchasing and doorstep delivery of prescription drugs. The convenience, accessibility, and availability of discounted prices are attracting more patients. Furthermore, expanding collaborations between pharmaceutical manufacturers and online platforms, along with advancements in digital healthcare infrastructure, are propelling this segments rapid growth.

Retail Pharmacies

The retail pharmacies segment is estimated to grow at a lucrative rate due to the expanding presence of retail pharmacy chains and improved access to prescription drugs. Increasing patient reliance on retail outlets for convenient purchases and professional guidance is driving demand. Additionally, better supply chain systems, affordability pricing, and growing availability of oncology medicines are contributing to the market expansion.

Regional Insights

Why North America Dominated the Liposomal Doxorubicin Market in 2024?

In 2024, North America dominated the market due to its strong healthcare infrastructure, high cancer prevalence, and early adoption of advanced drug delivery systems. The presence of major pharmaceutical companies and ongoing clinical research initiatives further strengthened regional growth. Additionally, favorable reimbursement policies, robust regulatory support, and increased investments in oncology therapeutics contributed to North America’s leading revenue share in the global market.

Rising Cancer Burden and Innovation Drive Growth in the U.S. Market

The U.S. liposomal doxorubicin market is expanding due to the increasing incidence of cancer, growing preference for targeted drug delivery systems, and strong presence of leading pharmaceutical companies. High healthcare spending, advanced R&D infrastructure, and continuous clinical trials are accelerating adoption. Moreover, favorable FDA approvals, availability of innovative formulations, and rising demand for safer, more effective chemotherapy options are further propelling market growth across the country.

Asia-Pacific Poised for Rapid Growth in the Liposomal Doxorubicin Market

The Asia-Pacific region is anticipated to grow at the fastest CAGR during the forecast period due to the rising cancer burden, improving access to modern therapies, and growing focus on affordable oncology treatments. Expanding healthcare infrastructure, supportive government initiatives, and increasing pharmaceutical manufacturing capacity are boosting availability. Moreover, rising clinical research activities and partnerships between local and global drug makers are accelerating the adoption of liposomal doxorubicin across key Asian markets.

India Emerges as a Growing Hub for the Liposomal Doxorubicin Market

The India market is witnessing significant growth due to the increasing cancer burden, expanding pharmaceutical manufacturing capacity, and growing preference for targeted drug delivery systems. Rising healthcare investments, availability of affordable generics, and improved access to oncology treatments are fueling market expansion. Moreover, supportive government initiatives, ongoing clinical trials, and collaborations between domestic and international drug developers are strengthening India’s position in the global liposomal doxorubicin market.

Europe: Rising Advanced Drug Delivery Systems

The Europe liposomal doxorubicin market is anticipated to expand steadily due to the growing emphasis on personalized medicine and the rising adoption of advanced drug delivery systems. Increasing clinical trials, collaborative research initiatives, and supportive healthcare policies are fostering innovation in oncology treatments. Additionally, expanding patient awareness, improved reimbursement structures, and strong distribution networks across key countries are further contributing to the region’s growing demand for liposomal doxorubicin.

UK: Growing Focus on Advanced Oncology Therapies

The U.K. market is witnessing steady expansion driven by the growing geriatric population, higher cancer recurrence rates, and increasing acceptance of liposomal formulations for better efficacy and reduced toxicity. The presence of leading pharmaceutical companies, supportive healthcare infrastructure, and favorable reimbursement policies is further promoting product uptake. Moreover, continuous clinical trials and regulatory approvals are accelerating the adoption of advanced liposomal cancer therapies in the country.

South America Therapeutic Momentum

South America is expected to grow at a significant rate in the liposomal doxorubicin market, driven by rising demand as cancer incidence exceeded 1.5 million new cases in 2024. Governments expanded oncology budgets and public tender programs to ensure access to advanced chemotherapeutics.

Brazil’s Oncology Push

Brazil’s Ministry of Health increased cancer-care funding in 2024 under the “Plano de Enfrentamento ao Câncer,” boosting liposomal doxorubicin uptake. Approximately 625,000 new cancer cases intensified hospital procurement and treatment investments.

MEA Healthcare Revitalization

MEA is expected to grow at a significant rate in the liposomal doxorubicin market. Middle Eastern and African nations strengthened oncology infrastructure via World Bank–supported initiatives in 2024. Rising breast and ovarian cancer cases, exceeding 520,000 regionally, drove demand for safer, targeted liposomal doxorubicin formulations.

GCC Policy-Driven Growth

GCC governments launched precision oncology programs in 2024, including Saudi Vision 2030’s cancer-care reforms. Early screening expansion and centralized drug procurement accelerated liposomal doxorubicin adoption across Saudi Arabia, the UAE, and Kuwait.

Company Landscape

Johnson & Johnson (Janssen Products, LP)

Company Overview

- Corporate Information, Headquarters: New Brunswick, New Jersey, US, Year Founded: 1886 (Johnson & Johnson), Ownership Type: Publicly Traded Company (NYSE: JNJ).

- History and Background, Johnson & Johnson (J&J) is one of the world's largest and most broadly-based healthcare companies. J&J acquired the rights to the original Liposomal Doxorubicin product, Doxil (marketed as Caelyx outside the US), from Sequus Pharmaceuticals.

Business Overview

- Business Segments/Divisions, Pharmaceuticals (Janssen), MedTech, Consumer Health (Recently spun off as Kenvue). The Liposomal Doxorubicin product (Doxil/Caelyx) falls under the Janssen Pharmaceuticals division, specifically within Oncology.

- Geographic Presence, Global, with a strong presence in North America and Europe, supported by its extensive international network.

- Key Offerings, The brand name, Doxil (Doxorubicin HCl Liposome Injection) in the US and Caelyx in many other regions, is a PEGylated liposomal formulation of doxorubicin.

- End-Use Industries Served, Healthcare/Pharmaceuticals, primarily focusing on Oncology (cancer treatment).

Key Developments and Strategic Initiatives

- Mergers & Acquisitions: J&J's continuous growth strategy includes strategic acquisitions to strengthen its pharmaceutical pipeline, though no recent major M&A related specifically to the Liposomal Doxorubicin product line is highlighted in 2024-2025.

- Partnerships & Collaborations: Collaborations with academic institutions and other biotech firms are ongoing across Janssen's portfolio for drug discovery and clinical trials. Janssen focuses on maintaining robust supply chain partnerships for Doxil/Caelyx manufacturing and distribution.

- Product Launches/Innovations, Focus is on maintaining the existing branded product, Doxil/Caelyx, as a proven standard of care in its indications, with ongoing research in J&J's broader oncology pipeline.

- Capacity Expansions/Investments, Significant and continuous R&D investment across the Janssen portfolio, with a focus on advancing novel oncology treatments.

- Regulatory Approvals, Doxil/Caelyx holds numerous regulatory approvals globally, including the US FDA, for its approved indications.

- Distribution channel strategy, primarily through Hospital Pharmacies and specialized distributors, often with exclusive arrangements due to the complexity and specialized nature of the cytotoxic drug.

Technological Capabilities/R&D Focus

- Core Technologies/Patents: The core technology is the proprietary PEGylated liposomal formulation, which provides prolonged circulation time and preferential accumulation at tumor sites, reducing cardiotoxicity. Although the core patents have expired, leading to generic competition.

- Research & Development Infrastructure: Extensive global R&D infrastructure under Janssen Research & Development, LLC, focusing on areas like solid tumor oncology, hematologic malignancies, and targeted therapies.

- Innovation Focus Areas, New indications, combination therapies, and post-market safety/efficacy studies for Doxil/Caelyx, while Janssen's broader focus is on novel mechanisms of action in oncology.

Competitive Positioning

- Strengths & Differentiators, First-to-market advantage and strong brand recognition (Doxil/Caelyx), proven clinical data and safety profile, established market trust among oncologists, and comprehensive global distribution network.

- Market presence & ecosystem role, Dominant market leader in branded liposomal doxorubicin, sets the benchmark for quality and efficacy in the liposomal doxorubicin segment.

SWOT Analysis

- Strengths: Established brand and trust, extensive clinical history, strong global distribution.

- Weaknesses: High cost compared to generics, original patents have expired.

- Opportunities: Exploring new combination therapies and indications, expanding market access in emerging economies.

- Threats: Aggressive competition from generic manufacturers (e.g., Sun Pharma's Lipodox), development of alternative novel oncology treatments.

Recent News and Updates

- Press Releases, Recent J&J news focuses on broader oncology pipeline approvals and advancements in new therapeutic areas, reflecting a diversified focus beyond Doxil/Caelyx.

- Industry Recognitions/Awards, J&J and Janssen consistently receive recognition for their overall R&D and pharmaceutical performance.

Sun Pharmaceutical Industries Ltd.

Company Overview

- Corporate Information, Headquarters: Mumbai, Maharashtra, India, Year Founded: 1983, Ownership Type: Publicly Traded Company (NSE: SUNPHARMA, BSE: 524715).

- History and Background, Sun Pharma is a leading global specialty generic company, the largest pharmaceutical company in India, and a key player in specialty generics globally. Its Liposomal Doxorubicin product, Lipodox, gained significant market share, particularly in the US and emerging markets, often during periods of Doxil/Caelyx shortages.

Business Overview

- Business Segments/Divisions, Specialty Generics, Generics, Active Pharmaceutical Ingredients (API), and Consumer Healthcare. Lipodox is a key product in its Oncology portfolio under its Specialty Generics and Global Generics divisions.

- Geographic Presence, Global footprint in over 100 countries, with major markets including India (No. 1 pharma company), the US (significant generic presence), Europe, and emerging markets.

- Key Offerings, Lipodox (Doxorubicin Hydrochloride Liposome Injection), a generic equivalent of Doxil/Caelyx, available in various strengths.

- End-Use Industries Served, Healthcare/Pharmaceuticals, primarily serving the Oncology market with a focus on accessible and affordable cancer treatments.

Key Developments and Strategic Initiatives

- Mergers & Acquisitions, Sun Pharma continuously engages in strategic acquisitions to bolster its generics and specialty pipeline, such as its past acquisition of Ranbaxy.

- Partnerships & Collaborations, Strategic alliances and partnerships are a core part of its business model to expand its global reach and access to complex generics.

- Product Launches/Innovations, Continuous focus on launching complex generics and specialty products, as seen by the US FDA approval and launch of their generic Liposomal Doxorubicin product. In August 2024, Lupin Limited (a competitor, but highlighting generic market activity) launched a generic Doxorubicin Hydrochloride Liposome Injection in the US, increasing the competitive pressure in the generic segment. Sun Pharma’s focus is on complex generics, including liposomal drugs.

- Capacity Expansions/Investments, Substantial R&D investments (6-8% of global revenues) focused on formulations, process chemistry, and complex generics like liposomal drugs and inhalers. Expanding manufacturing capacity across its 40+ global facilities.

- Regulatory Approvals, Holds US FDA approval for its generic Doxorubicin Hydrochloride Liposome Injection (Lipodox), along with approvals in multiple international markets.

- Distribution channel strategy, Leverages its robust generics distribution network to target both hospital pharmacies and retail/online pharmacies globally, prioritizing cost-effectiveness and broad availability.

Technological Capabilities/R&D Focus

- Core Technologies/Patents, Expertise in complex generics, including specialized formulations like liposomes (nanotechnology) for improved drug delivery. Possesses strong capabilities in API and formulation development.

- Research & Development Infrastructure, Extensive R&D team (over 2,900 personnel) with a focus on differentiated products, including liposomal injections, inhalers, and controlled-release dosage forms.

- Innovation Focus Areas, Developing next-generation complex generics, innovative specialty medicines in areas like oncology, and enhancing drug delivery systems to improve patient outcomes and address unmet needs.

Competitive Positioning

- Strengths & Differentiators, Cost-effective alternative to branded products, strong presence in emerging markets, deep expertise in complex generic formulations (Liposomal technology), robust global manufacturing and supply chain.

- Market presence & ecosystem role, Leading player in the generic segment of the Liposomal Doxorubicin market, acting as a crucial provider of affordable cancer treatments, and a major player in the global generics ecosystem.

SWOT Analysis

- Strengths: Lower price point driving market penetration, strong global generic supply chain, focus on complex generics technology.

- Weaknesses: Faces competition from multiple generic players, perceived as a generic, not an innovator brand.

- Opportunities: Expanding presence in regulated markets (US, Europe), leveraging strong API capabilities, and increasing global demand for affordable cancer drugs.

- Threats: Price erosion due to increasing generic competition, stringent regulatory scrutiny in developed markets, and dependence on generic market dynamics.

Recent News and Updates

- Press Releases, Recent news highlights overall strong financial performance, expansion in specialty businesses, and consistent focus on complex product approvals.

- Industry Recognitions/Awards, Frequently recognized as a top pharmaceutical company in India and a significant global generics player.

Liposomal Doxorubicin Market Value Chain Analysis

Clinical Trials

- (PLD), marketed as Doxil or Caelyx, offers a safer and more targeted alternative to conventional doxorubicin.

- Its liposomal formulation minimizes cardiotoxicity and other adverse effects.

- Clinical studies confirm its strong efficacy in treating various cancer types with improved patient safety.

Packaging and Serialization

- Liposomal doxorubicin products like Doxil require highly regulated packaging and serialization standards.

- The packaging safeguards the stability and integrity of liposomes against temperature fluctuations and contamination.

- Serialization provides full traceability, ensuring product authenticity and preventing counterfeiting across the supply chain.

Patient Support and Services

- Patient support for liposomal doxorubicin includes collaboration with healthcare providers and cancer care organizations.

- Services offer clinical guidance, financial aid, and emotional support tailored to patient needs.

- The type and availability of support vary based on cancer type, manufacturer programs, and regional access.

Company And its Offerings

- Merck & Co. Inc.- Offers Keytruda (pembrolizumab) for cancer immunotherapy and is involved in advanced oncology formulation.

- Cipla Ltd- Manufactures Liposomal Doxorubicin Injection used for treating ovarian cancer, multiple myeloma, and AIDS-related Kaposi’s sarcoma.

- Lupin Limited- Launched Doxorubicin Hydrochloride Liposome Injection in the U.S. for Multiple Myeloma.

- Sanofi- Focuses on oncology biologics and rare disease therapies and is active in liposomal and targeted chemotherapy research.

- Pfizer Inc.- Known for Doxil, a leading product used to treat ovarian cancer, multiple myeloma, and breast cancer.

Top Companies in the Liposomal Doxorubicin Market

- Sun Pharmaceutical Industries Ltd.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Cipla

- Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd.

- Lupin

- Cadila Pharmaceuticals

- SRS Life Sciences

- GSK plc

- Pfizer Inc.

- Sanofi

- Sigma-Aldrich Co.

Recent Developments in the Liposomal Doxorubicin Market

- In June 2025, Alembic Pharmaceuticals Limited received USFDA approval for its Doxorubicin Hydrochloride Liposome Injection, expanding its oncology portfolio. The drug is approved for treating multiple myeloma, ovarian cancer, and AIDS-related Kaposi Sarcoma, enhancing access to advanced cancer therapies in the U.S. market.

- In January 2024, CHEPLAPHARM Group acquired the commercial rights for Myocet from Teva in Europe, marking its first product purchase from the company. This move expanded CHEPLAPHARM’s oncology portfolio, with Myocet being used as a first-line treatment for metastatic breast cancer in adult women.

Segments Covered in the Report

By Product

- Doxil/Caelyx

- Lipodox

- Myocet

- Others

By Application

- Breast Cancer

- Ovarian Cancer

- AIDS-related Kaposi’s Sarcoma

- Multiple Myeloma

- Other Solid Tumors

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA