February 2026

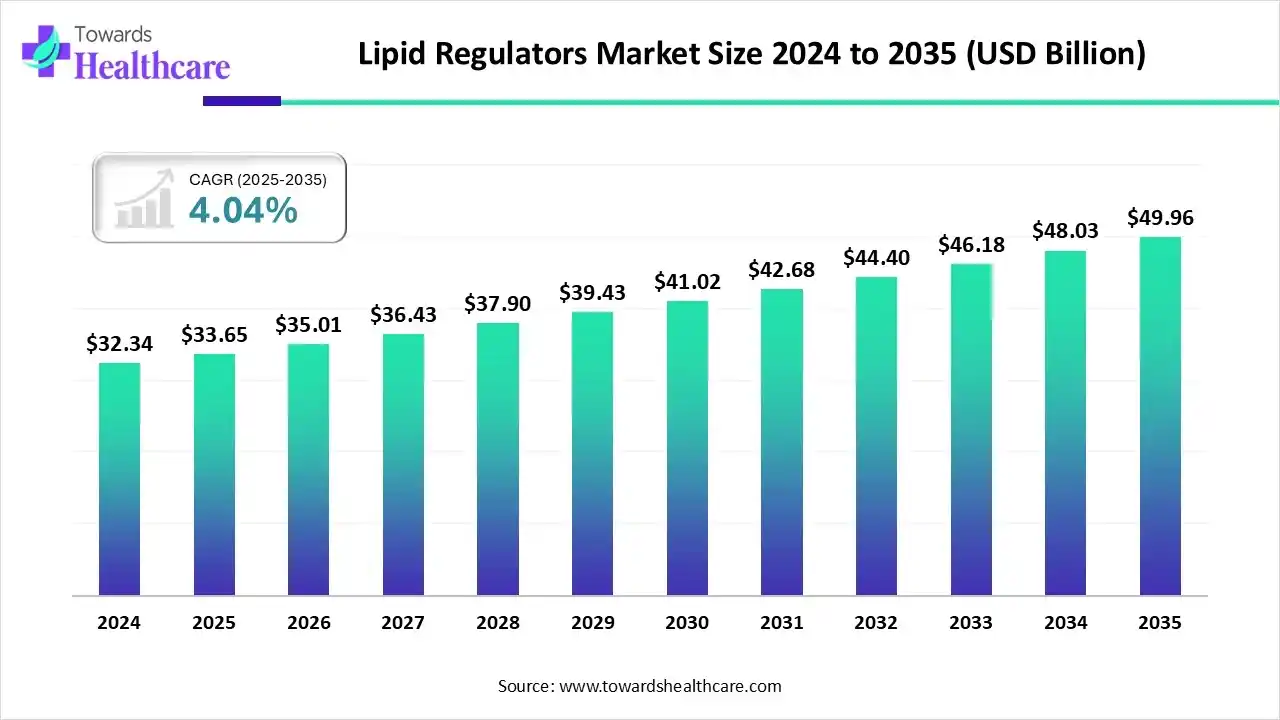

The lipid regulators market size stood at US$ 33.65 billion in 2025, grew to US$ 35.01 billion in 2026, and is forecast to reach US$ 49.96 billion by 2035, expanding at a CAGR of 4.04% from 2026 to 2035.

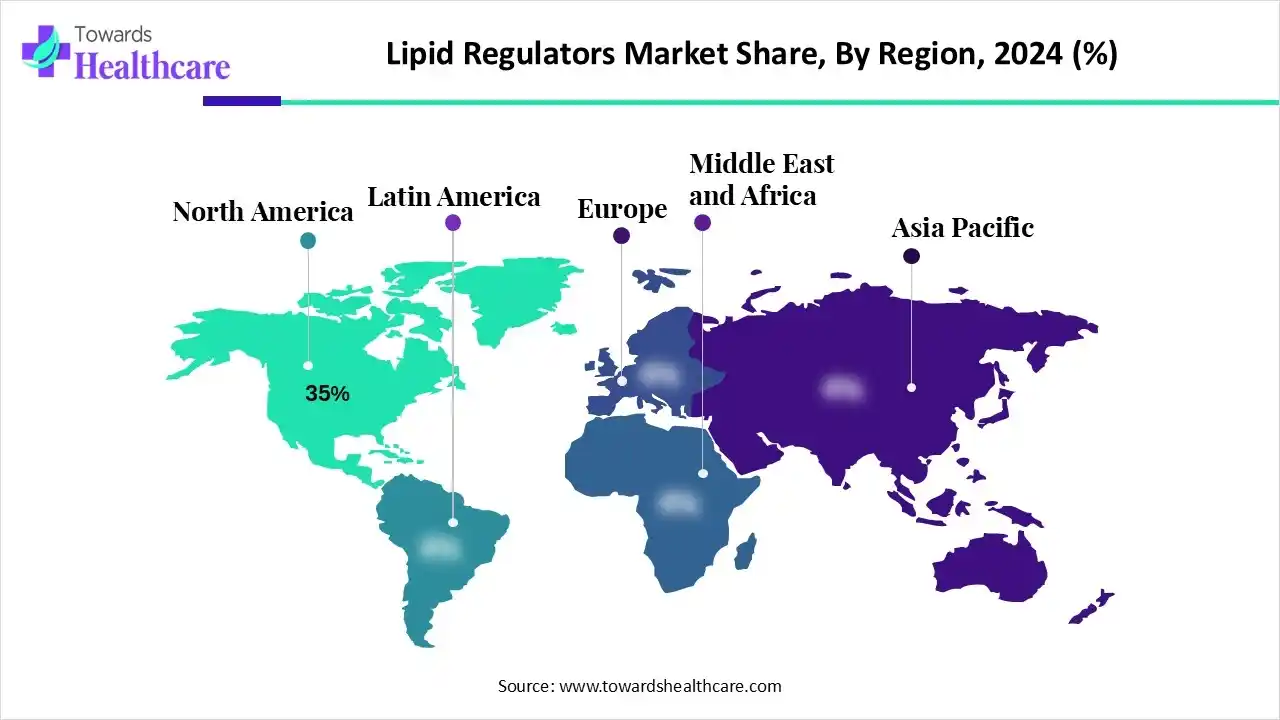

The lipid regulators market is expanding steadily, driven by the rising incidence of cardiovascular disorders, obesity, and high cholesterol levels. Growing awareness about preventive healthcare, advancements in drug formulations, and increased adoption of statins and fibrates are fueling market growth, with North America leading due to its robust healthcare infrastructure.

| Table | Scope |

| Market Size in 2025 | USD 33.65 Billion |

| Projected Market Size in 2035 | USD 49.96 Billion |

| CAGR (2026 - 2035) | 4.04% |

| Leading Region | North America by 35% |

| Market Segmentation | By Product Type, By Dosage Form, By Therapeutic Class, By Distribution Channel, By Manufacturer Type, By End-User Industry / Customer, By Region |

| Top Key Players | Pfizer, Novartis, Amgen, Sanofi, Regeneron Pharmaceuticals, Merck & Co., AstraZeneca, Eli Lilly and Company, Johnson & Johnson (Janssen), Bristol-Myers Squibb, Bayer AG, AbbVie, Boehringer Ingelheim, Takeda Pharmaceutical Company, Viatris, Teva Pharmaceutical Industries, Sandoz (Novartis generics), Sun Pharmaceutical Industries, Cipla, Dr. Reddy’s Laboratories |

The lipid regulators market is growing due to the rising prevalence of cardiovascular diseases and increasing demand for effective cholesterol management therapies. The market comprises pharmaceuticals and biologics used to manage blood lipid levels primarily to lower low-density lipoprotein cholesterol (LDL-C), reduce triglycerides, and raise high-density lipoprotein (HDL). It includes drug classes such as statins, ezetimibe, fibrates, bile acid sequestrants, omega-3 fatty acid therapies, PCSK9 inhibitors, siRNA therapies (e.g., inclisiran), combination lipid therapies, and generics.

Products in this market are prescribed for primary and secondary prevention of atherosclerotic cardiovascular disease, familial hypercholesterolemia, and severe hypertriglyceridemia. Market activity is driven by clinical guideline updates, aging populations, cardiovascular disease prevalence, patent expiries, availability of generics and biosimilars, and innovations in RNA-based and monoclonal antibody therapies.

Sustainability Trends: Sustainability trends in the market focus on developing eco-friendly drug manufacturing processes, reducing chemical waste, and promoting plant-based or natural lipid-lowering alternatives, aligning with global efforts toward greener and more sustainable pharmaceutical practices.

Global Expansion: The global expansion of the market is driven by increasing cardiovascular disease prevalence, rising healthcare investments, and growing adoption of advanced lipid-lowering therapies across emerging economies, supported by strategic collaborations and regulatory approvals worldwide.

Startup Ecosystems: The startup ecosystem in the market is expanding, with emerging biotech firms focusing on innovative lipid-lowering drugs, personalized medicine, and natural formulations, supported by growing venture funding, research collaborations, and advancements in cardiovascular health technologies.

AI is transforming the lipid regulators market by enabling faster drug discovery, personalized treatment plans, and predictive analysis for cardiovascular risks. It enhances clinical trial efficiency, supports real-time monitoring of lipid levels, and aids in developing targeted therapies, improving overall patient outcomes and market innovation.

Which Product type is Dominating the Market?

The oral small molecules segment led the lipid regulators market with revenue shares of 65% in 2024 due to its strong therapeutic effectiveness, affordability, and ease of use in managing cholesterol and triglyceride disorders. Drugs such as statins and fibrates remain the preferred choice among physicians due to their established safety profiles, proven clinical outcomes, and wide availability. Additionally, the introduction of a cost-effective generic version has further strengthened this segment's market position.

Injectables

The injectables segment is expected to witness the fastest growth during the forecast period owing preference for advanced biologic treatments and targeted lipid-lowering therapies. Improved efficacy, reduced dosing frequency, and better patient adherence have increased their acceptance. Furthermore, continuous R&D efforts, expanding clinical application, and supportive healthcare policies are driving the rapid adoption of injectable lipid-regulating products globally.

Combination Products

The combination product segment is projected to expand notably during the forecast period, supported by the growing demand for comprehensive lipid management solutions. These products provide balanced control of cholesterol and triglycerides while minimizing side effects. Rising clinical preference for dual-action therapies, coupled with ongoing innovation in drug formulations, is further boosting the adoption of combination lipid regulators.

What made the Oral Solid Dosage Segment Dominant in the Market in 2024?

The oral solid dosage segment accounted for the largest revenue share of 70% in the lipid regulators market, owing to its widespread availability and patient-friendly format. These formulations are easier to distribute, store, and prescribe compared to other forms. Additionally, advancements in oral drug formulations and the affordability of solid-dose medication have further reinforced their leading position in the market.

Parenteral/Injectables

The parenteral/injectables segment is projected to witness rapid growth during the forecast period, driven by the development of next-generation lipid-lowering agents and innovative delivery technologies. Growing patient preference for effective, long-acting treatment and increased investments in biologic research are enhancing the adoption of injectables, particularly for managing complex and resistant lipid disorders.

Other Innovative/Advanced Delivery

The innovative/advanced delivery segment is projected to expand significantly during the forecast period, supported by continuous advancements in controlled and sustained release technologies. These novel systems aim to improve treatment precision and patient comfort while reducing dosing frequency. Growing R&D investment and the shift towards modern, patient-centric therapies are further fueling demand for innovative lipid-regulating formulations.

How the Statins Dominated the Market in 2024?

The statins segment dominated the lipid regulators market with a major revenue share of 50% in 2024 because of its proven role in effectively reducing cholesterol and lowering the risk of heart-related disorders. Their wide clinical acceptance, favorable safety record, and cost-effectiveness make them a preferred treatment choice. Moreover, continuous innovations, strong patient compliance, and broad availability through branded and generic versions have sustained the segment's leading position in the global lipid regulators market.

PCSK9 Inhibitors

The PCSK9 inhibitors segment is anticipated to expand rapidly during the forecast period, driven by the rising prevalence of severe hypercholesterolemia and the demand for next-generation lipid-lowering therapies. Continuous clinical advancements, improved accessibility through pricing reforms, and growing physician preference for potent, long-acting biologic options are accelerating the adoption of PCSK9 inhibitors across global healthcare systems.

Ezetimibe

The ezetimibe segment is expected to grow at a significant rate during the forecast period due to its effectiveness in lowering cholesterol by inhibiting intestinal absorption of lipids. Its compatibility with statins for combination therapy enhances treatment outcomes and patient adherence. Additionally, the availability of affordable generic versions and increasing preference for multi-mechanism lipid control therapies are driving the steady expansion of the ezetimibe segment in the market.

Which Distribution Channel Dominated the Market in 2024?

The retail pharmacies/drug stores segment captured the largest lipid regulators market share of 50% in 2024, owing to their distribution networks and accessibility across urban and rural areas. Increased patient reliance on community pharmacies for regular refills and medication guidance, along with expanding partnerships between drug manufacturers and pharmacy chains, has further supported the segment's leading position in the lipid regulators market.

Online Pharmacies/E-pharmacy Platforms

The online pharmacies/E-pharmacy platforms segment is expected to expand rapidly during the forecast period, driven by the growing shift towards digital healthcare and remote purchasing. Improved access to prescription drugs, user-friendly mobile apps, and secure payment options are enhancing customer trust. Moreover, increasing awareness of digital health solutions and subscription-based medication services is fueling the market's strong growth trajectory.

Hospital Pharmacies/Institutional Tender

The hospital pharmacies and institutional tender segment is projected to witness notable growth during the forecast period, supported by expanding hospital networks and increased adoption of advanced lipid-lowering therapies in clinical care. Favorable reimbursement policies, large-scale procurement agreements, and the rising preference for hospital-dispensed prescriptions are further boosting the segment's role in ensuring consistent access to lipid-regulating medications.

How did the Local/Regional generic Manufacturers dominate the Market?

The local/regional generic manufacturers segment dominated the lipid regulators market with revenue shares of 60% in 2024, driven by their strong presence in emerging economies and ability to meet large-scale demand efficiently. These manufacturers benefit from lower production costs, flexible pricing, and faster regulatory approvals. Their focus on accessible formulations and partnership with regional distributors further enhanced their market reach and share in the lipid regulators industry.

Biotech/Specialty Biologics Firms

The biotech/specialty biologics firms segment is anticipated to expand rapidly during the forecast, supported by breakthroughs in novel lipid-targeting mechanisms and advanced therapeutic platforms. These forms are leveraging cutting-edge biotechnologies to develop safer and more effective treatments. Increased funding, strategic collaboration, and growing demand for high-efficacy biologic solutions are propelling the segment's strong growth momentum in the lipid regulators market.

MNC Pharmaceutical Companies

The MNC pharmaceutical companies segment is projected to witness notable growth during the forecast period, driven by their expertise in large-scale production and the adoption of advanced manufacturing technologies. Their focus on developing high-quality, patented formulations and expanding patient access through global healthcare initiatives has strengthened their market position. Additionally, strong brand recognition and international regulatory compliance continue to support their steady expansion in the lipid regulators industry.

How the Outpatient/Retail Patients Dominated the Market?

The outpatient/retail patients segment dominated the market with revenue shares of 65% in 2024, owing to the growing number of individuals managing lipid disorders through routine prescription outside hospital settings. The convenience of regular follow-ups with physicians, accessibility of medications through nearby pharmacies, and increasing adoption of long-term preventive therapies contributed to the segment's leading share in the lipid regulators market.

Hospital/Inpatient Care

The hospitals/inpatient care segment is expected to grow at the fastest CAGR during the forecast period. Hospitals and inpatient care are growing in the lipid regulators market due to the rising prevalence and severity of cardiovascular diseases, necessitating immediate and intensive care. Also, new advanced therapies, especially injectables, are often initiated in structured hospital settings.

Long-term Care & Nursing Homes

The long-term care & nursing homes segment is growing in the lipid regulators market dure to due to the rising aging population and the associated increase in chronic conditions like dyslipidemia, cardiovascular diseases, and multimorbidity. These conditions necessitate ongoing management and medication, driving demand within these facilities.

North America dominated the lipid regulators market with revenue shares of 35% in 2024, driven by a high burden of cardiovascular diseases, strong healthcare infrastructure, and early adoption of advanced lipid-lowering therapies. The presence of major pharmaceutical companies, robust R&D investments, and favorable reimbursement frameworks further supported market expansion. Additionally, growing awareness of cholesterol management and preventive healthcare practices among patients strengthened the region's leadership in the global lipid regulators market.

The U.S. lipid regulators market is growing due to the increasing prevalence of obesity, diabetes, and cardiovascular diseases, which drive demand for effective cholesterol-lowering treatments. Strong healthcare infrastructure, advanced R&D in lipid management drugs, and high adoption of innovative therapies such as biologics and combination products support this growth. Additionally, favorable reimbursement policies, widespread health awareness, and accessibility to both branded and generic medications further enhance market expansion across the country.

The Asia-Pacific region is expected to grow at the fastest CAGR in the lipid regulators market during the forecast period due to the increasing prevalence of cardiovascular diseases, obesity, and diabetes. Rapid urbanization, changing dietary habits, and growing healthcare investments are boosting demand for lipid-lowering therapies. Additionally, rising awareness about preventive care, expanding access to generic drugs, and government initiatives to improve cardiovascular health are further accelerating market growth across emerging economies in the region.

The India lipid regulators market is growing rapidly due to the increasing incidence of cardiovascular diseases, diabetes, and obesity linked to sedentary lifestyles and unhealthy diets. Expanding healthcare infrastructure, rising awareness about cholesterol management, and the availability of affordable generic drugs are driving market demand. Additionally, government initiatives promoting preventive healthcare and the presence of leading domestic pharmaceutical manufacturers are further boosting the growth of lipid regulators across the country.

Europe is expected to grow at a lucrative rate in the lipid regulators market due to the rising prevalence of hyperlipidemia and cardiovascular disorders. Strong government initiatives promoting heart health, increasing adoption of advanced lipid-lowering therapies, and a growing elderly population are fueling market expansion. Additionally, continuous R&D investments, availability of innovative biologics, and improved healthcare access across major European countries are further supporting the region’s promising growth outlook.

The UK lipid regulators market is growing due to the increasing prevalence of cardiovascular diseases, obesity, and diabetes, which are fueling demand for effective cholesterol management therapies. Strong government health initiatives, such as cardiovascular prevention programs, along with the availability of advanced lipid-lowering drugs, support market expansion. Additionally, growing awareness about preventive healthcare and the adoption of innovative treatment options are further driving steady growth in the UK lipid regulators market.

Rising cardiovascular disease prevalence and increased preventive healthcare spending are propelling lipid regulator use in South America, with governments emphasizing early cholesterol management through affordable, accessible therapies.

Brazil’s lipid regulator market grows through domestic manufacturing, government healthcare initiatives, and adoption of next-generation statins supporting personalized cardiovascular therapy and preventive care awareness across both urban and rural regions.

The Middle East and Africa experience growth as cardiovascular disorder rates climb, prompting healthcare infrastructure investments and greater availability of lipid-lowering drugs through public health insurance and digital healthcare channels.

High obesity, diabetes, and sedentary lifestyles drive GCC countries to integrate lipid regulators in national wellness programs, emphasizing early screening, physician training, and partnerships promoting long-term cardiovascular prevention.

Company Overview

Pfizer is a global biopharmaceutical company focused on discovering, developing, manufacturing, and marketing healthcare products, including innovative medicines and vaccines. Its goal is to bring therapies to people that significantly improve their lives.

Corporate Information (Headquarters, Year Founded, Ownership Type)

History and Background

Key Milestones/Timeline

Business Overview

Pfizer focuses on a science-based portfolio of innovative medicines and vaccines across several therapeutic areas, driven by a commitment to bold scientific breakthroughs.

Business Segments/Divisions

Pfizer Biopharmaceuticals Group (BupH) comprises Pfizer's innovative medicines and vaccines across multiple therapeutic areas, which include internal medicine (cardiovascular, metabolism, pain), inflammation, and immunology.

Geographic Presence

Key Offerings

End-Use Industries Served

Pharmaceutical/Healthcare, Hospitals, Retail Pharmacies, Government Healthcare Systems.

Key Developments and Strategic Initiatives

Mergers & Acquisitions

Recent Activity, In 2023, completed the acquisition of Seagen for approximately $43 billion, a move primarily aimed at boosting its oncology portfolio, but reinforcing its innovative drug strategy.

Partnerships & Collaborations

Product Launches/Innovations

Continuing to launch and expand indications for novel oral therapies and injectables across its core therapeutic areas.

Capacity Expansions/Investments

Ongoing investments in manufacturing and supply chain to support global demand for its innovative portfolio, including biologics and complex small molecules.

Regulatory Approvals

Securing various approvals globally for new indications, formulations, and combination therapies across its portfolio in 2024 and 2025.

Distribution channel strategy

Technological Capabilities/R&D Focus

Core Technologies/Patents

Research & Development Infrastructure

Global R&D centers dedicated to discovery, clinical development, and translational science.

Innovation Focus Areas

Cardiovascular and Metabolic Disease, Oncology, Vaccines, and Rare Disease.

Competitive Positioning

Strong Position, One of the largest global pharmaceutical companies with a powerful brand, extensive global reach, and a history of blockbuster drugs in the lipid-lowering space.

Competition, Faces intense competition from generic manufacturers for legacy products like Lipitor, and from other major biopharma companies developing novel non-statin lipid regulators, PCSK9 inhibitors, and siRNA therapies.

Strengths & Differentiators

Market presence & ecosystem role

SWOT Analysis

Recent News and Updates (2024-2025)

Press Releases

March 2025, Pfizer announced an increased dividend for shareholders, reflecting confidence in its post-Seagen integration and pipeline growth.

Industry Recognitions/Awards

Consistently recognized as a top R&D spender and a leader in corporate responsibility and patient advocacy within the pharmaceutical industry.

Company Overview

AstraZeneca is a multinational pharmaceutical and biotechnology company focused on the discovery, development, and commercialization of prescription medicines, primarily for the treatment of diseases in oncology, cardiovascular, renal, metabolism, respiratory, and immunology.

Corporate Information (Headquarters, Year Founded, Ownership Type)

History and Background

Key Milestones/Timeline

Business Overview

Operates as a science-led organization with a primary focus on innovative medicines across three core therapy areas, Oncology, BioPharmaceuticals (Cardiovascular, Renal, and Metabolism, and Respiratory and Immunology), and Rare Disease (Alexion).

Business Segments/Divisions

Geographic Presence

Global reach, with core markets in the US, Europe, and Emerging Markets, especially China.

Key Offerings

End-Use Industries Served

Pharmaceutical/Healthcare, Hospitals, Retail Pharmacies, Specialty Clinics.

Key Developments and Strategic Initiatives

Mergers & Acquisitions

Partnerships & Collaborations

Product Launches/Innovations

Focusing launches on novel biologics and highly targeted small molecules in Oncology and Rare Disease, while extending the lifecycle of CVRM drugs through new indications.

Capacity Expansions/Investments

Significant ongoing investment in global R&D and manufacturing sites, particularly to support the rapid scaling of its biologics and specialized therapies.

Regulatory Approvals

Secured multiple US and EU regulatory approvals in 2024 for new indications for its key Oncology and CVRM products, supporting portfolio longevity.

Distribution channel strategy

Leverages a well-established global distribution network, including direct sales to hospitals and specialized distributors for oncology and rare disease medicines.

Technological Capabilities/R&D Focus

Core Technologies/Patents

Holds key patents for its major brands (Tagrisso, Imfinzi, etc.) and is constantly filing for new intellectual property on novel targets and drug formulations.

Research & Development Infrastructure

Major R&D hubs in Cambridge (UK), Gaithersburg (US), and Gothenburg (Sweden), emphasizing collaborative, cross-disciplinary science.

Innovation Focus Areas

Oncology, CVRM, and Rare Disease, with a strong emphasis on disease modification and early intervention.

Competitive Positioning

Strengths & Differentiators

Market Presence & Ecosystem Role

A major global pharmaceutical provider, particularly influential in CVRM through guidelines-driven drugs like rosuvastatin and Farxiga.

SWOT Analysis

Recent News and Updates (2024-2025)

Press Releases

February 2025, AstraZeneca published data from a key CVRM trial showing significant benefits of one of its existing drugs in a new, high-risk patient population.

Industry Recognitions/Awards

Recognized for its advancements in oncology research and its commitment to reducing its environmental footprint.

| Company | Key Products | Therapeutic Focus |

| Pfizer Inc. | Lipitor (Atorvastatin) | A widely used statin that lowers LDL cholesterol and reduces cardiovascular disease risk |

| Novartis AG | Leqvio (Inclisiran) | A siRNA-based lipid-lowering therapy targeting PCSK9 has been approved with twice-yearly dosing. |

| Sanofi S.A. | Praluent (alirocumab) | A PCSK9 inhibitor is used in high cardiovascular-risk patients to lower LDL-C. |

| Merck & Co., Inc. | Zetia (ezetimibe)/Vytorin (ezetimibe+simvastatin) | Ezetimibe reduces cholesterol absorption. Vytorin offers combination therapy. |

| AstraZeneca plc | Cresotor (Rosuvastatin) | A potent statin indicated for hyperlipidemia and cardiovascular disease prevention. |

Read further to see how top players are shaping the future of lipid regulators market at: https://www.towardshealthcare.com/companies/lipid-regulators-companies

By Product Type

By Dosage Form

By Therapeutic Class

By Distribution Channel

By Manufacturer Type

By End-User Industry / Customer

By Region

February 2026

February 2026

February 2026

February 2026