January 2026

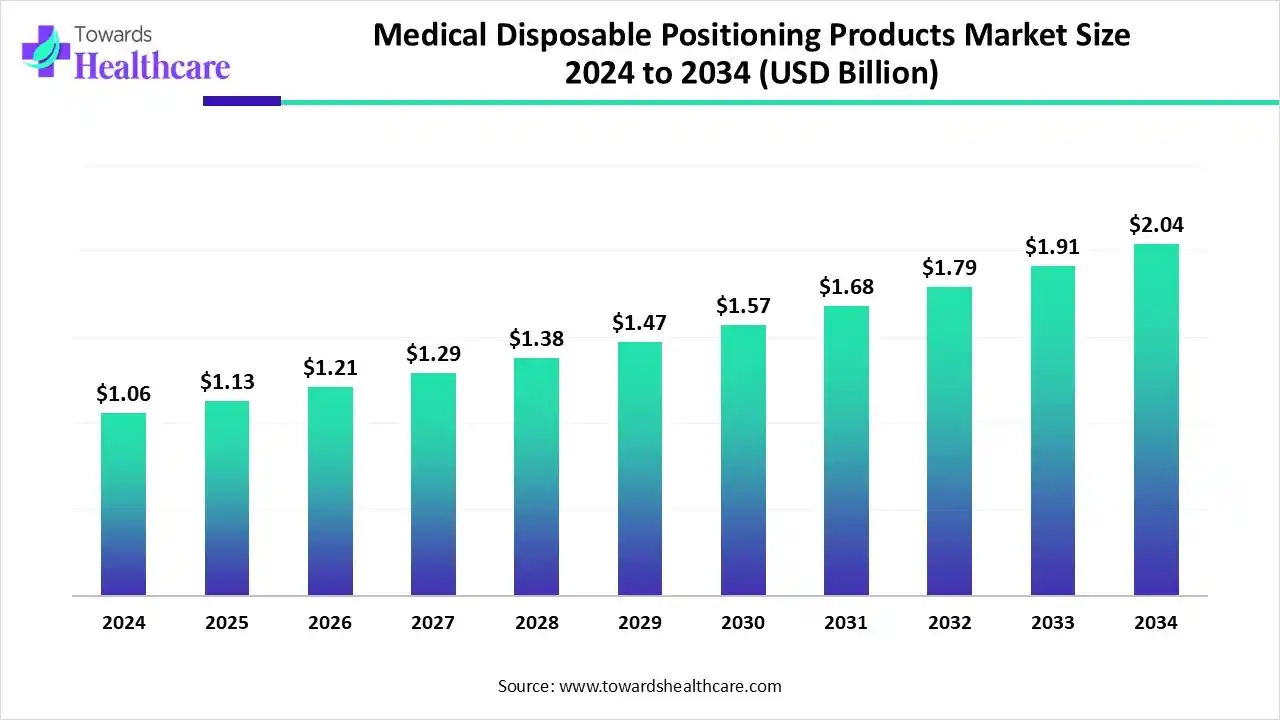

The medical disposable positioning products market size was valued at US$ 1.13 billion in 2025 and is projected to grow to 1.21 billion in 2026. Forecasts suggest it will reach approximately US$ 2.17 billion by 2035, registering a CAGR of 6.75% during the period.

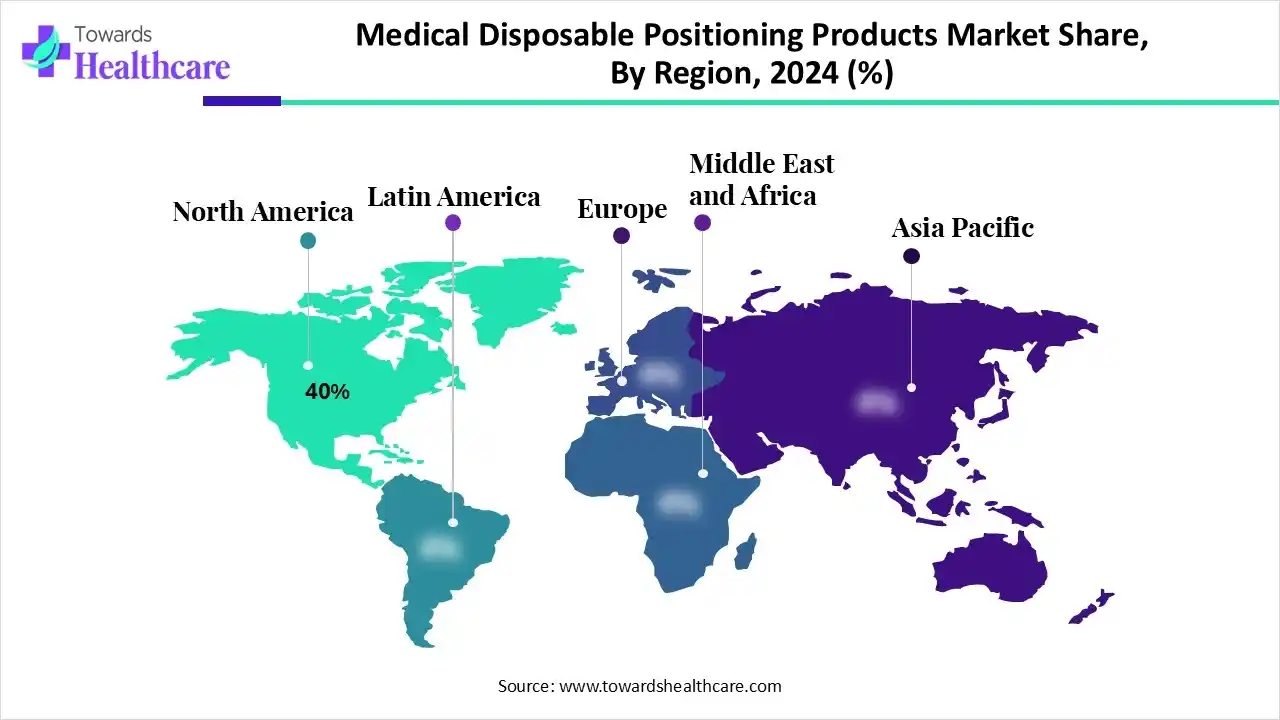

The medical disposable positioning products market is driven by the growing demand for infection control, patient safety, and precision during surgical and diagnostic procedures. Increasing adoption of single-use positioning devices in hospitals and ambulatory surgical centers enhances hygiene and reduces cross-contamination risks. Technological advancements in patient-support accessories further support market expansion. North America leads the market due to a well-established healthcare infrastructure, high surgical volumes, strong regulatory standards, and increasing awareness regarding patient comfort and operational efficiency.

| Table | Scope |

| Market Size in 2025 | USD 1.13 Billion |

| Projected Market Size in 2035 | USD 2.17 Billion |

| CAGR (2026 - 2035) | 6.75% |

| Leading Region | North America by 40% |

| Market Segmentation | By Product, By Material, By Application, By End User, By Region |

| Top Key Players | 3M Company, Stryker Corporation, Medline Industries, Mölnlycke Health Care, Cardinal Health, Hill-Rom Holdings, ConvaTec, DJO Global, Smith & Nephew, BD (Becton, Dickinson and Company), Beekley Medical, Tekni-Plex, Halyard Health, GE Healthcare, Terumo Corporation |

The medical disposable positioning products market is driven by rising demand for infection prevention, patient safety, and improved procedural accuracy in surgical and diagnostic settings. These products are designed for single use, minimizing contamination risks. Medical disposable positioning products include supports, pads, cushions, and straps used to correctly position patients during procedures. They enhance stability, comfort, and access for medical staff while ensuring hygiene compliance. Their disposability eliminates the need for sterilization, improving workflow efficiency and patient outcomes in healthcare facilities.

AI integration can significantly enhance the medical disposable positioning products market by improving product design, manufacturing efficiency, and clinical application. Artificial intelligence enables the development of smart positioning systems that adapt to patient anatomy for optimal alignment and comfort. AI-driven analytics help manufacturers predict demand, optimize supply chains, and minimize waste in disposable production. In clinical settings, AI-powered sensors and imaging assist healthcare professionals in precise patient placement, reducing procedure time and risk of pressure injuries. Additionally, AI supports personalized care by analyzing patient data to recommend suitable positioning aids, enhancing safety, accuracy, and overall healthcare outcomes.

Which Product Segment Dominated the Medical Disposable Positioning Products Market?

The patient positioning cushions segment dominates the market with a share of 50% due to its widespread use in surgeries, diagnostics, and therapeutic procedures. These cushions provide superior comfort, pressure relief, and stability, minimizing injury risks. Their disposable nature ensures hygiene, infection prevention, and enhanced patient safety across healthcare facilities.

Positioning Wedges & Pads

The positioning wedges & pads segment is anticipated to be the fastest-growing segment in the market with a CAGR of 8.5% due to increasing demand for patient comfort, pressure management, and procedural accuracy. Their versatility in surgical and diagnostic applications, along with single-use benefits ensuring hygiene and infection control, drives rapid adoption across healthcare facilities.

Why Did the Foam Segment Dominate the Medical Disposable Positioning Products Market?

The foam segment dominates the market with a share of 45% due to its excellent cushioning, flexibility, and cost-effectiveness. It provides superior patient comfort, support, and stability during surgical and diagnostic procedures. Additionally, foam’s lightweight and disposable properties enhance hygiene, reduce cross-contamination, and simplify handling in healthcare environments.

Gel

The gel segment is anticipated to be the fastest-growing with a CAGR of 8.0% material segment in the medical disposable positioning products market due to its superior pressure distribution, durability, and comfort. Gel-based products minimize tissue stress and skin injuries during long procedures, enhancing patient safety. Their adaptability and infection-resistant nature further drive adoption across healthcare settings.

What Made Surgical Procedures the Dominant Segment in the Medical Disposable Positioning Products Market?

The surgical procedures segment dominates the market with a share of 40% due to the high frequency of surgeries worldwide and the critical need for accurate patient alignment during operations. Disposable positioning devices ensure hygiene, minimize infection risks, and enhance procedural efficiency. Growing emphasis on patient safety, comfort, and post-operative outcomes further strengthens this segment’s dominance across hospitals and surgical centers.

Imaging & Diagnostic Procedures

The imaging & diagnostic procedures segment is estimated to be the fastest-growing, with a CAGR of 8.5% in the medical disposable positioning products market, due to rising demand for precise patient positioning in MRI, CT, and ultrasound examinations. Single-use supports enhance imaging accuracy, reduce contamination risks, and improve workflow efficiency, driving adoption across diagnostic and radiology centers.

Which End-User / Patient Type Segment Led the Medical Disposable Positioning Products Market?

The hospitals segment dominates the market with a share of 50% due to the high volume of surgical and diagnostic procedures performed in these settings. Hospitals prioritize infection control, patient safety, and procedural efficiency, driving the adoption of disposable positioning aids that ensure hygiene, comfort, and compliance with healthcare standards.

Clinics

The clinics segment is anticipated to be the fastest-growing in the market due to increasing outpatient and minimally invasive procedures. Clinics prefer disposable positioning devices for their cost-effectiveness, ease of use, and hygiene benefits. Rising focus on infection prevention and patient comfort further accelerates adoption in clinical settings.

North America dominates the market with a share of 40% due to its advanced healthcare infrastructure, high surgical volumes, and strong emphasis on patient safety and infection control. The presence of leading manufacturers, robust regulatory frameworks, and growing adoption of single-use medical devices further strengthen the region’s leadership in innovation and market penetration.

The U.S. leads the medical disposable positioning products market due to high healthcare spending, a large patient base, and frequent surgical procedures. Strong regulatory standards emphasizing infection control and patient safety promote the adoption of disposable products. Continuous product innovations, hospital modernization, and established medical device manufacturers further drive market growth and technological advancement.

Canada’s medical disposable positioning products market is growing steadily, supported by increasing surgical procedures, improved healthcare infrastructure, and heightened awareness of hygiene and patient safety. Government initiatives promoting infection control and the adoption of single-use medical devices enhance demand. Rising investments in advanced positioning solutions strengthen Canada’s market presence across hospitals and clinics.

The Asia-Pacific region is the fastest-growing in the medical disposable positioning products market due to expanding healthcare infrastructure, rising surgical procedures, and increasing awareness of infection control. Rapid urbanization, growing healthcare investments, and improving access to advanced medical facilities boost product demand. Additionally, rising patient safety standards, government healthcare reforms, and the adoption of cost-effective disposable solutions drive significant market growth across emerging economies such as China, India, and Japan.

Europe is a notably growing region in the medical disposable positioning products market due to rising surgical procedures, increasing focus on infection prevention, and strong regulatory emphasis on patient safety. The region benefits from advanced healthcare infrastructure, high awareness of hygiene standards, and continuous adoption of innovative disposable solutions. Additionally, growing demand for single-use products across hospitals and ambulatory centers supports Europe’s steady market expansion and technological advancement in patient positioning systems.

Germany’s medical disposable positioning products market is growing steadily, driven by its advanced healthcare infrastructure, high surgical volumes, and strict infection control regulations. Strong presence of leading medical device manufacturers and continuous innovation in patient safety solutions enhance the adoption of disposable positioning products across hospitals, clinics, and diagnostic centers nationwide.

South America is growing in the medical disposable positioning products market during the forecast period due to surgical procedure volumes across South America reaching about 32,935 in 2023, reflecting rising hospital activity. This growth drives higher consumption of disposable positioning products, helping facilities standardize patient alignment, improve surgical precision, and maintain infection control in busy operating rooms.

Argentina’s hospitals, including facilities with over 40 operating rooms, increasingly rely on disposable positioning aids. With 4.08 doctors per 1,000 inhabitants, demand for efficient, sterile, and quick-turnaround solutions continues rising, supporting safer, high-volume surgical environments and promoting wider market adoption nationwide.

The Middle East and Africa growth can be attributed to the rising cases of surgeries, reported over 1.3 million surgeries reported in 2024, boosting reliance on disposable positioning tools. Growing investments in healthcare infrastructure and surgical capacity encourage hospitals to adopt sterile, ready-to-use devices, reducing setup times and enhancing perioperative efficiency regionwide.

In 2023, UAE hospitals recorded over 25 million attendances and nearly 33,000 surgeries. Rising inpatient loads and medical tourism push facilities to adopt disposable positioning products, ensuring improved workflow efficiency, infection prevention, and consistent quality across public and private healthcare sectors.

Company Overview

Stryker is a global leader in medical technologies focused on surgery, orthopedics, neurotechnology, and patient care.

Corporate Information

Headquarters: Kalamazoo, Michigan, USA | Founded: 1941 | Ownership Type: Public (NYSE: SYK)

History and Background

Founded by Dr. Homer Stryker as The Orthopedic Frame Company; renamed Stryker Corporation in 1964.

Key Milestones / Timeline

1979 IPO; 2023 revenue surpassed USD 20 billion; 2024 Comprehensive Report emphasized innovation and sustainability.

Business Overview

Key Developments and Strategic Initiatives

Technological Capabilities / R&D Focus

Competitive Positioning

Recent News and Updates

Raised 2024 profit forecast due to strong global demand; declared a dividend increase of 5% in December 2024; announced the Inari acquisition in 2025.

Industry Recognitions / Awards

Recognized in 2024 for sustainability and healthcare innovation leadership.

Company Overview

Getinge AB is a leading Swedish medical technology company serving the healthcare and life science industries.

Corporate Information

Headquarters: Gothenburg, Sweden | Founded: 1904 | Ownership Type: Public (Aktiebolag)

History and Background

Started as a Swedish engineering firm, expanded into sterilization and hospital equipment, and later diversified into life science technologies.

Key Milestones / Timeline

2024 marked a record financial year with strong order intake and margin improvement.

Business Overview

Key Developments and Strategic Initiatives

Technological Capabilities / R&D Focus

Competitive Positioning

Recent News and Updates

2024 annual sales rose 9.2% organically; EBITA margin improved to 19.4%; announced limited U.S. sales of certain cardiovascular devices following FDA correspondence.

Industry Recognitions / Awards

Recognized in 2024 for sustainability, innovation, and customer loyalty in its Annual Report.

Research and development focus on identifying clinical needs, designing innovative disposable positioning aids, and testing prototypes for comfort, biocompatibility, and infection resistance.

Organizations: Stryker Corporation, Smith & Nephew plc, Steris plc, Getinge AB, and Xodus Medical Inc. actively invest in R&D to develop advanced and ergonomic disposable positioning products.

Products undergo clinical testing to validate safety, efficacy, and compliance with healthcare standards before regulatory approval and market entry.

Organizations: U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and Health Canada oversee approvals, while leading companies such as Stryker Corporation and Getinge AB conduct clinical validation in collaboration with hospitals.

Patient support and service focus on providing training, usage guidance, and post-sales assistance to ensure optimal product utilization and patient comfort.

Organizations: Stryker Corporation, Smith & Nephew plc, and Medline Industries offer clinical education programs, customer service helplines, and digital platforms for healthcare and patients.

By Product

By Material

By Application

By End User

By Region

January 2026

January 2026

January 2026

January 2026