February 2026

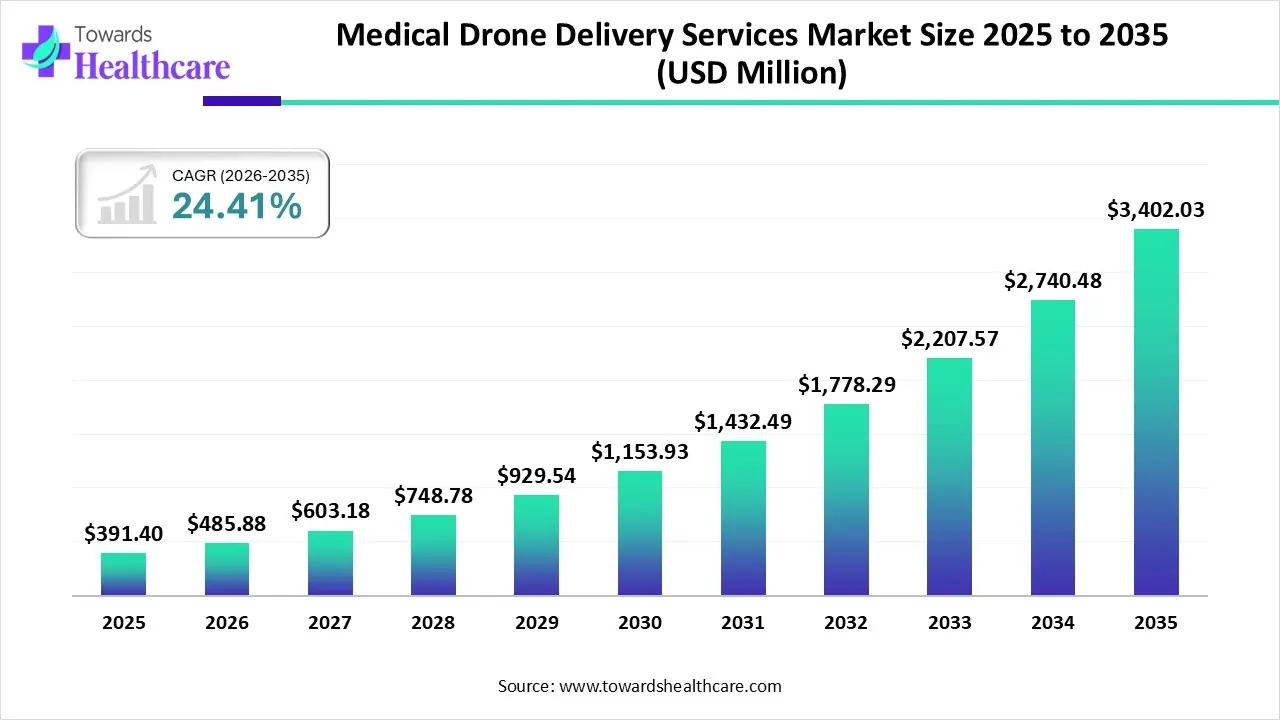

The global medical drone delivery services market size is calculated at US$ 391.4 million in 2025, grew to US$ 485.88 million in 2026, and is projected to reach around US$ 3402.03 Million by 2035. The market is expanding at a CAGR of 24.41% between 2026 and 2035.

The medical drone delivery services market is presently going through a revolutionary stage, propelled by both the growing need for effective healthcare delivery systems and technological advancements. Transporting medical supplies such as vaccines, blood products, and necessary medications, seems to be made faster and more dependable by the use of drones in medical logistics. The need for quick response times in underserved and remote locations, where conventional modes of transportation might not be sufficient, appears to be driving this trend toward aerial delivery systems.

| Key Elements | Scope |

| Market Size in 2025 | USD 391.4 Million |

| Projected Market Size in 2035 | USD 3402.03 Million |

| CAGR (2025 - 2035) | 24.41% |

| Leading Region | North America |

| Market Segmentation | By Application, Hospitals & Clinics, By Drone Type/Operation Classification, By Region |

| Top Key Players | Zipline, Matternet, Wingcopter, Swoop Aero, Amazon Prime Air, UPS Flight Forward, Flytrex, Drone Delivery Canada Corp., Airbus SE, DHL Group, EHang Holdings Limited, Skyports, Vayu Inc. (Vayu Drones), Elroy Air, Manna Drone Delivery, Draganfly Inc., Avy, Skye Air Mobility, TechEagle, Volocopter GmbH |

The global medical drone delivery services market covers services that use unmanned aerial vehicles (drones) to deliver medical supplies, including blood, vaccines, pharmaceuticals, lab samples, organs, and emergency kits, to hospitals, clinics, remote health posts, and other healthcare facilities. These services include route planning, drone operations (including beyond-visual-line-of-sight (BVLOS) flights), payload handling, cold-chain logistics, regulatory & air-traffic integration, landing/dispatch infrastructure, and fleet management.

Growth is driven by the need for faster delivery in remote/underequipped regions, regulatory advances allowing drone medicine delivery, pandemic-accelerated interest in contactless healthcare logistics, and increasing partnerships between drone firms and health systems.

AI equips drones with sophisticated navigation and decision-making capabilities, enabling them to adapt to changing conditions autonomously and optimize delivery routes in real time. In addition to improving delivery methods, the combination of drone technology and AI is a revolutionary step toward a more intelligent and effective future for medical delivery services. These intelligent drones can learn and adapt to various environments by analyzing vast volumes of data, ensuring safe, timely delivery.

Which Application Segment Dominated the Market in 2024?

Blood/Platelet/Plasma Delivery

The blood/platelet/plasma delivery segment accounted for approximately 35.9% of the medical drone delivery services market revenue in 2024. A significant challenge for blood banks around the world is the timely and secure distribution of high-quality blood products. Therefore, the medical industry has a lot of potential for rapid transportation via drones. Blood samples and medical supplies can be difficult and time-consuming to transport in remote, rural, or mountainous areas. In order to get around these obstacles, drones fly straight to their destinations. In underprivileged areas, and particularly during emergencies, this guarantees prompt diagnostics and better healthcare results.

Pharmaceutical & Drug Delivery

The pharmaceutical & drug delivery segment is expected to achieve the fastest CAGR of approximately 24.8% in the medical drone delivery services market during the forecast period. In the healthcare industry, prompt delivery of medical supplies is crucial, but this is made difficult by issues like bad weather, traffic, and a weak transportation system. Alternatively, in difficult-to-reach areas, drone operations can outperform last-mile logistics solutions.

Lab Samples & Diagnostics Delivery

The lab samples & diagnostic delivery segment is growing significantly in the medical drone delivery services market during the forecast period. Health systems and hospitals can now lower supply chain costs and increase efficiency by combining drone delivery, autonomous or automated delivery technology, and safe, temperature-controlled storage, such as the patented Dronedek system. These technologies offer a more dependable delivery method, can operate around the clock, and can lower the risk of pathogen transmission.

Which End-User Dominated the Market in 2024?

Emergency Medical Services (EMS) & Ambulance Networks

The emergency medical services (EMS) & ambulance networks segment dominated the medical drone delivery services market in 2024, accounting for approximately 47.2% of revenue. Life-saving emergency medical supplies can mean the difference between life and death in an emergency. First responders and bystanders are equipped with life-saving equipment and improved situational awareness when autonomous drone technology is incorporated into the EMS workflow.

Remote Health Posts/Rural Clinics

The remote health posts/rural clinics segment is expected to achieve the fastest CAGR of approximately 25% in the medical drone delivery services market during the forecast period. Access to healthcare for residents of isolated islands is a critical global issue because of their limited resources and geographic separation from the mainland. Remote inhabited islands are found in many nations, and these nations have a variety of healthcare policies to support their citizens. About 500,000 people reside on Japan's 306 isolated islands. Out of all the islands, 224 clinics have been run as rural public clinics (RPCs) in accordance with Japan's prefectural governments' rural plans to provide daily care and healthcare.

Blood Banks & Transfusion Services

The blood banks & transfusion services segment is growing significantly in the medical drone delivery services market during the forecast period. Globally, blood transfusions are essential to patient care. The complicated supply chains for transient products, the requirement for prompt access, and the varying demand at the hospital level make it difficult to obtain blood and blood products in many nations. Drone deliveries of blood products are used by blood banks and transfusion service providers to increase availability and delivery times.

Why the Fixed-Wing Drones Segment Dominated the Market in 2024?

Fixed-Wing Drones

The fixed-wing drones segment dominated the medical drone delivery services market in 2024. Due to their efficiency and extended operational capabilities, fixed-wing drones have become indispensable in a variety of industries. They are ideal for a range of applications because of their design, which permits continuous travel over large areas.

Hybrid VTOL (Vertical Take-Off & Landing) Drones

The hybrid VTOL (vertical take-off & landing) drones segment is expected to achieve the fastest CAGR in the medical drone delivery services market during the forecast period. Because VTOL drones combine the advantages of both fixed-wing and rotary-wing aircraft, they stand out among the other types of drones. These hybrid drones are a popular option since they combine endurance and maneuverability.

Beyond Visual Line of Sight (BVLOS) Operations

The beyond visual line of sight (BVLOS) operations segment is growing significantly in the medical drone delivery services market during the forecast period. Drone BVLOS flying offers several benefits, such as time and cost savings and the ability to reach remote or hazardous locations without endangering human life. Drones can travel farther, automate tasks, and carry out long-range missions without the assistance of human spotters thanks to BVLOS.

North America dominated the medical drone delivery services market in 2024. The presence of large corporations in the drone manufacturing industry, as well as investments in research and development and supportive regulatory policies, all benefit the region. Drone motor manufacturers should concentrate on using local manufacturing capabilities and technological advancements to meet the growing demand.

For rural communities, access to healthcare remains a significant obstacle. About 80% of the more than 46 million residents of the rural U.S. are medically underserved and face difficult obstacles to receiving healthcare. The potential of this technology to increase healthcare accessibility in vulnerable areas is demonstrated by the fact that several private companies in the U.S. have received regulatory approval to offer drone-based delivery services in specific locations.

Asia Pacific is estimated to host the fastest-growing medical drone delivery services market during the forecast period as a result of the region's expanding OEM population. Large numbers of drones are being exported from the region to service providers in North America and Europe. Additionally, the region's market is anticipated to be driven by the refurbishment and customization of standard commercial drones into medical drones. Since the Asia Pacific is the largest continent in terms of both population and size, there is a high demand for healthcare services, which is fueling the region's market expansion.

Drone technology is being quickly incorporated into China's medical emergency systems; innovations in several cities have shown improved critical care logistics efficiency. In late May, the Tianjin Municipality in North China successfully conducted a test flight of a simulated emergency blood supply, marking the launch of the city's first medical drone route. Drones are now a standard component of medical services in Zigong, which is located in Sichuan Province in southwest China. The city has opened 25 low-altitude routes connecting 28 locations for medical transportation, according to the municipal health commission. Drones had performed 5,270 medical flights as of May 27.

Europe is expected to grow at a significant CAGR in the medical drone delivery services market during the forecast period. driven by changes to regulations that facilitate the use of unmanned aircraft in cross-border supply chain and healthcare logistics applications. Drone adoption is being encouraged by the growing emphasis on sustainability and the digitization of the healthcare system in an effort to cut costs and delivery times. In Germany, Switzerland, and France, pilots and public-private partnerships are accelerating the use of medical drones for emergency services and rural healthcare in European countries.

In his first official visit to the area, Minister for Aviation and Maritime Mike Kane hailed a groundbreaking project that uses drones to transport medical supplies throughout Scotland as a “technological revolution” (27 August 2024). Project CAELUS, which is led by the airport, has received more than £7 million in funding from the UK government. Additionally, new UK regulations that would permit flights beyond the visual line of sight (BVLOS) limit in 2026 may allow the use of drones for NHS deliveries. In order to create a regulatory framework for BVLOS drone operations, the government is spending £16.5 million on the Civil Aviation Authority.

South America is expected to grow significantly in the medical drone delivery services market during the forecast period. South America is witnessing the rapid adoption of medical drone deliveries. Countries like Colombia and Chile are piloting systems for remote healthcare access, enhancing delivery speed and reliability in underserved regions.

Brazil leads regional innovation with government-backed trials for vaccine and blood transport via drones. Partnerships with logistics and tech firms are improving emergency response and rural healthcare access nationwide.

The Middle East and Africa are expected to grow at a lucrative CAGR in the medical drone delivery services market during the forecast period. MEA nations are leveraging drones to overcome healthcare access barriers. African countries and Gulf states are investing in medical logistics infrastructure to connect remote populations efficiently.

The UAE is scaling drone delivery across urban healthcare hubs. Initiatives in Dubai and Abu Dhabi integrate drones into hospitals for fast, safe transport of urgent medical supplies.

Company Overview:

Company Overview: Zipline is a robotics company that designs, manufactures, and operates a comprehensive instant logistics system using autonomous electric fixed-wing and hybrid aerial vehicles (drones) and associated ground infrastructure. Its mission is to provide universal access to urgent and routine necessities, starting with medical supplies.

Corporate Information

History and Background

History and Background: Founded by Keller Rinaudo Cliffton, Keenan Wyrobek, and William Hetzler, the company pivoted from robotics toys (Romo) in 2014 to focus on drone delivery for medical supplies. Launched its first commercial operations in Rwanda in 2016 to deliver blood and critical medical products to remote hospitals.

Key Milestones/Timeline

Business Overview

Key Developments and Strategic Initiatives

Distribution Channel Strategy

Technological Capabilities/R&D Focus

Competitive Positioning

Recent News and Updates

Company Overview:

Company Overview: Matternet is a leading developer of the world's first urban drone logistics platform, primarily focusing on enabling healthcare systems and partners to operate reliable, on-demand drone networks within cities and between medical facilities.

Corporate Information

History and Background

History and Background: Founded by Andreas Raptopoulos, Matternet has been a long-time pioneer in the drone delivery space, focusing heavily on urban environments and the healthcare supply chain. It was one of the first companies to receive commercial regulatory approval for urban drone delivery operations in Switzerland and the U.S.

Key Milestones/Timeline

Business Overview

Key Developments and Strategic Initiatives

Distribution Channel Strategy

Technological Capabilities/R&D Focus

Competitive Positioning

Recent News and Updates

| Company | Core Offerings | Key Contributions | Focus Areas | Geographic Presence |

| Wingcopter | eVTOL drones with long-range and triple-drop capability | Enables rapid delivery of vaccines, blood, and samples to remote areas | Medical logistics, humanitarian aid | Europe, Africa, Latin America |

| Swoop Aero | Integrated drone logistics platform | Connects hospitals and pharmacies through automated air networks | Health supply chains, vaccine delivery | Africa, Southeast Asia, Pacific |

| Amazon Prime Air | Autonomous delivery drones | Pioneering commercial drone logistics applicable to healthcare | Urban medical deliveries, emergency response | United States, UK |

| UPS Flight Forward | FAA-certified drone operations | First approved U.S. drone airline for medical transport | Hospital-to-lab deliveries, healthcare logistics | United States |

| Flytrex | Urban drone delivery systems | Expands medical and retail drone delivery access in cities | On-demand health products, food logistics | United States, Israel |

By Application

Hospitals & Clinics

By Drone Type/Operation Classification

By Region

February 2026

February 2026

February 2026

February 2026