February 2026

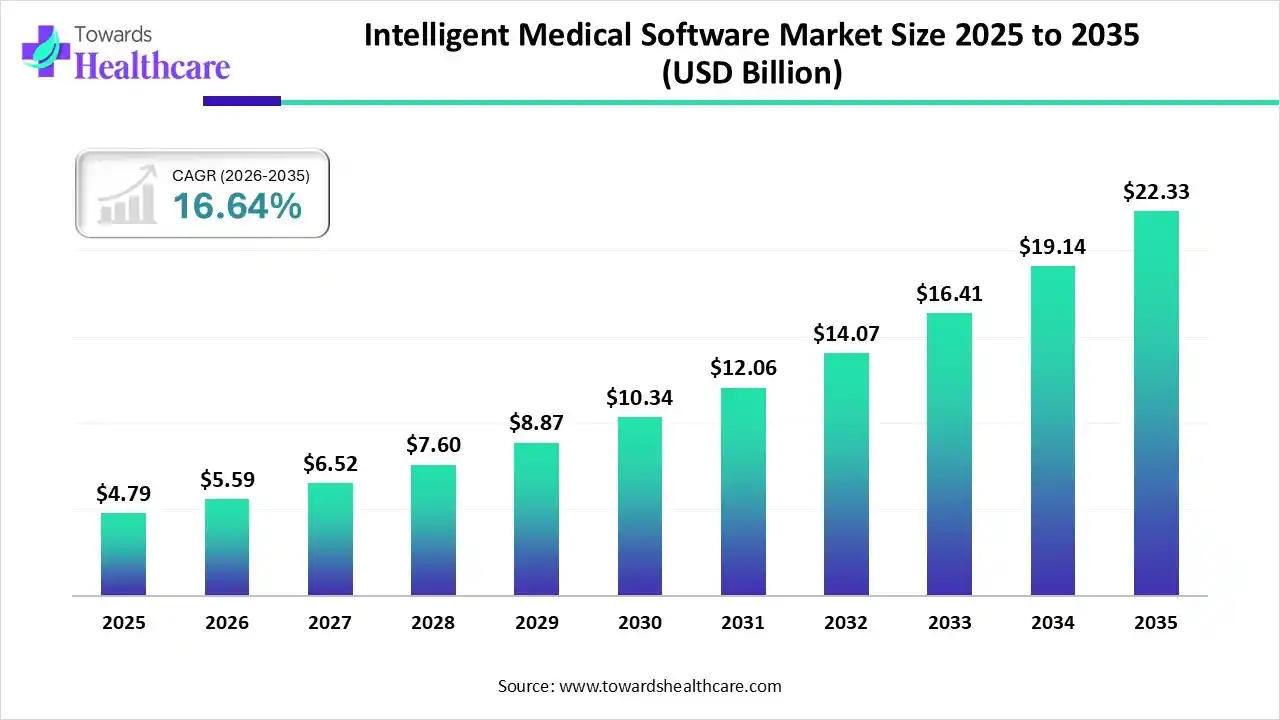

The intelligent medical software market size was valued at US$ 4.79 billion in 2025 and is projected to grow to 5.59 billion in 2026. Forecasts suggest it will reach approximately US$ 22.33 billion by 2035, registering a CAGR of 16.64% during the period.

The intelligent medical software market is rapidly expanding as the need for effective data-driven healthcare delivery grows. Healthcare providers are embracing AI-powered solutions more frequently to improve diagnostics, expedite patient care, and optimize clinical workflows. Growing investments in digital health technologies and rising awareness of AI benefits in healthcare are further fueling market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 5.59 Billion |

| Projected Market Size in 2035 | USD 22.33 Billion |

| CAGR (2026 - 2035) | 16.64% |

| Leading Region | North America |

| Market Segmentation | By Component, By Technology, By Functionality, By Application, By Deployment Mode, By End User, By Specialty Area, By Healthcare Setting, By Region |

| Top Key Players | IBM Watson Health, Oracle Health (Cerner), Epic Systems Corporation, Allscripts Healthcare Solutions, Philips Healthcare, Siemens Healthineers, GE HealthCare, Microsoft Healthcare Cloud, Google Health / DeepMind, Meditech, eClinicalWorks, Athenahealth, Nuance Communications (Microsoft), Health Catalyst, Tempus Labs |

Large volumes of patient data, including imaging, genomics lab results, and medical records, are analyzed by AI algorithms to help doctors make quicker and more accurate decisions. This greatly improves patient outcomes by lowering diagnostic errors, forecasting the course of the disease, and recommending individualized treatment plans.

AI–powered diagnostics tools integrated into platforms like Epic Systems help clinicians identify early signs of chronic diseases and recommend interventions.

By evaluating enormous volumes of data, including imaging scans, lab results, and patient records, AI assists physicians and clinicians in making better decisions. It increases precision and lowers errors by spotting trends and offering individualized treatment options.

AI is integrated with telehealth platforms and wearable technology to continuously monitor patients. Real-time alerts for abnormal readings enable prompt medical intervention, saving patients from having to travel to hospitals.

| Company | Headquarters | Core Focus Areas | Recent Launch (2024–2025) |

| GE HealthCare | Chicago, Illinois, USA | Medical imaging, AI diagnostics, radiation therapy, and interventional systems | CleaRecon DL: AI-based 3D image reconstruction for cone-beam CT (2025) |

| Philips Healthcare | Amsterdam, Netherlands | Ultrasound, CT/MRI imaging, cardiology, AI diagnostics, telehealth | Elevate Platform Upgrade: AI-enhanced ultrasound workflow and image optimization (2025) |

| Siemens Healthineers | Erlangen, Germany | Imaging systems (ultrasound, MRI, CT), digital pathology, and AI quantification tools | Acuson Sequoia 3.5: AI Abdomen for automated organ labeling and measurement (2024) |

| Microsoft Healthcare | Redmond, Washington, USA | Clinical documentation, AI assistants, NLP, health data integration | Dragon Copilot: AI assistant for automated clinical note-taking and voice-driven workflows (2025) |

| IBM Watson Health | Armonk, New York, USA | Health data analytics, clinical decision support, enterprise AI platforms | watsonx.Data Enhancements: Advanced AI tools for unstructured healthcare data (2025) |

The software/platform segment dominated the market in 2024 due to its growing interoperability among medical facilities. To handle electronic health records, diagnostic workflows, and patient data analytics, hospitals and clinics are increasingly implementing AI-driven software platforms. The need for cutting-edge real-time analytics tools and decision support systems has increased this segment's dominance.

The services segment is predicted to be the fastest-growing in the market during the forecast period as a result of hospitals switching to AI-enabled platforms and the growing demand for implementation, integration, and maintenance services. Furthermore, post-deployment support and tailored consulting are becoming crucial for smooth adoption, which is driving segment growth.

The AI & machine learning segment has dominated the intelligent medical software market in 2024 due to its widespread application in imaging, diagnostics, clinical decision making, and predictive analytics. Healthcare providers are using machine learning algorithms to increase the accuracy of diagnoses and automate data-intensive procedures, which will improve patient outcomes and operational efficiency.

The NLP & computer vision segment is predicted to be the fastest-growing segment in the market because it is increasingly being used in medical imaging and real-time data interpretation. Precision documentation and automated transcription are made possible by NLP, and computer vision improves medical imaging analysis to support quicker and more precise clinical insights.

The clinical decision support segment dominated the intelligent medical software market in 2024, motivated by the increasing focus on healthcare decisions supported by data. Intelligent software systems are being adopted by hospitals to help physicians interpret patient data, forecast disease risks, and optimize treatment plans. The proliferation of AI-powered diagnostic instruments has strengthened this hegemony even more.

The predictive analytics & forecasting is expected to be the fastest-growing segment in the market during the forecast period, driven by the rising need for early disease detection skills and proactive care models, which assist medical professionals in minimizing complications and lowering readmission rates.

The diagnostics & imaging analysis segment dominates the intelligent medical software market in 2024 due to AI algorithms for imaging in radiology, pathology, and cardiology being adopted at a rapid rate. Intelligent imaging technologies are increasing disease detection speed and accuracy, especially for neurological and cancer conditions.

The remote patient monitoring segment is expected to be the fastest-growing in the market during the forecast period because chronic illnesses are becoming more common, and home-based care is becoming more popular. AI-powered PRM systems facilitate ongoing health monitoring, which lowers hospital stays and enhances long-term patient care.

The cloud-based segment dominated the intelligent medical software market in 2024 due to cloud solutions' scalability, affordability, and remote accessibility. With cloud infrastructure, healthcare professionals can collaborate in real time, share data more easily, and update software more quickly without requiring a lot of on-premises IT resources.

The hybrid segment is expected to be the fastest-growing in the market during the forecast period because its businesses are trying to strike a balance between system flexibility and data privacy. By combining cloud convenience and on-premises security, hybrid deployment models enable healthcare providers to safely handle sensitive patient data while utilizing cloud-based analytics and scalability.

The hospitals & clinics segment dominates the market in 2024 due to their widespread use of AI-powered tools for workflow optimization, patient data management, and diagnostics. This segment's adoption of software has accelerated due to the growing patient loads and emphasis on operational efficiency.

The diagnostic laboratories segment is expected to be the fastest-growing in the market during the forecast period, motivated by the growing use of AI tools in genetic testing and pathology. Accuracy and turnaround times in lab operations are being improved by automation in sample processing and real-time analytics.

The radiology segment dominated the intelligent medical software market in 2024 due to the broad application of AI algorithms in workflow automation, anomaly detection, and image interpretation, while improving accuracy in identifying complex conditions AI AI-based radiology tools are drastically cutting down on diagnostic time.

The oncology & neurology segment is expected to be the fastest growing in the market during the forecast period, as AI-driven software continues to enhance early cancer detection and neurological disorders assessment. The use of machine learning models for tumor segmentation and brain scan analysis is gaining strong momentum.

The specialty clinics segment dominated the market with approximately a share in 2024, driven using intelligent medical platforms in particular fields like orthopedics, cardiology, and reproductive health. These facilities favor AI-enabled systems that improve treatment precision, automate administrative tasks, and provide customized insights.

The telehealth platforms segment is predicted to be the fastest-growing in the market during the forecast period, owing to the rapid digitalization of healthcare and rising demand for remote consultations. The integration of AI chatbots, diagnostic tools, and patient engagement software is propelling its growth.

North America dominated the intelligent medical software market in 2024 because of the well-established healthcare infrastructure, positive government initiatives, and widespread adoption of AI in hospitals. It continues to be at the forefront with significant technology and healthcare companies actively participating.

The U.S. government took significant steps in 2024 and 2025 to advance healthcare digitalization, primarily by promoting interoperability, tightening rules against "information blocking," and establishing regulations for artificial intelligence (AI) in health technology. Major actions included new final rules from the Office of the National Coordinator for Health Information Technology (ONC) and the Centers for Medicare & Medicaid Services (CMS).

Canada is witnessing the rising adoption of intelligent medical software driven by workflow automation and decision support enabled by AI. Businesses like Lumeca Health and WELL Health are spearheading innovation to improve productivity and patient involvement. Market expansion is being driven by telemedicine expansion and government-backed digital health initiatives.

Asia Pacific is expected to be the fastest-growing market during the forecast period, fueled by the rapid digital transformation of healthcare systems, increasing government investments, and expanding telemedicine adoption in countries.

India is witnessing growing demand for the intelligent medical software market, driven by the fast adoption of AI in hospital administration and diagnostics, with prominent players such as Qure. AI is leading the way in smart documentation and imaging analysis, as is Narayana Health. Growing investments in health technology and government digital health initiatives are speeding up market expansion.

By Component

By Technology

By Functionality

By Application

By Deployment Mode

By End User

By Specialty Area

By Healthcare Setting

By Region

February 2026

February 2026

February 2026

February 2026