January 2026

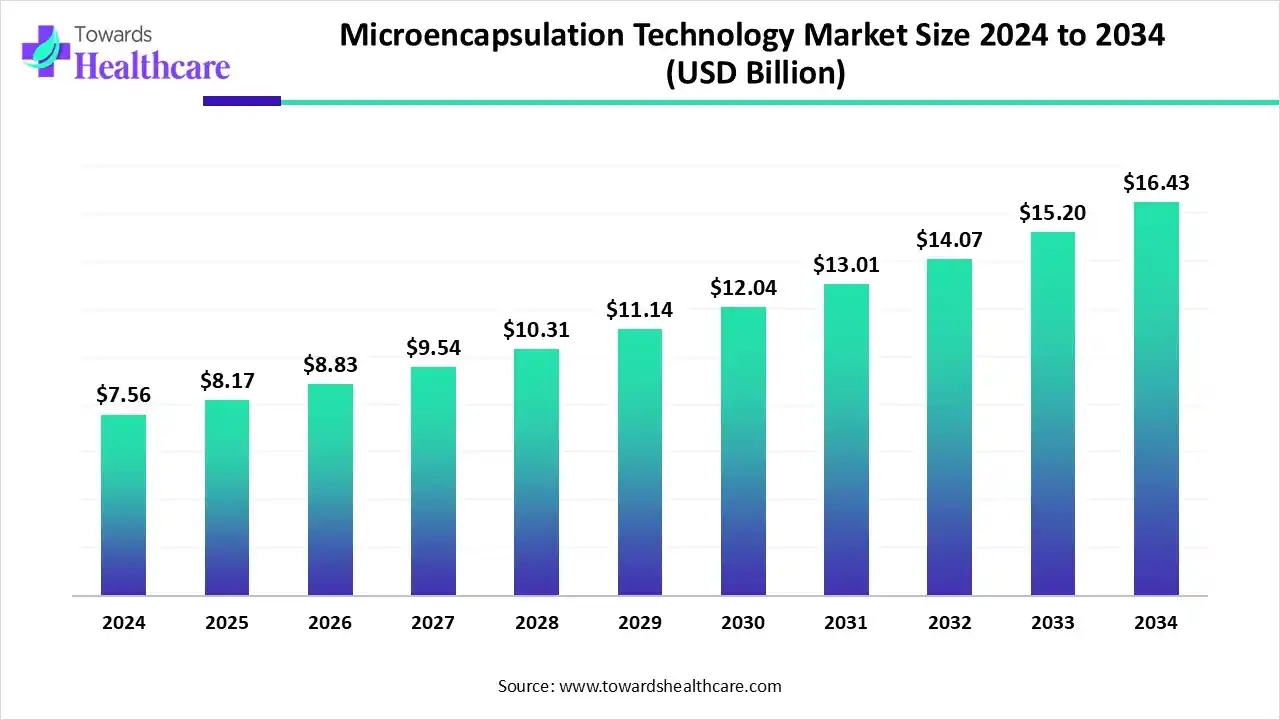

The global microencapsulation technology market size is calculated at US$ 7.56 billion in 2024, grew to US$ 8.17 billion in 2025, and is projected to reach around US$ 16.43 billion by 2034. The market is expanding at a CAGR of 8.07% between 2025 and 2034.

The microencapsulation technology market is expected to expand because of the many benefits of microencapsulation, such as enhanced ingredient handling, protected encapsulated chemicals, and controlled release of core elements. Additionally, it is anticipated that the technology's use to cover up the taste, smell, and activity of encapsulated materials would spur market expansion, demonstrating a greater understanding of its adaptable advantages across a range of sectors.

| Table | Scope |

| Market Size in 2025 | USD 8.17 Billion |

| Projected Market Size in 2034 | USD 16.43 Billion |

| CAGR (2025 - 2034) | 8.07% |

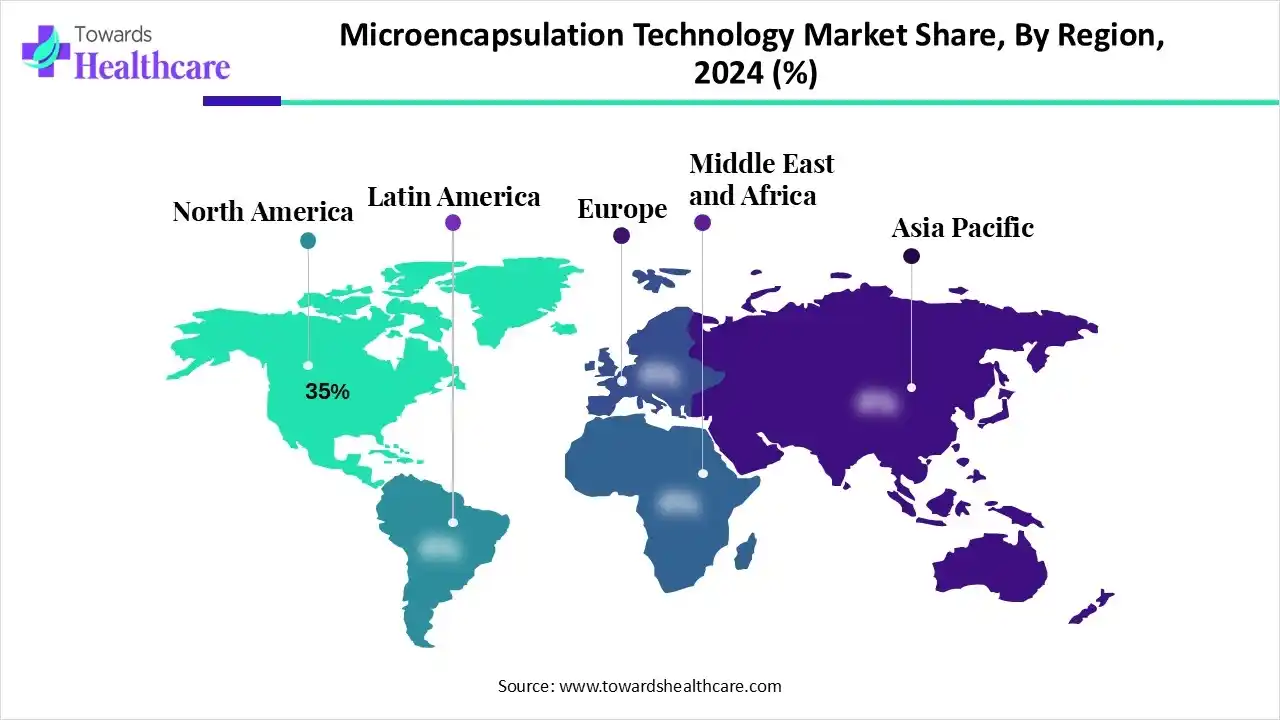

| Leading Region | North America by 35% |

| Market Segmentation | By Core Material, By Shell Material, By Technology/Process, By Application, By Region |

| Top Key Players | BASF SE, Givaudan SARoyal DSM N.V., Syngenta AG, Evonik Industries AG, DuPont de Nemours, Inc., 3M Company, International Flavors & Fragrances (IFF), Balchem Corporation, Firmenich SA, Encapsys, LLC (Milliken & Company), Reed Pacific Pty Ltd, Microtek Laboratories Inc., Lycored Ltd., Aveka Group, Lonza Group AG, Sensient Technologies Corporation, Cargill Inc., GAT Microencapsulation GmbH, Balchem Italia Srl |

The growing demand for controlled-release formulations, fortified food products, and advanced drug-delivery systems has been driving global expansion of the microencapsulation technology market. The market involves enclosing active ingredients, such as drugs, flavors, vitamins, enzymes, probiotics, pesticides, or fragrances, within tiny protective shells or coatings to control their release, improve stability, mask taste or odor, and enhance targeted delivery. These microcapsules are used across multiple industries, including pharmaceuticals, food & beverages, personal care, agriculture, and household products.

Microencapsulation technology is entering a new age of innovation thanks to AI and ML. As AI and ML develop further, these technologies might revolutionize data-driven research, quality control, predictive modeling, materials discovery, and process optimization. It is expected that more effective and efficient encapsulation methods would propel advancement in sectors like medicine. With the potential to enable previously unheard-of advances in materials science and engineering, AI and ML will likely influence the direction of microencapsulation in the future.

By core material, the pharmaceutical & healthcare actives segment dominated the microencapsulation technology market in 2024, accounting for approximately 34% of revenue. In pharmaceutical and nutraceutical solid dosage formulations, microencapsulation is a helpful technique for safeguarding and halting the deterioration of active substances. Encapsulation reduces side effects and increases therapeutic effectiveness. This encapsulating method has the potential to be used in pharmaceutical applications for targeted delivery and controlled-release goods.

By shell material, the polymers segment dominated the microencapsulation technology market in 2024, accounting for approximately 42% of revenue. The most promising option for artificial microcapsule systems, according to recent developments, is biodegradable polymers. For a wide range of applications, biodegradable systems in microencapsulation can provide characteristics including safety, effectiveness, biocompatibility, and biodegradability.

By shell material, the lipids & waxes segment is expected to grow at the fastest CAGR during the forecast period. The active component, the release mechanism, the encapsulating methods, the carrier material's characteristics, and the application scenarios all influence the choice of material. Given the critical relevance of the carrier material's properties, a comprehensive grasp of its basic characteristics is required.

By technology/process, the spray drying segment dominated the microencapsulation technology market in 2024, accounting for approximately 37% of revenue. Using a state-of-the-art technique called spray drying microencapsulation, active compounds are protected by a shell. Delivery is improved, and stability is maintained with this method. This procedure is used across a number of sectors, including food, cosmetics, medicines, and agriculture. Compared with alternative microencapsulation techniques such as coacervation and freeze-drying, spray-drying offers several benefits. These include speed, reduced operating costs, appropriateness for both heat-sensitive and heat-resistant materials, flexibility in capacity design, and particle size control.

By technology/process, the others segment is expected to grow at the fastest CAGR in the microencapsulation technology market during the forecast period. Numerous medical applications demonstrate the versatility and efficacy of liposomes as drug delivery vehicles. Their distinct bilayer structure makes them ideal for a range of release techniques and for the encapsulation of medications with diverse chemical properties. Conversely, microencapsulation methods, like the centrifugal suspension method, have several benefits, such as controlled release, the ability to cover up offensive flavors and odors, and the ability to shield delicate components from deterioration caused by heat, light, or air.

By application, the pharmaceutical & healthcare segment dominated the microencapsulation technology market in 2024, accounting for approximately 30% of revenue. The process of encapsulating active pharmaceutical ingredients (APIs) in microspheres, microcapsules, or microparticles is known as microencapsulation, and it is an essential method in pharmaceutical research. Traditional medication delivery methods may be surpassed by microencapsulation technology in the pharmaceutical sector.

By application, the personal care & cosmetics segment is expected to grow at the fastest CAGR during the forecast period. Applications for microencapsulation are growing in the personal care and cosmetics industries. Encapsulation is necessary to enhance the stability of biologically active chemicals included in many cosmetics and personal care products. Because microencapsulation might potentially meet all of these needs, it provides a special and perfect carrier system for active compounds used in cosmetics.

North America dominated the microencapsulation technology market, accounting for approximately 35% in 2024. The area has a significant presence of major companies in a number of industries, a well-established industrial base, and cutting-edge facilities for research and development. Microencapsulation technologies are widely used by large pharmaceutical, food & beverage, and personal care industries in North America. The early use of microencapsulation technology, significant investment in research and development, and strict quality requirements are the reasons for the region's supremacy.

In 2023, the United States spent $722.5 billion on pharmaceuticals, a 13.6% increase over 2022. This rise was driven by pricing (up 2.9%), new medications (up 4.2%), and utilization (up 6.5%). In 2023, semaglutide was the most popular medication, followed by apixaban and adalimumab. Nonfederal hospitals and clinics spent $135.7 billion on drugs, a 15.0% rise, and $37.1 billion, a 1.1% drop. Overall prescription medication spending was predicted to climb by 10.0% to 12.0% in 2024, while clinics and hospitals were predicted to have increases of 11.0% to 13.0% and 0% to 2.0%, respectively, over 2023.

Asia Pacific is estimated to host the fastest-growing microencapsulation technology market during the forecast period. As they search for cutting-edge micro encapsulation technologies to enhance product quality and sustainability, nations like China and India are emerging as important markets, particularly in the food & beverage and agrochemical sectors. Technological developments, local industry demands, and regulatory frameworks all contribute to regional expansion, which creates a vibrant worldwide market.

In terms of novel medications presently undergoing development and research, China's pharmaceutical sector is currently the second largest in the world, contributing around 30% of the worldwide total. Since the beginning of the 14th Five-Year Plan term (2021-2025), the nation has authorized the commercialization of 387 medications for children and 147 medications for uncommon diseases.

Europe is expected to grow at a significant CAGR in the microencapsulation technology market during the forecast period. In terms of raw material availability, coating technologies, and application areas, the region is the second biggest and among the most developed in the world. Furthermore, because of the high level of technological penetration in the pharmaceutical business in this part of Europe, developed economies such as Germany, the United Kingdom, France, and Italy contributed significantly to the region's revenue share.

Germany has an outstanding healthcare system: it employs around 6.1 million people, spends the largest percentage of its GDP on healthcare in Europe, and is in the top 10 nations in the world for healthcare spending per capita. Germany is by far the largest European market and performs noticeably better than its competitors on the continent, such as the United Kingdom, France, and Italy. It claims the third-largest medical technology market in the world, after the United States and Japan.

There are several steps involved in the research and development (R&D) of microencapsulated medications, ranging from the initial selection of materials to the optimization and testing of the finished product. Although the precise procedures differ according to the medication and intended release profile, they usually adhere to a methodical formulation, manufacturing, characterization, and assessment process.

A microencapsulated medication must pass preclinical and clinical studies (Phases I–IV) to demonstrate its safety and effectiveness before it can be sold. A marketing license is issued when documentation is reviewed by regulatory agencies such as the FDA.

Use techniques like coacervation or spray drying to encapsulate the medication in a polymer. To accomplish controlled release or flavor masking, the resultant microparticles are subsequently added to finished dosage forms as suspensions, tablets, or capsules.

BASF SE

Through its Nutrition and Care division, BASF provides microencapsulation for vitamins, carotenoids, and omega-3 fatty acids. This technique in pharma improves stability, hides bad medicine tastes, and increases absorption.

Givaudan SA

In contrast to its main market for flavors and fragrances, Givaudan is well-known for its fragrance encapsulation and doesn't seem to have any noteworthy, unique products for medicinal microencapsulation.

Royal DSM N.V.

For its nutritional goods, DSM employs microencapsulation to safeguard delicate components like vitamins and omega-3 fatty acids. Since the merger with Firmenich, it has placed more of an emphasis on nutritional additives and less on core pharmaceutical applications.

Syngenta AG

Syngenta mainly uses microencapsulation for agrochemicals, including fertilizers and insecticides with controlled release. The pharmaceutical industry is not the primary target of the company's contributions to microencapsulation.

Evonik Industries AG

Evonik uses continuous, emulsion-based methods to provide CDMO services for microparticles and nanoparticles. This improves patient medicine delivery by stabilizing drug molecules and permitting regulated, long-acting parenteral release.

By Core Material

By Shell Material

By Technology/Process

By Application

By Region

January 2026

January 2026

January 2026

January 2026