January 2026

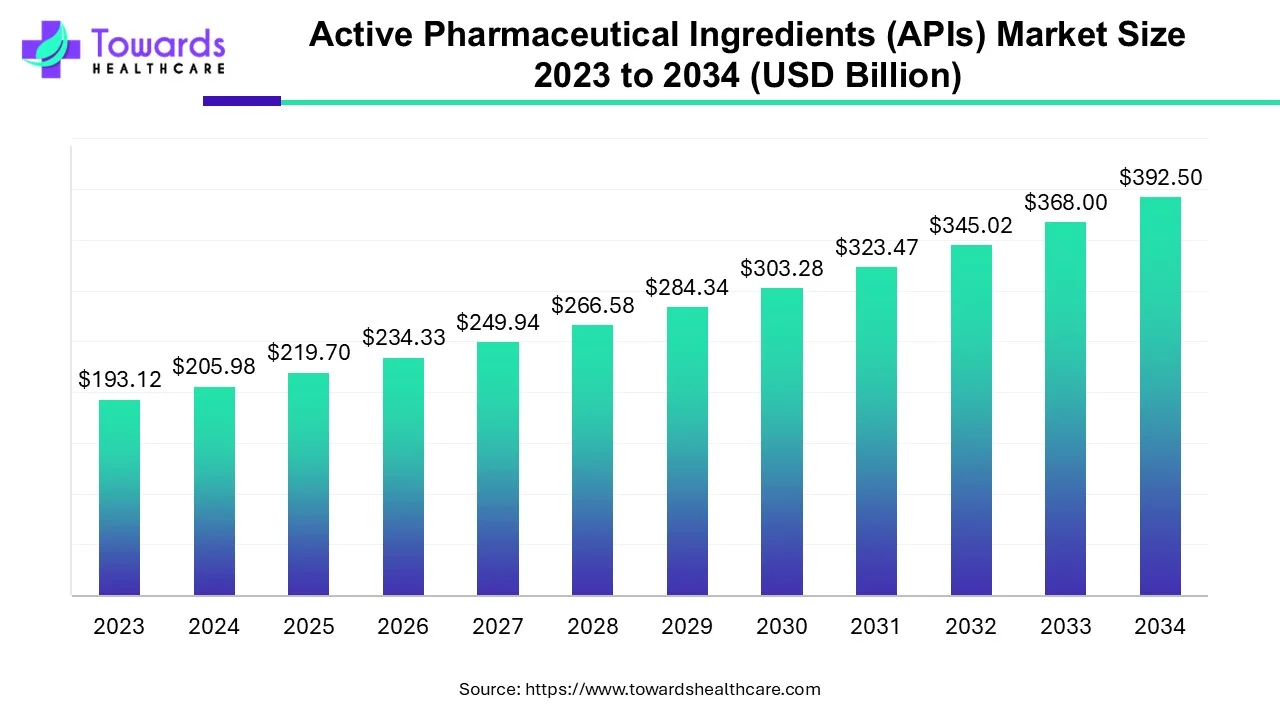

The global active pharmaceutical ingredients (APIs) market size is forecast to grow at a CAGR of 6.66%, from USD 219.7 billion in 2025 to USD 392.5 billion by 2034, over the forecast period from 2025 to 2034. The rising prevalence of chronic disorders, growing drug discovery research, and technological advancements drive the market.

US Food and Drug Administration approvals of 55 new drugs in 2023 significantly accelerated growth in the active pharmaceutical market.

Active Pharmaceutical Ingredients (APIs), chemical compounds vital for medication, are mainly manufactured in the United States, Europe, China and India. These substances, with pharmacological properties, are commonly used alongside other ingredients to diagnose, cure, and treat diseases. Recently, pharmaceutical companies have started importing APIs from producing countries. Modern medicines for disease prevention, treatment, diagnosis and cure consist of two primary components. The API, the active and biologically effective core, performs the necessary actions in the body. Excipients, like lactose or mineral oil, are chemically inactive, providing volume, flavour or colour, aiding API delivery throughout the body.

For Instance,

Continuous monitoring and reporting are integral components of compliance efforts. Generating and maintaining extensive documentation, including batch records, stability data and adverse event reporting, are essential. This ongoing commitment to compliance demands a dedicated workforce and robust technology infrastructure. The active pharmaceutical market focuses on producing and selling APIs or drugs with therapeutic effects. This market is crucial in developing and manufacturing medications for various medical conditions. The active pharmaceutical market has witnessed significant growth in recent years due to increased demand for innovative treatments, advancements in research and development and the global expansion of healthcare infrastructure. Technological innovations, regulatory reforms and a growing ageing population have further fueled this growth. The market has expanded significantly, driven by scientific progress, demand and regulatory changes.

| Metric | Details |

| Market Size in 2024 | USD 205.98 Billion |

| Projected Market Size in 2034 | USD 392.5 Billion |

| CAGR (2025 - 2034) | 6.66% |

| Leading Region | North America |

| Market Segmentation | By Synthesis Type, By Manufacturer Type, By Type, By Drug Type, By Application and By Region |

| Top Key Players | Teva Pharmaceutical Industries Ltd., Pfizer Inc, Novartis International AG, BASF SE, Dr. Reddy's Laboratories Ltd. |

The Active Pharmaceutical Ingredients (APIs) market stands to benefit significantly from artificial intelligence (AI) integration, driving innovation and efficiency. AI technologies are set to enhance various aspects of the API lifecycle, from discovery to manufacturing and quality control. AI-driven drug discovery platforms can analyze vast datasets to identify potential drug candidates more quickly and accurately than traditional methods. This accelerates the development of new APIs and reduces time-to-market, addressing the growing demand for novel therapies.

In manufacturing, AI optimizes production processes by predicting equipment failures, managing supply chains, and improving yields. Machine learning algorithms can forecast demand fluctuations, streamline inventory management, and ensure consistent product quality. Additionally, AI-enhanced analytics facilitate real-time monitoring and control of API production, ensuring adherence to regulatory standards and reducing the risk of contamination or defects.

Overall, AI's role in the APIs market not only promises cost reductions and operational efficiencies but also accelerates the introduction of groundbreaking therapies. By integrating AI, companies can achieve a competitive edge, meet evolving market demands, and drive sustainable growth in the pharmaceutical industry.

The ageing population has contributed to the growth of the active pharmaceutical ingredients (APIs) market due to an increased prevalence of age-related health issues. As people age, there is a higher demand for pharmaceuticals to address conditions such as cardiovascular diseases, diabetes and neurodegenerative disorders. This demographic shift has driven pharmaceutical companies to focus on developing and producing a broader range of APIs to meet the rising healthcare needs of older people.

Additionally, advancements in medical research and technology have led to the discovery of new APIs that target specific ailments associated with ageing. These developments have spurred innovation in the pharmaceutical industry, leading to the expansion of the APIs market.

Furthermore, globalization and increased access to healthcare services have widened the market for APIs. Emerging economies with growing ageing populations are becoming significant consumers of pharmaceutical products, driving the demand for APIs on a global scale. The ageing population's impact on the APIs market is multifaceted, encompassing increased demand for pharmaceuticals, advancements in medical research, stringent regulatory standards and global market expansion. These factors collectively contribute to the continuous growth and evolution of the APIs market.

The surge in demand for medication plays a pivotal role in propelling the growth of the active pharmaceutical ingredients (APIs) market, manifesting through various critical facets. Firstly, the escalating global population and ageing demographics increase the prevalence of diverse medical conditions. This upsurge in healthcare needs necessitates heightened pharmaceutical production, subsequently driving the demand for APIs as essential components in drug formulation.

Additionally, outbreaks of new diseases or the resurgence of existing ones create a dynamic scenario that amplifies the demand for specific medications. This situation necessitates rapid development and production of pharmaceuticals, intensifying reliance on APIs manufacturers to promptly supply the necessary ingredients.

| Sr. No | FDA Approval Date | Active Ingredient | Indication |

| 1. | 28 December 2022 | Anacaulase-bcdb | To remove eschar in adult with full thickness thermal burns |

| 2. | 22 December 2022 | Mosunetuzumab-axgb | To treat adult with HIV |

| 3. | 18 November 2022 | Teplizumab-mzwv | To delay the onset of stage 3 type of 1 Diabetes |

| 4. | 14 November 2022 | Mirvetuximab soravtansine-gynx | To treat patient with recurrent ovarian cancer |

| 5. | 27 October 2023 | Mirkizumab-mrkz | To treat ulcerative colitis |

| 6. | 15 November 2023 | Repotrectinib | To treat ROS1-positive non-small cell lung cancer |

| 7. | 18 December 2023 | Birch triterpenes | To treat wounds associated with dystrophic bullosa |

| 8. | 21 December 2023 | Eplontersen | To treat polyneuropathy |

Advances in medical research lead to the development of novel treatment modalities and therapeutic approaches. Introducing new medications or innovative formulations triggers an increased demand for APIs customized to these innovative pharmaceuticals. The increasing interconnectedness of the global healthcare landscape means that pharmaceutical companies are catering to diverse markets. There is a growing demand for APIs with varying specifications to meet the regulatory standards and specific healthcare needs of different regions, further stimulating the APIs market's growth.

The trend towards precision medicine, where treatments are personalized to individual patients based on genetic, environmental and lifestyle factors, requires specialized pharmaceuticals. This customization often involves unique APIs formulations, fostering a demand for more diverse and specialized active ingredients.

Government initiatives to enhance healthcare access and favourable policies significantly boost medication demand. Such initiatives may include subsidized healthcare programs, vaccination campaigns or disease prevention efforts, all contributing to increased pharmaceutical production and APIs market growth—the overall demand for APIs as an integral part of the pharmaceutical supply chain.

Furthermore, the multifaceted increase in medication demand, driven by demographic shifts, disease dynamics, technological advancements and global healthcare initiatives, serves as a foundational driver for the expansion of the active pharmaceutical ingredients market.

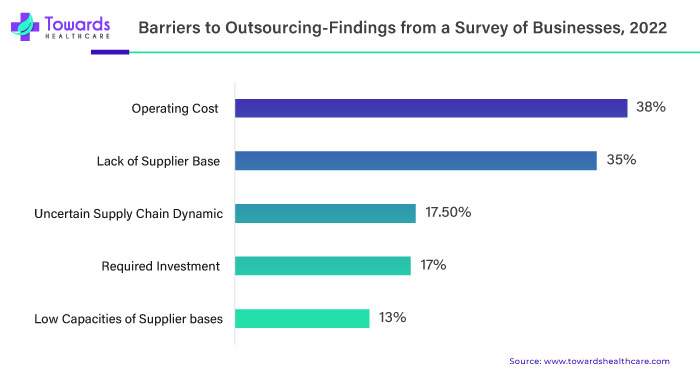

The active pharmaceutical ingredients (APIs) market faces a formidable challenge in the form of the substantial cost of compliance. One key aspect contributing to this challenge is the global imposition of stringent regulatory requirements by health authorities. Pharmaceutical manufacturing must adhere to rigorous standards such as Good Manufacturing Practices (GMP) and Good Laboratory Practices (GLP). Achieving compliance necessitates establishing robust quality management systems, conducting regular audits and strict adherence to intricate documentation protocols.

A significant portion of the financial burden associated with compliance is directed towards investment in quality assurance and control. APIs manufacturers must invest substantially in measures such as establishing quality control laboratories, implementing comprehensive quality management systems and employing skilled personnel. These efforts are crucial for monitoring and ensuring the quality of the APIs throughout the entire manufacturing process.

Validation and testing costs further contribute to the financial strain on APIs manufacturers. Regulatory agencies often mandate extensive validation studies to demonstrate manufacturing processes' consistency, efficacy and safety. These studies are not only time-consuming but also require significant financial resources. Routine testing of raw materials, intermediates and finished products adds a layer to the overall compliance costs. The regulatory filings and inspections process represents another substantial financial commitment for APIs manufacturers. Additionally, undergoing inspections by health authorities incurs additional costs. Any deficiencies identified during inspections may result in the need for corrective actions, further escalating expenses.

Continuous monitoring and reporting are integral components of compliance efforts. Generating and maintaining extensive documentation, including batch records, stability data and adverse event reporting, are essential. This ongoing commitment to compliance demands a dedicated workforce and robust technology infrastructure. Global harmonization challenges add another layer of complexity. Divergent regulatory requirements across different regions and countries complicate compliance efforts, necessitating companies to adapt to various standards and undergo multiple approval processes.

For Instance,

The active pharmaceutical ingredients (APIs) market presents a promising future with the integration of biomass recycling and conversion. Overcoming challenges in consumer demand and business opportunities, the Active Pharmaceutical Ingredients Committee (APIC) emphasizes the need for streamlined approaches in identifying novel technologies within the circular economy. Advantages in biomass utilization, APC conversion, effective waste recycling, and management policies are crucial.

Recent biotechnological advancements, including genetic engineering and bioengineering, contribute to developing microbial strains and models, enhancing biomass yield, CO2 utilization, lipid accumulation and bioremediation. Integrating various technologies and computer engineering is critical to achieving a circular economy for valuable bioproducts like APC and biofuels. The efficient utilization of biomass raises questions, particularly regarding the substantial agricultural waste often burned due to a lack of knowledge or modern equipment availability.

Additionally, with a focus on sustainability, cost-effectiveness and renewable energy resources, industries seek long-term solutions for organic biomass recycling. The conversion of biomass to APC becomes a significant approach, addressing the demand in the pharmaceutical industry. Despite the growing interest, critical problems and challenges associated with biomass recycling and APC conversion require global scientific attention.

The integration of metagenomics techniques emerges as valuable evidence. These techniques offer a better understanding of the mechanisms, metabolic pathways and system biology approaches of microorganisms involved in the biomass-to-APC conversion process. This integration opens new opportunities and contributes to the expansion of the APIs market.

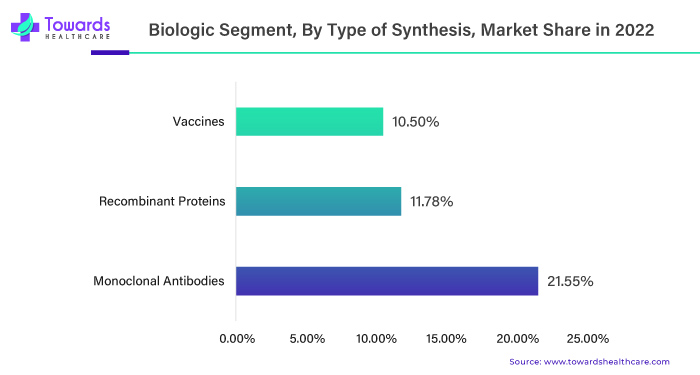

Monoclonal antibodies have significantly impacted the active pharmaceutical ingredients (APIs) market by driving growth through therapeutic advancement. Their precise targeting in treating various diseases, including cancer and autoimmune disorders, has increased demand for active pharmaceutical ingredients (APIs) in their production. This trend is likely to continue as research and development efforts focus on expanding the therapeutic applications of monoclonal antibodies.

Monoclonal antibodies have found applications in treating many diseases, including but not limited to cancer, rheumatoid arthritis, multiple sclerosis and inflammatory bowel diseases. This diverse range of applications contributes to the growing demand for APIs.

Monoclonal antibody demand continues to rise and pharmaceutical companies invest in research and development to create innovative theories mainly for cancer, contributing to their market dominance in the active pharmaceutical ingredients sector.

| Sr. No | US-FDA Approval Date | Brand Name | Indication |

| 1. | January 2022 | kimmtrak | To treat metastatic uveal melanoma |

| 2. | August 2022 | Tecvayli | To treat multiple myeloma |

| 3. | September 2022 | Opdualag | To treat melanoma |

By synthesis type, the synthetic segment held a dominant presence in the market in 2024. Synthetic APIs are small molecules and have a lower molecular weight. Hence, they are easily absorbed and distributed throughout the body. Synthesis of synthetic APIs through synthetic involves a multi-step reaction process and different varieties of chemicals. Numerous chemical raw materials are processed and undergo several chemical transformations. Compared to the biotech process, the synthetic process is simpler and involves the use of stable products. The chemicals utilized in the process are also more affordable than in the biotech process.

By synthesis type, the biotech segment is expected to grow at the fastest rate in the market over the studied period. Biotech APIs include monoclonal antibodies, hormones, cytokines, recombinant proteins, etc. The synthesis process of biotech APIs is more complex, involving biological products. These APIs provide targeted action and result in fewer side effects. The burgeoning biotechnology sector boosts the segment’s growth.

By manufacturer type, the captive APIs segment held the largest share of the market in 2024. Captive API manufacturing refers to producing APIs in the in-house facilities of the company. The increasing investments and the availability of advanced manufacturing infrastructure augment the segment’s growth. In-house production enables manufacturers to have complete control over their manufacturing process and keep control over their privacy research data.

By manufacturer type, the merchant APIs segment is expected to grow at the fastest rate in the market during the forecast period. Merchant APIs refers to outsourcing API manufacturing to CMOs and CDMOs. They offer customized services and possess state-of-the-art manufacturing facilities. The increasing number of CMOs/CDMOs and the presence of skilled professionals augment the segment’s growth. CMOs/CDMOs assist manufacturers in diverse activities from designing to regulatory approval, enabling them to focus more on product marketing.

By type, the innovative APIs segment led the global market in 2024. The increasing number of new product launches due to the need for novel therapies potentiates the segment’s growth. The U.S. FDA approved 50 novel drugs in 2024. The rising incidences and prevalence of chronic disorders and growing research and development activities allow researchers to develop novel branded/innovative APIs. The increasing number of patents also favors the segment’s growth.

By type, the generic APIs segment is anticipated to grow with the highest CAGR in the market during the studied years. The demand for generic APIs is increasing due to their cost-effectiveness, easy availability, and similar biological effects as branded drugs. The increasing number of patent expirations and lower manufacturing costs also propel the segment’s growth. Generic drugs account for 90% of all prescriptions in the U.S. The increasing use of generic APIs is estimated to significantly impact the sales of branded APIs.

By drug type, the prescription segment registered its dominance over the global market in 2024. The segment’s growth is due to the rising prevalence of severe chronic disorders such as diabetes, cardiovascular disorders, cancer, and neurological disorders The APIs for these diseases need prescriptions for dispensing medications as they have more adverse effects than OTC drugs. Prescription APIs are given after a complete analysis of the patient’s condition, facilitating faster recovery.

By drug type, the OTC segment is estimated to show the fastest growth over the forecast period. The increasing incidences of common disorders such as fever, common cold & cough, and pain potentiates the demand for OTC APIs. Some common examples of OTC APIs include paracetamol, aspirin, NSAIDs, antihistamines, and antacids. They are easily available and are cost-effective. The increasing demand for self-medication also promotes the segment’s growth.

By application, the cardiology segment held the major share of the market in 2024. The increasing prevalence of cardiovascular disorders and growing research and development activities govern the segment’s growth. Around 620 million people in the world are living with heart and circulatory diseases. They are usually caused due to stress, the geriatric population, and smoking. Cardiovascular diseases are the leading cause of death worldwide. The different drug classes for cardiovascular disorders include HMG-CoA reductase inhibitors, vasodilators, vasoconstrictors, and anticoagulants.

By application, the oncology segment is predicted to witness the fastest growth in the market over the forecast period. The increasing incidence of cancer and its complexity necessitate the use of oncology drugs for its effective treatment. In the U.S., more than 2 million new cancer cases are estimated to be reported in 2025. The growing research and development activities and increasing investments favor the segment’s growth. Several government organizations launch policies and initiatives for the early detection of cancer, enabling healthcare professionals to treat the disorder at an early stage.

North America currently lead the active pharmaceutical ingredients (APIs) market due to rising illnesses, especially among the ageing population. The United States government's current political and trade actions, such as increasing import tariffs and taxes, may escalate operational costs for manufacturers, potentially leading to price hikes. The Food and Drug Administration (FDA) has extended application fees for new drug approvals and increased random inspections of contract manufacturing facilities outside the U.S. to ensure high-quality products in the American market.

In July 2024, in collaboration with the Department of Health and Human Services’ (HHS) Office of Industrial Base Management and Supply Chain (IBMSC), the U.S. Department of Commerce’s Bureau of Industry and Security (BIS), Office of Strategic Industries and Economy Security, announced today that the U.S. government is undertaking a thorough evaluation of the U.S. Active Pharmaceutical Ingredient (API) industrial base to better understand the supply chain network supporting U.S. pharmaceutical manufacturing capabilities. As a consequence, the federal government will be able to better plan and create financing plans to ensure the supply chain's availability and security, as well as to increase awareness of the existing lack of local manufacturing capabilities and other possible problems.

Canada accounts for 2.1% of the global pharmaceutical market. In Canada, 27.1% of prescriptions by quantity and 81.3% of sales by value are for brand-name goods.

What's left are generics. Health Canada is informing interested parties about the temporary strategy for enforcing Drug Establishment Licensing regulations for specific Active Pharmaceutical Ingredients (APIs) used in the production of pharmaceutical medications for humans and animals that are also utilized outside of the pharmaceutical sector

The active pharmaceutical ingredients (APIs) market in Europe is diverse, with key players distributed across countries such as Germany, Switzerland and the United Kingdom. These regions boast advanced pharmaceutical industries and research facilities, contributing to the development and production of APIs. Regulatory standards, including those set by the European Medicines Agency, play a crucial role in shaping the landscape. Additionally, collaborations between pharmaceutical companies and research institutions further influence the geographical dynamics of the European API market.

In addition to helping to significantly enhance and expedite clinical trials on pharmaceuticals for human use in Germany, the following national initiatives announced by the German Federal Government are meant to reinforce the CTR's existing bureaucratic reduction efforts. The BMG will also publish a handout with realistic example contract terms to speed up contract talks between sponsors and trial centers, and consequently, the actual start of clinical trials.

The Asia Pacific region is projected to experience rapid growth. Countries like China and India, known for producing APIs at lower costs, contribute significantly. Additionally, the increasing healthcare expenditure in the region is expected to drive market expansion. The availability of suitable manufacturing infrastructure promotes the indigenous manufacturing of APIs. Favorable regulatory frameworks and government initiatives lead to the development of novel APIs. The Chinese NMPA approved a total of 123 new chemical drugs in 2024. The burgeoning pharmaceutical sectors owing to increasing investments and collaborations also contribute to market growth.

As the clear leader in the global market for active pharmaceutical ingredients (APIs), China has completely changed the way pharmaceutical supply chains function all over the world. Given that it produces 20% of the world's APIs and sells to 189 nations, China has a significant impact on the creation of generic medications. The country is now the backbone of the global pharmaceutical supply chain due to its enormous manufacturing capacity, cost advantages of 35–40% below Western rivals, and more advanced quality control systems.

India is the third-largest producer of APIs in the world, with an 8% market share. Over 500 distinct APIs are produced in India, which also produces 57% of the APIs on the WHO prequalified list. Over the first four years, the Indian API market is expected to develop at a compound annual growth rate (CAGR) of 13.7%, which is about 8% faster than the worldwide API industry. Many venture capitalists and investors have found the Indian API industry to be profitable. India's robust domestic market, sophisticated chemical industry, highly qualified workforce, strict quality and manufacturing requirements, and affordable prices (about 40% less than in the West) for building and operating a modern facility provide an additional advantage.

Latin America is expected to grow at a considerable CAGR in the active pharmaceutical ingredients (APIs) market in the upcoming period. The rapidly expanding pharmaceutical sector and the presence of suitable manufacturing infrastructure are the major growth factors of the market in Latin America. The increasing number of pharma startups and increasing investments and collaborations propel market growth. Favorable government support and trade policies also contribute to market growth.

Mexico is the second-largest pharmaceutical market in Latin America. Mexico produces about 4% of its API needs and imports most of the APIs from China and India. However, efforts are being made to strengthen national manufacturing capacity to compete with China and India. (Source: Mexico Business) Approximately 400 laboratories manufacture pharmaceuticals in Mexico.

It is estimated that there are more than 340 pharmaceutical companies in Brazil. As of April 2025, there were 20 pharma startups in Brazil, of which 3 startups are funded. The Brazilian government recently announced an investment of BRL 4.2 billion ($842 million) under the Growth Acceleration Program to enhance national production and foster public-private partnerships. This includes the production of advanced therapies, vaccines, oncological products, and APIs. (Source: BMI Fitch Solutions)

Dr. Chris Savile, President and CEO of Willow, commented on the collaboration with Laurus Labs that the partnership is a culmination of the company’s new focus on pharmaceutical ingredients and investment over the past two years. The company is proud of the integration of its technology platform into Laurus to support their commercialization of more sustainable, cost-effective products.

The active pharmaceutical ingredients (APIs) market is dynamic and emerging trends involve an increased focus on biotechnology-derived APIs and advancements in manufacturing processes. Regulatory compliance and quality standards play a crucial role in companies. Patent expirations, regulatory changes and global demand for generic drugs influence market dynamics. Collaborations, mergers and acquisitions are common strategies for companies seeking to strengthen their positions in this competitive sector.

By Synthesis Type

By Manufacturer Type

By Type

By Drug Type

By Application

By Region

January 2026

November 2025

November 2025

November 2025