February 2026

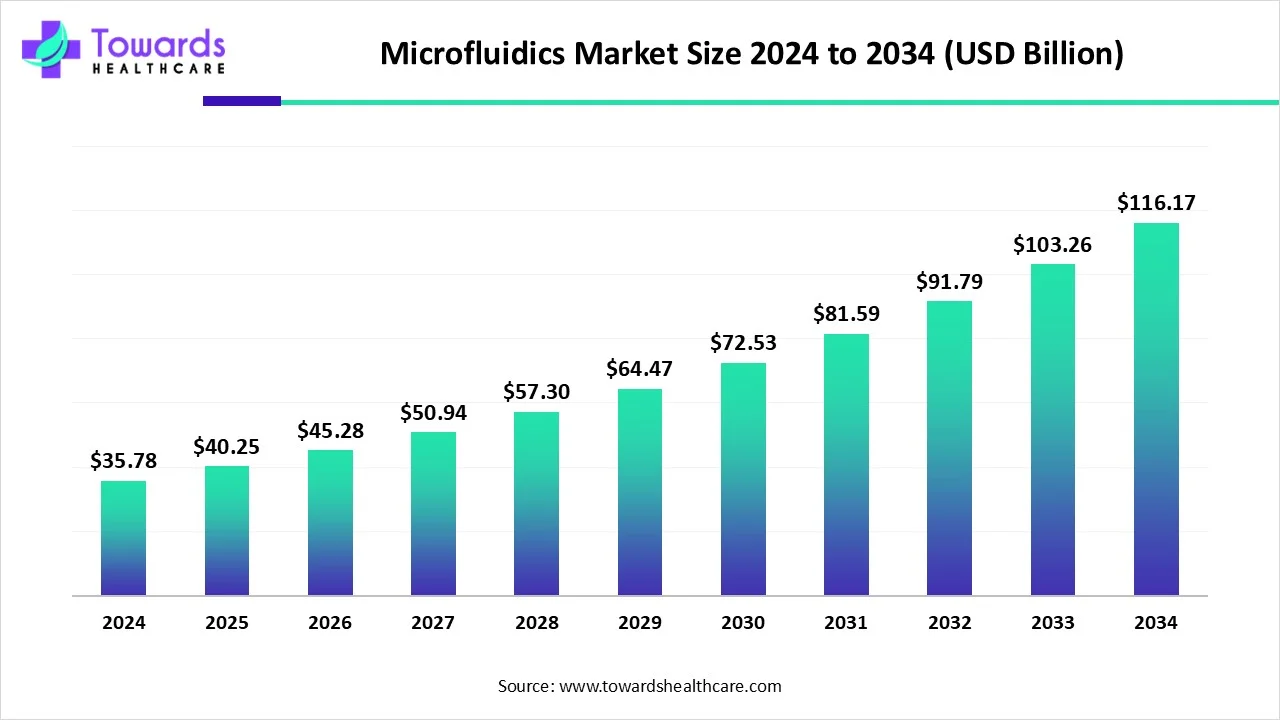

The global microfluidics market size is anticipated to grow from USD 45.28 billion in 2026 to USD 116.17 billion by 2035, with a compound annual growth rate (CAGR) of 12.50% during the forecast period from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2025 | USD 40.25 Billion |

| Projected Market Size in 2035 | USD 130.7 Billion |

| CAGR (2026 - 2035) | 12.5% |

| Leading Region | North America |

| Market Segmentation | By Application, By Material, By Technology, By Region |

| Top Key Players | Abbott, RedShiftBio, Takara Bio Inc., Agilent Technologies, Inc., Standard BioTools, PerkinElmer, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Danaher Corporation, Illumina, Inc., F. Hoffmann-La Roche Ltd. |

A system that manipulates a limited number of fluids through tiny channels that range in size from ten to hundreds of micrometers is known as microfluidics. The study of fluid behavior through microchannels and the technology for creating microminiaturized devices with chambers and tunnels that allow fluids to flow or be contained are combined to form the microfluidics market. Molecular biology, microelectronics, and analysis are all interdisciplinary fields that are part of the microfluidics business. It may be usefully incorporated into the design of low-volume fluid processing systems to accomplish high-throughput screening, multiplexing and automation. The increasing use of microfluidics technology and devices in point-of-care diagnostics, the development of diagnostic devices through technology, and the global rise in the prevalence of chronic illnesses are the main drivers of the microfluidics market.

The microfluidics market is expanding due in large part to the rising need for point-of-care (POC) diagnostics. With POC testing, there is no need for laborious laboratory processing because quick and easy diagnostic findings may be obtained right at the patient's side. In situations like emergency rooms, clinics, and remote or resource-constrained settings, where prompt diagnostic and treatment decisions are vital, this skill is especially important. Because they automate and downsize intricate laboratory procedures onto a tiny chip or cartridge, microfluidic devices are essential to POC testing.

For instance,

To guarantee the effectiveness and safety of the equipment, manufacturers of medical devices must abide by strict regulatory standards. In recent years, there has been a significant increase in the time and complexity of the medical device approval process. For some integrated microfluidic medical devices, obtaining regulatory clearance may take some time, and if the authority rejects the device, there is a chance that investment may be wasted. Businesses confront a significant obstacle when introducing novel and cutting-edge items to the market. The expansion of the microfluidics market is being hampered by these issues.

With a lot of promise in the healthcare industry, microfluidics has become a very interesting and promising technology. There is a plethora of opportunities in many industries because of its exceptional capacity to manage tiny sample numbers, execute fast replies, and get high sensitivity and throughput data. Personalized healthcare and medical diagnosis could benefit greatly from wearable microfluidics, a ground-breaking invention that was made possible by the combination of microfluidics and cutting-edge technologies such as biosensors, soft materials, artificial intelligence (AI), and microelectronics and combined with IoT, AI, IoMT, and IoP. In order to improve healthcare results, more sophisticated technologies will likely be used in the field, leading to more innovative approaches, better integration techniques, and a wider variety of microfluidic wearable devices.

Which Application Segment Dominated the Microfluidics Market?

The medical/healthcare segment held the largest share of the market. Microfluidic systems provide a range of biomedical techniques and technologies to improve human well-being and convenience. These systems' developments pave the way for next-generation microfluidics, which incorporate automation, manipulation, and intelligent readout systems. The necessity for point-of-care (POC) testing and quick technical advancements in molecular diagnostics has increased due to an aging population, an increase in chronic illness cases, and the health demands of developing nations. These are the main drivers propelling the rise of the market for lab-on-a-chip components in microfluidics.

For instance,

Why Did the PDMS Segment Dominate the Microfluidics Market?

The PDMS segment dominated the microfluidics market with the largest share in 2023. One substance that commonly comes up in academic discussions about microfluidics is polydimethylsiloxane (PDMS). Its widespread application in microfluidic experiments has led to a notable increase in its popularity and reputation among scholars and researchers. PDMS is a polymer that is frequently employed in academic microfluidic labs because of its beneficial qualities, which include transparency, biocompatibility, and comparatively easy replication.

How the Lab-on-a-Chip Segment Dominated the Microfluidics Market?

The lab-on-a-chip segment held the dominant share of the microfluidics market in 2023. Numerous applications, such as DNA analysis, human diagnostics, and, to a lesser extent, chemical synthesis, are the focus of lab-on-a-chip research. Because the downsizing of biochemical processes lowers costs, parallelizes operations, and improves diagnostic speed, sensitivity, and accuracy, lab-on-a-chip becomes a viable diagnostic tool. In addition to showcasing integration and parallelization capabilities, lab-on-a-chip outperforms traditional technologies in terms of performance. Genetic sequencing has a whole new range of possibilities thanks to lab-on-a-chip technology. Given the latest findings and solutions that have entered the microfluidics industry, lab-on-a-chip is poised to significantly transform the practice of diagnostics. The need for lab-on-a-chip testing in clinical diagnosis is growing, and a number of devices have been brought to market for important uses, such as heart attack diagnoses, HIV detection, and glucose monitoring.

North America dominated the microfluidics market in 2023. Additionally, it is projected that the region will increase significantly during the predicted period. The use of contemporary miniaturized technologies, the existence of developed economies with their established healthcare infrastructure, and ongoing R&D endeavors by both public and private entities are propelling market expansion in this area. The supremacy of the region was mostly attributed to the U.S. The nation is home to several brand-new microfluidics businesses in addition to numerous well-established ones. In the U.S., point-of-care plays a significant role in microfluidics market dynamics. A number of parties, such as the government, businesses, and influential figures, are implementing incentives to include point-of-care in the management of various illnesses.

For instance,

U.S. Market Trends

The healthcare sector in the U.S. is well established, with the presence of skilled personnel as well as technological advancements. This, in turn, increases the innovation in the biotechnological as well as pharmaceutical companies. At the same time, rising demand for early diagnosis as well as accurate results is increasing their focus on these innovations. At the same time, the technological advancements also enhance the manufacturing process. This further leads to increasing collaborations as well. Moreover, the increasing investments also enhance the development process. All these factors contribute to the market growth.

Canada Market Trends

Canada consists of a number of pharmaceutical as well as biotechnological industries. They are well equipped with various technological advancements. This, in turn, enhances the production process. The increasing incidence of diseases is increasing the demand for the use of microarray systems for effective diagnosis. Thus, this drives the increased development of such a new system. Furthermore, this also increases the collaborations. At the same time, the regulatory bodies help in fast approval, and the government helps by providing investments.

Asia Pacific is expected to grow at the fastest rate during the forecast period. Some of the main factors propelling the growth of the microfluidics market include the increasing demand from the biomedical and pharmaceutical sectors, PoCT, the rising prevalence of chronic illnesses, and increased R&D spending, especially in China. In the area, several methods are being developed and evaluated for 30 printing microfluidic devices with fluid management and operational components.

China Market Trends

In order to modernize the nation's industrial sector completely and establish China as a significant actor that is independent of other nations, the Chinese government has developed a strategic plan. The "Made in China 2025" initiative has a special emphasis on medications and medical equipment. By 2025, businesses in these areas will have access to nearly limitless capital, enabling them to compete with overseas businesses and reclaim a sizable portion of the market. Microfluidic technology, a vital tool for life sciences applications and diagnostics, will undoubtedly profit from this significant investment. Large multinational corporations like Roche and Abbott now dominate the Chinese diagnostics industry, but new Chinese enterprises are starting to compete with them.

India Market Trends

The microfluidics industry is expanding due in part to the efforts of nations like India. The Indian Microfluidics Association (IMA), for example, was founded on January 1st, 2024, and marks a significant advancement in scientific cooperation and innovation in India. This innovative project, supported by six committed visionaries from business, research, and academia, represents a turning point in the understanding and investigation of microfluidics. Fueled by an uncompromising dedication to pushing the frontiers of this multidisciplinary discipline, the IMA cultivates a vibrant community of experts, scientists, and engineers working at the intersection of biology, nanotechnology, and fluid dynamics. The IMA sees itself as a key platform for the dynamic interchange of ideas that will define the future of microfluidics science, not only in India but worldwide. It positions itself as a catalyst for cutting-edge research and development.

Europe is expected to grow at a considerable CAGR in the upcoming period. The rising adoption of advanced technologies and favorable government support bolster market growth. Advances in microfluidic technologies enable researchers to develop novel medical devices and laboratory equipment. The shifting trend towards the lab-on-a-chip technique favors market growth. The increasing investments and collaborations among key players contribute to market growth.

UK Market Trends

Leeds hosted the 2nd UK Microfluidics Conference in June 2025 to share the latest updates about the use of microfluidics for analytical chemistry, environmental monitoring, crystallization, particle synthesis, cell analysis, protein analysis, medical diagnostics, and organ-on-chip. The UK government actively supports innovations in the pharmaceutical and biotech sectors. It launched the UK Innovation Strategy to make the UK a global hub for innovation by 2035.

| Company Name | Takara Bio Inc. |

| Headquarters | Shiga, Japan, Asia Pacific |

| Recent Development | In May 2024, the first dissolvable microfluidic transduction enhancer on the market, the Lenti-X Transduction Sponge, is a first for in vitro lentivirus-mediated gene delivery methods. It was unveiled today by Takara Bio U.S., Inc., a fully-owned subsidiary of Takara Bio Inc. The Lenti-X Transduction Sponge attains high transduction efficiency in any cell type with a simple, walkaway approach, opening up new research opportunities in the field of gene and cell therapy. |

| Company Name | RedShiftBio |

| Headquarters | Massachusetts, U.S., North America |

| Recent Development | In May 2024, at the Protein & Antibody Engineering Summit (PEGS) in Boston, Massachusetts, RedShiftBio, a pioneer in cutting-edge biophysical characterization and bioprocess analytical solutions, announced the introduction of Aurora, TX. The company's most recent and sophisticated instrument, the Aurora TX, sets a new benchmark in biomolecular analysis with its groundbreaking microfluidic modulation spectroscopy technology and ultra-sensitive, ultra-precise measurements of biomolecule stability and structure. This instrument is now even more enhanced with the addition of thermal ramping capability. |

The microfluidics market ecosystem is shaped by several core components and leading companies that drive innovation and growth. At its heart, microfluidics involves precise control of fluid flows in micro-scale channels, essential for applications in diagnostics, drug delivery, and biological research.

Key components of this ecosystem include microfluidic devices, which integrate microchannels, sensors, and valves to manipulate small volumes of fluids. These devices are critical in lab-on-a-chip systems, enabling rapid and efficient analysis.

Leading companies in the microfluidics market contribute significantly by developing and refining these technologies. For instance, companies like Illumina and Fluidigm focus on advanced microfluidic devices for genomics and proteomics. PerkinElmer and Agilent Technologies provide sophisticated microfluidic systems for analytical and clinical applications. Dolomite Microfluidics and Syrris are known for their innovative microfluidic components and solutions, enhancing lab automation and chemical synthesis. LabSmith and Micronit Microtechnologies offer customizable microfluidic platforms for a wide range of research and industrial needs.

Together, these components and companies create a dynamic and evolving microfluidics ecosystem, pushing the boundaries of scientific discovery and practical applications.

By Application

By Material

By Technology

By Region

February 2026

February 2026

February 2026

February 2026