December 2025

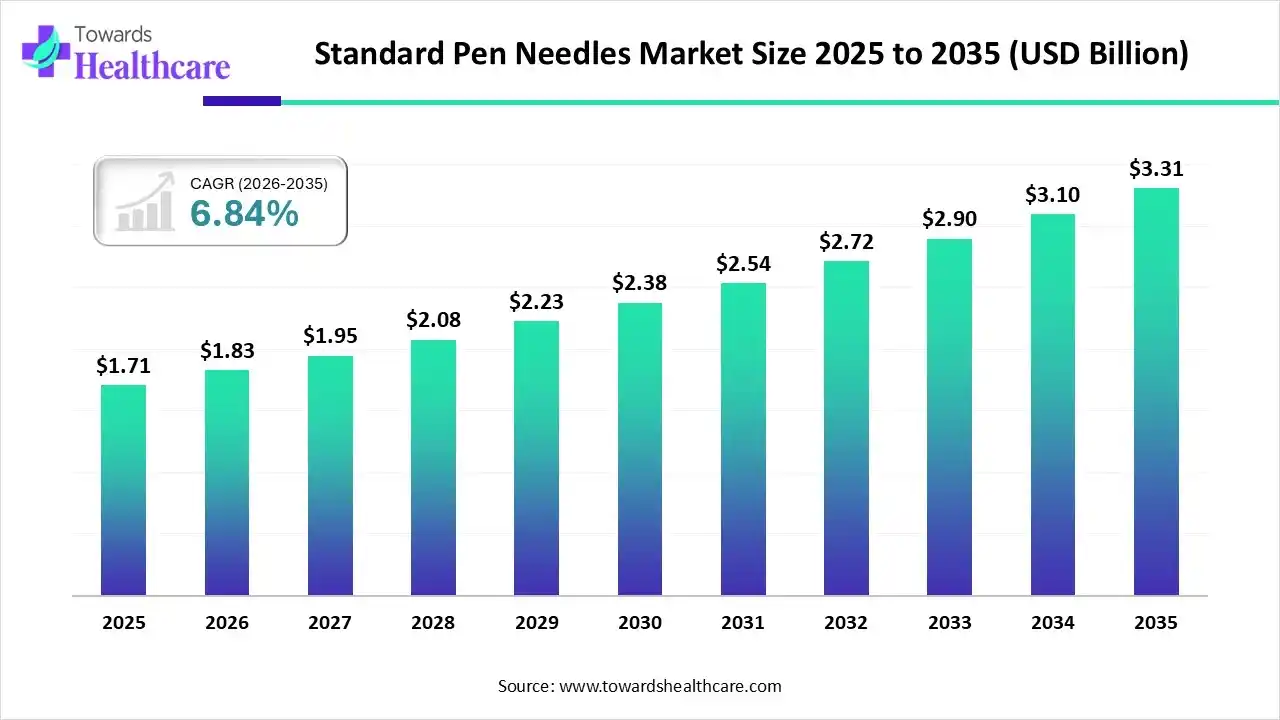

The global standard pen needles market size is expected to be worth around USD 3.31 Billion by 2035, from USD 1.71 billion in 2025, growing at a CAGR of 6.84% during the forecast period from 2026 to 2035.

The standard pen needles market is experiencing robust growth, driven by the increasing use of insulin pens and the growing demand for self-administration. Standard pen needles are available in various sizes, tailored to individual insulin injections and patient needs. Government bodies launch initiatives and provide funding to support early diagnosis and treatment of diabetes. Novel insulin pens are developed to help reduce injection pain, enhancing patient comfort.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.83 Billion |

| Projected Market Size in 2035 | USD 1.71 Billion |

| CAGR (2026 - 2035) | 6.84% |

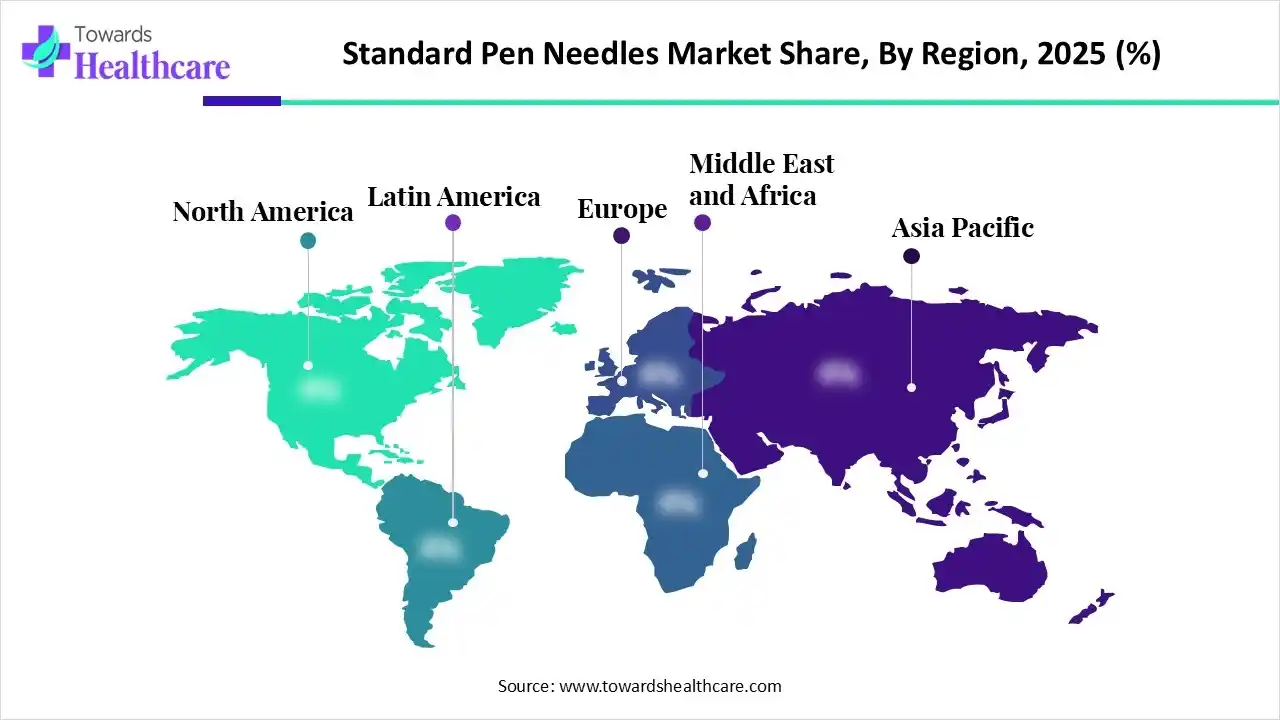

| Leading Region | North America |

| Market Segmentation | By Drug Type, By Disease Indication, By Needle Size, By Distribution Channel, By Region |

| Top Key Players | Becton, Dickinson and Company, Allison Medical, Terumo Corporation, Hindustan Syringes & Medical Devices Ltd., Klinion, Cardinal Health, Inc., Sol-Millennium Medical, Oven Mumford, AdvaCare Pharma, McKesson Medical-Surgical, Inc. |

The standard pen needles market refers to the development and distribution of needles used in different insulin pens for insulin delivery. Pen needles are single-use, small, disposable needles that contain an insulin cartridge and are used to inject the insulin into the subcutaneous fat layer beneath the skin. They can be as thin as a couple of human hairs and are frequently designed for less pain and improved insulin flow into the body. They range from 4 mm to 12 mm, with a diameter of 29 to 32 gauge.

Artificial intelligence (AI) is embedded in insulin pens to support patient-directed interventions, improving diabetes management decisions for patients in real-time. Smart insulin pens and connected software can be enabled with real-time dosing alerts and reminders. AI and machine learning (ML) algorithms can analyze vast amounts of data and suggest the desired size and type of pen needles. They also assist manufacturers in the bulk production of pen needles, enhancing efficiency, accuracy, and reproducibility.

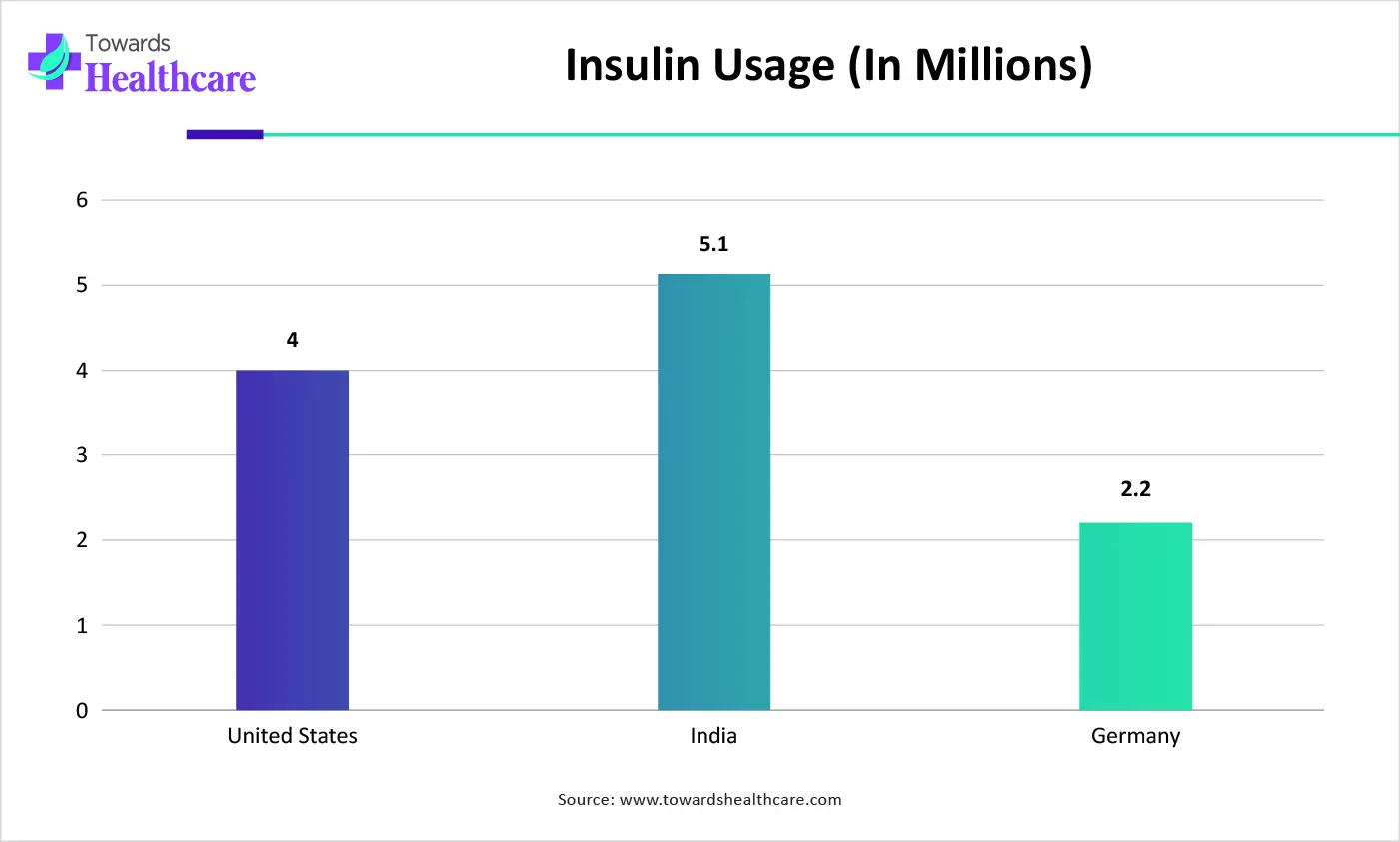

| Countries | Insulin Usage (in millions) |

| United States | 4 |

| India | 5.1 |

| Germany | 2.2 |

Which Drug Type Segment Dominated the Standard Pen Needles Market?

The insulin segment held a dominant position in the market in 2025, due to the rising prevalence of type 1 diabetes and the need for subcutaneous drug delivery. Insulin is unstable for oral administration; hence, it is administered through the subcutaneous route only, necessitating the use of pen needles. It is estimated that over 100 million diabetes patients need insulin globally. Standard pen needles contribute to the comfort and efficacy of the insulin injection.

GLP-1

The GLP-1 segment is expected to grow at the fastest CAGR in the market during the forecast period. Standard pen needles are essential for delivering GLP-1 analogs, treating patients with diabetes or obesity. Most patients are aware of weight loss medications, such as Wegovy or Ozempic. According to a new Circana report, GLP-1 medications for weight loss are set to account for 35% of U.S. food and beverage sales by 2030.

Why Did the Diabetes Segment Dominate the Standard Pen Needles Market?

The diabetes segment held the largest revenue share of the market in 2025, due to the growing pediatric and geriatric population and the increasing diabetes prevalence. The International Diabetes Federation (IDF) reported that approximately 589 million individuals were living with diabetes globally. Standard pen needles are widely used among diabetics to deliver the precise dose of insulin. They have proven to reduce injection anxiety among young children and older adults.

Obesity

The obesity segment is expected to grow with the highest CAGR in the market during the studied years. Obesity is a major public health concern among people of all age groups and is a serious issue, particularly in wealthy countries. It is mainly caused by sedentary lifestyles and the increasing consumption of fast foods. The World Obesity Federation predicts that obesity will increase by more than 115% from 524 million in 2010 to 1.13 billion by 2030.

How the 4 mm Segment Dominated the Standard Pen Needles Market?

The 4 mm segment contributed the biggest revenue share of the market in 2025, due to its relatively small size, causing the least pain. 4 mm needles are the shortest, most comfortable, and effective for all body types. They are mostly used for children and adults, especially those with sensitive skin. They are compatible with multiple insulin pens. Shorter needles reduce the risk of injecting into muscle while providing the same insulin delivery results.

6 mm

The 6 mm segment is expected to witness significant growth in the market over the forecast period. 6 mm needles are used by people who prefer a bit more depth and have thicker skin. They enhance the administration of insulin through pen injectors, ensuring minimal discomfort and efficient delivery. They offer widespread compatibility and a user-friendly design. They are integral for healthcare professionals and pharmacies to offer versatile and patient-centered solutions.

Which Distribution Channel Segment Led the Standard Pen Needles Market?

The retail pharmacy segment led the market in 2025, due to the availability of a favorable infrastructure and suitable capital investments. This enables retail pharmacies to adopt a wide range of pen needles of different sizes, serving a larger patient population. Retail pharmacies possess skilled professionals who provide tailored services to patients. They offer numerous benefits, such as specialized discounts, 24/7 facilities, and same-day delivery.

Online Pharmacy

The online pharmacy segment is expected to expand rapidly in the market in the coming years. Online pharmacies offer patients multiple options and allow them to compare prices, allowing them to choose products at affordable prices. They enable free home delivery and special discounts. Patients can purchase pen needles from manufacturers and suppliers of various countries, irrespective of geographical barriers.

North America dominated the global market in 2025. The availability of a robust healthcare infrastructure, state-of-the-art research and development facilities, and the presence of key players are the factors that govern market growth in North America. Government organizations provide funding to support the development of advanced insulin pens and pen needles to cater to a larger patient population. Moreover, technological innovations and favorable regulatory support bolster market growth.

U.S. Market Trends

Key players, such as Cardinal Health, McKesson Medical-Surgical, and Sol-Millennium Medical, are major contributors to the market in the U.S. Out-of-pocket costs of insulin in the U.S. are capped at $35 million per monthly prescription among Medicare Part D enrollees. The Centers for Medicare and Medicaid Services releases programs to reduce the cost of insulin for Medicare beneficiaries, increasing affordability.

Asia-Pacific is expected to host the fastest-growing market in the coming years. Countries like China, India, and Japan have the highest number of people with diabetes and obesity globally. This necessitates the demand for insulin administration, thereby requiring pen needles. People are becoming aware of advanced drug delivery devices for insulin, enhancing patient comfort. Government initiatives encourage the general public to screen for and diagnose metabolic diseases, such as diabetes and obesity, enabling healthcare professionals to provide early intervention.

India Market Trends

India records the highest diabetes and obesity prevalence across the world. More than 101 million people are estimated to have diabetes, while approximately 80 million Indians are obese. The Indian government’s Ayushman Bharat Pradhan Mantri Jan Aarogya Yojana improves healthcare access, enabling citizens to seek treatment for various illnesses, including diabetes and obesity.

Europe is expected to grow at a considerable CAGR in the upcoming period. The rising adoption of advanced technologies, such as ultra-thin wall designs and safety-engineered needles, and the burgeoning healthcare sector propel the market. European nations make constant efforts to reduce the burden of chronic diseases among Europeans by raising awareness of the diagnosis and treatment of such disorders. The increasing investments and collaborations among key players also augment market growth.

Insulin pens and pen needles are strictly regulated by regulatory agencies and are available on prescription. Approximately 4 million single-use insulin pens are prescribed in England annually, accounting for about half of all prescriptions. The NHS West Yorkshire ICB recommends prescribing diabetes pen needles costing less than £3 per 100 needles, enhancing affordability.

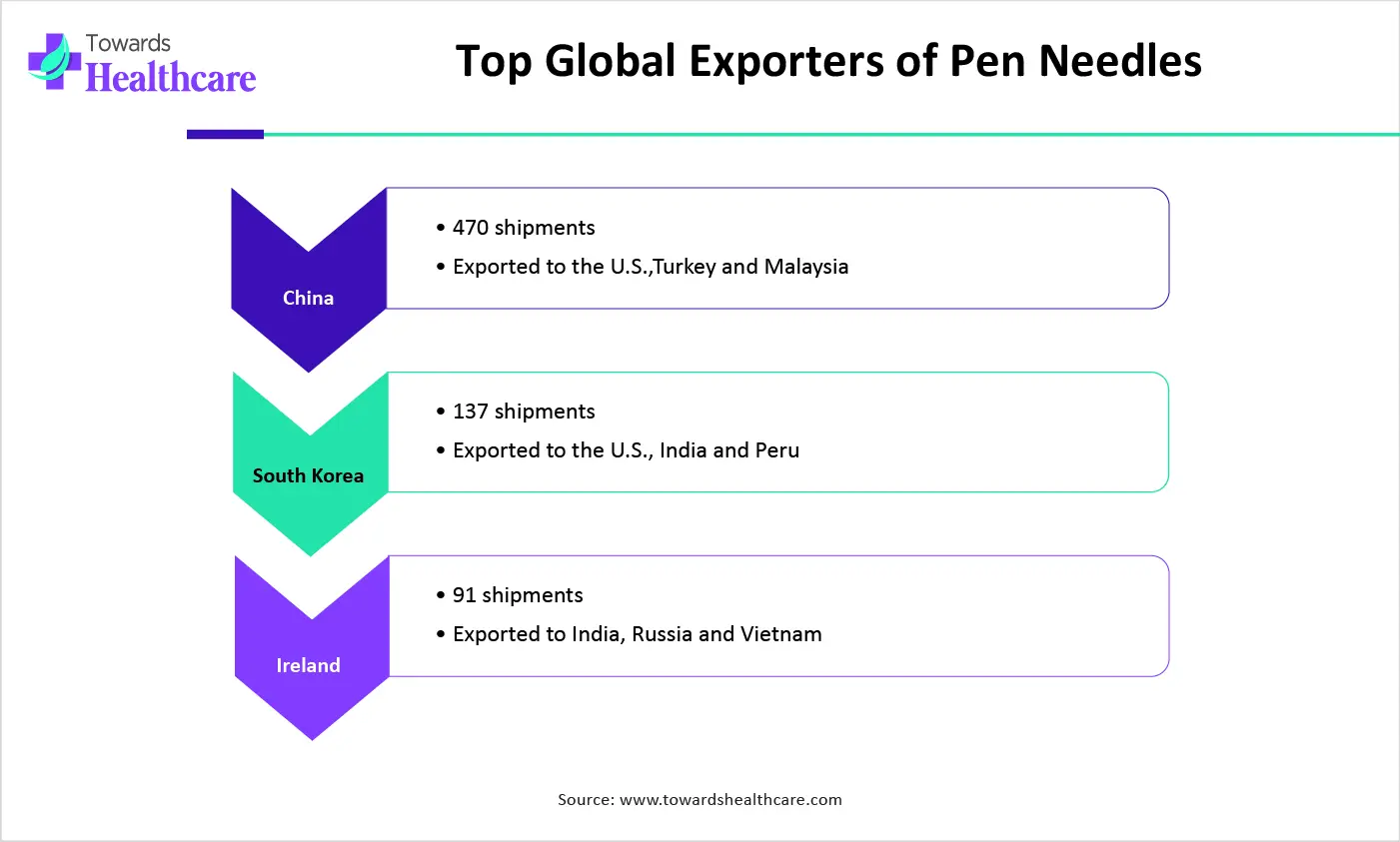

| Export Countries | Number of Shipments (May 2024 to April 2025) | Import Countries |

| China | 471 | U.S., Turkey, and Malaysia |

| South Korea | 138 | U.S., India, and Peru |

| Ireland | 92 | India, Russia, and Vietnam |

| Companies | Headquarters | Offerings |

| Becton, Dickinson and Company | New Jersey, United States | It offers Ultra-Fine Pen Needles and Nano 4mm Pen Needles that feature ultra-thin wall technology, ensuring the highest inner diameter. |

| Allison Medical | Colorado, United States | SureComfort pen needles are ISO compliant with all major diabetes pens & dosers, with new sizes, lubricated for superior injection comfort. |

| Terumo Corporation | Tokyo, Japan | Terumo Fineglide Pen Needles 4mm 32G are compatible with most standard insulin pens, providing versatility and ease of use. |

| Hindustan Syringes & Medical Devices Ltd. | Haryana, India | It manufactures sterile, single-use Dispovan insulin pen needles that are the least painful and patient-friendly. |

| Klinion | Oud Beijerland, Netherlands | It offers pen needles in various combinations with a length of 4, 5, 6, 8, or 12mm, and a thickness of 32G, 31G, or 29G. |

| Cardinal Health, Inc. | Ohio, United States | Monoject Standard Pen Needles features shorter needle lengths and 32G options to help make injections less painful. |

| Sol-Millennium Medical | Chicago, United States | Sol-M Pen Needles support accurate and reliable insulin delivery and are engineered for comfortable medication delivery with silicone oil lubrication. |

| Oven Mumford | Oxfordshire, United Kingdom | It offers Unifine Pentips Standard Insulin Pen Needle 31G 8mm for optimal performance. |

| AdvaCare Pharma | Wyoming, United States | Its Insulin Pen Needles come in various sizes, ranging from 29G to 32G. |

| McKesson Medical-Surgical, Inc. | Virginia, United States | It offers Standard Insulin Pen Needle Comfort EZ 32G that is silicone-coated with special lubrication for a more comfortable injection. |

By Drug Type

By Disease Indication

By Needle Size

By Distribution Channel

By Region

December 2025

January 2026

November 2025

November 2025