Middle East and Africa Biotechnology Market Size, Dynamics with Top Key Players

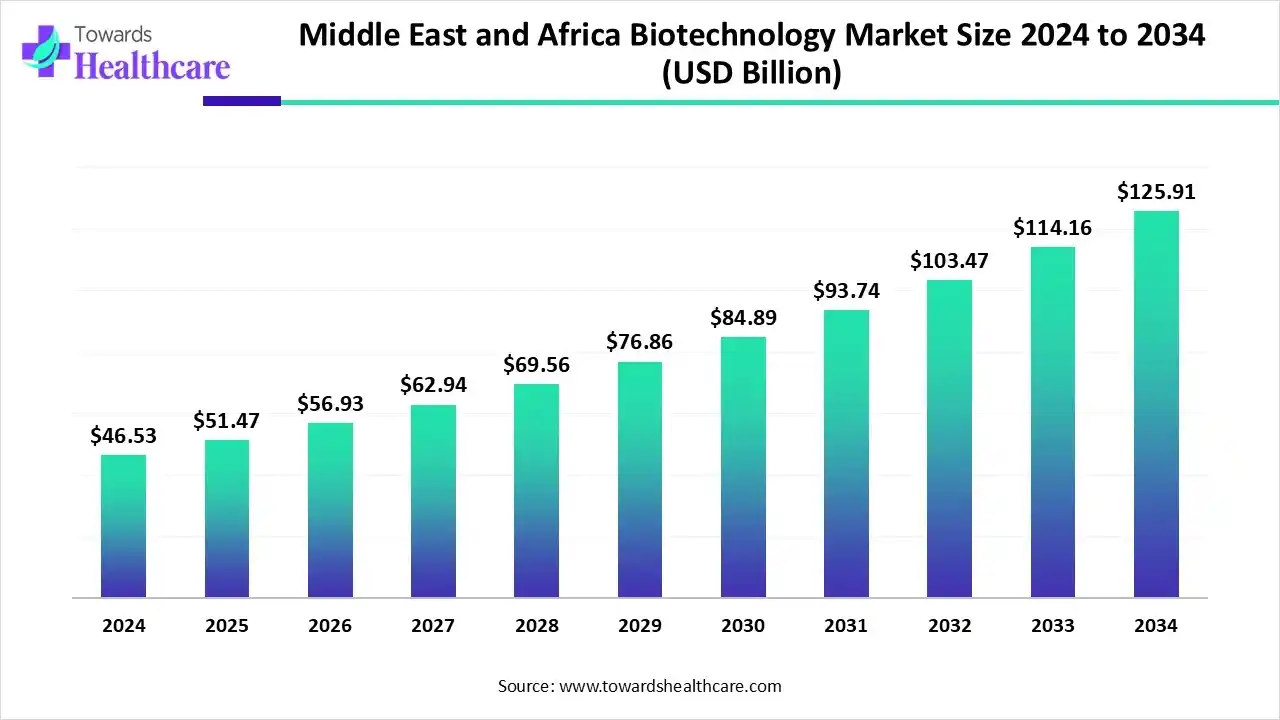

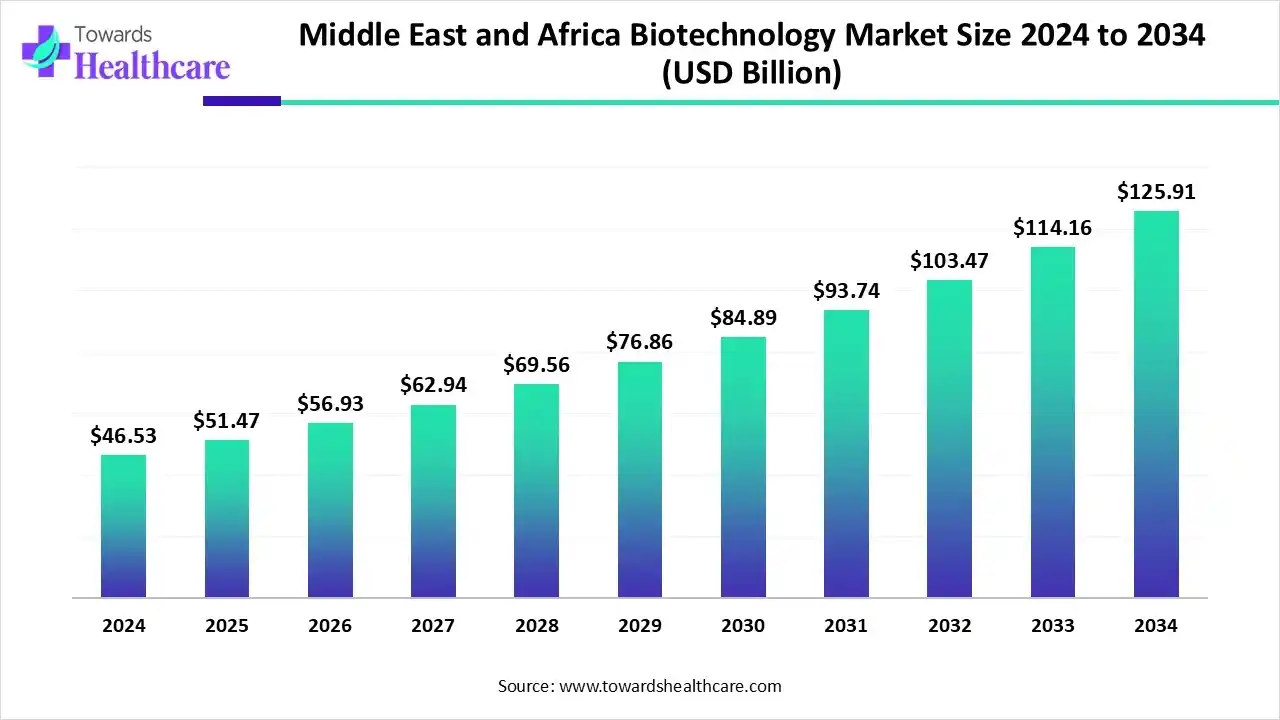

The Middle East and Africa biotechnology market size recorded US$ 46.53 billion in 2024, set to grow to US$ 51.47 billion in 2025 and projected to hit nearly US$ 125.91 billion by 2034, with a CAGR of 10.80% throughout the forecast timeline.

The Middle East and Africa biotechnology market is witnessing steady growth driven by increasing demand for food security, drought-resistant crops, and sustainable farming practices. South Africa dominates the region due to its strong regulatory framework, advanced research infrastructure, and early adoption of genetically modified crops such as maize, soybean, and cotton. Government initiatives, international collaborations, and rising investments in biotechnology further support market expansion. Meanwhile, countries like Kenya, Nigeria, and Egypt are gradually strengthening their biotechnology ecosystems to meet regional agricultural challenges.

Key Takeaways

- Middle East and Africa biotechnology market to crossed USD 46.53 billion by 2024.

- Market projected at USD 125.91 billion by 2034.

- CAGR of 10.80% expected in between 2025 to 2034.

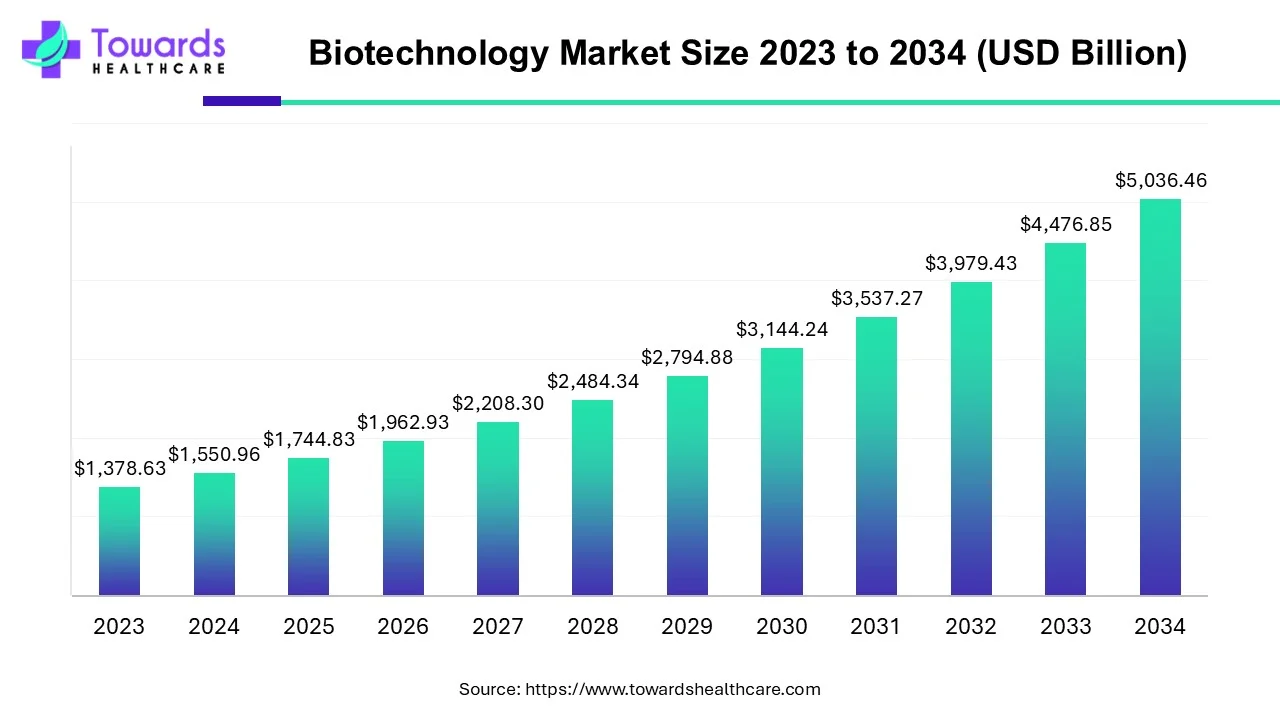

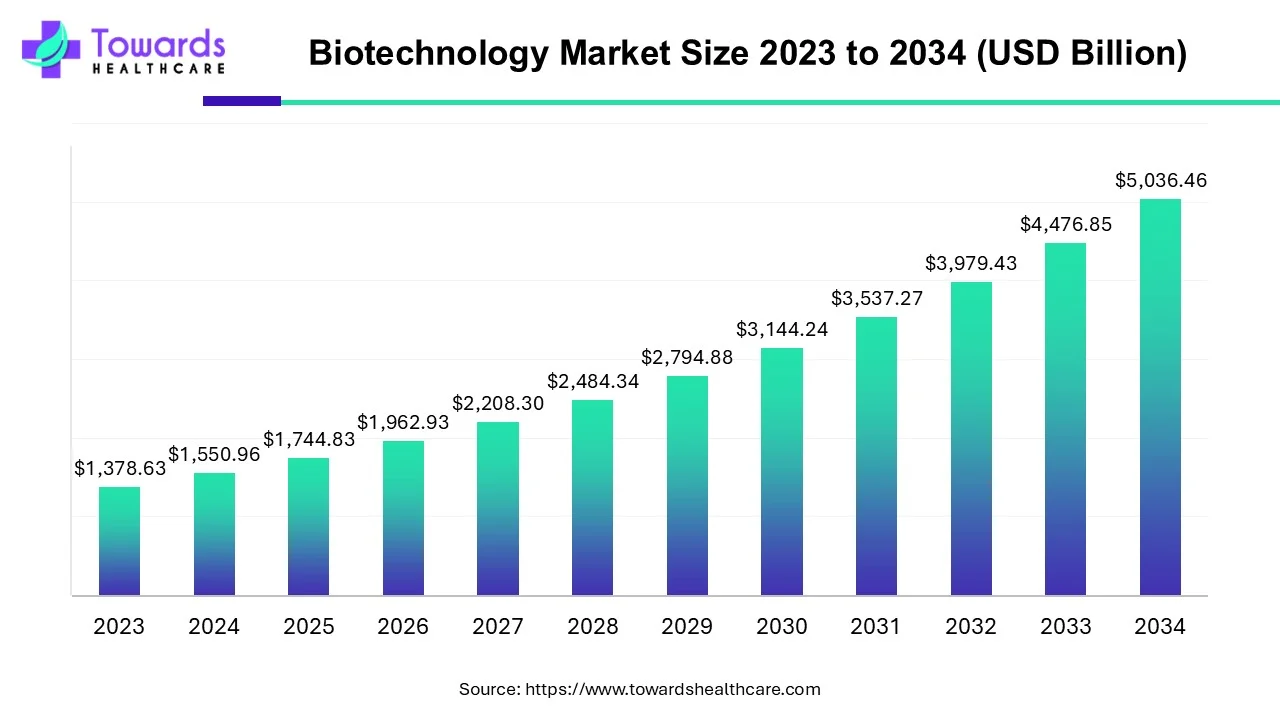

- The biotechnology market is expected to grow from USD 1,744.83 billion in 2025 to USD 5,036.46 billion by 2034, at a CAGR of 12.5%.

- South Africa held a major revenue share of approximately 25% in the Middle East and Africa biotechnology market in 2024.

- Other Growing Countries are expected to witness the fastest growth during the predicted timeframe.

- By application/end-use sector, the health/medical biotechnology segment registered its dominance over the global market with a share of 46% in 2024.

- By application/end-use sector, the bioinformatics & others segment is expected to grow with the highest CAGR in the market during the studied years.

- By technology/platform/product type, the PCR & DNA sequencing technologies segment held the largest revenue share of approximately 30% in the market in 2024.

- By technology/platform/product type, the nanobiotechnology/gene editing/emerging tech segment is expected to show the fastest growth over the forecast period.

- By product type/offering, the instruments & hardware segment held a dominant presence in the Middle East and Africa Biotechnology Market with a share of approximately 35% in 2024.

- By product type/offering, the contract research & CDMO-type services segment is expected to witness the fastest growth in the market over the forecast period.

Quick Facts Table

| Table |

Scope |

| Market Size in 2025 |

USD 51.47 Billion |

| Projected Market Size in 2034 |

USD 125.91 Billion |

| CAGR (2025 - 2034) |

10.80% |

| Market Segmentation |

By Application / End-Use Sector, By Technology / Platform / Product Type, By Product Type / Offering, By Country / Geography

|

| Top Key Players |

Thermo Fisher Scientific, Abbott Laboratories, F. Hoffmann-La Roche, Charles River Laboratories, Eurofins Scientific, Promega Corporation, Bio-Rad Laboratories, PerkinElmer Inc., Takara Bio Inc., Trinity Biotech, Afrigen Biologics & Vaccines (South Africa), Pfizer, Sanofi, G42 Healthcare (UAE), Roche Diagnostics

|

What is Biotechnology?

Rising food security needs, water scarcity, government initiatives, and global collaborations are key factors driving the Middle East and Africa biotechnology market. Biotechnology is the application of biological systems, organisms, and cellular processes to develop products and technologies that improve health, agriculture, industry, and the environment. Its main branches include medical biotechnology (vaccines, gene therapy), agricultural biotechnology (GM crops, biofertilizers), industrial biotechnology (enzymes, biofuels), and environmental biotechnology (bioremediation, waste treatment). Techniques such as genetic engineering, molecular markers, tissue culture, and synthetic biology are widely used, making biotechnology a transformative field addressing global and regional challenges.

Market Outlook

- Industry Growth Overview -The Middle East and Africa biotechnology market is experiencing steady growth, driven by rising food security needs, adoption of genetically modified crops, increasing government support, and international collaborations. South Africa leads the region, while other countries are gradually strengthening biotechnology adoption.

- Major Investors -: Major investors in the market include international agribusiness firms, government-backed funds, and research organizations. Their investments support innovation, infrastructure development, and the commercialization of biotech products, enabling advancements in GM crops, biofertilizers, and vaccines while fostering sustainable agricultural practices and regional food security.

- Startup Ecosystem-The startup ecosystem in the Middle East and Africa biotechnology market is rapidly evolving, driven by innovation in agri-biotech, healthcare, and bio-based solutions. Emerging startups focus on genetically modified crops, biofertilizers, precision farming, and medical biotech. Supported by incubators, government initiatives, and cross-border collaborations, these startups are boosting regional innovation, employment, and sustainability in biotechnology.

Middle East and Africa Biotechnology Market Trends

- Hybrid & climate-resilient seeds - Strong adoption of hybrid seeds and seed varieties resistant to heat, drought, and disease in the face of climate change.

- Plant Growth Regulators (PGR) - More use of PGRs in fruits & vegetables, expansion in protected cultivation, demand for residue-free and controlled-release formulations.

- Adoption of Inorganic Growth Strategies - like partnerships, acquisitions, and technology transfers can significantly accelerate the growth of the Middle East & Africa biotechnology market. These strategies help companies leapfrog infrastructure gaps, access new technologies, scale operations faster, and improve regulatory compliance. For instance, in June 2025, South Africa’s Biovac partnered with India’s Biological E in a vaccine technology-transfer deal to manufacture a pneumococcal conjugate vaccine for Africa, boosting local vaccine production and health security.

How Can AI Improve the Middle East and Africa Biotechnology Market?

AI integration can significantly enhance the market by enabling precision agriculture, predictive breeding, and optimized resource management. Machine learning algorithms analyze soil, weather, and crop data to improve yield, detect diseases early, and recommend appropriate interventions. AI-driven genomics accelerates the development of climate-resilient and high-quality crops, while robotics and automation enhance efficiency in laboratories and production facilities.

Biotechnology Development Areas

| Country |

Development Focus |

Key Highlights |

| Saudi Arabia |

National Biotech Strategy & Genomics |

- Released a national biotech strategy in January 2024, aiming for self-sufficiency in vaccines and biomanufacturing.

- Plans to contribute $34.6 billion to GDP by 2040, positioning itself as a leading biotech hub in MENA.

- Prioritizing genomics, vaccines, and plant optimization.

|

| UAE |

AI-Driven Biomanufacturing & Diagnostics |

- Adoption of AI and 3D printing technologies in biomanufacturing.

- Establishment of innovation labs to foster biotech advancements.

|

| Regional |

Biotech Investment & Regulatory Reforms |

- Showcase of biotech ambitions at BIO 2025 with major investments and regulatory reforms.

- Emphasis on life sciences diplomacy and partnerships to grow the biotech industry.

|

Biotechnology Advancements in South Africa (2024–2025)

| Area of Innovation |

Key Developments |

| Genomics & Sequencing |

- Expansion of Next Generation Sequencing (NGS) services, including long-read sequencing.

- Introduction of Oxford Nanopore Technology for advanced DNA sequencing.

- Growth of pharmacogenomics initiatives for personalized medicine.

|

| Precision Medicine |

- Implementation of Genome-Wide Association Studies (GWAS) to understand genetic variations.

|

| Agricultural Biotechnology |

- Adoption of genome editing tools for crop improvement.

- Utilization of plant tissue culture and hybrid technology for enhanced agricultural productivity.

|

| Biotech Startups & Incubators |

- Launch of LaunchLab CERI BIO at Stellenbosch University to support biotech startups.

- Development of a hydroponic manufacturing facility in Mauritius by Cape Bio Pharms.

|

| Vaccine Development |

- Afrigen's partnership with CEPI to develop human mRNA vaccines, including for Rift Valley Fever.

|

Segmental Insights

Which Application/End-Use Sector Segment Dominated the Middle East and Africa Biotechnology Market?

The health/medical biotechnology segment dominates the market with a share of approximately 46% due to rising demand for advanced healthcare solutions, increasing prevalence of chronic diseases, and growing investment in vaccine development, diagnostics, and personalized medicine. Government support, public-private partnerships, and regional R&D initiatives further strengthen this segment’s leadership.

The bioinformatics & others segment is estimated to be the fastest-growing segment in the Middle East and Africa biotechnology market due to increasing adoption of AI, machine learning, and big data analytics in genomics, drug discovery, and precision medicine. Rising investments in research, expansion of computational biology infrastructure, and collaborations with global biotech firms further accelerate innovation and market growth in these advanced technology-driven areas.

Why Did the Contraception / Family Planning Segment Dominate the Middle East and Africa Biotechnology Market?

The PCR & DNA sequencing technologies segment dominates the market with a share of 30% due to their critical role in diagnostics, genetic research, and personalized medicine. Widespread adoption in clinical laboratories, research institutions, and agricultural genomics, combined with advancements in next-generation sequencing and high-throughput PCR platforms, enables rapid, accurate analysis, strengthening their position as essential tools across healthcare, research, and biotechnology applications in the region.

The nanobiotechnology/gene editing/emerging tech segment is anticipated to be the fastest-growing with share of approximately 23% in the market due to increasing adoption of CRISPR, RNA-based therapies, and nanomaterials in healthcare and agriculture. Rising R&D investments, supportive government policies, and collaborations with global biotech firms accelerate innovation, enabling precise genetic modifications, advanced therapeutics, and sustainable agricultural solutions across the region.

What Made the Instruments & Hardware Segment the Dominant Segment in the Middle East and Africa Biotechnology Market?

The instruments & hardware segment dominates the market with a share of 35% due to its essential role in laboratories, research facilities, and diagnostic centers. High demand for advanced equipment like sequencers, PCR machines, centrifuges, and spectrometers, coupled with ongoing technological upgrades and strong adoption in healthcare, agricultural, and industrial biotechnology, drives the segment’s prominence and widespread utilization across the region.

The Contract Research & CDMO-type services segment is estimated to be the fastest-growing, with a share of approximately 15% segment in the Middle East and Africa biotechnology market due to increasing outsourcing of R&D, biomanufacturing, and clinical trials. Rising demand for cost-effective solutions, regulatory support, and collaborations with global biotech firms enable companies to accelerate product development, scale operations, and access advanced expertise across healthcare, agricultural, and industrial biotechnology sectors.

Regional Analysis

Which Factors Contribute to South Africa’s Dominance in the Middle East and Africa Biotechnology Market?

South Africa dominates the market due to its advanced research infrastructure, supportive regulatory framework, and early adoption of genetically modified crops and medical biotechnology. The country has established strong institutions for genomics, vaccine development, and agricultural biotechnology, fostering innovation and commercialization. Government initiatives, public-private partnerships, and international collaborations further strengthen its position, enabling large-scale R&D, technology transfer, and production capabilities.

Major investors in South Africa’s biotechnology market include multinational agribusiness and pharmaceutical companies, government-backed funds, and private venture capital firms. Notable players like Bayer, Syngenta, Biovac, and Afrigen have invested in vaccine production, agricultural biotech, and genomics research. These investments have enhanced R&D infrastructure, accelerated the commercialization of genetically modified crops and medical biotech products, and strengthened local manufacturing capabilities. Government initiatives, combined with strategic international collaborations, have further boosted innovation, technology adoption.

Growth Opportunities of the Other Countries in the Middle East and Africa Biotechnology Market?

Countries like Egypt, Nigeria, Kenya, the rest of the GCC, and other Sub-Saharan African nations are witnessing rapid growth in biotechnology due to several key factors. Rising population and food security concerns drive the adoption of genetically modified crops and advanced agricultural practices. Government initiatives, supportive policies, and investment in biotech research and infrastructure promote innovation in healthcare, agriculture, and industrial biotechnology. Increasing collaborations with global biotech firms and participation in international research networks enhance technology transfer and capacity building.

Additionally, growing awareness of precision medicine, bioinformatics, and vaccine development, coupled with the establishment of incubators and startup ecosystems, accelerates market adoption, making these regions the fastest-growing segments in the Middle East and Africa biotechnology market.

Global Biotechnology Market Growth

The biotechnology market is projected to grow from USD 1,744.83 billion in 2025 to USD 5,036.46 billion by 2034, achieving a CAGR of 12.5% over the forecast period, driven by continuous innovation and technological advancements within the industry.

Value Chain Analysis

Research & Development (R&D)

- Target identification and validation for crops, vaccines, or therapeutics.

- Laboratory research, including genetic engineering, molecular biology, and bioinformatics analyses.

- Preclinical studies for safety and efficacy evaluation.

- Scale-up experiments for biomanufacturing processes.

Clinical Trials & Approval

- Clinical trial design and protocol development.

- Phase I–III human trials for safety, efficacy, and dosage determination.

- Regulatory submission for approval and monitoring.

- Post-marketing surveillance for safety and effectiveness.

Patient Support & Services

- Distribution of biotechnology products (vaccines, therapeutics, GM crops) to hospitals, clinics, and farms.

- Patient and farmer education programs on usage and safety.

- Adverse event reporting and feedback systems.

- Post-sales support, telemedicine, and digital platforms for healthcare guidance.

Top Vendors in the Middle East and Africa Biotechnology Market & Their Offerings

G42 Healthcare (UAE)

- Focus Areas: AI-driven healthcare, genomics, diagnostics, digital health.

- Key Offerings: Omics Centre of Excellence, population genomics, AI-powered diagnostics.

- Significance: Pioneering in integrating AI with healthcare solutions in the UAE.

Hayat Biotech (UAE)

- Focus Areas: Vaccine development and manufacturing.

- Key Offerings: COVID-19 vaccines, including inactivated vaccines.

- Significance: Joint venture between Sinopharm CNBG and G42, contributing to vaccine accessibility in the region.

Biovac (South Africa)

- Focus Areas: Vaccine production and biomanufacturing.

- Key Offerings: Manufacturing of vaccines for diseases like tuberculosis and hepatitis B.

- Significance: Strengthening Africa's vaccine production capabilities.

Afrigen Biologics (South Africa)

- Focus Areas: Biopharmaceuticals and vaccine development.

- Key Offerings: Development of mRNA vaccines and biosimilars.

- Significance: Leading efforts in mRNA vaccine technology on the African continent.

Dei BioPharma (Uganda)

- Focus Areas: Vaccine and pharmaceutical manufacturing.

- Key Offerings: Production of vaccines, insulin, oncology drugs, and herbal medicines.

- Significance: One of Africa’s largest vaccine and drug manufacturing facilities, enhancing healthcare self-sufficiency.

Yemaachi Biotech (Ghana)

- Focus Areas: Genomic data and cancer research.

- Key Offerings: African Cancer Atlas, genomic data for cancer research.

- Significance: Building Africa's largest cancer database to inform drug discovery and treatment research.

Eva Pharma (Egypt)

- Focus Areas: Pharmaceutical manufacturing and distribution.

- Key Offerings: Manufacturing of rheumatoid arthritis drug Olumiant under license from Eli Lilly.

- Significance: Expanding access to essential medications across Africa.

Top Companies in the Middle East and Africa Biotechnology Market

- Thermo Fisher Scientific

- Abbott Laboratories

- F. Hoffmann-La Roche

- Charles River Laboratories

- Eurofins Scientific

- Promega Corporation

- Bio-Rad Laboratories

- PerkinElmer Inc.

- Takara Bio Inc.

- Trinity Biotech

- Afrigen Biologics & Vaccines (South Africa)

- Pfizer

- Sanofi

- G42 Healthcare (UAE)

- Roche Diagnostics

Recent Developments in the Middle East and Africa Biotechnology Market

- In March 2025, Thermo Fisher Scientific launched the Vulcan Automated Lab, enhancing process development and control in semiconductor manufacturing. This system improves productivity, optimizes yield, and reduces operating costs, addressing the growing demand for precise atomic-level metrology.

- In February 2025, Anbio Biotechnology showcased cutting-edge diagnostic solutions at Medlab Middle East 2025 in Dubai. Their participation highlighted advancements in in-vitro diagnostic technologies, contributing to the region's healthcare diagnostics capabilities.

- In February 2025, Hipro presented innovative diagnostic products at Medlab Middle East 2025, emphasizing advancements in diagnostic technologies. Their participation underscored the growing focus on enhancing diagnostic capabilities in the region.

Segments Covered in the Report

By Application / End-Use Sector

- Health / Medical Biotechnology

- Food & Agriculture Biotechnology

- Industrial Biotechnology (biofuels, bioplastics, enzymes, etc.)

- Natural Resources & Environment (bioremediation, pollution control)

- Bioinformatics & Others (tool development, computational biotech)

By Technology / Platform / Product Type

- PCR & DNA Sequencing Technologies

- Fermentation & Cell Culture Technologies

- Chromatography & Assay / Purification Technologies

- Tissue Engineering & Regeneration

- Nanobiotechnology / Gene Editing / Emerging Tech

By Product Type / Offering

- Instruments & Hardware

- Consumables / Reagents / Kits

- Services & Software / Analytical / Bioinformatics

- Contract Research & CDMO-type Services

By Country / Geography

- South Africa

- Saudi Arabia

- UAE

- Other Growing Countries

- Rest