February 2026

The drug delivery CDMO market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2026 to 2035. This growth is driven by emerging trends and strong demand across key sectors.

The growing chronic diseases and advancements in advanced therapies are fuelling the demand for drug delivery CDMO services. Similarly, the growing AI integration, outsourcing trends, expanding research and development activities, and new drug delivery platform launches are also promoting the market growth.

The drug delivery CDMO market is driven by the transition towards complex biologics, a surge in GLP-1 therapies, and the demand for specialized, high-potency manufacturing. The drug delivery CDMO encompasses specialized organizations that provide comprehensive services for the development and manufacturing of drug delivery systems (e.g., injectables, inhalers, transdermals). These partners integrate drug formulation with advanced delivery technologies to improve bioavailability, patient compliance, and therapeutic efficacy.

AI offers a wide range of applications in the drug delivery CDMO, supporting the formulation development by predicting the optimal drug formulation and drug release patterns. It also optimizes the manufacturing parameters and offers enhanced quality control. It also shows compliance with the regulatory standards and accelerates the development timelines, promoting the development of new drug delivery systems and complex molecules.

Due to growing chronic diseases, there is a rise in the development of biologics, cell and gene therapies, personalized therapies, and novel APIs, which is increasing the demand for drug delivery CDMO services.

The increasing research and development complexities, regulatory hurdles, and development costs are increasing the outsourcing trends to leverage various services of the drug delivery CDMOs, which is also creating new opportunities for the full-service CDMOs.

The growing digitalization is driving the adoption and development of advanced technologies such as automation and digital platforms, enhancing the speed, efficiency, and quality of drug development and manufacturing in the drug delivery CDMOs.

Why Did the Manufacturing Services Segment Dominate in the Drug Delivery CDMO Market in 2025?

The manufacturing services segment held the largest share of approximate 58.5% in the market in 2025, due to high demand for specialized facilities. The growth in the development of complex drug delivery systems also increased their use for technical expertise and advanced equipment, where their affordable services also increased the collaborations.

Drug Development Services

The drug development services segment is expected to show the highest growth with approximately 12.2% CAGR during the predicted time, due to growing research and development activities. Moreover, growing novel formulations and the rising shift towards personalized therapies are also increasing their use.

How the Oral Solids Segment Dominated the Drug Delivery CDMO Market in 2025?

The oral solids segment led the market with an approximate 42.0% share in 2025, due to their high acceptance rates and ease of administration. These formulations offered enhanced stability and longer shelf life, which increased their production. Additionally, their wide range of applications also increased their outsourcing.

Injectables

The injectables segment is expected to show the fastest growth rate with an approximate 11.5% CAGR during the predicted time, due to the growing development of biologics and vaccines. The increasing incidence of chronic diseases are also increasing their innovations, leading to increased use of drug delivery CDMO.

Which Molecule Type Segment Held the Dominating Share of the Drug Delivery CDMO Market in 2025?

The small molecules segment held the dominating share of approximate 55% in the market in 2025, due to growth in their development and approval rates. Their broad therapeutic use and growth in generic product developments also increased their demand, driving the use of drug delivery CDMO services.

Biologics/Large Molecules

The biologics/large molecules segment is expected to show the highest growth with approximately 10.4% CAGR during the upcoming years, due to their growing clinical pipeline. The expanding outsourcing trends, increasing research and development activities, and patent expiration are also increasing the demand for drug delivery CDMOs.

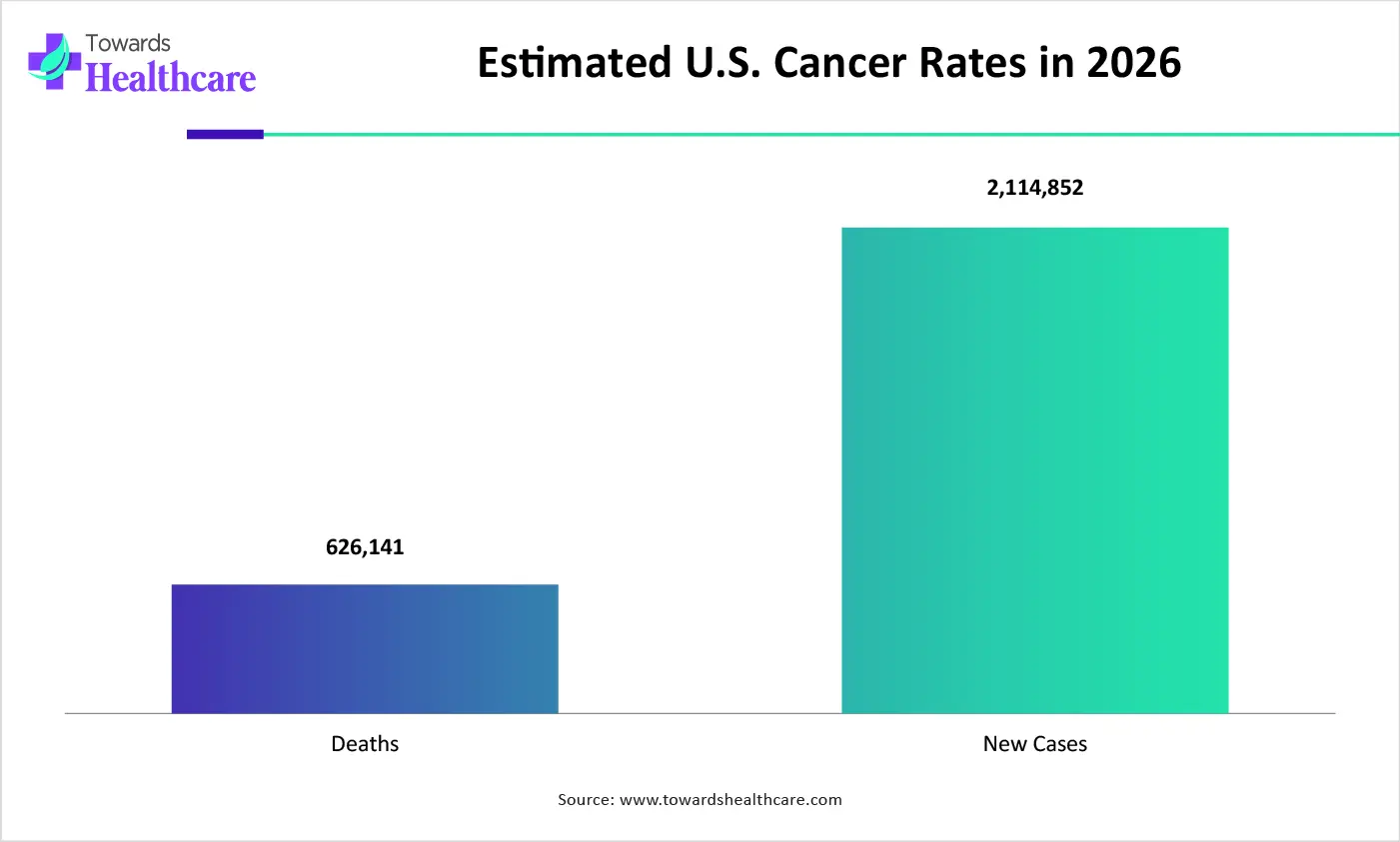

What Made Oncology the Dominant Segment in the Drug Delivery CDMO Market in 2025?

The oncology segment led the market with an approximate 36.5% share in 2025, due to growth in the cancer burden. This increased the oncology research and development activities supported by investments from various sources, which promoted the development of various therapeutic options and increased the use of drug delivery CDMO services.

Metabolic Disorders/GLP-1

The metabolic disorders/GLP-1 segment is expected to show the fastest growth rate with an approximate 13.8% CAGR during the upcoming years, due to increasing incidences of diabetes and obesity. This is encouraging the use of drug delivery CDMO services to develop various next-generation dual or triple receptor agonists and once-a-week injectables.

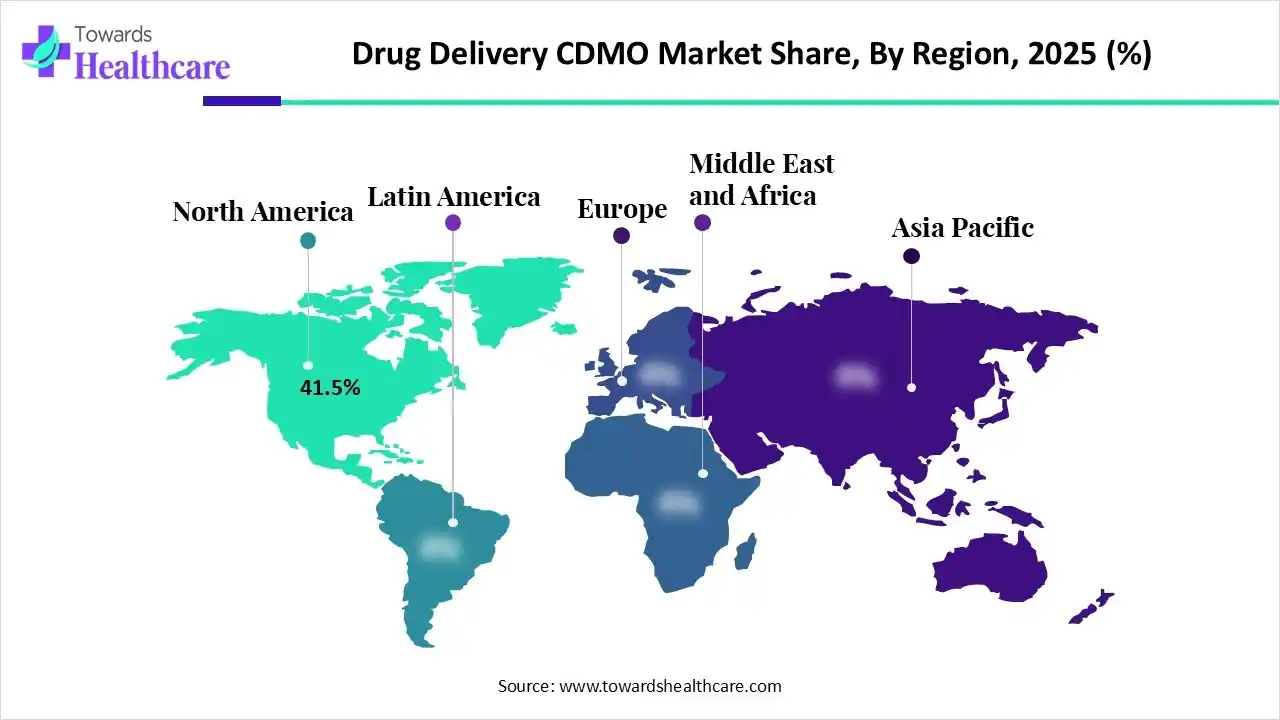

North America dominated the drug delivery CDMO market with approximate 41.5% in 2025, due to the presence of robust pharmaceutical and biotechnology companies. The growth in healthcare investments and advanced manufacturing infrastructure also increased the development of various complex therapies, driving the use of drug delivery CDMO, which contributed to the market growth.

U.S. Market Trends

The presence of robust industries and advanced manufacturing infrastructure in the U.S. is driving the development of new specialized therapies and biologics, which is increasing their outsourcing, driving the demand for drug delivery CDMOs. Additionally, stringent regulations and growing diseases are also increasing their demand.

Asia Pacific is expected to host the fastest-growing drug delivery CDMO market with an approximate 10.8% CAGR during the forecast period, driven by affordable manufacturing services. The expanding industries and healthcare sector are also increasing the adoption and development of various novel formulations and generic products, which is increasing the demand for drug delivery CDMO services, enhancing the market growth.

China Market Trends

The growing chronic disease in China is increasing the adoption of biologics, vaccines, and advanced therapies, promoting collaboration with drug delivery CDMOs. Moreover, growing research and development activities, outsourcing trends, technological advancements, and government initiatives are also increasing their demand.

Europe is expected to grow significantly in the drug delivery CDMO market during the forecast period, due to growth in the biologic and specialty drug development. The presence of well-developed pharma and biotech industries is also increasing their research and development activities, which is increasing the collaboration with drug delivery CDMOs, backed by investment, promoting the market growth.

UK Market Trends

The presence of strong research and development hubs in the UK is increasing the advancements in the biologics, cell and gene therapies, and vaccines, which is leading to the increased demand for drug delivery CDMOs. Additionally, robust regulatory frameworks and government initiatives are also increasing their use.

| Companies | Headquarters | Drug Delivery CDMO Services |

| Lonza Group AG | Basel, Switzerland | High-potency OSD, jet milling, and spray-dried dispersions |

| Catalent, Inc. | Somerset, U.S. | Softgel innovation, modified release technologies, and large-scale lipid-based delivery |

| Thermo Fisher Scientific | Waltham, U.S. | End-to-end oral solid dosage, next-gen on-body delivery systems, and sterile injectables |

| Samsung Biologics | Incheon, South Korea | Offers industrial-scale biologics |

| WuXi AppTec/WuXi Biologics | Shanghai, China | Integrated discovery-to-manufacturing services |

| Recipharm AB | Stockholm, Sweden | High-potency API manufacturing, smart device integration, and pulmonary delivery |

| Siegfried Holding AG | Zofingen, Switzerland | Offers ophthalmic and nasal delivery systems |

| Boehringer Ingelheim | Ingelheim am Rhein, Germany | Specialized high-volume fill finish services |

| Kindeva Drug Delivery | Woodbury, U.S. | Offers expertise for complex combination development |

| Piramal Pharma Solutions | Mumbai, India | High-potency API services, integrated sterile injectable manufacturing, and cancer drug delivery |

By Service Type

By Dosage Form

By Molecule Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026