February 2026

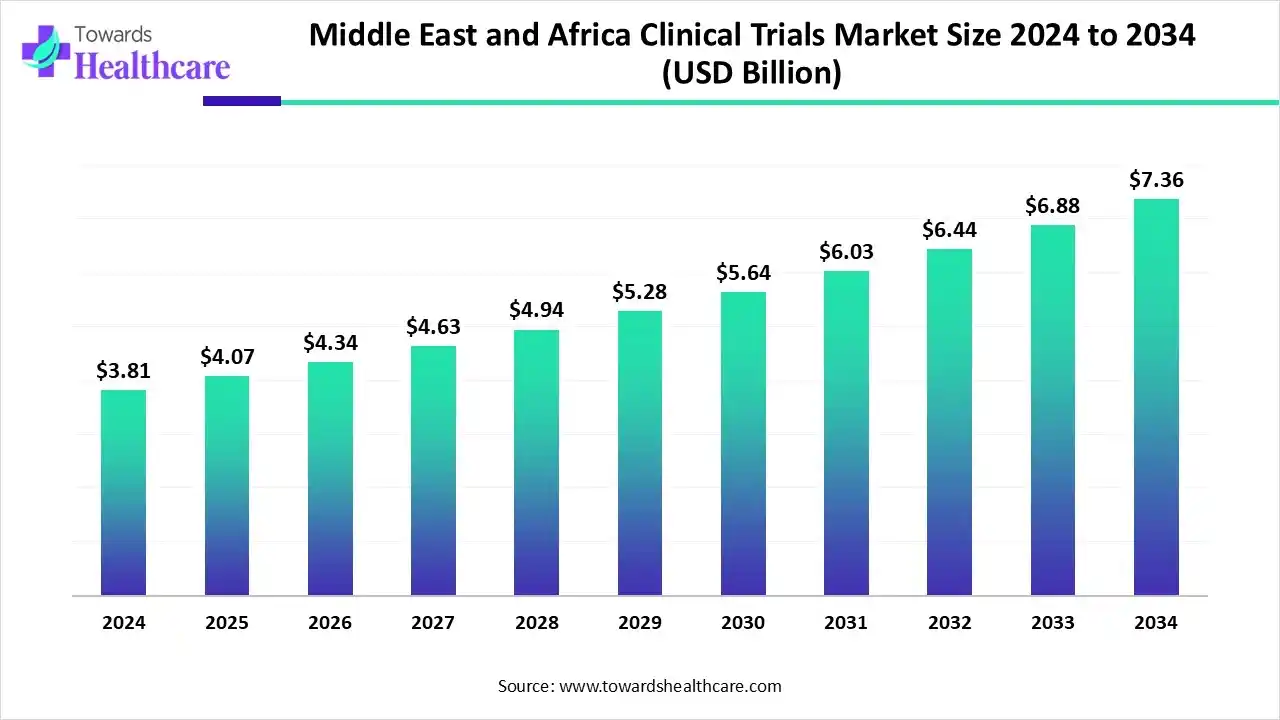

The Middle East and Africa clinical trials market size recorded US$ 2.81 billion in 2025, set to grow to US$ 4.07 billion in 2026 and projected to hit nearly US$ 5.79 billion by 2035, with a CAGR of 6.80% throughout the forecast timeline.

The Middle East and Africa clinical trials market is experiencing significant growth, driven by the rising prevalence of chronic and lifestyle diseases, expanding healthcare infrastructure, and supportive government regulations. The region attracts global pharmaceutical and biotechnology companies due to South Africa’s dominance, offering advanced medical facilities, skilled clinical research professionals, and a diverse patient population. Increasing collaborations with Contract Research Organizations, growing awareness among patients about clinical trials, and investment in research for HIV, tuberculosis, and non-communicable diseases further bolster the market’s expansion.

| Table | Scope |

| Market Size in 2025 | USD 2.81 Billion |

| Projected Market Size in 2035 | USD 5.79 Billion |

| CAGR (2025 - 2035) | 6.80% |

| Market Segmentation | By Phase, By Study Design, By Indication, By Country / Geography |

| Top Key Players | IQVIA, MCT CRO, Phoenix Clinical Research, Carexso, Neuralink (UAE-Prime Trial), Kilimanjaro Clinical Research Institute (Tanzania), National Institute for Medical Research (Tanzania), Amref Health Africa, Yemaachi Biotech (Ghana) |

The Middle East and Africa clinical trials market is driven by multiple factors, including the rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, the expansion of healthcare infrastructure, skilled clinical research professionals, supportive government regulations, and increasing collaborations with global pharmaceutical companies and CROs. Growing patient awareness and access to advanced treatments also contribute to higher trial participation rates.

Clinical trials are structured research studies conducted to evaluate the safety, efficacy, and side effects of new drugs, medical devices, or treatments in humans. They follow strict ethical and scientific guidelines, progressing through phases (Phase I–IV) to test dosage, effectiveness, and long-term outcomes. These trials are essential for drug approval, regulatory compliance, and evidence-based medical practice, often involving randomized controlled studies, observational research, or post-marketing surveillance to ensure comprehensive data collection and patient safety. They form the backbone of modern medical innovation and therapeutic development.

Digital and Decentralized Clinical Trials

The Middle East is increasingly adopting digital and decentralized clinical trials (DCTs), leveraging technologies like telemedicine, wearable devices, and mobile applications. These innovations enable remote patient monitoring, reducing the need for frequent site visits and enhancing patient recruitment and retention. For instance, in 2025, Qatar committed approximately US$2.5 billion under its “Digital Agenda 2030” to support AI and data initiatives, facilitating the growth of DCTs in the region.

Increased Focus on Rare and Chronic Diseases

There is a growing emphasis on clinical trials targeting rare and chronic diseases, such as cancer, diabetes, and cardiovascular disorders, due to their rising prevalence in the Middle East. In 2025, the UAE's roadmap to build a future-fit healthcare system highlighted the importance of innovation in precision health to tackle such diseases. The Danish pharmaceutical company Novo Nordisk (NOVOb.CO) C3 made its debut in South Africa with the introduction of its weight-loss medication Wegovy.

The Middle East is witnessing an increase in collaborations between local research institutions and global pharmaceutical companies, enhancing the region's clinical trial capabilities. These partnerships facilitate knowledge exchange, resource sharing, and access to advanced technologies. For instance, IQVIA's Global Health Week in Abu Dhabi in 2025 brought together global experts to discuss innovation in precision health and the use of advanced analytics.

Emphasis on Patient-Centric Approaches

There is a significant shift towards patient-centric approaches in clinical trials, focusing on improving patient engagement, experience, and retention. In 2025, the Middle East Summit emphasized digital health as a priority, with patient engagement and experience initiatives being central aspects of digital health strategies. Additionally, case studies presented at the Clinical Trials Congress 2025 illustrated how patient-centric approaches enhance satisfaction, data quality, and trial success rates.

AI integration can significantly enhance the Middle East and Africa clinical trials market by improving patient recruitment, trial design, and real-time data analysis. Advanced algorithms help identify suitable participants faster, predict potential outcomes, and monitor patient responses efficiently. AI-driven analytics optimize resource allocation, reduce trial timelines, and minimize errors.

Artificial Intelligence and data analytics are transforming clinical trial operations in the Middle East by improving data collection, patient recruitment, and real-world evidence monitoring. In October 2025, AstraZeneca entered a US$555 million deal with Algen Biotechnologies to jointly develop gene-editing therapies using CRISPR technology, showcasing the integration of AI in drug development.

| Trial / Initiative | Sponsor / Organizer | Country / Sites | Phase / Type | Therapeutic area | Start (yr/mo) |

| UAE-PRIME (Neuralink feasibility study) | Neuralink, in collaboration with the Cleveland Clinic Abu Dhabi | UAE (Abu Dhabi) | Feasibility / Early human study | Brain-computer interface (motor/speech impairment) | May 2025 |

| Large Phase 1/2 oncology programme (Ellipses Pharma) | Ellipses Pharma | UAE (multiple sites reported) | Phase 1/2 | Oncology (early-stage cancer therapies) | Dec 2024 (inaugurated) |

| Ebola (Sudan-strain) vaccine trial (contact-based study) | WHO / international partners / Makerere Lung Institute | Uganda (African site) | Interventional vaccine trial | Infectious disease (Ebola — Sudan strain) | Feb 2025 (launched) |

| African COVID-vaccine & platform coordination (CONCVACT / Africa CDC) | Africa CDC consortium (CONCVACT) | Multiple African countries (coordinated network) | Program / multi-site trials & capacity building | Vaccines (COVID and other priorities) | 2024–2025 (acceleration in 2025) |

| African-PREDICT (cardio-metabolic cohort / ongoing research) | Academic consortium (South Africa leads) | South Africa (and regional collaborators) |

Observational/ longitudinal study (ongoing) |

Hypertension / cardiovascular research | Ongoing (registered earlier; active through 2024–25) |

| Regional vaccine trial & manufacturing enabling projects | National governments + WHO/industry (various) | Africa (Rwanda, Morocco, etc.) | Trials + manufacturing scale-up programs | Vaccines (malaria, COVID-related, mpox support) | 2024–2025 (rollouts & pilot trials) |

| Multiple oncology and biologics Phase II–III trials with MEA sites | Global pharma / CROs (e.g., sponsors running global trials with MEA sites) | South Africa, Egypt, UAE, Morocco (selected sites) | Phase II / III (multi-center) | Oncology, immunotherapy | 2024–2025 (sites added to global programs) |

The phase 3 segment dominates the market due to its critical role in evaluating drug efficacy and safety in large patient populations. High prevalence of chronic diseases, well-established clinical infrastructure, and increasing participation in late-stage trials by global pharmaceutical companies further drive the prominence of Phase III studies.

The phase 2 segment is anticipated to be the fastest-growing in the Middle East and Africa clinical trials market due to the increasing focus on assessing the efficacy and safety of new drugs in targeted patient populations. The rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer drives demand for innovative therapies, necessitating more Phase II studies.

The interventional study segment is dominating as well as fastest fastest-growing segment in the market due to its critical role in evaluating new drugs, medical devices, and treatment protocols under controlled conditions. These studies allow researchers to actively administer interventions and closely monitor patient responses, generating high-quality, actionable data. The segment benefits from the region’s well-established hospitals, skilled clinical research professionals, and supportive regulatory frameworks, which facilitate efficient trial conduct.

The oncology segment is both the dominant and fastest-growing segment in the market due to the rising prevalence of cancer and increasing demand for innovative therapies. Advanced hospitals and research centers in countries like South Africa and the UAE support complex oncology trials. Global pharmaceutical companies are investing heavily in targeted cancer therapies, immunotherapies, and precision medicine, often collaborating with local institutions.

South Africa dominates the Middle East and Africa clinical trials market due to its well-established healthcare infrastructure, advanced medical facilities, and experienced clinical research workforce, which provide an ideal environment for high-quality studies. The country’s robust regulatory framework and ethical guidelines enable smooth trial approvals, attracting multinational pharmaceutical and biotechnology companies. A diverse patient population allows comprehensive data collection across various demographics, while strategic partnerships with global Contract Research Organizations (CROs) facilitate efficient trial execution.

Major investors include Pfizer, Novartis, Roche, Johnson & Johnson, and GlaxoSmithKline, which fund advanced clinical research across oncology, infectious diseases, and chronic conditions. Additionally, regional CROs like IQVIA, Parexel, and MCT CRO receive significant backing to expand trial operations. These investors provide financial support, technological infrastructure, and expertise, enabling South Africa to attract multinational trials, accelerate drug development, and strengthen its position as the leading hub for clinical research in Africa.

The UAE is a notably growing region in the clinical trials market due to government support, advanced healthcare infrastructure, and strategic partnerships with global pharmaceutical companies. Major investors such as Pfizer, Novartis, Roche, IQVIA, and Parexel are funding trials in oncology, infectious diseases, and chronic conditions. These investments, combined with skilled professionals and regulatory facilitation, drive the UAE’s rapid growth in clinical research.

Saudi Arabia is growing at a considerable rate in the Middle East and Africa clinical trials market due to strong government initiatives, significant healthcare investments, and supportive regulatory frameworks. The country’s focus on modernizing hospitals, developing specialized research centers, and attracting global pharmaceutical companies has enhanced trial capabilities. Additionally, the rising prevalence of chronic and lifestyle diseases, coupled with collaborations with Contract Research Organizations (CROs), ensures efficient trial execution and strengthens Saudi Arabia’s position in the regional clinical research landscape.

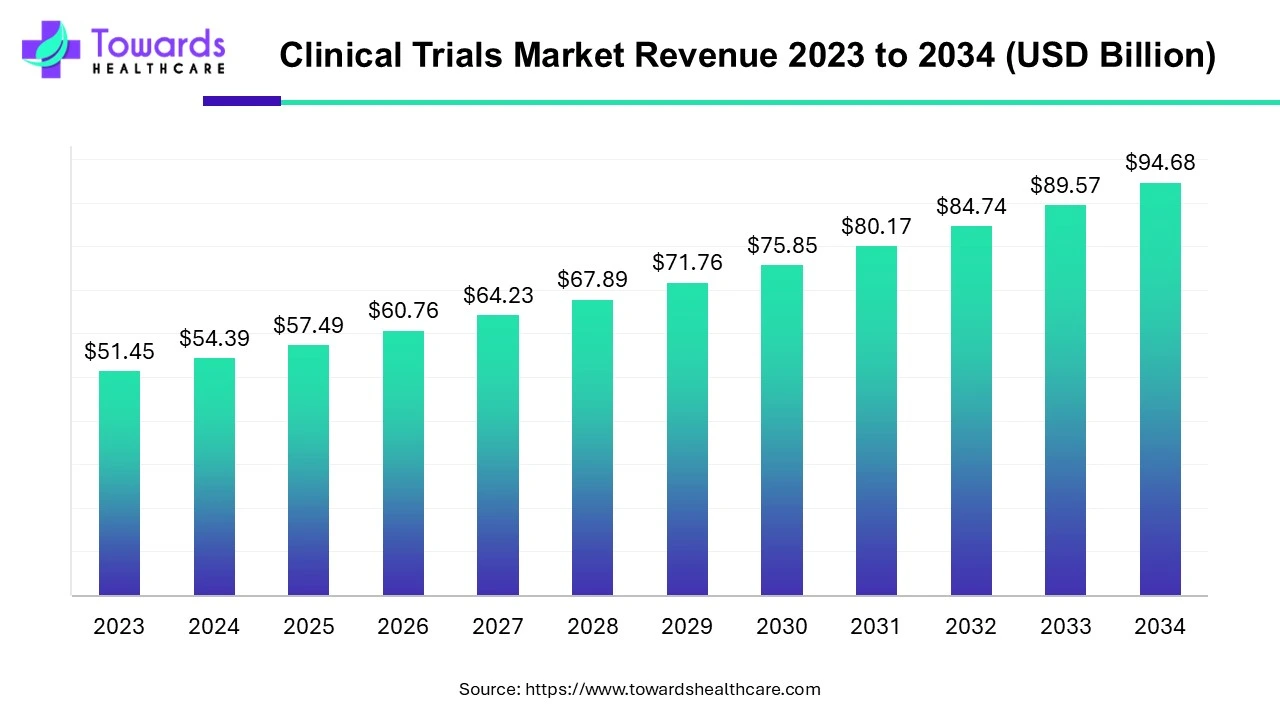

The global clinical trials market is valued at USD 98.91 billion in 2026 and is projected to reach USD 174.18 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.7% over the forecast period from 2026 to 2035.

Middle East

A global leader in data analytics and clinical research, IQVIA offers comprehensive R&D solutions across the MEA region, leveraging advanced technology and analytics to support healthcare advancements.

Based in the MEA region, MCT CRO has conducted over 300 clinical trials across more than 35 countries, specializing in regulatory processes, patient recruitment, and site management.

An ISO-accredited full-service Contract Research Organization (CRO) in the MENA region, Phoenix CR offers services in medical writing, biostatistics, pharmacovigilance, and project management.

A Clinical Site Management Organization (CSMO) in the MEA region, Carexso focuses on optimizing clinical trial processes through data, analytics, and innovative technologies, managing all aspects from recruitment to result curation.

Elon Musk's Neuralink, in collaboration with the Cleveland Clinic, launched its first international clinical trial in Abu Dhabi, focusing on brain-computer interface technology for individuals with motor and speech impairments.

IAVI partners with over 40 research centers across 14 African countries, conducting vaccine trials for HIV, tuberculosis, and emerging infectious diseases, adhering to international standards.

Based in Moshi, Tanzania, KCRI is a medical research institute integrated with the Kilimanjaro Christian Medical Centre, focusing on clinical research in various health domains.

NIMR is dedicated to advancing health research and enhancing public health in Tanzania, conducting a wide range of health research areas.

A Kenyan-based non-governmental organization, Amref Health Africa, provides community and environmental healthcare to countries in Africa, focusing on health systems strengthening and clinical research.

Yemaachi Biotech aims to build Africa's largest cancer database based on genetic and clinical information from up to 7,500 patients, contributing to drug discovery and treatment research.

By Phase

By Study Design

By Indication

By Country / Geography

February 2026

February 2026

February 2026

February 2026