December 2025

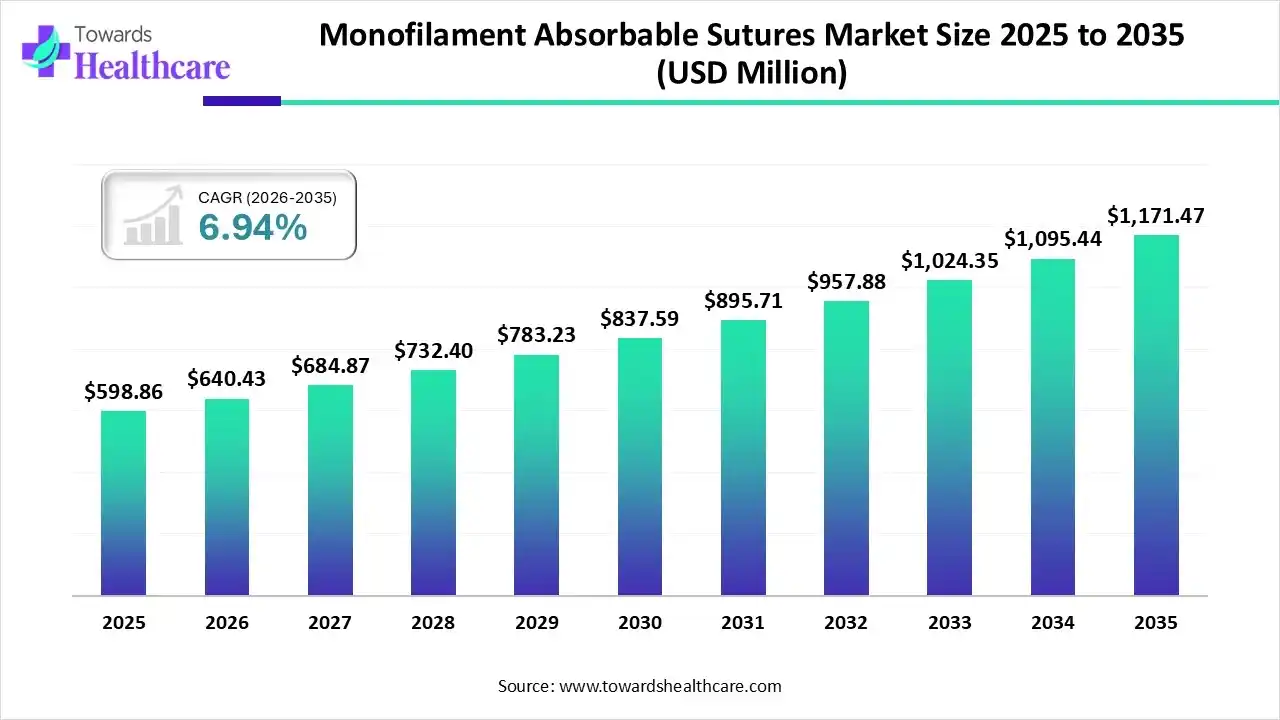

The global monofilament absorbable sutures market size was estimated at USD 598.86 million in 2025 and is predicted to increase from USD 640.43 million in 2026 to approximately USD 1171.47 million by 2035, expanding at a CAGR of 6.94% from 2026 to 2035.

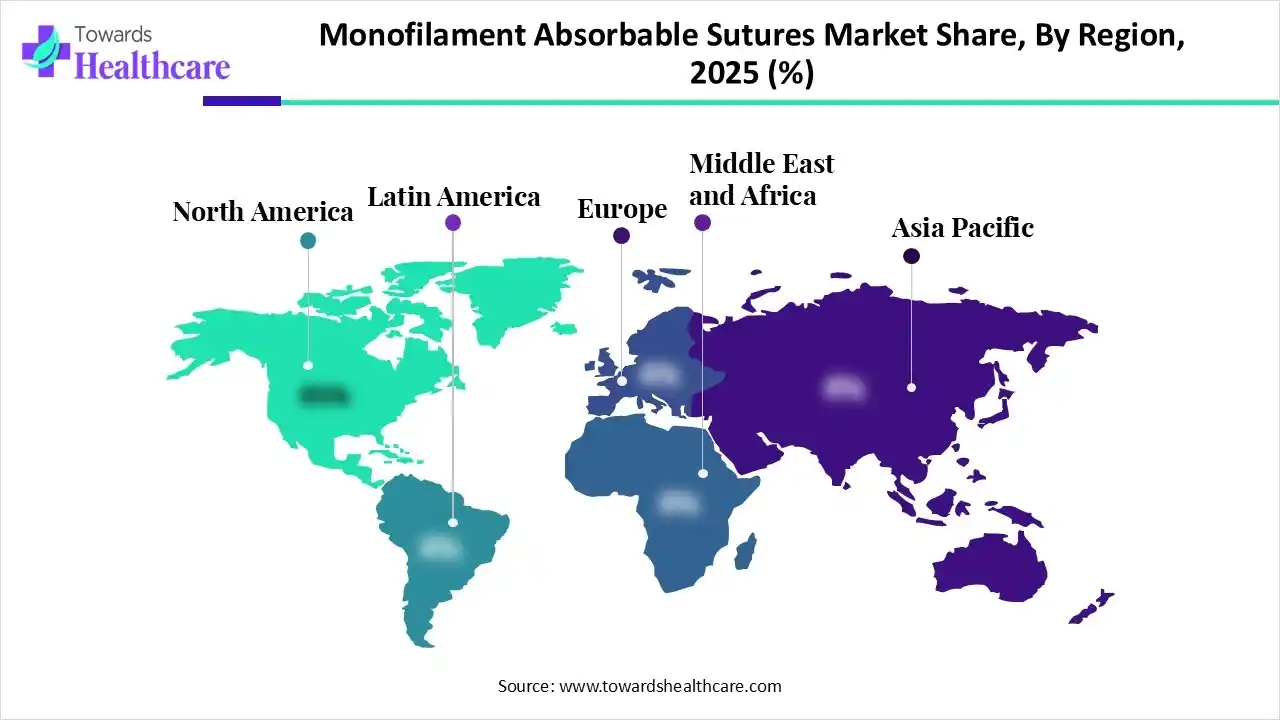

The monofilament absorbable sutures market is witnessing steady growth, driven by rising surgical procedure volumes, increasing preference for minimally invasive surgeries, and growing demand for advanced wound-closure solutions. These sutures offer reduced infection risk, smooth tissue passage, and predictable absorption, making them widely adopted across surgeries. North America leads the market, supported by a well-established healthcare infrastructure, rapid adoption of advanced surgical technologies, strong reimbursement frameworks, and the presence of leading medical device manufacturers and research-driven innovations.

| Key Elements | Scope |

| Market Size in 2026 | USD 640.43 Million |

| Projected Market Size in 2035 | USD 1171.47 Million |

| CAGR (2026 - 2035) | 6.94% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application, By End-User, By Region |

| Top Key Players | Ethicon (Johnson & Johnson), Medtronic plc, B. Braun Melsungen AG, Smith & Nephew plc, Teleflex Incorporated, Peters Surgical, DemeTECH Corporation, Sutures India Pvt. Ltd., Assut Medical |

Monofilament absorbable sutures are surgical sutures made from a single, smooth strand of biodegradable material that is gradually broken down and absorbed by the body after wound healing. Their monofilament structure allows easy passage through tissue, minimizes tissue trauma, and reduces the risk of bacterial adherence and infection compared to braided sutures. These sutures are commonly used in internal soft-tissue approximation, minimally invasive procedures, and surgeries where suture removal is undesirable.

The market is driven by increasing surgical volumes, rising preference for minimally invasive procedures, increasing focus on infection control, and technological advancements in biodegradable suture materials, especially in well-developed healthcare systems such as North America.

AI integration can significantly impact the monofilament absorbable sutures industry by improving product design, manufacturing precision, and clinical outcomes. Machine-learning algorithms can optimize polymer composition and tensile strength to ensure consistent absorption rates and superior knot security. AI-enabled quality control systems can detect micro-defects during production, reducing failure risks and waste. In surgical settings, AI-driven imaging and robotics can support precise suture placement, minimizing tissue trauma and infection risk. Additionally, predictive analytics can help manufacturers forecast demand, streamline supply chains, and accelerate innovation, ultimately enhancing efficiency, reliability, and patient safety across surgical procedures.

The growing adoption of minimally invasive and laparoscopic procedures is driving demand for monofilament absorbable sutures, as they offer smooth tissue penetration, reduced trauma, and predictable absorption, supporting faster healing and lower postoperative complication rates.

Healthcare providers are increasingly prioritizing infection control, boosting demand for monofilament absorbable sutures due to their single-strand structure, which minimizes bacterial adherence and lowers the risk of surgical site infections compared to braided alternatives.

An aging population, growing epidemiology of chronic diseases, and increasing trauma and orthopedic cases are contributing to higher surgical volumes, directly supporting sustained demand for reliable, absorbable wound-closure solutions across multiple surgical specialties.

Ongoing innovation in polymer science is allowing the development of sutures with improved tensile strength, controlled absorption profiles, and enhanced knot security, increasing surgeon confidence and expanding clinical applications for monofilament absorbable sutures.

Improving healthcare infrastructure, expanding access to surgical care, and increasing healthcare expenditure in emerging economies are expected to create new growth opportunities, supporting wider adoption of monofilament absorbable sutures in hospital and ambulatory settings.

North America is expected to maintain market leadership due to high procedure volumes, early adoption of advanced surgical products, strong regulatory standards, and the presence of major medical device manufacturers, which drive consistent product demand.

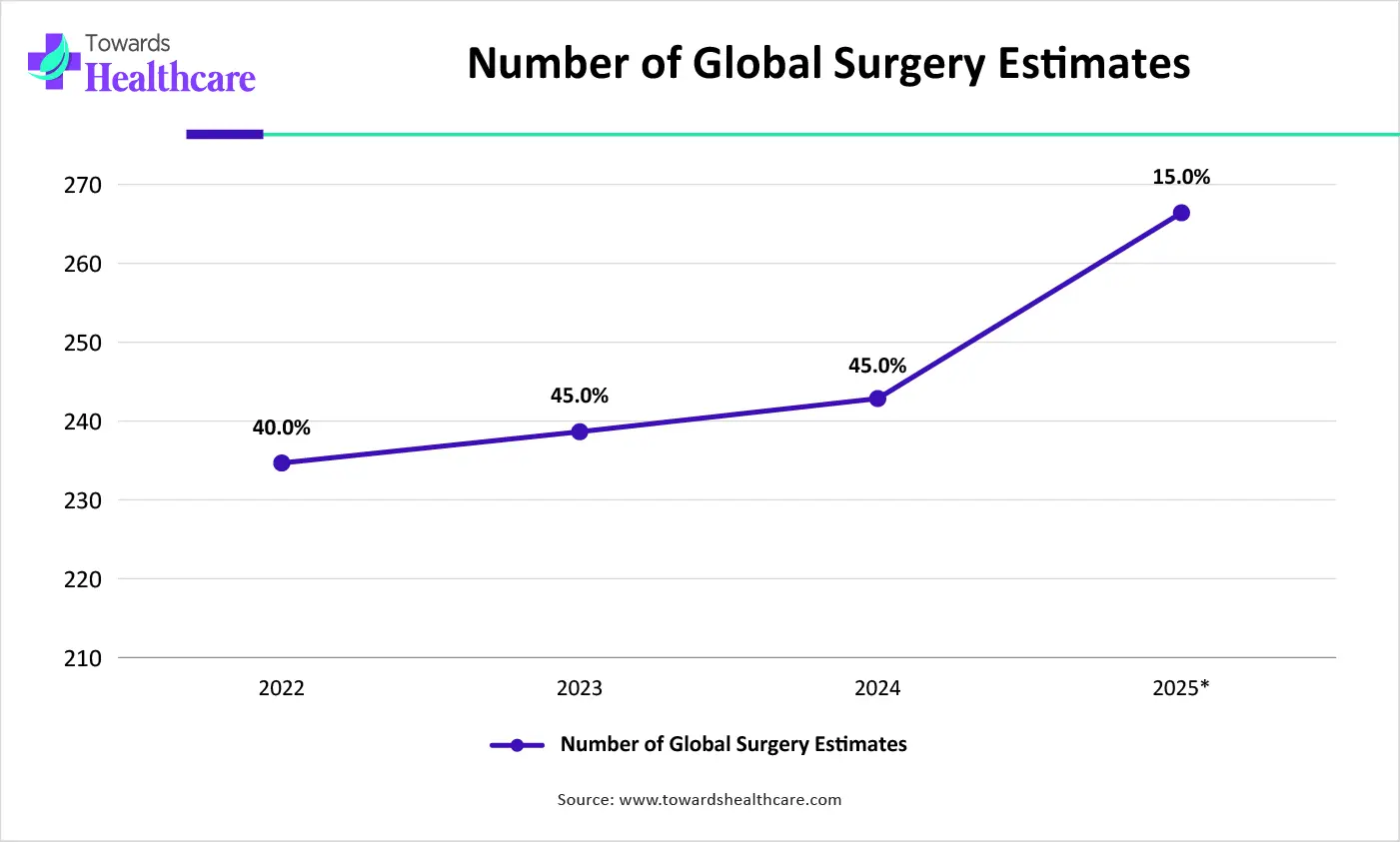

| Year | Global Surgery Estimates |

| 2022 | 236 |

| 2023 | 238 |

| 2024 | 245 |

| 2025* | 267 |

Which Type Segment Dominated the Monofilament Absorbable Sutures Market?

The synthetic segment is the dominant segment in the market due to its superior tensile strength, consistent absorption rates, and lower inflammatory response. These attributes enhance surgical performance and wound healing reliability. Additionally, synthetic sutures offer predictable handling, reduced infection risk, and greater surgeon preference across complex and minimally invasive procedures, driving strong adoption.

Natural

The natural segment is estimated to be the fastest-growing segment in the monofilament absorbable sutures market due to increasing demand for biocompatible and easily absorbable materials in soft-tissue surgeries. Its favorable healing profiles, broad clinical acceptance, and cost advantages in emerging healthcare markets drive rapid adoption, particularly in general surgery and resource-limited settings.

Why Did the Orthopedics Segment Dominate the Monofilament Absorbable Sutures Market?

The orthopedics segment is the dominant segment in the market due to high surgical volumes, frequent tendon and ligament repair procedures, and the need for strong yet absorbable closure materials. Their reliable tensile strength, reduced tissue reaction, and predictable absorption make them preferred in complex musculoskeletal surgeries.

Cardiology

The cardiology segment is anticipated to be the fastest-growing segment in the monofilament absorbable sutures market due to rising cardiovascular procedures and a growing preference for sutures that minimize foreign body presence. Their predictable absorption, reduced inflammatory response, and reliable tissue support enhance outcomes in delicate cardiovascular surgeries, driving accelerated adoption.

Which End User Segment Led the Monofilament Absorbable Sutures Market?

The hospitals & ASCs segment is the dominant segment in the market due to high volumes of surgical procedures performed in these settings, well-established procurement practices, and preference for reliable wound-closure materials. Their advanced infrastructure, skilled surgical teams, and focus on quality care drive consistent demand for absorbable sutures.

Specialty Clinics

The specialty clinics segment is anticipated to be the fastest-growing segment in the monofilament absorbable sutures market due to rising outpatient surgical procedures, increasing focus on targeted and minimally invasive treatments, and expanding access to specialized care. Quick recovery priorities, streamlined workflows, and growing patient preference for clinic-based interventions boost demand for absorbable sutures.

North America dominated the monofilament absorbable sutures market in 2025 due to its advanced healthcare infrastructure, high surgical procedure volumes, and early adoption of innovative wound-closure technologies. Strong reimbursement systems, strict regulatory standards ensuring product quality, and the presence of leading medical device manufacturers further support widespread usage across hospitals and ambulatory surgical centers in the region.

The U.S. is the dominant country in the North America monofilament absorbable sutures market due to high surgical volumes, widespread adoption of advanced surgical techniques, and strong hospital and ASC infrastructure. Favorable reimbursement policies, strict quality standards, and the presence of major medical device manufacturers further drive consistent demand.

Asia Pacific is estimated to host the fastest-growing market during the forecast period. The expanding healthcare infrastructure, rising surgical procedure volumes, growing access to advanced medical care, and increasing healthcare spending. Rapid urbanization, rising chronic diseases, and the expanding presence of global and local manufacturers further drive adoption across emerging markets.

China is the dominant country in the Asia‑Pacific monofilament absorbable sutures market due to its large patient population, rapidly expanding healthcare infrastructure, and increasing number of surgical procedures. Supportive government healthcare initiatives, rising medical device investments, and the presence of both domestic and international manufacturers further strengthen the country’s leadership in the region.

Europe is expected to grow at a significant CAGR in the monofilament absorbable sutures market during the forecast period. Due to rising surgical procedure volumes, increasing adoption of minimally invasive and advanced wound‑closure technologies, and supportive healthcare infrastructure. High awareness of infection control, strong regulatory standards, and the presence of key medical device manufacturers further drive market expansion across the region.

The UK is the dominant country in the Europe monofilament absorbable sutures market due to its advanced healthcare infrastructure, high number of surgical procedures, and early adoption of innovative surgical technologies. Strong regulatory frameworks, well-established hospital networks, and the active presence of key medical device manufacturers further support widespread usage and market leadership.

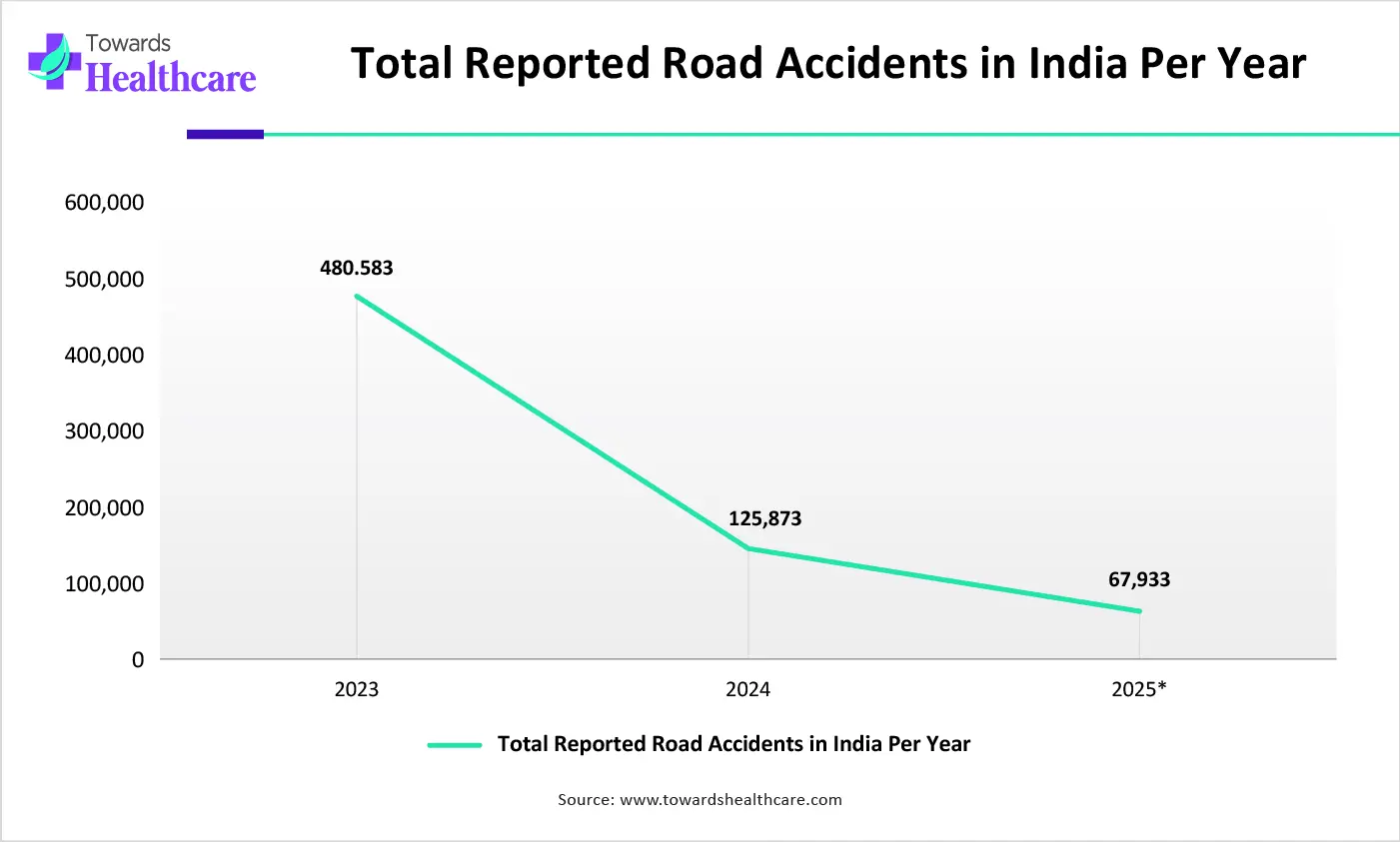

| Year | Number of Road Accidents in India Per Year |

| 2023 | 480,583 |

| 2024 | 125,873 |

| 2025 (Jan-Jun) | 67,933 |

| Company | Key Monofilament Absorbable Suture Offerings / Focus | Headquarters |

| Ethicon (Johnson & Johnson) | Monocryl, PDS, PROLENE monofilament absorbable sutures | U.S. |

| Medtronic plc | CAPROSYN, PDS II, SURGILOOP absorbable sutures | Ireland |

| B. Braun Melsungen AG | MONOSYN, PREMIODE, SAFIL Blue absorbable sutures | Germany |

| Smith & Nephew plc | Specialized absorbable sutures tailored to orthopedic and sports medicine | UK |

| Teleflex Incorporated | Absorbable monofilament products are complementary to vascular and general surgery portfolios. | U.S. |

| Peters Surgical | Standard and advanced absorbable sutures for general and specialty surgery. | France |

| DemeTECH Corporation | Cost-competitive absorbable monofilament sutures | U.S. |

| Surgical Specialties Corporation | Absorbable monofilament sutures for varied surgical applications | U.S. |

| Sutures India Pvt. Ltd. | Monofilament absorbable sutures (including ophthalmic, general surgery options) | India |

| Assut Medical | Absorbable monofilament sutures are used across specialties | Switzerland |

By Type

By Application

By End-User

By Region

December 2025

December 2025

December 2025

November 2025