December 2025

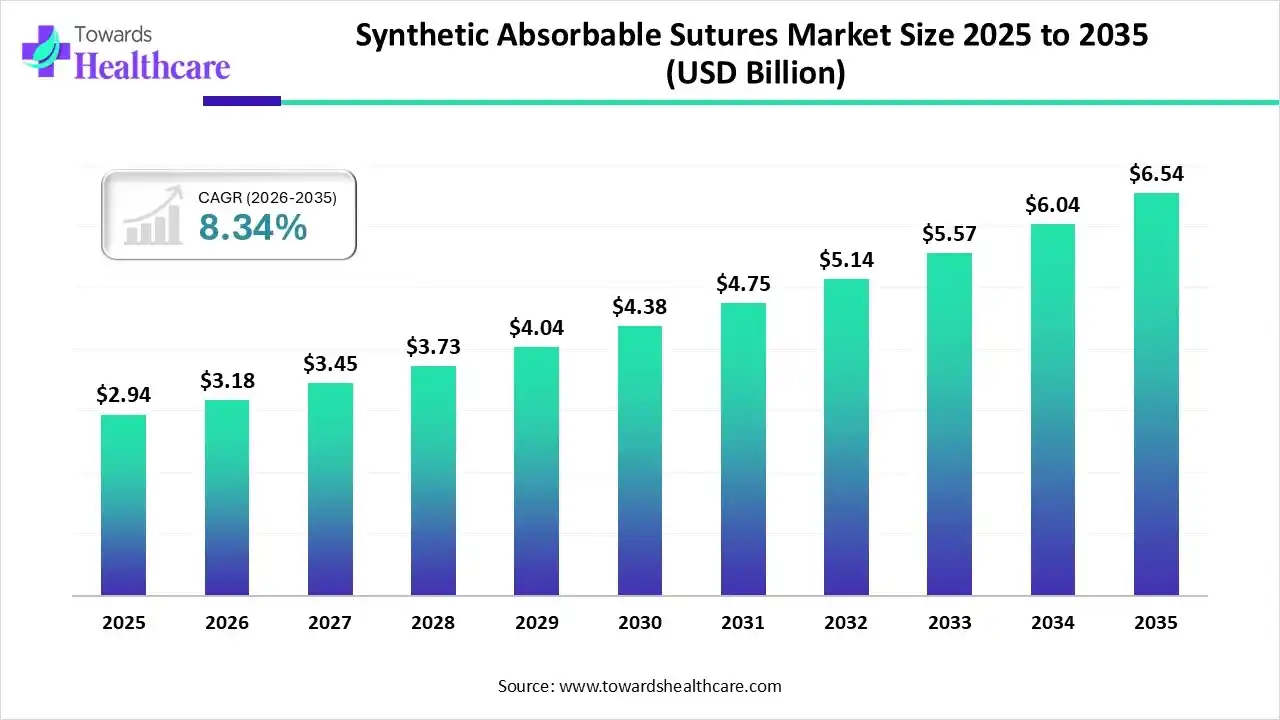

The global synthetic absorbable sutures market size was estimated at USD 2.94 billion in 2025 and is predicted to increase from USD 3.18 billion in 2026 to approximately USD 6.54 billion by 2035, expanding at a CAGR of 8.34% from 2026 to 2035.

With a substantial rise in chronic disease cases, mainly in diabetes, cancer, and CVD, demand for minimally invasive procedures, such as absorbable sutures. Prominently, the widespread researchers are posing the development of monofilament solutions, smart sutures that contain advanced sensors. Also, the market is highly leveraging composite materials, nanotechnology, and effective drug-eluting sutures, customising their properties.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.18 Billion |

| Projected Market Size in 2035 | USD 6.54 Billion |

| CAGR (2026 - 2035) | 8.34% |

| Leading Region | North America |

| Market Segmentation | By Product, By Material, By Application, By End-user, By Region |

| Top Key Players | Johnson & Johnson Services, Inc., DemeTECH Corporation, Dolphin Sutures, Lotus Surgicals Pvt Ltd, Medtronic, Suture Planet, Medico, Healthium Medtech Limited, ORION SUTURES INDIA PVT. LTD. |

Sutures are dissolvable stitches made from polymers, such as PGA, Polyglactin 910, PDS, and Monocryl. They follow a water-based process, and future offers effective internal wound support with minimal inflammation, which is known as the synthetic absorbable sutures market. The rising volume of surgeries kindly fuels this market due to the geriatric populations & several chronic conditions, as well as a rise in preference for minimally invasive procedures and breakthroughs in material science. In 2025, researchers are pushing the development of "smart" sutures with embedded sensors or shape-memory polymers for tracking the wound healing process in real-time or to self-tighten in response to the body's environment.

Specifically, the diverse application of AI around the globe is leveraging major advances in this market. AI has a key role in research & development to speed up the discovery of new, performance-optimized synthetic polymers with customized degradation rates and strengthened biocompatibility. Along with this, one of the substantial efforts in 2025 is the adoption of AI in robot-driven surgery for automated suturing, which helps in the analysis of real-time imaging and data to guide needle placement. Medtronic and Ethicon (Johnson & Johnson) are widely using integrated AI in their surgical systems to boost precision.

The market players are exploring novelty in the prevention of Surgical Site Infections (SSIs) by fostering antimicrobial-coated sutures, especially triclosan, which has a higher demand and expansion.

Moreover, the globe is encouraging the development of novel composite materials, with raised absorption, drug-eluting sutures, and the inclusion of nanofiber technology for tailored diameters and wider properties.

In the future, researchers will study sutures having shape-memory & self-tightening properties to offer properly sized forces, optimize knot stability, and lower the complexity of traditional knotting, mainly in minimally invasive surgeries.

Alongside, the firms will step into the use of poly-4-hydroxybutyrate (P4HB) and chitosan-based polymers to leverage accelerated biocompatibility, predictable absorption profiles, and tunable mechanical properties.

In December 2025, it partnered with Northern Virginia Oral, Maxillofacial & Implant Surgery.

In September 2025, a firm raised a €10 million extension of its oversubscribed €35 million Series C financing round to revolutionize colorectal surgery.

In September 2025, it collaborated with Telix Pharmaceuticals Limited to focus on widening the progression of advanced training models, with escalated integration of cutting-edge radio-guided surgical technologies.

In August 2025, they partnered with SMSIMSR to unveil South India’s premier robotic cardiac surgery & training hub.

In June 2025, a developer received an investment from Welsh, Carson, Anderson & Stowe (WCAS) to evolve and operate high-quality, patient-centric ambulatory surgery centers (ASCs).

Which Product Led the Synthetic Absorbable Sutures Market in 2025?

The multifilament/braided segment captured the biggest revenue share of the market in 2025. Particular properties are rougher, braided surface grips better, enabling secure knots that resist loosening, which is vital for ligatures and high-tension closures. Recently, the major development comprises new diacetyl chitin-based multifilament sutures that demonstrate promise in retaining substantial strength and encouraging faster tissue regeneration, with complete absorption in about 42 days.

Monofilament

In the coming era, the monofilament segment is predicted to register the fastest growth in the synthetic absorbable sutures market. They have various benefits, such as minimal infection risk through the smooth surface, preventing bacterial harborage, less tissue drag/trauma, and predictable absorption via hydrolysis. The latest example is P4HB (Poly-4-hydroxybutyrate), with the brand name MonoMax, developed through a unique fermentation process, to omit metal catalysts and lower tissue reaction. In 2025, a study displayed the use of curcumin-loaded, titanium dioxide (TiO2)-reinforced chitosan sutures, which raise tensile strength and antibacterial activity.

How did the Polyglactin 910 Segment Dominate the Market in 2025?

In 2025, the polyglactin 910 segment registered dominance in the synthetic absorbable sutures market. As it has outstanding handling, predictable strength loss, less tissue reaction, and versatile absorption rates (fast or standard) is assisting its wide range of adoption among the manufacturers and healthcare systems. In 2025, manufacturers, like Dolphin Sutures, have established Petcryl 910, and Suture Planet made Netcryl with consistent features, including an absorbable coating to ensure smooth tissue passage and knot placement.

Poliglecaprone 25

Whereas, the poliglecaprone 25 segment is anticipated to grow rapidly in the coming era. It has a prominent advantage in plastic surgery due to creating fine surgical scars, superior to non-absorbable sutures. Now, it is known by brands called MONOCRYL (Ethicon/J&J MedTech) and Petcryl Mono (Dolphin Sutures). Researchers used a subcuticular stitch with poliglecaprone 25 absorbable suture to interrupt the mattress stitch with polyamide (non-absorbable) suture for Pfannenstiel skin closure after C-sections.

Which Application Dominated the Synthetic Absorbable Sutures Market in 2025?

In 2025, the orthopedics segment held the largest share of the market. The segment is mainly driven by the growing orthopedic surgeries (knees, hips), ageing populations, and emphasis on infection control. The market explored biocomposite suture anchors by combining synthetic polymers with bioactive ceramics, such as 𝛽-tricalcium phosphate or hydroxyapatite. This further bolsters bone integration (osteoconduction) and resorbs gradually, and also facilitates a balance of strength and biological performance in ligament and tendon repairs.

Cardiology

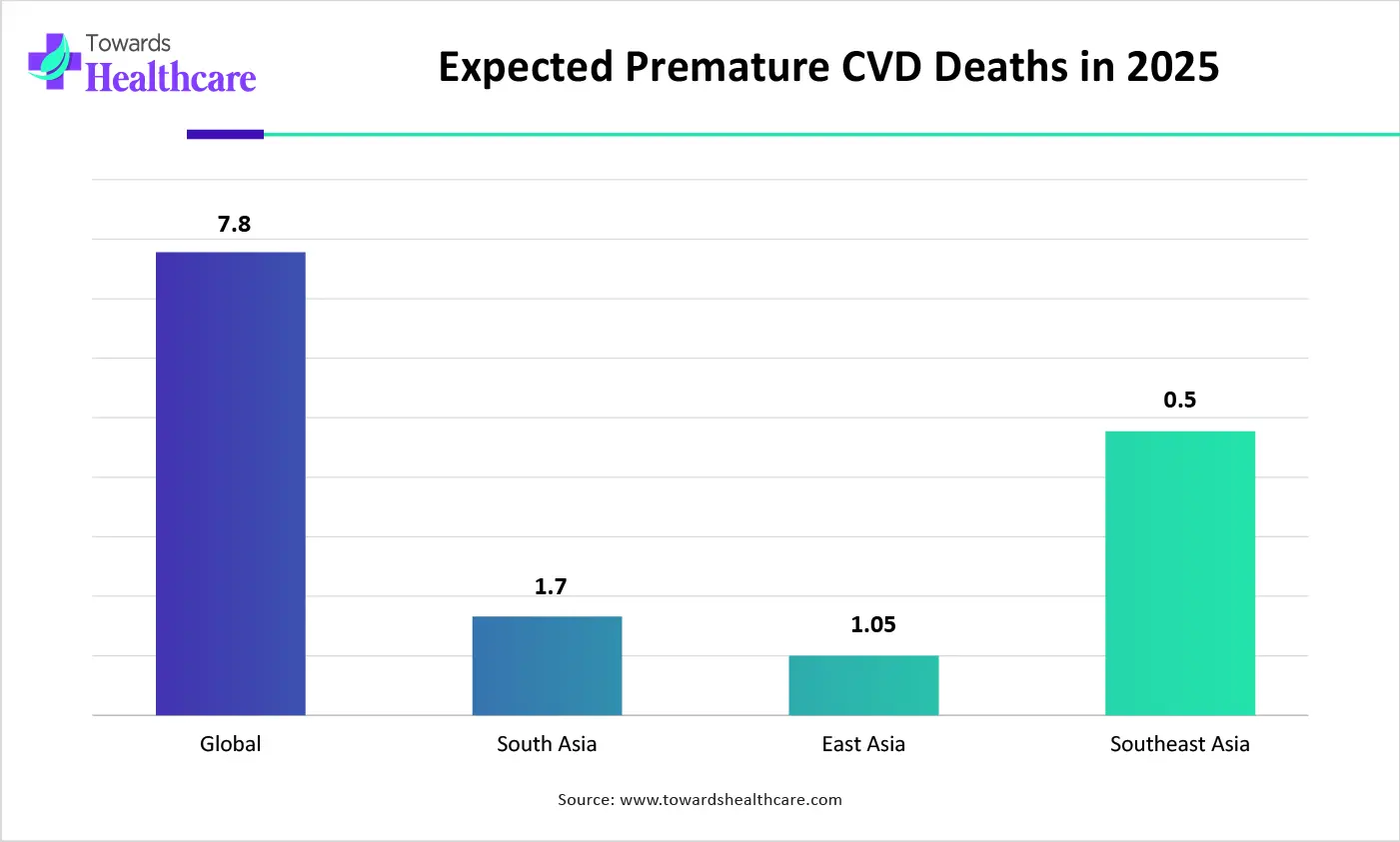

The cardiology segment is estimated to grow at the fastest CAGR. Globally rising CVD (heart failure, CAD) rates are resulting in deaths that are increasingly demanding advanced surgical sutures. Nowadays, researchers are engineering with specific, predictable absorption rates to meet the healing timeline of cardiac tissues and ensure robust assistance without long-term foreign material presence.

What Made the Hospitals & ASCs Segment Dominant in the Market in 2025?

The hospitals & ASCs segment led the market with the biggest share of the synthetic absorbable sutures market in 2025. It is primarily propelled by the increasing general, orthopedic, gynaecological, and cardiovascular surgeries, and the accelerating need for the MIS and laparoscopic procedures. They are broadly using the recently FDA-approved Suture-TOOL System (Suturion AB) for abdominal wall closure after laparotomy in adult patients, as it is a single-use, suture applicator system, pre-mounted with a polydioxanone (PDO) resorbable suture.

Specialty Clinics

In the prospective period, the specialty clinics segment is predicted to expand rapidly. Advantages of these clinics are the elimination of suture removal, minimal patient visits, and alignment with high-volume, short-stay models. The market emphasises enhancing surgeons' experience, with advancements, like low-memory racetrack packaging and strengthened needle coatings, such as RediPass coating from MYCO Medical, for ensuring smooth tissue passage and easy handling during accurate procedures in clinics.

In the synthetic absorbable sutures market, North America captured a dominant share in 2025, due to the rise of patients with diabetes, cancer, CVD, especially among the geriatric population, & expanding preference for minimally invasive procedures. The region is encouraging the development of self-anchoring or barbed sutures to skip the need for knots, with lowered closure time, particularly in laparoscopic and robotic-assisted surgeries. In 2025, Johnson & Johnson's Ethicon brand launched its innovative barbed sutures for laparoscopic hysterectomies, having minimal operating time.

Besides this, the U.S. market is putting efforts into executing more sophisticated surgical solutions among its healthcare systems,

As the Asia Pacific is a centre of diverse chronic disease prevalence, it will support expanding it at the highest CAGR. Also, there is the escalating medical tourism, especially in India and South Korea, which is fueling demand for high-quality surgical supplies. At the same time, India’s local manufacturers are immensely involved in scaling up production of materials, specifically polypropylene and polyglactin, to lower reliance on imports.

On the other hand, South Korea is also enhancing its domestic manufacturing with significant active investments in R&D and production, like Samyang Holdings Corp., which opened a large production facility in Hungary for manufacturing biodegradable suture yarn for the European market.

The synthetic absorbable sutures market in MEA is specifically driven by the ongoing initiatives, including in January 2025, Suturion AB attended the Arab Health conference held in Dubai, UAE, which presented its suture products, focusing on raising brand visibility and engaging with healthcare professionals across the region.

However, in Africa, with a notable CAGR, recently ORION SUTURES INDIA PVT. LTD. was revealed at Africa Health in South Africa. This prominently emphasises awareness about their braided dissolvable stitches among local consumers and healthcare providers.

| Johnson & Johnson Services, Inc. | Recently, it explored Coated VICRYL Plus Antibacterial, VICRYL RAPIDE, under the VICRYL (Polyglactin 910) type. |

| DemeTECH Corporation | It specialises in numerous synthetic absorbable sutures made from diverse polymers, like DemeCRYL (Polyglactin 910). |

| Dolphin Sutures | This provides Petcryl 910, Duracryl, and Petcryl Mono by using different kinds of materials. |

| Lotus Surgicals Pvt Ltd | A company offers various braided types, such as SOLUS, Solus 910, and Solus 910 Swift, additionally monofilaments, including Monolus and Mass. |

| Medtronic | Its offerings include Polysorb, Maxon, Biosyn, Caprosyn, and Velosorb Fast. |

| Suture Planet | This provides a wider range of Polyglactin 910, Polyglycolic Acid, such as Netcryl and PGA/Netbond, respectively. |

| Braun SE | It unveiled Monomax, MonoPlus, Monosyn, Novosyn, Novosyn CHD, Novosyn Quick, and Safil. |

| Medico | It usually offers different kinds of braided and monofilament solutions. |

| Healthium Medtech Limited | A company facilitated under the brand name is Trusynth, Truglyde, PD Synth, and Monoglyde. |

| ORION SUTURES INDIA PVT. LTD. | This mainly leverages high-quality surgical sutures, like absorbable and non-absorbable sutures, hernia mesh, and bone wax. |

By Product

By Material

By Application

By End-user

By Region

December 2025

December 2025

December 2025

January 2026