December 2025

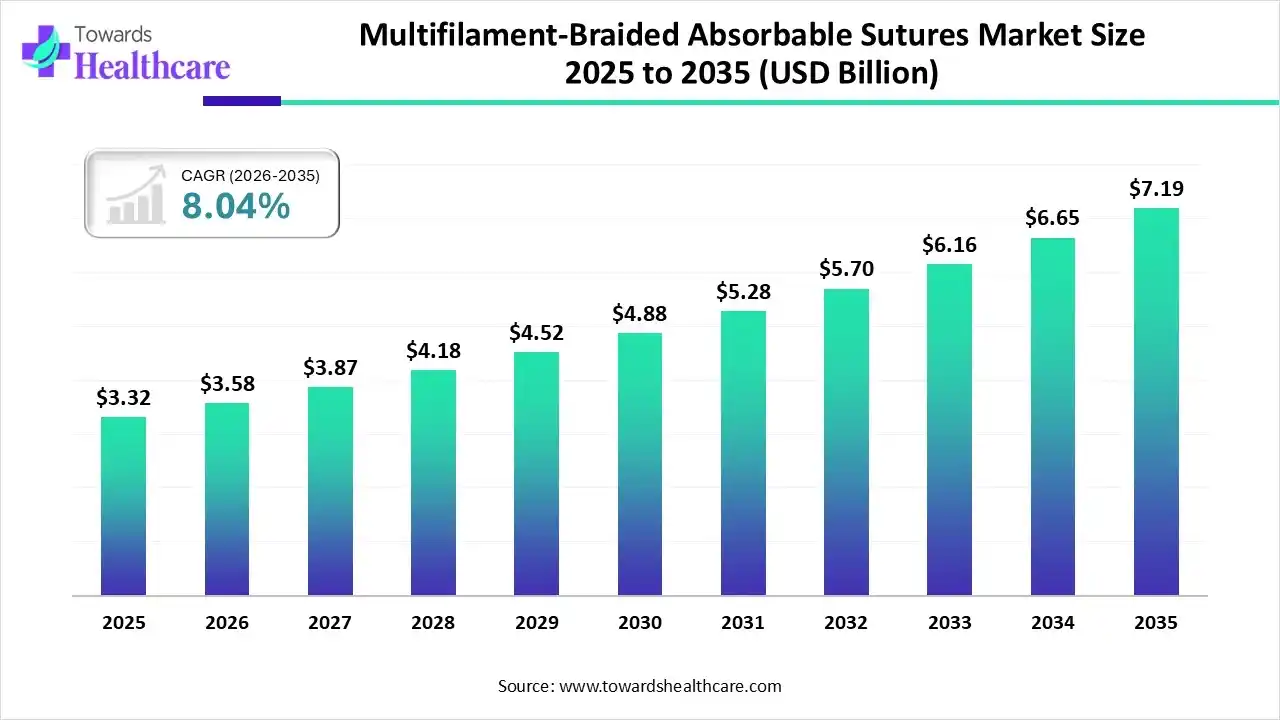

The multifilament/braided absorbable sutures market size was estimated at USD 3.32 billion in 2025 and is predicted to increase from USD 3.58 billion in 2026 to approximately USD 7.19 billion by 2035, expanding at a CAGR of 8.04% from 2026 to 2035.

The multifilament/braided absorbable sutures market is primarily driven by the presence of the leading industrial players, including Johnson & Johnson, Medtronic, B. Braun SE, etc., with their established natural and synthetic brands. These sutures serve as the cornerstone of surgical practice in cardiology, orthopedics, and gynecology.

The multifilament/braided absorbable sutures market is rapidly expanding due to a massive shift towards antimicrobial coatings and high-performance synthetic materials. There is a wide trend of various products and materials, such as polyglactin 910, polyglycolic acid, and antibacterial variants. The global market of these materials is driven by their core properties and clinical uses, which include high flexibility and knot security. The major industrial players in this market are Johnson & Johnson, Medtronic, B. Braun SE, and Healthium Medtech.

AI is vital in driving advanced manufacturing, precision surgical applications, and material design. AI plays a major role in manufacturing and material innovation, which further expands the market. AI contributes to predictive design, quality control, and manufacturing efficiency. It promotes surgical applications such as robotic precision, real-time skill assessment, and surgical training.

How does the Synthetic Segment Dominate the Multifilament/Braided Absorbable Sutures Market in 2025?

The synthetic segment dominated the market in 2025, owing to the predictable support, high initial strength, and superior handling for internal tissue closure offered by synthetic types of multifilament/braided absorbable sutures. The common synthetic materials used are polyglactin 910, polyglycolic acid, and rapidly absorbing polyglactin. They provide antibacterial protection, a coating for smoothness, and a warning of infection risk.

Natural

The natural segment is expected to grow at the fastest CAGR in the multifilament/braided absorbable sutures market during the forecast period due to tissue support for internal wounds provided by natural types of multifilament/braided absorbable sutures. They provide superior handling features and knot security compared to monofilaments. They are easy to use for surgeons at delicate surgical sites.

What made Orthopedics the Dominant Segment in the Multifilament/Braided Absorbable Sutures Market in 2025?

The orthopedics segment dominated the market in 2025, owing to the primary clinical applications and versatile performance of multifilament/braided absorbable sutures. They maintain high tensile strength and enable infection control in orthopedics. They also offer knot security and easy handling features, which are critical in orthopedics.

Gynecology

The gynecology segment is estimated to grow at the fastest rate in the multifilament/braided absorbable sutures market during the predicted timeframe, primarily due to the significant role of multifilament/braided absorbable sutures in uterine closure, vaginal procedures, and soft tissue repair. They offer numerous benefits, such as ease of use, knot reliability, and reduced risk of infection. They have wide applications in the ligation of blood vessels and soft tissue approximation.

How did the Hospitals & ASCs Segment Dominate the Multifilament/Braided Absorbable Sutures Market in 2025?

The hospitals & ASCs segment dominated the market in 2025, owing to the important functions of multifilament/braided absorbable sutures in wound support and internal wound closure. They have wide applications in various fields such as gynecology, obstetrics, general surgery, cardiovascular, and oral surgery. The leading materials used in hospitals and ASCs are polyglactin 910, polyglycolic acid, irradiated polyglactin, and natural collagen.

Specialty Clinics

The specialty clinics segment is anticipated to grow at a notable rate in the multifilament/braided absorbable sutures market during the upcoming period due to temporary tissue support, infection control, and superior handling and stability provided by multifilament/braided absorbable sutures in specialty clinics. They have major clinical applications across dental and oral surgery, orthopedics, obstetrics, general surgery, and surgical training. The common multifilament absorbable materials are copolymers of glycolide and L-lactide, synthetic homopolymers, and partially hydrolyzed polyglactin.

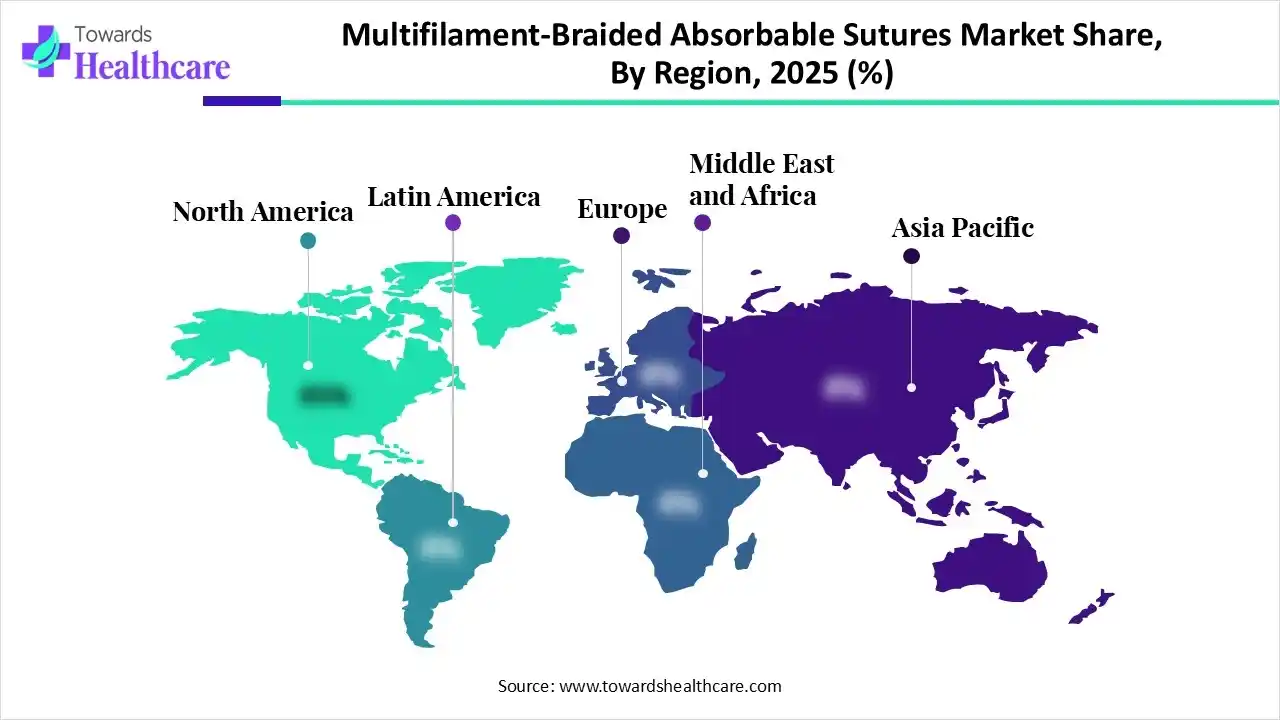

North America dominated the market in 2025, owing to the clinical and surgical demand for multifilament/braided absorbable sutures, the rise in chronic conditions, and the high volume of surgeries. The government programs and policy initiatives that are driving the multifilament/braided absorbable sutures market have focused on supply chain modernization, standardization, and safety. The regional market is also driven by both government activities and private sector innovation. They have focused on reducing infection at surgical sites and supply chain modernization.

The U.S. Food and Drug Administration (FDA) plays a major role in the oversight and classification of these sutures as Class II medical devices. The FDA ensures the safety and efficacy of sutures, providing clearance in the market. The federal Medicare and Medicaid reimbursement policies drive the huge adoption of advanced wound-closure tools in the U.S.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to infrastructure modernization, economic expansion, and medical tourism. The Asian Pacific countries, like China, are growing due to the expanding infrastructure and awareness of infection control. Moreover, India is growing through the rising chronic diseases, while Japan is expanding due to the rising aging population and robust R&D in precision tools. There is increased healthcare access and strong medical tourism in Southeast Asia, further expanding the multifilament/braided absorbable sutures market.

The Indian government provides strong support to the medical device industry, domestic manufacturing, and procurement of multifilament/braided absorbable sutures. It has launched the production-linked incentive (PLI) scheme, medical textiles (quality control) order, and the scheme for strengthening the medical device industry (SMDI).

Europe is expected to grow at a notable rate in the market in 2025, driven by technological innovations, superior material performance, and regulatory support. The major government and regulatory programs include the European medical device nomenclature update and the EU mission on cancer & beating cancer plan. The leading companies, like Johnson & Johnson and Google Health, made a partnership for AI integration into surgical systems. There is an increased demand for absorbable sutures infused with antimicrobial agents for general and abdominal surgeries.

Germany is massively growing in the multifilament/braided absorbable sutures market through various government initiatives and legislative changes. These include the Medical Research Act, innovation funding, standard contractual clauses, and reimbursement deadline extension. The leading manufacturers of these products in Germany are Ethicon, B. Braun SE, and Medtronic.

| Sr. No. | Name of the Company | Headquarter | Latest Update |

| 1 | Ethicon (Johnson & Johnson) | Raritan, New Jersey, U.S. | In November 2025, J&J reported its mission to innovate medicines and therapies for lung cancer, inflammatory bowel disease, major depressive disorder, myasthenia gravis, bladder cancer, and more. |

| 2 | Medtronic | Minneapolis, Minnesota, USA | Medtronic is aiming to establish its Polysorb and Velosorb product lines of sutures. |

| 3 | B. Braun Melsungen AG | Melsungen, Germany | In September 2025, B. Braun Melsungen AG received ISO 27001 certification for information security. |

| 4 | DemeTECH Corporation | Miami Lakes, Florida, USA | DemeTECH Corporation is leading with its well-renowned surgical sutures, bone wax, and mesh. |

| 5 | Teleflex Incorporated | Wayne, Pennsylvania, USA | Teleflex Incorporated supports industry leaders in the design and development of medical devices. |

| 6 | Healthium Medtech | Bengaluru, India | Healthium Medtech is leading with its key focus areas such as infection prevention, arthroscopy, advanced wound care, and advanced surgery. |

| 7 | Dolphin Sutures | Bengaluru, Karnataka, India | Dolphin Sutures manufactures both natural and synthetic absorbable sutures. |

| 8 | Lotus Surgicals | Mumbai, Maharashtra, India | Lotus Surgicals stands out as the one-stop solution for all wound management needs. |

| 9 | Orion Sutures India | Bengaluru, Karnataka | Orion Sutures India remains ahead with above 600 exclusive distributors, and more than 650 attended exhibitions. |

| 10 | Genesis Medtech | Singapore | Genesis Medtech stays focused on resolving the challenges of lung cancer beyond the diagnosis. |

By Type

By Application

By End-User

By Region

December 2025

December 2025

December 2025

November 2025