February 2026

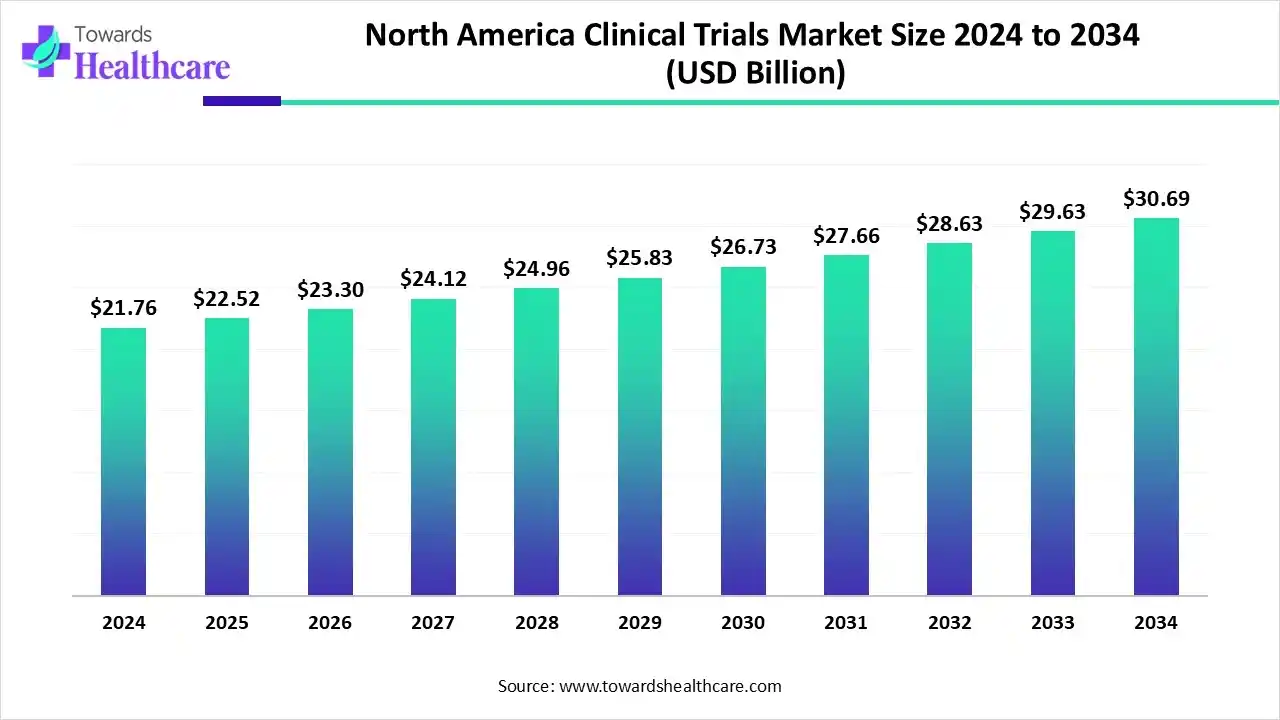

The North America clinical trials market size is calculated at US$ 55.48 billion in 2025, grew to US$ 58.82 billion in 2026, and is projected to reach around US$ 99.10 billion by 2035. The market is expanding at a CAGR of 5.40% between 2026 and 2035.

The U.S. and Canada are focusing on the faster regulatory process for achieving innovative therapies in cancer, rare disease & orphan conditions. Moreover, the North America clinical trials market is exploring innovation in decentralized & virtual clinical trials, with the exploration of various AI-powered tools. At the same time, diverse pharmaceutical & biotechnology companies are putting efforts into the development of personalized therapies used in the growing chronic diseases. As well as the leading players are transforming Phase IV solutions, with novel solutions in patient recruitment and clinical data management systems.

| Table | Scope |

| Market Size in 2025 | USD 55.48 billion |

| Projected Market Size in 2035 | USD 99.10 billion |

| CAGR (2026 - 2035) | 5.40% |

| Market Segmentation | By Phase, By Therapeutic Area, By Service Type, By End-User/Sponsor, By Technology, By Country |

| Top Key Players | Medpace Holdings, Inc., PRA Health Sciences (part of ICON), Charles River Laboratories, PPD (Thermo Fisher Scientific), Worldwide Clinical Trials, WuXi AppTec (US Operations), Veristat |

The North America clinical trials market encompasses the ecosystem of research services, technologies, and infrastructure that support the evaluation of new drugs, biologics, devices, and therapies through human clinical studies. It covers the entire lifecycle from Phase I to Phase IV trials, incorporating advanced digital technologies, regulatory compliance, patient recruitment, and contract research partnerships, making North America the largest global hub for clinical trial activities.

| Organizations/Regulatory Body | Initiatives |

| The U.S. Department of Health and Human Services | Doubled about funding for its Childhood Cancer Data Initiative (CCDI) at the National Institutes of Health (NIH). |

| The Stem Cell Network (SCN) | Made a $13.5 million investment in 36 new regenerative medicine research projects and clinical trials. |

| Government of Canada | Supported clinical research through initiatives, including the $250 million Clinical Trials Fund and investments from agencies like the Canadian Institutes of Health Research (CIHR). |

The widespread adoption of AI algorithms in consistent clinical trials is boosting patient recruitment, simplifying trial design, and empowering drug discovery for new and repurposed therapies. The recent transformation comprises IQVIA's AI-assisted tools for accurate patient recruitment, Antidote's public trial matching platform employing NLP to structure trial criteria, and Pfizer's alliance with IBM Watson to analyze scientific literature for immuno-oncology targets. Alongside, Medable and Science 37 have utilized AI for decentralized trials, whereas Sanofi and Johnson & Johnson have explored AI for virtual patient modeling and drug discovery to expand development timelines.

In 2024, the phase III segment dominated the market. The major factors, like the presence of a strong life sciences ecosystem, a huge burden of chronic and rare diseases, and rising technological integration, are supporting the overall phase III process. A rise in the need for definitive proof of effectiveness for regulatory approval, the demand for treatments in high-need areas like oncology, as well as the latest efforts, including Alzheimer's with Eli Lilly's donanemab (which showed plaque clearance) and Immunoglobulin A Nephropathy with Sibeprenlimab, have led to the overall expansion.

However, the phase IV segment is anticipated to expand at a rapid CAGR. North America is experiencing regulatory needs, the demand for real-world evidence (RWE), and the requirement for long-term safety and efficacy data are fueling the phase IV development. Recently, a Roche trial for a multiple sclerosis drug released new standards for inclusive research with emphasis on Black and Hispanic/Latinx participants, and different post-marketing surveillance studies monitoring the long-term safety and efficiency of broadly used drugs.

The oncology segment registered dominance in the North America clinical trials market in 2024. Ongoing research and development (R&D) investments and faster advancements in tailored medicine and technology are propelling the oncology area.

In September 2025, Imlunestrant was approved by the FDA for advanced or metastatic ER-positive, HER2-negative breast cancer with an ESR1 mutation that has grown after other endocrine therapy. Additionally, the Canadian BR38 trial integrated radiotherapy with immunotherapy for metastatic NSCLC with restricted growth.

Although the rare diseases & orphan conditions segment is predicted to register the fastest growth, a greater involvement of favorable regulatory incentives, such as market exclusivity from the Orphan Drug Act, a robust biopharmaceutical and biotech research infrastructure, with broader investment in R&D, is assisting the revolution of novel therapies. The region is focusing on gene therapies, monoclonal antibodies, and small-molecule drugs targeting many conditions, specifically Duchenne muscular dystrophy, hemophilia, congenital adrenal hyperplasia, and Niemann-Pick disease.

In April 2025, Janssen Pharmaceuticals received FDA approval for this monoclonal antibody used for treating generalized myasthenia gravis, a rare neuromuscular disorder.

In 2024, the site management & monitoring segment accounted for the biggest share of the market. A prominent catalyst is the growing demand for specialized outsourcing solutions is impacting comprehensive services. Besides this, the presence of significant pharmaceutical companies and CROs is supporting the overall monitoring processes. The major contributing tools are Clinical Trial Management Systems (CTMS) to track timelines, manage site activities, monitor key performance indicators (KPIs), and develop real-time reports.

On the other hand, the patient recruitment & retention segment will expand rapidly. A rise in clinical trial complexity, accelerating investment in medical research, and technological innovation are bolstering the segmental expansion. Recent approaches include AI-enabled platforms (e.g., Elligo and Avallano's myTrialsConnectSM), decentralized clinical trial (DCT) approaches applying telemedicine, mobile apps, and online platforms for a broader range of reach, boosting the market progress.

The pharmaceutical companies segment captured a major share of the North America clinical trials market in 2024. The segment is fueled by the escalating investments by these types of companies to fulfill the increasing demand for novel therapies for chronic diseases like cancer and diabetes.

Recently, in September 2025, Pfizer demonstrated Phase 3 data for its updated mRNA-based COVID-19 vaccine formula, which showed a robust immune response in high-challenge populations.

However, the biotechnology companies segment is anticipated to expand at the fastest CAGR during 2025-2034. The expanding developments in precision medicine and the accelerating demand for advanced treatments used in chronic diseases are assisting in the innovative steps of these companies. The latest FDA approval encompasses Linvoseltamab-gcpt (Lynozyfic), a bispecific antibody for relapsed or refractory multiple myeloma, received in July 2025. Also, Amgen and Kyowa Kirin explored a Phase 3 study of rocatilimab in September 2025, a treatment for adults with moderate-to-severe atopic dermatitis.

In 2024, the clinical data management systems (CDMS) segment held a dominant share of the market. Primarily, the segment is driven by the increasing number of clinical trials, the enforcement of strict regulatory requirements from bodies, and the widespread adoption of advanced technologies, including cloud solutions and AI integration. Recent advancements, like MaxisIT's DTect AI and IQVIA's CDAS, are leveraging the industry's movement towards advanced analytics and smarter trial management.

The decentralized/virtual clinical trials (DCTs) segment is estimated to register rapid growth in the coming era. The non-going efforts in patient-centric models powered by digital health technologies, along with the expansion of the pandemic's disruption, are imposing the immersion of innovative trial solutions. A major example is the ADAPTABLE trial, which studied optimal aspirin dosage for heart conditions, conducted at a large-scale, fully decentralized trial. Recently, the TELEPIK trial for advanced breast cancer applied a hybrid model for remote monitoring and a fully remote study on functional constipation in the US.

By capturing the largest revenue share, the United States led the North America clinical trials market in 2024. The presence of a strong hub of academic research and biopharmaceutical innovation, rising investment in R&D, and breakthroughs in technology are fueling the US progress. In the last few days, they have launched a precision medicine trial for myeloid cancers, an AI algorithm adoption for matching volunteers to trials, and the start of trials for a twice-yearly HIV prevention injection.

For instance,

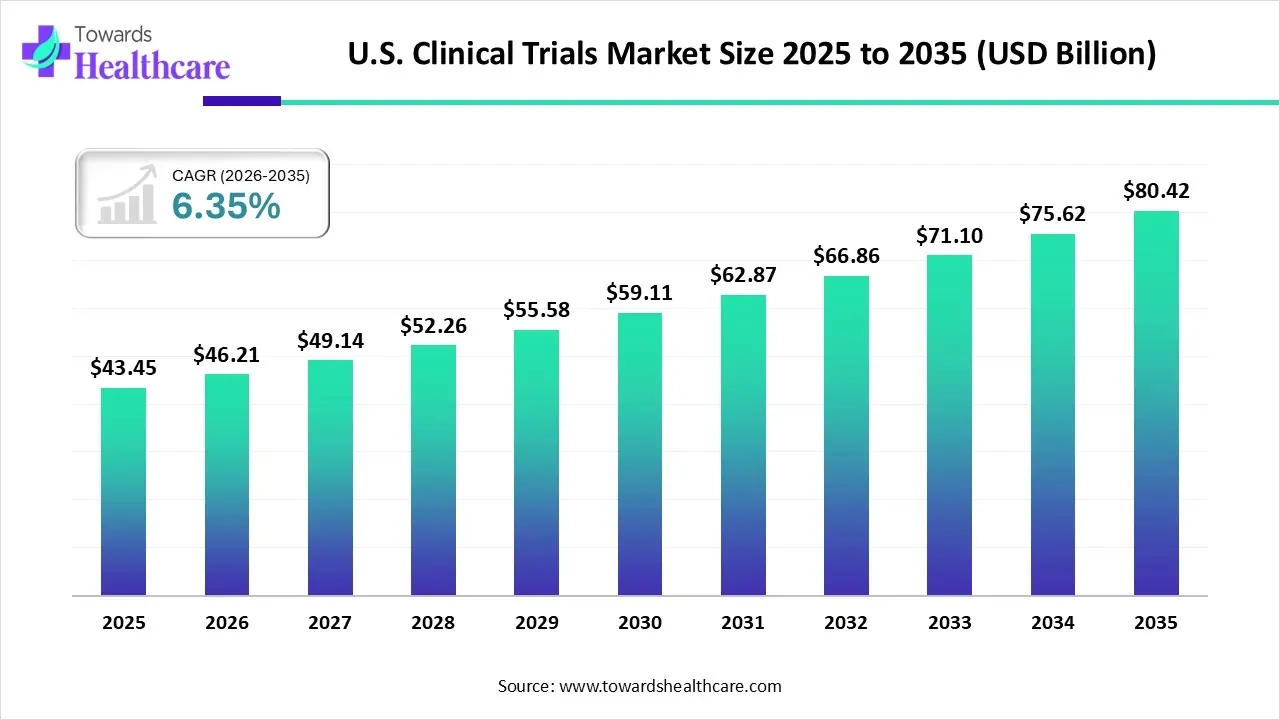

The U.S. clinical trials market size is calculated at US$ 43.45 in 2025, grew to US$ 46.21 billion in 2026, and is projected to reach around US$ 80.42 billion by 2035. The market is expanding at a CAGR of 6.35% between 2026 and 2035.

In the prospective period, Canada is predicted to witness the fastest expansion in the North America clinical trials market. A prominent driver is the guidance and favourable regulatory environment, particularly from Health Canada is imposing affordability, protocol changes, and timeline compression in the trials. Also, Health Canada is allowing a 30-day Clinical Trial Application (CTA) review period, which further facilitates efficiency and clarity for sponsors by allowing protocol adjustments and rapid trial timelines. As well, continuous collaborations with Contract Research Organizations (CROs) are fostering Canada’s trials.

For this market,

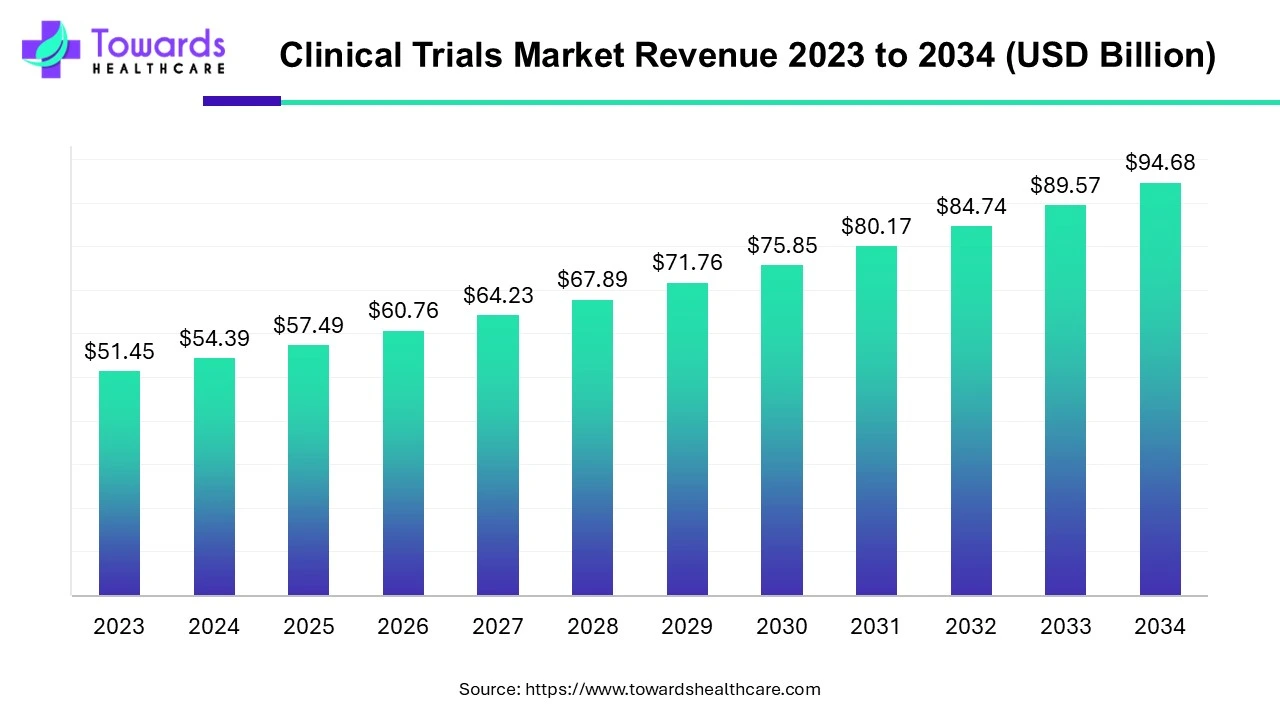

The global clinical trials market is valued at USD 98.91 billion in 2026 and is projected to reach USD 174.18 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.7% over the forecast period from 2026 to 2035.

By Phase

By Therapeutic Area

By Service Type

By End-User/Sponsor

By Technology

By Country

February 2026

February 2026

February 2026

February 2026