January 2026

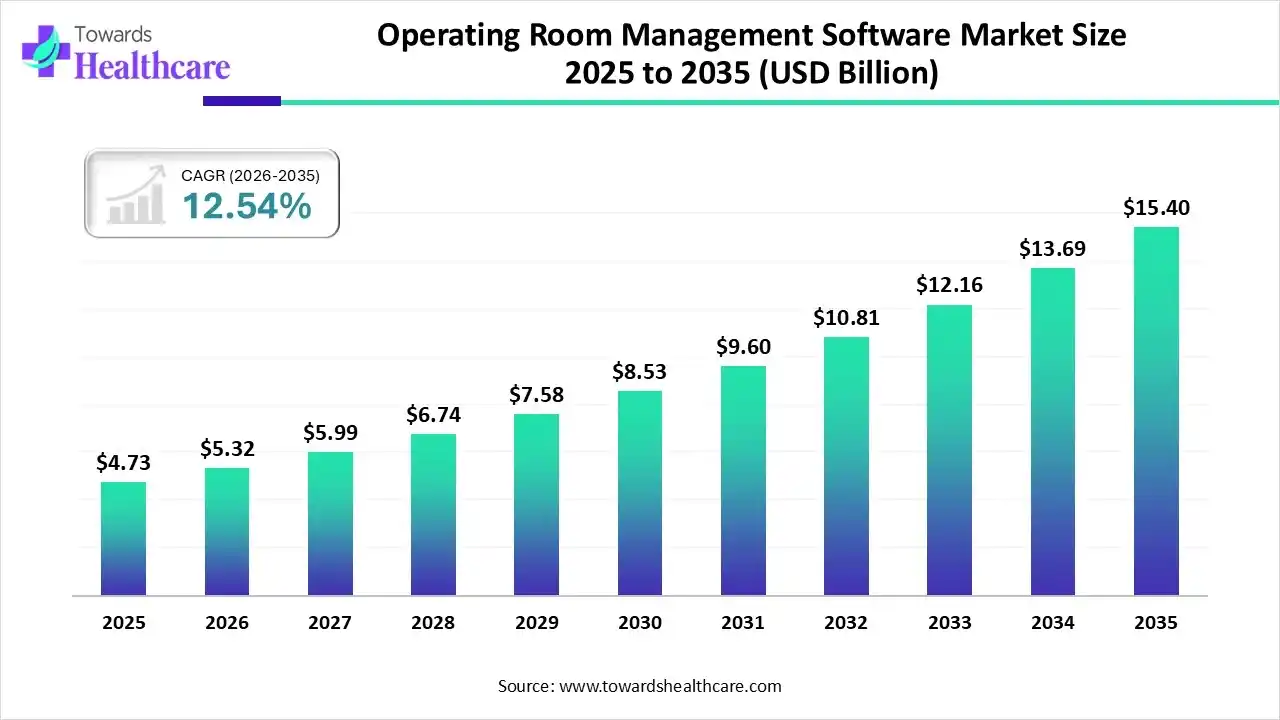

The global operating room management software market size was estimated at USD 4.73 billion in 2025 and is predicted to increase from USD 5.32 billion in 2026 to approximately USD 15.4 billion by 2035, expanding at a CAGR of 12.54% from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 5.32 Billion |

| Projected Market Size in 2035 | USD 15.4 Billion |

| CAGR (2026 - 2035) | 12.54% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By Mode of Delivery, By Region |

| Top Key Players | Epic Systems, Oracle, GE HealthCare, Medtronic, Siemens Healthineers, Philips Healthcare, Stryker Corporation, McKesson Corporation, Becton, Dickinson and Company, HealthPlix |

The operating room management software market is experiencing massive growth across the globe due to the urgent need to streamline surgical workflows, integrate AI and cloud-based solutions, and improve efficiency. Healthcare systems are increasingly using AI for predictive analytics. It helps them manage resource allocation, improve surgical scheduling, forecast case durations, and enhance patient safety. The software solutions have introduced automation in manual tasks like billing, documentation, and inventory tracking to reduce errors for improved patient care.

There is a rising trend of cloud-based and web-based software deployments, which offer remote access, greater accessibility, and scalability than on-premise systems. The operating room management software market is expanding due to AI and machine learning integration, cloud-based solutions, interoperability, and workflow automation. The seamless connectivity solutions are integrated with hospital information systems, supply chain management software, and picture archiving and communication systems to ensure real-time data sharing across departments.

The leading software providers are GE HealthCare, Oracle, Epic Systems Corporation, Koninklijke Philips N.V., Medtronic Plc, etc. They contribute to enhanced patient care, improved efficiency, reduced costs, and data-driven decision-making.

AI greatly contributes to revolutionizing operating room management and enhancing surgical outcomes. AI is helpful in automated documentation, communication, scheduling, turnover management, and real-time workflow monitoring. AI-driven tools enable effective postoperative care, accurate preoperative planning, and real-time intraoperative navigation.

How does the Scheduling & Resource Management Software Segment Dominate the Operating Room Management Software Market in 2025?

The scheduling & resource management software segment dominated the market in 2025, with a revenue share of 35%, owing to its potential in optimizing surgical scheduling, resource allocation, enhanced data management and communication, and performance monitoring and analytics. This software benefits in the form of increased efficiency and throughput, reduced costs, improved patient care and satisfaction, and scalability. The rapid shift towards cloud-based and AI-driven solutions raises the importance of scheduling & resource management software.

The integrated EMR/EHR modules segment is expected to grow at the fastest CAGR in the operating room management software market during the forecast period due to their assistance in enhanced surgical planning, documentation, detailed patient data access, improved care coordination, and communication. They help in making clinical decisions, improving operating room scheduling, and managing resources. They streamline billing and financial management, and drive data security and regulatory compliance.

What made On-premise Solutions the Dominant Segment in the Operating Room Management Software Market in 2025?

The on-premise solutions segment dominated the market in 2025, with a revenue share of 40%, owing to the growing need for stringent security, maximum data control, and customization for large healthcare facilities. They bring operational reliability, enable long-term cost management, and adhere to regulatory compliance. They focus on interoperability to ensure seamless data exchange with improved decision-making.

The cloud-based solutions segment is estimated to grow at the fastest rate in the operating room management software market during the predicted timeframe due to enhanced scalability and cost efficiency introduced to hospitals and ambulatory surgical centers. Surgeons, anesthesiologists, and administrative staff are enabled to access real-time data on patients’ health. This results in improved communication, faster decision-making, remote consultations, and remote monitoring.

How did the Scheduling & Resource Optimization Segment Dominate the Operating Room Management Software Market in 2025?

The scheduling & resource optimization segment dominated the market in 2025, with a revenue share of 35%, owing to the increased focus on real-time scheduling, resource allocation, enhanced cloud solutions, and improved patient outcomes. This operating room optimization enables the allocation of staff and personnel, equipment and supplies, and post-operative care unit beds. The ORM software helps in the financial well-being of healthcare organizations.

The inventory & asset management segment is anticipated to grow at a notable rate in the operating room management software market during the upcoming period due to robust security measures, access controls, data encryption, and secure data centers. The inventory software helps to achieve sustainability and support greener practices by tracking emissions, energy usage, and waste created by assets. This helps organizations meet environmental compliance and business goals.

Which Segment by Mode of Delivery Dominated the Operating Room Management Software Market in 2025?

The web-based platforms segment dominated the market in 2025, with a revenue share of 50%, owing to the enhanced security protocols of web-based platforms. They prefer advanced encryption and authentication to meet stringent healthcare regulations like HIPAA and GDPR. They focus on building trust and ensuring patient data confidentiality.

The mobile applications segment is predicted to grow at a rapid rate in the operating room management software market during the studied period due to increased focus on data security and compliance, and improved user experience. They optimize workflows and surgical scheduling, and enable telemedicine and remote monitoring integration. They enhance surgical efficiency and patient safety, and provide real-time data access.

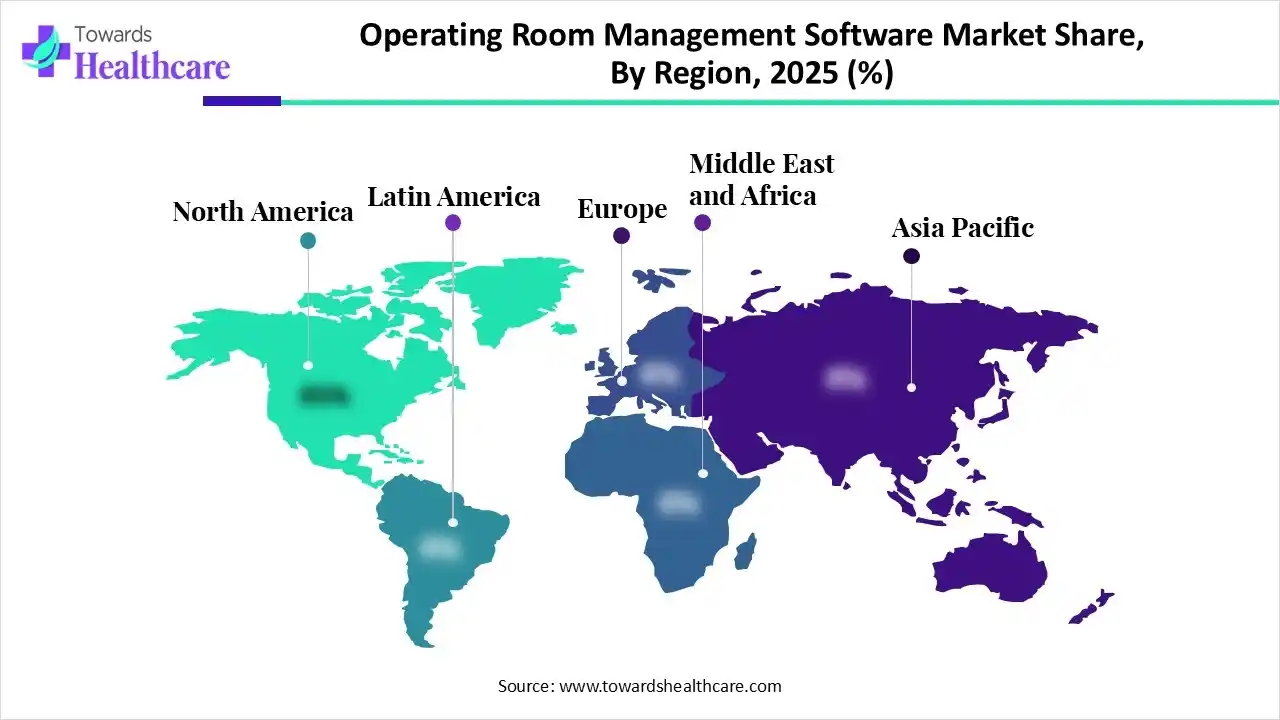

North America dominated the operating room management software market, with a revenue share of 35% in 2025. The leading North American companies, like Stryker, Olympus, Medtronic, and Johnson & Johnson, are making efforts to achieve strategic growth through new product development, R&D, and partnerships. This regional growth is driven by the rising trend of data sharing and digital health, EHR integration, private sector innovation, and healthcare infrastructure projects. The private company innovations, including services and systems, respond to the need for cost reduction and efficiency in hospitals.

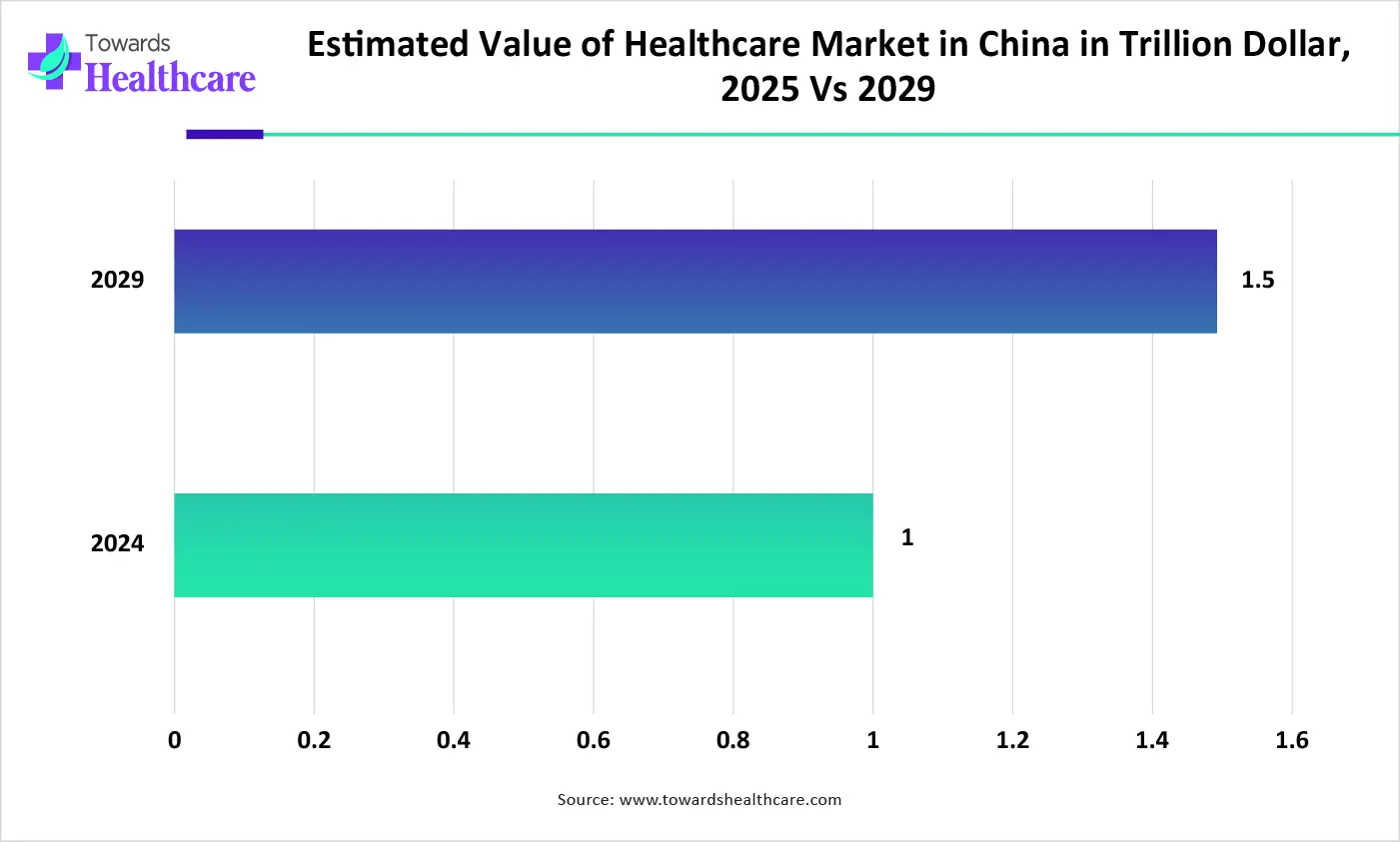

Asia Pacific is estimated to host the fastest-growing position in the operating room management software market during the forecast period. The rising number of surgical procedures, increased focus on cost reduction and efficiency, and advancements in healthcare technology have driven the Asian Pacific market for ORM software. There is an increasing demand for minimally invasive surgeries and the growing awareness of patient safety and quality of care. India’s digital health initiatives, Singapore’s AI framework, Delhi’s Hospital Information Management System (HIMS) project, and Australia's regulatory focus accelerated this regional market’s growth.

India is growing significant in the Asia Pacific region because the Ministry of Health and Family Welfare is dedicated to transforming healthcare through digitalization. The increased focus on affordability and accessibility, public-private collaboration, interoperability, and standardization drives the Indian ORM software market. As of January 2025, more than 5 lakh health professionals are registered, and more than 73 crore Ayushman Bharat Health Accounts (ABHA) have been created successfully.

Europe is expected to grow at a significant CAGR in the market during the forecast period. In November 2025, the European Investment Fund committed €30 million to Indico Capital Partners' new technology fund of €125 million to boost innovation in Spain, Italy, and Portugal. In October 2025, the European Central Bank announced the launch of the Eurosystem collateral management system in June 2025. This will be a unified system to harmonise the management of collateral for Eurosystem credit operations.

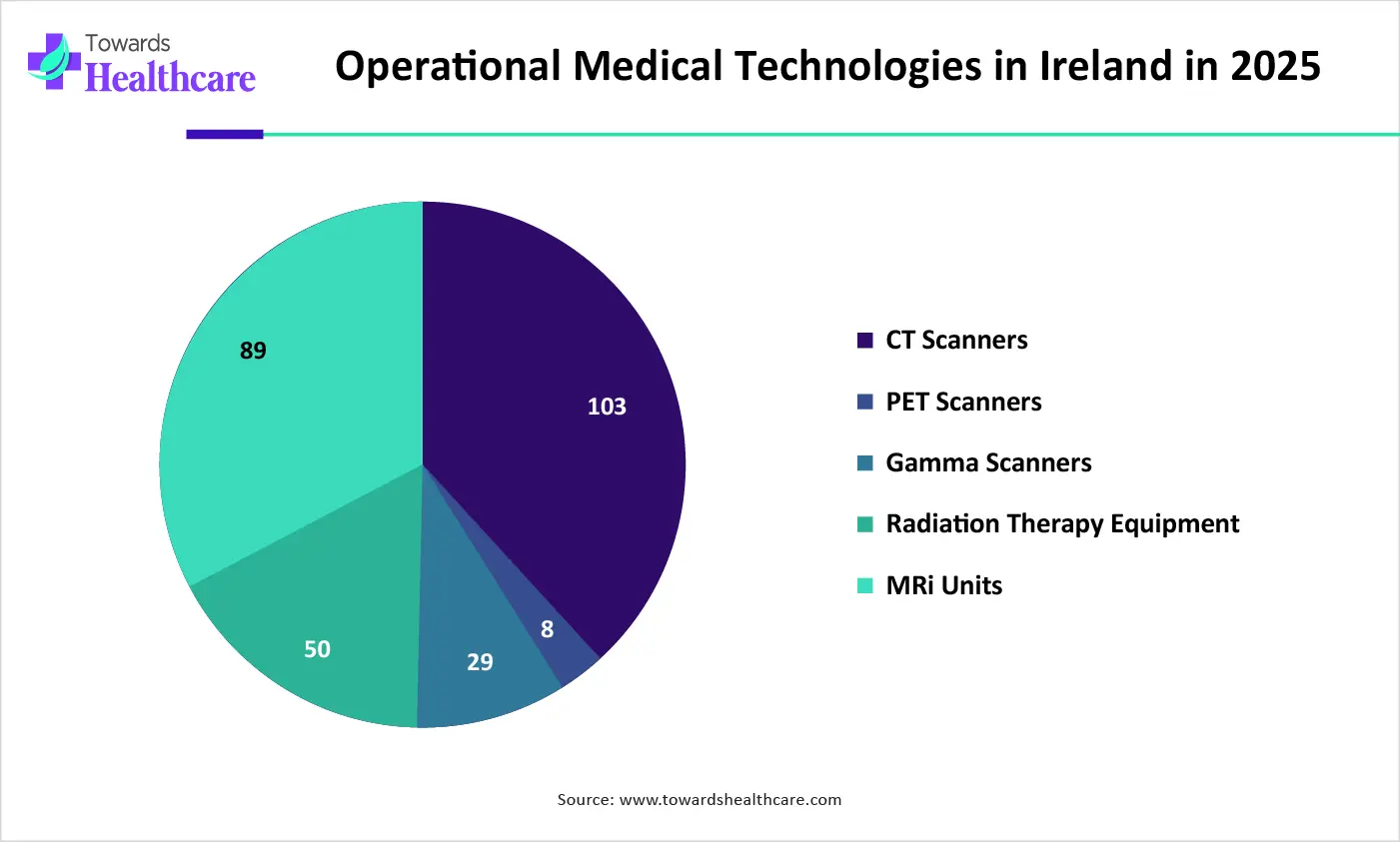

Ireland has experienced a rapid technological adoption in the year 2025, with many operational technologies in the medical sector. About 103 CT scanners, 8 PET scanners, 29 gamma cameras, and 50 radiation therapy equipment were operational in Ireland. A total of 89 MRI units were operational in 2025, 84.3% of which were being used in a hospital setting.

| Sr. No. | Name of the Company | Headquarters | Latest Update |

| 1. | Epic Systems | Verona, Wisconsin, United States | Since February 2025, more than 18,000 staff members of Memorial Sloan Kettering Cancer Center (MSK) across hospitals and outpatient sites have been using a unified Electronic Health Record (EHR) from Epic Systems. |

| 2. | Oracle | Austin, Texas, United States | In September 2025, Oracle launched the Oracle Fusion Cloud Supply Chain & Manufacturing (SCM) to help healthcare organizations automate inventory management with RFID. |

| 3. | GE HealthCare | Chicago, Illinois, USA | Centricity Perioperative Anesthesia is an Anesthesia Information Management System (AIMS) from GE HealthCare, leading the way in perioperative software that streamlines workflow. |

| 4. | Medtronic | Dublin, Ireland | In September 2025, Medtronic expanded the AiBLE spine surgery ecosystem through a partnership with Siemens Healthineers and new technologies. |

| 5. | Siemens Healthineers | Erlangen, Germany | In January 2025, Siemens Healthineers introduced its recent innovations, including Dry Cool technology and, Dual Source CT scanner SOMATOM Pro. Pulse, and Digital X-ray systems MULTIX Impact E. |

| 6. | Philips Healthcare | Amsterdam, Netherlands | In December 2025, Philips Healthcare reported its advanced visualization and AI partnerships to simplify workflows for radiologists. |

| 7. | Stryker Corporation | Kalamazoo, Michigan, United States | Stryker Corporation offered the Fortress modular wall system, which is fast to install, allows for flexibility, and allows the operating room staff to easily adjust to technologies. |

| 8. | McKesson Corporation | Irving, Texas, United States | In May 2025, McKesson Corporation reported that consolidated revenues of $90.8 billion increased 19% for the fourth quarter of 2025 and consolidated revenues of $359.1 billion increased 16% for the full year 2025. |

| 9. | Becton, Dickinson and Company | Franklin Lakes, New Jersey, United States | In November 2025, Becton, Dickinson, and Company reported the expansion of its Surgiphor surgical wound irrigation system to Europe to assist hospitals in improving patient safety. |

| 10. | HealthPlix | Bangalore, India | HealthPlix is renowned for HIPAA-certified advanced technologies for providing exceptional care. |

By Product Type

By Deployment Type

By Application

By Mode of Delivery

By Region

January 2026

January 2026

January 2026

January 2026