February 2026

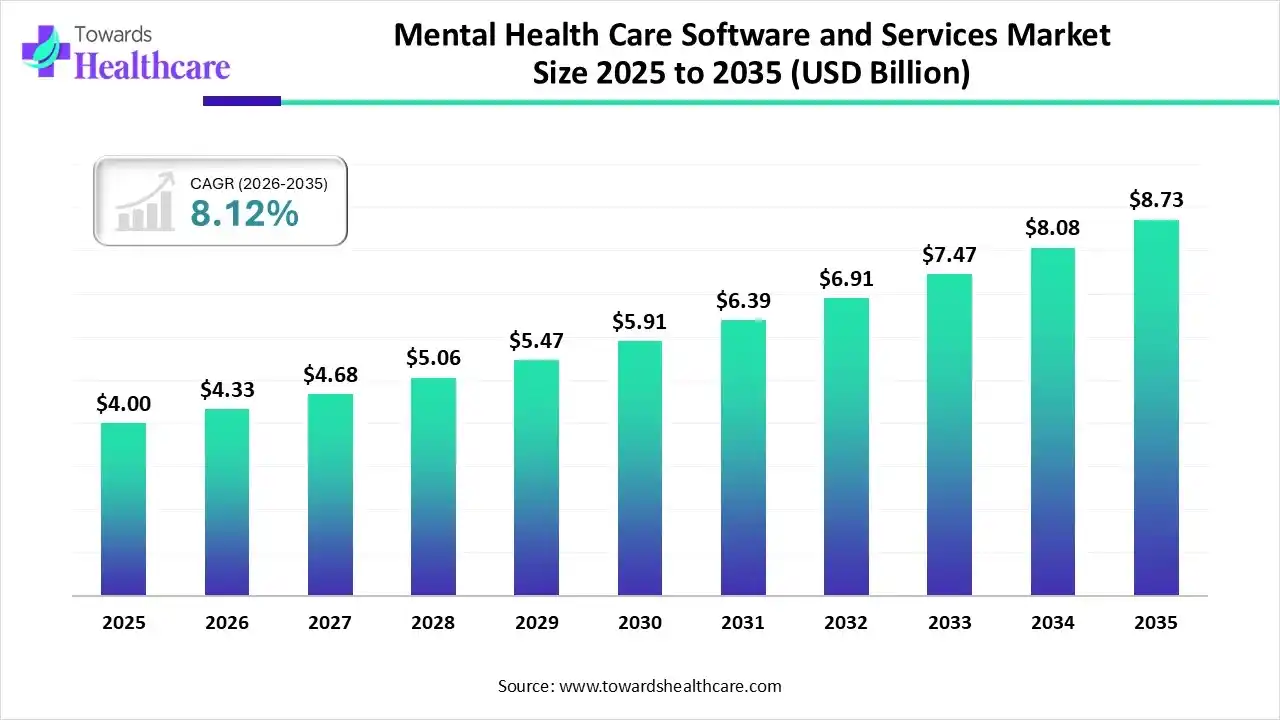

The global mental health care software and services market size is expected to be worth around USD 8.73 Billion by 2035, from USD 4 billion in 2025, growing at a CAGR of 8.12% during the forecast period from 2026 to 2035.

The mental health care software and services market is experiencing robust growth, driven by the rising prevalence of mental health disorders, the need to streamline hospital operations, and technological advancements. Hospitals & clinics receive investments from the government and private bodies to install software. Government organizations also launch initiatives to support the adoption of digitization in the healthcare sector.

| Key Elements | Scope |

| Market Size in 2026 | USD 4.33 Billion |

| Projected Market Size in 2035 | USD 8.73 Billion |

| CAGR (2026 - 2035) | 8.12% |

| Leading Region | North America |

| Market Segmentation | By Component, By Functionality, By Mode of Delivery, By End-User, By Region |

| Top Key Players | Clinicea, Ensora Health, Zanda Health, ScienceSoft, Core Solutions, Inc., Ezovion, AdvancedMD, The Access Group, eClinicalWorks, SimplePractice |

The mental health care software and services market refers to developing software solutions and providing software services to streamline operations. Software tools handle multiple activities, including practice management, shared electronic medical records (EMR)/electronic health records (EHRs), billing and invoicing, appointment scheduling, client assessments, risk identification, and reporting. Software and services solutions reduce the burden on mental health care professionals, enabling them to focus more on patient care.

The advent of artificial intelligence (AI) is revolutionary, reshaping the way patients are diagnosed, treated, and monitored. By leveraging artificial intelligence (AI) in healthcare, healthcare providers can streamline administrative tasks, enhance workflow efficiency, and support informed clinical decision-making. AI and machine learning (ML) algorithms can analyze vast amounts of patient data and detect behavioral patterns. They also help in scheduling appointments, providing reminders to both providers and patients. Moreover, AI can also help in billing and claims processing, minimizing the risk of delay and failure.

Which Component Segment Dominated the Mental Health Care Software and Services Market?

The software segment held a dominant position in the market in 2025, due to increasing investments and the rising adoption of advanced technologies. Software tools perform a variety of functions to benefit both patients and healthcare professionals. By leveraging software tools in mental healthcare, doctors have direct access to data without relying on third-party providers. Software solutions reduce the burden on doctors, allowing them to focus more on patient care.

Services

The services segment is expected to grow at the fastest CAGR in the market during the forecast period. Services provide digital tools for clinicians, patients, and organizations, encompassing EHR/EMR systems, practice management, and telehealth platforms. They eliminate the need for IT infrastructure and annual license subscription, reducing exorbitant maintenance costs. Service providers have skilled professionals to provide relevant expertise for complex problems.

How the Clinical Segment Dominated the Mental Health Care Software and Services Market?

The clinical segment held the largest revenue share of the market in 2025, due to the increasing number of patient admissions and the growing demand for personalized care. Mental health software can enable remote monitoring and AI-based therapy, eliminating the need for patients to visit hospitals or clinics. It can keep track of patient records, from initial evaluation to treatment regimens. Doctors can write prescriptions at a faster speed using reusable protocols.

Administrative

The administrative segment is expected to grow with the highest CAGR in the market during the studied years. EHRs perform various administrative tasks, such as appointment scheduling, sending reminders, and note-taking. Hospitals eliminate the need to appoint employees for administrative tasks, saving costs. Automation improves workflow, reduces manual errors, and enhances patient experience. EHRs increase patient engagement and make mental health resources more accessible.

Why Did the Cloud-based Segment Dominate the Mental Health Care Software and Services Market?

The cloud-based segment contributed the biggest revenue share of the market in 2025, due to advances in internet connectivity and the ability to enhance scalability. Cloud-based tools can store large amounts of patient data, which can be accessed by providers and patients from anywhere and at any time. They eliminate the need for a specialized infrastructure and minimize maintenance costs. They can provide a flexible workspace that can expand or contract based on changing needs.

Web-based

The web-based segment is expected to expand rapidly in the market in the coming years. Web-based tools are operated on a remote server and are accessed by users through a web browser on their device, such as a computer, tablet, or smartphone. They are developed using web technologies like HTML, CSS, and JavaScript to provide a seamless and responsive patient experience. In addition, they are platform-independent and can run on any operating system with a compatible web browser.

Which End-User Segment Led the Mental Health Care Software and Services Market?

The providers segment led the market in 2025, due to the need to streamline clinical and administrative workflows. Providers adopt software and services to provide the best healthcare services and care among their competitors. They can also reduce the time spent on maintaining patient records and billing, while focusing more on patient care. Software tools help automate tasks, enhance productivity, and increase the accuracy of diagnosis and treatment. They can serve a larger patient population worldwide through telehealth platforms.

Patients

The patients segment is expected to witness the fastest growth in the market over the forecast period. Patients prefer using mental healthcare software and services to minimize traveling to hospitals or clinics, benefiting patients living in remote areas. This helps them save time and costs, and continue their routine tasks. Telehealth can help reduce social stigma, enhancing patient convenience. It facilitates secure messaging and real-time communication between providers.

North America dominated the global market in 2025. The availability of a robust healthcare infrastructure, the presence of key players, and the rising adoption of advanced technologies are major factors that govern market growth in North America. Regulatory agencies support the adoption of digital tools in healthcare organizations through favorable regulatory policies. The increasing prevalence of mental health disorders and the growing awareness of employees’ health augment the market.

U.S. Market Trends

Key players, such as Ensora Health, ScienceSoft, and Core Solutions, Inc., are the major contributors to the market in the U.S. It is estimated that over 96% of all hospitals in the U.S. have adopted EHRs. The National Alliance on Mental Illness reported that approximately 70.8% of U.S. adults received treatment for serious mental illness in 2024.

Asia-Pacific is expected to host the fastest-growing market in the coming years. People from China, India, Japan, and Australia are becoming aware of mental health care, promoting the use of mental health care software. The growing demand for personalized care and the increasing patient population are boosting market growth. Government and private bodies are making constant efforts to enhance equitable access to digital mental health, especially after the COVID-19 pandemic.

India Market Trends

India is transforming the healthcare sector with the rapid adoption of digital tools. As of 2025, approximately 35% of Indian hospitals have implemented EMR/EHR systems, especially in urban areas. This number is projected to rise over the coming years. In 2024, around 40% of clinicians used AI, marking a 3 times growth from 12% in 2024. Healthcare AI companies like Wysa revolutionize the Indian market and result in a technology-driven future.

Europe is expected to grow at a considerable CAGR in the upcoming period. Government organizations launch initiatives to promote mental health care awareness and adopt digital tools. The increasing demand for data-driven and evidence-based care fosters market growth. The growing number of mental health startups and rising venture capital investments also contribute to market growth. Mental health professionals switch to software and services to serve a larger patient population owing to their shortage across the region.

UK Market Trends

Approximately 3.7 million people received support from England’s NHS mental health services between 2023 and 2024. The UK government invests heavily in digital technologies for mental healthcare. In September 2025, the UK government announced an investment of £3.6 million in business-led projects developing therapeutic extended reality solutions to provide mental healthcare services.

| Companies | Headquarters | Offerings |

| Clinicea | Singapore | Clinicea Mental Health EMR simplifies the workflow of psychiatrists, counselors, and mental health specialists |

| Ensora Health | Alabama, United States | It offers AI-powered therapy software, EHR for therapists, and billing solutions to streamline workflows and simplify practice management. |

| Zanda Health | California, United States | Zanda offers Mental Health EHR to automate online intake forms and keep client data organized. |

| ScienceSoft | Texas, United States | ScienceSoft offers end-to-end consulting, software development, and application support services to mental health organizations and institutions. |

| Core Solutions, Inc. | Pennsylvania, United States | It is a leading provider of behavioral health by offering IDD EHR and AI-powered software. |

| Ezovion | United Kingdom | Ezovion is a comprehensive SaaS-based HMS that enhances healthcare operations and offers hospital management software. |

| AdvancedMD | Utah, United States | The company helps optimize mental health practice with integrated office, EHR, and billing software to improve patient care and administrative efficiency. |

| The Access Group | Loughborough, United Kingdom | Its digital healthcare software provides integrated solutions for the management and delivery of acute, community, and mental health. |

| eClinicalWorks | Massachusetts, United States | It offers an integrated EHR with practice management and patient engagement tools for behavioral health and mental health services. |

| SimplePractice | California, United States | SimplePractice is a leading practice management software for mental health, performing a wide range of functions, from admin work to clinical care |

By Component

By Functionality

By Mode of Delivery

By End-User

By Region

February 2026

February 2026

February 2026

February 2026