February 2026

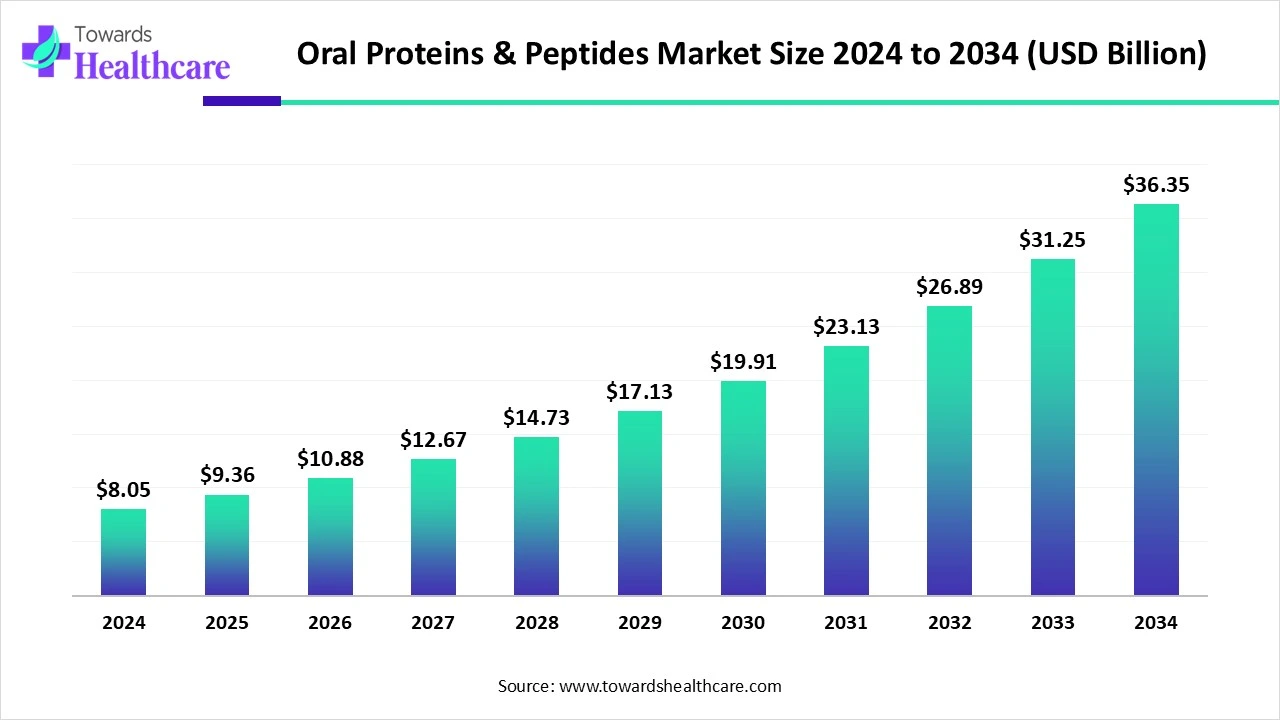

The global oral proteins & peptides market size is calculated at US$ 8.05 billion in 2024, grew to US$ 9.36 billion in 2025, and is projected to reach around US$ 36.35 billion by 2034. The market is expanding at a CAGR of 16.34% between 2025 and 2034.

As oral drug delivery systems possess patient convenience, affordability, and long shelf-life are fueling the global oral proteins & peptides market development. Alongside, emerging noninvasive applications of these oral therapeutics, including plant-derived approaches, such as HPMC capsules, are assisting overall market expansion. Also, formulation science, molecular engineering, and groundbreaking ingestible delivery devices to achieve systemic exposure are incorporated in the global market progress. Besides this, the accelerating digital health technologies, especially remote patient monitoring, are impacting innovations in the developing market.

| Table | Scope |

| Market Size in 2025 | USD 9.36 Billion |

| Projected Market Size in 2034 | USD 36.35 Billion |

| CAGR (2025 - 2034) | 16.34% |

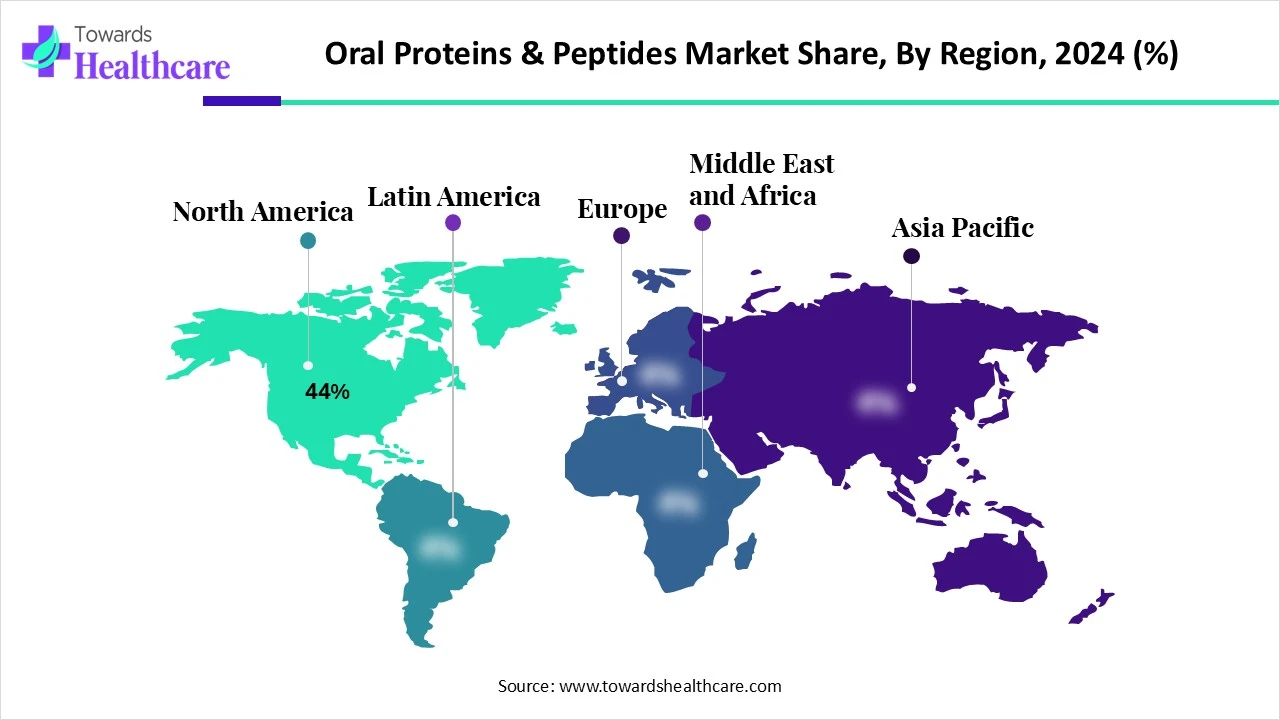

| Leading Region | North America Share 44% |

| Market Segmentation | By Molecule Class, By Therapeutic Area, By Dosage Form, By End User / Sponsor Type, By Region |

| Top Key Players | Novo Nordisk, Eli Lilly, Pfizer, Chiesi, Rani Therapeutics, Biora Therapeutics, Entera Bio, Oramed Pharmaceutical, Enteris BioPharma, Lonza, Catalent, Thermo Fisher Scientific, Evonik Health Care, Adare Pharma Solutions, BASF Pharma Solutions, Ashland, Roquette, Hovione, Zealand Pharma, Protagonist Therapeutics |

The oral proteins & peptides market covers prescription therapeutics that deliver biologically active peptides and proteins by the oral route, historically limited by enzymatic degradation and poor intestinal permeability. The field integrates formulation science (permeation enhancers, enzyme inhibitors, enteric targeting), molecular engineering (cyclization, stapling, PEGylation), and novel ingestible delivery devices to achieve systemic exposure. Flagship successes (e.g., oral GLP-1 analogs) and an expanding late-stage pipeline (endocrine, metabolic, bone, and rare diseases) are accelerating adoption as patients and payers seek needle-free alternatives to injections.

In the global market, a rise in demand for non-invasive drug delivery systems and the expansion of the biopharmaceutical sector are fueling developments in this area.

Primarily, the widespread application of AI algorithms is also impacting the overall progression of the market. Mainly, it consists of the analysis of a huge dataset of known peptides and their activities, as well as AI can enhance peptide structures for their excellent stability, efficacy, and target specificity.

For instance,

Enhancement in Patient Preference and Investments

In the era, the oral proteins & peptides market is mainly propelled by the boosting patient choices for oral medication/therapeutics. As this route enables the convenient and minimized discomfort among patients with major benefits in long-term or lifelong therapies is influencing ultimate market growth. Whereas, for this preference, the increasing step towards noninvasive treatment choices is also fueling the development of novel delivery methods. Alongside, numerous pharmaceutical companies are widely investing in advancements in oral protein and peptide therapies.

Limitations in High Expenses and Clinical Trials

The need for widespread spending in the developing and producing oral proteins and peptide-derived drugs, as well as in strong testing, is creating a significant hurdle in the market expansion. Moreover, suboptimal absorption or inadequacy in therapeutic effects are evolving as another barrier in the early-stage clinical trials.

Wide-Range Applications in Health Concerns

During 2025-2034, the oral proteins & peptides market will have several opportunities in the acceleration of severe and chronic health conditions, such as diabetes, gastrointestinal disorders, autoimmune diseases, and cancer etc. However, once-daily obesity regimens, combinations (peptide + small molecule), and patient-centric packaging are managing fasting requirements. Along with this, another developing opportunity in this market is the integration of digital health technologies, including remote patient monitoring and wearable devices, which can improve patient compliance and treatment outcomes for oral protein and peptide therapies.

.webp)

In 2024, the peptides segment accounted for a major revenue share of the market. The segment is driven by its broader advantages in the market, especially its smaller size, specificity, and possibilities for optimized bioavailability. Additionally, oral delivery of certain peptides, such as insulin, has the potential to mimic the natural physiological pathway and enable better glucose homeostasis as compared to subcutaneous injections. As well as advancements in nanotechnology and drug delivery approaches, particularly nanoparticles and protective coatings, are widely involved in the development of the peptide molecule class.

On the other hand, the proteins segment is predicted to expand rapidly. Ongoing research activities and the affordability of oral protein formulations are mainly fueling the segment growth. These continuous research approaches have increasingly contributed to the transformation in targeted delivery systems. Apart from this, the escalating cases of diabetes, gastrointestinal disorders, and hormonal imbalances are highly demanding oral protein and its derivative therapies. Around the world, a rise in awareness of the benefits of proteins and supplements for comprehensive well-being is also impacting market expansion.

By therapeutic area, the metabolic diseases segment dominated the oral proteins & peptides market. Inclusion of Type 2 Diabetes, obesity are mainly fueling the growth in the metabolic diseases and ultimately a demand for advanced oral protein and peptide therapies. Widespread usage of glucagon-like peptide-1 (GLP-1) receptor agonists in the treatment of metabolic diseases like diabetes and obesity is boosting the adoption of semaglutide (Rybelsus), liraglutide (Victoza), and exenatide (Byetta) among patients.

Whereas the endocrine disorders segment is anticipated to expand at the fastest CAGR. In the prevalence of osteoporosis, oral formulations of parathyroid hormone (PTH) analogs are highly employed to enhance bone density and minimize fracture risk. In addition, researchers are innovating other oral peptide therapies for conditions, including growth hormone deficiency, thyroid disorders, and other hormonal imbalances. Furthermore, the development in the customization of oral peptide therapies to individual patient needs and characteristics is a major domain of future development.

By dosage form, the tablets segment was dominant in the global oral proteins & peptides market in 2024. The increasing patients' preference for this type of dosage form is driving the segment progression. Also, they possess a minimum risk of infection, with ease of handling, accurate dosing, and longer shelf stability as compared to other forms is fueling overall its adoption. Tablets are assisting novel developments in their intestinal absorption by incorporating nanoparticles, permeation enhancers, and intestinal microdevices.

The hard/soft gelatin or HPMC capsules segment will register the fastest expansion during 2025-2034. Across the globe, an accelerating focus on the development of vegetarian and halal-certified products in which HPMC capsules are playing a vital role. As HPMC is a plant-derived drug, it further helps in fulfilling demand for the increasing demand for vegetarian and halal-certified pharmaceutical and nutraceutical products. Alongside, enhancing consumer awareness and choice for products that can align with their dietary and religious beliefs is also propelling the adoption of hard/soft gelatin or HPMC capsules.

The pharmaceutical & biotechnology companies segment captured the largest share of the market in 2024. Many leading players are focusing on the production of oral proteins and peptides therapeutics, which are going to treat rising chronic diseases like diabetes, heart concerns, and cancers, etc. As well as escalating consistent drug delivery systems, comprising nano-encapsulation and permeation enhancers, are supporting overall technological advances in these companies and subsequently optimizing the bioavailability and efficacy of oral protein and peptide drugs. Moreover, expanding collaborations among diverse companies are also fueling the overall segment development.

And, the CMOS/CDMS & technology licensors segment will expand rapidly. A significant role of these organizations is in the production and development of oral protein and peptide formulations, allowing expertise in drug delivery technologies, formulation development, and scaling-up production, impacting the overall market expansion. Along with this, the involvement of companies in the patent ground-breaking technologies for oral protein and peptide delivery, like spray drying, encapsulation, and device-enabled approaches, licenses these technologies to CMOS/CDMOs and pharmaceutical companies, with allowance them to employ these advancements in their products.

In the global oral proteins & peptides market, the prescription (Rx) segment registered dominance in 2024. In specific diseases, there is a huge need for well-prescribing drugs, which include certain oral proteins and peptides with a specific design. Mainly, widespread healthcare professionals, such as doctors or nurse practitioners, are prescribing highly efficient oral therapeutics in chronic conditions. Whereas these approaches give rise to a proper diagnosis, dosage, and monitoring, mainly for drugs that can affect hormone levels or have other critical physiological effects.

Although the specialty pharmacy & clinic distribution segment is estimated to witness the fastest growth during 2025-2034. The segment will grow due to the possession of specialized handling, storage, and administration. This further assists expertise in these areas, which is ideal for distribution. In the case of patient education relevant to proper medication use, side effect management, and adherence to treatment regimens, these pharmacies and clinics are playing a major role. Often, they involve the navigation of insurance coverage and reimbursement processes, ensuring patients can access these high-cost therapies.

In the global oral proteins & peptides market share by 44%, North America held the biggest revenue share in 2024. Behind this, the contribution of early approvals, reimbursement pathways, strong clinical development ecosystem is greatly fueling the adoption of complex oral protein and peptide therapeutics. As well as, North America is expanding its leading alliances among biotech firms, research institutions, and pharmaceutical companies, fostering innovations and boosting the development and commercialization of new therapies.

For this market,

In the US, its robust regulatory landscape and active encouragement by diverse regulatory bodies in the R&D of novel oral protein and peptide-based drugs are further propelling the oral proteins & peptides market expansion.

For instance,

A well-equipped healthcare infrastructure and an enhanced preference for non-invasive treatments among Canada’s patients and healthcare providers are boosting demand for oral protein and peptide therapies.

For this market,

Across the global oral proteins & peptides market, the Asia Pacific is anticipated to register the fastest expansion during 2025-2034. Majorly impacting factors in this region’s market expansion are a rise in the burden of metabolic diseases like diabetes, obesity, etc., associated with the growing geriatric population. This has been widely started in India, China, Japan, and Korea, with emphasis on the clinical trials and manufacturing capacity of the oral proteins & peptides-based drugs. Also, a surge in patient preference for oral medications for increasing GIT disorders and cancers is impacting the overall market growth.

In July 2025, Emcure Pharmaceuticals and Sanofi India made an exclusive distribution and promotion agreement for Sanofi’s oral anti-diabetic (OAD) products in India, effective immediately.

In March 2025, Merck partnered with Chinese biotech company Jiangsu Hengrui, committing nearly $2 billion to develop an oral lipid-lowering drug.

The oral proteins & peptides market in Europe is fueled by its mature R&D approaches, with raised investments in demanding plant-based and natural protein sources is ultimately giving significant expansion. Besides this, Europe’s strict regulatory considerations for pharmaceutical products ensure patient safety and support the development of high-quality oral protein and peptide therapies. Emerging trend in Europe for preventative healthcare is another major driver for the use of protein and peptide-based products for both therapeutic and nutritional purposes.

The oral proteins & peptides market encompasses peptide synthesis, genetic engineering, and drug delivery technologies to develop more effective and stable oral formulations.

Key Players: Novo Nordisk A/S, AbbVie Inc., and Pfizer Inc.

To enhance stability and membrane permeability, lipid-based nanocarriers such as oil-in-water nanoemulsions, self-emulsifying drug delivery systems (SEDDS), solid lipid nanoparticles (SLN), nanostructured lipid carriers (NLC), liposomes, and micelles are used in respective formulations and final dosage preparation.

Key Players: CD Formulation, UPM Pharmaceuticals

Various ongoing clinical trials are involved in the enhancement of patient outcomes, coupled with regulatory guidelines for fast track and breakthrough therapy designation in the oral proteins & peptides market.

Key Players: Biocon Ltd., Sanofi, Chiasma, Inc., UNGC, Proxima Concepts Limited (Diabetology Ltd.), US FDA, EMA, ICH

By Molecule Class

By Therapeutic Area

By Dosage Form

By End User / Sponsor Type

By Route-to-Market / Channel

By Region

February 2026

February 2026

February 2026

January 2026