January 2026

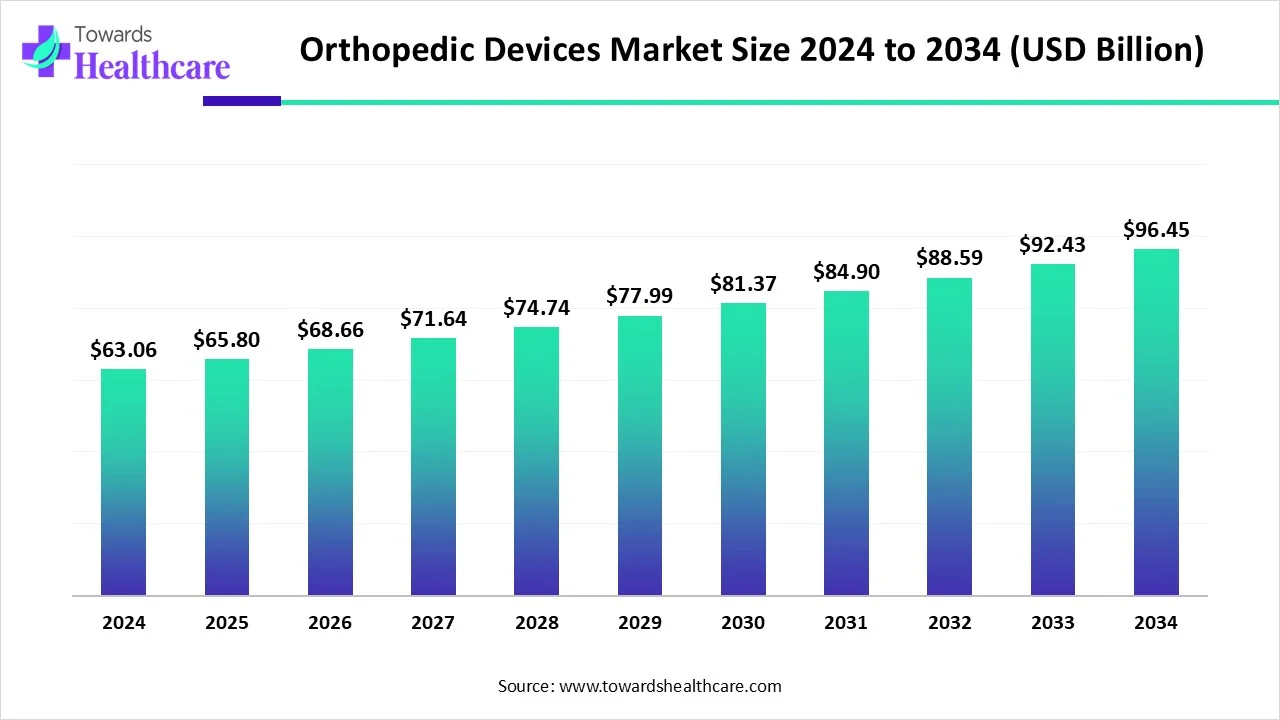

The global orthopedic devices market size is calculated at USD 63.06 billion in 2024, grew to USD 65.8 billion in 2025, and is projected to reach around USD 96.45 billion by 2034. The market is expanding at a CAGR of 4.34% between 2025 and 2034.

The orthopedic devices market is mainly driven by the rising prevalence of orthopedic disorders. Several government organizations launch initiatives to encourage people to prevent, diagnose, and treat orthopedic disorders at an early stage. The development of innovative orthopedic devices, owing to advances in medical technologies and manufacturing techniques, presents future growth opportunities for the market. The use of single-use medical devices is in high demand. Advancements in orthopedic care are made to lead to shorter recovery times and better clinical outcomes.

| Metric | Details |

| Market Size in 2025 | USD 65.8 Billion |

| Projected Market Size in 2034 | USD 96.45 Billion |

| CAGR (2025 - 2034) | 4.34% |

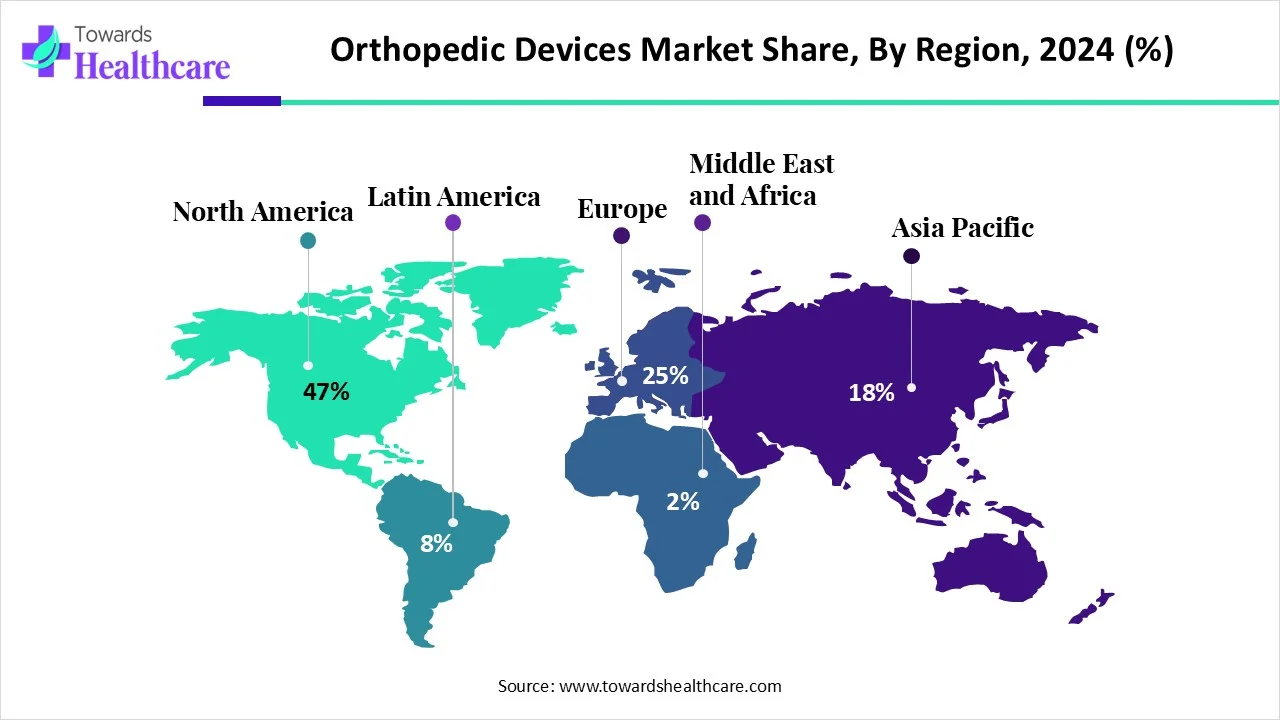

| Leading Region | North America share by 47% |

| Market Segmentation | By Product, By End-Use, By Region |

| Top Key Players | Alphatec Scientific, DePuy Synthes, Fusion Orthopedics USA LLC, Group FH ORTHO, Johnson & Johnson, Madison Ortho, Medtronic, Miraclus Orthotech, Stryker Corporation, UPM Biomedicals, Zimmer Biomet |

Orthopedic devices are medical devices used to treat or prevent orthopedic disorders, including trauma, congenital conditions, and degenerative diseases. Orthopedic disorders mainly affect bones, tendons, muscles, ligaments, joints, and nerves. They support or replace muscles or bones and aid in the rehabilitation process post-surgery. Some common examples of orthopedic devices include orthopedic implants, surgical instruments, casting materials, and bone graft delivery devices. These devices enable people to lead a normal life without anyone’s support.

Numerous factors influence market growth, including the rising prevalence of orthopedic disorders and the growing demand for personalized treatment. The rapidly expanding medical device sector and increasing investments from government and private organizations drive the market. Technological advancements drive the latest innovations in orthopedic devices. The growing shift towards a healthy lifestyle also encourages people to use orthopedic devices and become independent.

Integrating artificial intelligence (AI) can revolutionize orthopedic devices by introducing automation and enhancing efficiency. AI-enabled implants can monitor a patient’s conditions and detect abnormalities, providing real-time insights to healthcare professionals. This enables them to make proactive decisions and provide tailored treatment. AI-built sensors can detect changes in strain, temperature, pressure, alignment, and biochemical conditions within the implant’s environment. Moreover, AI can also revolutionize the manufacturing of orthopedic devices through the use of robots. Robots can automate the manufacturing process of orthopedic devices, reducing human intervention and ensuring high precision and consistency.

Rising Prevalence of Orthopedic Disorders

The major growth factor of the orthopedic devices market is the rising prevalence of orthopedic disorders. They are a major concern among individuals of all ages. The most common types of these disorders are arthritis, osteoarthritis, rheumatoid arthritis, bursitis, and elbow pain. From a recent survey report, it was found that osteoarthritis affects 7.6% of the global population, and is projected to rise by 60-100% by 2050. Osteoarthritis is the seventh-leading cause of disability globally, majorly impacting knee joints. (Source - Science Direct). The increasing geriatric population is at high risk for developing orthopedic disorders. The global population aged 80 years and above is estimated to reach 265 million, and that of 65 years and above would be 2.2 billion by late 2070s. (Source - United Nation)

Biocompatibility Issues

The biomaterials used for developing orthopedic devices are not necessarily biocompatible with humans. This may cause major allergic reactions, such as hypersensitivity reactions, lipid uptake, calcification, and matching tissue biomechanics. Biocompatibility is essential for ensuring the long-term success of the prosthesis and minimizing complications such as inflammation and rejection.

What is the Future of the Orthopedic Devices Market?

The future of the market is promising, driven by the use of advanced manufacturing technology, such as 3D printing. 3D printing, or additive manufacturing, offers numerous benefits compared to conventional manufacturing. It aids in developing tailored orthopedic devices based on patients’ conditions. Researchers can design novel devices and avoid bulk manufacturing, thereby reducing wastage. The use of biocompatible materials helps to reduce adverse effects. Polymers, such as polyether ether ketone (PEEK) and polycarbonate resins, are widely used as they are highly compatible. Thus, the increasing adoption of 3D printing has shown promise in enhancing patient outcomes and surgical efficiency.

By product, the joint replacement/orthopedic implants segment held a dominant presence in the market in 2024. The segmental growth is attributed to the increasing number of orthopedic surgeries and joint replacement procedures. Knee replacements accounted for the highest number of joint replacements, due to the rising prevalence of arthritis and the growing geriatric population. The increasing use of smart implants and the use of 3D printing technology for designing and developing boost the segment’s growth. The growing demand for minimally invasive surgeries also promotes the use of orthopedic implants, enabling faster recovery times for patients.

By product, the orthobiologics segment is expected to grow at the fastest CAGR in the market during the forecast period. Biological materials are widely preferred in orthopedic devices due to higher compatibility and reduced adverse effects. The rising demand for stem cell therapy, blood components, and growth factors augments the segment’s growth. Orthobiologics promote healing and tissue regeneration, improving joint function. They are used to treat a wide range of orthopedic injuries, both acute and chronic, and degenerative conditions without surgery.

By end-use, the hospitals segment dominated the market in 2024. The availability of suitable capital investment and favorable infrastructure fosters the segment’s growth. This enables healthcare organizations or hospitals to adopt cutting-edge technologies. Patients mostly prefer hospitals for advanced orthopedic care due to the presence of skilled professionals and cutting-edge technologies. Skilled professionals can monitor a patient post-surgery. Patients also benefit from favorable reimbursement policies from hospitals, making it a suitable choice. The increasing number of acute orthopedic injuries leads to rising hospital admissions.

By end-use, the outpatient facilities segment is expected to grow with the highest CAGR in the market during the studied years. Outpatient facilities include ambulatory surgical centers (ASCs) and specialized clinics. These facilities provide state-of-the-art care without admitting a patient. The increasing number of ASCs and specialized clinics promotes the segment’s growth. These facilities have specialized equipment and skilled professionals. Patients prefer ASCs as they provide treatment for any musculoskeletal disorders and provide high-quality care, enabling patients to recover in the comfort of their homes.

North America held a major revenue share of the market share by 47% in 2024. Favorable regulatory policies and the rising adoption of advanced technologies are the major factors that govern market growth in North America. Government organizations support early diagnosis and treatment of orthopedic disorders. The increasing number of orthopedic surgeries and the presence of key players contribute to market growth. Moreover, the increasing collaborations and mergers, and acquisitions facilitate the development of novel and innovative orthopedic devices. The availability of state-of-the-art research and development facilities propels market growth.

The American Joint Replacement Registry (AJRR) surpassed 4 million hip and knee arthroplasty procedures as of October 2024. About 3.7 million of these procedures were performed between 2012 and 2023. (Source - AAOS) California has the highest number of active orthopedic surgeons, accounting for 2,870, followed by Texas and New York with 1,924 and 1,700, respectively. The U.S. accounted for the highest export of orthopedic appliances, accounting for $14.6 billion in 2023. (Source - OEC)

The Canadian Orthopedic Association is an association of orthopedic surgeons in Canada, aiming to maintain the highest standards of orthopedic care for Canadian patients. The Canadian government is making constant efforts to ensure the safety, effectiveness, and quality of medical devices. In February 2025, Contura Orthopedics announced the launch of Contura Orthopedics (Canada) Ltd. to supply Health Canada-approved Arthrosamid for patients with knee pain caused by osteoarthritis. (Source - PR Newswire)

Asia-Pacific is expected to grow at the fastest CAGR in the orthopedic devices market during the forecast period. The rapidly expanding medical device sector and the increasing geriatric population augment market growth. The increasing number of medical device startups and favorable government support propel the market. Numerous people are becoming aware of the early diagnosis and treatment of orthopedic disorders. The growing demand for home healthcare leads to an increased need for rehabilitation.

The Chinese government’s “Made in China” policy encourages manufacturers to indigenously produce medical devices in China. The “Made in China 2025” policy focuses on medtech, intending to achieve 70% of domestic production of mid-to-high-end devices by 2025 and 95% by 2030. (Source - Fortuneindia) Moreover, the Chinese government also provides incentives to encourage the adoption of advanced medical equipment in Chinese hospitals.

Nearly 50 million patients are estimated to suffer from knee osteoarthritis in India. The Indian government announced a Rs 500 crore MedTech programme to assist local producers of medical equipment in resuming production and enhance the export of medical devices. The current export of medical devices from India stands at US$ 3.7 billion, making it the fourth-largest market in Asia. (Source - Manufacturingtodayindia)

Europe is expected to grow at a considerable CAGR in the orthopedic devices market in the upcoming period. The increasing prevalence of orthopedic disorders and favorable trade policies foster the market. Switzerland and Ireland were the top 3 exporters of orthopedic devices in 2023. The presence of a robust healthcare infrastructure and growing research and development activities support the development and deployment of orthopedic devices in healthcare organizations. The rising investments by the government and private organizations also drive the market. The growing geriatric population and the presence of key players contribute to market growth.

Switzerland accounted for the second-highest export of orthopedic appliances in the world in 2023. It exported orthopedic appliances worth $7.92 billion. The major importers were the U.S., the Netherlands, and Germany. (Source - OEC) According to the Federal Statistical Office, in 2023, approximately 1.73 million people aged 65 years and above were living in Switzerland, a 2.3% increase from 2023. (Source - Swissinfo)

Ireland exported orthopedic appliances worth $7.61 billion in 2023, making it the third-largest exporter in the world. (Source - OEC) The geriatric population aged 65 years and above grew by more than 40% between 2013 and 2023, from 569,000 to 806,000. (Source - CSO)The Irish medical technology sector generates sales of around €6 billion annually. (Source - Healthtechireland)

The Middle East & Africa are considered to be a significantly growing area in the orthopedic devices market, due to the rising prevalence of bone-related disorders and the increasing adoption of advanced technologies. The growing geriatric population and post-menopausal women potentiate the chance of bone/joint replacement surgeries. Government bodies provide funding for developing novel, indigenous orthopedic devices. They also provide reimbursement for the treatment of musculoskeletal disorders.

Companies like Auxein, ORTEK Medical, and Bonetech Medisys offer advanced orthopedic devices to healthcare organizations and patients in the UAE. It is estimated that around 20% of the population in Dubai has some form of arthritis.

As of September 23, 2025, 12 studies were registered on the clinicaltrials.gov website related to orthopedic devices in Saudi Arabia. Saudi Orthopedics, Inc., Healtec, and Rameem are major manufacturers and providers of high-quality orthopedic devices in Saudi Arabia. A cross-sectional study has demonstrated that the prevalence of knee osteoarthritis was 18.9%.

Johana Kuncová-Kallio, Director of UPM Biomedicals, commented that they are the first company to develop plant-based nanocellulose for use in medical devices, enabling minimally invasive procedures. FibGel can provide safe, sustainable, and animal-free material in an injectable hydrogel form. The company aims to initiate clinical trials in 2025 and collaborate with more companies interested in developing new solutions in the areas of soft tissue repair, joint and disk repair, wound care, drug delivery, and cell therapy. (Source - Azom)

Research activities on orthopedic devices are conducted to incorporate wearable sensors and motion analysis technologies. Scientists also use 3D printing techniques to manufacture customized devices at affordable prices.

Orthopedic devices undergo clinical trials to assess their functionality and compatibility with human organs. They are subsequently approved by regulatory agencies like the FDA, EMA, and NMPA.

Orthopedic devices are delivered to hospitals and pharmacies through distributors and wholesalers to ensure the timely delivery of devices, benefiting a large patient population.

Orthopedic devices benefit patients by enhancing mobility and alleviating pain, thereby enabling them to improve their quality of life and return to an active lifestyle.

By Product

By End-Use

By Region

January 2026

December 2025

December 2025

December 2025