December 2025

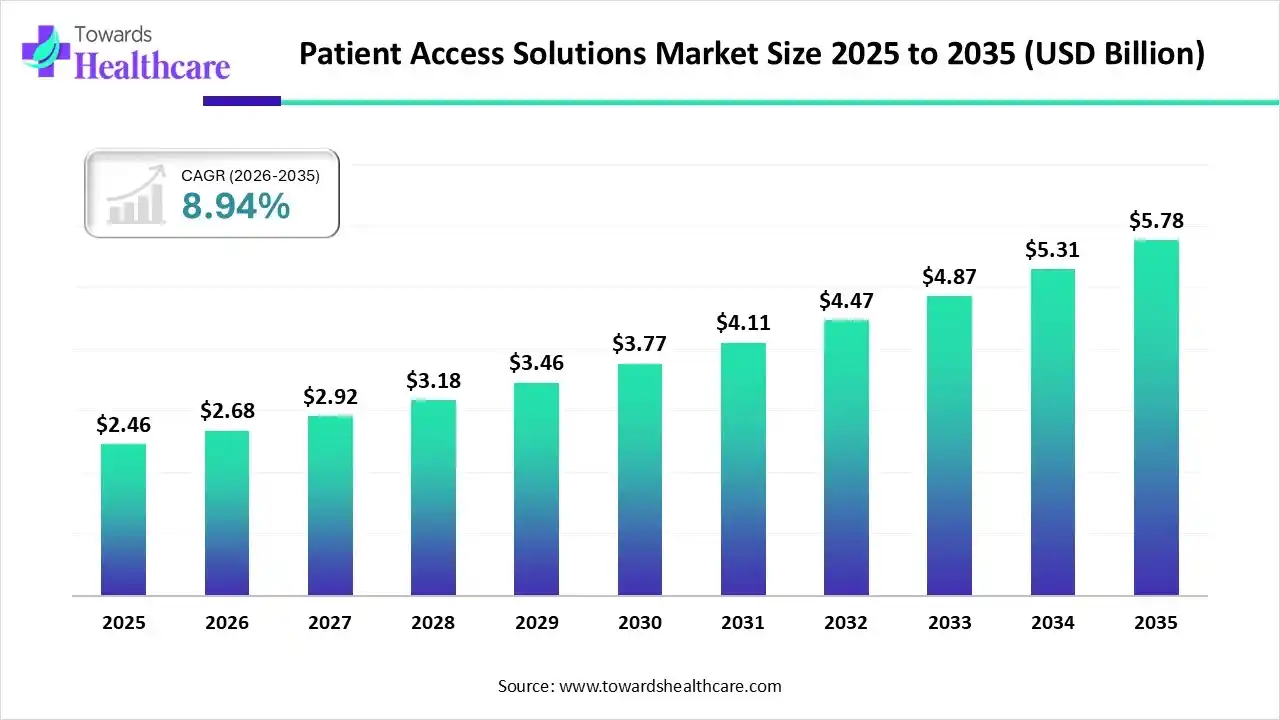

The global patient access solutions market size is calculated at US$ 2.46 billion in 2025, grew to US$ 2.68 billion in 2026, and is projected to reach around US$ 5.78 billion by 2035. The market is expanding at a CAGR of 8.94% between 2026 and 2035.

The patient access solutions market is growing steadily as healthcare providers adopt digital platforms to streamline scheduling, insurance verification, billing, and patient onboarding. North America dominates the market due to advanced healthcare IT infrastructure, widespread use of electronic health records, and a strong focus on reducing administrative burden and revenue cycle inefficiencies, along with high adoption of AI-based automation across hospitals and clinics.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.68 Billion |

| Projected Market Size in 2035 | USD 5.78 Billion |

| CAGR (2026 - 2035) | 8.94% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Dosage Form,By Distribution Channel, By End-User Industry / Customer, By Region |

| Top Key Players | Epic Systems, Oracle Health (Cerner), McKesson, Veradigm (formerly Allscripts), athenahealth, Waystar, Phreesia, Kyruus Health, Optum |

Which Product Type Segment Dominated the Patient Access Solutions Market?

The tablets and capsules segment dominates the market, accounting for 70% of revenue due to their widespread use across chronic and acute therapies, ease of manufacturing, and well-established distribution channels. Their oral administration enhances patient adherence and convenience, while compatibility with specialty pharmacies and hub programs streamlines access and reimbursement processes. Additionally, standardized dosing and packaging make them cost-effective and efficient for large-scale patient support initiatives.

Fixed-Dose Combination (FDC) Tablets

The Fixed-Dose Combination (FDC) tablets segment is estimated to be the fastest-growing segment, as it has the formulations that combine two or more active pharmaceutical ingredients in a single tablet at a specific ratio. They simplify treatment regimens, improve patient adherence, reduce pill burden, and enhance clinical outcomes, particularly in chronic or multi-drug therapies such as cardiovascular, diabetes, or HIV management. FDCs also streamline manufacturing, distribution, and patient access programs.

Why Did the Oral Solid Dosage Segment Dominate the Patient Access Solutions Market?

The oral solid dosage segment dominates the market, accounting for 72% of revenue due to its ease of administration, high patient compliance, and wide applicability across various therapeutic areas. Its stable formulation, cost-effective manufacturing, and compatibility with distribution and patient support programs enhance accessibility, streamline supply chains, and ensure consistent therapy delivery, making it the preferred choice among healthcare providers and patients.

Fixed-Dose Combination (FDC) Tablets

The fixed-dose combination (FDC) tablets segment is anticipated to be the fastest-growing in the patient access solutions market due to its ability to simplify multi-drug regimens, reduce pill burden, and improve patient adherence. Its convenience enhances treatment compliance, supports better clinical outcomes, and integrates efficiently with specialty pharmacies and patient support programs, driving rapid adoption across chronic and complex therapies.

What Retail Pharmacies/Drugstores are the Dominant Segment in the Patient Access Solutions Market?

The retail pharmacies/drugstores segment dominates the market, accounting for 60% of revenue due to their extensive reach, convenient locations, and established relationships with patients. They enable efficient prescription fulfillment, support adherence programs, and integrate with patient assistance and specialty services, ensuring seamless therapy access and improved patient engagement across diverse healthcare settings.

Online Pharmacies/E-Pharmacy Platforms

The online pharmacies/e-pharmacy platforms segment is estimated to be the fastest-growing in the market due to increasing digital adoption, the convenience of home delivery, and 24/7 accessibility. Their integration with patient support programs, automated refills, and real-time prescription management enhances adherence, streamlines access, and expands reach to remote or underserved patient populations.

How Retail Outpatient/Retail Patients Led the Patient Access Solutions Market?

The outpatient or retail patient segment dominates the market, accounting for 75% of revenue due to its large patient base, frequent healthcare interactions, and high prescription volumes. Convenient access to pharmacies and clinics, combined with integration of patient support programs, ensures adherence, streamlined therapy delivery, and effective management of chronic and acute conditions across diverse populations.

Hospitals/Inpatient Care (Acute/ICU)

The hospitals/inpatient care (acute/ICU) segment is anticipated to be the fastest-growing in the patient access solutions market due to increasing adoption of specialty therapies, complex treatment regimens, and advanced care requirements. Integration of patient support programs, streamlined medication distribution, and enhanced adherence monitoring in hospital settings drives rapid uptake and improved clinical outcomes.

North America captured the largest revenue of 28% of the patient access solutions market due to its highly developed healthcare infrastructure, strong adoption of electronic health records, and rapid digitalization of administrative workflows across hospitals and clinics. The region benefits from advanced insurance systems, high awareness of revenue cycle optimization, and early integration of AI-based automation. Supportive government regulations promoting interoperability and patient data access further strengthen North America’s leadership in this market.

The U.S. is the dominant country in the North America patient access solutions market due to its advanced healthcare IT infrastructure, widespread use of electronic health records, and strong focus on reducing administrative costs and claim denials. High adoption of AI-driven automation, government interoperability mandates, and strong investments from private healthcare providers further reinforce its leadership.

Asia-Pacific is the fastest-growing region in the patient access solutions market due to the rapid digital transformation of healthcare systems, increased adoption of electronic health records, and strong government initiatives supporting hospital automation. Expanding medical insurance coverage, rising patient volumes, and growing awareness of revenue cycle optimization are accelerating demand. Investments from global and regional health-tech companies further boost the expansion of patient access platforms across the region.

China is the dominant country in the Asia-Pacific patient access solutions market due to the rapid digitalization of hospitals, strong government support for health IT adoption, and nationwide expansion of electronic health records. Large patient volumes and rising insurance coverage drive demand for automated scheduling, billing, and eligibility verification. Significant investments from domestic tech companies and cloud-based healthcare platforms further strengthen China’s leadership.

Europe is growing at a notable rate in the patient access solutions market due to its increasing adoption of digital health systems, rising emphasis on improving hospital workflow efficiency, and expansion of national e-health programs. The region’s shift toward interoperable patient data exchange, rising implementation of insurance verification tools, and focus on reducing billing errors and administrative burden are boosting demand. Strong investments from healthcare providers and technology vendors further support market growth across Europe.

The U.K. dominates the Europe patient access solutions market due to its highly digitalized healthcare ecosystem, strong national commitment to electronic health records, and continuous investment in NHS digital transformation programs. Widespread adoption of automated scheduling, billing, and insurance verification tools strengthens operational efficiency across hospitals. Government policies promoting interoperability, patient portals, and AI-driven administrative automation further reinforce the UK's leadership in patient access solutions across the region.

| Year | Number of Community Pharmacies | Number of Items Dispensed |

| 2022/2023 | 11,414 | 1,079,000,000 |

| 2023/2024 | 12,009 | 1,113,000,000 |

| 2024/2025 | 11,098 | 1,156,000,000 |

| Vendor | Key patient-access offerings (concise) |

| Epic Systems | Integrated access & revenue-cycle suite: appointment scheduling, patient registration & self-service (MyChart), referrals/authorizations, front-end eligibility checks, and integration with Epic RCM. |

| Oracle Health (Cerner) | Patient administration & revenue-cycle platform: self-service scheduling/registration, EHR integration, eligibility verification, cloud-hosted revenue and claims workflow automation. |

| McKesson | End-to-end provider solutions including specialty patient access (CoverMyMeds/AMP), medication access/affordability services, practice management integration, and pharmacy-centric access support. |

| Veradigm (formerly Allscripts) | EHR + practice management + patient engagement modules: registration, patient portals, scheduling, API/connectivity for third-party access tools, and practice workflow customization. |

| athenahealth | Cloud-native patient engagement & practice management: digital portals, appointment management, intake/registration, patient communication, and integrated billing/RCM services |

| Waystar | Cloud RCM + patient financial experience platform: eligibility & benefits verification, payment & estimate tools, claims/denials management, and automation to improve patient collections. |

| Phreesia | Patient intake & access platform: digital check-in/registration, forms, insurance capture, payments at point-of-service, specialty intake templates, and EHR integrations |

| Kyruus Health | Care-access platform focused on provider-search & patient-provider matching, scheduling/visibility, provider data management, and enabling search → schedule → start patient journeys. |

| R1 RCM | End-to-end revenue cycle & patient access services: blended self-service intake, insurance verification, patient payment/collections tools, denial prevention, and AI/automation-enabled workflows. |

| Optum / Optum360 | Large-scale patient access & engagement services: contact-center scheduling, digital access, patient clearance/financial clearance, coding/claims support (Optum360), and analytics-driven operations. |

By Product Type

By Dosage Form

By Distribution Channel

By End-User Industry / Customer

By Region

North America

South America

Europe

Asia Pacific

MEA:

December 2025

December 2025

December 2025

December 2025