February 2026

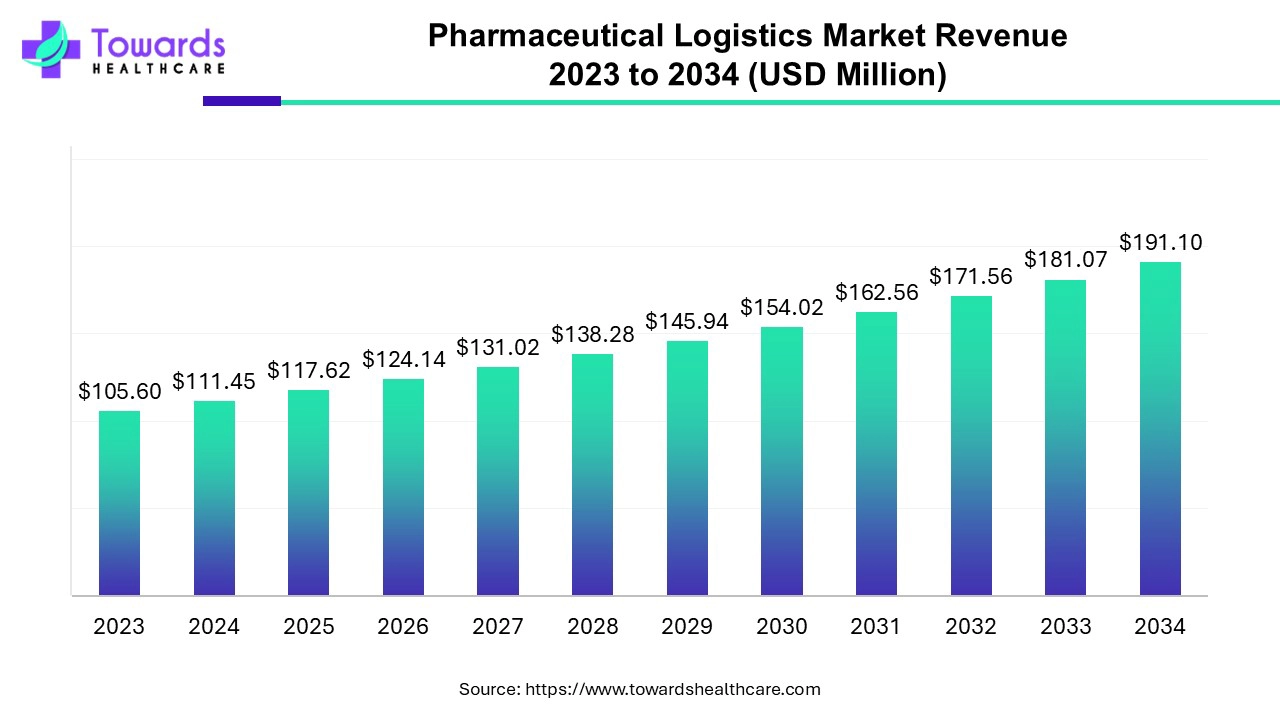

The pharmaceutical logistics market was estimated at US$ 105.6 million in 2023 and is projected to grow to US$ 191.1 million by 2034, rising at a compound annual growth rate (CAGR) of 5.54% from 2024 to 2034.

Pharmaceutical logistics involves procuring, storing, and transporting pharmaceutical goods like medications, medical devices, and equipment. The service includes the management of the supply chain in the pharmaceutical field from the procurement of raw materials from the vendor to the transport of finished products to the customers. It is a complex process requiring careful planning and implementation to ensure safe and efficient delivery of products.

The rising demand and need for pharmaceuticals are the major drivers of the market. The increasing incidences of chronic and acute disorders, rising population, and COVID-19 pandemic generated the demand for several pharmaceutical products such as drugs and medical devices. The market is also driven by the advent of biological products such as vaccines, cell and gene therapy products, and precision medicines, which require stringent regulatory requirements and temperature-controlled transportation. Additionally, recent technological advancements such as the use of AI and ML automate the entire logistics process, resulting in better outcomes and customer satisfaction.

| Metric | Details |

| Market Size in 2024 | USD 111.45 Million |

| Projected Market Size in 2034 | USD 191.1 Million |

| CAGR (2025 - 2034) | 5.54% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application, By Region |

| Top Key Players | Agility Logistics, AmerisourceBergen, Cardinal Health, Inc., CEVA Logistics, C.H. Robinson, DB Schenker, Expeditors, Kerry Logistics, Kuehne + Nagel, Maersk, Marken LLP, Nippon Express, Pharma Logistics, SF Express |

Advanced technologies like artificial intelligence (AI) and machine learning (ML) algorithms streamline the supply chain of pharmaceutical goods. It provides real-time data and analytics about the delivery of pharmaceutical goods and determines the best possible routes. Telematics and remote monitoring in cold chain logistics facilitate cargo transportation, providing efficiency and better connectivity. AI can notify companies about their inventory levels and support the supply chain. Additionally, cloud computing and the internet-of-things (IoT) can monitor dosage, temperature deviation, ingredient types, etc., and generate a quality management system, ensuring product integrity throughout the supply chain process. Therefore, integrating AI into delivery and transportation can guarantee the safe, effective, and timely distribution of necessary prescription drugs, enhancing patient outcomes and satisfaction.

The major challenge for pharmaceutical logistics is the stringent regulatory requirements. Pharmaceuticals are supplied across various countries, requiring companies to fulfill different regulations for storage, transport, and documentation. Another challenge is the rise in transportation costs due to increasing petrochemical prices. Additionally, the lack of tracking of goods reduces efficiency and workforce productivity.

There is a rise in the demand for the use of biologics such as vaccines, insulin, etc., to deal with the rising chronic diseases. This is increasing the use of cold chain logistics for the temperature-sensitive biologics. Due to their strict storage condition, the use of cold chain logistics is being preferred option for their transportation. The personalized biologics are also being developed, which is increasing their demand. Thus, pharmaceutical logistics are being used for the proper transportation of these biologics, enhancing the pharmaceutical logistics market growth.

For instance,

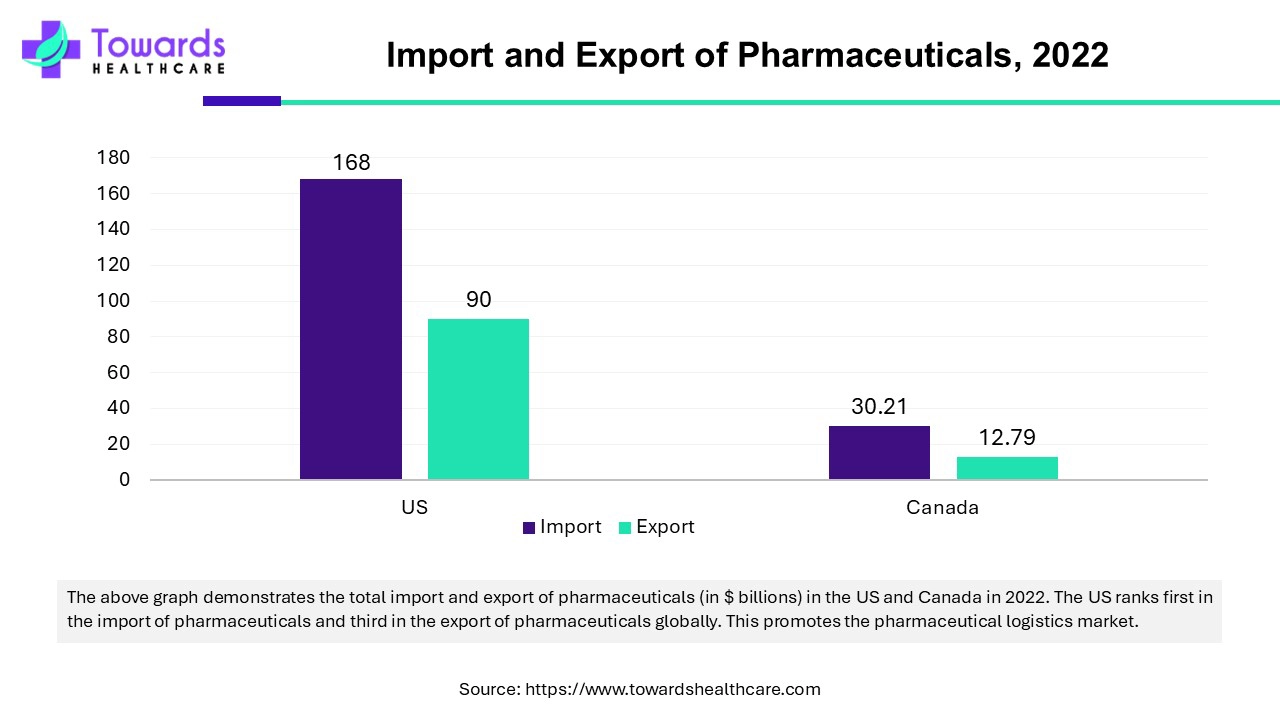

North America held a dominant presence in the pharmaceutical logistics market in 2023. The presence of key pharmaceutical companies, technological advancements, and favorable infrastructure drive the market. The market is also driven by favorable government policies to promote pharmaceutical logistics in the region. The US Department of Health and Human Services (HHS) released a white paper on April 2024 highlighting steps to prevent and mitigate drug shortages and proposing additional solutions for policymakers to consider. Additionally, the Drug Supply Chain Security Act (DSCSA) by the US Government highlights steps to achieve an interoperable and electronic way to identify and trace certain prescription drugs at the package level as they move through the supply chain, preventing the entry of harmful drugs. According to the Canadian Institute for Health Information’s National Health Expenditure report, pharmaceuticals are the second-largest component of healthcare expenditures, representing approximately 14% of total spending.

For instance,

Asia-Pacific is anticipated to grow at the fastest rate in the pharmaceutical logistics market during the forecast period. The growing healthcare expenditure, rising population and chronic disorders, increasing demand for generics, and growing demand for online pharmacies drive the market. China and India are the major exporters of pharmaceuticals in the Asia-Pacific region. In 2022, China was amongst the top five importers of pharmaceuticals with a value of $37.4 billion, while it ranked 13th in the export of pharmaceuticals with $15.3 billion. India’s pharmaceutical exports rose 9.67% year-on-year to $27.9 billion in 2023-24. India supplies approximately 60% of the global demand for vaccines. Additionally, Japan exported $10.6 billion in pharmaceuticals in 2022. Furthermore, favorable government policies and suitable pharmaceutical manufacturing infrastructure augment the market.

Europe is estimated to be significantly growing during the forecast period. The main drivers of the European market are rising healthcare costs, a particular emphasis on cold chain logistics, and an increase in the number of medications that are sensitive to temperature. One of the main causes of the rising demand for pharmaceutical products is the rising prevalence of chronic illnesses. According to PubMed Central, chronic conditions such as cancer, heart disease, chronic respiratory conditions, diabetes, and mental disorders accounted for 8.5% of all deaths in EU countries, which raised the need for pharmaceuticals. The area is also going through a shift to sustainable logistics, where transportation companies choose eco-friendly supply chain options and cut down on routes that use a lot of gasoline.

The Middle East and Africa are expected to grow significantly in the pharmaceutical logistics market during the forecast period. The expanding healthcare is increasing the demand for pharmaceutical logistics. The growing use of vaccines, along with other biologics, is also increasing their use. They are also being used to supply the products to the remote areas. Thus, all these factors, along with government support, are promoting the market growth.

By type, the non-cold chain logistics segment dominated the pharmaceutical logistics market in 2023. Non-cold chain logistics involves storing and transporting pharmaceuticals that do not require accurate temperature control. The products include several generic drugs, antibiotics, and over-the-counter (OTC) medications. The rising demand for such products, favorable infrastructure, and cost-effectiveness of non-cold chain logistics drive the market. Non-cold chain logistics also do not require specialized equipment and unique handling processes. The market is also driven by technological advancements such as management systems for transportation and warehouses. The cold chain segment is expected to grow fastest during the forecast period. The increasing demand for biologicals due to the COVID-19 pandemic and rising chronic illnesses boost the market. In addition, the adoption of AI also boosts the healthcare market, facilitating temperature monitoring throughout transport.

By application, the biopharma segment held the largest share of the market in 2023. Biopharmaceuticals are medicines that are derived from living organisms. Examples of biopharmaceuticals include vaccines, blood and blood components, allergenic, cell and gene therapies, and recombinant therapeutic proteins. These products require stringent conditions for storage and transport, such as cold temperatures and regulatory compliance. The increasing prevalence of chronic disorders like infectious diseases, cancer, autoimmune disorders, and hematological disorders increases the demand for biopharmaceuticals, thereby necessitating their efficient and timely delivery. The chemical pharma segment is anticipated to grow with the highest CAGR in the market during the studied years. Chemical pharma are the products other than biologicals that are synthesized from chemicals. The growing demand for raw materials, bulk pharmaceuticals, common cough and cold drugs, and generics augment the market.

In April 2025, after announcing the collaboration between SkyCell and Microsoft, the EMEA digital natives technical director at Microsoft, Elena González-Blanco García, stated that, to develop more efficient and safer supply chains, they will be advancing pharmaceutical logistics by utilizing the transformative power of AI on Microsoft Azure OpenAI. Thus, the crucial treatment will be provided to the patients securely and swiftly, ultimately enhancing their progress in the industry with the help of this approach.

In February 2025, fourth-quarter 2024 financial results were announced by Expeditors International of Washington, Inc. A growth of 54% to $1.68 for EPS1 was observed. 49% to $236 million rise in the net earnings attributable to shareholders was noted. Similarly, 51% to $301 million growth in operating income was reported. At the same time, revenue growth was reported to be 30% to $3.0 billion. Moreover, a growth of 11% and 14% was observed in the airfreight tonnage and ocean container volume, respectively.

In January 2025, financial results were released by C.H. Robinson Worldwide, Inc. The gross profits, income from operations, and adjusted operating margin showed a growth of 10.4% to $672.9 million, 71.1% to $183.8 million, and 940 basis points to 26.8%, respectively. A rise of 369.2% to $1.22 in EPS, 142.0% to $1.21 adjusted EPS, and 220.6 million to $267.9 million in cash generated by operations were reported for the fourth quarter.

Moreover, the full-year report showed a growth in gross profits by 5.8% to $2.7 billion, income from operations by 30.0% to $669.1 million, and the adjusted operating margin by 440 basis points to 24.2%. Whereas the diluted EPS and adjusted EPS showed a growth of 41.9% to $3.86 and 36.7% to $4.51, respectively.

By Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026