February 2026

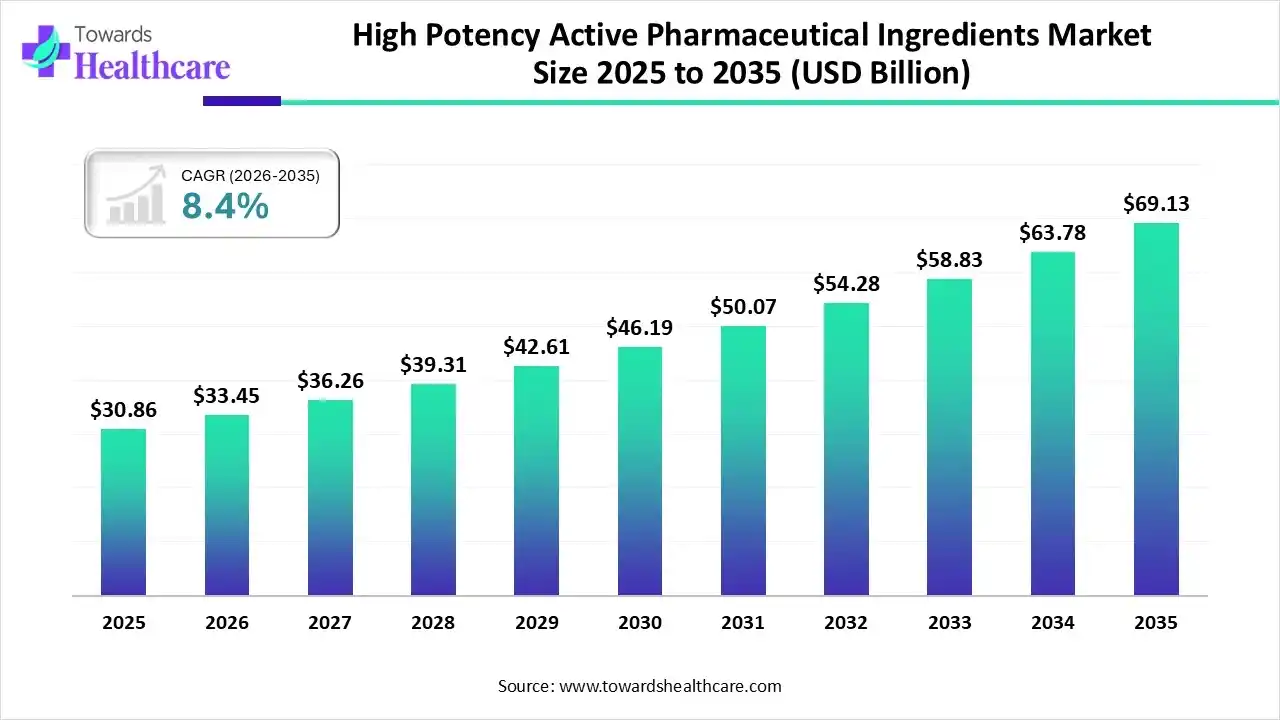

The global high potency active pharmaceutical ingredients market size was estimated at USD 30.86 billion in 2025 and is predicted to increase from USD 33.45 billion in 2026 to approximately USD 69.13 billion by 2035, expanding at a CAGR of 8.4% from 2026 to 2035.

The market is growing steadily, driven by rising demand for oncology, hormone, and targeted therapies, along with increased outsourcing to specialized CDMOs and stricter regulatory compliance requirements.

High-potency active pharmaceutical ingredients (HPAPIs) are highly potent drug substances effective at very low doses, requiring specialized handling, manufacturing, and containment due to their toxicity and pharmacological activity. The high potency active pharmaceutical ingredients market is expanding due to the rising prevalence of targeted and precision therapies, and strong growth in oncology drug pipelines. Advances in containment technologies, greater outsourcing to specialized CDMOs, and stricter regulatory standards further support market growth by ensuring a safe, scalable, and compliant HPAPI market.

For Instance,

Artificial intelligence can transform the high potency active pharmaceutical ingredients market by accelerating drug discovery, optimizing process development, and improving yield prediction for complex, high-potency compounds. AI-driven analytics enable better risk assessment, real-time quality monitoring, and faster scale-up, while automation and predictive maintenance enhance safety, regulatory compliance, and cost efficiency across HPAPI manufacturing and supply chains.

| Key Elements | Scope |

| Market Size in 2026 | USD 33.45 Billion |

| Projected Market Size in 2035 | USD 69.13 Billion |

| CAGR (2026 - 2035) | 8.4% |

| Leading Region | North America |

| Market Segmentation | By Product, By Manufacturer Type, By Drug Type, By Application, By Region |

| Top Key Players | BASF SE, CordenPharma, BristolMyers Squibb, CARBOGEN AMCIS AG, Pfizer, Inc., Boehringer Ingelheim, Dr. Reddy’s Laboratories |

Why Did the Synthetic Segment Dominate in the Market in 2025?

The synthetic segment dominated the high potency active pharmaceutical ingredients market during the forecast period due to its wide use in oncology, hormone, and CNS therapies. Synthetic HPAPIs offer consistent quality, scalable production, and well-established manufacturing processes. Their compatibility with advanced chemical synthesis and strong regulatory acceptance further supported higher adoption compared to biotech-derived alternatives.

Biotech

The biotech segment is expected to grow at the fastest CAGR during the forecast period due to increasing development of biologics, antibody drug conjugates, and targeted therapies. Rising investments in biotechnology, advances in cell and gene engineering, and growing demand for precision oncology treatment are accelerating adoption. Additionally, strong clinical pipelines and improved bioprocessing technologies are supporting the rapid commercialization of biotech-based HPAPIs.

How the In-house Segment Dominated the Market in 2025?

The in-house segment dominated the high potency active pharmaceutical ingredients market in 2025 as large pharmaceutical companies prioritize control over quality, intellectual property, and regulatory compliance. In-house production enables better process optimization, secure handling of high-potency compounds, and reliable supply for oncology and chronic disease pipelines, reducing dependency on external manufacturers.

Outsourced

The outsourced segment is expected to grow at the fastest CAGR during the forecast period as pharmaceutical companies seek efficiency and faster time-to-market. Specialized CDMOs offer advanced containment infrastructure, regulatory expertise, and scalable HPAPI capabilities. The growing complexity of potent molecules, coupled with rising clinical pipelines and limited in-house capacity, is further accelerating outsourced adoption.

Why the Innovative Segment Dominated the Market?

The innovative segment dominated the high potency active pharmaceutical ingredients market due to the rapid development of novel oncology and targeted therapies. These drugs require highly potent compounds to deliver therapeutic effects at low doses. Strong R&D investments, expanding clinical pipelines, and increased approvals for first-in-class and specialty medicines further drove demand for innovative HPAPIs.

Generic

The generic segment is expected to grow at the fastest CAGR during the forecast period due to patent expirations of several high-potency oncology and hormone drugs. Rising demand for cost-effective therapies, increasing cancer prevalence, and wider access to affordable medicines are driving generic adoption. Additionally, improving manufacturing capabilities and regulatory approvals for generic HPAPIs are supporting rapid market expansion.

Why Did the Oncology Segment Dominate in the Market in 2025?

The oncology segment led the high potency active pharmaceutical ingredients market in 2025 due to the rising global cancer burden and strong growth in oncology drug pipelines. Many cancer therapies require highly potent compounds to achieve targeted efficacy at low doses. Increased approvals of novel anticancer drugs and sustained investment in oncology research further reinforced the market-leading position.

| Year | Oncology Approval (Drug/API) |

| 2024 | Osimertinib with chemotherapy (Tagrisso) |

| Lifileucel (Amtagvi) | |

| Tepotinib (Tepmetko) | |

| Irinotecan liposome (Onivyde combo) | |

| Erdafitinib (Balversa) | |

| Nivolumab + hyaluronidasenvhy (Opdivo Qvantig) | |

| Encorafenib + cetuximab + mFOLFOX6 | |

| 2025 | Acalabrutinib + bendamustine + rituximab (Calquence combo) |

| Brentuximab vedotin + lenalidomide & rituximab (Adcetris combo) | |

| Vimseltinib (Romvimza) | |

| Pembrolizumab + chemo (Keytruda combos) |

Glaucoma

The glaucoma segment is expected to grow at the fastest CAGR during the forecast period due to the rising aging population and increasing prevalence of eye disorders worldwide. High-potency APIs are widely used in ophthalmic drugs to achieve efficacy at low doses. Advancements in targeted eye therapies, improved drug delivery, and growing awareness about early drug delivery systems and growing awareness about early glaucoma treatment are further accelerating market growth.

North America dominated the global high potency active pharmaceutical ingredients market in 2025 due to strong pharmaceutical R&D investments, a robust oncology drug pipeline, and the presence of leading pharma and CDMO players. Advanced manufacturing infrastructure, strict regulatory frameworks ensuring quality and safety, and high adoption of innovative and targeted therapies strengthened the region's market leadership.

Key Factors Behind the U.S. Market Leadership in 2025

The U.S. captured a revenue share of the high potency active pharmaceutical ingredients market in 2024 due to its strong concentration of leading pharmaceutical companies, extensive oncology and specialty drug pipelines, and high R&D spending. Advanced manufacturing capabilities, early adoption of innovative therapies, favorable regulatory pathways, and the presence of major HPAPI-focused CDMOs further supported the country’s market leadership.

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period due to expanding pharmaceutical manufacturing capacity, rising cancer prevalence, and increasing demand for affordable therapies. Growing investment in API production, cost-efficient manufacturing, and rapid expansion of CDMOs in countries like China and India are accelerating market growth. Supportive government initiatives and improving regulatory frameworks further enhance the region's growth potential.

India emerging as a High-Growth HPAPI Powerhouse

India is anticipated to grow at a rapid CAGR during the forecast period due to its strong position as a global API manufacturing hub and expanding capabilities in high-potency compounds. Rising investment in oncology drug production, increasing outsourcing from global pharmaceutical companies, and cost-efficient manufacturing are key drivers. Additionally, government support for pharmaceutical exports, improving regulatory compliance, and the growing presence of HPAPI-focused CDMOs are accelerating market growth.

Europe is anticipated to grow at a notable CAGR during the forecast period due to increasing investments in oncology and speciality drug development, advanced pharmaceutical infrastructure, and stringent regulatory standards that ensure high-quality HPAPI production. The presence of leading pharmaceutical companies, rising adoption of innovative therapies, and expansion of contract manufacturing organizations further support the region’s steady market growth.

UK Set to Achieve Rapid Growth in the HPAPI Market

The Uk is anticipated to grow at a rapid CAGR during the forecast period due to its strong pharmaceutical R&D ecosystems, increasing focus on oncology and specialty therapies, and well-established HPAPI manufacturing capabilities. Supportive government policies, expansion of contract development and manufacturing organizations, and growing adoption of innovative high-potency drugs are driving the country’s accelerated market growth.

| Companies | Headquarters | Offerings |

| BASF SE | Ludwigshafen, Germany | Develops high-quality APIs and supports the production of potent pharmaceutical compounds through advanced chemical synthesis. |

| CordenPharma | Plankstadt, Germany | Provides contract development and manufacturing (CDMO) services for complex and highly potent APIs. |

| BristolMyers Squibb | New Jersey, USA | Focuses on oncology and specialty medicines that utilize HPAPIs for effective treatment at low doses. |

| CARBOGEN AMCIS AG | Bubendorf, Switzerland | Offers custom synthesis and high-containment manufacturing solutions, including for antibody–drug conjugate intermediates. |

| Pfizer, Inc. | New York, USA | Produces and develops HPAPI-based therapies, particularly in oncology and targeted drug segments. |

| Boehringer Ingelheim | Ingelheim, Germany | Manufactures HPAPIs for oncology and specialty treatments, using stringent safety and containment standards. |

| Dr. Reddy’s Laboratories | Hyderabad, India | Provides end-to-end HPAPI development and manufacturing with advanced containment to manage occupational exposure. |

By Product

By Manufacturer Type

By Drug Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026