January 2026

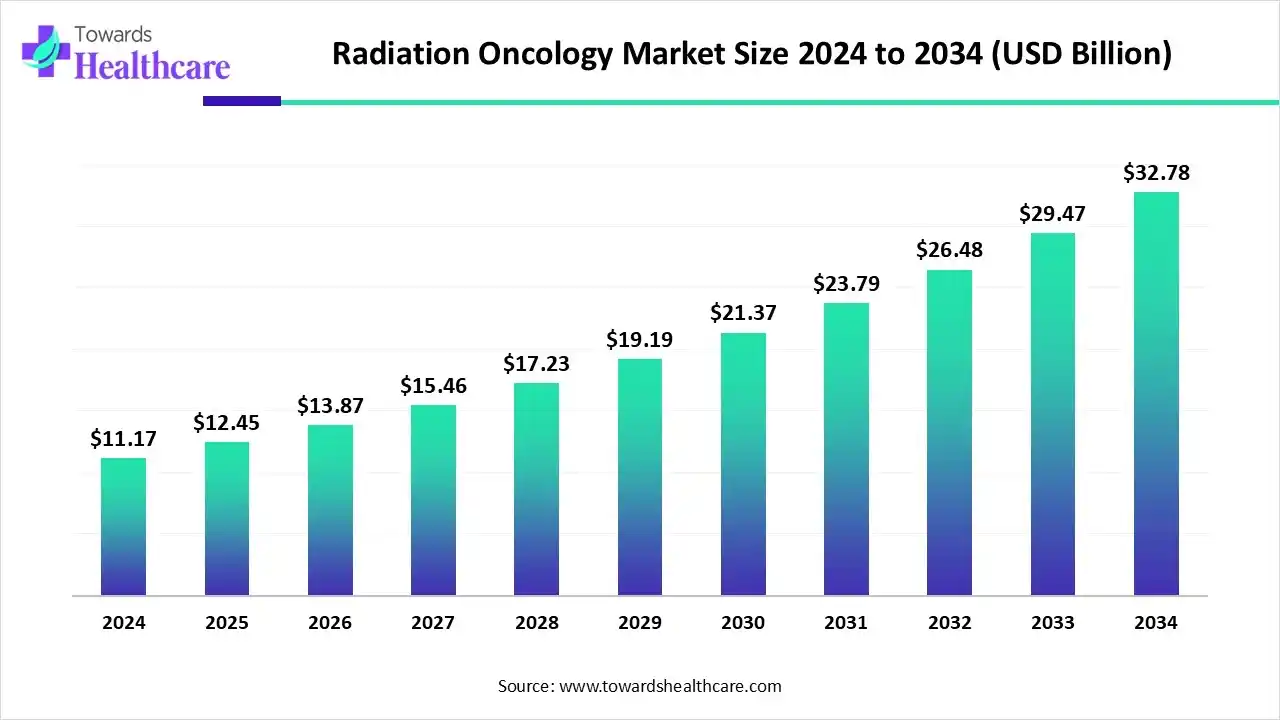

The global radiation oncology market size is calculated at USD 12.45 billion in 2025, grew to USD 13.87 billion in 2026, and is projected to reach around USD 36.78 billion by 2035. The market is expanding at a CAGR of 11.44% between 2026 and 2035.

The radiation oncology market is primarily driven by the increasing awareness of radiation therapy and the rising incidence of cancer. Government and private organizations provide funding for treatment, especially in emerging markets. The growing demand for personalized treatment potentiates the demand for radiation therapy. Artificial intelligence (AI) improves the accuracy, precision, and efficiency of radiation therapy for patients with cancer. Technological innovations, such as robotics and automation, present future opportunities for radiation oncology.

| Table | Scope |

| Market Size in 2025 | USD 12.45 Billion |

| Projected Market Size in 2035 | USD 36.78 Billion |

| CAGR (2026 - 2035) | 11.44% |

| Leading Region | North America |

| Market Segmentation | By Type of Radiation Therapy, By Application/Cancer Type, By End-User, By Region |

| Top Key Players | Hitachi Ltd., ViewRay Inc., Mevion Medical Systems, Ion Beam Applications (IBA), Isoray Inc., Nordion (Canada) Inc. (Sotera Health), RefleXion Medical, Brainlab AG, Mirion Technologies, Becton, Dickinson and Company (BD), Panacea Medical Technologies Pvt. Ltd., P-Cure Ltd., C-RAD AB, Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions Corporation |

The radiation oncology market is fueled by the global increase in cancer cases, growing geriatric population, emerging novel modalities, and rising healthcare expenditures. It encompasses the use of ionizing radiation to treat various types of cancer. This specialty involves the application of radiation therapy to eradicate cancer cells, shrink tumors, and alleviate symptoms associated with malignancies. Radiation oncology integrates advanced technologies, including external beam radiation therapy (EBRT), internal beam radiation therapy (such as brachytherapy), and emerging modalities like proton therapy and radiopharmaceuticals. The market includes equipment manufacturers, service providers, and healthcare institutions offering radiation therapy services.

AI is expected to revolutionize radiation oncology by introducing automation and facilitating personalized treatment. It assists healthcare professionals in automated treatment planning, adaptive radiotherapy, and IGRT, supporting clinical decisions. AI and machine learning (ML) algorithms can analyze vast amounts of patient data and enhance patient experience and outcomes. The AI-based Radiation Planning Assistant (RPA) enhances global access to radiation therapy, particularly in countries where radiotherapy specialists are scarce.

MVisionAI offers Dose+, an AI-powered dose prediction software, to assist radiation therapy professionals in treatment planning by providing patient-specific dose predictions.

Government bodies of numerous countries support radiation oncology by various initiatives and policies, including:

| Month, Year | Company | Product | Product Launch Country | Specialty |

| September, 2025 | Accuray Incorporated | Accuray Stellar Solution | U.S. | An all-in-one radiotherapy platform that offers multiple delivery modalities, including real-time motion tracking, offline adaptive protocols, and treatment evaluation & training |

| September, 2025 | Subang Jaya Medical Center (SMJC) | ExacTrac Dynamic System | Malaysia | Uses surface guidance, thermal imaging, and X-ray monitoring to track patient positioning continuously, delivering radiotherapy with sub-millimetric precision |

| May, 2025 | RaySearch Laboratories | v2025 version of the RayStation treatment planning system | Sweden | Automatically generates numerous treatment plans and offers RayStation Ablation for liver ablation guidance |

| May, 2024 | GE Healthcare | Revolution RT | U.S. & France | A radiation therapy computed tomography solution to boost imaging accuracy by simplifying the simulation workflow |

By type of radiation therapy, the external beam radiation therapy (EBRT) segment held a dominant presence in the market with a share of approximately 42% in 2024, due to the need for non-invasive therapy and the ability to provide precisely controlled radiation beams. EBRT uses high-energy beams that can create highly charged particles. It enhances patient convenience by destroying cancer cells from a distance with minimal damage to healthy tissues. EBRT is also used to support other treatments, like shrinking tumors before surgery and relieving symptoms.

By type of radiation therapy, the internal beam radiation therapy (brachytherapy) segment is expected to expand rapidly in the market in the coming years. The demand for brachytherapy is increasing due to the growing need for targeted therapy and advancements in combination therapy with EBRT. Brachytherapy refers to placing radioactive seeds, pellets, capsules, or other implants inside or near a tumor that releases radiation over time. It is primarily used for gynecological and prostate cancers. According to a GEC-ESTRO Brachy-HERO survey, there is an average of one brachytherapy center per 0.8 million inhabitants in Europe.

By application/cancer type, the breast cancer segment led the market with a share of approximately 34% in 2024, due to the increasing incidence of advanced breast cancer and to minimize the risk of breast cancer recurrence. The American Cancer Society estimated that approximately 316,950 women will be diagnosed with invasive breast cancer in 2025.Radiation therapy for breast cancer uses high-energy X-rays, protons, or other particles to kill cancer cells. It can help relieve symptoms caused by cancer that has spread to other body parts.

By application/cancer type, the lung cancer segment is expected to witness the fastest growth in the market over the forecast period. The increasing lung cancer incidence promotes the use of radiation therapy. Radiation can be used before lung cancer surgery to shrink the tumor or after surgery to kill remaining cancer cells. It can also relieve symptoms, such as pain, bleeding, or airway blockage by the tumor. EBRT, IBRT, intensity modulated radiation therapy (IMRT), and stereotactic body radiation therapy are different types of radiotherapy used for lung cancer.

By end-user, the hospitals segment held the largest revenue share of approximately 55% in the market in 2024, due to suitable capital investment and the increasing number of hospital admissions. Hospitals invest heavily in adopting advanced technologies for cancer treatment. They possess healthcare professionals from various departments and provide multidisciplinary expertise to patients. Patients prefer taking treatments from hospitals due to favorable reimbursement policies.

By end-user, the oncology centers segment is expected to grow at the fastest CAGR in the market during the forecast period. The increasing number of oncology centers and the presence of skilled professionals boost the segment’s growth. Skilled professionals provide personalized treatment and care to cancer patients. There are about 73 NCI-designed cancer centers in the U.S. Oncology centers have state-of-the-art equipment and facilities, potentiating the segment’s growth.

North America dominated the market with a share of approximately 80% in 2024. The availability of a robust healthcare infrastructure, the presence of key players, and suitable regulatory policies are the growth factors that govern market growth in North America. The rising prevalence of cancer and the growing demand for personalized treatment propel the market. Favorable government support leads to infrastructure development and the launch of novel radiotherapy equipment and solutions.

Key players, such as GE Healthcare, Becton, Dickinson and Company, and Accray, Inc., are the major contributors to the market in the U.S. The American Society for Radiation Oncology (ASTRO) launched the Radiation Oncology Case Rate (ROCR) Value-Based Payment Program Act to stabilize access to radiation therapy and protect patient care across the country.

Canada is home to 48 cancer centers across different cities. Canadian universities and institutions host fellowship programs in radiation oncology to train individuals from different nations. Apart from promoting radiation therapy, the Canadian government provides guidelines to prevent potential health effects from radiation exposure.

Asia-Pacific is expected to host the fastest-growing market in the coming years. The burgeoning healthcare sector and the increasing adoption of advanced technologies foster market growth. Government organizations launch initiatives to create awareness about screening and early cancer diagnosis. This enables healthcare professionals to provide early intervention. The increasing investments, collaborations, and public-private partnerships contribute to market growth. Australia and the International Atomic Energy Agency (IAEA) launched a new radiation oncology development project to advance Rays of Hope in the Asia-Pacific region.

The burden of cancer cases in China is high, accounting for 24% of newly diagnosed cancer cases and 30% of cancer-related deaths worldwide. West China Hospital of Sichuan University, Sun Yat-sen University Cancer Center, and Tianjin Medical University Cancer Institute & Hospital are some centers that provide high-quality radiation therapy. Asia contributes to 21% of the global radiation oncology research output, with China accounting for 5%.

As of July 2023, there were approximately 609 radiotherapy centers in India, with 671 linear accelerators. The Indian government is at the forefront of driving a cancer-free India with funding and national policies. The Pradhan Mantri Jan Arogya Yojana covers over 68 lakh cancer treatments worth Rs 13,000 crore that have been administered under this policy. It covers around 200 cancer treatment packages, including surgical, medical, and radiation oncology.

By Type of Radiation Therapy

By Application/Cancer Type

By End-User

By Region

January 2026

January 2026

January 2026

January 2026