January 2026

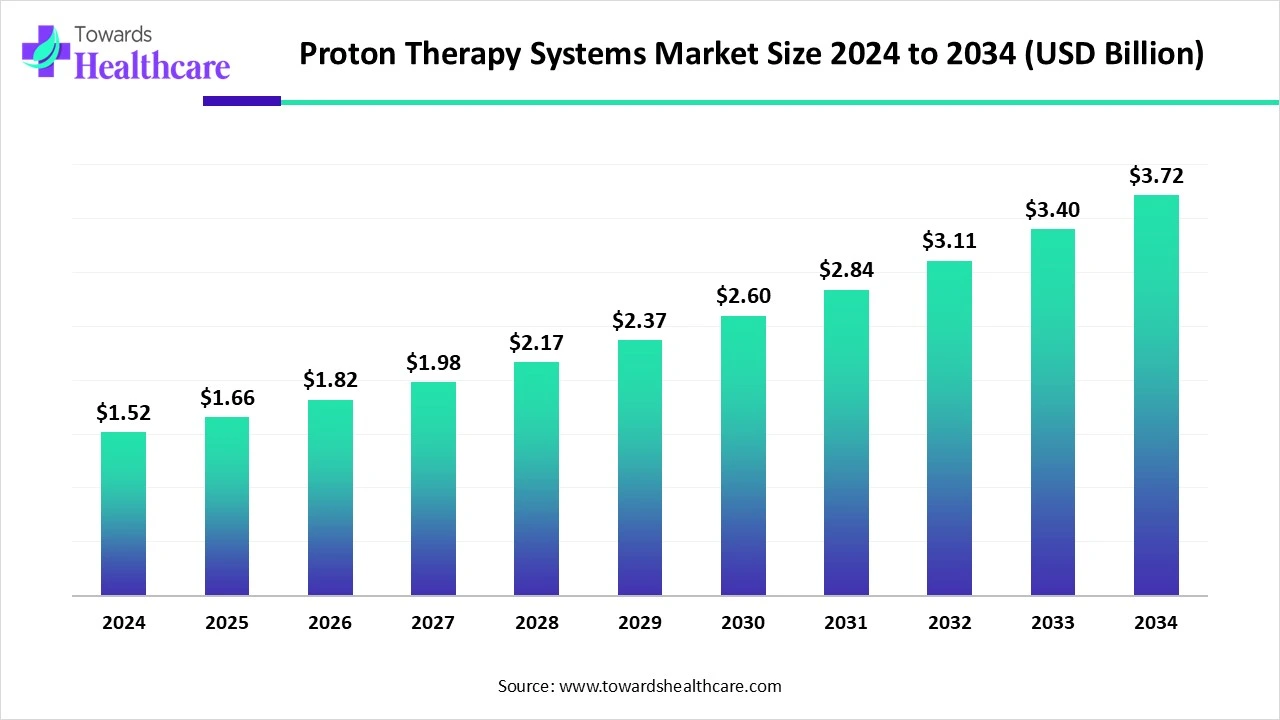

The global proton therapy systems market size began at US$ 1.52 billion in 2024 and is forecast to rise to US$ 1.66 billion by 2025. By the end of 2034, it is expected to surpass US$ 3.72 billion, growing steadily at a CAGR of 9.44%.

The proton therapy systems market is witnessing strong growth, fueled by the increasing global burden of cancer and the need for highly precise, less invasive treatment options. Proton therapy offers targeted radiation with minimal damage to surrounding healthy tissues, making it especially beneficial for pediatric and complex cancer cases. Advancements in system design, growing hospital investments, and supportive government initiatives are boosting adoption. Expansion into emerging markets and continuous technological innovation are expected to further accelerate market growth in the coming years.

| Table | Scope |

| Market Size in 2025 | USD 1.66 Billion |

| Projected Market Size in 2034 | USD 3.72 Billion |

| CAGR (2025 - 2034) | 9.44% |

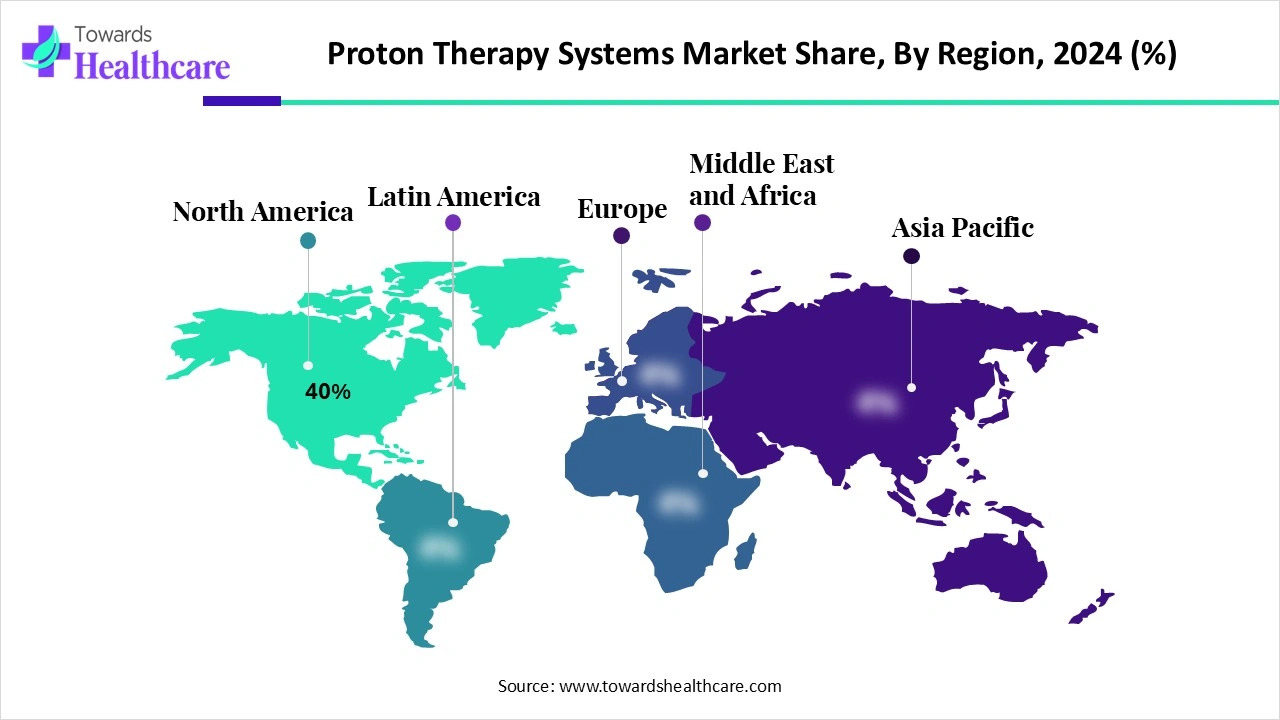

| Leading Region | North America 40% |

| Market Segmentation | By System Setup/Facility Type, By Accelerator Type, By Beam Delivery Mode, By Application /Clinical Indication, By Region |

| Top Key Players | IBA (Ion Beam Applications), Varian (now part of Siemens Healthineers), Hitachi, Ltd., Sumitomo Heavy Industries, Mevion Medical Systems, ProNova Solutions, Mitsubishi Electric / Mitsubishi Heavy Industries, Optivus Proton Therapy, ProTom International, Advanced Oncotherapy (LIGHT system developer), Toshiba (historical involvement/components), ION Beam Applications / IBA subsidiaries & product lines., Provision Healthcare, Panacea (regional system integrator/center developer), Best Medical International / Best Particle Therapy, ITEL Telecomunicazioni (beamline & control integrator), Breitfeld & Schliekert / gantry component suppliers, Accuray (adjacent radiotherapy tech & partnerships), Regional OEMs & Chinese proton system developers, Specialist service providers |

Proton therapy systems are specialized medical accelerators and beam-delivery solutions that use high-energy protons to irradiate tumors with precision (steep dose fall-off beyond the Bragg peak), reducing dose to surrounding healthy tissues versus conventional photon (X-ray) radiotherapy. The market covers full treatment systems (accelerator + gantry/beamline + treatment delivery & planning software), cyclotrons/synchrotrons, single-room and multi-room installations, accessories (imaging/positioning, patient-specific apertures/bolus), service & maintenance, and clinical implementation services.

Growth is driven by rising cancer incidence, clinical adoption for pediatric and complex tumors, improving cost/footprint economics of compact single-room systems, and expanding reimbursement/center build-out in APAC and EMEA. Innovation is driving the proton therapy systems market by enabling next-generation features such as smaller system footprints, improved beam delivery techniques, and adaptive treatment planning. Enhanced integration of digital tools and automation is boosting accuracy and patient safety while also lowering operational costs and expanding clinical adoption globally.

For Instance,

Technological Advancements: Innovations such as pencil beam scanning, compact systems, and AI integration are enhancing treatment accuracy while lowering operational costs.

New Product Launches: The introduction of advanced proton therapy systems with improved precision and efficiency is boosting market growth by expanding access to cutting-edge cancer treatments.

AI can significantly impact the market by enhancing treatment planning, optimizing beam delivery, and enabling real-time tumor tracking for greater precision. Machine learning algorithms can analyze patient data to personalize therapies, reduce errors, and improve outcomes. AI-driven automation also streamlines workflow, lowers operational costs, and increases throughput in treatment centers. These advancements make proton therapy more efficient, accessible, and effective, driving adoption across hospitals and cancer care facilities globally.

Rising Global Prevalence of Cancer

The increasing incidence of cancer worldwide is propelling the portion therapy systems market as more patients require advanced treatment solutions. Proton therapy’s ability to deliver focused radiation with reduced side effects makes it an attractive option for complex and recurrent cancers. This growing patient population is prompting healthcare providers to invest in proton therapy facilities, driving demand for state-of-the-art systems and expanding the proton therapy systems market for precision cancer treatment technologies.

For Instance,

High Cost of Equipment and Treatment

The expensive nature of proton therapy systems and procedures restricts widespread adoption in the proton therapy systems market. High capital expenditure for building specialized facilities, coupled with costly maintenance and operation, makes it challenging for many hospitals to implement. Additionally, treatment fees are considerably higher than traditional radiation therapy, limiting patient access, especially in low-and low-income regions. These financial barriers slow the expansion of proton therapy centers and constrain market growth despite increasing demand for advanced cancer treatment solutions.

Growing Adoption of Advanced, compact, and Cost-efficient Proton Therapy technologies

The increasing use of compact and more affordable proton therapy systems offers a promising opportunity by making advanced cancer treatment accessible to more healthcare facilities and patients. These next-generation technologies reduce space and cost requirements while maintaining high precision, encouraging adoption in both developed and emerging regions. Combined with innovations like AI-assisted planning and real-time imaging, they enable more effective and personalized therapies, expanding the market potential and accelerating growth in the global proton therapy systems sector.

For Instance,

The single-room compact proton systems segment leads the market and is projected to grow rapidly because it provides high-precision proton therapy in a more space and cost-efficient format. These systems are easier to install and operate than traditional multi-room setups, making them ideal for hospitals with limited space or budgets. Their ability to deliver effective, targeted cancer treatment while minimizing infrastructure requirements is driving widespread adoption, positioning this segment for significant growth during the forecast period.

The cyclotron-based systems segment dominated the proton therapy systems market in 2024 because of their efficiency, compact design, and consistent proton beam production. These systems are widely implemented in clinical centers due to their reliability and ability to support a high volume of patients. Their adaptability for various treatment setups, combined with lower operational and maintenance demands compared to alternative accelerators, has made cyclotron-based systems the preferred choice for healthcare providers, securing the largest revenue share in the market.

The synchrotron-based systems segment is projected to expand rapidly as it offers superior beam control and energy variability, enabling treatment of challenging tumors with high precision. These systems are well-suited for multi-room proton therapy centers and advanced applications like pencil beam scanning. As hospitals increasingly invest in state-of-the-art facilities to deliver cutting-edge cancer care, the demand for synchrotron-based accelerators is rising, driving their fastest growth in the proton therapy systems market during the forecast period.

The pencil beam scanning (PBS) segment led the market in 2024 due to its ability to deliver proton therapy with exceptional accuracy and minimal impact on healthy tissues. Its precise, layer-by-layer radiation approach allows for complex tumor targeting and dose modulations, improving treatment outcomes. Hospitals and cancer centers favor PBS for its compatibility with advanced imaging and adaptive therapy techniques, making it the most widely adopted beam delivery mode and driving its dominant market position in proton therapy systems.

The adaptive & image-guided proton delivery segment captured the largest revenue share as it allows clinicians to adjust treatment in real time based on patient anatomy and tumor movements. This technology enhances treatment accuracy, minimizes damage to surrounding healthy tissues, and improves outcomes for complex and moving tumors. Its adoption in advanced cancer centers, coupled with growing demand for precision therapies, has made it a preferred choice, contributing significantly to the market's revenue dominance in 2024.

The solid tumors segment dominated the proton therapy systems market in 2024, as these cancers are highly prevalent and benefit most from targeted radiation. Proton therapy’s precision allows for effective treatment of solid masses while reducing side effects on nearby healthy tissue. Growing adoption in oncology centers, combined with favorable clinical results and increasing awareness among patients and physicians, has led to higher utilization of proton therapy for solid tumors, securing the largest revenue share in the market.

The pediatric oncology segment is projected to expand rapidly as proton therapy offers targeted treatment with minimal harm to developing tissues, making it safer for children. Its effectiveness in managing complex pediatric cancers, combined with growing hospital investments in pediatric with growing hospital investments in pediatric-focused proton therapy centers and increased clinician focused proton therapy centers and increased clinician preference, is driving adoption. Rising awareness of long-term benefits for young patients and the demand for precision therapies in pediatric oncology are expected to fuel the fastest growth of this segment during the forecast period.

North America led the market share 40% in 2024, owing to well-developed medical infrastructure, early adoption of advanced cancer treatment technologies, and substantial funding for research and facility development. The region’s established proton therapy centers, favorable insurance coverage, and high patient demand for precise, minimally invasive treatments contributed to strong market penetration, securing the largest revenue share. Additionally, continuous technological advancements and clinical expertise in proton therapy reinforced North America’s dominant position globally.

The U.S. market is expanding as hospitals and cancer centers increasingly adopt advanced, precise treatment options to meet rising demand. High cancer prevalence, supportive insurance coverage, and substantial investments in cutting-edge proton therapy facilities drive growth. Innovations such as image-guided systems, compact single-room setups, and AI-assisted planning improve treatment accuracy and operational efficiency, encouraging wider adoption. Combined, these factors position the U.S. as a leading market for proton therapy systems globally.

The market in Canada is expanding as hospitals seek advanced solutions to treat complex and hard-to-reach tumors with minimal damage to healthy tissues. Growing awareness among patients and clinicians, combined with government support and investments in healthcare infrastructure, is encouraging the establishment of proton therapy centers. Innovations like compact single-room systems and real-time image-guided therapy are improving treatment precision and accessibility, driving adoption and positioning Canada for steady growth in the proton therapy systems market.

The Asia-Pacific market is projected to expand rapidly as governments and private healthcare providers invest in advanced cancer treatment facilities. Rising cancer incidence, growing patient awareness, and increased availability of compact, cost-efficient proton therapy systems are fueling adoption. Additionally, favorable healthcare policies, technological advancements, and a focus on precision treatments for complex and pediatric cancers are contributing to the region’s fastest growth rate, positioning Asia-Pacific as a key emerging market in the global proton therapy systems landscape.

Proton therapy systems require approval from national regulators like the U.S. FDA or India’s AERB, ensuring safety and effectiveness through design, performance, and clinical evaluations before clinical use.

Proton therapy systems are being evaluated in clinical trials at leading cancer centers and through organizations such as the National Cancer Institute. These studies target cancers like prostate, brain, and pediatric tumors to assess whether proton therapy matches or outperforms conventional X-ray treatments.

Patient support in proton therapy encompasses clinical services, including consultations, treatment simulations, and customized therapy plans, along with psychosocial care like child life specialists to assist pediatric patients and their families.

Researchers from Hochschule Zittau/Görlitz and Helmholtz-Zentrum Dresden–Rossendorf, alongside Valencia scientists, have launched a project to enhance proton therapy treatment verification using the Prompt Gamma Ray Timing (PGT) method. The project develops a simulation model to track proton beam range and adjust doses in real time, accounting for patient movements or tumor changes. Dr. Sonja Schellhammer stated, “By developing a simulation model, we can detect deviations during treatment and create data for AI-based analysis and measurement system optimization,” improving therapy precision and safety.

By System Setup/Facility Type

By Accelerator Type

By Beam Delivery Mode

By Application /Clinical Indication

By Region

January 2026

January 2026

January 2026

January 2026